Industrial-2-4 Ghz Wireless Technologies Market Report

Published Date: 31 January 2026 | Report Code: industrial-2-4-ghz-wireless-technologies

Industrial-2-4 Ghz Wireless Technologies Market Size, Share, Industry Trends and Forecast to 2033

This report examines the Industrial-2-4 GHz Wireless Technologies market, providing a comprehensive analysis of market trends, size, and segmentation from 2023 to 2033, along with insights into regional dynamics and leading companies in the industry.

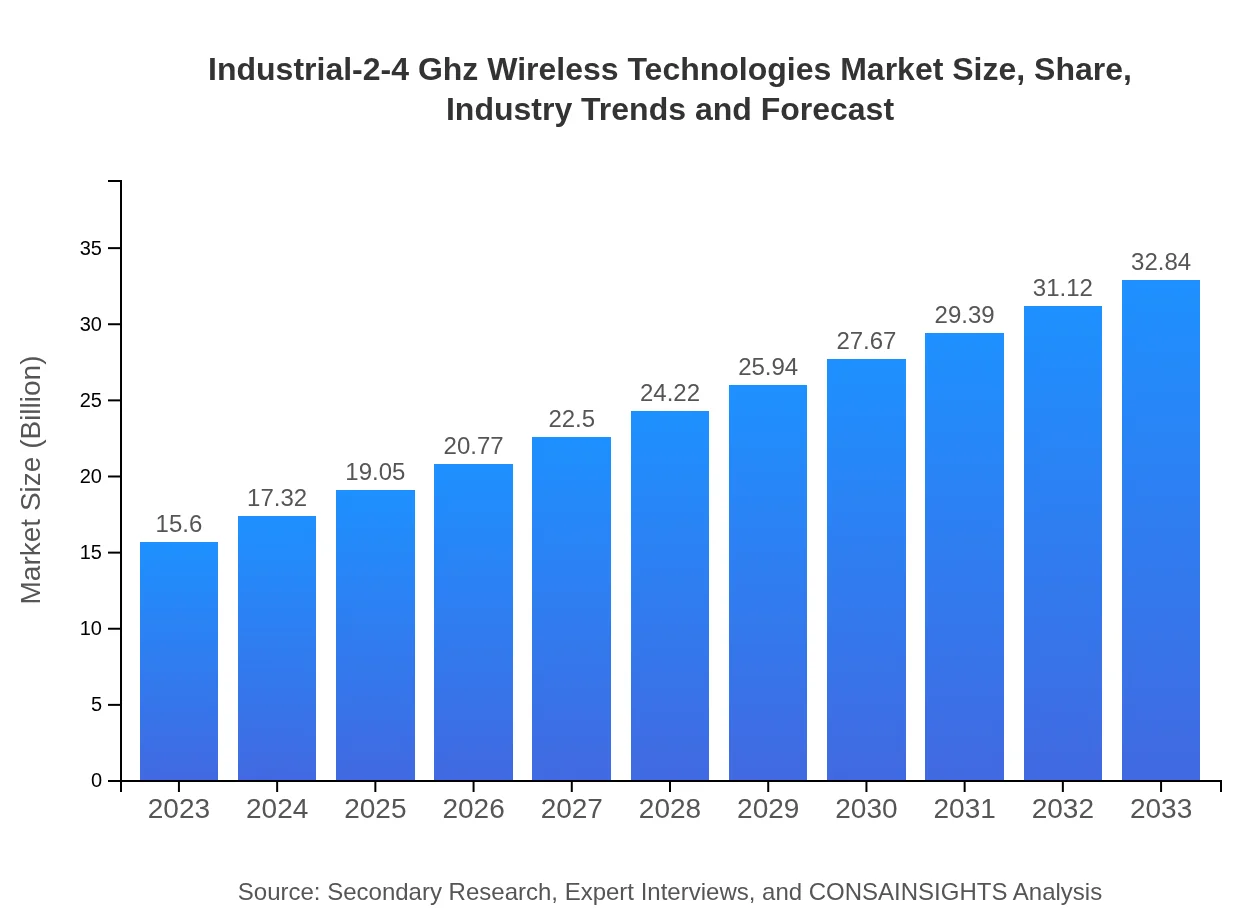

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $15.60 Billion |

| CAGR (2023-2033) | 7.5% |

| 2033 Market Size | $32.84 Billion |

| Top Companies | Cisco Systems, Bluetooth SIG, NXP Semiconductors, Texas Instruments |

| Last Modified Date | 31 January 2026 |

Industrial-2-4 Ghz Wireless Technologies Market Overview

Customize Industrial-2-4 Ghz Wireless Technologies Market Report market research report

- ✔ Get in-depth analysis of Industrial-2-4 Ghz Wireless Technologies market size, growth, and forecasts.

