Industrial Computed Radiography Market Report

Published Date: 31 January 2026 | Report Code: industrial-computed-radiography

Industrial Computed Radiography Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Industrial Computed Radiography market, including market size, growth forecasts, trends, and regional insights from 2023 to 2033.

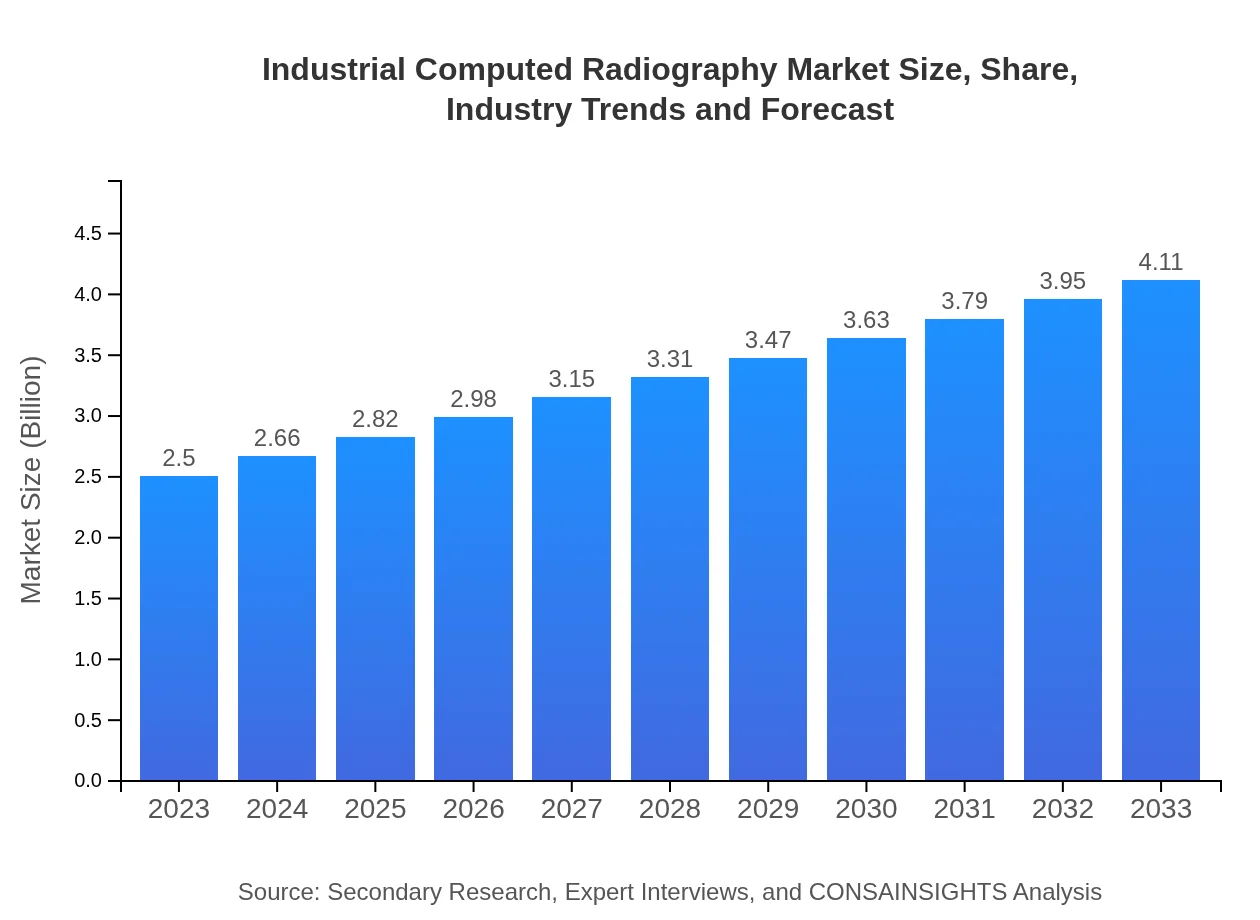

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $2.50 Billion |

| CAGR (2023-2033) | 5% |

| 2033 Market Size | $4.11 Billion |

| Top Companies | GE Measurement & Control, Fujifilm, Olympus Corporation, Siemens AG, Carestream Health |

| Last Modified Date | 31 January 2026 |

Industrial Computed Radiography Market Overview

Customize Industrial Computed Radiography Market Report market research report

- ✔ Get in-depth analysis of Industrial Computed Radiography market size, growth, and forecasts.

