Industrial Control And Factory Automation Market Report

Published Date: 22 January 2026 | Report Code: industrial-control-and-factory-automation

Industrial Control And Factory Automation Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Industrial Control and Factory Automation market, highlighting market trends, segmentation, regional insights, and future forecasts from 2023 to 2033. Comprehensive data and predictions will aid stakeholders in making informed decisions.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

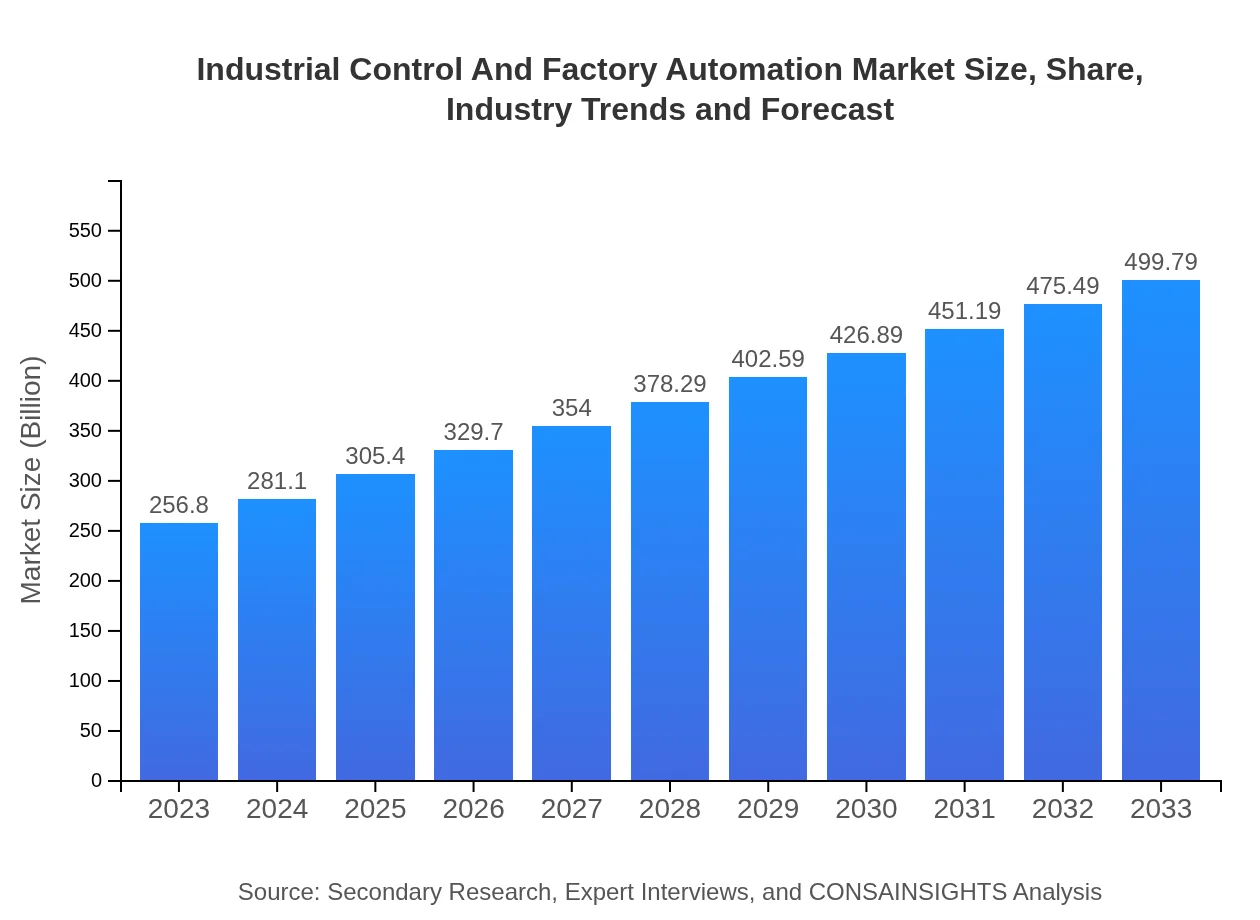

| 2023 Market Size | $256.80 Billion |

| CAGR (2023-2033) | 6.7% |

| 2033 Market Size | $499.79 Billion |

| Top Companies | Siemens AG, Rockwell Automation, Schneider Electric, Honeywell International Inc., ABB Ltd. |

| Last Modified Date | 22 January 2026 |

Industrial Control And Factory Automation Market Overview

Customize Industrial Control And Factory Automation Market Report market research report

- ✔ Get in-depth analysis of Industrial Control And Factory Automation market size, growth, and forecasts.

