Industrial Control Systems Market Report

Published Date: 22 January 2026 | Report Code: industrial-control-systems

Industrial Control Systems Market Size, Share, Industry Trends and Forecast to 2033

This report analyzes the Industrial Control Systems market, offering insights on growth trends, segmentation, regional dynamics, and competitive landscape. It covers the forecast period from 2023 to 2033, providing data-driven projections for the industry.

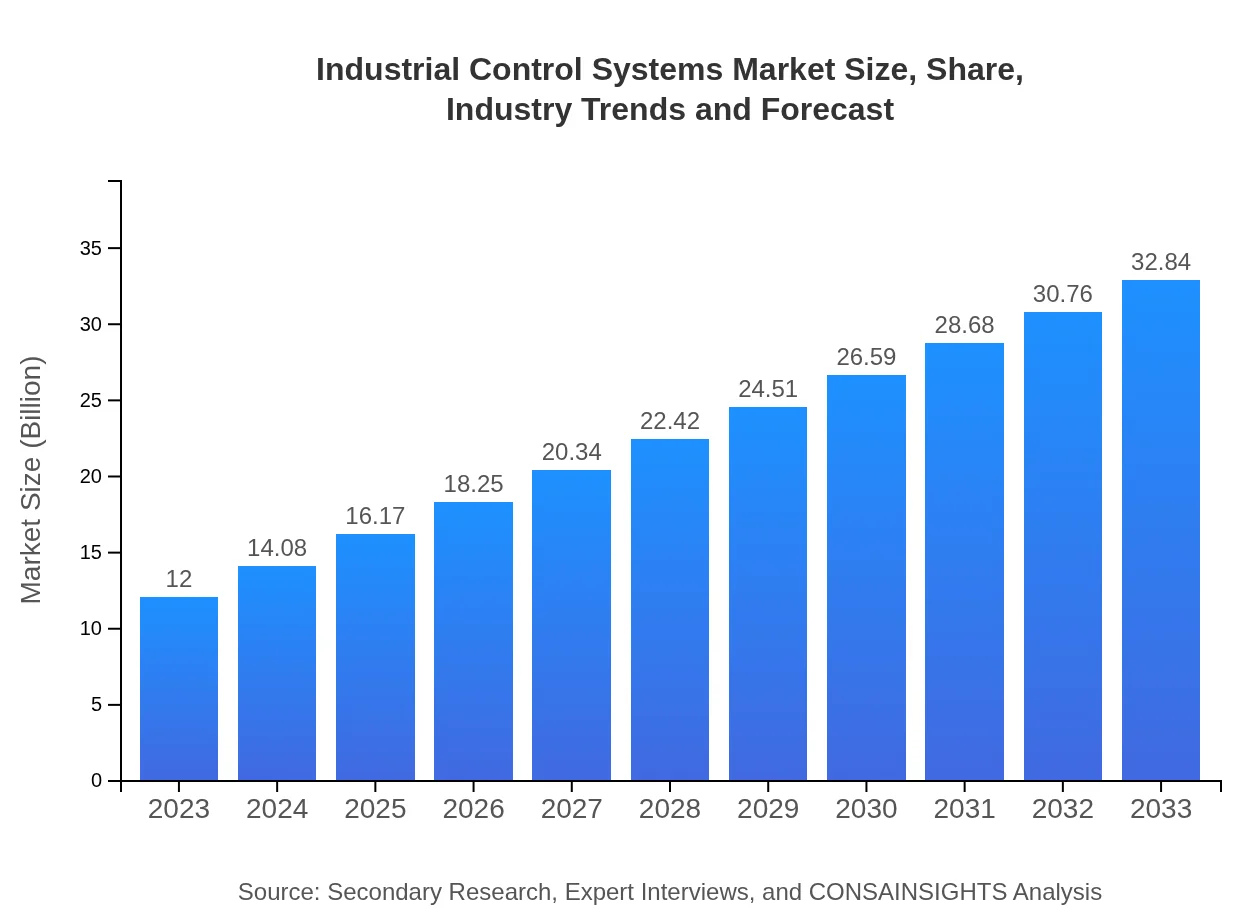

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $12.00 Billion |

| CAGR (2023-2033) | 10.2% |

| 2033 Market Size | $32.84 Billion |

| Top Companies | Siemens AG, Honeywell International Inc., Schneider Electric, Emerson Electric Co., Rockwell Automation Inc. |

| Last Modified Date | 22 January 2026 |

Industrial Control Systems Market Overview

Customize Industrial Control Systems Market Report market research report

- ✔ Get in-depth analysis of Industrial Control Systems market size, growth, and forecasts.

