Industrial Automation Oil And Gas Market Report

Published Date: 22 January 2026 | Report Code: industrial-automation-oil-and-gas

Industrial Automation Oil And Gas Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Industrial Automation Oil and Gas market, focusing on market dynamics, trends, forecasts, and segmentation from 2023 to 2033. Key insights into regional performances and technological advancements are also highlighted.

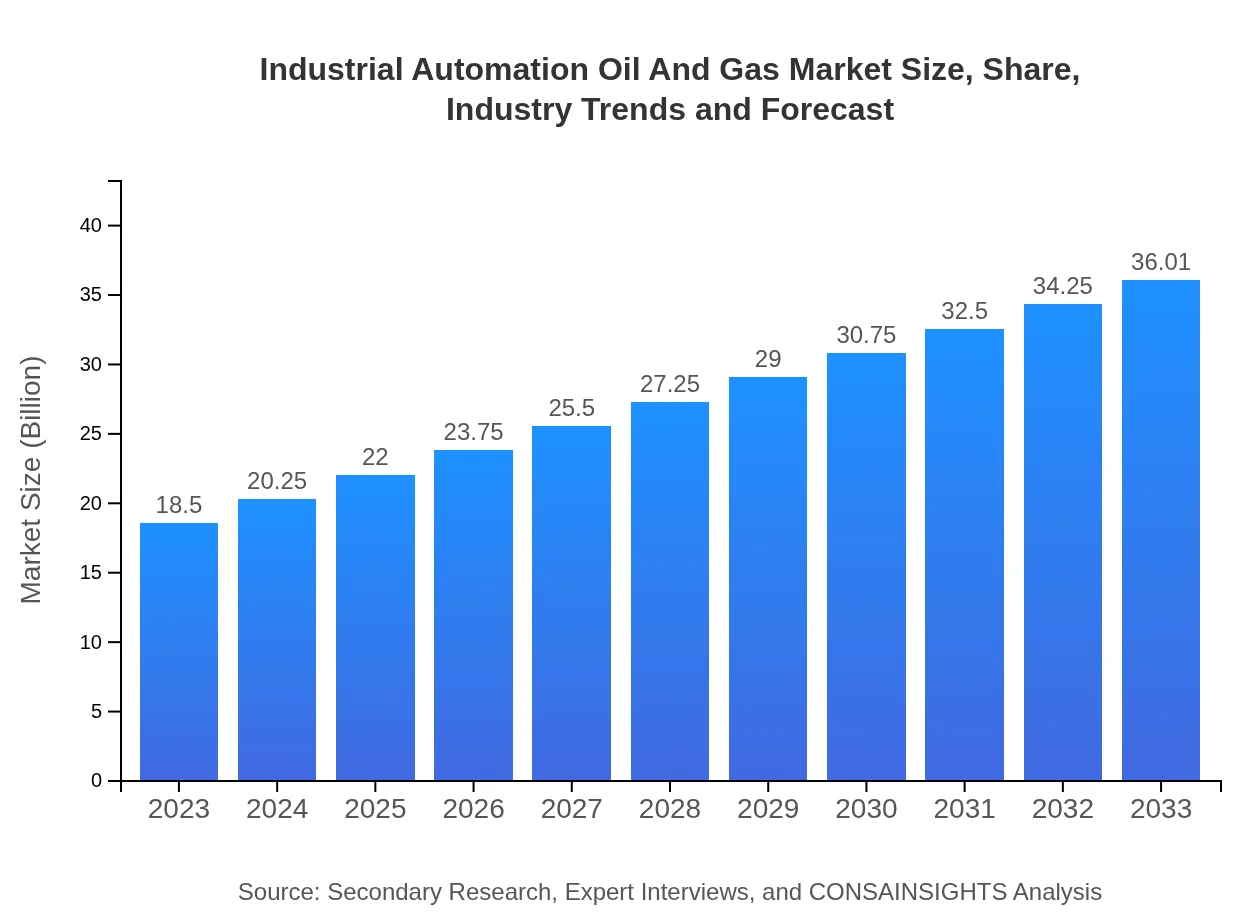

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $18.50 Billion |

| CAGR (2023-2033) | 6.7% |

| 2033 Market Size | $36.01 Billion |

| Top Companies | Schneider Electric, Siemens AG, Honeywell International Inc., Emerson Electric Co., Rockwell Automation |

| Last Modified Date | 22 January 2026 |

Industrial Automation Oil And Gas Market Overview

Customize Industrial Automation Oil And Gas Market Report market research report

- ✔ Get in-depth analysis of Industrial Automation Oil And Gas market size, growth, and forecasts.

