Industrial Direct Radiography Market Report

Published Date: 31 January 2026 | Report Code: industrial-direct-radiography

Industrial Direct Radiography Market Size, Share, Industry Trends and Forecast to 2033

This report provides an insightful analysis of the Industrial Direct Radiography market for the forecast years 2023 to 2033, highlighting key trends, market segments, and regional insights essential for stakeholders and investors.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

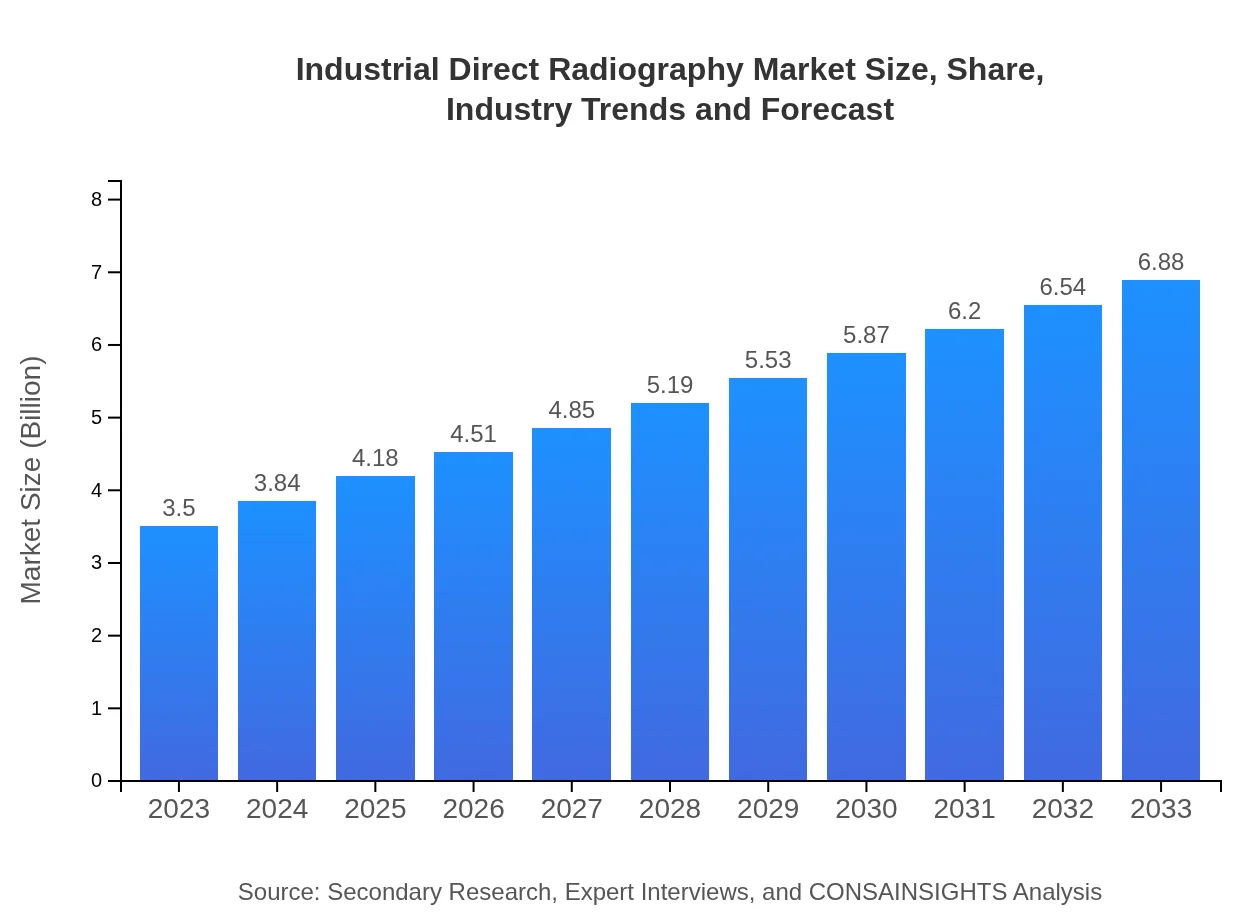

| 2023 Market Size | $3.50 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $6.88 Billion |

| Top Companies | GE Inspection Technologies, Siemens Healthineers, Carestream Health, Fujifilm |

| Last Modified Date | 31 January 2026 |

Industrial Direct Radiography Market Overview

Customize Industrial Direct Radiography Market Report market research report

- ✔ Get in-depth analysis of Industrial Direct Radiography market size, growth, and forecasts.

