Industrial Gas Turbine Market Report

Published Date: 22 January 2026 | Report Code: industrial-gas-turbine

Industrial Gas Turbine Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Industrial Gas Turbine market, examining trends, growth prospects, and forecasts from 2023 to 2033. It offers insights into market size, segmentation, regional performance, and technological advancements shaping the industry.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

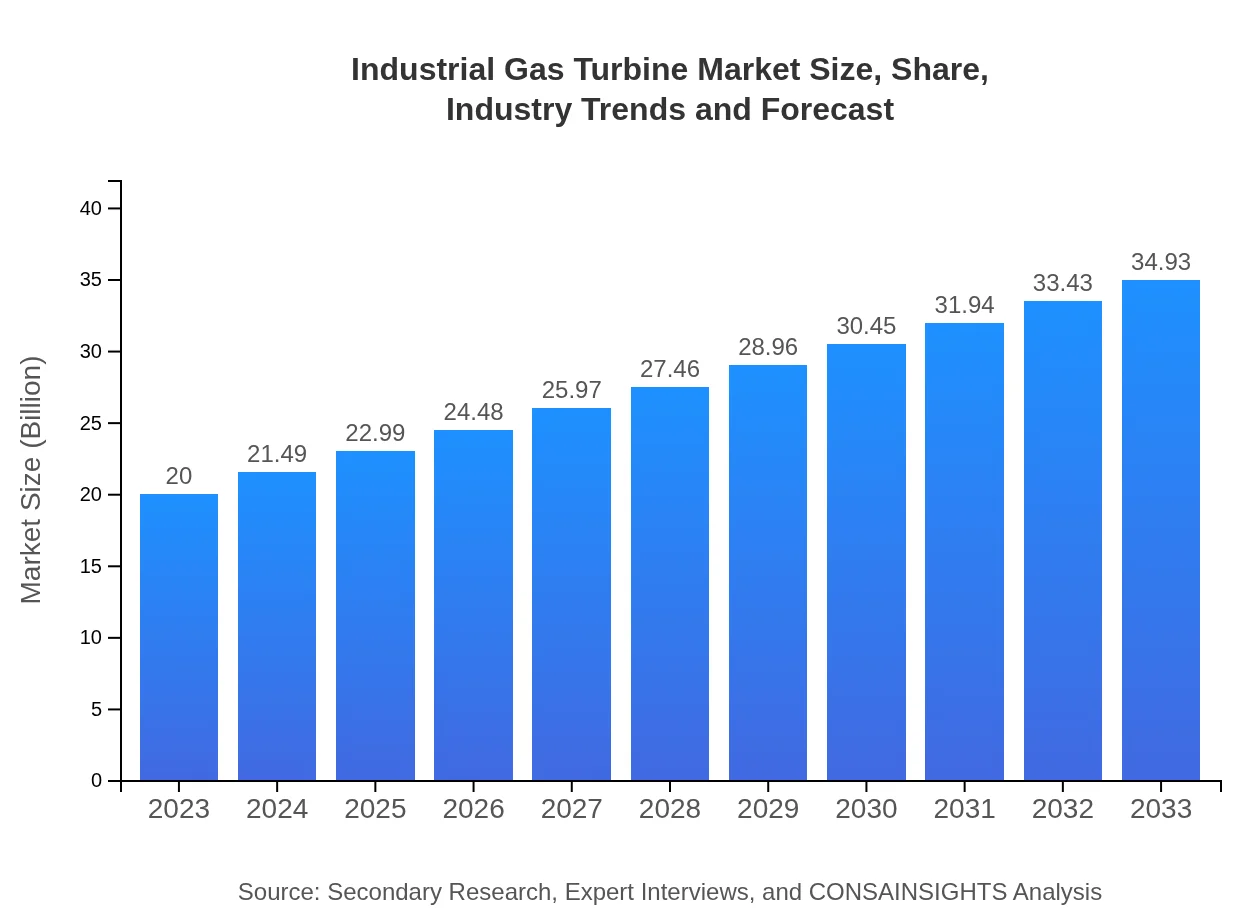

| 2023 Market Size | $20.00 Billion |

| CAGR (2023-2033) | 5.6% |

| 2033 Market Size | $34.93 Billion |

| Top Companies | General Electric, Siemens Energy, Mitsubishi Power, Ansaldo Energia, Rolls-Royce |

| Last Modified Date | 22 January 2026 |

Industrial Gas Turbine Market Overview

Customize Industrial Gas Turbine Market Report market research report

- ✔ Get in-depth analysis of Industrial Gas Turbine market size, growth, and forecasts.

