Industrial Automation Software Market Report

Published Date: 22 January 2026 | Report Code: industrial-automation-software

Industrial Automation Software Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Industrial Automation Software market, covering key insights, market size, and forecasts from 2023 to 2033. It includes segmentation, regional analysis, industry trends, and challenges impacting growth.

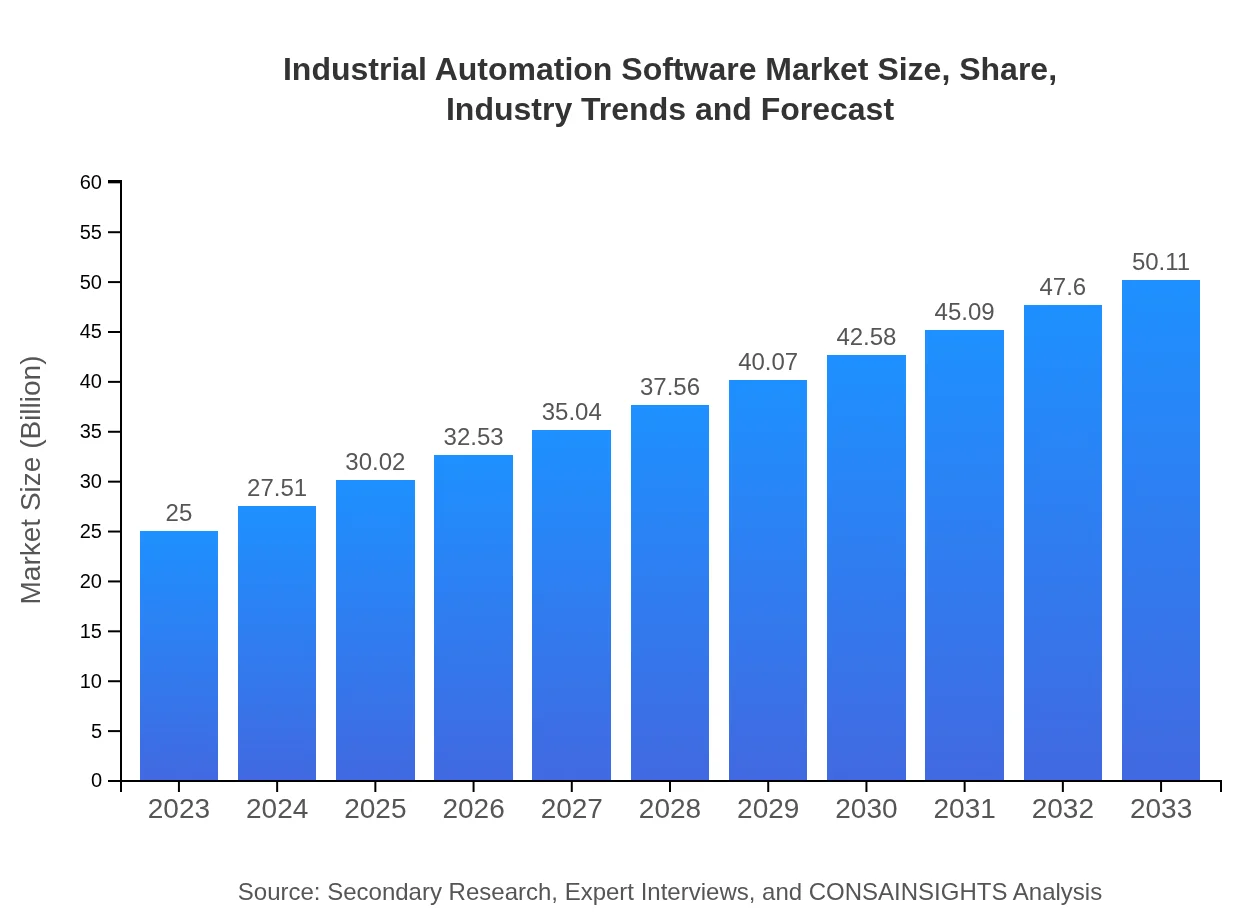

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $25.00 Billion |

| CAGR (2023-2033) | 7% |

| 2033 Market Size | $50.11 Billion |

| Top Companies | Siemens AG, Rockwell Automation, Schneider Electric, Honeywell International Inc. |

| Last Modified Date | 22 January 2026 |

Industrial Automation Software Market Overview

Customize Industrial Automation Software Market Report market research report

- ✔ Get in-depth analysis of Industrial Automation Software market size, growth, and forecasts.

