Industrial Computed Tomography Market Report

Published Date: 31 January 2026 | Report Code: industrial-computed-tomography

Industrial Computed Tomography Market Size, Share, Industry Trends and Forecast to 2033

This report delves into the Industrial Computed Tomography (CT) market, providing comprehensive insights on market dynamics, size, trends, and forecasts from 2023 to 2033, highlighting both growth opportunities and challenges within the industry.

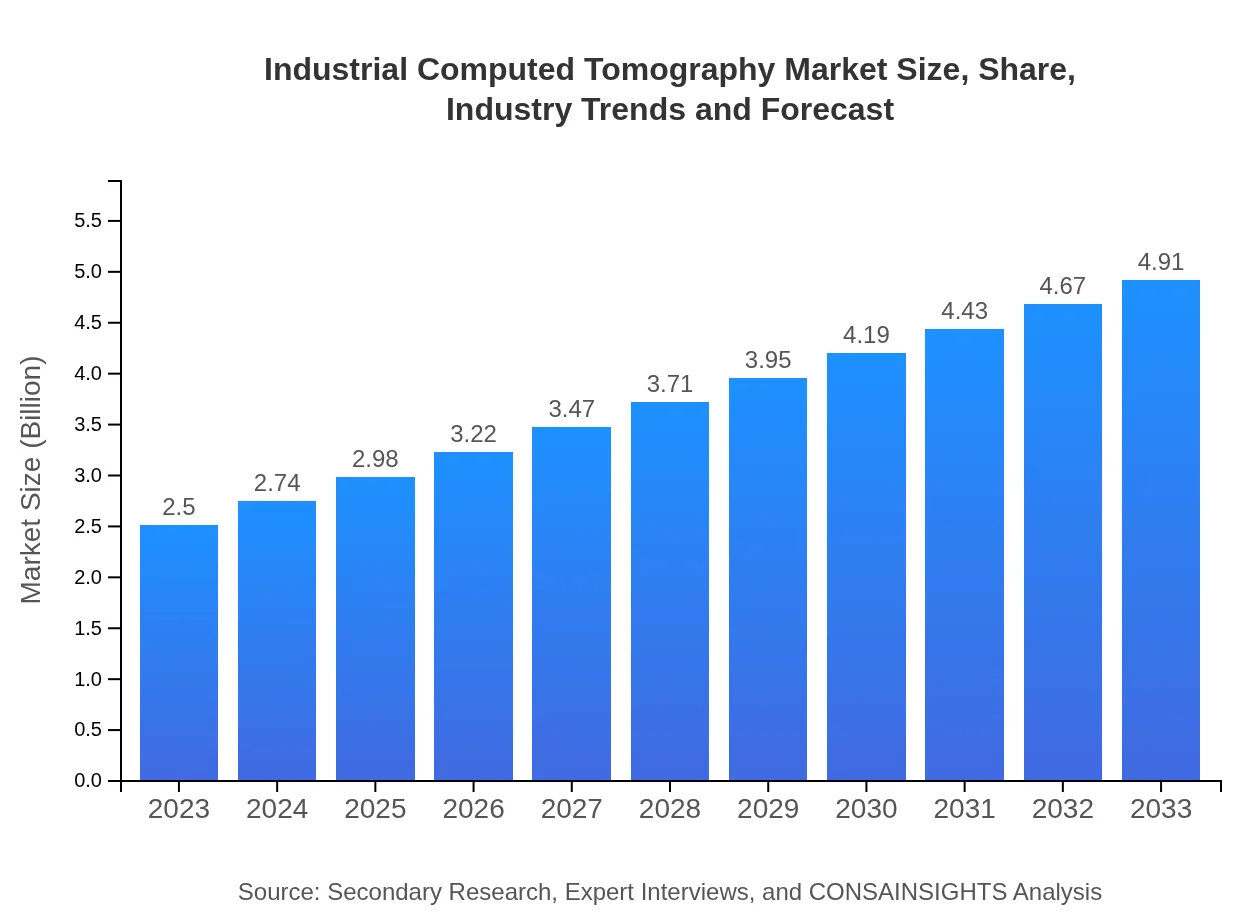

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $2.50 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $4.91 Billion |

| Top Companies | GE Measurement & Control, Siemens AG, Nikon Metrology, Sandvik |

| Last Modified Date | 31 January 2026 |

Industrial Computed Tomography Market Overview

Customize Industrial Computed Tomography Market Report market research report

- ✔ Get in-depth analysis of Industrial Computed Tomography market size, growth, and forecasts.