- ✔ Understand Industrial Direct Radiography's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Industrial Direct Radiography

What is the Market Size & CAGR of Industrial Direct Radiography market in 2023?

Industrial Direct Radiography Industry Analysis

Industrial Direct Radiography Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Industrial Direct Radiography Market Analysis Report by Region

Europe Industrial Direct Radiography Market Report:

The European market is expected to rise significantly from $1.04 billion in 2023 to $2.05 billion by 2033, due to increased regulatory measures and the push for digital solutions in industrial applications.Asia Pacific Industrial Direct Radiography Market Report:

The Asia Pacific region is projected to grow from $0.69 billion in 2023 to $1.36 billion by 2033. This growth is driven by increasing industrialization and demand for advanced manufacturing processes across emerging economies.North America Industrial Direct Radiography Market Report:

North America is anticipated to grow from $1.17 billion in 2023 to $2.31 billion by 2033. This region remains dominant due to established industries such as aerospace and automotive which heavily rely on direct radiography for quality assurance.South America Industrial Direct Radiography Market Report:

South America’s market size is expected to expand from $0.25 billion in 2023 to $0.49 billion in 2033, supported by investments in infrastructure and energy sectors which require non-destructive testing solutions.Middle East & Africa Industrial Direct Radiography Market Report:

The market in the Middle East and Africa is moving from $0.34 billion in 2023 to $0.67 billion in 2033, largely owing to the expansion of oil and gas explorations that call for effective inspection technologies.Tell us your focus area and get a customized research report.