- ✔ Understand Industrial Automation Oil And Gas's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Industrial Automation Oil And Gas

What is the Market Size & CAGR of Industrial Automation Oil And Gas market in 2023?

Industrial Automation Oil And Gas Industry Analysis

Industrial Automation Oil And Gas Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Industrial Automation Oil And Gas Market Analysis Report by Region

Europe Industrial Automation Oil And Gas Market Report:

Europe is also a significant market, with a value of 5.36 billion USD in 2023, projected to nearly double to 10.44 billion USD by 2033. Continuous regulatory pressures regarding environmental compliance and a strong inclination towards sustainability are driving innovations and investments in this region.Asia Pacific Industrial Automation Oil And Gas Market Report:

In the Asia Pacific region, the Industrial Automation Oil and Gas market was valued at 3.79 billion USD in 2023 and is expected to reach 7.38 billion USD by 2033, with an impressive CAGR of 6.85%. Rapid industrialization and increasing investments in energy infrastructure drive this growth, positioning Asia Pacific as a critical player in the global market.North America Industrial Automation Oil And Gas Market Report:

North America leads the market, with a valuation of 6.20 billion USD in 2023 and expected to grow to 12.07 billion USD by 2033, marking a CAGR of 6.73%. The region’s focus on energy efficiency and digital integration is significantly impacting operational capabilities, with substantial investments from major oil and gas companies in automation technologies.South America Industrial Automation Oil And Gas Market Report:

The South American market held a value of 0.56 billion USD in 2023, projected to grow to 1.09 billion USD by 2033. This growth at a CAGR of 6.85% is largely facilitated by innovations in exploration and production techniques, fueled by increasing collaboration between local operators and global technology providers.Middle East & Africa Industrial Automation Oil And Gas Market Report:

The Middle East and Africa market, valued at 2.58 billion USD in 2023, is expected to reach 5.03 billion USD by 2033, growing at a CAGR of 6.84%. Key factors include ongoing oil exploration projects and government initiatives focused on enhancing operational efficiencies through automation technologies.Tell us your focus area and get a customized research report.