- ✔ Understand Industrial Computed Tomography's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Industrial Computed Tomography

What is the Market Size & CAGR of Industrial Computed Tomography market in 2023?

Industrial Computed Tomography Industry Analysis

Industrial Computed Tomography Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Industrial Computed Tomography Market Analysis Report by Region

Europe Industrial Computed Tomography Market Report:

The European market is projected to grow from $0.63 billion in 2023 to $1.25 billion by 2033. The region's focus on precision engineering, along with rigorous quality standards across sectors, promotes the adoption of advanced non-destructive testing methods including industrial CT.Asia Pacific Industrial Computed Tomography Market Report:

In 2023, the Asia Pacific industrial CT market stands at approximately $0.53 billion and is projected to grow to $1.04 billion by 2033. This growth is fueled by increased manufacturing activities in countries like China and India, alongside a rising demand for quality assurance processes in various industries.North America Industrial Computed Tomography Market Report:

North America holds a significant share of the industrial CT market, valued at $0.92 billion in 2023, expected to rise to $1.81 billion by 2033. The region benefits from established industries, stringent regulatory frameworks, and a strong focus on technological innovation, pushing widespread CT usage.South America Industrial Computed Tomography Market Report:

The South American market is estimated at $0.23 billion in 2023, with anticipated growth to $0.46 billion by 2033. Although currently smaller, the region is experiencing a gradual increase in industrial CT adoption driven by advancements in local manufacturing and quality inspection technologies.Middle East & Africa Industrial Computed Tomography Market Report:

In 2023, the market in the Middle East and Africa is around $0.18 billion, expected to reach $0.36 billion by 2033. The growth in this region is primarily driven by investments in infrastructure and quality enhancements in oil and gas, manufacturing, and automotive sectors.Tell us your focus area and get a customized research report.