- ✔ Understand Industrial-2-4 Ghz Wireless Technologies's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Industrial-2-4 Ghz Wireless Technologies

What is the Market Size & CAGR of Industrial-2-4 Ghz Wireless Technologies market in 2023?

Industrial-2-4 Ghz Wireless Technologies Industry Analysis

Industrial-2-4 Ghz Wireless Technologies Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Industrial-2-4 Ghz Wireless Technologies Market Analysis Report by Region

Europe Industrial-2-4 Ghz Wireless Technologies Market Report:

In Europe, the market is anticipated to grow from $3.81 billion in 2023 to $8.02 billion by 2033. The region focuses on regulatory standards for wireless communications, fostering innovation and integration of smart systems in industry. The emphasis on sustainability and energy efficiency plays a crucial role in shaping demand.Asia Pacific Industrial-2-4 Ghz Wireless Technologies Market Report:

The Asia Pacific region is projected to contribute significantly to the market, with a valuation of $3.12 billion in 2023, expected to grow to $6.56 billion by 2033. Growth drivers include rapid industrialization, urbanization, and increasing investments in smart technologies. The region is a hub for manufacturing and innovation, presenting excellent growth opportunities for 2-4 GHz technologies.North America Industrial-2-4 Ghz Wireless Technologies Market Report:

North America exhibits a robust market projected to grow from $6.04 billion in 2023 to $12.72 billion by 2033. The region leads in adopting advanced wireless technologies across industries, driven by a strong focus on smart manufacturing and IoT integration. The presence of major technological players further bolsters market growth.South America Industrial-2-4 Ghz Wireless Technologies Market Report:

South America is estimated to reach a market size of $1.44 billion in 2023, growing to $3.03 billion by 2033. The region's growth is being fueled by expanding industrial sectors and investments in wireless communication infrastructures. However, challenges such as regulatory hurdles and infrastructure limitations may hinder faster growth.Middle East & Africa Industrial-2-4 Ghz Wireless Technologies Market Report:

The Middle East and Africa are expected to see growth from $1.19 billion in 2023 to $2.52 billion by 2033. This growth is driven by increasing investments in telecommunications and infrastructure improvements aimed at enhancing connectivity in various sectors, particularly in logistics and healthcare.Tell us your focus area and get a customized research report.