- ✔ Understand Industrial Automation Software's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Industrial Automation Software

What is the Market Size & CAGR of Industrial Automation Software market in 2023?

Industrial Automation Software Industry Analysis

Industrial Automation Software Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Industrial Automation Software Market Analysis Report by Region

Europe Industrial Automation Software Market Report:

Europe’s market is valued at $7.07 billion in 2023, with projections of $14.17 billion by 2033. Major markets like Germany, France, and the UK are advancing automation in manufacturing, particularly with the rise of Industry 4.0 initiatives.Asia Pacific Industrial Automation Software Market Report:

The Asia Pacific region holds a significant share in the Industrial Automation Software market, valued at $4.68 billion in 2023, expected to reach $9.38 billion by 2033. Countries like China and India are driving this growth due to rapid industrialization and government initiatives promoting smart manufacturing.North America Industrial Automation Software Market Report:

North America leads the market with a size of $9.56 billion in 2023, projected to grow to $19.16 billion by 2033. The United States and Canada are at the forefront of adopting automation solutions, supported by a well-established industrial base and technological advancements.South America Industrial Automation Software Market Report:

In South America, the market size is currently $1.49 billion and is anticipated to grow to $2.99 billion by 2033. The region's growth is fueled by increasing investments in automation technologies across industries like oil and gas and manufacturing.Middle East & Africa Industrial Automation Software Market Report:

The Middle East and Africa region has a market size of $2.21 billion in 2023, with a forecast of $4.42 billion by 2033. The growth is primarily driven by investments in oil and gas sectors and the push for modernization in various industries.Tell us your focus area and get a customized research report.

