Industrial Gearbox Market Report

Published Date: 22 January 2026 | Report Code: industrial-gearbox

Industrial Gearbox Market Size, Share, Industry Trends and Forecast to 2033

This report provides an extensive analysis of the Industrial Gearbox market, including insights on market size, trends, segmentation, and regional performance from 2023 to 2033. It aims to guide stakeholders in making informed decisions based on forecasted growth and emerging technologies.

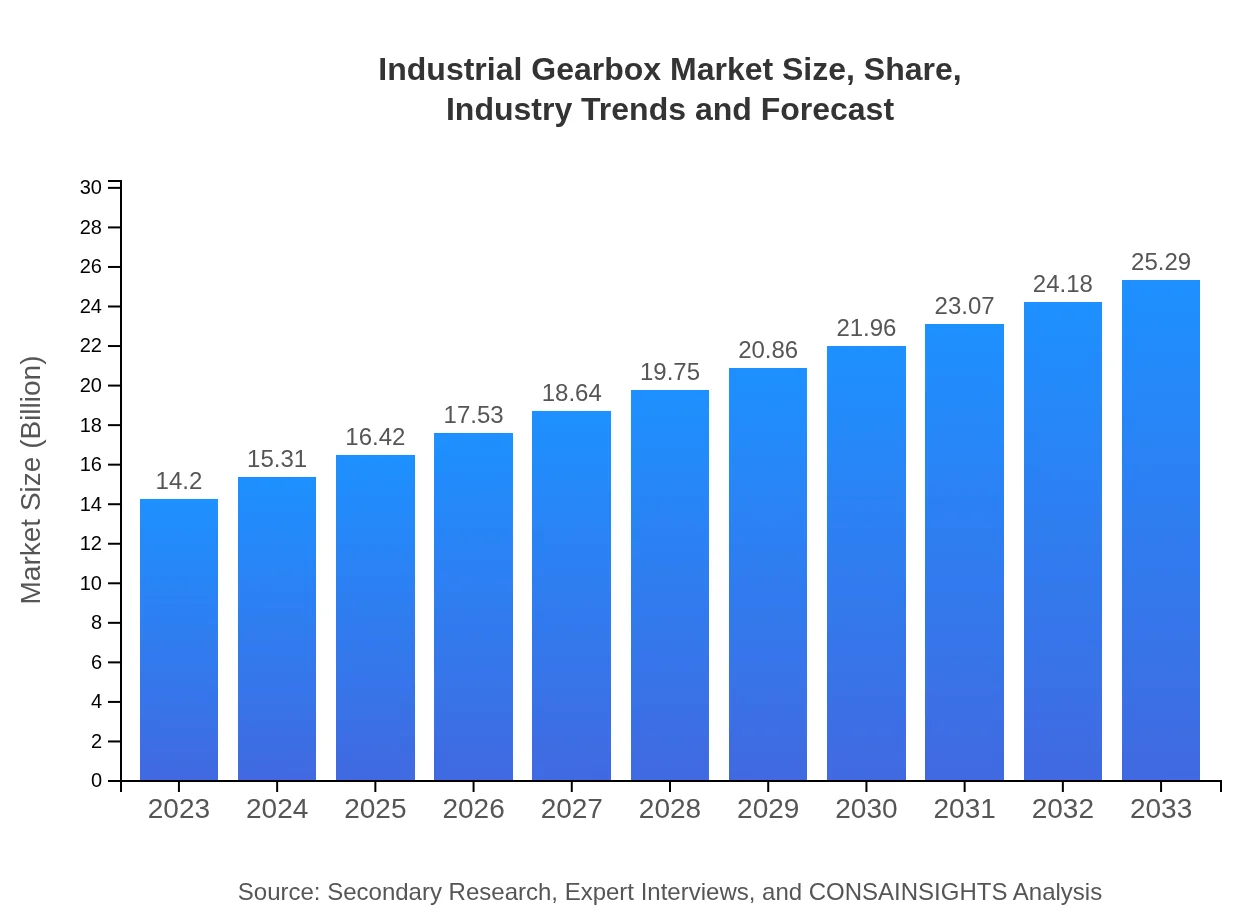

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $14.20 Billion |

| CAGR (2023-2033) | 5.8% |

| 2033 Market Size | $25.29 Billion |

| Top Companies | Siemens AG, Nord Drivesystems, Flender GmbH, Rockwell Automation, David Brown Santasalo |

| Last Modified Date | 22 January 2026 |

Industrial Gearbox Market Overview

Customize Industrial Gearbox Market Report market research report

- ✔ Get in-depth analysis of Industrial Gearbox market size, growth, and forecasts.

