Indoor Location Market Report

Published Date: 31 January 2026 | Report Code: indoor-location

Indoor Location Market Size, Share, Industry Trends and Forecast to 2033

This report explores the Indoor Location market from 2023 to 2033, providing insights on market trends, regional analysis, and future forecasts for industry growth and challenges ahead.

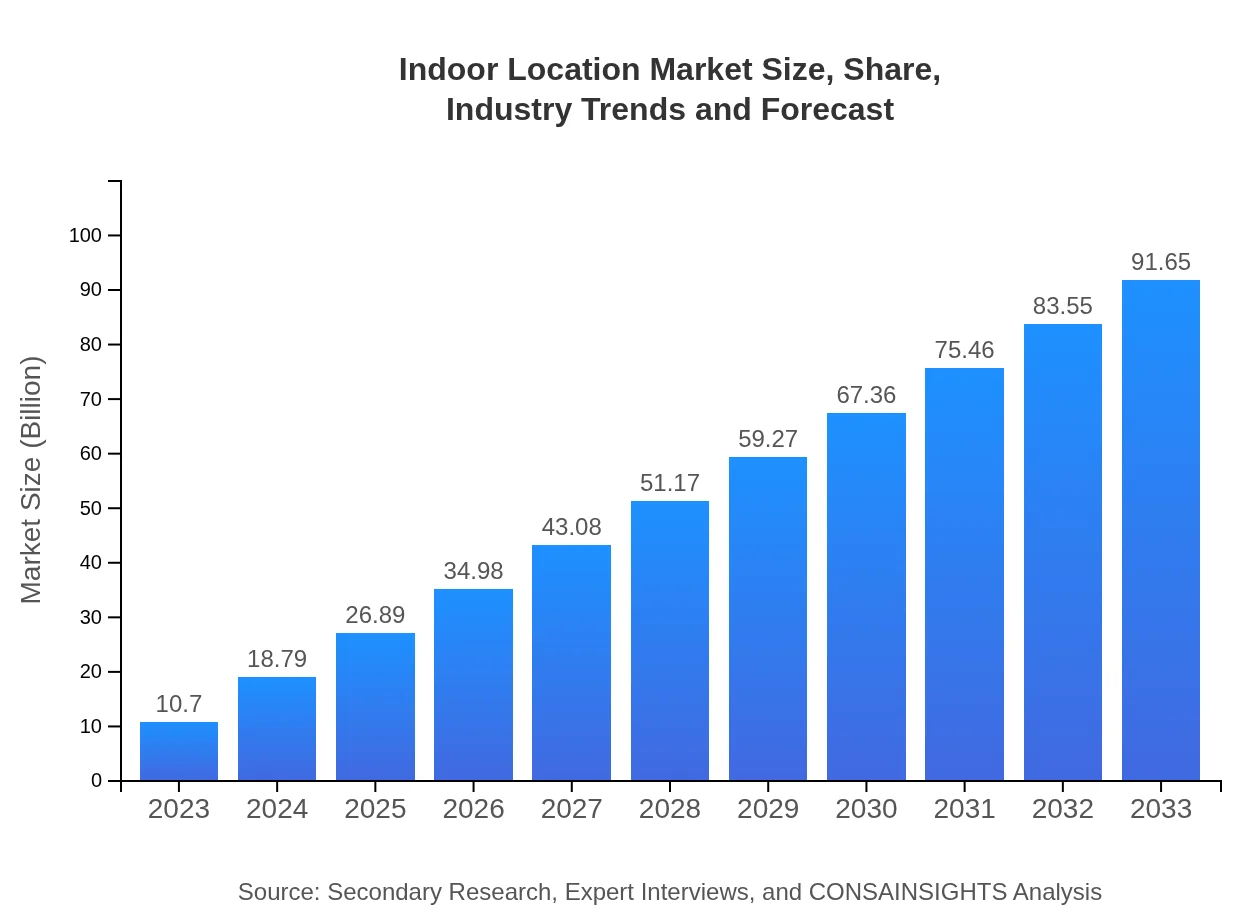

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $10.70 Billion |

| CAGR (2023-2033) | 22.5% |

| 2033 Market Size | $91.65 Billion |

| Top Companies | Zebra Technologies, Cisco Systems, Trimble, Google, Apple |

| Last Modified Date | 31 January 2026 |

Indoor Location Market Overview

Customize Indoor Location Market Report market research report

- ✔ Get in-depth analysis of Indoor Location market size, growth, and forecasts.