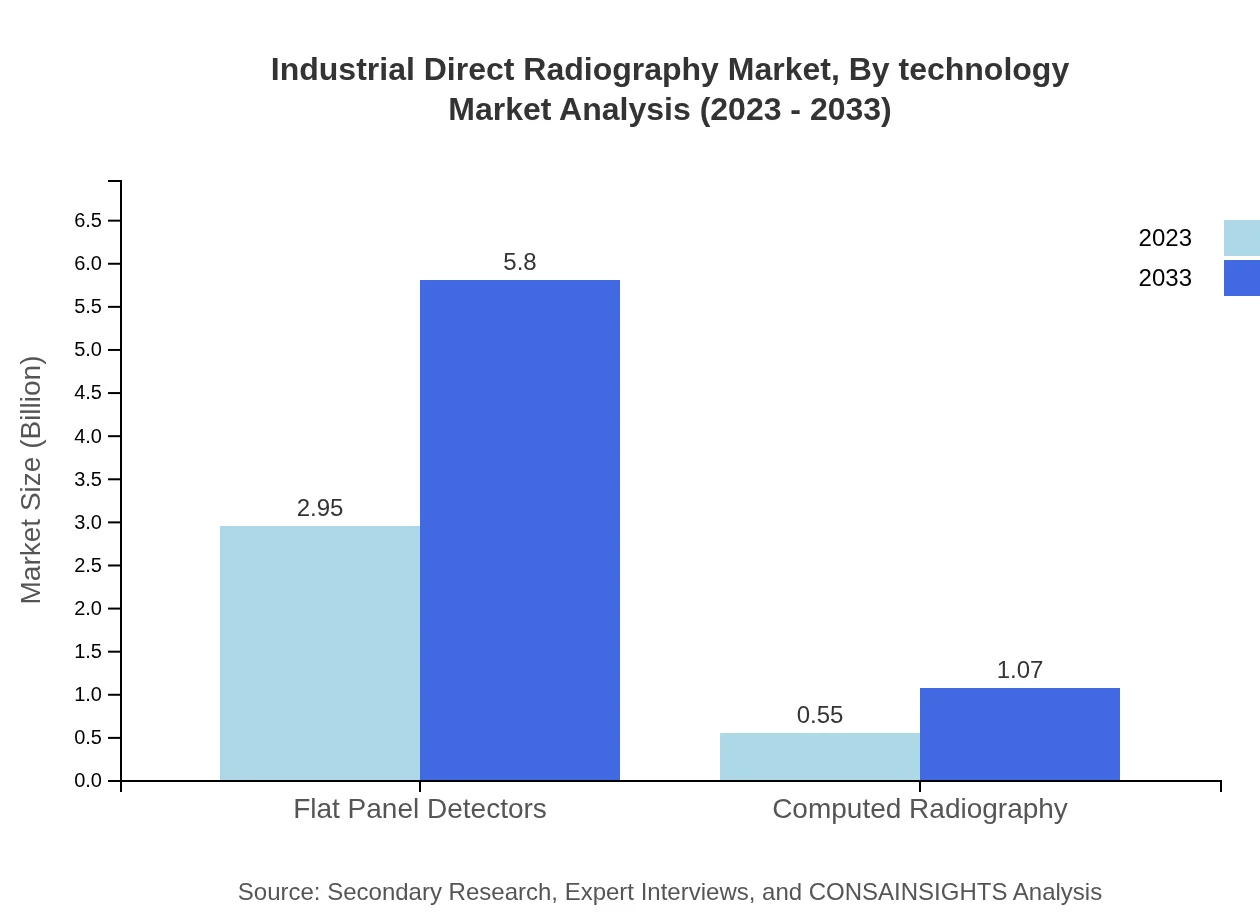

Industrial Direct Radiography Market Analysis By Technology

Digital radiography dominates the Industrial Direct Radiography market and is expected to grow from $2.95 billion in 2023 to $5.80 billion by 2033, while computed radiography is projected to increase from $0.55 billion to $1.07 billion in the same period.