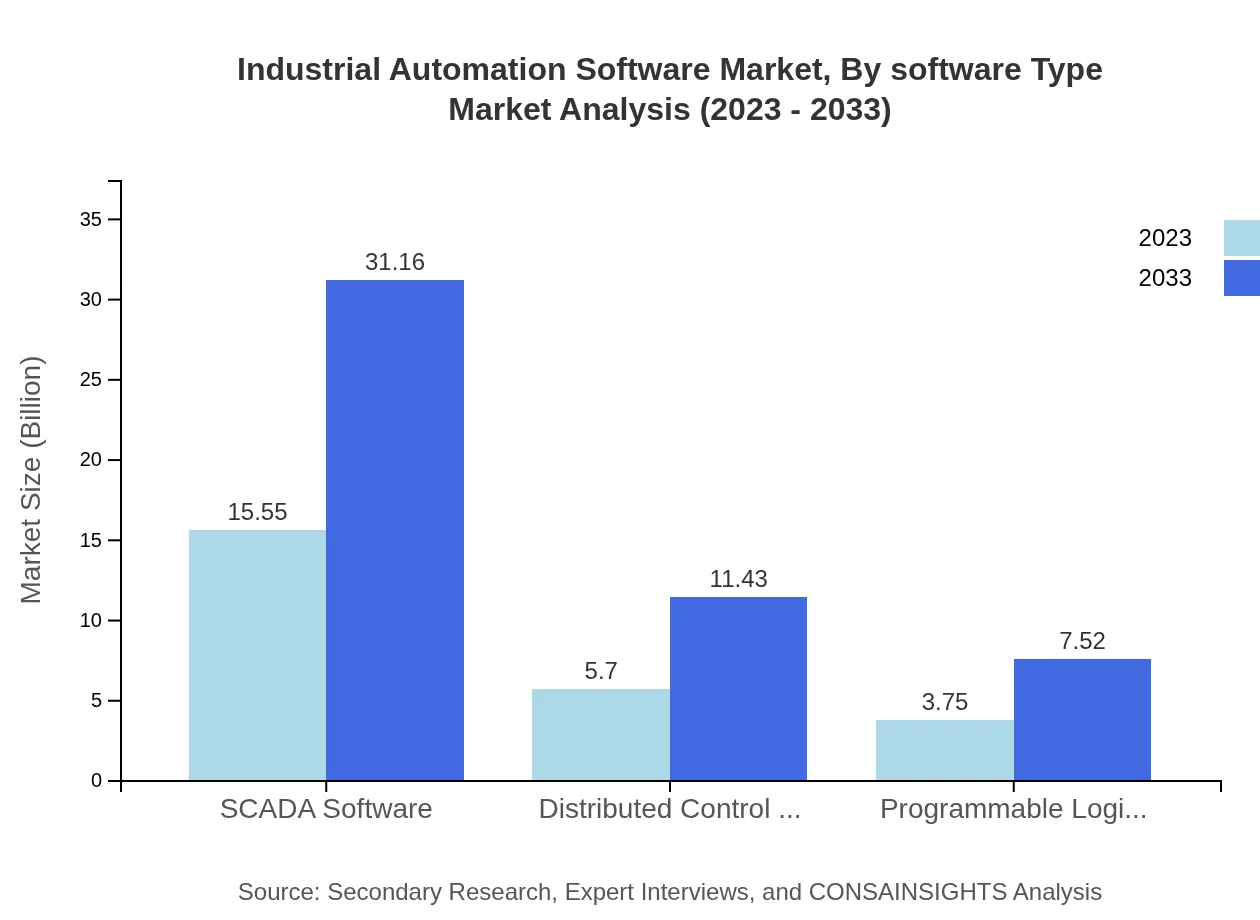

Industrial Automation Software Market Analysis By Software Type

In 2023, the SCADA software segment dominates the market with a size of $15.55 billion, accounting for 62.19% share. It is expected to reach $31.16 billion by 2033. The DCS segment follows, valued at $5.70 billion and growing to $11.43 billion, holding a 22.81% share. Important also are the PLC systems, valued at $3.75 billion, reflecting a 15% market share in 2023.