- ✔ Understand Indoor Location's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Indoor Location

What is the Market Size & CAGR of Indoor Location market in 2023?

Indoor Location Industry Analysis

Indoor Location Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Indoor Location Market Analysis Report by Region

Europe Indoor Location Market Report:

Europe's Indoor Location market is expected to experience substantial growth from $3.95 billion in 2023 to $33.85 billion by 2033. The growing focus on retail analytics and enhanced customer engagement drives demand, particularly in countries like Germany, the UK, and France, which are increasingly adopting smart technologies.Asia Pacific Indoor Location Market Report:

The Asia Pacific Indoor Location market is expected to grow from $1.84 billion in 2023 to $15.80 billion in 2033, driven by rapid urbanization, increased smartphone penetration, and advancements in smart city initiatives. Countries such as China and India are at the forefront due to their burgeoning retail and healthcare sectors, significantly increasing demand for indoor mapping and navigation solutions.North America Indoor Location Market Report:

North America is a leading region for the Indoor Location market, projected to grow from $3.46 billion in 2023 to $29.68 billion in 2033. The region's advancement in technology adoption, coupled with significant investments in smart buildings and retail innovations, underscores its position as a key driver for the industry's growth.South America Indoor Location Market Report:

In South America, the market is anticipated to expand from $0.41 billion in 2023 to $3.51 billion by 2033. Countries such as Brazil and Argentina are focusing on enhancing their retail experiences through indoor location technologies, while the healthcare segment is also opening new avenues as hospitals adopt efficient patient tracking systems.Middle East & Africa Indoor Location Market Report:

The Middle East and Africa market is anticipated to rise from $1.03 billion in 2023 to $8.81 billion in 2033. With an increase in IoT and smart city projects, countries like the UAE and South Africa are investing heavily in indoor location technologies to improve urban management and customer experiences.Tell us your focus area and get a customized research report.