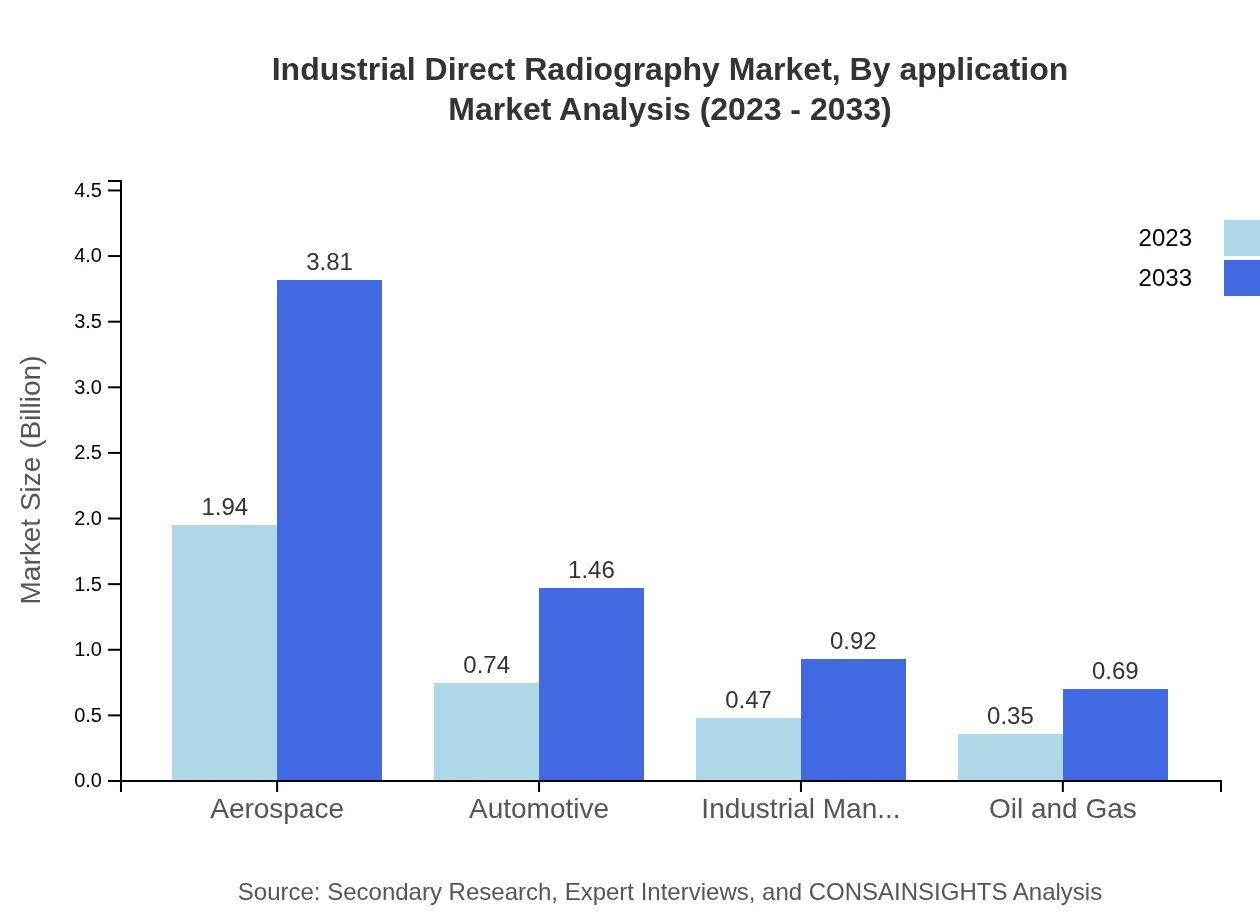

Industrial Direct Radiography Market Analysis By Application

The aerospace industry leads the market, expected to rise from $1.94 billion in 2023 to $3.81 billion by 2033. The manufacturing industry follows, growing from $0.74 billion to $1.46 billion, and the construction industry is projected to go from $0.47 billion to $0.92 billion.

