Industrial Air Compressor Market Report

Published Date: 22 January 2026 | Report Code: industrial-air-compressor

Industrial Air Compressor Market Size, Share, Industry Trends and Forecast to 2033

This report presents an in-depth analysis of the Industrial Air Compressor market from 2023 to 2033, highlighting key market dynamics, trends, and forecasts, including technological advancements and regional insights.

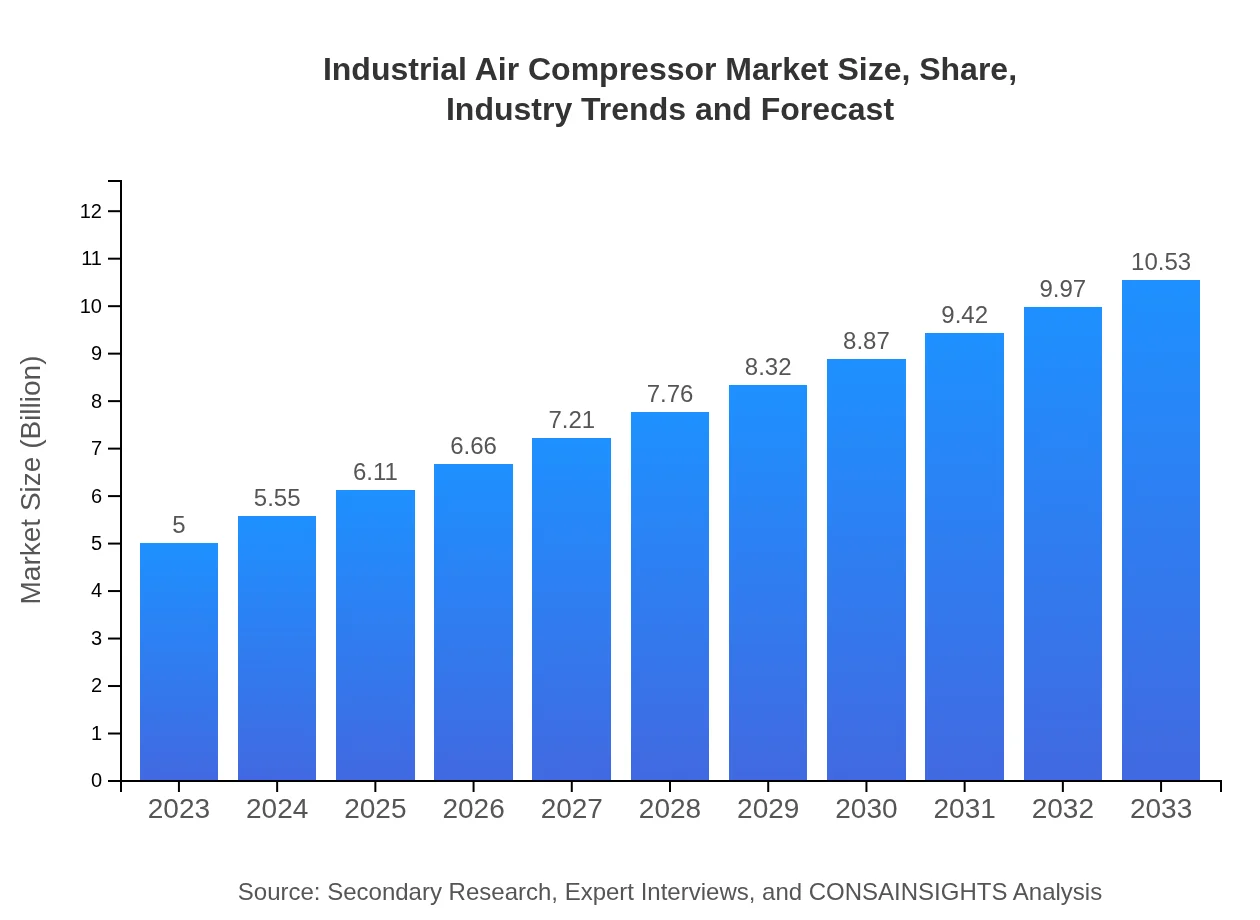

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.00 Billion |

| CAGR (2023-2033) | 7.5% |

| 2033 Market Size | $10.53 Billion |

| Top Companies | Atlas Copco, Ingersoll Rand, Kaeser Compressors, Hitachi Industrial Equipment Systems, Sullair |

| Last Modified Date | 22 January 2026 |

Industrial Air Compressor Market Overview

Customize Industrial Air Compressor Market Report market research report

- ✔ Get in-depth analysis of Industrial Air Compressor market size, growth, and forecasts.