- ✔ Understand Industrial Gas Turbine's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Industrial Gas Turbine

What is the Market Size & CAGR of Industrial Gas Turbine market in 2023?

Industrial Gas Turbine Industry Analysis

Industrial Gas Turbine Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Industrial Gas Turbine Market Analysis Report by Region

Europe Industrial Gas Turbine Market Report:

Europe presents a promising landscape for Industrial Gas Turbines, influenced by strict environmental regulations and a focus on renewable energy. The market is anticipated to grow from $5.87 billion in 2023 to $10.25 billion in 2033. Countries like Germany and the UK are investing heavily in gas-fired power plants, further supporting market expansion.Asia Pacific Industrial Gas Turbine Market Report:

Asia Pacific is witnessing robust growth in the Industrial Gas Turbine market, driven by industrialization and increased energy consumption. The market size is projected to grow from $3.75 billion in 2023 to $6.55 billion by 2033. Countries like China and India are leading the charge, with substantial investments in power generation and infrastructural development, while stringent pollution control regulations are also propelling the shift towards cleaner gas technologies.North America Industrial Gas Turbine Market Report:

North America remains a leader in the Industrial Gas Turbine market, with the market size estimated at $7.55 billion in 2023, projected to reach $13.19 billion by 2033. The U.S. is emphasizing energy diversification and transitioning to cleaner sources, with significant investments in renewables and natural gas infrastructure, spurring growth in gas turbine technologies.South America Industrial Gas Turbine Market Report:

The South American market for Industrial Gas Turbines is relatively small but is expected to gain momentum, growing from $0.33 billion in 2023 to $0.57 billion by 2033. Brazil and Argentina are key contributors, driven by their efforts to diversify energy sources and enhance capacity in power generation, albeit still facing challenges related to economic stability.Middle East & Africa Industrial Gas Turbine Market Report:

The Middle East and Africa region is experiencing growth driven by the diversification of energy sources. The market size is expected to increase from $2.50 billion in 2023 to $4.37 billion by 2033. Investments in renewable energy and natural gas infrastructure are leading initiatives, with countries like Saudi Arabia and UAE at the forefront.Tell us your focus area and get a customized research report.