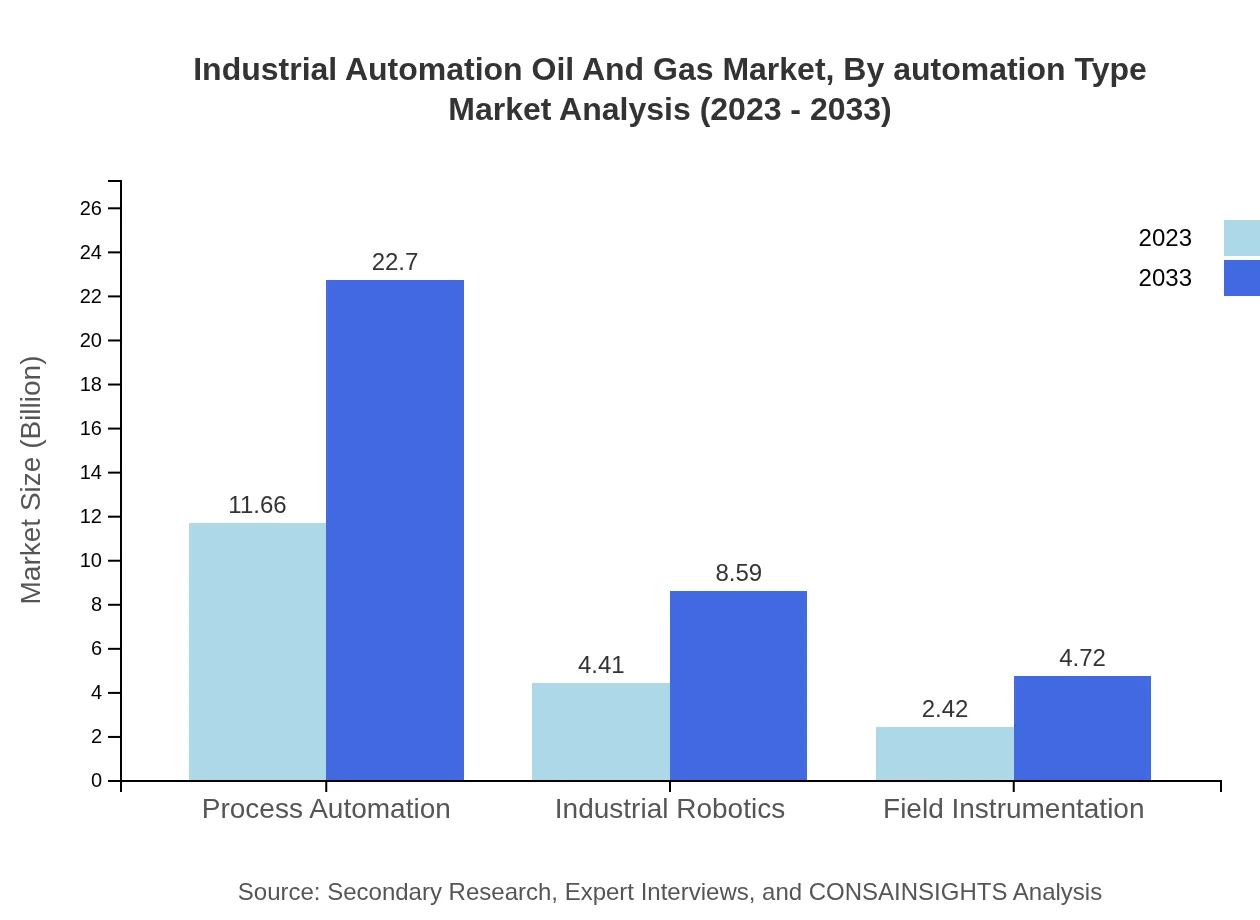

Industrial Automation Oil And Gas Market Analysis By Automation Type

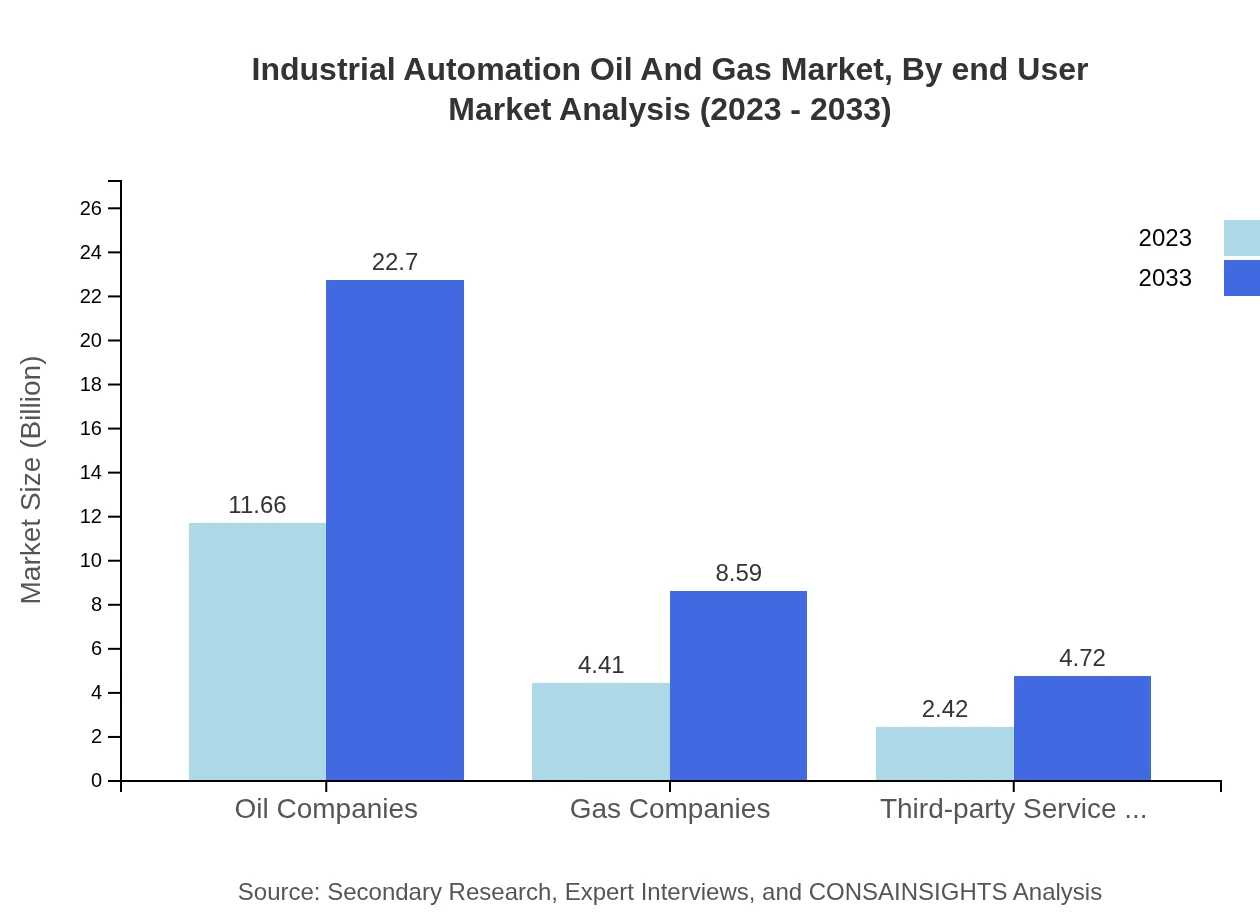

The market is predominantly driven by Oil Companies, valued at 11.66 billion USD in 2023, forecasted to grow to 22.70 billion USD by 2033. Gas Companies represent a significant share, starting at 4.41 billion USD in 2023 and reaching 8.59 billion USD by 2033. Third-party service providers are crucial for maintaining market balance, with a market share of 2.42 billion USD expected to expand to 4.72 billion USD over the forecast period.