- ✔ Understand Industrial Control Systems's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Industrial Control Systems

What is the Market Size & CAGR of Industrial Control Systems market in 2023?

Industrial Control Systems Industry Analysis

Industrial Control Systems Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Industrial Control Systems Market Analysis Report by Region

Europe Industrial Control Systems Market Report:

In Europe, the ICS market is projected to increase significantly, from $3.36 billion in 2023 to $9.18 billion by 2033. The focus on reducing carbon footprints and enhancing energy efficiency in industrial operations is propelling investments in advanced control technologies. Regulatory frameworks aimed at enhancing safety and operational reliability further encourage widespread adoption.Asia Pacific Industrial Control Systems Market Report:

The Asia Pacific region holds substantial growth potential for the ICS market, expected to grow from $2.29 billion in 2023 to $6.28 billion by 2033. The rapid industrialization and significant investments in infrastructure development across countries like China and India are driving this trend. Additionally, the region's increasing emphasis on smart manufacturing and automation technologies positions it as a key player in the global market landscape.North America Industrial Control Systems Market Report:

The North American ICS market is the largest, with a value expected to rise from $4.55 billion in 2023 to $12.44 billion by 2033. This growth is attributed to the region's established industrial base, the presence of leading technology providers, and substantial investments in cybersecurity for critical infrastructure. Additionally, increasing regulatory requirements drive investments in modernizing legacy control systems.South America Industrial Control Systems Market Report:

In South America, the ICS market is projected to grow from $0.95 billion in 2023 to $2.59 billion by 2033. Rising investments in energy, mining, and agricultural sectors are the primary drivers for this growth. As countries in this region seek to optimize their production processes and improve efficiency through automation, the demand for advanced industrial control systems is anticipated to rise.Middle East & Africa Industrial Control Systems Market Report:

The Middle East and Africa's ICS market is set to grow from $0.86 billion in 2023 to $2.35 billion by 2033. The region's increasing focus on diversifying economies, along with infrastructural development projects, are fueling demand for industrial control systems. Moreover, the ongoing digital transformation across industries in this region is likely to enhance market possibilities.Tell us your focus area and get a customized research report.