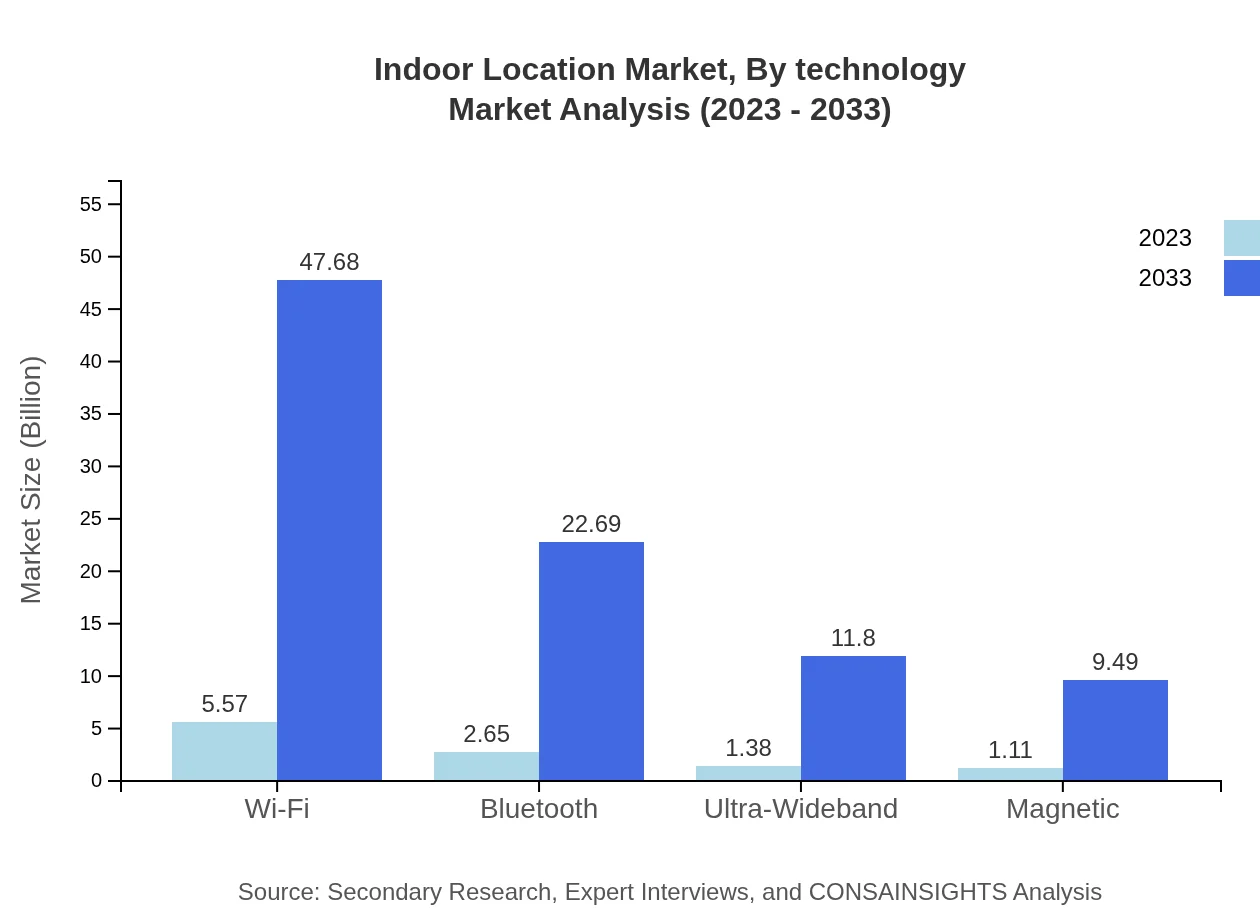

Indoor Location Market Analysis By Technology

The technology segment comprises solutions such as Wi-Fi, Bluetooth, Ultra-Wideband, and Magnetic technologies. Wi-Fi, leading the market with a projected size of $5.57 billion in 2023, will grow to $47.68 billion in 2033. Bluetooth technology is gaining momentum, expected to rise from $2.65 billion to $22.69 billion, while Ultra-Wideband and Magnetic technologies will also see substantial increases in their respective segments.

