Industrial Display Market Report

Published Date: 31 January 2026 | Report Code: industrial-display

Industrial Display Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Industrial Display market from 2023 to 2033. It includes market size, growth projections, industry insights, and regional trends essential for stakeholders to understand the current landscape and future opportunities.

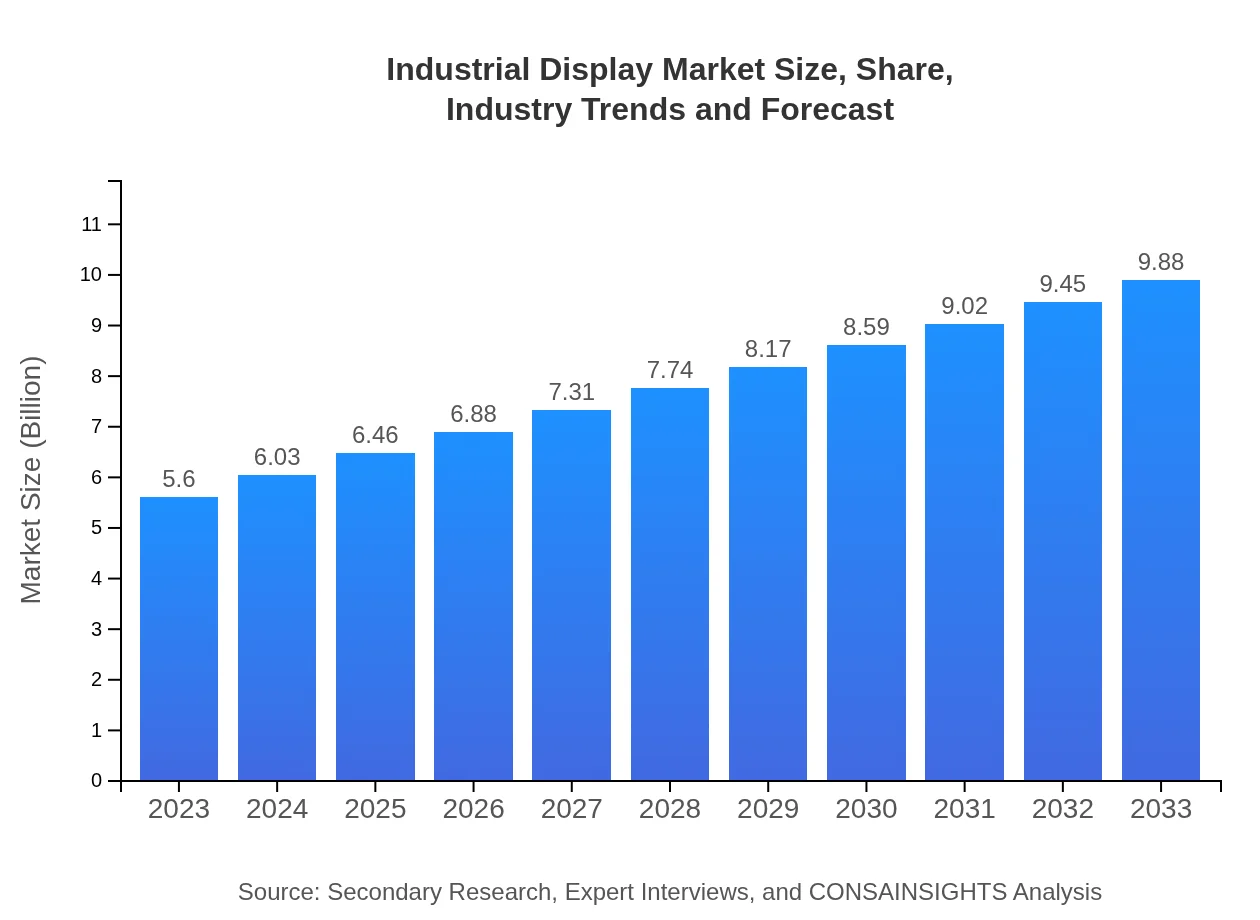

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.60 Billion |

| CAGR (2023-2033) | 5.7% |

| 2033 Market Size | $9.88 Billion |

| Top Companies | Samsung Display, LG Display, Deloitte, Sharp Corporation |

| Last Modified Date | 31 January 2026 |

Industrial Display Market Overview

Customize Industrial Display Market Report market research report

- ✔ Get in-depth analysis of Industrial Display market size, growth, and forecasts.