- ✔ Understand Industrial Gearbox's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Industrial Gearbox

What is the Market Size & CAGR of Industrial Gearbox market in 2023?

Industrial Gearbox Industry Analysis

Industrial Gearbox Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Industrial Gearbox Market Analysis Report by Region

Europe Industrial Gearbox Market Report:

The European Industrial Gearbox market stood at approximately $4.48 billion in 2023 and is expected to grow to $7.98 billion by 2033. The region is characterized by a strong industrial base and stringent regulations fostering the adoption of energy-efficient technologies.Asia Pacific Industrial Gearbox Market Report:

In 2023, the Industrial Gearbox market in the Asia Pacific region is valued at approximately $2.67 billion, anticipated to grow to about $4.76 billion by 2033. Rapid industrialization, coupled with rising infrastructure development projects in countries like China and India, significantly drives demand.North America Industrial Gearbox Market Report:

North America is a significant player, with the market valued at roughly $4.96 billion in 2023 and projected to reach around $8.83 billion by 2033. The demand is driven by advanced manufacturing processes and a growing emphasis on automation across industries.South America Industrial Gearbox Market Report:

The South American market is relatively smaller, with a value of about $0.15 billion in 2023. By 2033, this is expected to rise to $0.27 billion, primarily driven by enhancements in agricultural supply chains and investments in renewable energy.Middle East & Africa Industrial Gearbox Market Report:

In the Middle East and Africa, the market was valued at approximately $1.94 billion in 2023 and is forecasted to grow to $3.46 billion by 2033. Growth in this region is primarily fueled by investments in oil and gas infrastructure and growing manufacturing hubs.Tell us your focus area and get a customized research report.