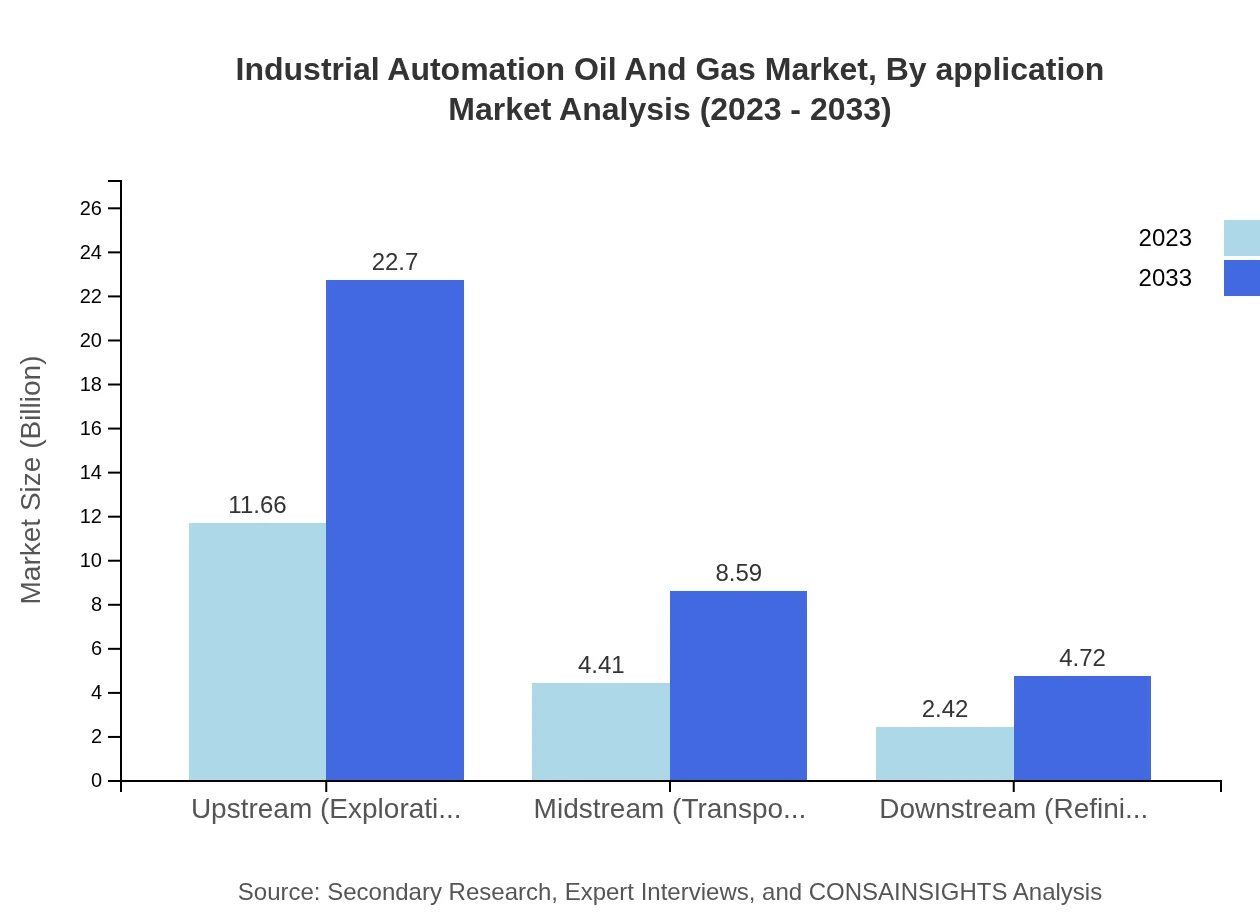

Industrial Automation Oil And Gas Market Analysis By Application

In terms of application segments, Upstream activities account for the majority, valued at 11.66 billion USD in 2023 with a growth trajectory leading to 22.70 billion USD by 2033. Midstream processes show strong stability, projected to move from 4.41 billion USD to 8.59 billion USD. Meanwhile, Downstream applications are anticipated to grow steadily from 2.42 billion USD to 4.72 billion USD, emphasizing efficiency and compliance with emerging industry standards.