- ✔ Understand Industrial Display's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Industrial Display

What is the Market Size & CAGR of Industrial Display market in 2023?

Industrial Display Industry Analysis

Industrial Display Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Industrial Display Market Analysis Report by Region

Europe Industrial Display Market Report:

The European market is anticipated to grow from $1.88 billion in 2023 to $3.31 billion in 2033. Increased regulations in manufacturing standards and innovations in display technology are key drivers in this region, especially in countries like Germany and France.Asia Pacific Industrial Display Market Report:

The Asia Pacific region is projected to grow from $0.98 billion in 2023 to $1.73 billion in 2033. This rapid growth is attributed to the massive industrial sector in countries like China and Japan, driving demand for advanced display technologies to improve operational efficiencies in manufacturing and transportation.North America Industrial Display Market Report:

North America currently leads the Industrial Display market, projected to rise from $1.97 billion in 2023 to $3.48 billion in 2033. The growth is fueled by major industries like automotive and pharmaceuticals investing in advanced display systems for automation and improved logistics.South America Industrial Display Market Report:

In South America, the market is expected to increase from $0.18 billion in 2023 to $0.32 billion by 2033, supported by initiatives in digital transformation across various industries. However, economic challenges may affect growth rates.Middle East & Africa Industrial Display Market Report:

The Middle East and Africa market is set to move from $0.58 billion in 2023 to $1.03 billion in 2033. Growth is being driven by investments in the transportation and energy sectors, necessitating advanced display technologies for improved safety and efficiency.Tell us your focus area and get a customized research report.