- ✔ Understand Industrial Computed Radiography's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Industrial Computed Radiography

What is the Market Size & CAGR of Industrial Computed Radiography market in 2023?

Industrial Computed Radiography Industry Analysis

Industrial Computed Radiography Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Industrial Computed Radiography Market Analysis Report by Region

Europe Industrial Computed Radiography Market Report:

The European market is well-established, with a size of $0.84 billion in 2023, projected to grow to $1.39 billion by 2033. The demand for ICR is driven by stringent regulatory frameworks in industries like aerospace and automotive, necessitating advanced testing solutions.Asia Pacific Industrial Computed Radiography Market Report:

In the Asia Pacific region, the Industrial Computed Radiography market size was $0.42 billion in 2023 and is projected to grow to $0.69 billion by 2033. Factors contributing to this growth include rapid industrialization, increased infrastructure spending, and a rising focus on safety regulations.North America Industrial Computed Radiography Market Report:

The North American Industrial Computed Radiography market is substantial, with a size of $0.89 billion in 2023, expected to reach $1.46 billion by 2033. The region's growth is propelled by a strong emphasis on safety regulations and continuous innovation in imaging technologies.South America Industrial Computed Radiography Market Report:

South America represents a smaller segment, with a market size of $0.09 billion in 2023, anticipated to rise to $0.15 billion by 2033. Growth in this region is driven by investments in the mining and energy sectors, where non-destructive testing is critical.Middle East & Africa Industrial Computed Radiography Market Report:

In the Middle East and Africa, the market is likely to grow from $0.25 billion in 2023 to $0.42 billion by 2033, spurred by developments in the oil and gas sector and an increasing need for infrastructure investments.Tell us your focus area and get a customized research report.