- ✔ Understand Industrial Air Compressor's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Industrial Air Compressor

What is the Market Size & CAGR of the Industrial Air Compressor market in 2023 and 2033?

Industrial Air Compressor Industry Analysis

Industrial Air Compressor Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Industrial Air Compressor Market Analysis Report by Region

Europe Industrial Air Compressor Market Report:

Europe's Industrial Air Compressor market is projected to expand from $1.43 billion in 2023 to $3.02 billion by 2033. Increasing regulatory mandates concerning energy efficiency and environmental sustainability are driving the adoption of advanced compressor technologies. Germany, the UK, and France are leading markets due to their industrial base and technological advancements.Asia Pacific Industrial Air Compressor Market Report:

In the Asia Pacific region, the Industrial Air Compressor market is anticipated to grow from $1.09 billion in 2023 to $2.29 billion in 2033. Rapid industrialization and infrastructure development in countries like China and India are driving this growth. Furthermore, the increasing adoption of energy-efficient solutions and rising demand for automation in manufacturing processes is expected to bolster market dynamics in this region.North America Industrial Air Compressor Market Report:

The North American market is witnessing robust growth, with the market size anticipated to rise from $1.62 billion in 2023 to $3.42 billion in 2033. Development in the manufacturing sector and substantial investments in infrastructure projects are significant contributors. Moreover, the strong presence of key manufacturers in the region propels competition and innovation.South America Industrial Air Compressor Market Report:

The South American market for Industrial Air Compressors is projected to grow from $0.41 billion in 2023 to $0.87 billion by 2033. Key drivers include increasing investments in the construction and mining sectors. Additionally, the focus on optimizing energy consumption amid economic fluctuations will significantly influence market growth.Middle East & Africa Industrial Air Compressor Market Report:

In the Middle East and Africa, the market is expected to grow from $0.44 billion in 2023 to $0.93 billion by 2033. Oil and gas, construction, and manufacturing sectors are significant influences, with heightened investment in infrastructure and energy development aiding market progression.Tell us your focus area and get a customized research report.