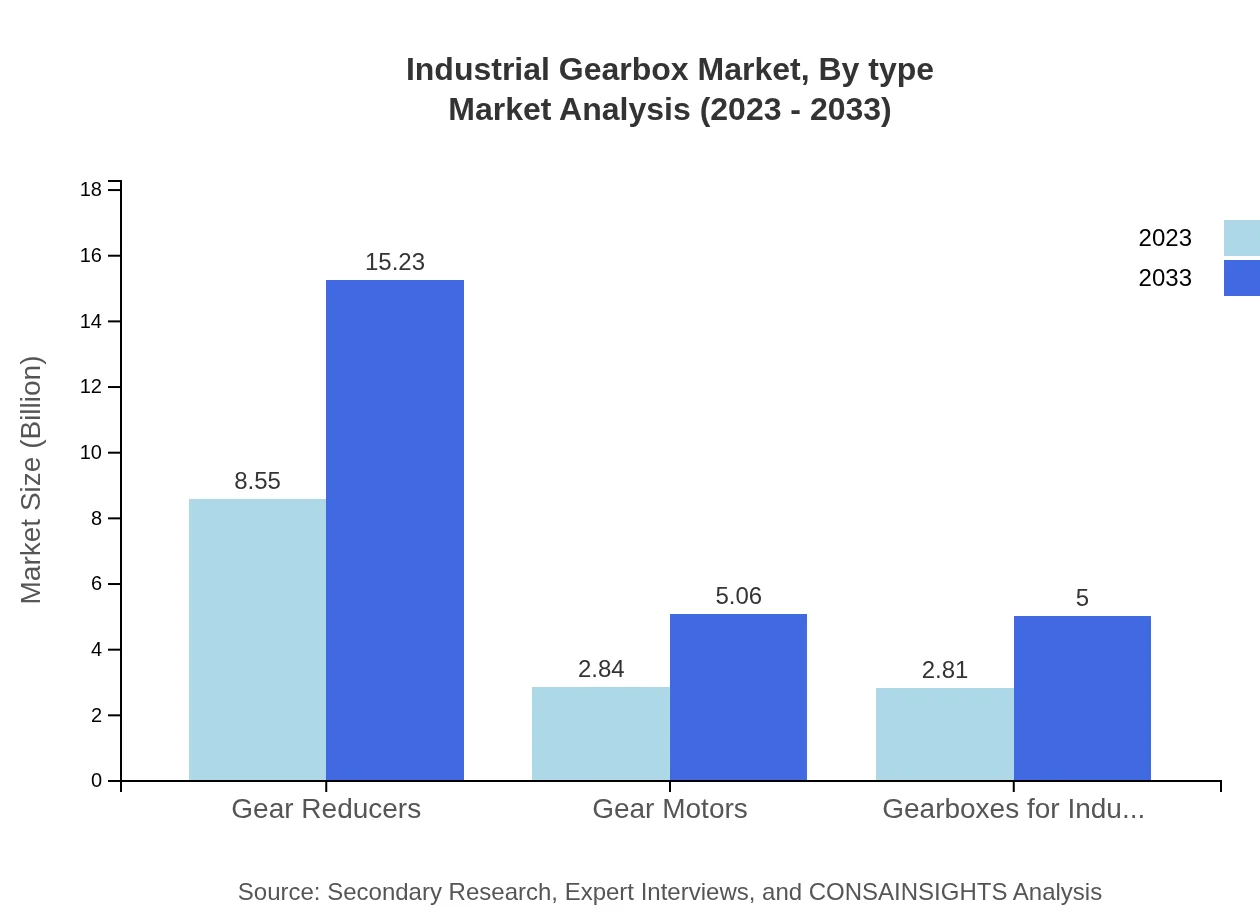

Industrial Gearbox Market Analysis By Type

In 2023, gear reducers dominate the market with a valuation of $8.55 billion, expected to grow to $15.23 billion by 2033. Gear motors, with a current value of $2.84 billion, will see substantial growth, reaching $5.06 billion over the next decade. Specialized gearboxes for industrial applications are projected to grow from $2.81 billion to $5.00 billion, highlighting their increasing importance.