- ✔ Understand Industrial Control And Factory Automation's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Industrial Control And Factory Automation

What is the Market Size & CAGR of Industrial Control And Factory Automation market in 2023?

Industrial Control And Factory Automation Industry Analysis

Industrial Control And Factory Automation Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Industrial Control And Factory Automation Market Analysis Report by Region

Europe Industrial Control And Factory Automation Market Report:

Europe's market is set to expand significantly, from $69.93 billion in 2023 to $136.09 billion by 2033. The region's focus on sustainability and the European Union's Green Deal initiative are propelling industries towards more efficient and automated processes. Countries such as Germany and the UK lead in adopting Industry 4.0 practices, leveraging automation for greater productivity.Asia Pacific Industrial Control And Factory Automation Market Report:

In the Asia Pacific region, the Industrial Control And Factory Automation market is witnessing substantial growth, expected to reach $103.86 billion by 2033, up from $53.36 billion in 2023. The rapid industrialization and adoption of smart manufacturing practices in countries like China, Japan, and India are major contributors to this growth. Additionally, a burgeoning investment in renewable energy and infrastructure is spurring further advancements in automation technologies.North America Industrial Control And Factory Automation Market Report:

In North America, the Industrial Control And Factory Automation market is expected to grow from $91.50 billion in 2023 to $178.07 billion by 2033. The region is characterized by a high adoption rate of advanced technologies, including IoT and AI, driving the implementation of smart factories. Furthermore, strong regulatory frameworks in sectors like food processing and pharmaceuticals necessitate robust automation solutions.South America Industrial Control And Factory Automation Market Report:

The South American market is projected to grow from $16.59 billion in 2023 to $32.29 billion by 2033. This growth is fueled by increased government initiatives and private investments focusing on modernization of manufacturing processes and infrastructure improvement. Key industries such as automotive and mining are adopting automation technologies to enhance productivity and reduce operational costs.Middle East & Africa Industrial Control And Factory Automation Market Report:

In the Middle East and Africa, the market will grow from $25.42 billion in 2023 to $49.48 billion by 2033. Increased investments in oil and gas infrastructure and manufacturing capabilities are promoting the need for advanced automation solutions. The growth of local industries and the shift towards smart city projects are further driving demand for industrial control technologies.Tell us your focus area and get a customized research report.