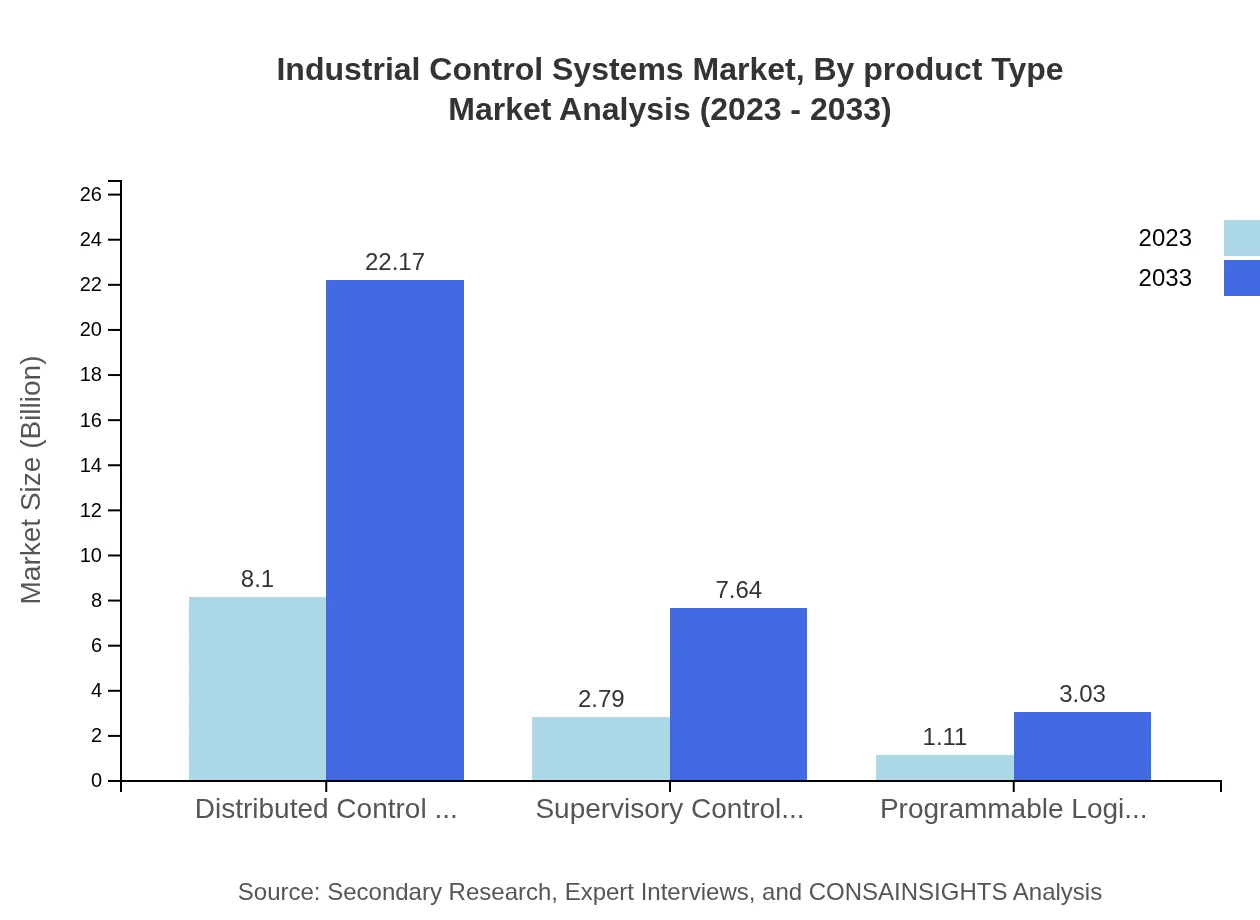

Industrial Control Systems Market Analysis By Product Type

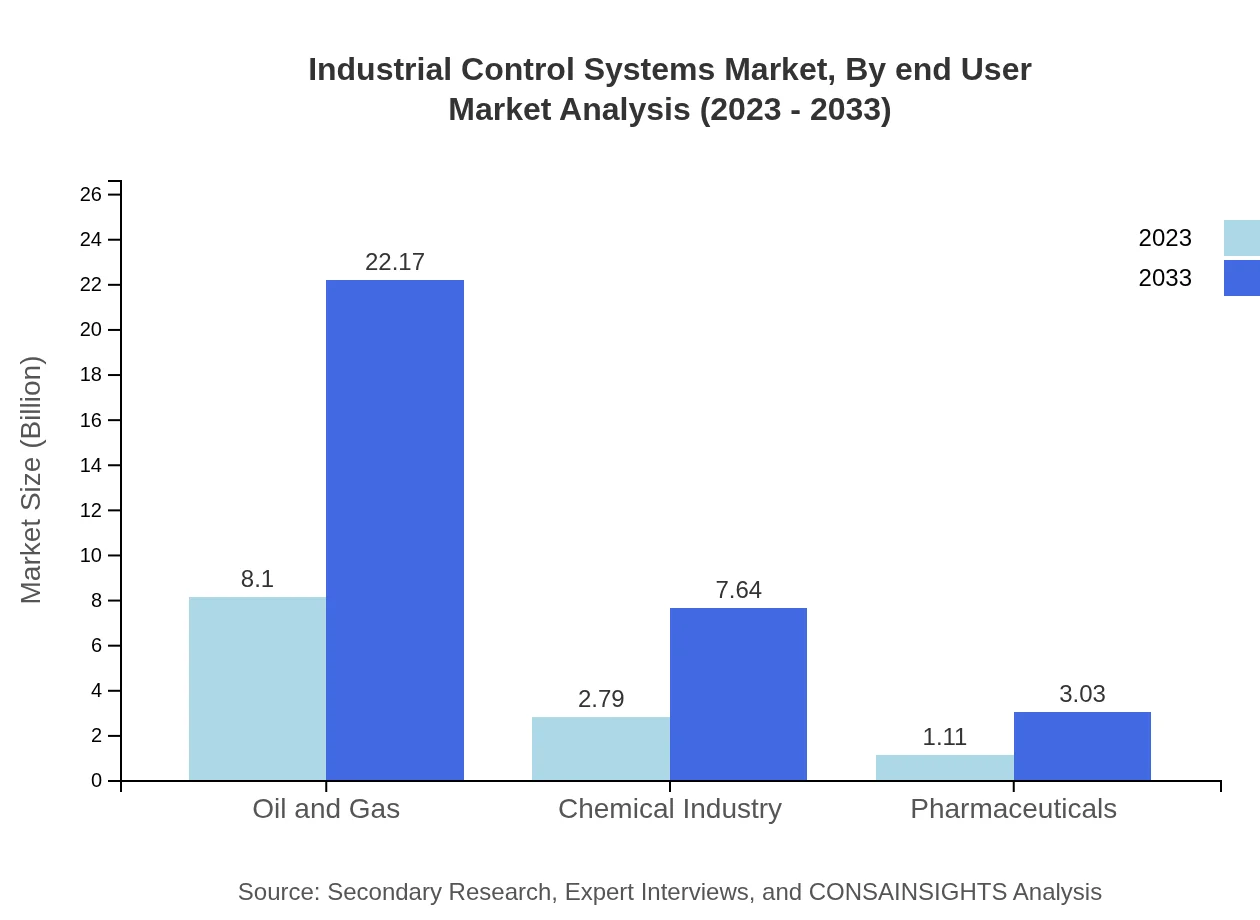

Different product types in the Industrial Control Systems market exhibit distinct performance metrics. Distributed Control Systems (DCS) dominate the market, projected to grow from $8.10 billion in 2023 to $22.17 billion by 2033, representing a share of 67.51%. Supervisory Control and Data Acquisition (SCADA) systems follow, with anticipated growth from $2.79 billion to $7.64 billion, accounting for 23.25%. Programmable Logic Controllers (PLC) is expected to grow from $1.11 billion to $3.03 billion, representing a 9.24% share, illustrating their indispensable role in automation processes across industries.