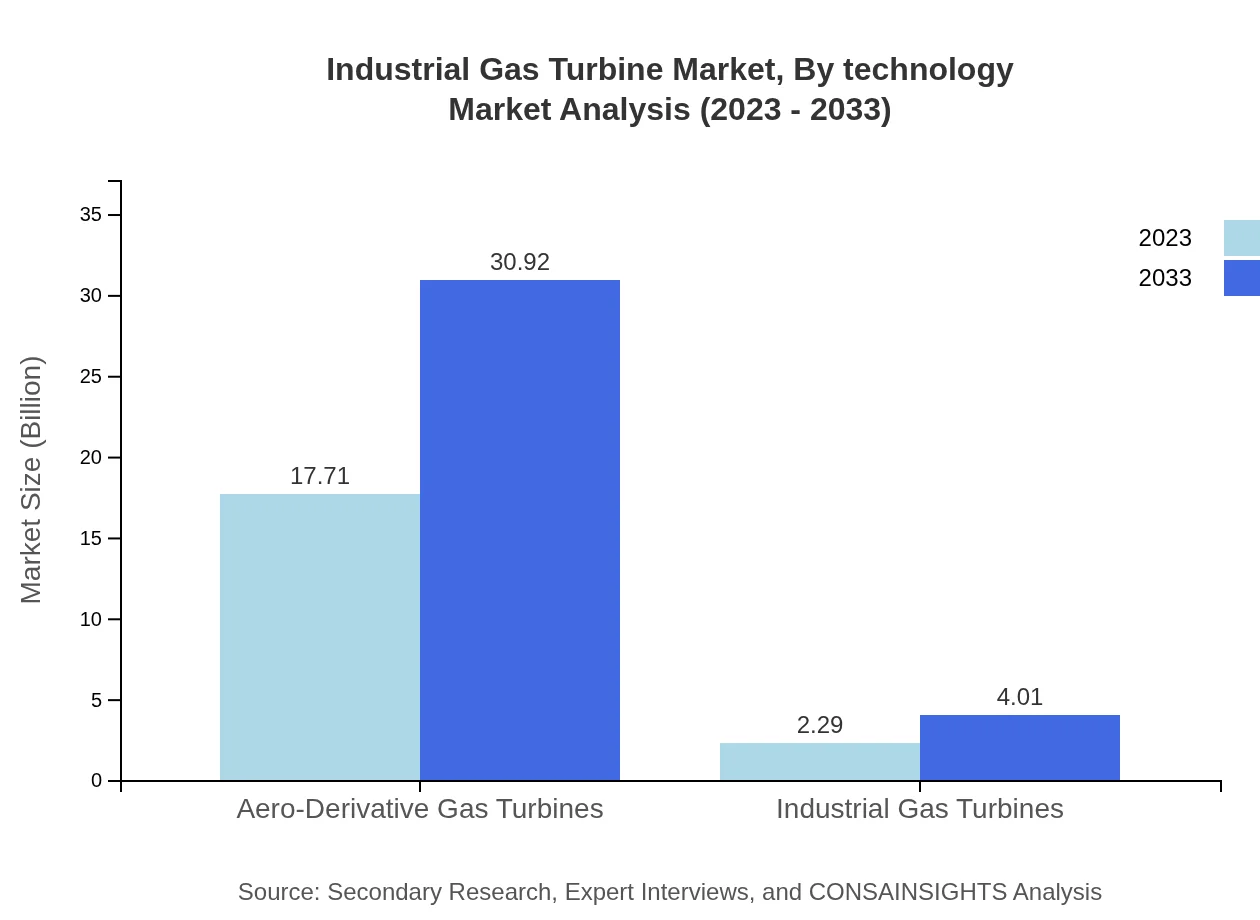

Industrial Gas Turbine Market Analysis By Technology

The Industrial Gas Turbine market can be analyzed by technology with aero-derivative gas turbines representing a significant segment due to their efficiency and adaptability across various applications. These turbines dominate the market, projected to show sales increment from $17.71 billion in 2023 to $30.92 billion by 2033. Heavy-duty gas turbines, while also critical, are forecasted to grow steadily, aligning with industrial needs for larger power outputs.