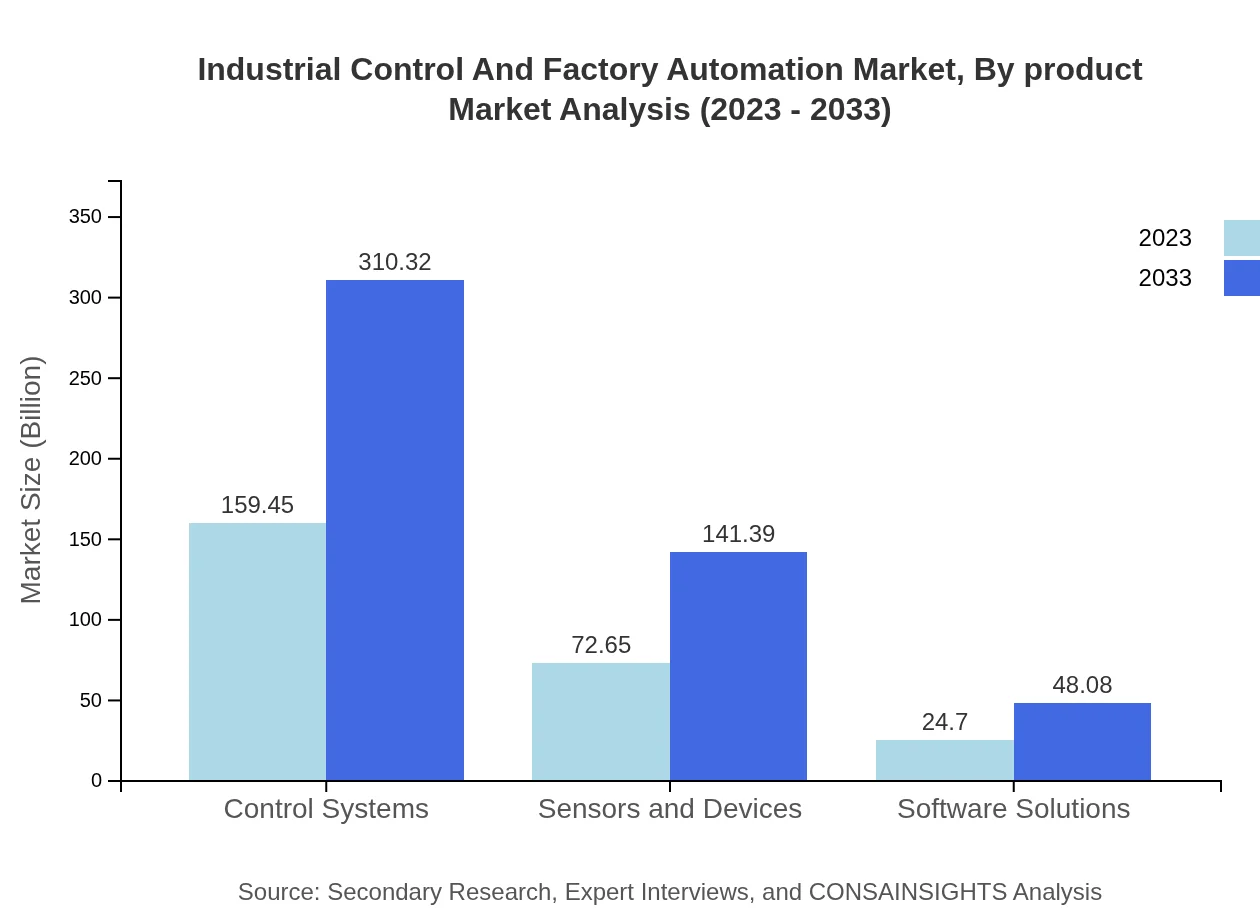

Industrial Control And Factory Automation Market Analysis By Product

The product segment of the Industrial Control And Factory Automation market includes control systems, sensors and devices, software solutions, and more. The control systems market alone is significant, expected to rise from $159.45 billion in 2023 to $310.32 billion by 2033, owing to increased demand for process automation and control technologies. Sensors and devices follow closely, projected to reach $141.39 billion by 2033 from $72.65 billion in 2023.