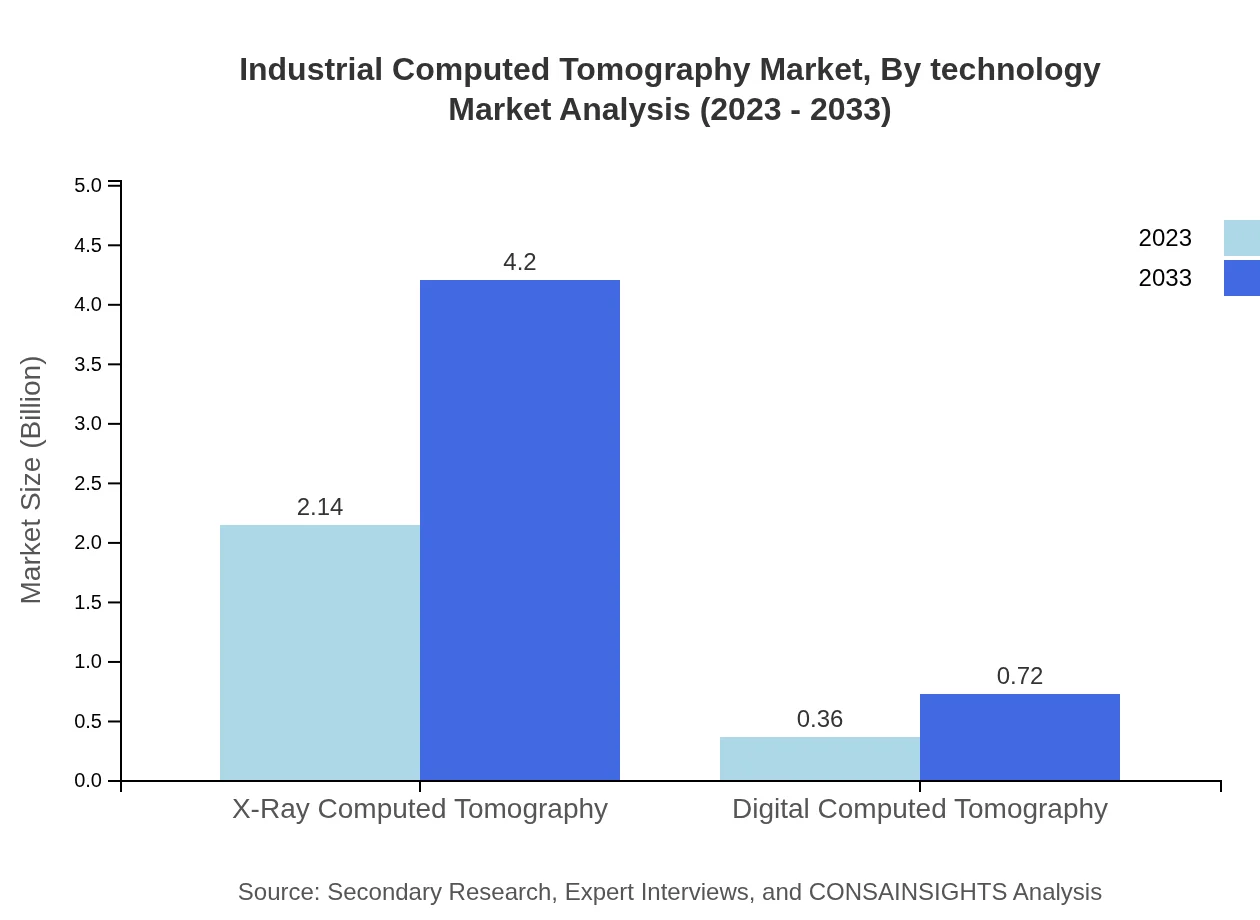

Industrial Computed Tomography Market Analysis By Technology

The Industrial Computed Tomography market segment analysis reveals that X-Ray Computed Tomography dominates with a market size of $2.14 billion in 2023, accounting for 85.41% market share. Digital Computed Tomography, valued at $0.36 billion, represents 14.59% share. Both technologies are fundamental, with X-Ray CT providing deeper insights into materials while digital technology enhances scanning speed and resolution.