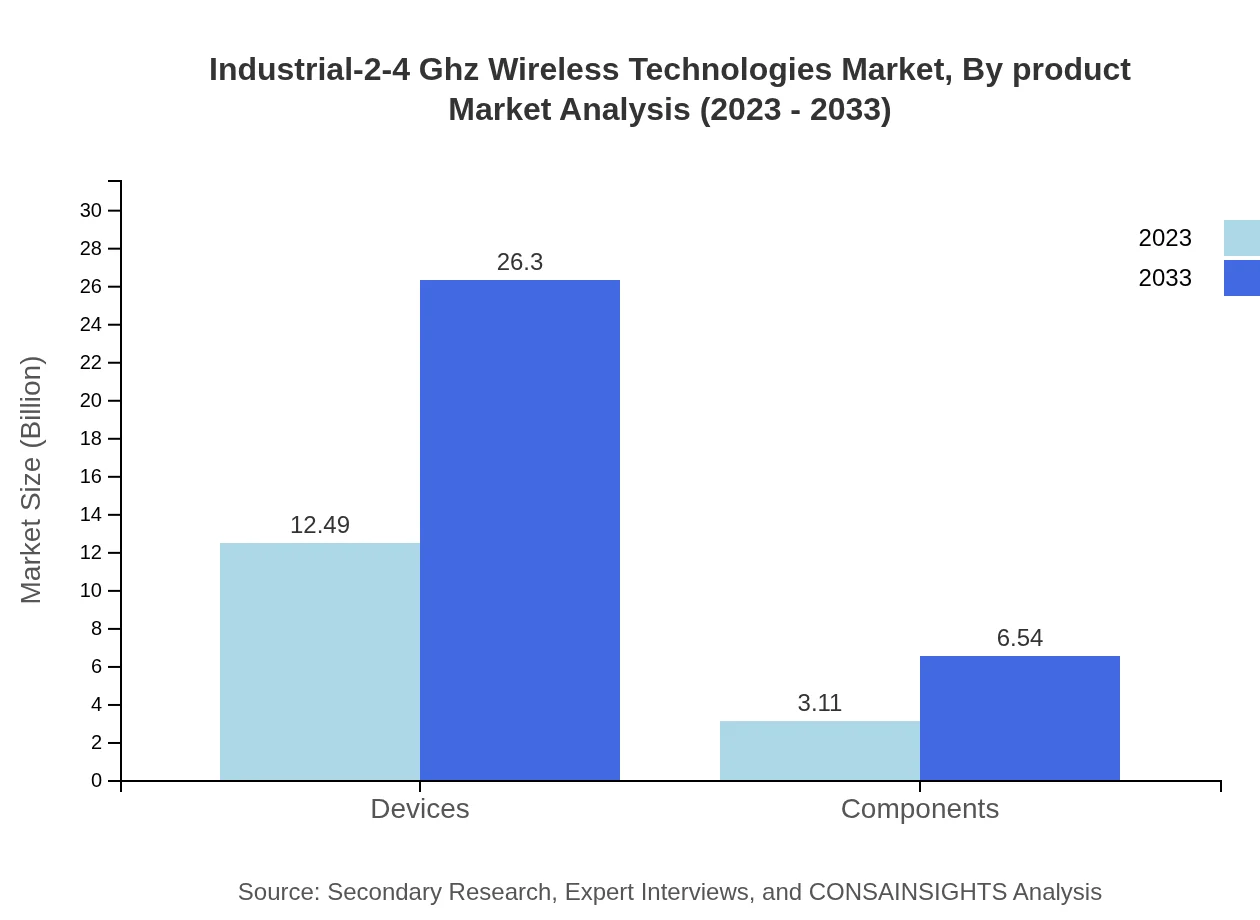

Industrial-2-4 Ghz Wireless Technologies Market Analysis By Product

The product segment dominates the market with devices leading at $12.49 billion in 2023 and expected to reach $26.30 billion by 2033. Zigbee technology holds a significant market share of 50.12% in 2023, affirming its critical role in short-range communications. Other products like Wi-Fi and Bluetooth also contribute notably, reflecting the diverse application landscape.