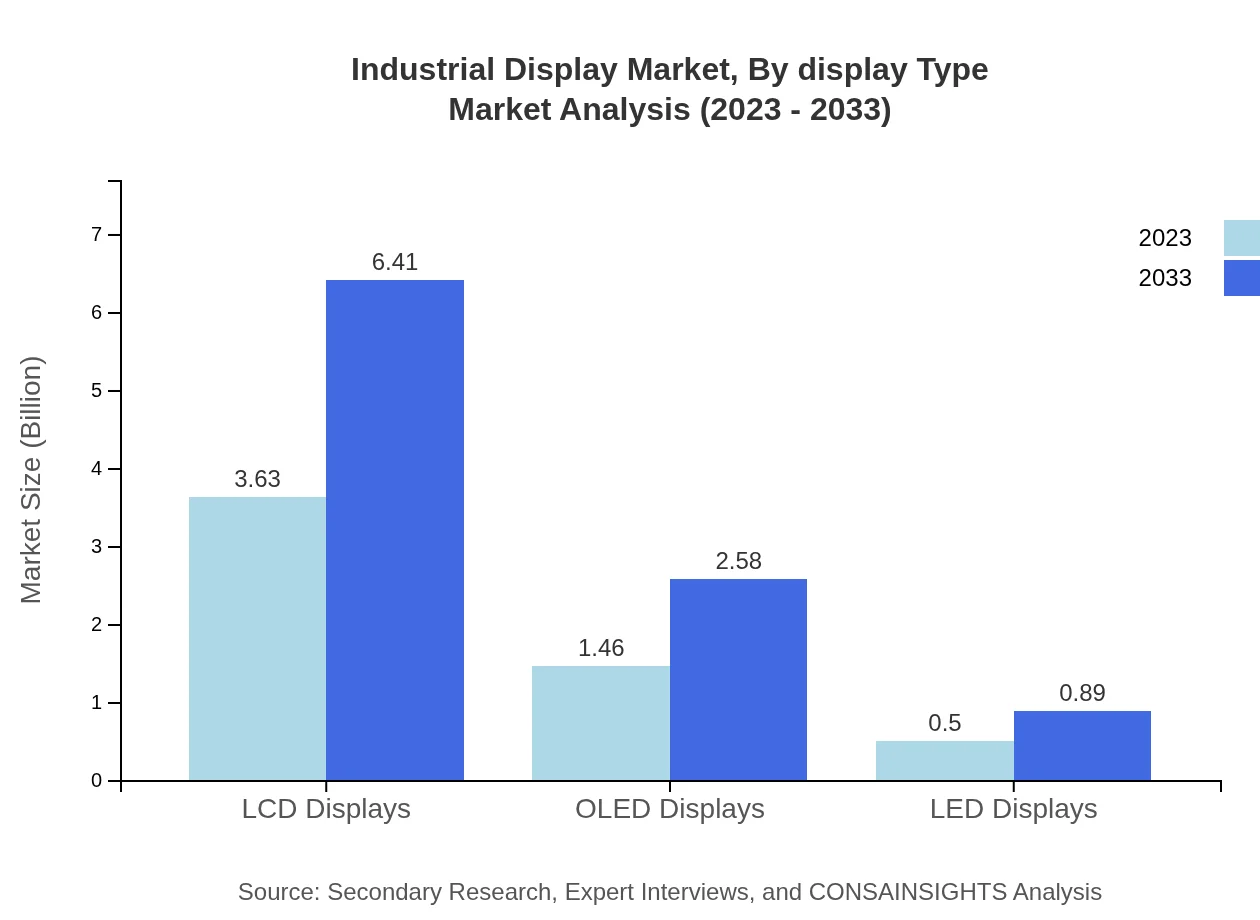

Industrial Display Market Analysis By Display Type

The Industrial Display market, segmented by display type, is primarily driven by LCDs, accounting for $3.63 billion in 2023 and expected to reach $6.41 billion by 2033. OLED displays, while currently $1.46 billion, are anticipated to grow to $2.58 billion, while LED displays represent a smaller segment with a rise from $0.50 billion to $0.89 billion.