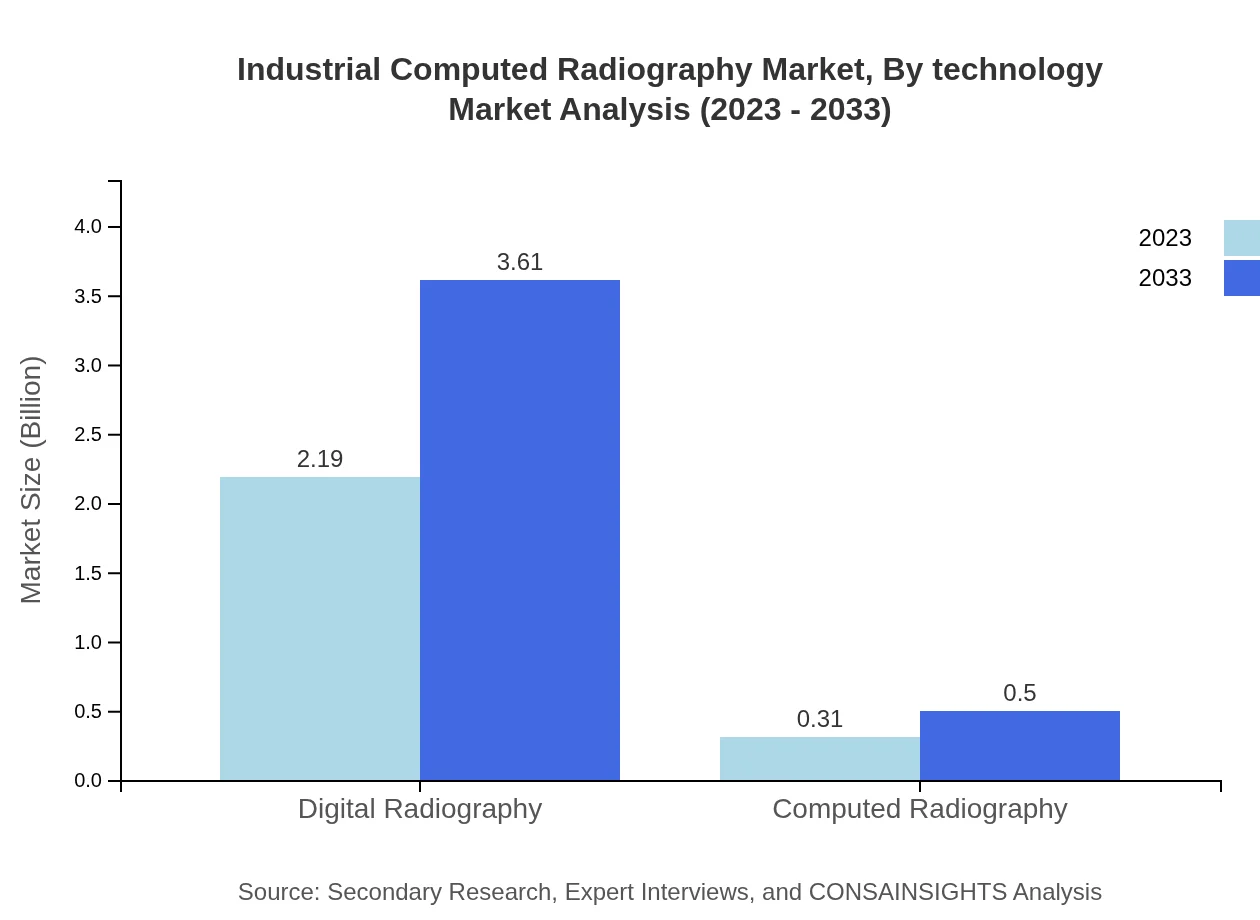

Industrial Computed Radiography Market Analysis By Technology

The market segmentation by technology includes Digital Radiography, which is projected to dominate the market due to its efficiency and speed, showing a robust market size of $2.19 billion by 2023 and forecasting growth to $3.61 billion by 2033. Traditional Computed Radiography continues to play a significant role but is gradually seeing reduced adoption in favor of more modern solutions.