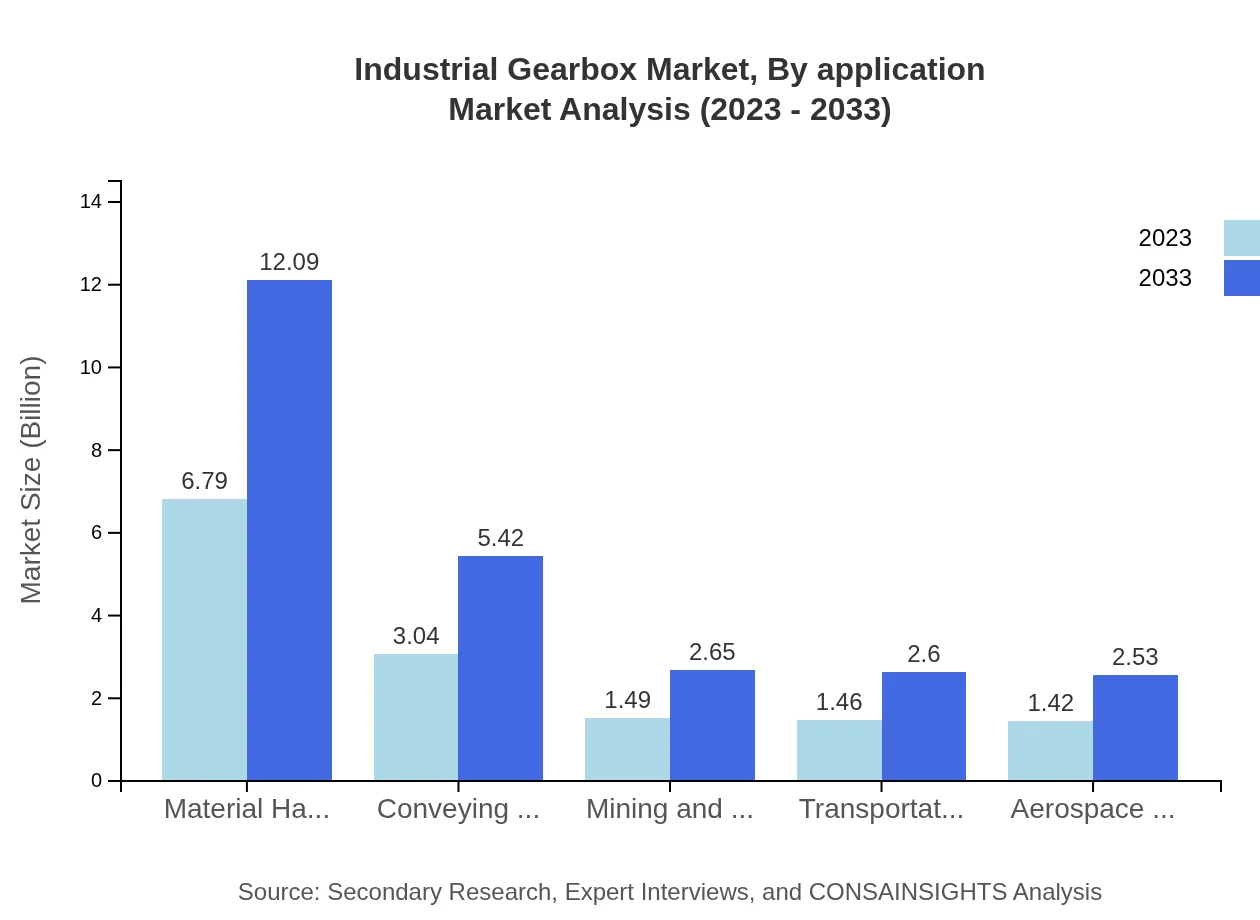

Industrial Gearbox Market Analysis By Application

By application, manufacturing holds the largest share, valued at $6.79 billion in 2023, poised to reach $12.09 billion by 2033. Automotive and oil and gas applications contribute significantly, with current values of $3.04 billion and $1.49 billion, respectively. The food and beverage sector is also notable, anticipated to grow from $1.46 billion in 2023 to $2.60 billion by 2033.

