Industrial Cooling System Market Report

Published Date: 22 January 2026 | Report Code: industrial-cooling-system

Industrial Cooling System Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Industrial Cooling System market from 2023 to 2033, encompassing insights on market size, trends, segmentation, and regional developments.

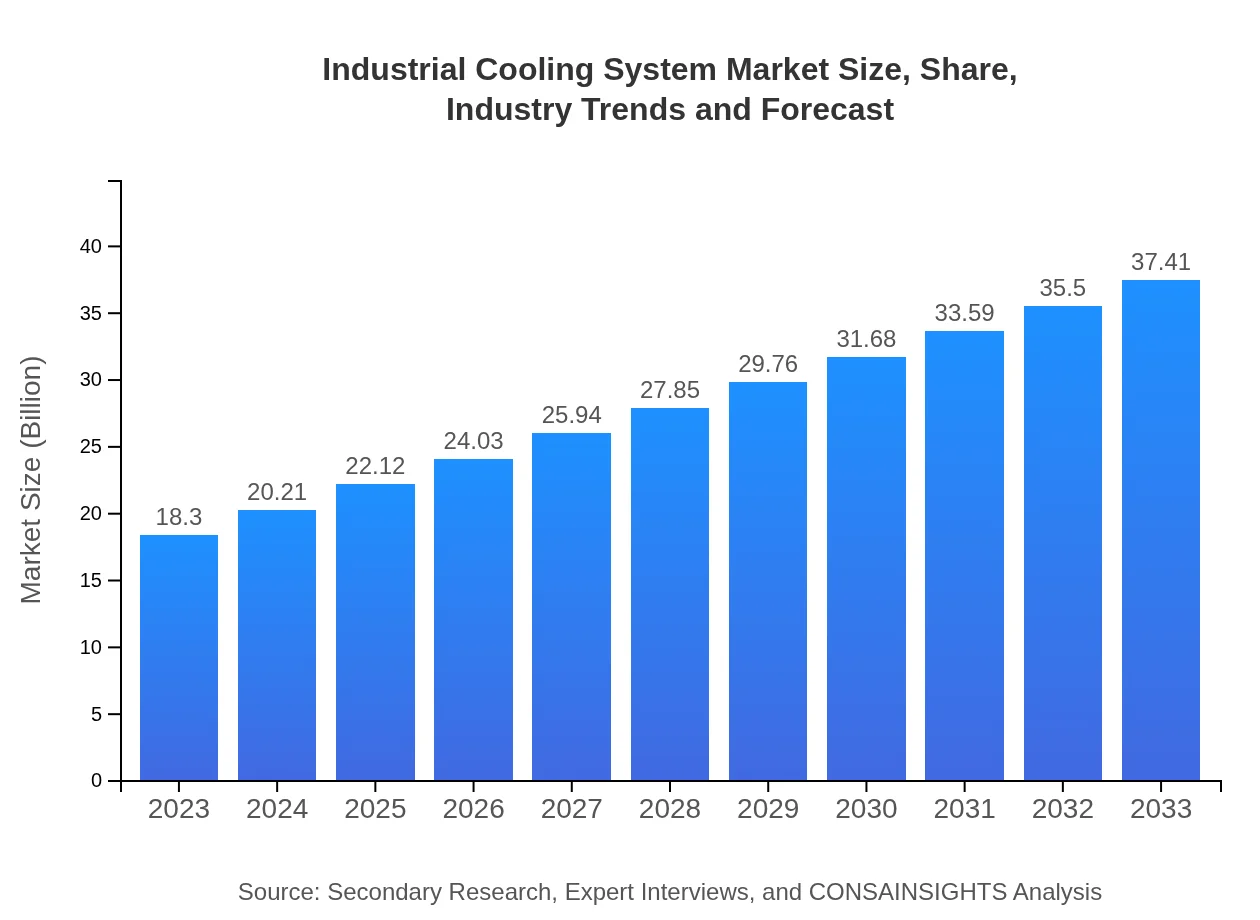

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $18.30 Billion |

| CAGR (2023-2033) | 7.2% |

| 2033 Market Size | $37.41 Billion |

| Top Companies | Carrier Global Corporation, Trane Technologies, Emerson Electric Co., Johnson Controls International Plc, Daikin Industries, Ltd. |

| Last Modified Date | 22 January 2026 |

Industrial Cooling System Market Overview

Customize Industrial Cooling System Market Report market research report

- ✔ Get in-depth analysis of Industrial Cooling System market size, growth, and forecasts.