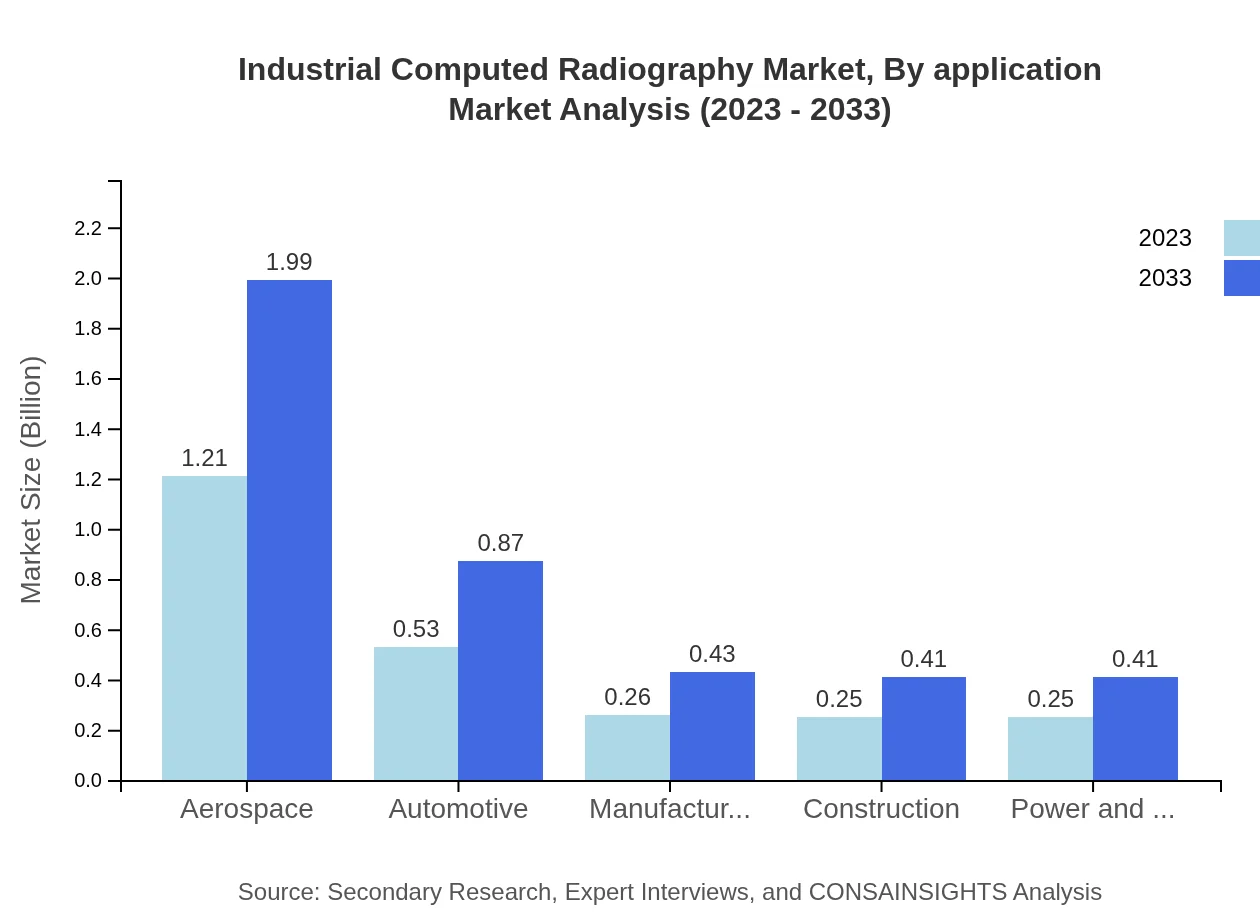

Industrial Computed Radiography Market Analysis By Application

Major applications of Industrial Computed Radiography include Aerospace, Automotive, and Energy. The aerospace segment is notably large, holding a market share of 48.36% in 2023, growing to 48.36% by 2033, driven by high safety standards. The automotive sector follows with a 21.12% market share, growing from $0.53 billion in 2023 to $0.87 billion by 2033.