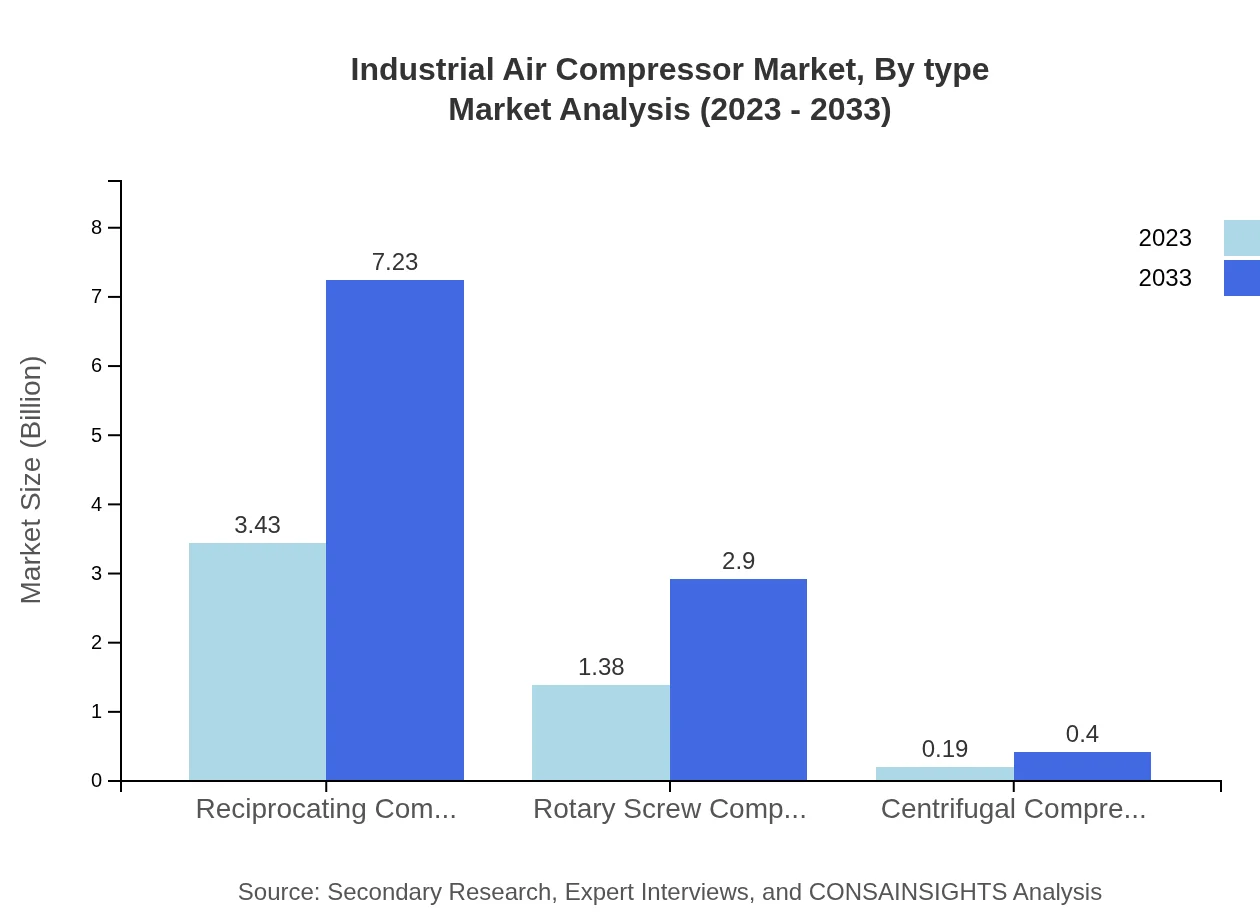

Industrial Air Compressor Market Analysis By Type

The market analysis by type reveals that reciprocating compressors dominate the market, with a value of $3.43 billion in 2023, expected to rise to $7.23 billion by 2033. They hold a consistent market share of 68.66%. Rotary screw compressors follow closely, with sales moving from $1.38 billion to $2.90 billion in the same timeframe, holding a 27.58% share. Centrifugal compressors, although smaller at $0.19 billion growing to $0.40 billion, represent specialized applications. Overall, reciprocating compressors continue to be favored due to their efficiency and versatility.