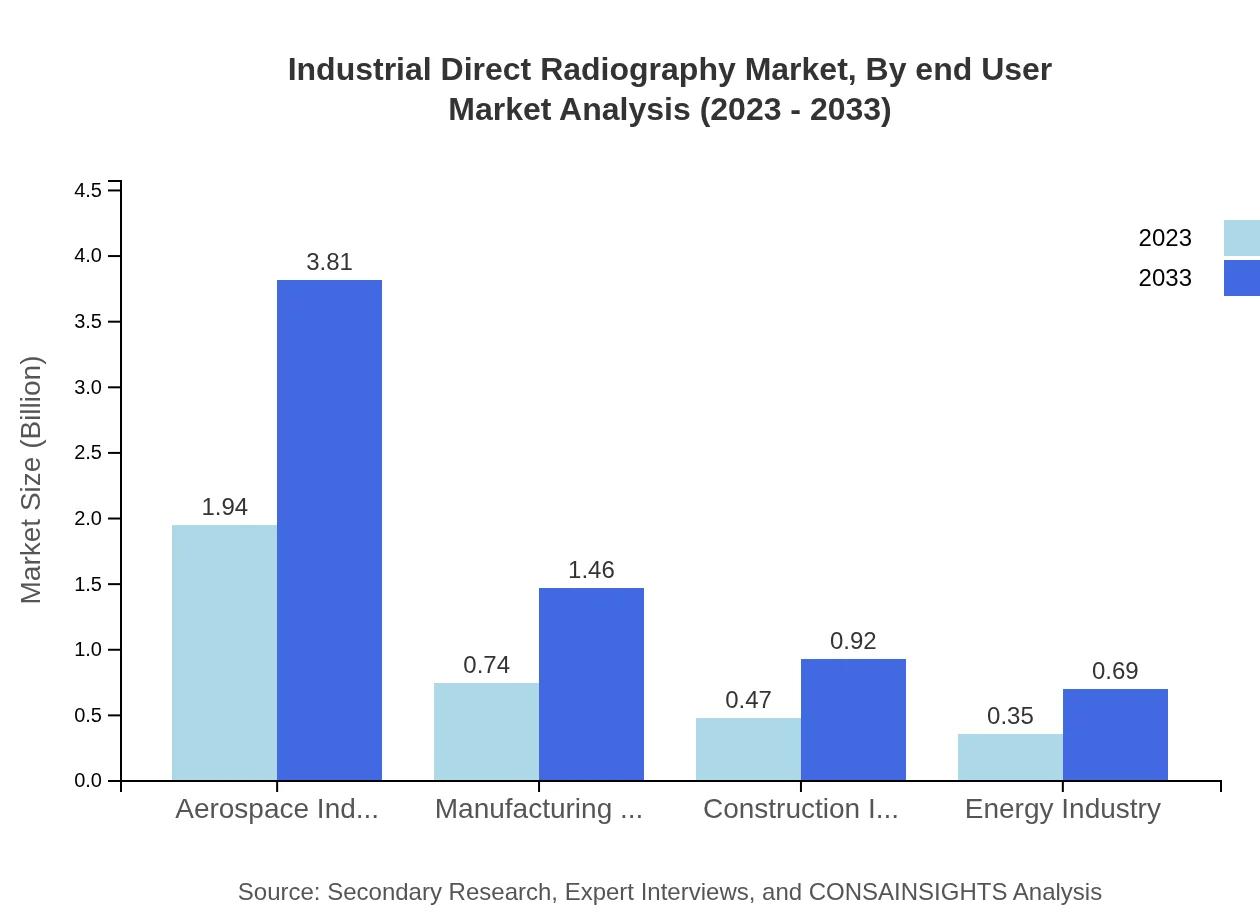

Industrial Direct Radiography Market Analysis By End User

Aerospace accounts for approximately 55.41% market share in 2023, while automotive holds about 21.19%. The industrial manufacturing sector, including heavy machinery and construction, represents around 13.33%. Energy, including oil and gas, maintains a steady share of 10.07%.