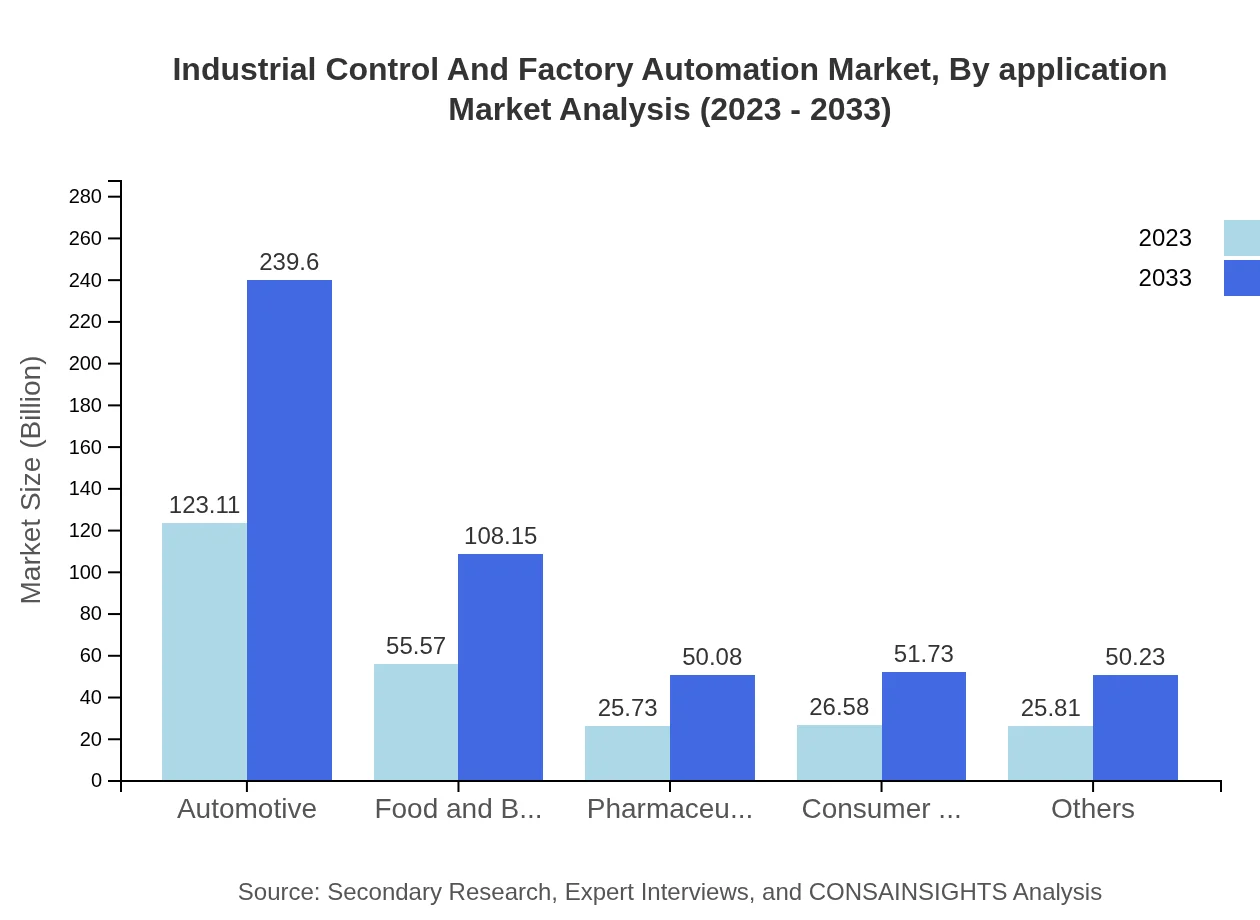

Industrial Control And Factory Automation Market Analysis By Application

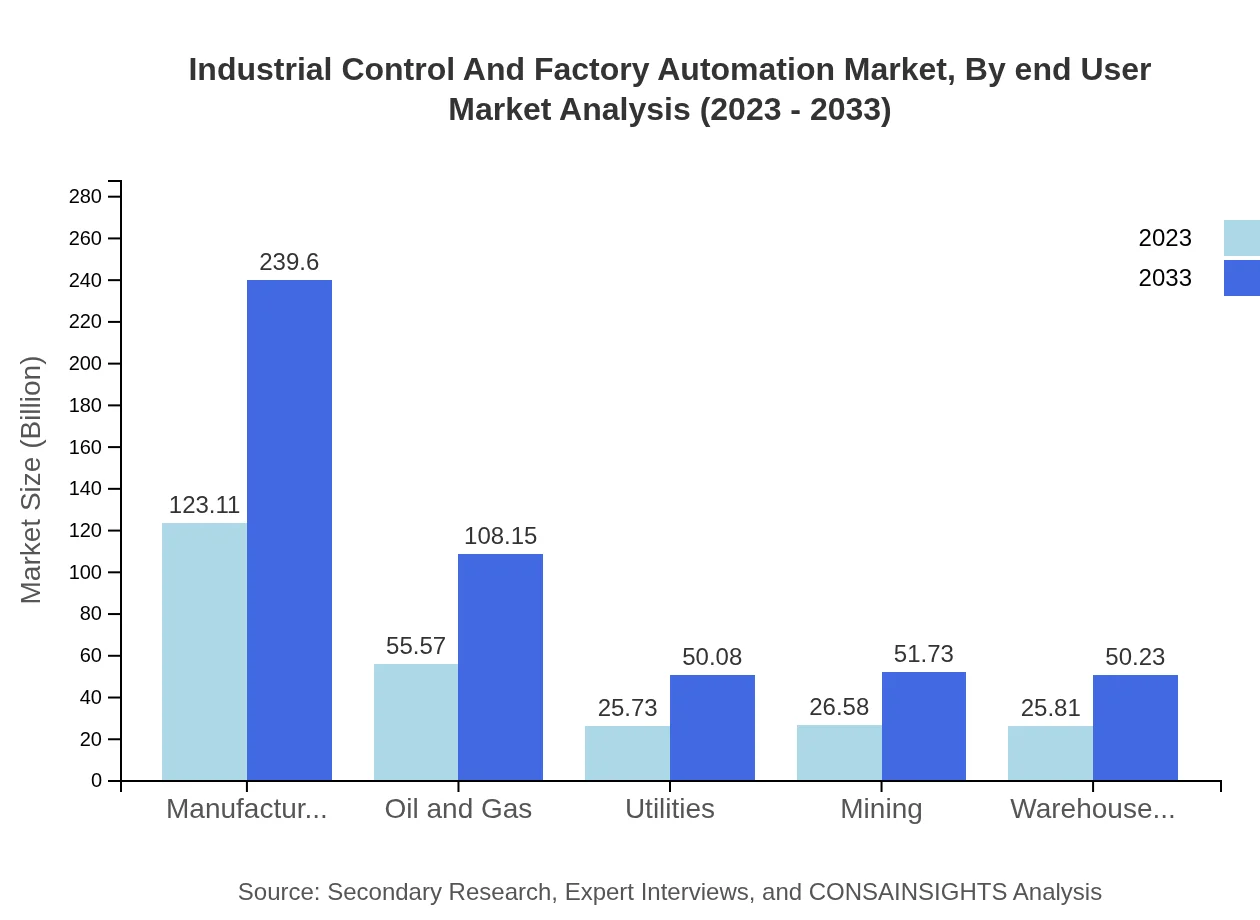

Key applications in this market include manufacturing, oil and gas, food and beverage, and mining. The manufacturing sector leads the market, anticipated to grow from $123.11 billion in 2023 to $239.60 billion by 2033 as businesses aim to increase efficiency and production capacity. Other significant applications include utilities and automotive, with expected continued investments in automation technologies across these sectors.