- ✔ Understand Industrial Cooling System's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Industrial Cooling System

What is the Market Size & CAGR of Industrial Cooling System market in 2023?

Industrial Cooling System Industry Analysis

Industrial Cooling System Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Industrial Cooling System Market Analysis Report by Region

Europe Industrial Cooling System Market Report:

In Europe, the market is anticipated to grow from $4.61 billion in 2023 to $9.43 billion by 2033. The demand for innovative cooling technologies and compliance with environmental standards are key factors driving this growth.Asia Pacific Industrial Cooling System Market Report:

In the Asia Pacific region, the Industrial Cooling System market is projected to grow from $3.62 billion in 2023 to $7.39 billion by 2033. This growth will be driven by increasing industrial activities, rapid urbanization, and technological advancements in manufacturing processes.North America Industrial Cooling System Market Report:

North America is expected to experience significant growth, with the market increasing from $6.93 billion in 2023 to $14.16 billion by 2033. This growth is influenced by stringent energy efficiency regulations and a strong push for sustainable industrial practices.South America Industrial Cooling System Market Report:

The South American market is estimated to rise from $0.83 billion in 2023 to $1.69 billion by 2033. This increase reflects the region's growing industrial sector and the need for efficient cooling solutions.Middle East & Africa Industrial Cooling System Market Report:

The Middle East and Africa market is forecasted to increase from $2.32 billion in 2023 to $4.74 billion by 2033, propelled by infrastructural developments and industrial expansion in the region.Tell us your focus area and get a customized research report.