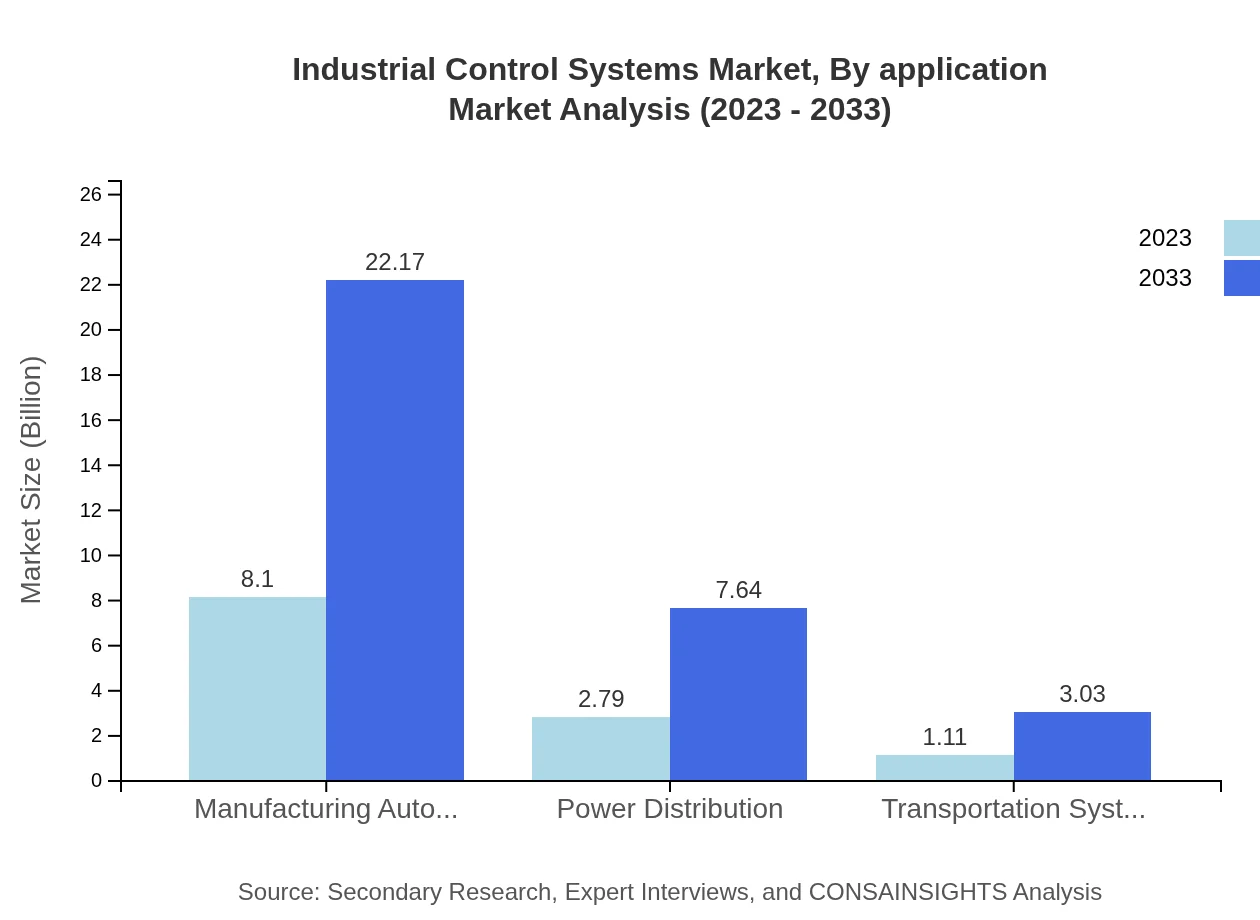

Industrial Control Systems Market Analysis By Application

The application segments for Industrial Control Systems include Oil and Gas, Chemical, Pharmaceuticals, Manufacturing Automation, IoT Integration, Cloud Computing, and Power Distribution. The Oil and Gas segment is significant, expected to maintain a share of 67.51% and grow from $8.10 billion to $22.17 billion by 2033. Other sectors like Chemical and Pharmaceuticals are also crucial, with forecasts ranging from $2.79 billion to $7.64 billion and $1.11 billion to $3.03 billion, respectively.