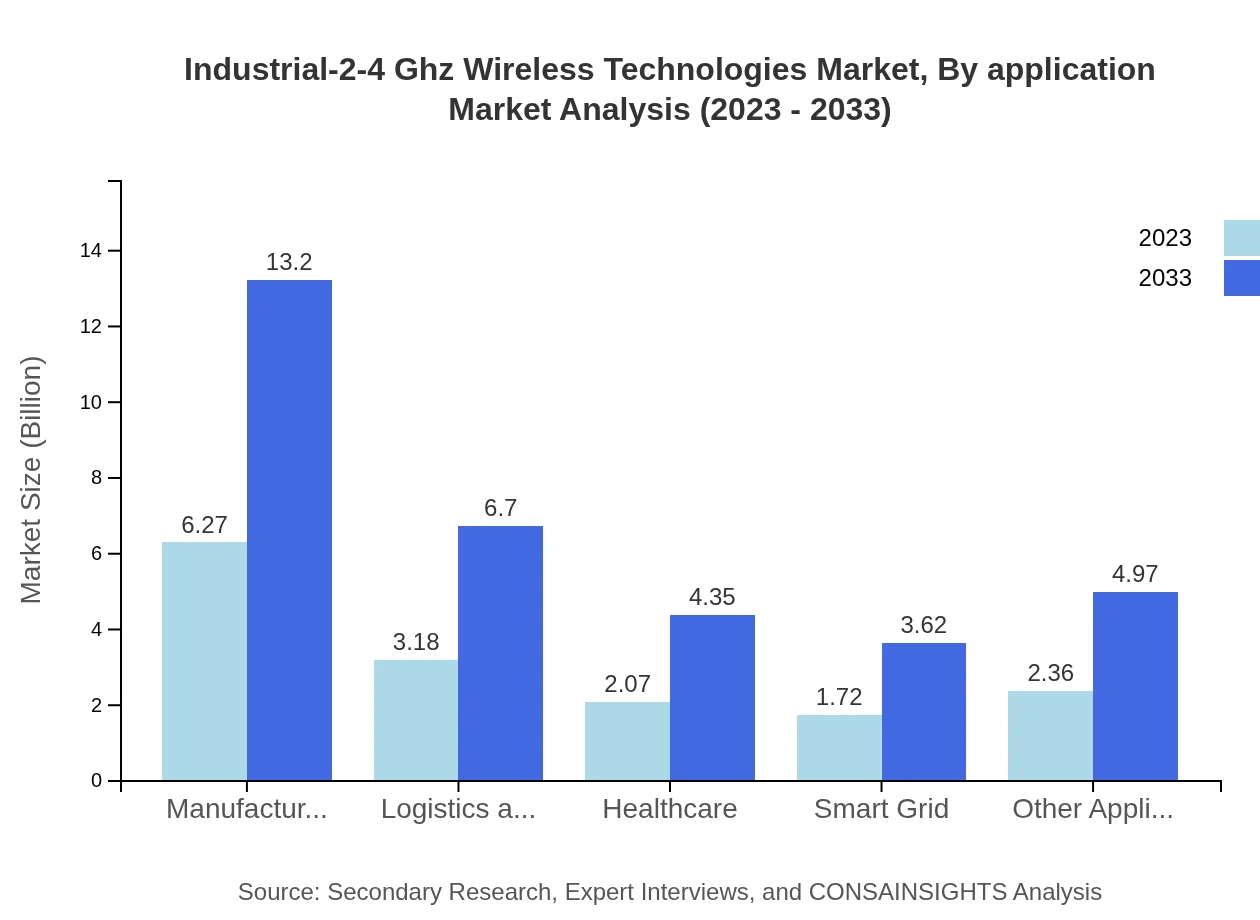

Industrial-2-4 Ghz Wireless Technologies Market Analysis By Application

Applications in manufacturing and energy and utilities showcase substantial size, with $6.27 billion and $6.27 billion respectively, both projected to double by 2033. The healthcare sector also represents a significant segment, focusing on improving operational efficiency and patient monitoring systems driven by advanced wireless technologies.