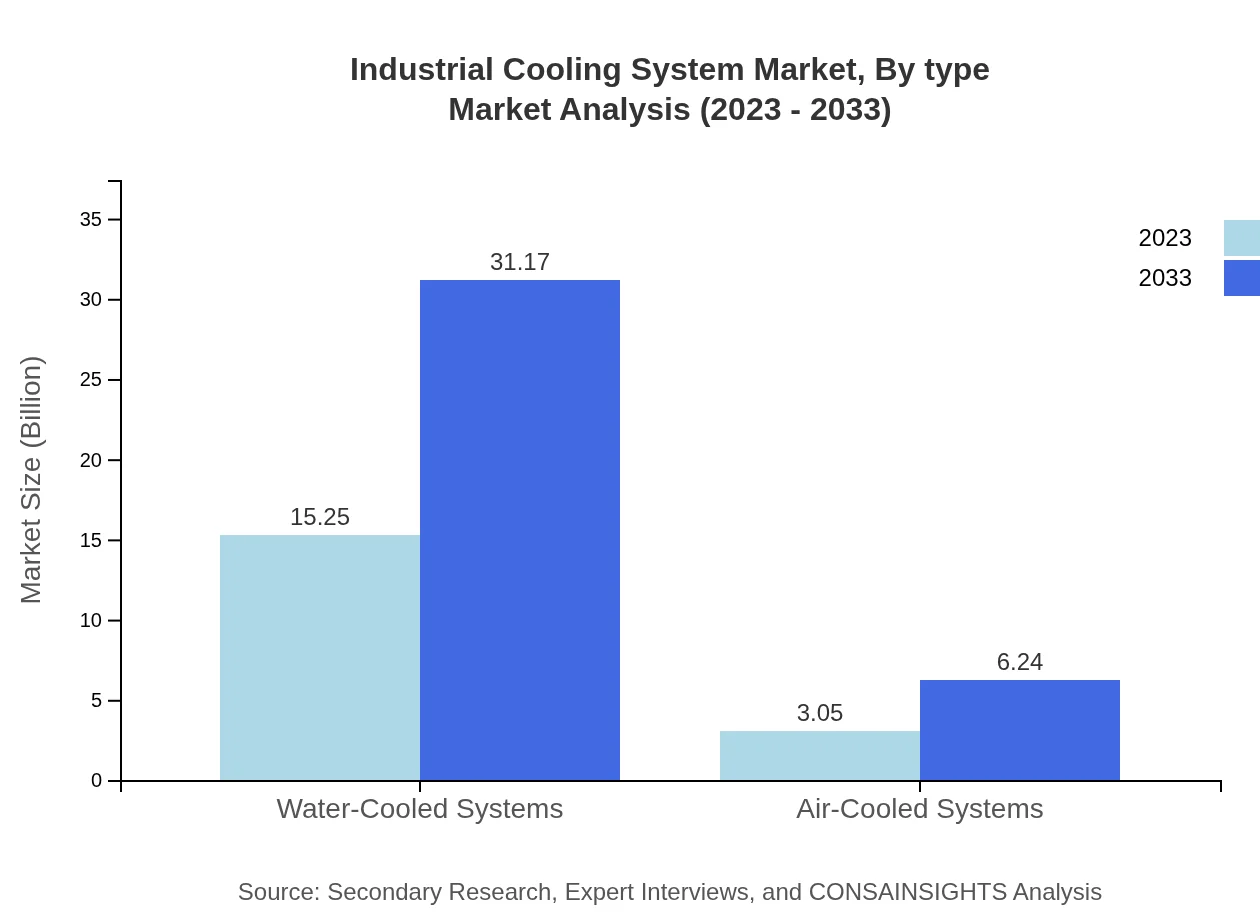

Industrial Cooling System Market Analysis By Type

The analysis indicates that water-cooled systems dominate the market, accounting for a significant share with a market size of $15.25 billion in 2023, expected to grow to $31.17 billion by 2033. Air-cooled systems also contribute notably, starting at $3.05 billion in 2023 and projected to reach $6.24 billion by 2033.