Industrial Display Market Analysis By Application

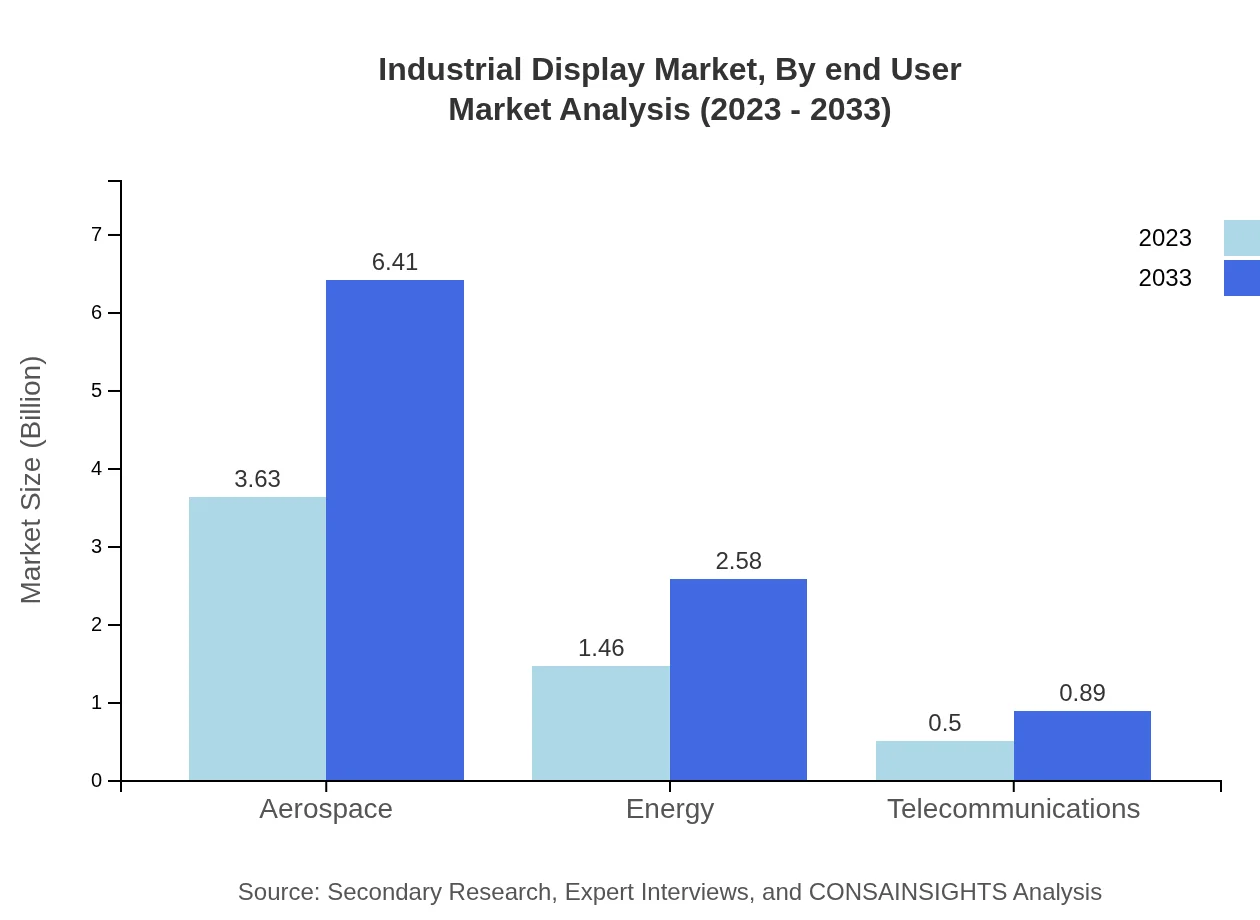

By application, the aerospace sector demands advanced displays, valued at $3.63 billion in 2023 and expected to grow to $6.41 billion by 2033. Energy applications will also show significant growth from $1.46 billion to $2.58 billion, while telecommunications and medical fields will exhibit growth from $0.50 billion to $0.89 billion.