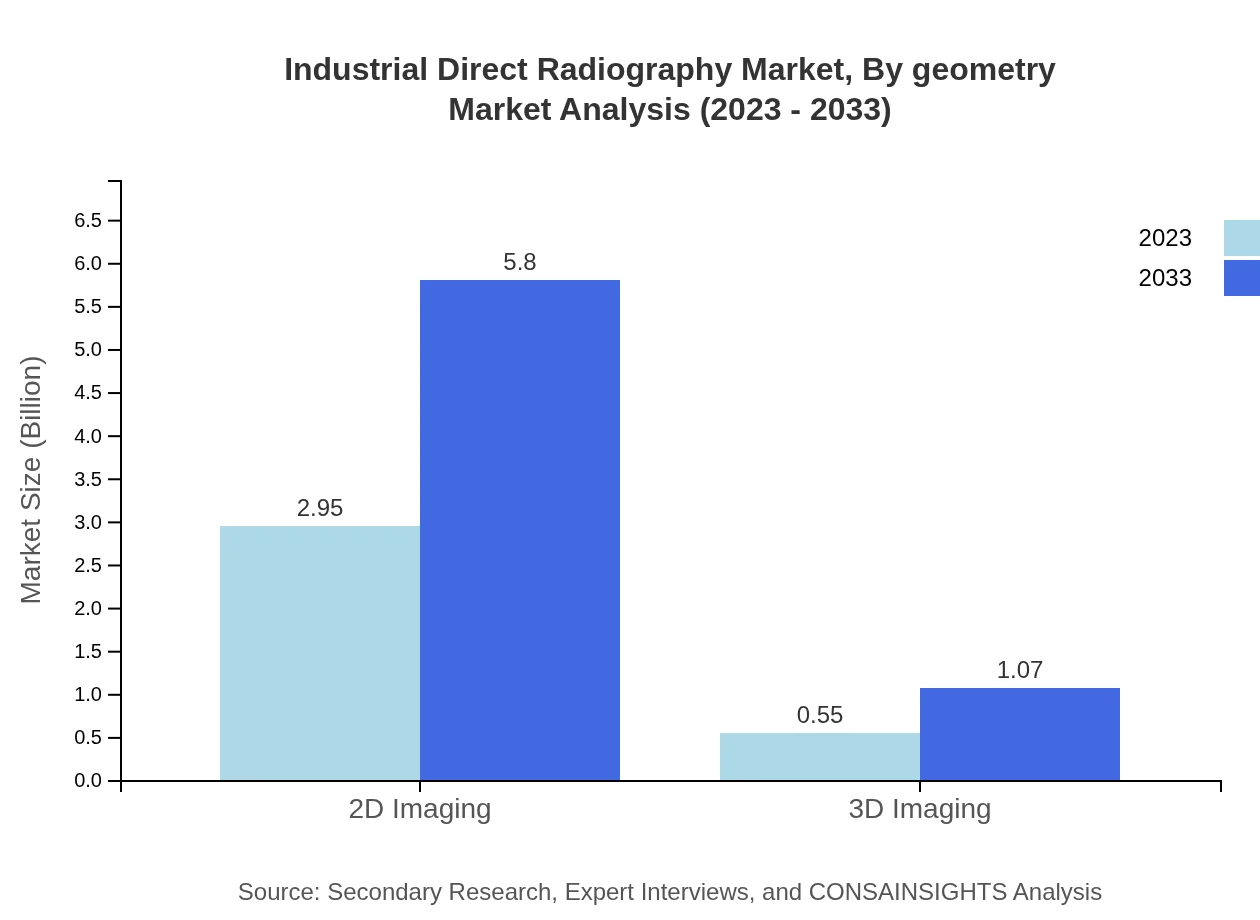

Industrial Direct Radiography Market Analysis By Geometry

2D imaging technology holds a significant market share of 84.38% in 2023, while 3D imaging technology, though smaller, is gaining traction with growth from $0.55 billion to $1.07 billion by 2033.