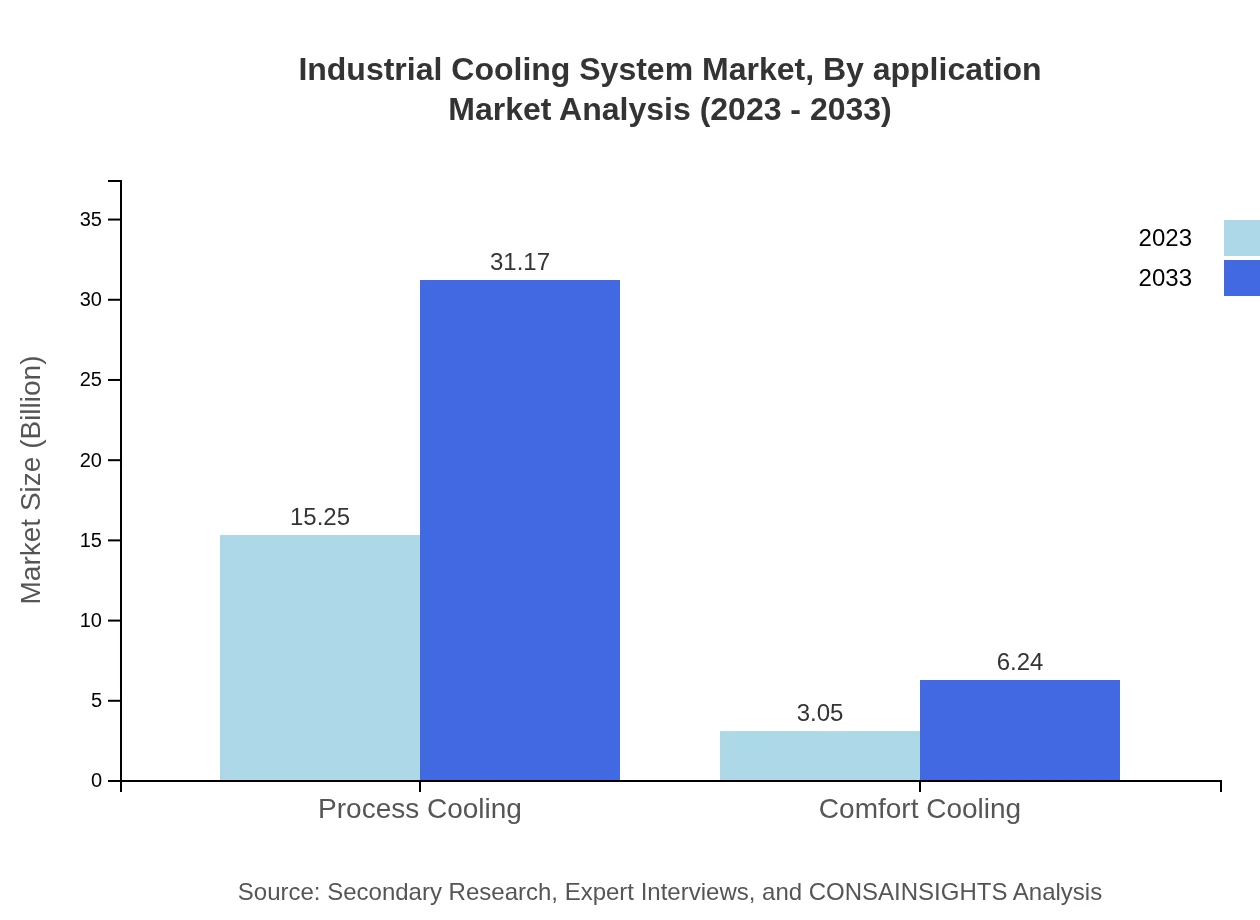

Industrial Cooling System Market Analysis By Application

In terms of application, process cooling takes the lead with a substantial market share, beginning at $15.25 billion in 2023 and anticipated to rise to $31.17 billion by 2033. Comfort cooling applications are smaller, starting at $3.05 billion and growing to $6.24 billion over the same period.