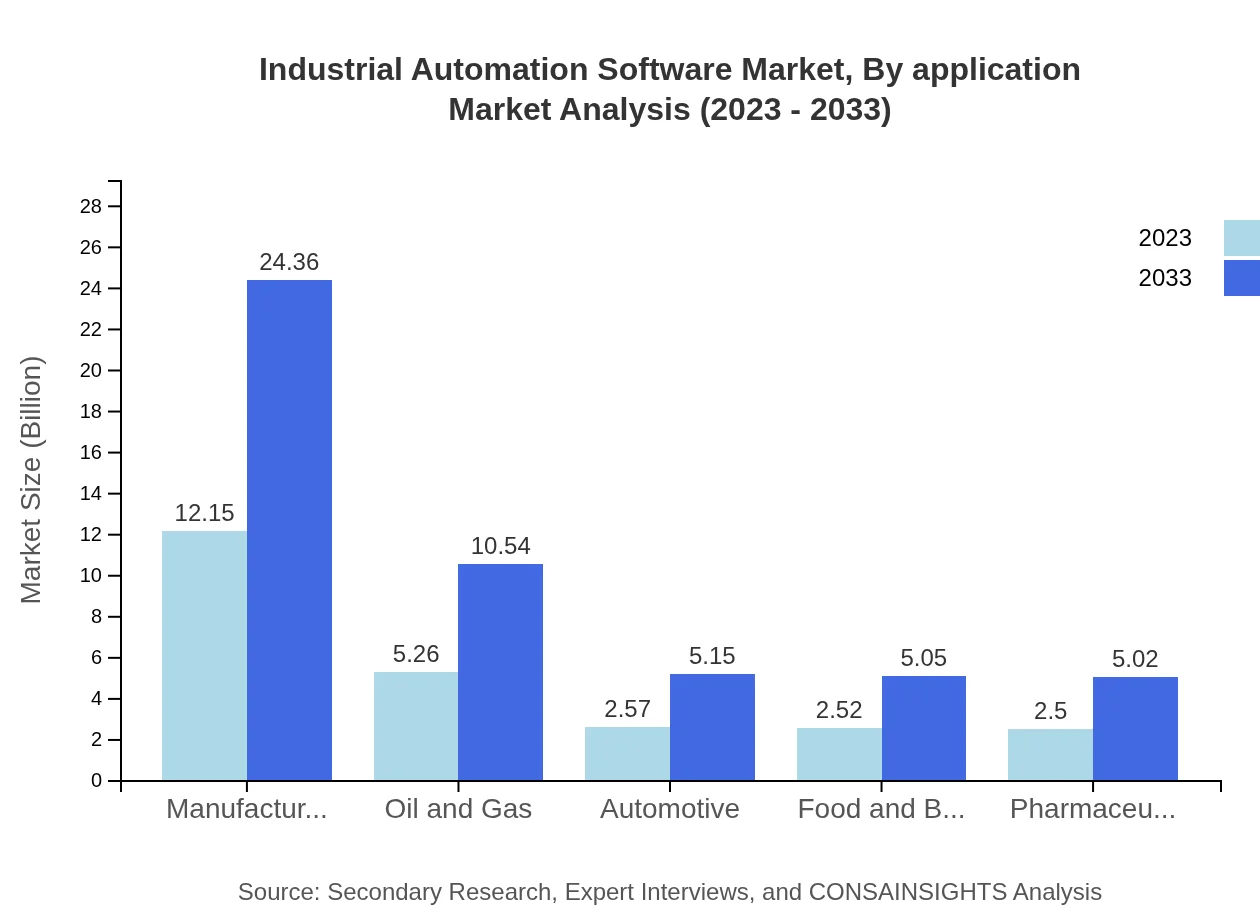

Industrial Automation Software Market Analysis By Application

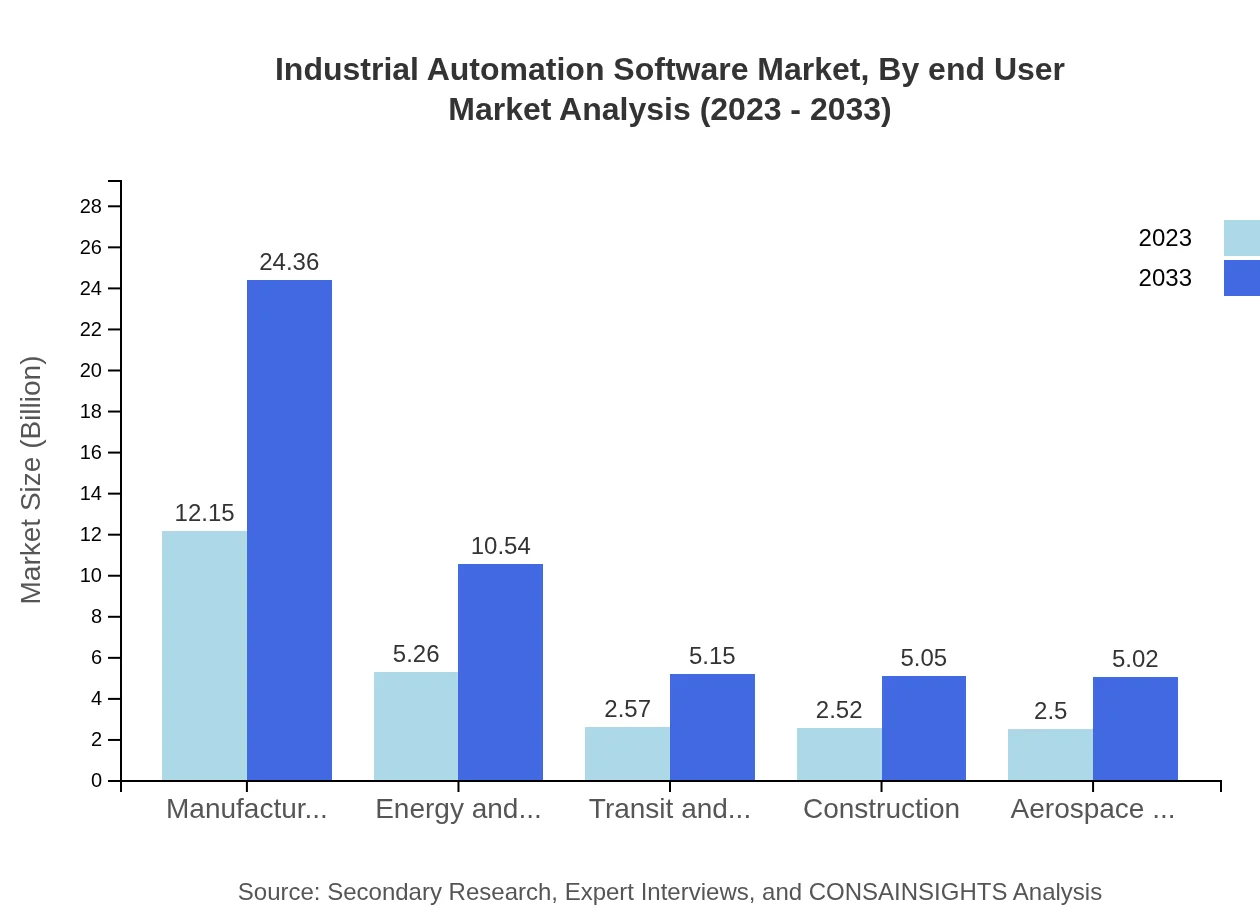

In the manufacturing sector, the automation software market is projected to grow from $12.15 billion in 2023 to $24.36 billion by 2033, capturing a significant market share of 48.62%. The energy and utilities sector holds a size of $5.26 billion, with expectations to double to $10.54 billion, maintaining a 21.03% share.