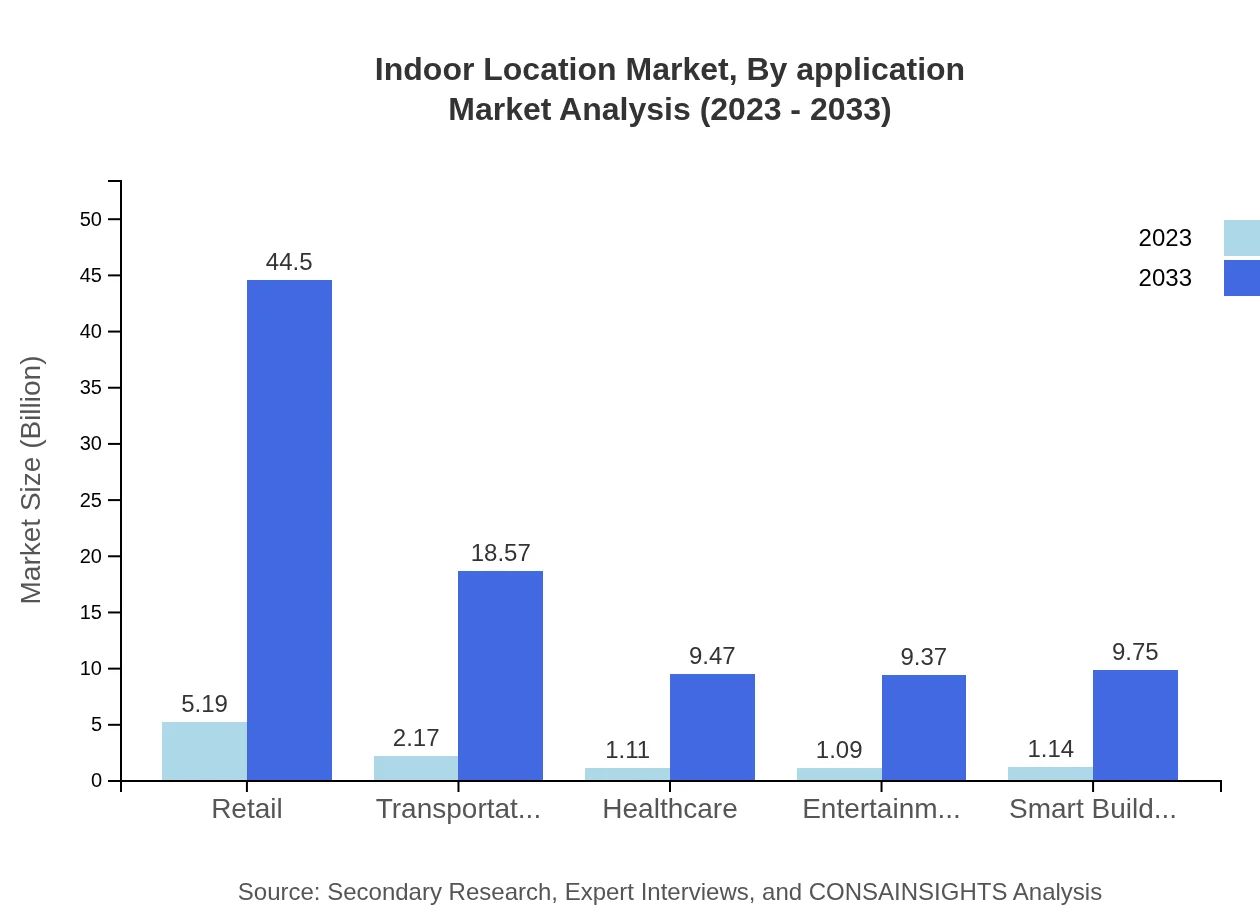

Indoor Location Market Analysis By Application

Applications of Indoor Location solutions touch multiple sectors, including retail, healthcare, education, and transportation. The retail application will grow from $5.19 billion to $44.50 billion, driven by analytics and enhanced customer service solutions, while healthcare applications are projected to grow from $2.17 billion to $18.57 billion, with a focus on asset tracking and patient management.