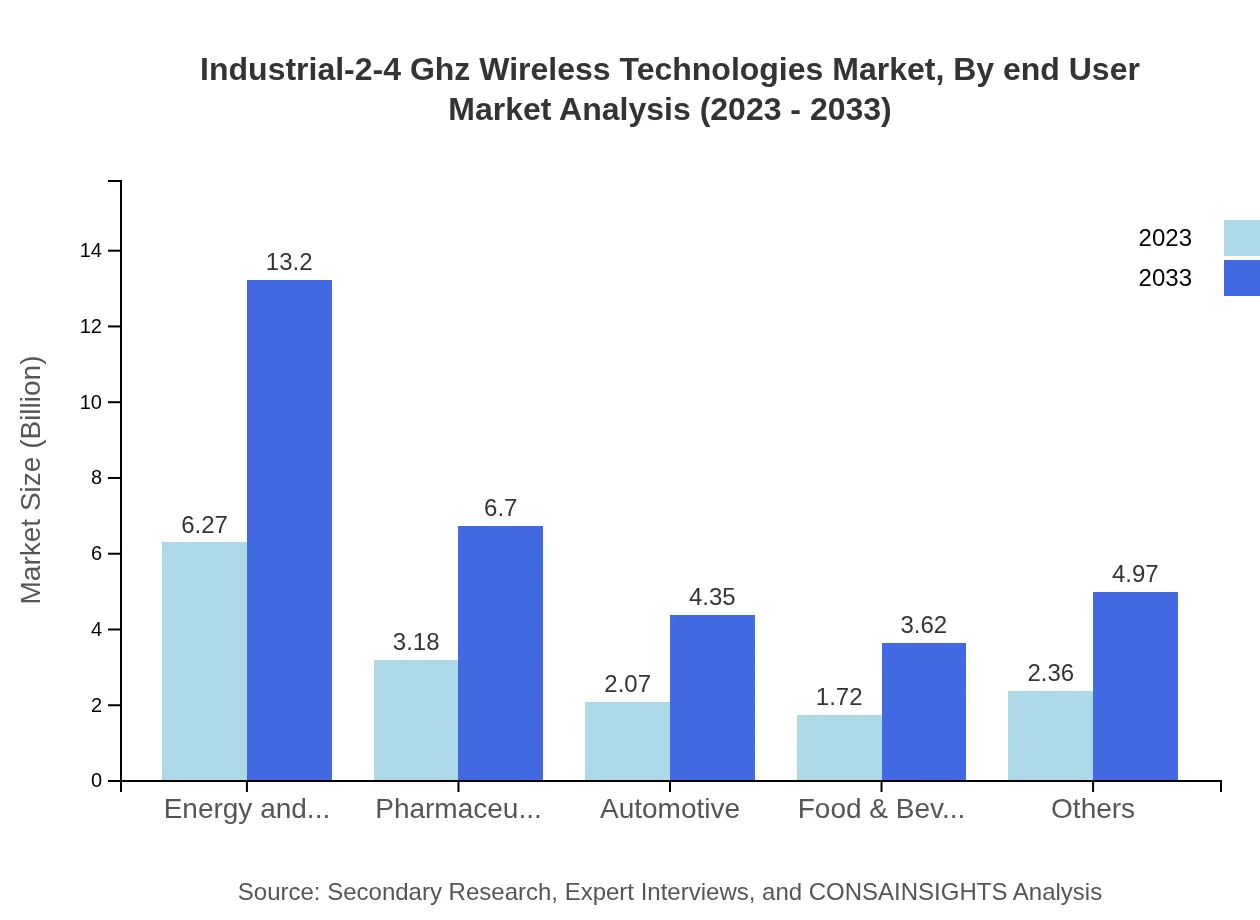

Industrial-2-4 Ghz Wireless Technologies Market Analysis By End User

Key end-user sectors include manufacturing and logistics, which together contribute to nearly 60% of the overall market size in 2023. The demand for automation and efficient supply chain solutions continues to drive adoption in these segments, reflecting the critical need for seamless connectivity in modern industrial operations.