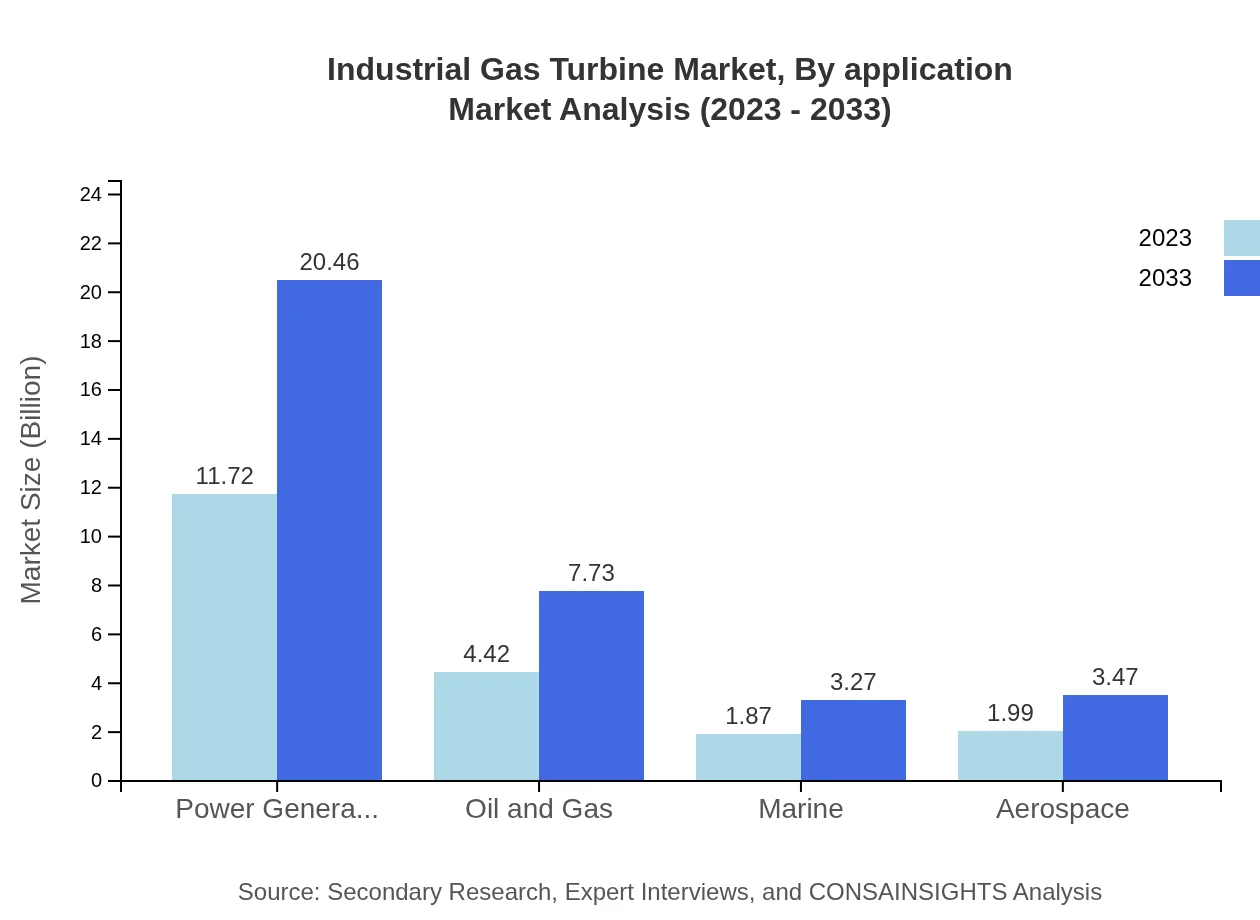

Industrial Gas Turbine Market Analysis By Application

Applications of industrial gas turbines mainly encompass power generation and manufacturing processes. Power generation holds a substantial market share of 58.59% in 2023, projected to maintain a similar share by 2033, indicating its vital role in energy production. Meanwhile, the industrial manufacturing segment is expected to grow significantly, reflecting increased output requirements for various industries.