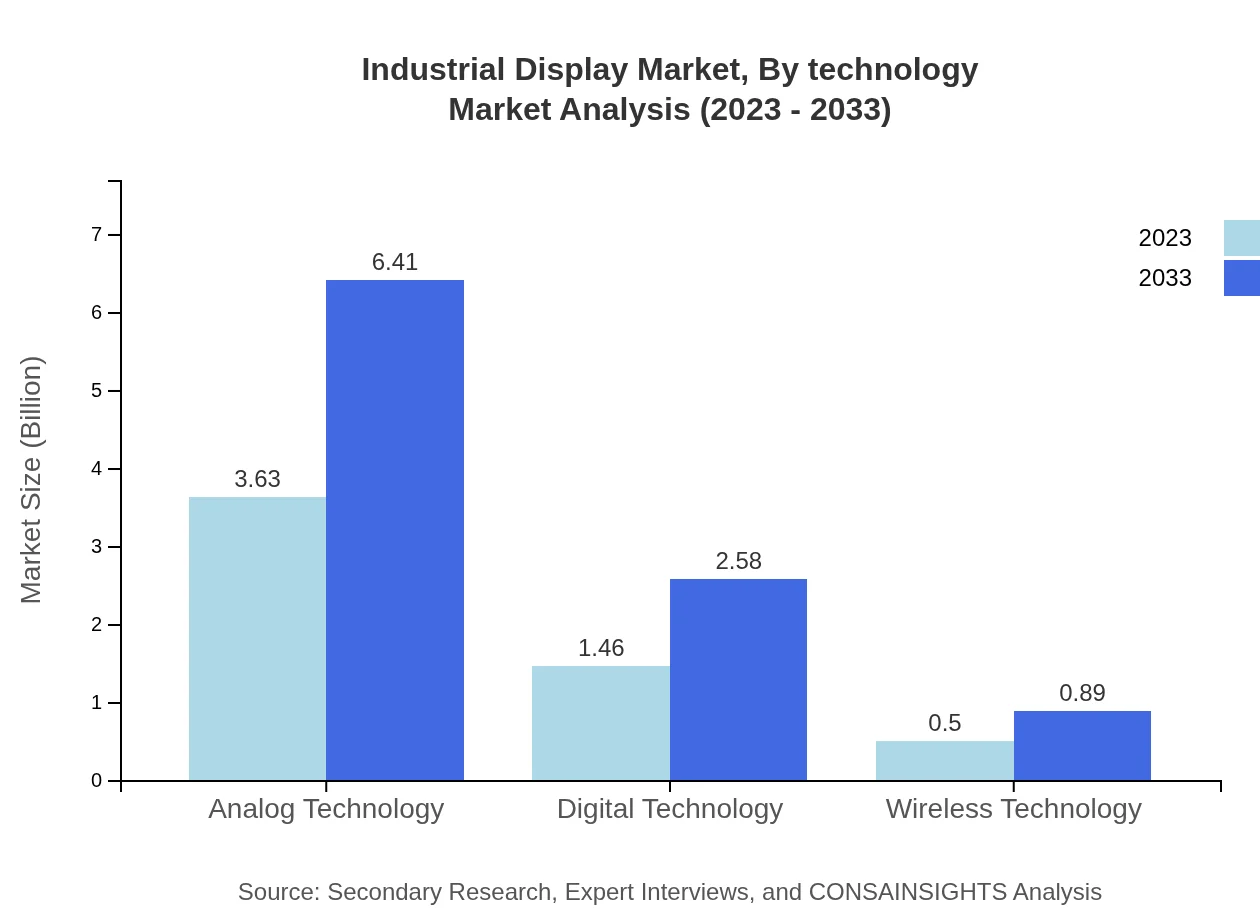

Industrial Display Market Analysis By Technology

The market segments by technology show analog technology leading with $3.63 billion in 2023, growing to $6.41 billion by 2033. Digital technology provides a competitive edge with growth from $1.46 billion to $2.58 billion. Wireless technology remains a minor segment at $0.50 billion, projected to reach $0.89 billion by 2033.