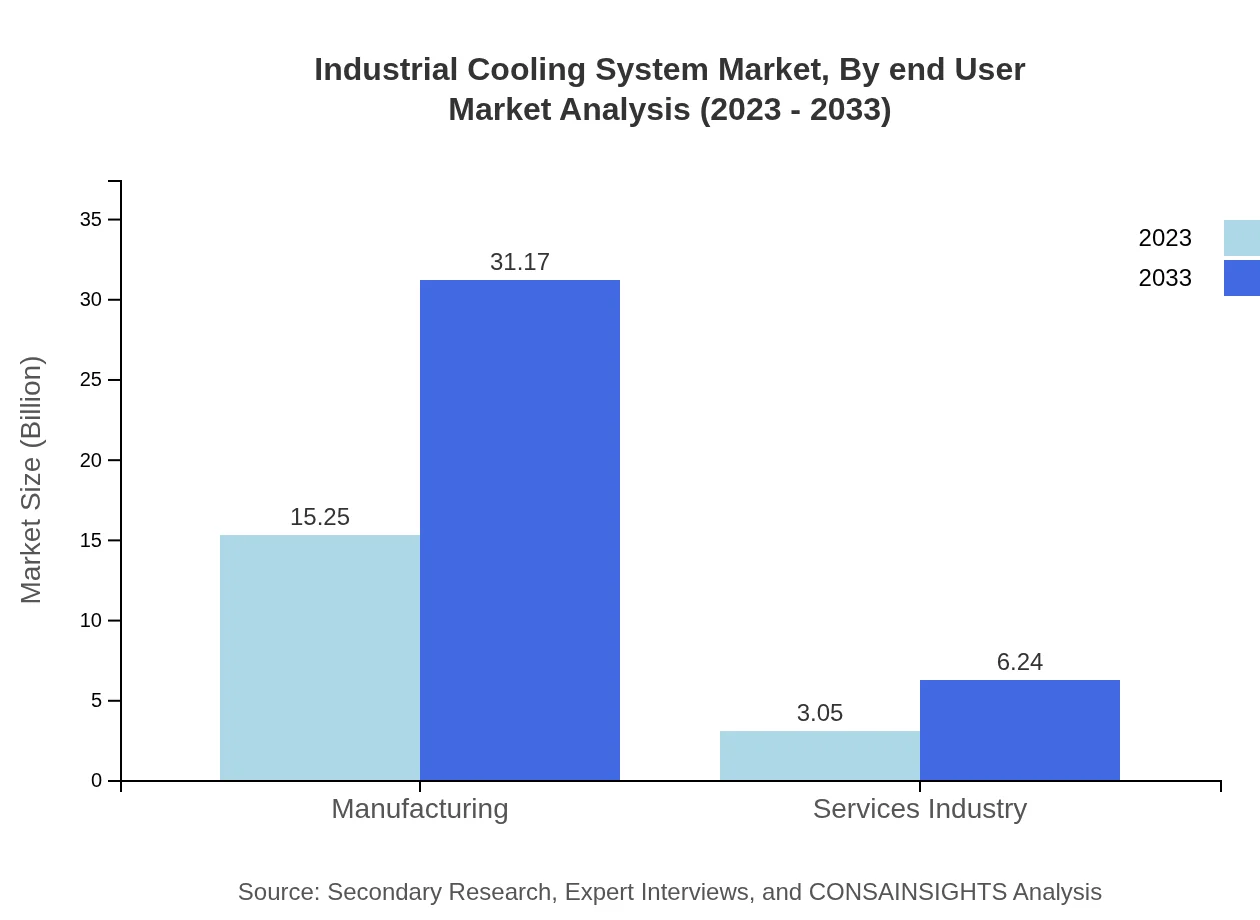

Industrial Cooling System Market Analysis By End User

Manufacturing is the primary end-user of industrial cooling systems, accounting for 83.33% of the market share in both 2023 and 2033, with a market size projected to grow from $15.25 billion to $31.17 billion. The services industry, although smaller, shows robust growth potential, moving from $3.05 billion to $6.24 billion.