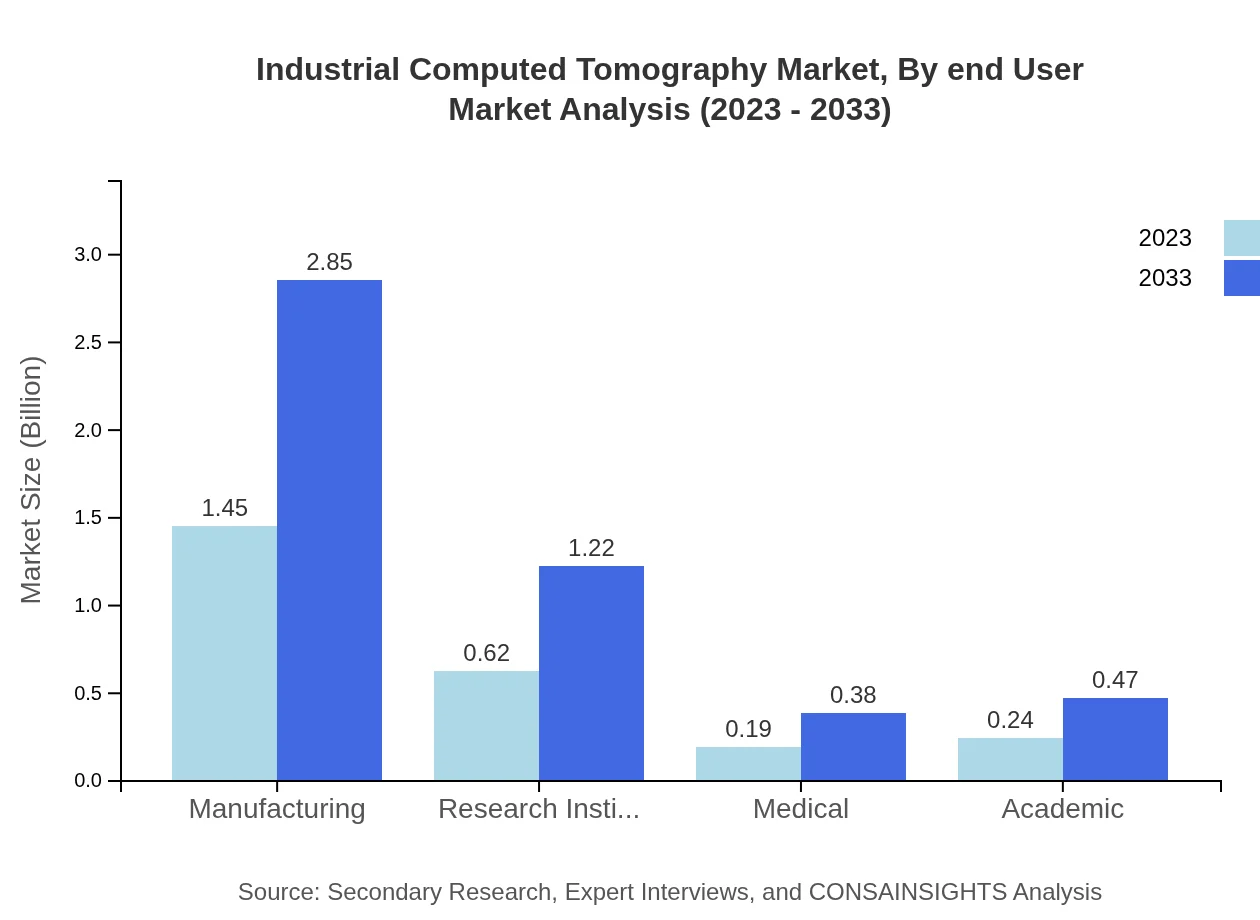

Industrial Computed Tomography Market Analysis By Application

The manufacturing segment leads in market size at $1.45 billion in 2023, impeding no other segment has yet matched its share of 57.95%. Research institutes are also significant, with a valuation of $0.62 billion and a 24.9% share. The medical and academic fields are smaller but growing, indicating expanding applications for industrial CT in diverse areas.