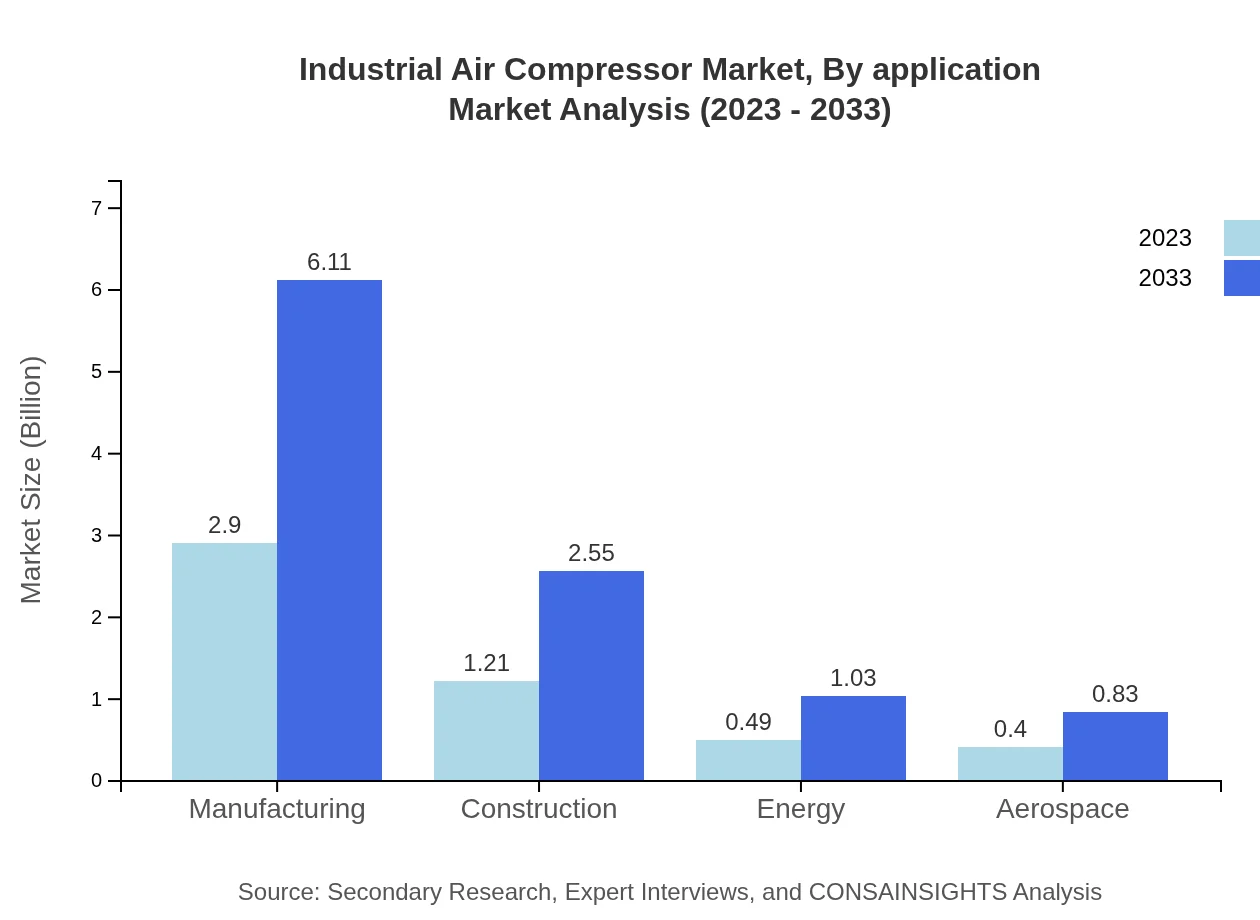

Industrial Air Compressor Market Analysis By Application

The application segment highlights that manufacturing leads with $2.90 billion in 2023 and is projected to grow to $6.11 billion by 2033. Accounting for 58.09% of the market, the manufacturing sector relies heavily on compressed air for various processes. Construction follows, expanding from $1.21 billion to $2.55 billion, holding a 24.25% share. The energy sector also showcases growth potential, increasing from $0.49 billion to $1.03 billion, indicating its critical role in energy generation and management.