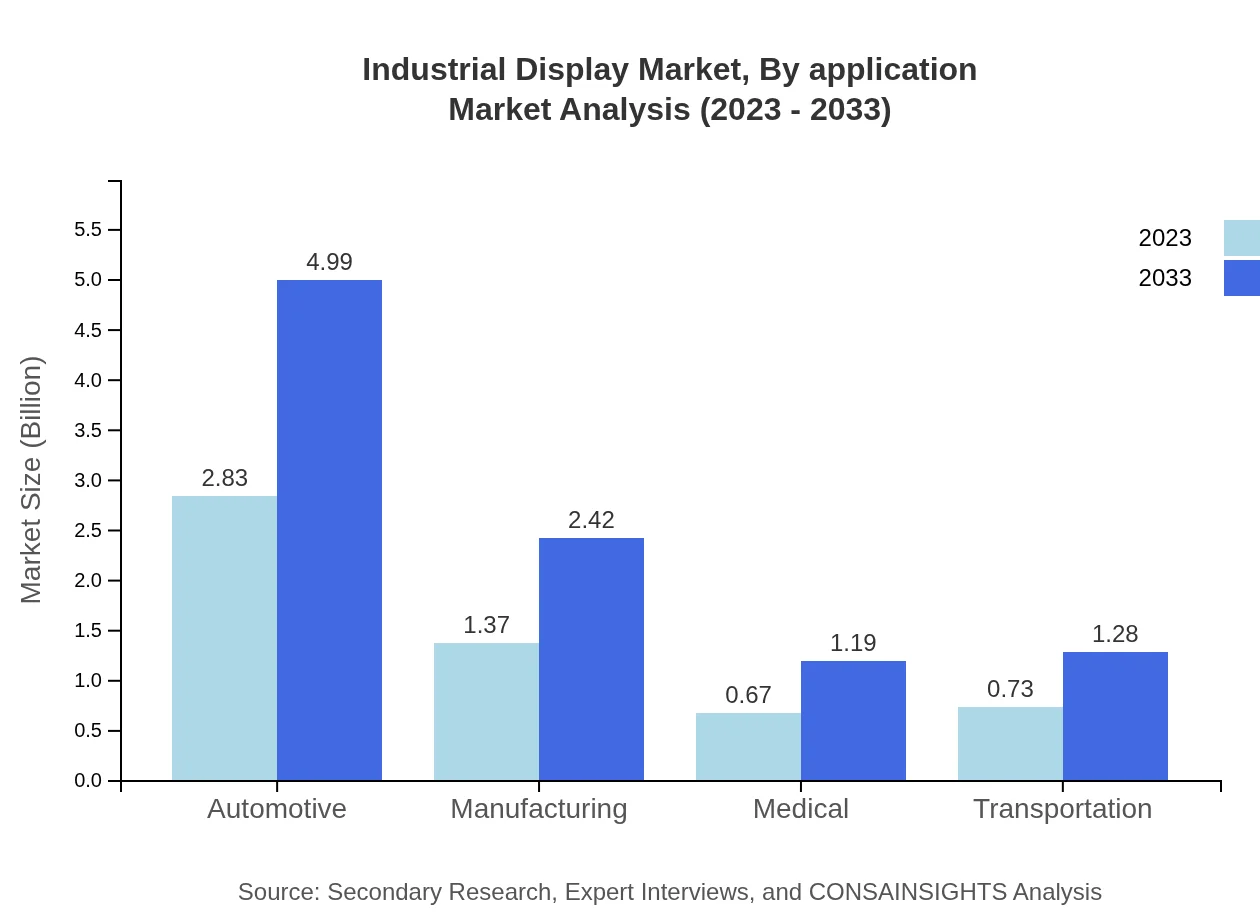

Industrial Display Market Analysis By End User

Industries such as automotive lead with $2.83 billion in 2023, growing to $4.99 billion by 2033, demonstrating the drive for advanced display interfaces in the automotive sector. Manufacturing follows at $1.37 billion, expected to increase to $2.42 billion, while medical applications expand from $0.67 billion to $1.19 billion.