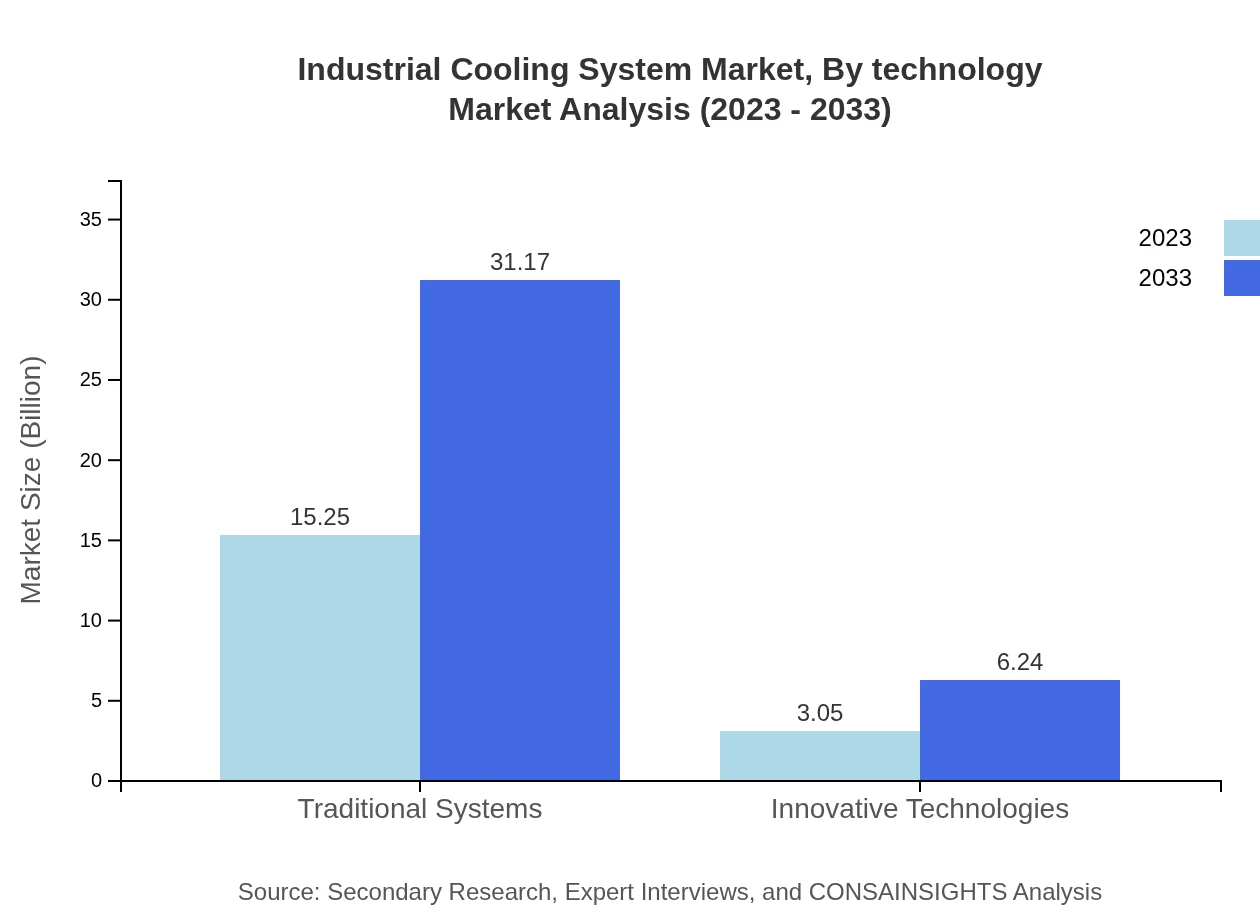

Industrial Cooling System Market Analysis By Technology

The segment analysis reveals that traditional cooling systems retain the largest market share at 83.33%, reflecting their critical role in the industry. However, innovative technologies are gaining traction, with a projected size increase from $3.05 billion in 2023 to $6.24 billion in 2033.

Industrial Cooling System Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Industrial Cooling System Industry

Carrier Global Corporation:

A leading provider of heating, ventilating, and air conditioning (HVAC) systems, Carrier is known for its innovative cooling solutions and commitment to sustainability.Trane Technologies:

Trane is recognized for its energy-efficient HVAC systems and advanced cooling technologies that enhance operational performance in various industrial sectors.Emerson Electric Co.:

Specializing in automation technology and electronic solutions, Emerson offers products and services related to industrial cooling systems across multiple sectors.Johnson Controls International Plc:

Johnson Controls provides numerous technologies related to HVAC and industrial cooling with a focus on smart building solutions and energy efficiency.Daikin Industries, Ltd.:

Daikin is a global leader in air conditioning and cooling solutions, known for its innovative products and extensive service offerings.We're grateful to work with incredible clients.

FAQs

What is the market size of industrial cooling system?

The industrial cooling system market is currently valued at $18.3 billion with a projected CAGR of 7.2% from 2023 to 2033. This growth reflects increasing industrial demands for efficient cooling solutions.

What are the key market players or companies in this industrial cooling system industry?

The industrial cooling system landscape features major players including Carrier, Trane, and Johnson Controls. These companies lead through innovation and sustainable technology, addressing growing energy efficiency demands.

What are the primary factors driving the growth in the industrial cooling system industry?

Key factors boosting growth include rising industrial production, stricter environmental regulations, and advancements in energy-efficient technologies. Demand for reliable cooling solutions in energy-intensive industries further propels market expansion.

Which region is the fastest Growing in the industrial cooling system?

North America is anticipated to be the fastest-growing region in the industrial cooling system market. With a market increase from $6.93 billion in 2023 to $14.16 billion by 2033, it showcases substantial investment in infrastructure.

Does ConsaInsights provide customized market report data for the industrial cooling system industry?

Yes, ConsaInsights offers tailored market report data for the industrial cooling system industry, helping clients gain insights specific to their business needs, enabling informed decision-making.

What deliverables can I expect from this industrial cooling system market research project?

From this market research project, you can expect comprehensive reports detailing market size, trends, competitor analysis, and forecasts, along with strategic recommendations tailored to your business objectives.

What are the market trends of industrial cooling system?

Current market trends indicate a shift towards innovative cooling technologies, increased automation, and integration of IoT for enhanced efficiency. Sustainability is also a core focus, driving investment in eco-friendly cooling solutions.