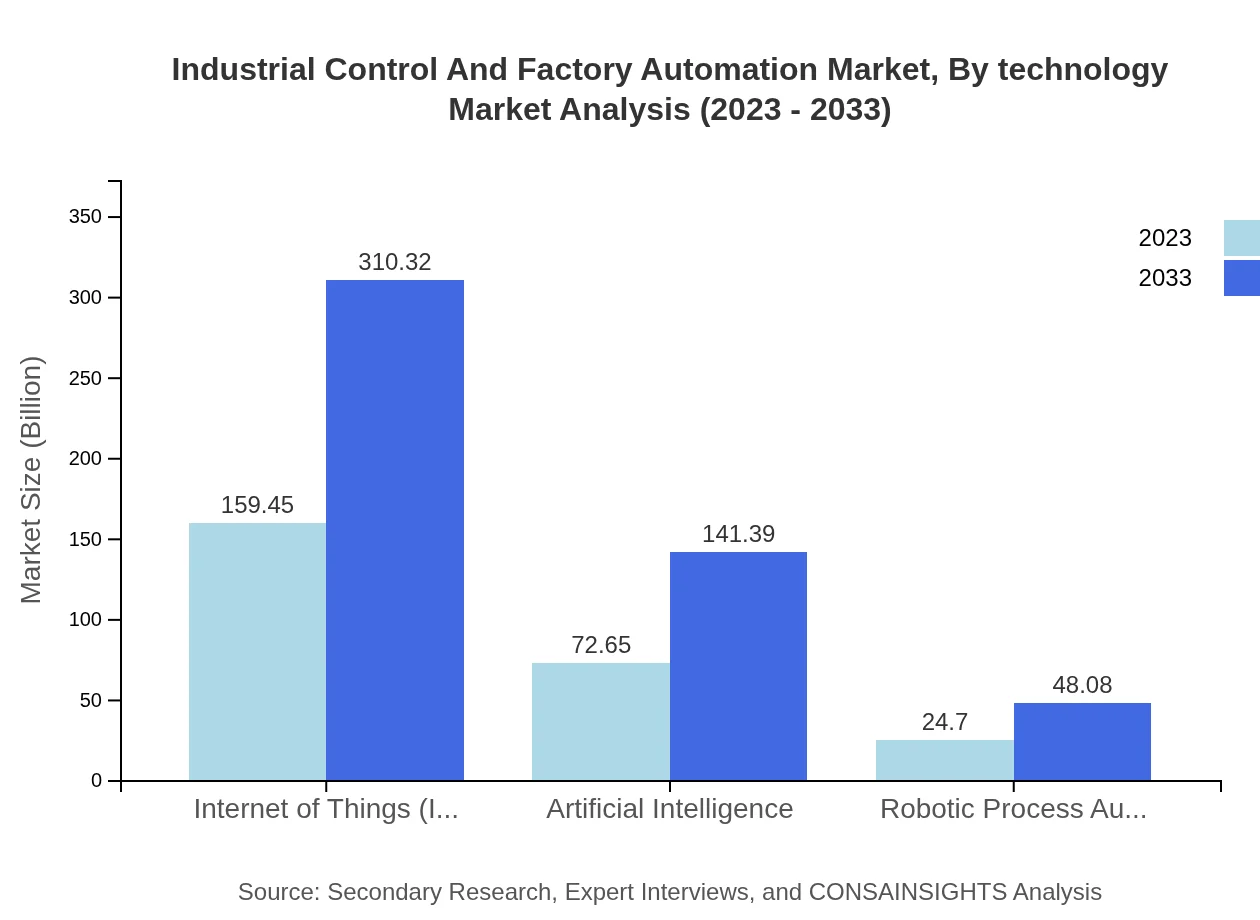

Industrial Control And Factory Automation Market Analysis By Technology

Technological advancements significantly impact the Industrial Control And Factory Automation market landscape. Research shows substantial growth in IoT integrations, AI, and robotics, with IoT alone expected to rise from $159.45 billion to $310.32 billion by 2033. Robotics Process Automation (RPA) also shows promising growth potential, indicating a stable demand for automation technologies across industries.

Industrial Control And Factory Automation Market Analysis By End User

End-user industries such as automotive, food and beverage, pharmaceuticals, and consumer goods are driving growth in the Industrial Control And Factory Automation market. The automotive sector, for example, is valued at $123.11 billion in 2023 and is projected to grow to $239.60 billion by 2033, reflecting a shift towards more automated assembly lines and smart manufacturing practices.

Industrial Control And Factory Automation Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Industrial Control And Factory Automation Industry

Siemens AG:

A leading global provider of automation and control systems, Siemens offers integrated hardware and software solutions for industrial environments, enhancing productivity and energy efficiency.Rockwell Automation:

This company specializes in advanced industrial automation and information solutions, dedicated to helping manufacturers achieve intelligent operation and automation efficiencies.Schneider Electric:

Recognized for its innovative solutions in energy management and automation, Schneider Electric enables industries to achieve sustainable progress and operational excellence.Honeywell International Inc.:

Honeywell delivers smart building solutions and automation technologies that improve operational effectiveness and safety across various industries.ABB Ltd.:

ABB is a pioneer in industrial automation and robotics, providing advanced technologies that enhance efficiency, reliability, and sustainability in manufacturing processes.We're grateful to work with incredible clients.

FAQs

What is the market size of industrial Control And Factory Automation?

The industrial control and factory automation market is valued at $256.8 billion in 2023, with a projected CAGR of 6.7% leading to significant growth by 2033.

What are the key market players or companies in this industrial Control And Factory Automation industry?

Key players in industrial control and factory automation include Siemens AG, Rockwell Automation, Schneider Electric, Honeywell, and ABB Ltd., which significantly contribute to technology development and market dynamics.

What are the primary factors driving the growth in the industrial Control And Factory Automation industry?

Growth is driven by the increasing demand for efficiency, advancements in IoT and AI technologies, the necessity for predictive maintenance, and rising labor costs that accelerate automation adoption across industries.

Which region is the fastest Growing in the industrial Control And Factory Automation?

Asia Pacific is the fastest-growing region, projected to expand from $53.36 billion in 2023 to $103.86 billion by 2033, fueled by rapid industrialization and technological advancements.

Does ConsaInsights provide customized market report data for the industrial Control And Factory Automation industry?

ConsaInsights offers customized market report data tailored to specific client needs, ensuring relevant insights and analytical frameworks that address unique business challenges in the industrial automation sector.

What deliverables can I expect from this industrial Control And Factory Automation market research project?

Expect comprehensive reports detailing market analysis, growth drivers, competitive landscape, segment analysis, regional insights, and forecasts along with actionable recommendations tailored to your strategic needs.

What are the market trends of industrial Control And Factory Automation?

Trends include increased integration of AI and IoT, focus on sustainability in operations, growth in robotics and automation technologies, and the shift towards smart factories for enhanced productivity.