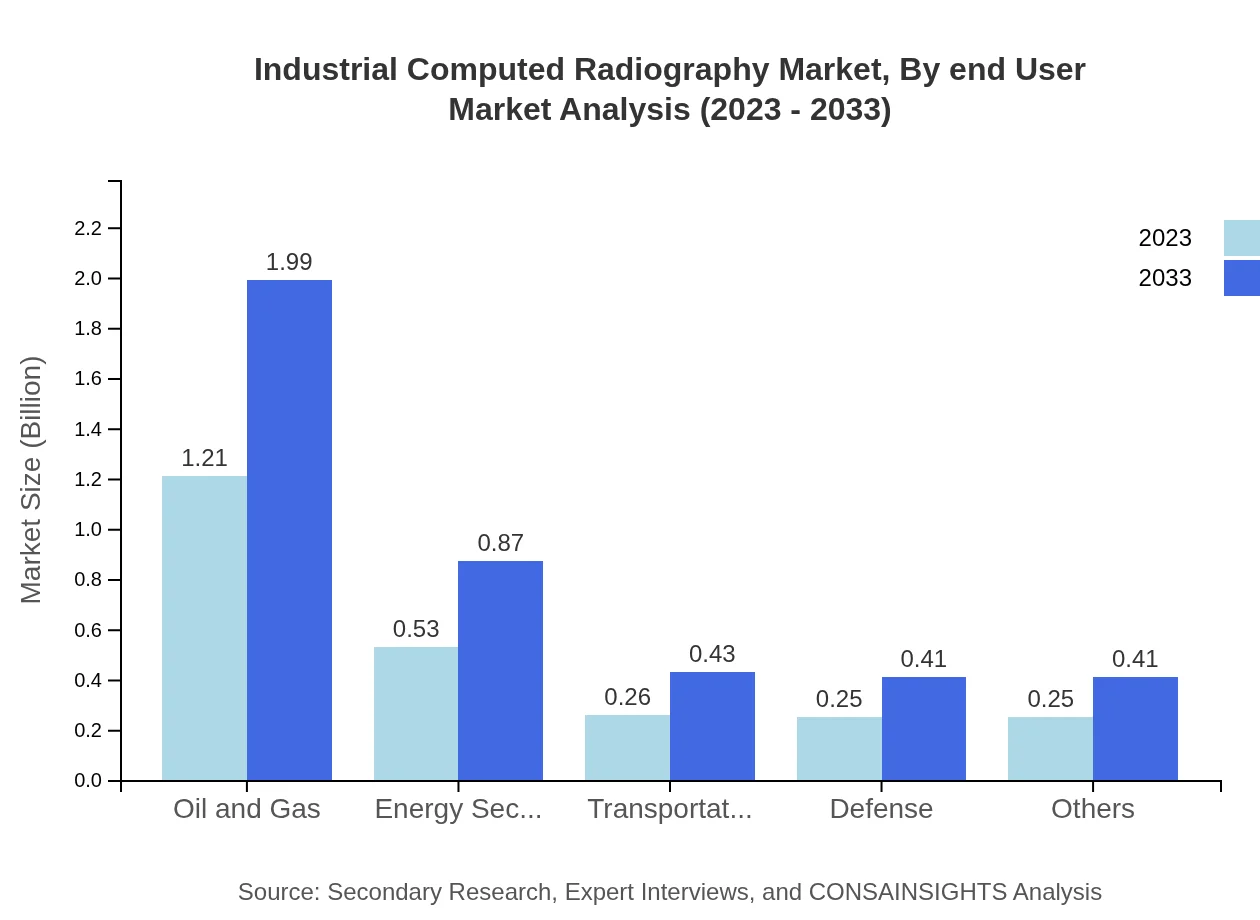

Industrial Computed Radiography Market Analysis By End User

End-users of Industrial Computed Radiography technologies span across sectors such as Oil and Gas, Energy, and Manufacturing. Oil and Gas dominates with a share of 48.36% in 2023 and is expected to maintain its share by 2033, showcasing the sector's critical reliance on NDT solutions for safety and compliance.