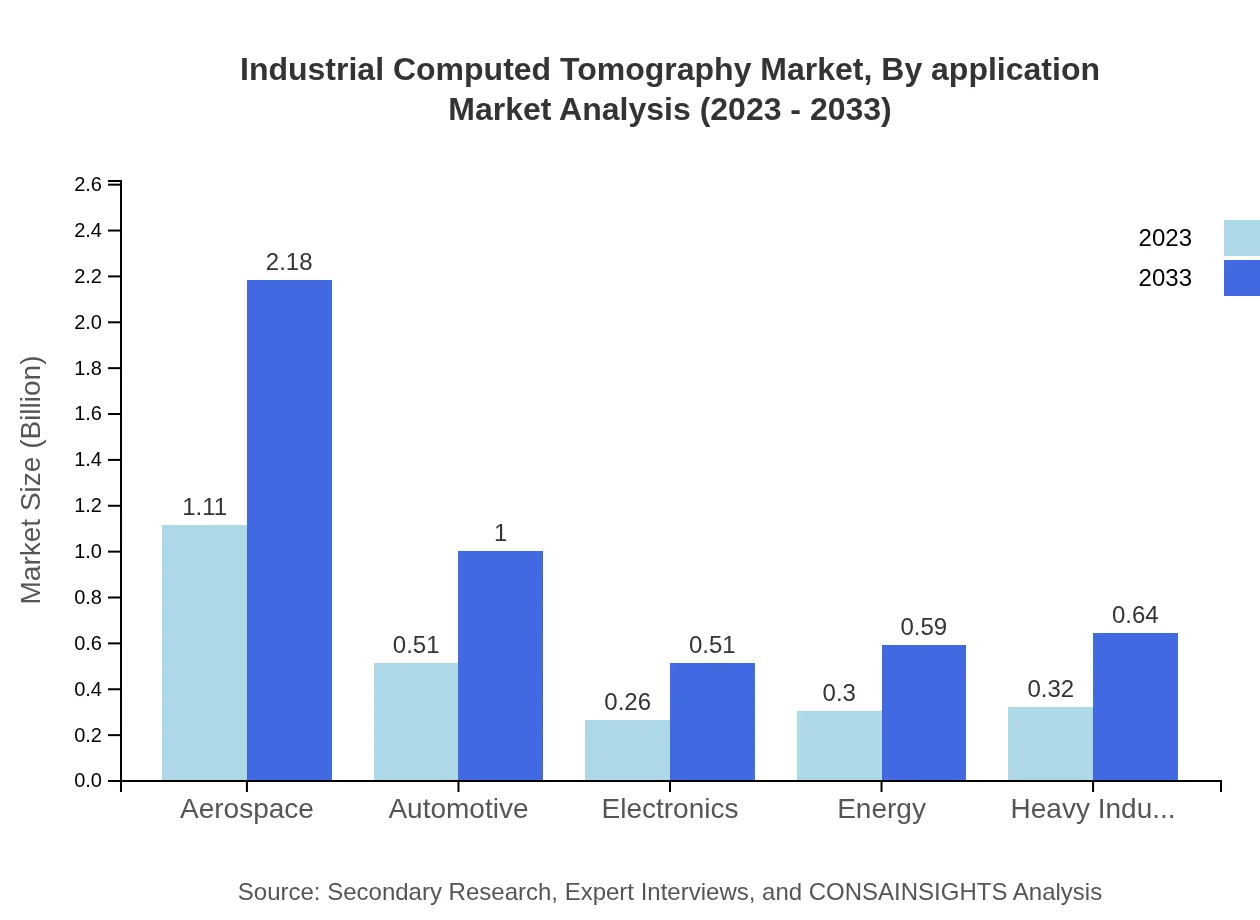

Industrial Computed Tomography Market Analysis By End User

The aerospace sector shows a robust demand for industrial CT, with a market size of $1.11 billion in 2023 and a share of 44.27%. The automotive sector follows at $0.51 billion (20.33%). Electronics and energy industries also show notable engagement, signifying the industry's broad use across strategic sectors.