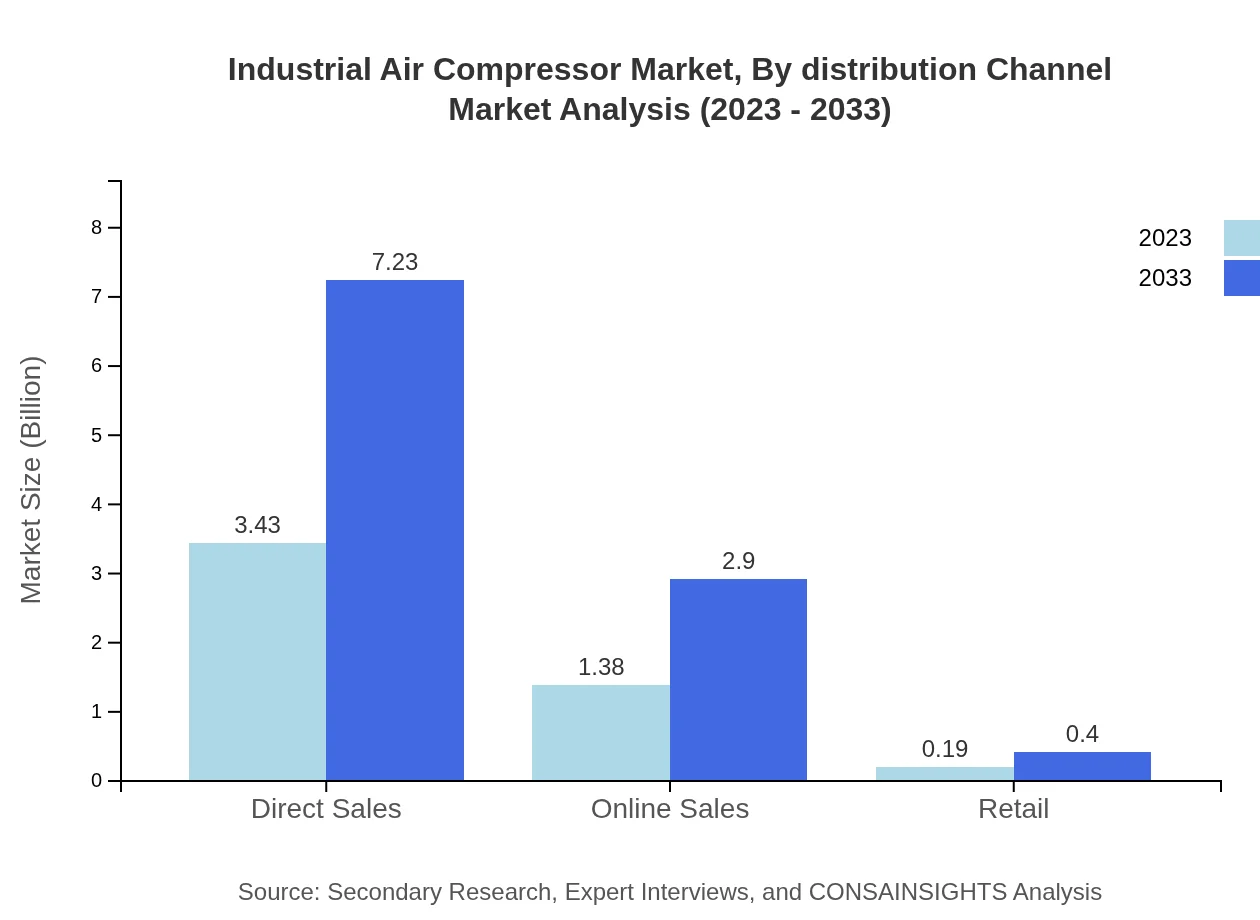

Industrial Air Compressor Market Analysis By Distribution Channel

Direct sales dominate distribution with a size of $3.43 billion in 2023, expected to reach $7.23 billion by 2033, maintaining a 68.66% share. Online sales are also growing, projected to go from $1.38 billion to $2.90 billion, marking a 27.58% share as e-commerce becomes a key avenue for efficiency in purchasing. Retail presence, although smaller at $0.19 billion to $0.40 billion, captures niche markets and regional dynamics.