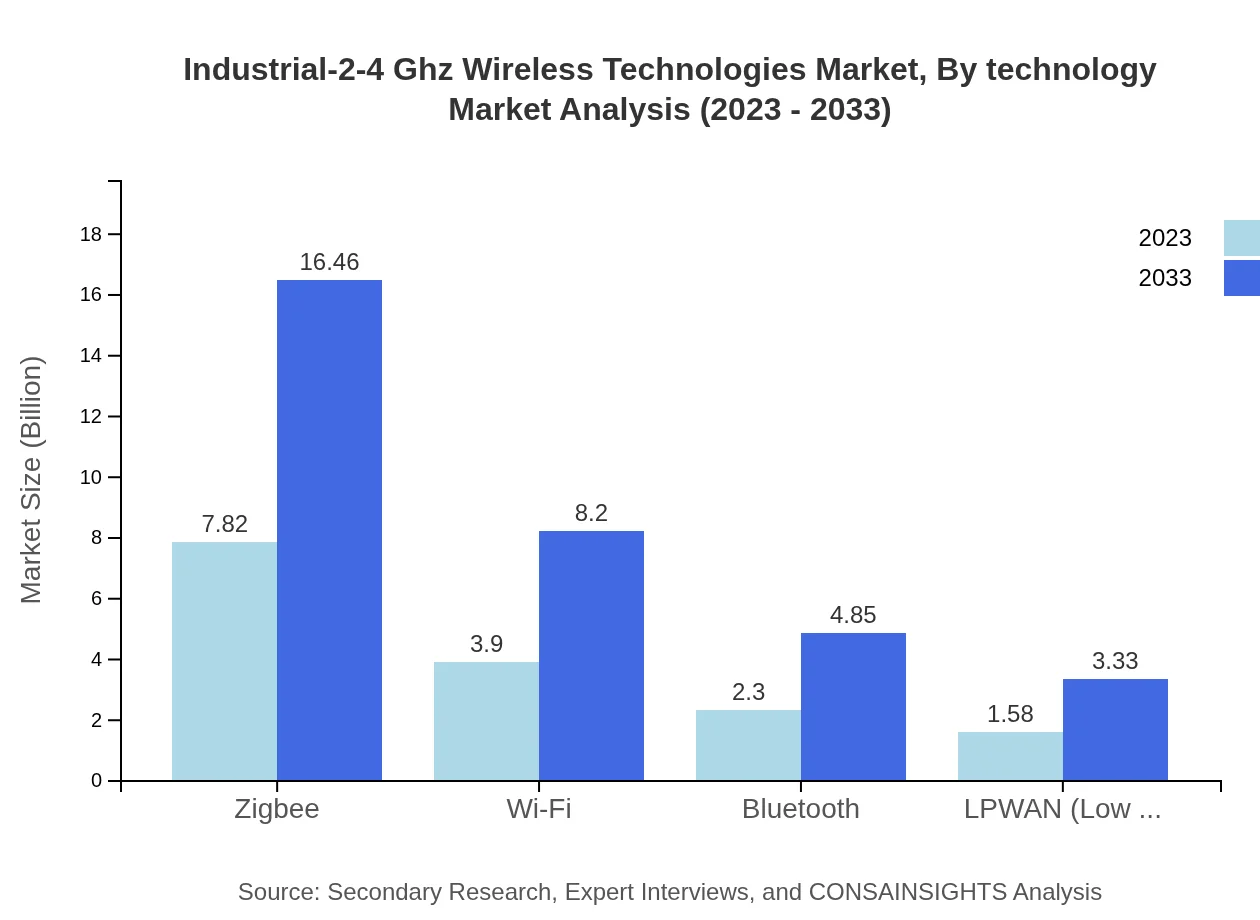

Industrial-2-4 Ghz Wireless Technologies Market Analysis By Technology

Technological innovations such as Low Power Wide Area Networks (LPWAN) and Zigbee technology are revolutionizing the market, providing enhanced connectivity solutions. Zigbee, for instance, retains a remarkable share of 50.12% in 2023, leading in wireless connectivity standards for industrial applications due to its energy efficiency and reliability.