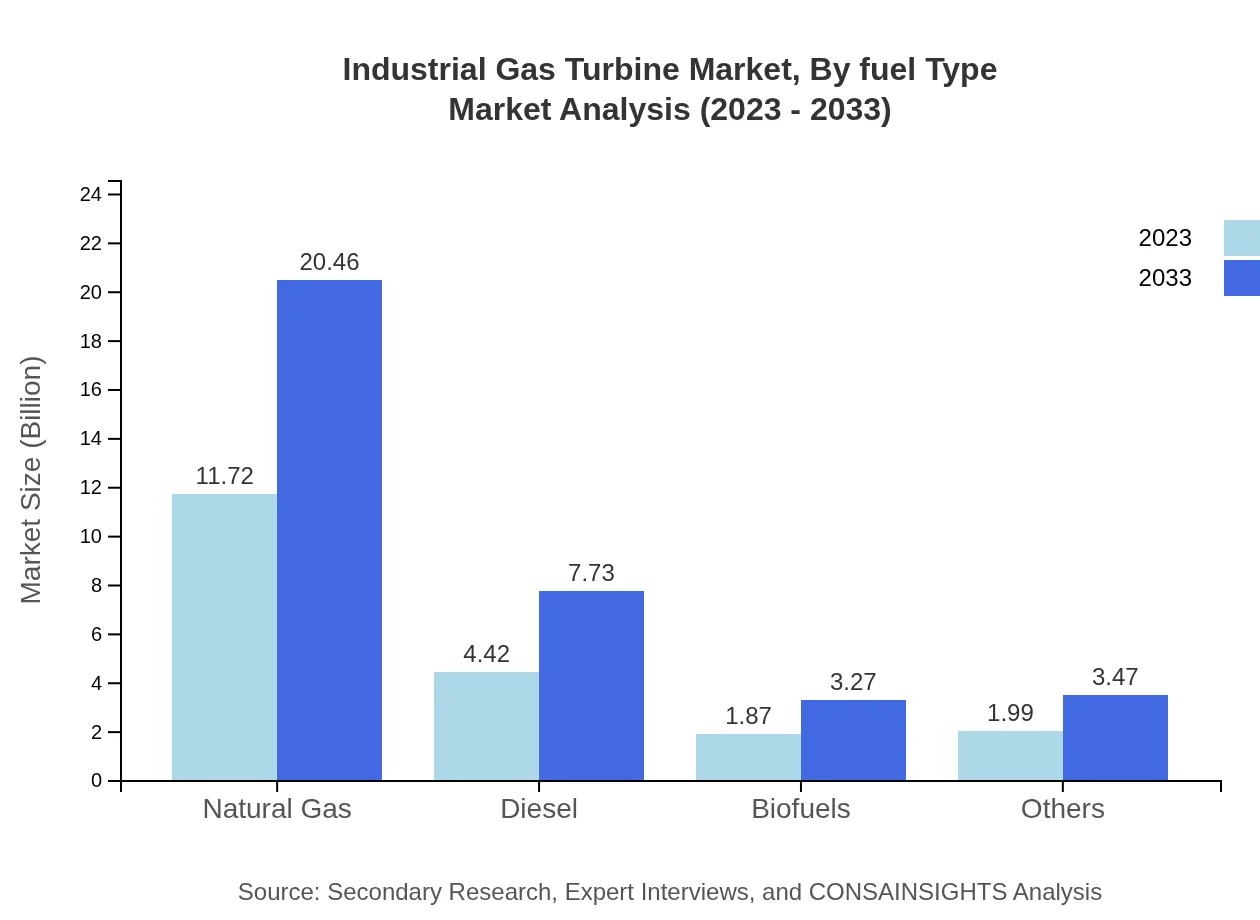

Industrial Gas Turbine Market Analysis By Fuel Type

The fuel type shows a dominant preference for natural gas, representing around 58.59% of the market share in 2023, leading to anticipated growth to match sector efficiencies by 2033. The rise of biofuels is notable, with expected growth from $1.87 billion to $3.27 billion over the same period as demand for sustainable energy solutions increases.