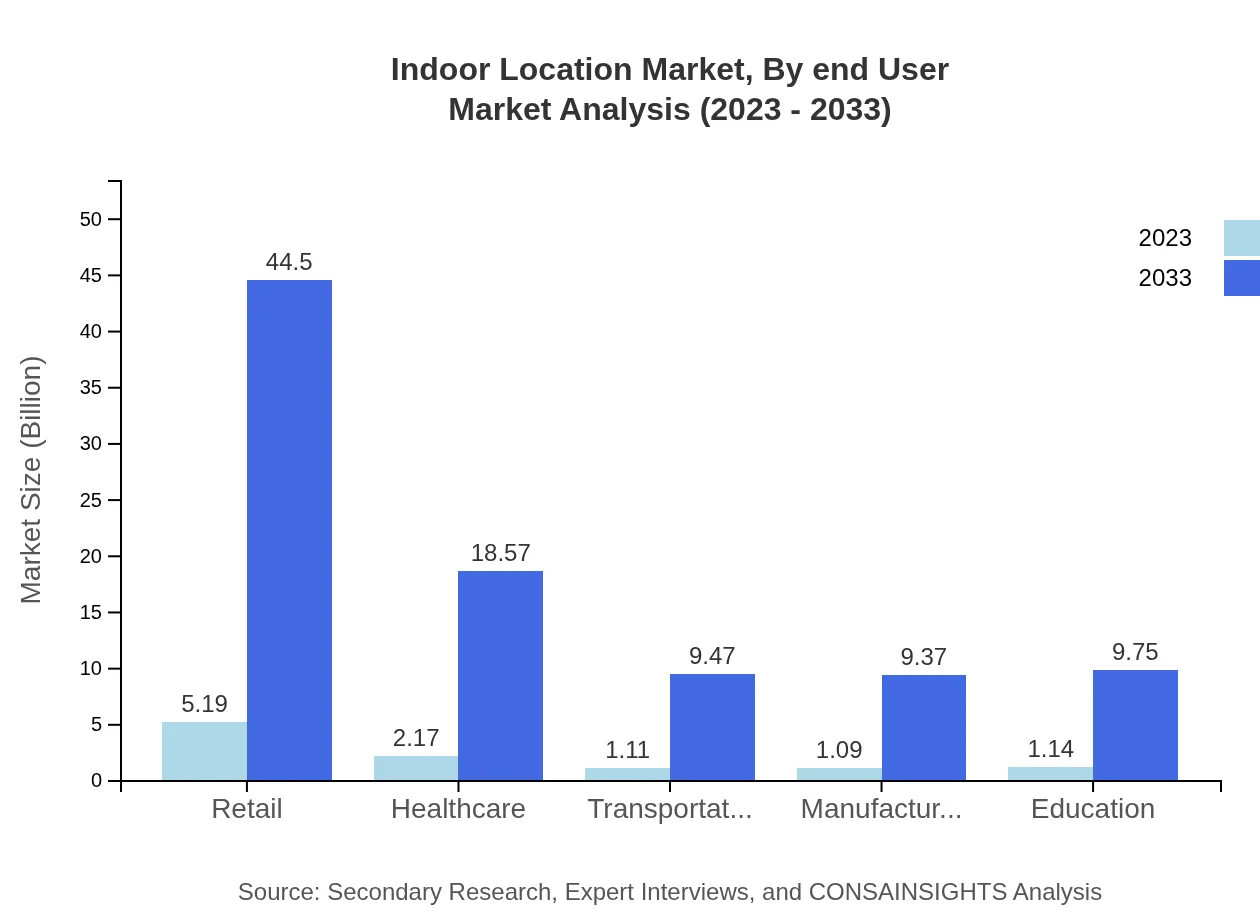

Indoor Location Market Analysis By End User

Major end-user industries for Indoor Location solutions include retail, healthcare, education, and smart cities. The retail sector shows a significant market share of 48.55% in 2023, while healthcare accounts for approximately 20.26%. With the rise of smart cities, these segments will continue to evolve, opening new avenues for indoor technology applications.