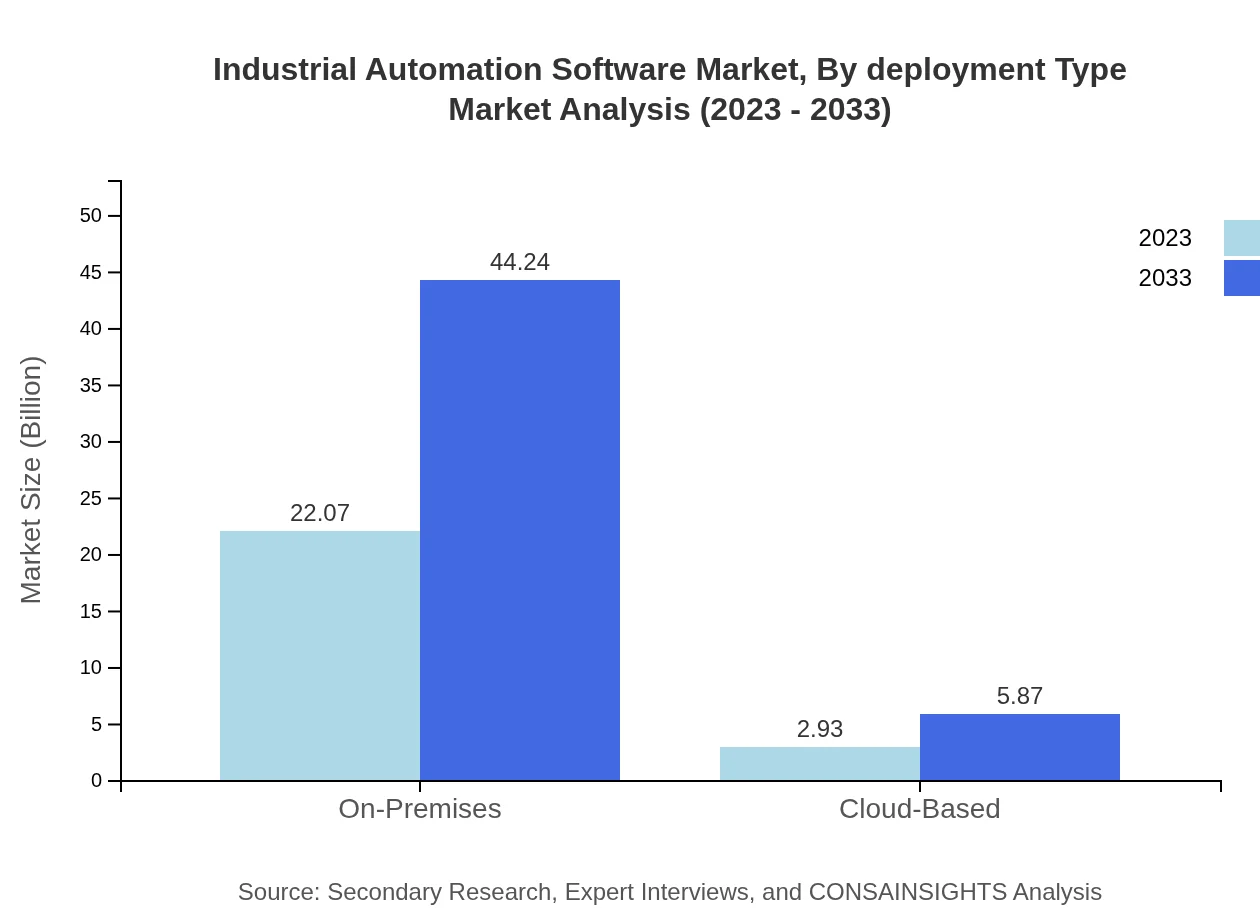

Industrial Automation Software Market Analysis By Deployment Type

The on-premises deployment type leads the market with a size of $22.07 billion in 2023, anticipated to grow to $44.24 billion by 2033, showing a robust share of 88.29%. In contrast, cloud-based deployments represent a smaller yet growing segment at $2.93 billion, with projections to reach $5.87 billion, accounting for 11.71% in the same period.

Industrial Automation Software Market Analysis By End User

The automotive sector contributes significantly to the market, with a size of $2.57 billion in 2023, anticipated to reach $5.15 billion by 2033. Similarly, the pharmaceuticals and food and beverage industries reflect growth trends, with projected sizes of $5.02 billion and $5.05 billion respectively by 2033.

Industrial Automation Software Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Industrial Automation Software Industry

Siemens AG:

Siemens AG is a global leader in automation and digitization, providing a wide range of software solutions for industrial applications, including their renowned Tecnomatix and Simatic software.Rockwell Automation:

Rockwell Automation specializes in industrial automation and information technology, known for their FactoryTalk and Allen-Bradley product lines that enhance operational efficiency.Schneider Electric:

Schneider Electric offers a comprehensive portfolio of automation solutions that integrate IoT capabilities, driving efficiency in energy management and sustainable solutions.Honeywell International Inc.:

Honeywell provides automation and control solutions, focusing on process industries with offerings that include advanced process control and field equipment.We're grateful to work with incredible clients.

FAQs

What is the market size of industrial Automation Software?

The global industrial automation software market is valued at approximately $25 billion in 2023, with a compound annual growth rate (CAGR) of 7%. This growth signifies a robust demand for innovative automation technologies across various industries.

What are the key market players or companies in the industrial Automation Software industry?

Key players in the industrial automation software market include Siemens, Rockwell Automation, Schneider Electric, Emerson Electric, and Honeywell. These companies hold significant market shares and are known for their advanced solutions enhancing industrial productivity and efficiency.

What are the primary factors driving the growth in the industrial Automation Software industry?

The growth of the industrial automation software sector is primarily driven by the increasing need for operational efficiency, the rise of Industry 4.0 technologies, a growing focus on safety regulations, and the demand for predictive maintenance solutions to reduce downtime and operational costs.

Which region is the fastest Growing in the industrial Automation Software?

Among various regions, North America is currently the fastest-growing in the industrial automation software market, projected to increase from $9.56 billion in 2023 to $19.16 billion by 2033, reflecting a substantial opportunity for expansion and innovation.

Does ConsaInsights provide customized market report data for the industrial Automation Software industry?

Yes, ConsaInsights offers customized market report data for the industrial automation software industry, allowing clients to obtain tailored insights based on specific requirements, such as regional analyses, competitive landscapes, and segmentation by market dynamics.

What deliverables can I expect from this industrial Automation Software market research project?

Deliverables include comprehensive reports outlining market forecasts, competitive analyses, segmentation insights, regional trends, and detailed assessments of industry structure. Clients will receive executive summaries, infographics, and recommendations for strategic planning.

What are the market trends of industrial Automation Software?

Current trends in the industrial automation software market include the rise of IoT integration, increasing adoption of AI and machine learning for predictive analytics, a surge in cloud-based solutions, and a heightened focus on cybersecurity measures in automation processes.