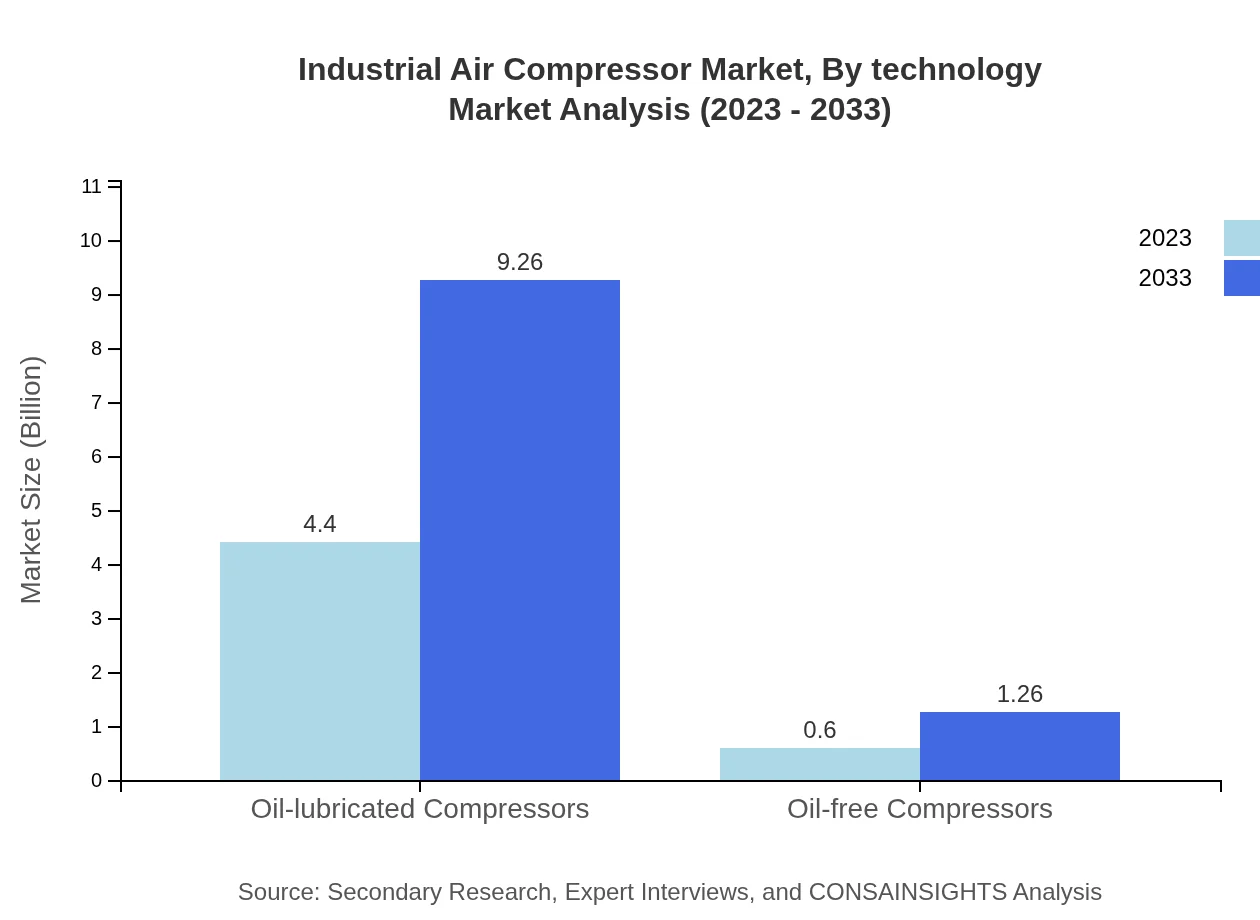

Industrial Air Compressor Market Analysis By Technology

Technological innovation drives the Industrial Air Compressor market, with advancements in oil-free and energy-efficient compressor technologies. The increasing focus on reducing lifecycle costs and environmental impact results in a shift towards sustainable technologies like oil-free compressors, whose market is expanding from $0.60 billion in 2023 to $1.26 billion by 2033, thereby attracting various industrial sectors aiming for reduced operational costs.