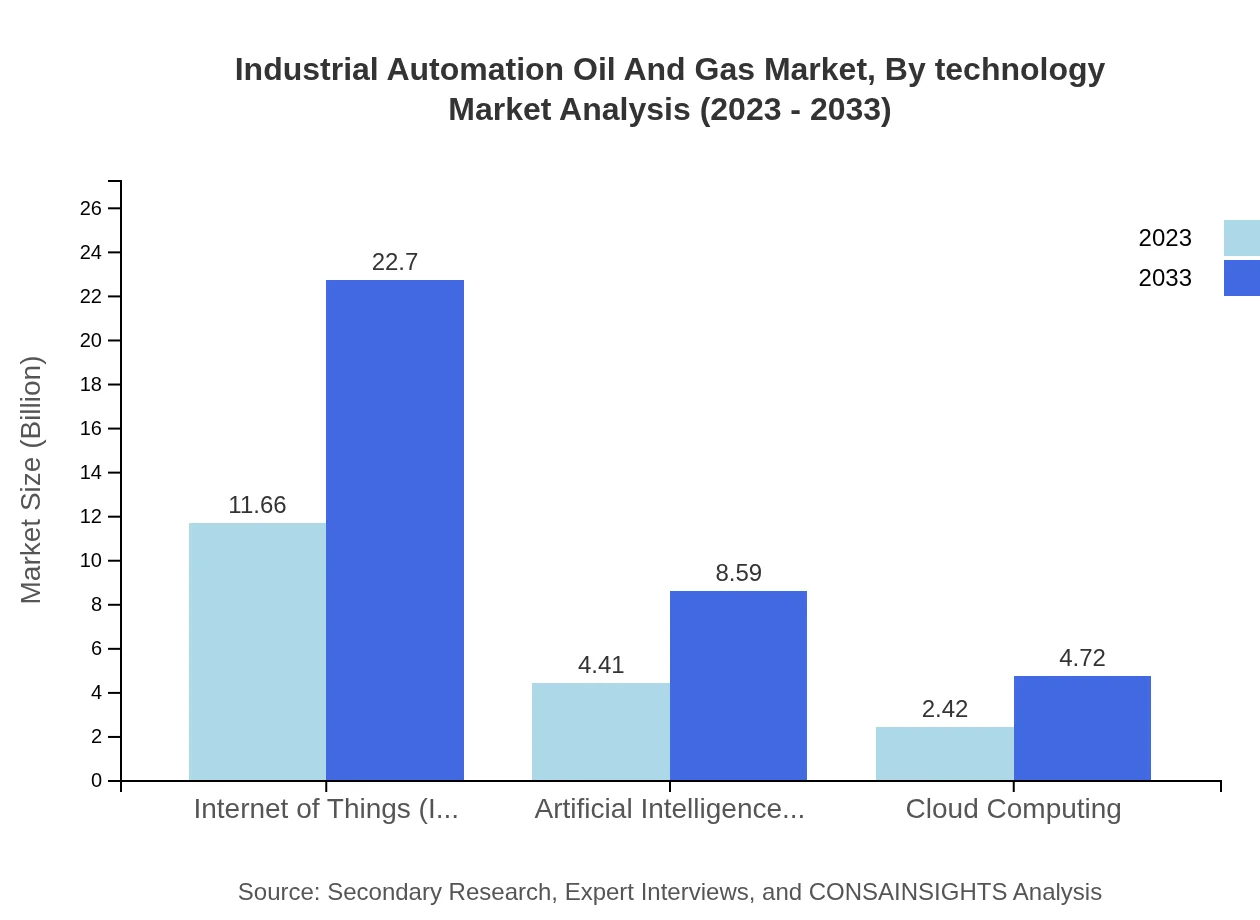

Industrial Automation Oil And Gas Market Analysis By Technology

Market technology trends are driven by IoT, with growth from 11.66 billion USD in 2023 to 22.70 billion USD by 2033. Similarly, Artificial Intelligence and Machine Learning applications are witnessing significant uptake, with projected values from 4.41 billion USD to 8.59 billion USD. Moreover, Cloud Computing technologies are vital to the sector, expanding from 2.42 billion USD to 4.72 billion USD due to their role in enhancing operational capabilities.

Industrial Automation Oil And Gas Market Analysis By End User

Oil and Gas companies represent the largest share, driving high demand within the market. The projected sizes for Oil Companies are estimated to grow significantly, reflecting a stable market environment. The influence of large-scale oil extraction operations highlights the necessity for robust automation processes to enhance productivity and operational reliability across the board.