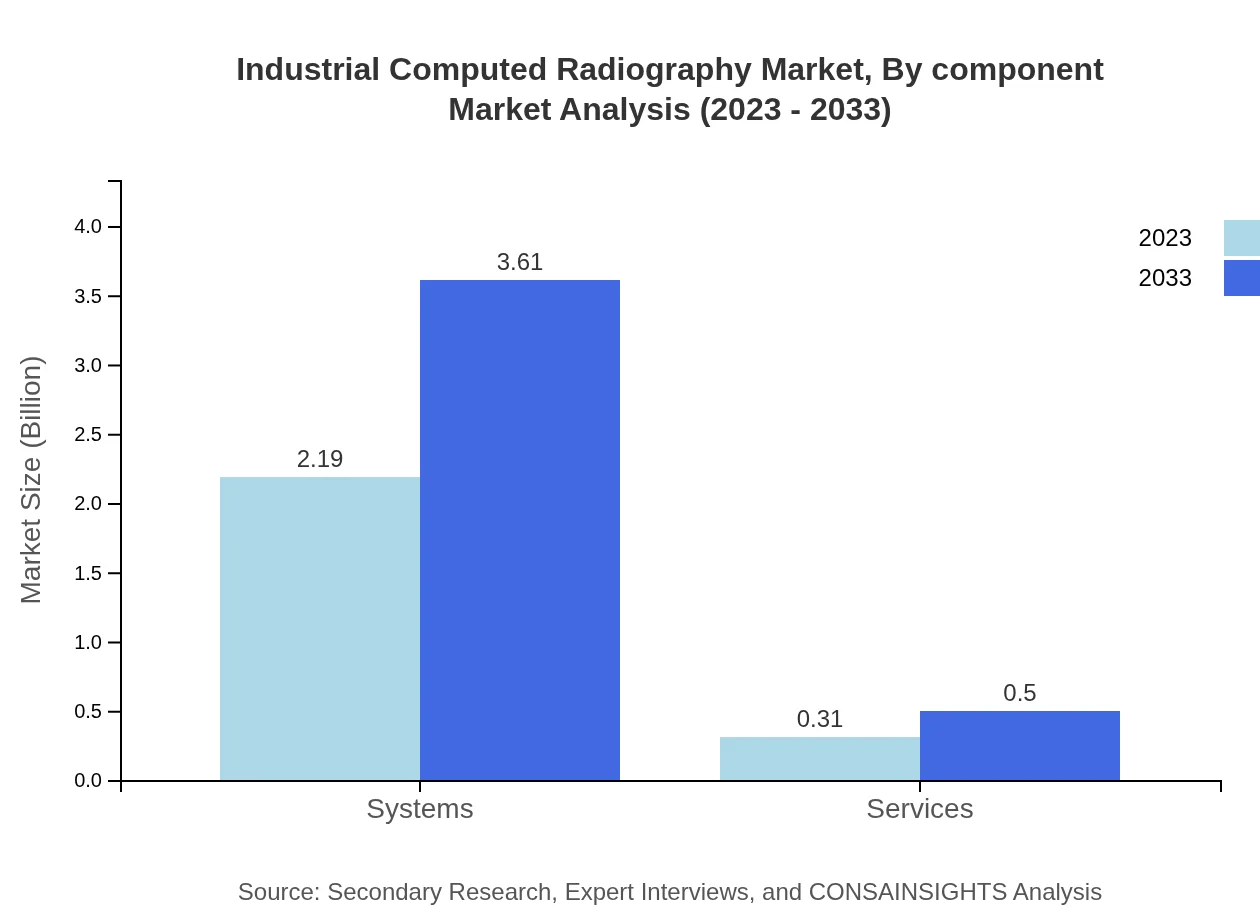

Industrial Computed Radiography Market Analysis By Component

The key components of Industrial Computed Radiography include systems and services. Systems account for approximately 87.73% of the market share and are projected to see a rise from $2.19 billion in 2023 to $3.61 billion by 2033. Services, on the other hand, hold a smaller share but remain vital for the implementation and maintenance of inspection processes.