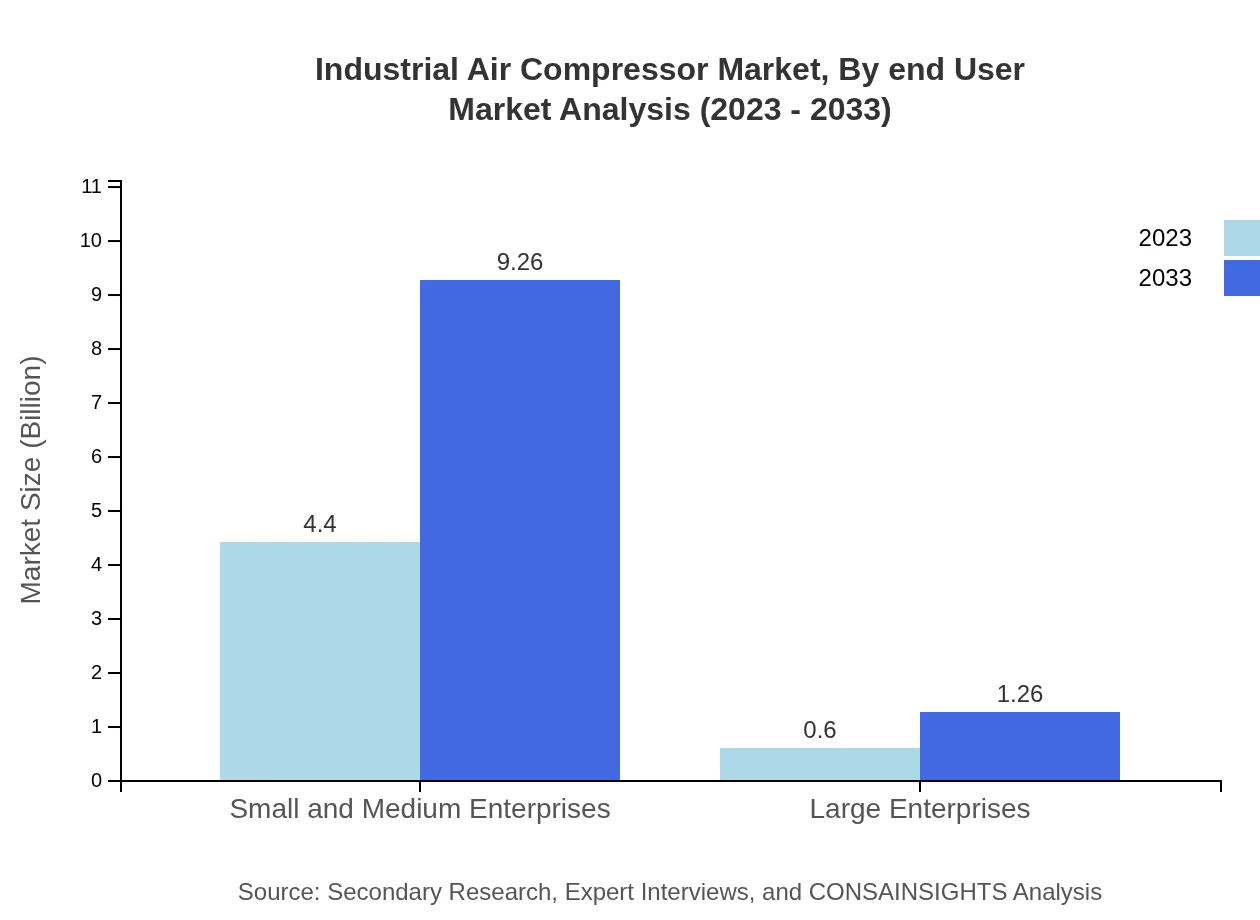

Industrial Air Compressor Market Analysis By End User

The end-user segment underscores the prominence of small and medium enterprises (SMEs), which hold an 87.99% market share, reflecting their reliance on affordable and versatile air compressor solutions. The market size for SMEs will grow from $4.40 billion to $9.26 billion by 2033. In contrast, large enterprises, while accounting for a smaller share at 12.01%, are growing steadily from $0.60 billion to $1.26 billion, indicating rising investments in advanced technologies.

Industrial Air Compressor Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in the Industrial Air Compressor Industry

Atlas Copco:

A leading manufacturer of industrial air compressors, known for its innovative technology and focus on sustainability, providing energy-efficient products for various applications.Ingersoll Rand:

Renowned for its high-performance air compressor solutions, Ingersoll Rand focuses on reducing operational costs and enhancing efficiency for their customers.Kaeser Compressors:

Specializes in providing premium air compressor systems and is recognized for its advancements in compressed air management and distribution technologies.Hitachi Industrial Equipment Systems:

Hitachi offers a wide range of air compressors along with integrated solutions, focusing on smart technologies and energy efficiency.Sullair:

A manufacturer that has established a strong reputation in the portable and stationary air compressor markets, known for reliability and innovative engineering.We're grateful to work with incredible clients.

FAQs

What is the market size of industrial Air Compressor?

The global industrial air compressor market is valued at approximately $5 billion in 2023, with an expected growth at a CAGR of 7.5%, reaching significant market size as industries increasingly rely on efficient air compression technologies by 2033.

What are the key market players or companies in this industrial Air Compressor industry?

Key players in the industrial air compressor market include Atlas Copco, Ingersoll Rand, and Kaeser Compressors. These companies significantly contribute to technological advancements, producing high-efficiency compressors widely used in various sectors.

What are the primary factors driving the growth in the industrial Air Compressor industry?

Growth in the industrial air compressor industry is primarily driven by increasing demand for energy-efficient equipment, the expansion of manufacturing processes, and advancements in technology that enhance compressor efficiency and reduce operational costs.

Which region is the fastest Growing in the industrial Air Compressor?

The Asia Pacific region is the fastest-growing market for industrial air compressors, projected to grow from $1.09 billion in 2023 to $2.29 billion by 2033, driven by rapid industrialization and increasing demand for energy in manufacturing.

Does ConsaInsights provide customized market report data for the industrial Air Compressor industry?

Yes, ConsaInsights offers customized market report data tailored to the industrial air compressor industry, providing specific insights and analyses that align with your business needs and strategic objectives.

What deliverables can I expect from this industrial Air Compressor market research project?

Deliverables from the industrial air compressor market research project include comprehensive market analysis reports, regional data insights, competitive landscape analysis, and segmented market forecasts that inform strategic decision-making.

What are the market trends of industrial Air Compressor?

Current market trends include the rise of energy-efficient compressors, the increasing adoption of smart technologies for monitoring performance, and a shift towards oil-free compressors to comply with stricter environmental regulations.