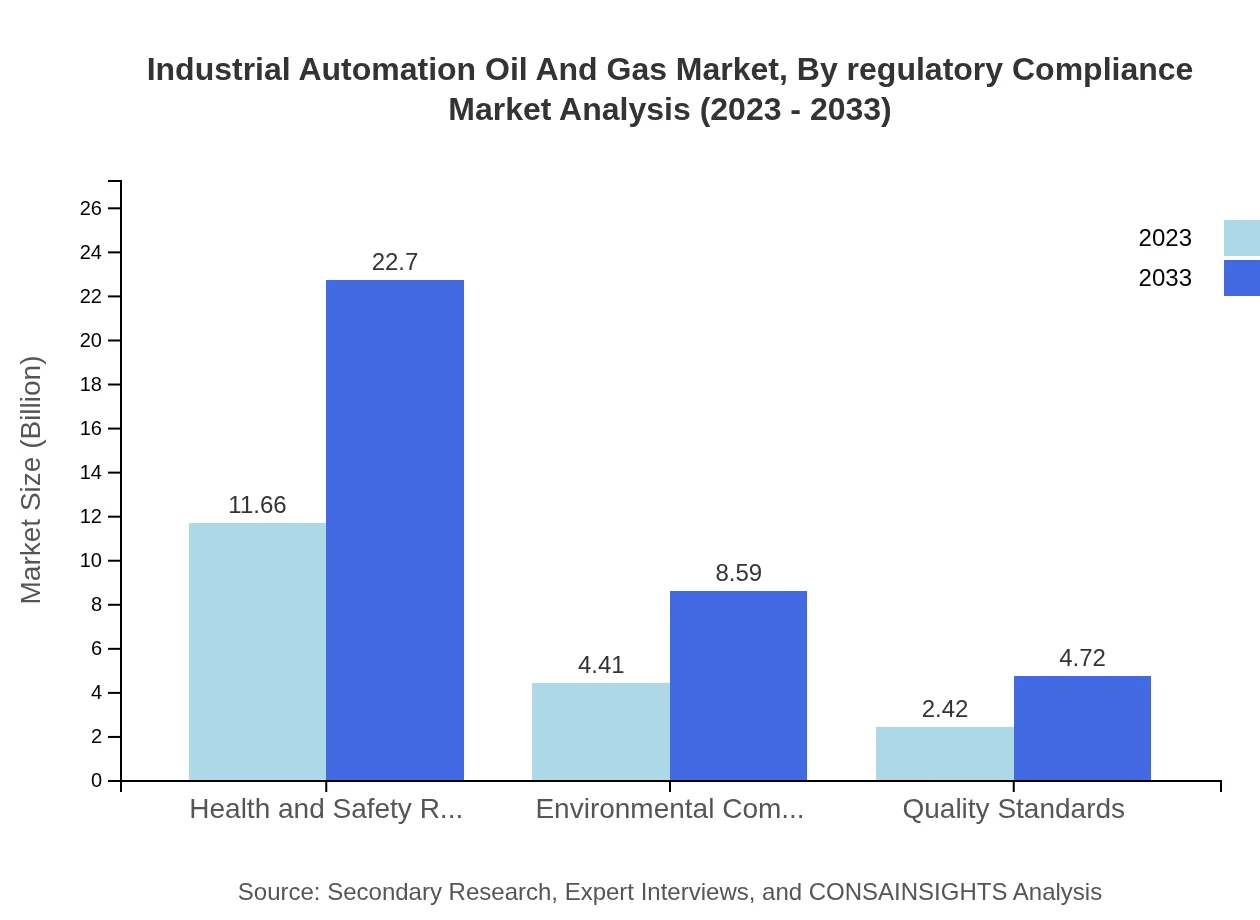

Industrial Automation Oil And Gas Market Analysis By Regulatory Compliance

Compliance with health and safety regulations is paramount, representing a substantial market segment valued at 11.66 billion USD in 2023, growing to 22.70 billion USD by 2033. Environmental compliance also plays an essential role, from 4.41 billion USD in 2023 to 8.59 billion USD in 2033, driven by stricter global regulations necessitating advanced automation technologies.

Industrial Automation Oil And Gas Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Industrial Automation Oil And Gas Industry

Schneider Electric:

A global specialist in energy management and automation, Schneider Electric provides innovative solutions aimed at maximizing operational efficiency while ensuring environmental stewardship in the oil and gas sector.Siemens AG:

Siemens AG stands as a key player in the industrial automation market, offering a plethora of products and solutions that facilitate efficient production and operational excellence across various applications in oil and gas.Honeywell International Inc.:

Honeywell leads in providing advanced automation solutions that improve operational safety and efficiency within the oil and gas sector, ensuring compliance with increasing regulatory standards.Emerson Electric Co.:

Emerson focuses on helping businesses in the oil and gas industry improve performance through automation and technology, specifically offering solutions that enhance efficiency and reliability in production and processing.Rockwell Automation:

Renowned for its control systems and software, Rockwell Automation specializes in delivering automation solutions that enhance productivity and safety in oil and gas operations around the globe.We're grateful to work with incredible clients.

FAQs

What is the market size of industrial automation in the oil and gas sector?

The global Industrial Automation Oil and Gas market is projected to reach approximately 18.5 billion in 2023 with a CAGR of 6.7% extending towards 2033.

What are the key market players or companies in this industrial automation oil and gas industry?

Key players in the Industrial Automation Oil and Gas market include major oil and gas companies, technology providers, and automation system integrators driving innovation and competitive strategies in this landscape.

What are the primary factors driving the growth in the industrial automation oil and gas industry?

Growth drivers in this industry include the need for operational efficiency, regulatory compliance, advancements in technology such as IoT, AI, and machine learning, and the rising demand for optimized resource management.

Which region is the fastest Growing in the industrial automation oil and gas sector?

The fastest-growing region is projected to be North America, expanding from 6.20 billion in 2023 to 12.07 billion by 2033, showcasing significant growth in industrial automation solutions.

Does ConsaInsights provide customized market report data for the industrial automation oil and gas industry?

Yes, ConsaInsights specializes in providing customized market reports tailored to specific needs and requirements in the industrial automation oil and gas sector.

What deliverables can I expect from this industrial automation oil and gas market research project?

Deliverables include detailed market analysis, competitive landscape, regional insights, segment data, trends, forecasts, and actionable recommendations for strategic planning.

What are the market trends of industrial automation in the oil and gas sector?

Current trends include increasing integration of AI and IoT technologies, emphasis on process automation, sustainability pressures, and enhancements to safety and health regulations in oil and gas operations.