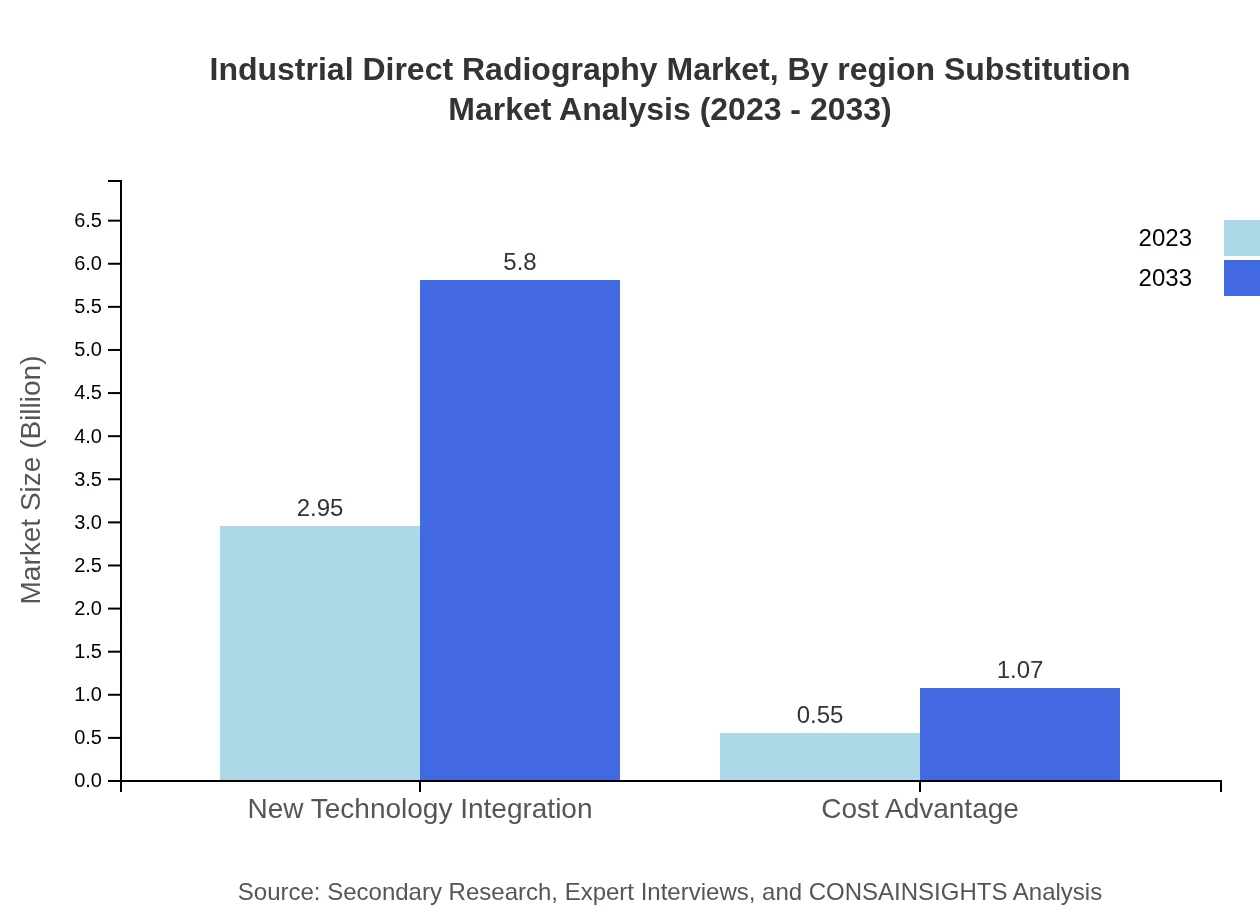

Industrial Direct Radiography Market Analysis By Region Substitution

The market reflects a notable substitution increase as digital systems replace traditional methods. A high adoption rate of new technology integration is observed, particularly in North America and Europe, indicating a shift towards increased efficiency in radiographic testing.

Industrial Direct Radiography Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Industrial Direct Radiography Industry

GE Inspection Technologies:

A leading provider of non-destructive testing solutions, known for its innovation in radiography technology and commitment to quality.Siemens Healthineers:

Offers a wide range of imaging and diagnostic solutions, including direct radiography systems tailored for industrial applications.Carestream Health:

Specializes in digital imaging and healthcare solutions, contributing significantly to the industrial imaging market with state-of-the-art direct radiography products.Fujifilm:

Known for its advancement in imaging technologies, Fujifilm's products in this sector focus on quality assurance in various industries.We're grateful to work with incredible clients.

FAQs

What is the market size of industrial direct radiography?

The industrial direct radiography market is currently valued at approximately $3.5 billion, with a projected CAGR of 6.8% from 2023 to 2033.

What are the key market players or companies in this industrial direct radiography industry?

Key players in the industrial direct radiography market include companies such as GE Inspection Technologies, Nikon Corporation, and Fujifilm. These industry leaders are known for innovation and offering advanced radiography solutions.

What are the primary factors driving the growth in the industrial direct radiography industry?

The growth in the industrial direct radiography industry is driven by technological advancements, increasing demand for non-destructive testing methods, and stringent safety regulations across various sectors.

Which region is the fastest Growing in the industrial direct radiography?

The fastest-growing region in the industrial direct radiography market is North America, with a market size projected to grow from $1.17 billion in 2023 to $2.31 billion by 2033.

Does ConsaInsights provide customized market report data for the industrial direct radiography industry?

Yes, ConsaInsights offers customized market report data tailored to clients' specific needs in the industrial direct radiography sector, ensuring relevant insights.

What deliverables can I expect from this industrial direct radiography market research project?

Deliverables from the industrial direct radiography market research project include comprehensive market analysis reports, data visualizations, segment analysis, and competitive landscape reviews.

What are the market trends of industrial direct radiography?

Current market trends include the increasing adoption of digital radiography solutions, growing investment in automation, and a heightened focus on improving inspection efficiency and accuracy.