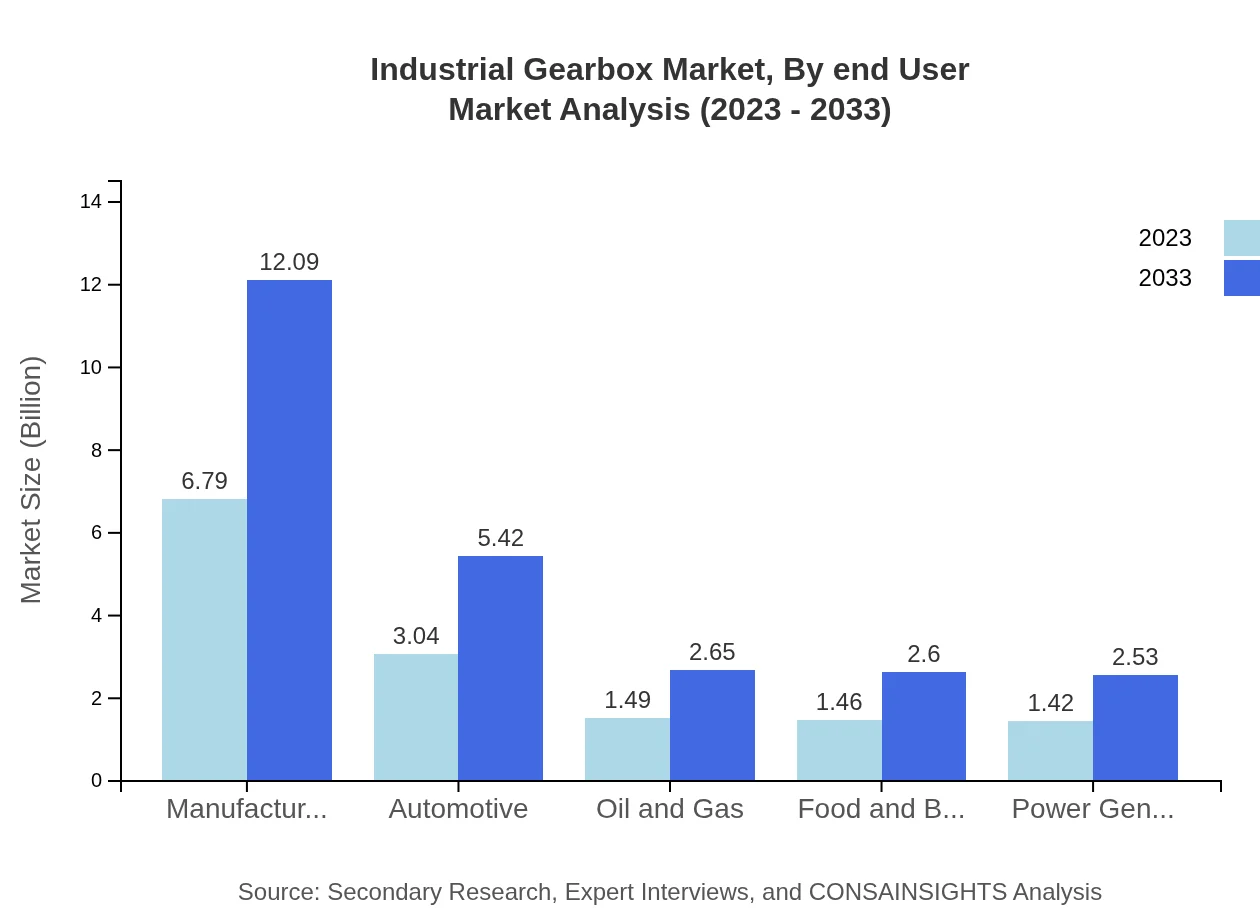

Industrial Gearbox Market Analysis By End User

In terms of end-user segments, the manufacturing industry leads the market with a staggering 47.81% share, followed closely by automotive at 21.42% and oil and gas at 10.48%. Other sectors, including food and beverage, material handling, and mining and construction, play vital roles in propelling market growth.