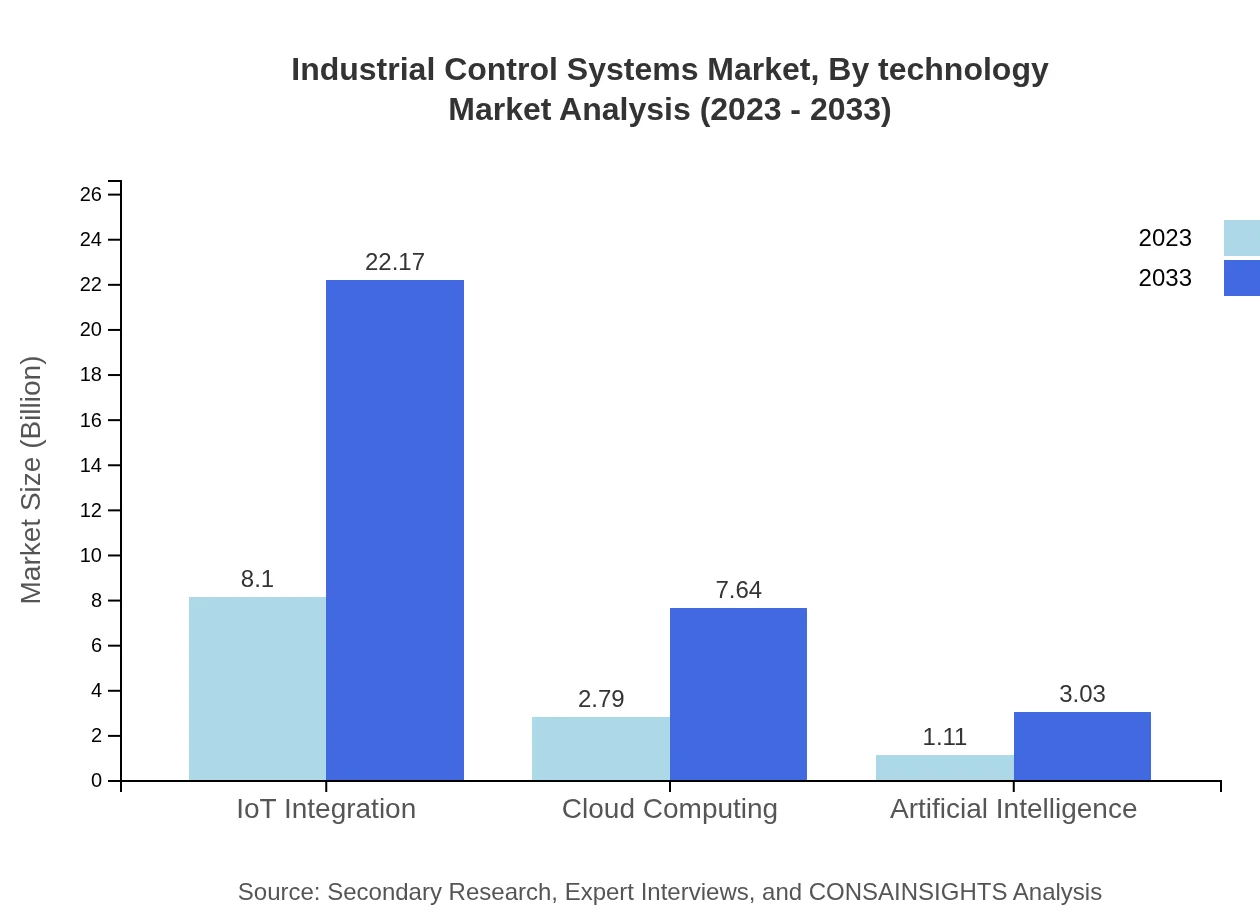

Industrial Control Systems Market Analysis By Technology

Technological advancements are revolutionizing the Industrial Control Systems landscape. The emphasis on IoT integration, artificial intelligence, and cloud computing is reshaping traditional operations. IoT Integration is set to grow from $8.10 billion to $22.17 billion, while Cloud Computing projects a growth from $2.79 billion to $7.64 billion by 2033. These technologies enhance interoperability, real-time monitoring, and data analytics, solidifying their critical role in modern industrial operations.

Industrial Control Systems Market Analysis By End User

End-user industries utilizing Industrial Control Systems span across utilities, energy, manufacturing, and transportation. The Manufacturing Automation sector is a major influencer, projected to grow from $8.10 billion to $22.17 billion by 2033. The transport sector also anticipates significant investments, with a focus on integrating operational control systems into its complex frameworks, aiming for enhanced efficiency and safety.

Industrial Control Systems Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Industrial Control Systems Industry

Siemens AG:

Siemens AG is a global leader in industrial automation and control systems, renowned for its innovative DCS and SCADA solutions. The company focuses on integrating IoT technologies to enhance operational efficiency and safety.Honeywell International Inc.:

Honeywell offers a comprehensive suite of ICS solutions, specialized in providing advanced process controls and safety automation systems, catering to various industries including oil and gas and manufacturing.Schneider Electric:

Schneider Electric specializes in digital transformation of energy management and automation. Their portfolio includes cutting-edge control systems that improve operational performance in industrial applications.Emerson Electric Co.:

Emerson Electric Co. is a multinational corporation that provides engineering services and solutions for a wide range of industrial sectors, focusing majorly on DCS and process automation.Rockwell Automation Inc.:

Rockwell Automation is at the forefront of smart manufacturing with their innovative industrial control and information solutions, ensuring efficiency and safety in industrial processes.We're grateful to work with incredible clients.

FAQs

What is the market size of industrial Control Systems?

The global industrial control systems market is valued at approximately $12 billion in 2023, with an expected CAGR of 10.2% through 2033. This growth reflects increasing demand for automation and enhanced industrial processes worldwide.

What are the key market players or companies in this industrial Control Systems industry?

Key players in the industrial control systems industry include major corporations specializing in automation and control solutions. Their contributions shape the market with innovative technologies for various sectors such as oil & gas, chemicals, and automotive.

What are the primary factors driving the growth in the industrial Control Systems industry?

The growth in the industrial control systems industry is driven by advancements in IoT, demand for automation, and the need for increased operational efficiency. Rising investments in smart manufacturing and digital transformation also play significant roles.

Which region is the fastest Growing in the industrial Control Systems?

The fastest-growing region in the industrial control systems market is North America, projected to grow from $4.55 billion in 2023 to $12.44 billion by 2033. This growth is supported by technological advancements and increased adoption of automated systems.

Does ConsaInsights provide customized market report data for the industrial Control Systems industry?

Yes, ConsaInsights offers customized market reports tailored to specific needs in the industrial control systems sector. This allows clients to access detailed insights relevant to their strategic decision-making.

What deliverables can I expect from this industrial Control Systems market research project?

Clients can expect comprehensive deliverables such as market analysis reports, competitive assessments, regional growth forecasts, and trend analysis, ensuring informed decision-making based on the latest data in the industrial control domain.

What are the market trends of industrial Control Systems?

Current trends in the industrial control systems market include the integration of AI and IoT, a shift towards cloud-based solutions, and increasing focus on cybersecurity for operational technology environments. These trends highlight the industry's evolution towards smarter, safer systems.