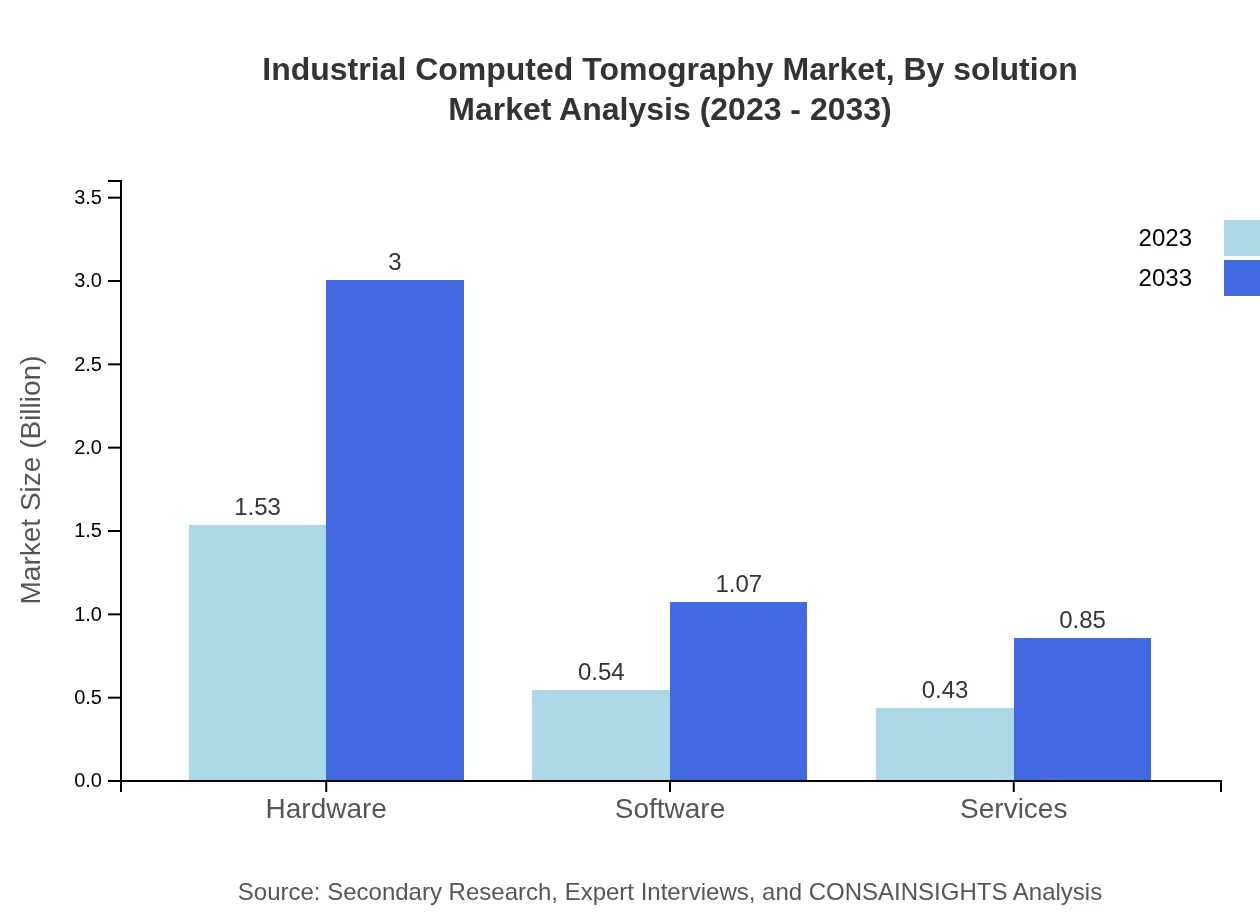

Industrial Computed Tomography Market Analysis By Solution

Hardware remains the largest segment, valued at $1.53 billion (61.02% share) in 2023. Software solutions follow, valued at $0.54 billion, representing a share of 21.68%, reflecting growing software integration in CT systems for enhanced functionalities in data processing and analysis.