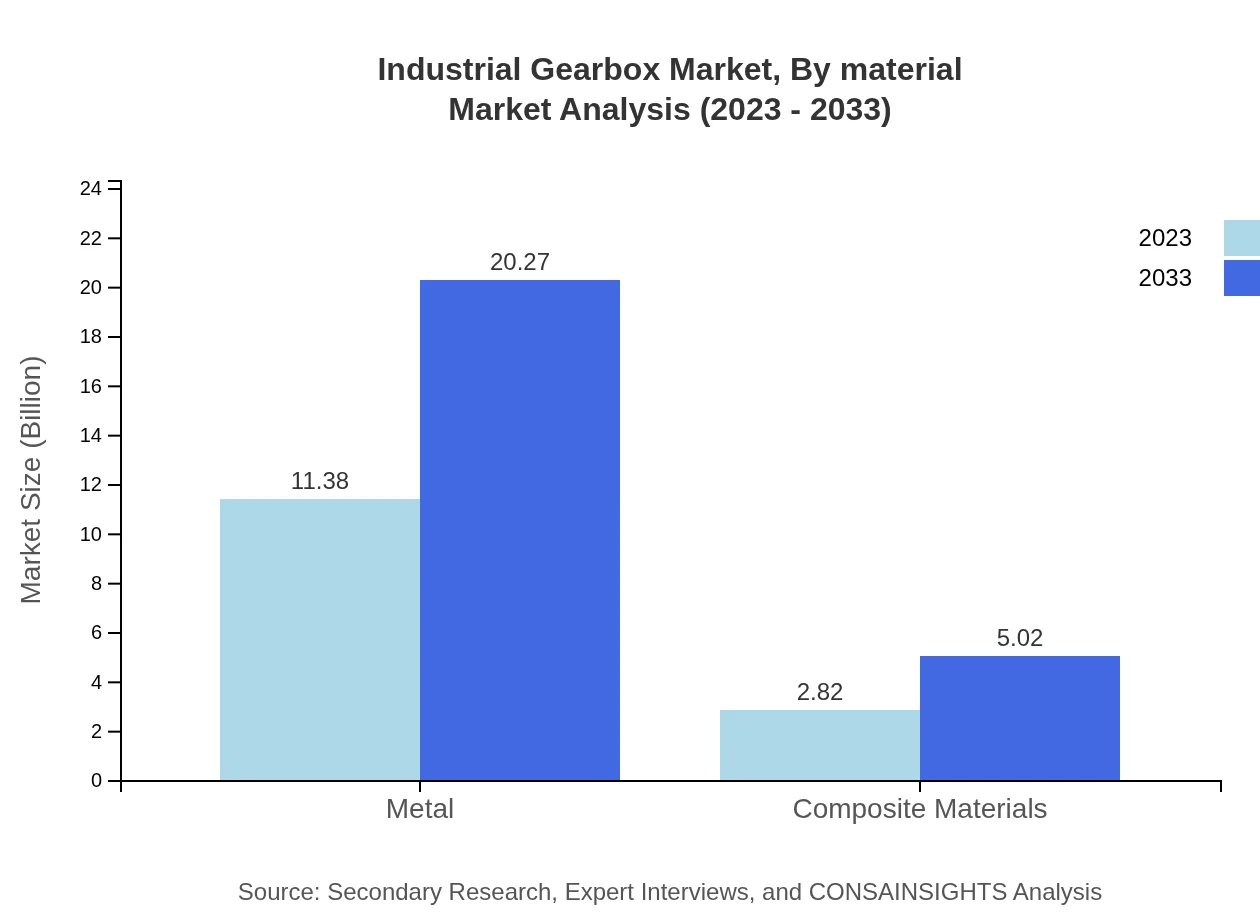

Industrial Gearbox Market Analysis By Material

The market is segmented by material, with metal frameworks leading at 80.16%, indicating a preference for durability and strength. Composite materials also hold a significant share of about 19.84%, primarily utilized in lightweight and corrosion-resistant applications. This trend highlights the growing demand for advanced materials in manufacturing.