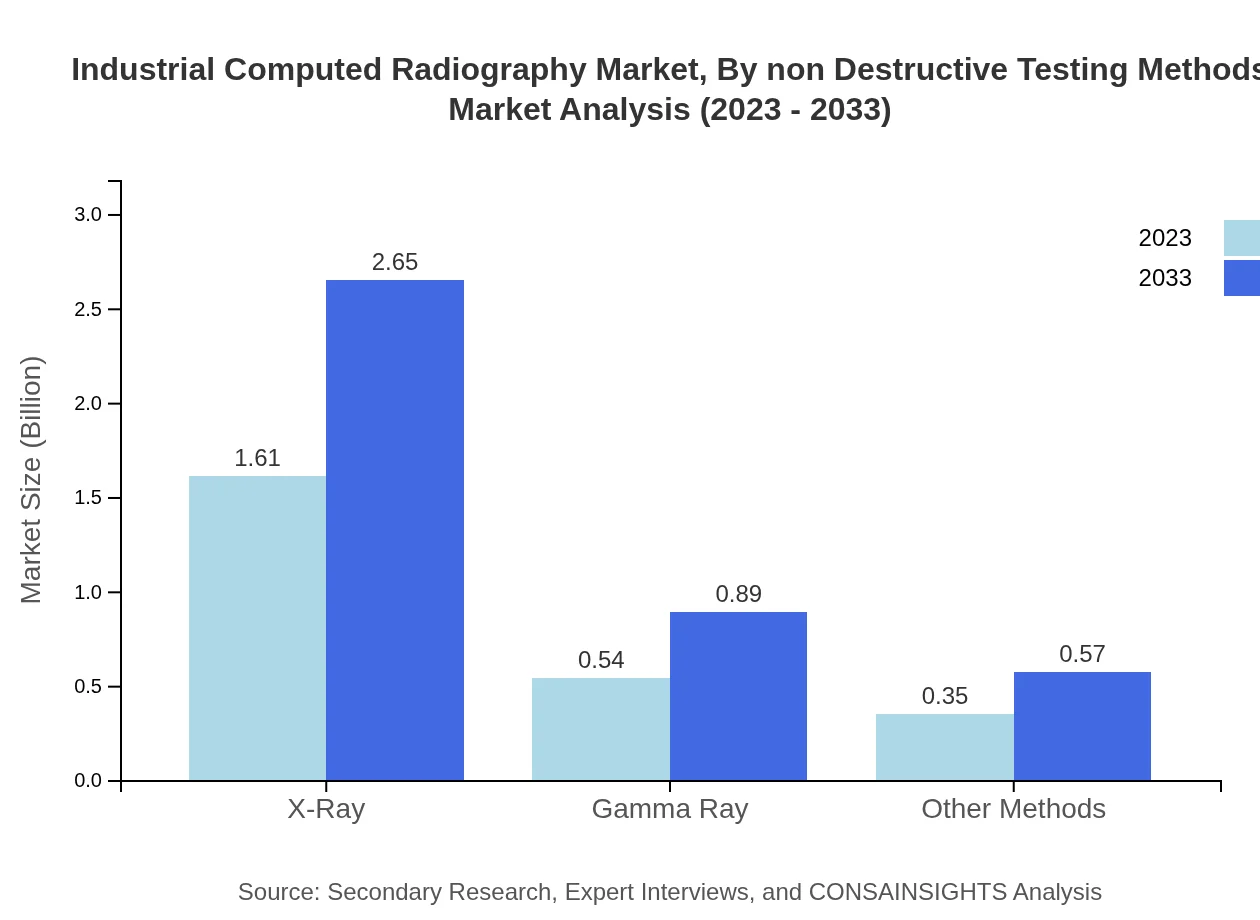

Industrial Computed Radiography Market Analysis By Non Destructive Testing Methods

Non-destructive testing methods in the ICR market include X-Ray, Gamma Ray, and other emerging technologies. X-Ray technology leads significantly, holding a market share of 64.44% with a size of $1.61 billion in 2023, projected to grow to $2.65 billion by 2033.

Industrial Computed Radiography Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Industrial Computed Radiography Industry

GE Measurement & Control:

A leading provider of technologies and solutions for industrial inspection, GE offers advanced computed radiography solutions that integrate seamlessly with existing workflows.Fujifilm:

Fujifilm is well-known for its digital imaging technologies and has made significant advancements in the field of computed radiography, contributing innovations that enhance imaging quality.Olympus Corporation:

Olympus offers comprehensive NDT solutions, including powerful radiography instruments that support various industrial applications across the globe.Siemens AG:

As a technology giant, Siemens has integrated advanced computed radiography systems in their offerings for industries such as automotive and aerospace, ensuring high safety standards.Carestream Health:

Carestream specializes in medical imaging and non-destructive testing solutions, providing industry partners with effective and reliable ICR technologies.We're grateful to work with incredible clients.

FAQs

What is the market size of industrial Computed Radiography?

The industrial computed radiography market is valued at approximately $2.5 billion in 2023. With a projected CAGR of 5%, this market is anticipated to experience growth, driven by advancements in technology and increasing applications across various sectors.

What are the key market players or companies in the industrial Computed Radiography industry?

Key players in the industrial computed radiography market include GE Healthcare, Fujifilm, Carestream Health, and Agfa HealthCare. These companies are pivotal in driving innovation and providing comprehensive solutions that cater to diverse industrial needs.

What are the primary factors driving the growth in the industrial Computed Radiography industry?

Key drivers include the increasing demand for non-destructive testing, technological advancements in digital imaging, and increased investments in industries like oil and gas and aerospace. The need for safety and compliance standards further propels market growth.

Which region is the fastest Growing in the industrial Computed Radiography market?

North America is the fastest-growing region for industrial computed radiography. By 2033, the market is expected to grow from $0.89 billion to $1.46 billion, reflecting a strong demand in various industries within the region.

Does ConsaInsights provide customized market report data for the industrial Computed Radiography industry?

Yes, ConsaInsights offers tailored market reports for the industrial computed radiography sector. These reports can be customized to meet specific client needs, ensuring relevant insights and data utilization.

What deliverables can I expect from this industrial Computed Radiography market research project?

Deliverables include comprehensive market analysis, segmentation data, competitive landscape insights, growth forecasts, and tailored recommendations based on the latest trends and market developments in the industrial computed radiography sector.

What are the market trends of industrial Computed Radiography?

Current trends include the adoption of automation, integration of AI for improved diagnostics, and an increasing focus on digital solutions. The sector is also witnessing a rise in the usage of advanced materials for enhanced imaging quality.