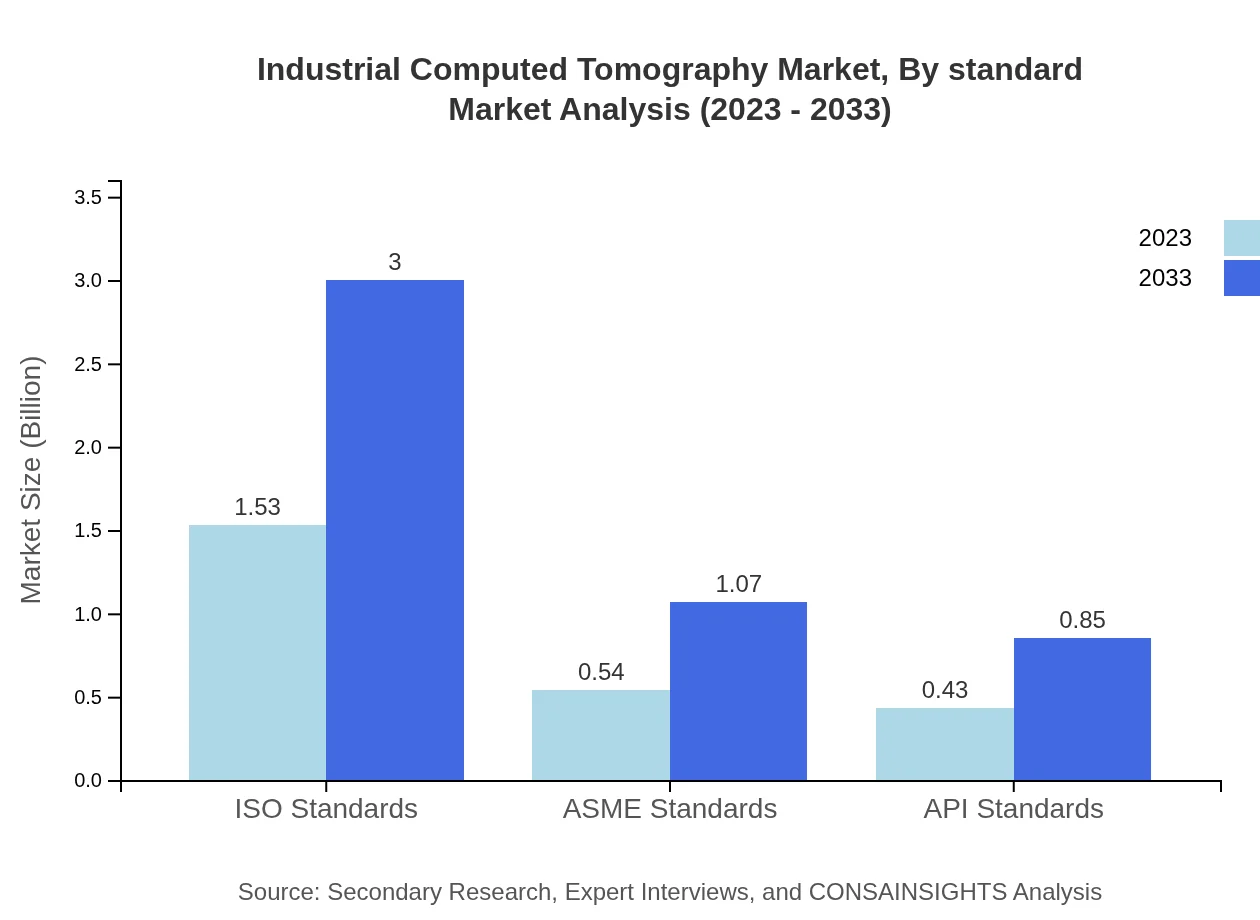

Industrial Computed Tomography Market Analysis By Standard

ISO Standards dominate the market, holding a significant market size of $1.53 billion (61.02% share). ASME Standards and API Standards, positioned at $0.54 billion and $0.43 billion respectively, depict the diverse regulatory frameworks guiding industrial CT implementation across various sectors.

Industrial Computed Tomography Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Industrial Computed Tomography Industry

GE Measurement & Control:

A leader in testing and inspection technology, GE Measurement & Control provides advanced industrial inspection solutions, including comprehensive CT systems critical for maintaining quality in manufacturing.Siemens AG:

Siemens offers innovative imaging solutions and services, providing robust industrial CT systems that cater to a wide range of applications, particularly in the automotive and aerospace sectors.Nikon Metrology:

Nikon Metrology specializes in 3D metrology systems, including industrial CT systems that enhance imaging capabilities, supporting non-destructive testing across various industries.Sandvik:

Sandvik’s industrial CT solutions are acclaimed for delivering precision in manufacturing processes, enabling high-quality inspections and ensuring compliance with industry standards.We're grateful to work with incredible clients.

FAQs

What is the market size of industrial Computed Tomography?

The industrial computed tomography market is estimated at $2.5 billion in 2023, with a projected CAGR of 6.8% leading to significant growth by 2033.

What are the key market players or companies in the industrial Computed Tomography industry?

Key players in the industrial computed tomography market consist of major manufacturers of CT systems, software developers, and service providers, all competing to innovate in advanced imaging technologies.

What are the primary factors driving the growth in the industrial Computed Tomography industry?

Growth is driven by increasing demand for non-destructive testing, advancements in imaging technology, and broad adoption across sectors like manufacturing and aerospace, which seek high precision inspections.

Which region is the fastest Growing in the industrial Computed Tomography?

Asia Pacific is the fastest-growing region, expanding from $0.53 billion in 2023 to $1.04 billion by 2033, driven by burgeoning industrial sectors and rising investments in advanced technologies.

Does ConsaInsights provide customized market report data for the industrial Computed Tomography industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the industrial computed tomography sector, allowing businesses to gain targeted insights and strategic advantages.

What deliverables can I expect from this industrial Computed Tomography market research project?

Expect comprehensive reports including market analysis, growth forecast, regional insights, competitive landscape details, and an exploration of key market trends and drivers.

What are the market trends of industrial Computed Tomography?

Current trends include increasing automation in inspection processes, rising applications in healthcare and aerospace, and a shift towards integrating AI to enhance efficiency in computed tomography.