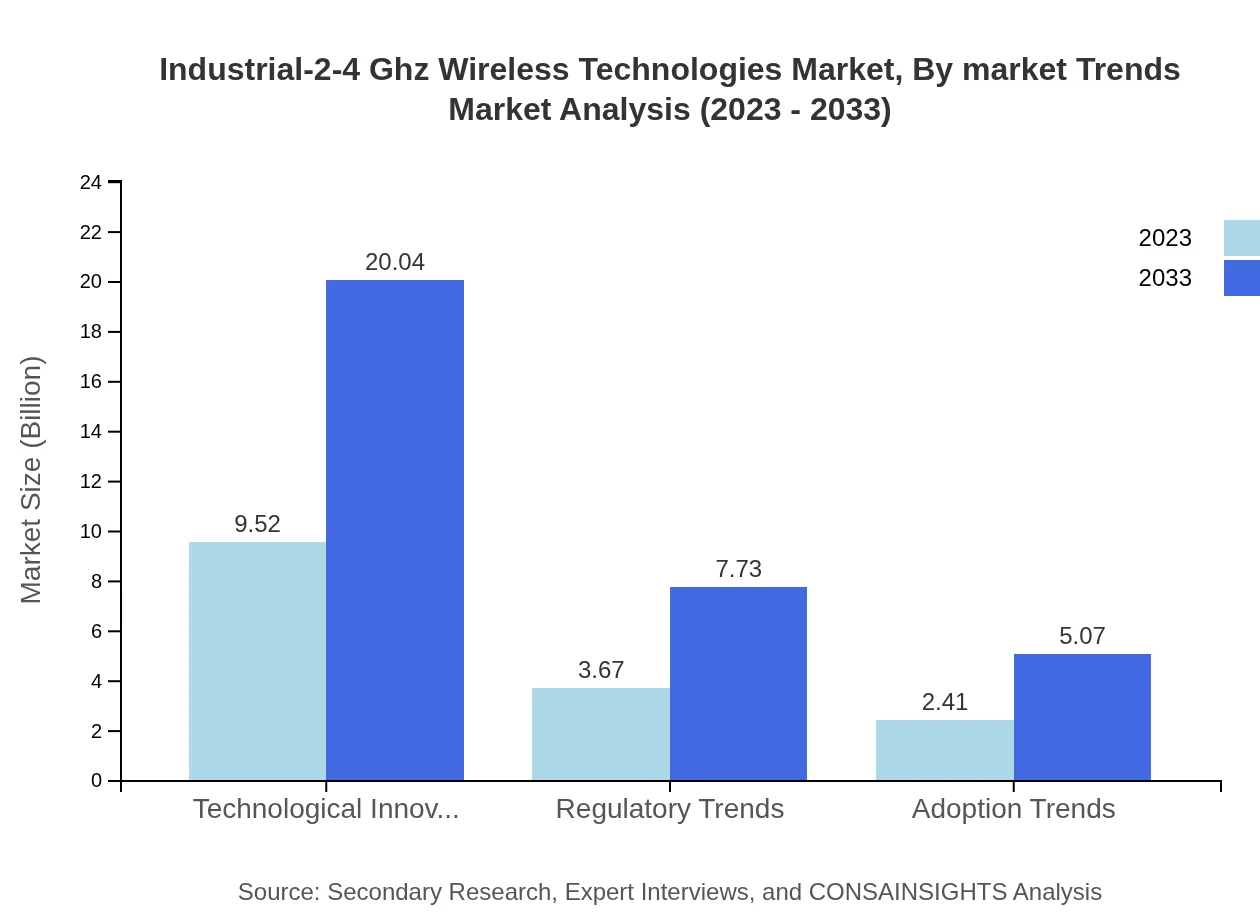

Industrial-2-4 Ghz Wireless Technologies Market Analysis By Market Trends

Market trends indicate a rising shift towards increased automation and smart technology integration, influencing the development of wireless connectivity solutions. Regulatory trends are also shaping innovations, urging industries towards adopting compliant technologies and fostering significant investments in infrastructure improvements necessary for modern applications.

Industrial-2-4 Ghz Wireless Technologies Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Industrial-2-4 Ghz Wireless Technologies Industry

Cisco Systems:

Cisco provides comprehensive networking solutions and is a leader in wireless technology innovations, focusing on IoT and smart manufacturing applications.Bluetooth SIG:

Bluetooth Special Interest Group (SIG) oversees development and compliance of Bluetooth technology, vital for short-range industrial communications and automation solutions.NXP Semiconductors:

NXP Semiconductors specializes in wireless technology solutions, including Zigbee and LPWAN, driving advancements in connected devices and smart city applications.Texas Instruments:

Texas Instruments is renowned for its semiconductor solutions that enable various wireless communication technologies, playing a pivotal role in smart industrial solutions.We're grateful to work with incredible clients.

FAQs

What is the market size of industrial-2-4 Ghz Wireless Technologies?

The industrial 2-4 GHz wireless technologies market is projected to reach approximately $15.6 billion by 2033, growing at a CAGR of 7.5% from its current size in 2023.

What are the key market players or companies in this industrial-2-4 Ghz Wireless Technologies industry?

Key players in the industrial 2-4 GHz wireless technologies market include major tech companies specializing in wireless communication technologies, IoT solutions, and manufacturing automation systems.

What are the primary factors driving the growth in the industrial-2-4 Ghz Wireless Technologies industry?

Growth drivers include increasing automation in industries, advances in IoT applications, demand for wireless connectivity, and the need for efficient energy management in industrial operations.

Which region is the fastest Growing in the industrial-2-4 Ghz Wireless Technologies?

North America is currently the fastest-growing region in the industrial 2-4 GHz wireless technologies market, with significant growth anticipated, increasing from $6.04 billion in 2023 to $12.72 billion by 2033.

Does ConsaInsights provide customized market report data for the industrial-2-4 Ghz Wireless Technologies industry?

Yes, ConsaInsights offers customized market reports that can be tailored to specific needs and focus areas within the industrial 2-4 GHz wireless technologies sector.

What deliverables can I expect from this industrial-2-4 Ghz Wireless Technologies market research project?

Deliverables include detailed market analyses, comprehensive segmentation reports, growth forecasts, competitive landscapes, and insights into emerging trends and regulatory impacts.

What are the market trends of industrial-2-4 Ghz Wireless Technologies?

Key trends include an increasing focus on smart manufacturing, a shift towards energy-efficient technologies, the integration of AI in wireless systems, and growing investments in infrastructure for industrial IoT applications.