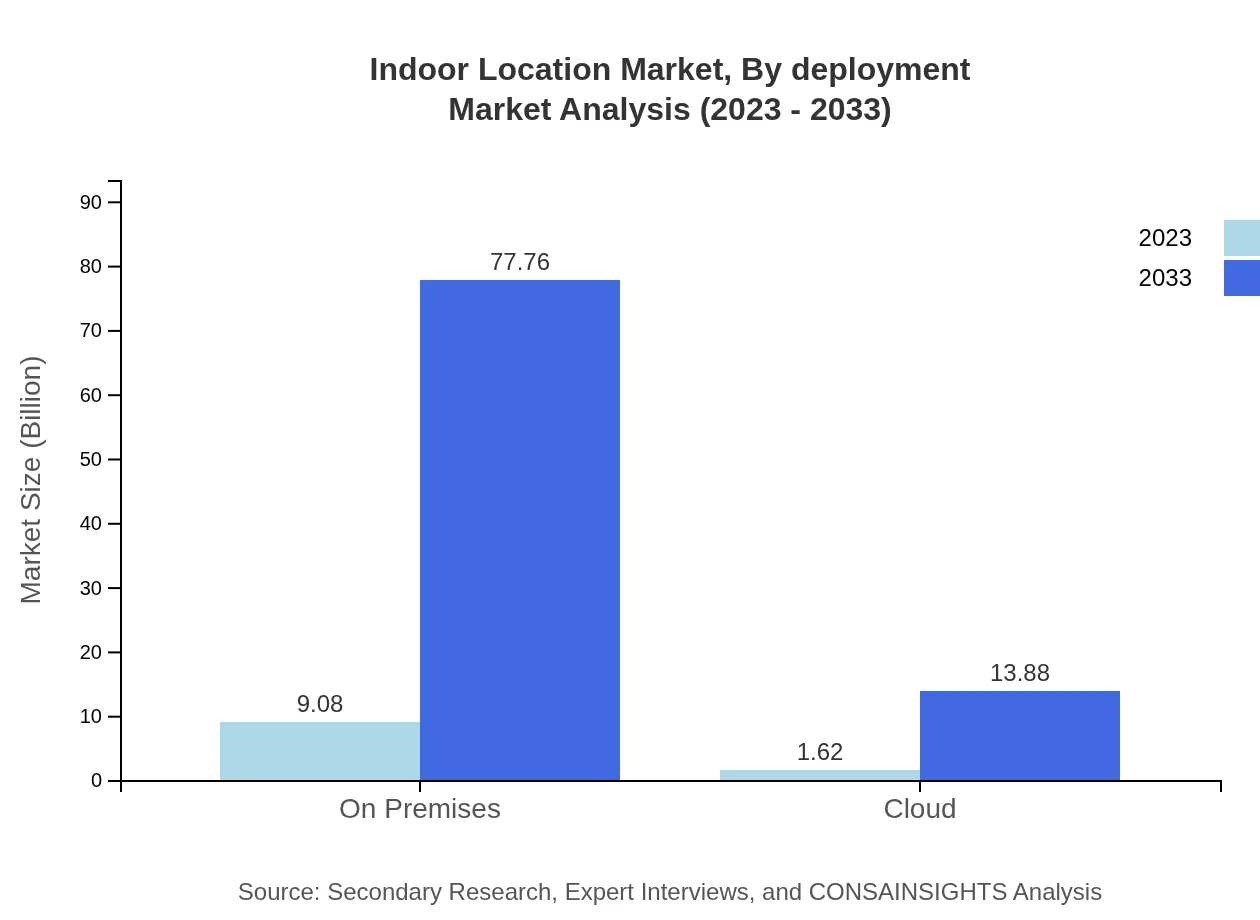

Indoor Location Market Analysis By Deployment

Deployment modes are critical in leveraging Indoor Location technologies, predominantly presented in on-premises and cloud models. The on-premises solution commands a substantial market share at 84.85% in 2023, while cloud deployment is projected to become increasingly popular due to its scalability and flexibility, expanding from $1.62 billion to $13.88 billion.

Indoor Location Market Analysis By Growth Lever

Global Indoor Location Market, By Growth Lever Market Analysis (2023 - 2033)

Factors propelling market growth include the advent of smart devices, consumer demand for real-time data, and integration within smart city frameworks. As technologies evolve and consumers' expectations rise, Indoor Location solutions will continue to play a vital role in enhancing operational efficiencies across multiple sectors.

Indoor Location Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Indoor Location Industry

Zebra Technologies:

A leader in asset visibility and analytics solutions, Zebra Technologies has a robust offering in indoor location technologies, primarily catering to retail and logistics sectors.Cisco Systems:

Cisco offers advanced indoor positioning solutions leveraging Wi-Fi technologies, playing a pivotal role in the smart building and enterprise sectors.Trimble:

Trimble is renowned for integrating positioning technologies in various markets including transportation and construction, providing data-driven insights.Google:

With advancements in its mapping technology, Google provides indoor mapping solutions that empower businesses to enhance customer engagement.Apple:

Apple invests in Indoor Location technologies focusing on augmented reality experiences and is pivotal in enhancing customer-centric services.We're grateful to work with incredible clients.

FAQs

What is the market size of Indoor Location?

The Indoor Location market is projected to reach $10.7 billion by 2033, with a significant CAGR of 22.5% from 2023. This growth is fueled by advancements in positioning technologies and increased adoption of smart applications.

What are the key market players or companies in the Indoor Location industry?

Key players in the Indoor Location market include major technology firms specializing in location-based services, such as Cisco, Google, and Zebra Technologies. They drive innovation in positioning solutions and compete for market share through strategic partnerships.

What are the primary factors driving the growth in the Indoor Location industry?

Growth in the Indoor Location industry is driven by the increasing need for accurate location tracking in sectors like retail and healthcare, the rise of smart cities, and advancements in technologies such as Wi-Fi and Bluetooth that enhance indoor navigation.

Which region is the fastest Growing in the Indoor Location market?

The fastest-growing region in the Indoor Location market is Europe, expected to grow from $3.95 billion in 2023 to $33.85 billion by 2033. This rapid growth is influenced by robust infrastructure and increasing demand for smart technology.

Does ConsaInsights provide customized market report data for the Indoor Location industry?

Yes, ConsaInsights offers customized market report data tailored to specific business needs in the Indoor Location industry, helping clients identify market trends, competitor strategies, and growth opportunities.

What deliverables can I expect from this Indoor Location market research project?

Deliverables from the Indoor Location market research include detailed market analysis reports, segment-wise insights, competitive landscape assessment, and growth forecasts, providing comprehensive data for strategic decision-making.

What are the market trends of Indoor Location?

Current trends in the Indoor Location market include the growing integration of IoT with location technologies, increasing demand for location-based services in retail, and a shift towards cloud-based solutions for better scalability and efficiency.