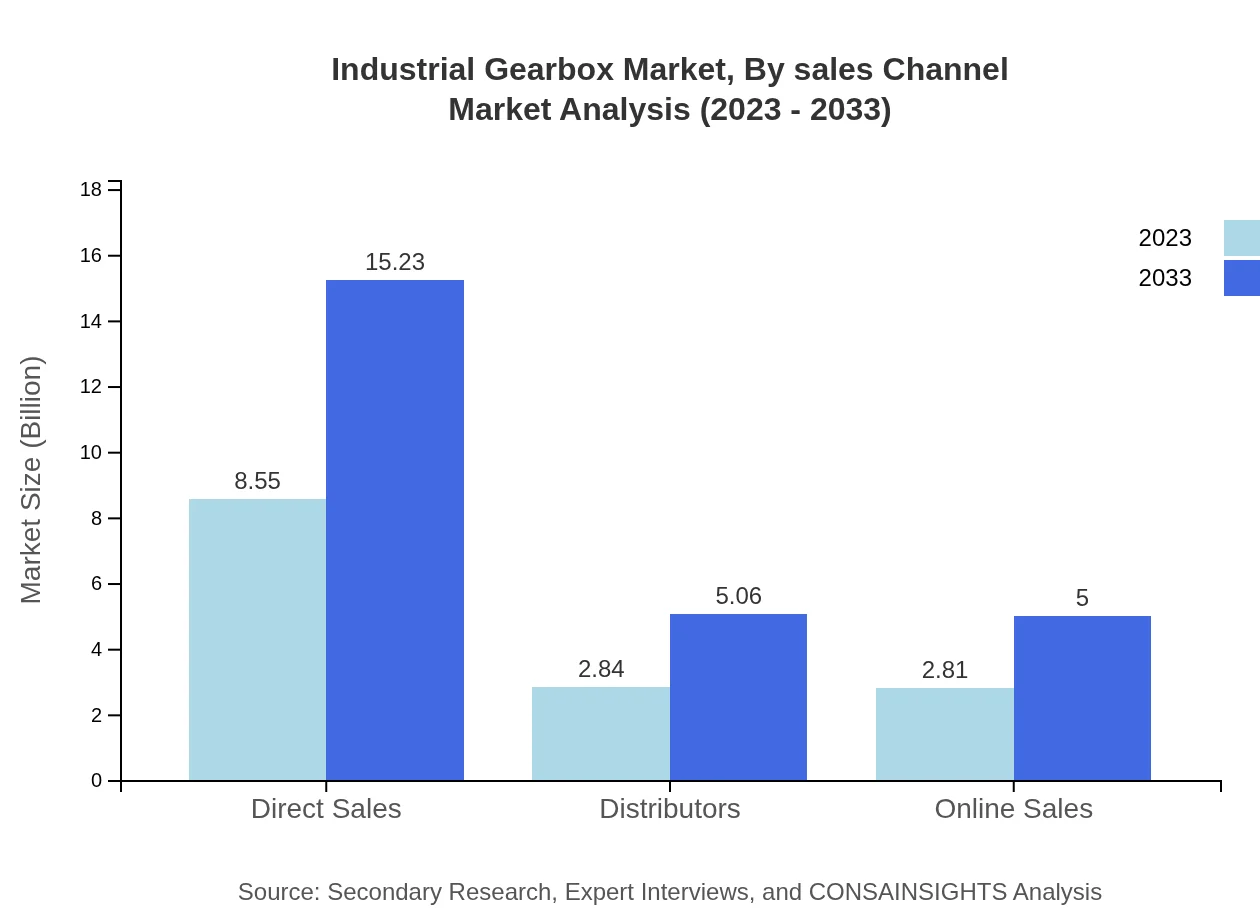

Industrial Gearbox Market Analysis By Sales Channel

Direct sales account for a dominant market share of 60.22% in 2023 and will continue to be pivotal through 2033. Distributors and online sales channels are also significant, contributing approximately 20.02% and 19.76%, respectively, as industries increasingly leverage digital platforms for procurement.

Industrial Gearbox Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Industrial Gearbox Industry

Siemens AG:

Siemens is a leading multinational corporation known for its robust industrial solutions, including advanced gearbox technologies utilized in various sectors, contributing to efficiency and reliability.Nord Drivesystems:

Nord Drivesystems specializes in drive technology and gearboxes, renowned for innovative and efficient systems geared towards automation, making significant strides in the Industrial Gearbox market.Flender GmbH:

Part of the Siemens Group, Flender GmbH is a prominent player offering a comprehensive range of gear units and drive solutions, enhancing productivity across multiple industries.Rockwell Automation:

Rockwell Automation integrates advanced technologies with traditional gearbox solutions, focusing on automation and control systems that significantly improve operational efficiencies.David Brown Santasalo:

David Brown Santasalo specializes in the design and manufacture of industrial gearboxes and is renowned for its high-quality solutions used in demanding environments.We're grateful to work with incredible clients.

FAQs

What is the market size of industrial gearbox?

The industrial gearbox market is projected to grow from $14.2 billion in 2023 to an estimated 2033 size reflecting a CAGR of 5.8%. This growth underscores the increasing demand across various industries.

What are the key market players or companies in this industrial gearbox industry?

Key players in the industrial gearbox industry include companies like Siemens, David Brown Santasalo, and Gearbox Express which dominate the market with innovative products and strong distribution networks.

What are the primary factors driving the growth in the industrial gearbox industry?

Growth in the industrial gearbox sector is driven by increasing automation in manufacturing, the rise in renewable energy projects, and technological advancements that enhance performance and efficiency of gear systems.

Which region is the fastest Growing in the industrial gearbox?

The fastest-growing region in the industrial gearbox market is North America, projected to expand its market from $4.96 billion in 2023 to $8.83 billion by 2033, showcasing significant industrial growth.

Does ConsaInsights provide customized market report data for the industrial gearbox industry?

Yes, ConsaInsights offers customized market reports tailored to the specific needs of clients in the industrial gearbox industry, ensuring relevant and precise data for informed decision-making.

What deliverables can I expect from this industrial gearbox market research project?

Clients can expect detailed market analysis, trends, segment breakdown, regional insights, and forecasts, delivered in easy-to-understand formats, aiding strategic planning and investment strategies.

What are the market trends of industrial gearbox?

Market trends indicate a shift towards gear reducers, which are projected to grow significantly, along with an increasing share of online sales and direct sales channels, as industries become more digitized.