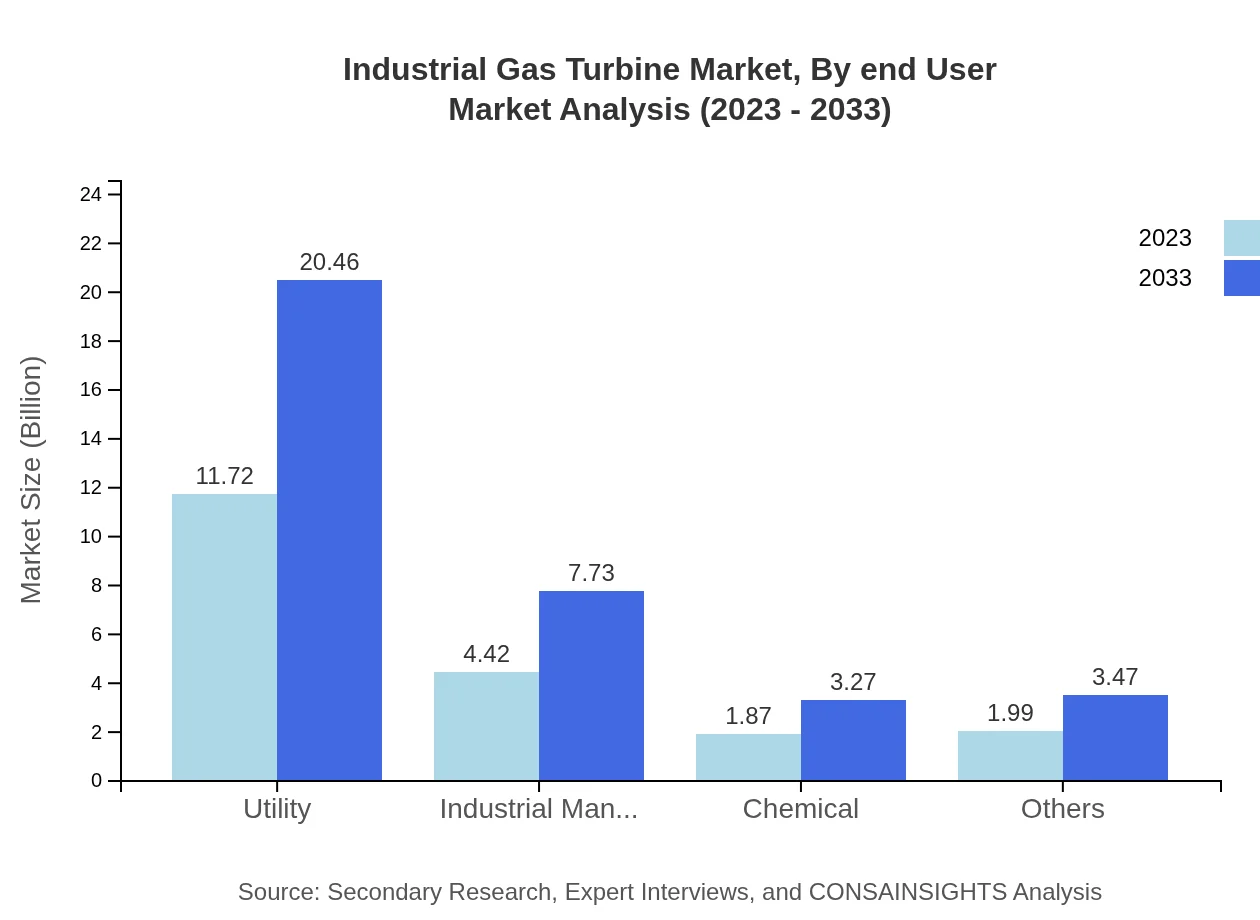

Industrial Gas Turbine Market Analysis By End User

Major end-user industries for gas turbines include oil and gas, power generation, and manufacturing, showcasing their versatility. The power generation segment remains the largest end-user at 58.59% of the market share, poised for growth. Marine and aerospace applications, though smaller, are also critical and expected to grow as technology and energy needs evolve.

Industrial Gas Turbine Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Industrial Gas Turbine Industry

General Electric:

General Electric (GE) is a leading player in the Industrial Gas Turbine market, known for technological innovations and a comprehensive range of gas turbine solutions utilized in power generation and industrial applications.Siemens Energy:

Siemens Energy specializes in gas turbine technologies, providing advanced solutions that enhance efficiency and reduce emissions, playing a significant role in the global market for industrial gas turbines.Mitsubishi Power:

Mitsubishi Power is a key manufacturer in the gas turbine industry, noted for producing high-efficiency turbines and expanding its footprint in both traditional and renewable energy sectors.Ansaldo Energia:

Ansaldo Energia is recognized for its capabilities in power generation, offering cutting-edge gas turbines and continuing to innovate in the industrial gas turbine space.Rolls-Royce:

Rolls-Royce is a prominent figure in manufacturing aero-derivative gas turbines for a variety of applications, enhancing performance through ongoing research and development.We're grateful to work with incredible clients.

FAQs

What is the market size of industrial Gas Turbine?

The industrial gas turbine market is projected to grow from a base market size of $20 billion in 2023, with a compound annual growth rate (CAGR) of 5.6%, indicating substantial growth potential until 2033.

What are the key market players or companies in this industrial Gas Turbine industry?

Key players in the industrial gas turbine market include General Electric, Siemens AG, and Mitsubishi Heavy Industries, leading in technological advancements and market share, significantly impacting the industry dynamics.

What are the primary factors driving the growth in the industrial Gas Turbine industry?

Growth in the industrial gas turbine industry is driven by increased energy demand, advancements in turbine efficiency, and a shift towards cleaner energy sources, including natural gas and renewables, enhancing operational performance.

Which region is the fastest Growing in the industrial Gas Turbine?

North America is the fastest-growing region, expanding from $7.55 billion in 2023 to $13.19 billion in 2033, driven by investments in power generation and industrial applications.

Does ConsaInsights provide customized market report data for the industrial Gas Turbine industry?

Yes, ConsaInsights specializes in providing customized market reports tailored to specific client needs, delivering insights on varied market parameters like segmentation, regional analysis, and future forecasts.

What deliverables can I expect from this industrial Gas Turbine market research project?

Deliverables from the industrial gas turbine market research project include a comprehensive report, segmented data analysis, market forecasts, competitive landscape insights, and tailored recommendations based on client requirements.

What are the market trends of industrial Gas Turbine?

Key trends in the industrial gas turbine market include a shift towards digitalization, increasing adoption of hybrid systems, and a focus on sustainability, reflecting the industry's adaptation to modern energy requirements.