Industrial Display Market Analysis By Channel

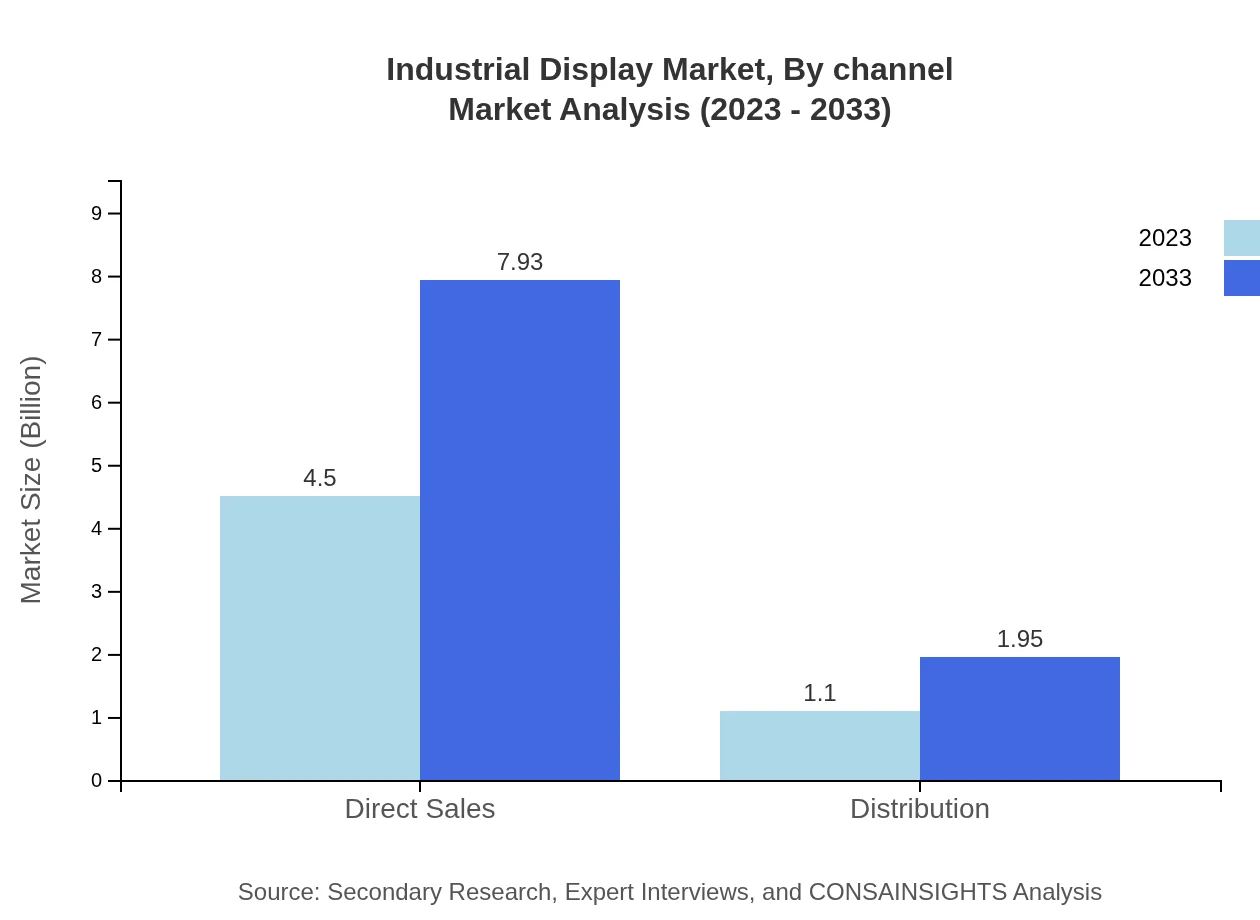

Direct sales dominate the distribution channel, valued at $4.50 billion in 2023, anticipated to grow to $7.93 billion by 2033. Distribution channels will increase from $1.10 billion to $1.95 billion, reflecting the market's growing outreach and penetration initiatives.

Industrial Display Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Industrial Display Industry

Samsung Display:

Samsung Display is a leading manufacturer known for its cutting-edge display technology across various segments, including OLED, LCD, and LED displays, serving multiple industrial applications.LG Display:

LG Display specializes in large-size panels and is renowned for innovations in OLED technology, focusing on energy efficiency and high-resolution displays for industrial environments.Deloitte:

Deloitte provides strategic insights and consulting services focusing on helping companies leverage display technology for enhanced operational capabilities and industrial automation.Sharp Corporation:

Sharp is recognized for its diverse range of display products, particularly in industrial applications, contributing to advancements in display technologies and manufacturing processes.We're grateful to work with incredible clients.

FAQs

What is the market size of industrial Display?

The industrial display market is currently valued at approximately $5.6 billion in 2023, with a projected CAGR of 5.7%, indicating a robust growth trajectory over the next decade. The market is expected to expand significantly by 2033.

What are the key market players or companies in this industrial Display industry?

Key players in the industrial display market include major companies like Samsung Electronics, LG Display, and Panasonic. These companies focus on innovation and technological advancements to meet growing consumer demands and enhance market presence.

What are the primary factors driving the growth in the industrial Display industry?

The growth in the industrial display market is primarily driven by rising demand for automation, technological advancements, and increased investments in manufacturing sectors. Additionally, the expansion of smart cities and infrastructure projects further fuels demand.

Which region is the fastest Growing in the industrial Display?

Asia Pacific is the fastest-growing region in the industrial display market, with a projected increase from $0.98 billion in 2023 to $1.73 billion by 2033. This growth is propelled by rapid industrialization and urbanization in emerging economies.

Does ConsaInsights provide customized market report data for the industrial Display industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the industrial display industry. Clients can request specific segments, regions, or trends for more targeted insights.

What deliverables can I expect from this industrial Display market research project?

From the industrial display market research project, you can expect comprehensive reports including market size data, growth forecasts, competitor analysis, and insights into market trends and consumer behavior across different regions.

What are the market trends of industrial Display?

Current trends in the industrial display market include a shift towards digital technology, a growing demand for OLED and LED displays, and increased integration of interactive display solutions in various sectors.