Industrial Inertial Systems Market Report

Published Date: 31 January 2026 | Report Code: industrial-inertial-systems

Industrial Inertial Systems Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Industrial Inertial Systems market, covering market size, growth forecasts, industry insights, technological advancements, and regional breakdowns from 2023 to 2033.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

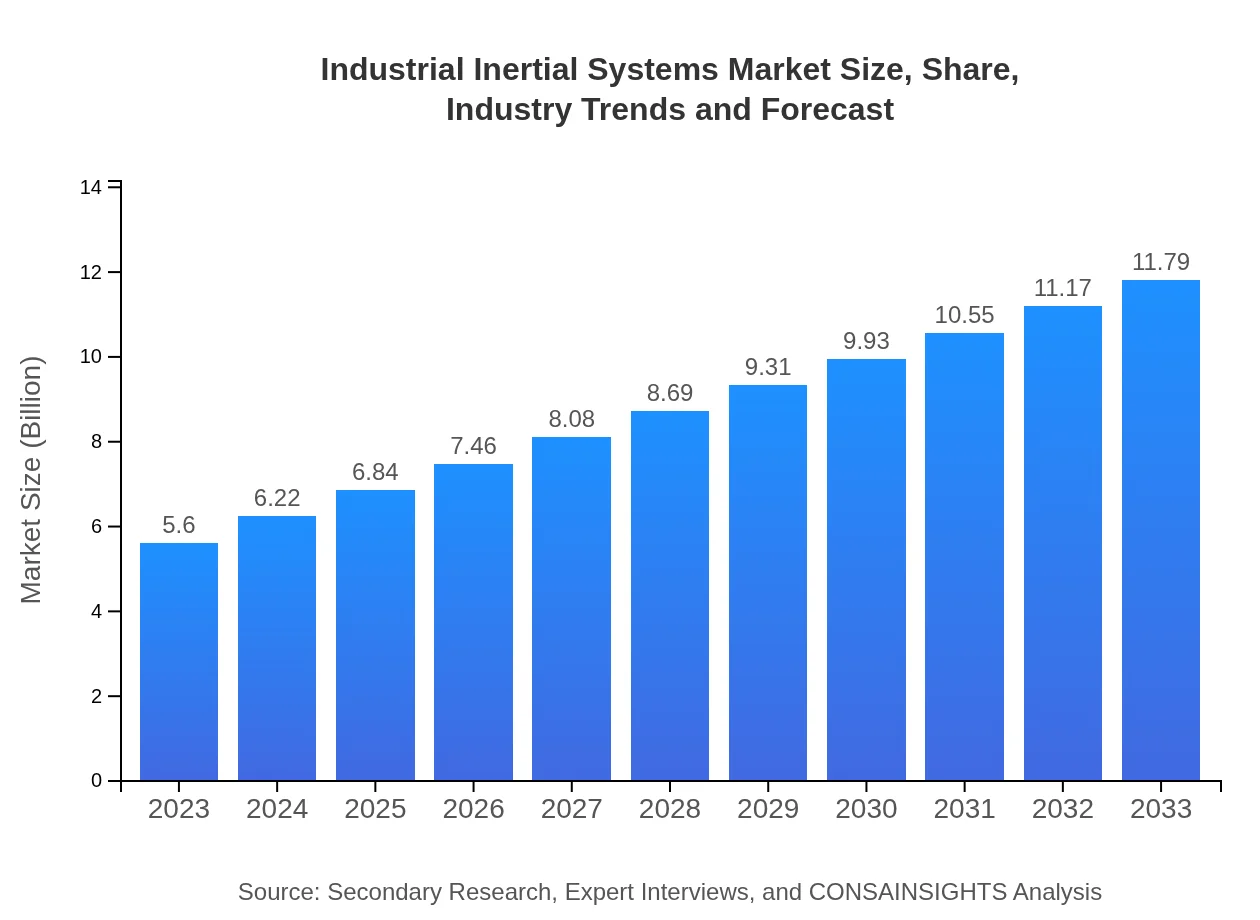

| 2023 Market Size | $5.60 Billion |

| CAGR (2023-2033) | 7.5% |

| 2033 Market Size | $11.79 Billion |

| Top Companies | Honeywell International Inc., Northrop Grumman Corporation, Thankar, Bosch Sensortec |

| Last Modified Date | 31 January 2026 |

Industrial Inertial Systems Market Overview

Customize Industrial Inertial Systems Market Report market research report

- ✔ Get in-depth analysis of Industrial Inertial Systems market size, growth, and forecasts.

- ✔ Understand Industrial Inertial Systems's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Industrial Inertial Systems

What is the Market Size & CAGR of Industrial Inertial Systems market in 2023?

Industrial Inertial Systems Industry Analysis

Industrial Inertial Systems Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Industrial Inertial Systems Market Analysis Report by Region

Europe Industrial Inertial Systems Market Report:

Europe's market is valued at approximately $1.52 billion in 2023, with forecasts showing growth to $3.21 billion by 2033. The demand is buttressed by strong regulations in aerospace and defense sectors and a push towards automation in manufacturing.Asia Pacific Industrial Inertial Systems Market Report:

In 2023, the Asia Pacific region holds a market size of approximately $1.19 billion, projected to grow to $2.50 billion by 2033. The growth is driven by increased manufacturing capabilities, the rising demand for automation, and significant investments into technology for sectors like automotive and aerospace.North America Industrial Inertial Systems Market Report:

North America, with a market size of $1.95 billion in 2023, is projected to reach $4.10 billion by 2033. The region's dominance stems from advanced aerospace applications and the presence of major players driving innovation in sensor technology.South America Industrial Inertial Systems Market Report:

The South American market is expected to grow from $0.44 billion in 2023 to $0.93 billion in 2033, fueled by investments in industrial infrastructure and development in countries like Brazil and Argentina, sparking interest in efficient motion measurement systems.Middle East & Africa Industrial Inertial Systems Market Report:

The Middle East and Africa region shows promising growth, with a market size of $0.50 billion in 2023 anticipated to increase to $1.06 billion by 2033, supported by infrastructural investments and rising defense budgets.Tell us your focus area and get a customized research report.

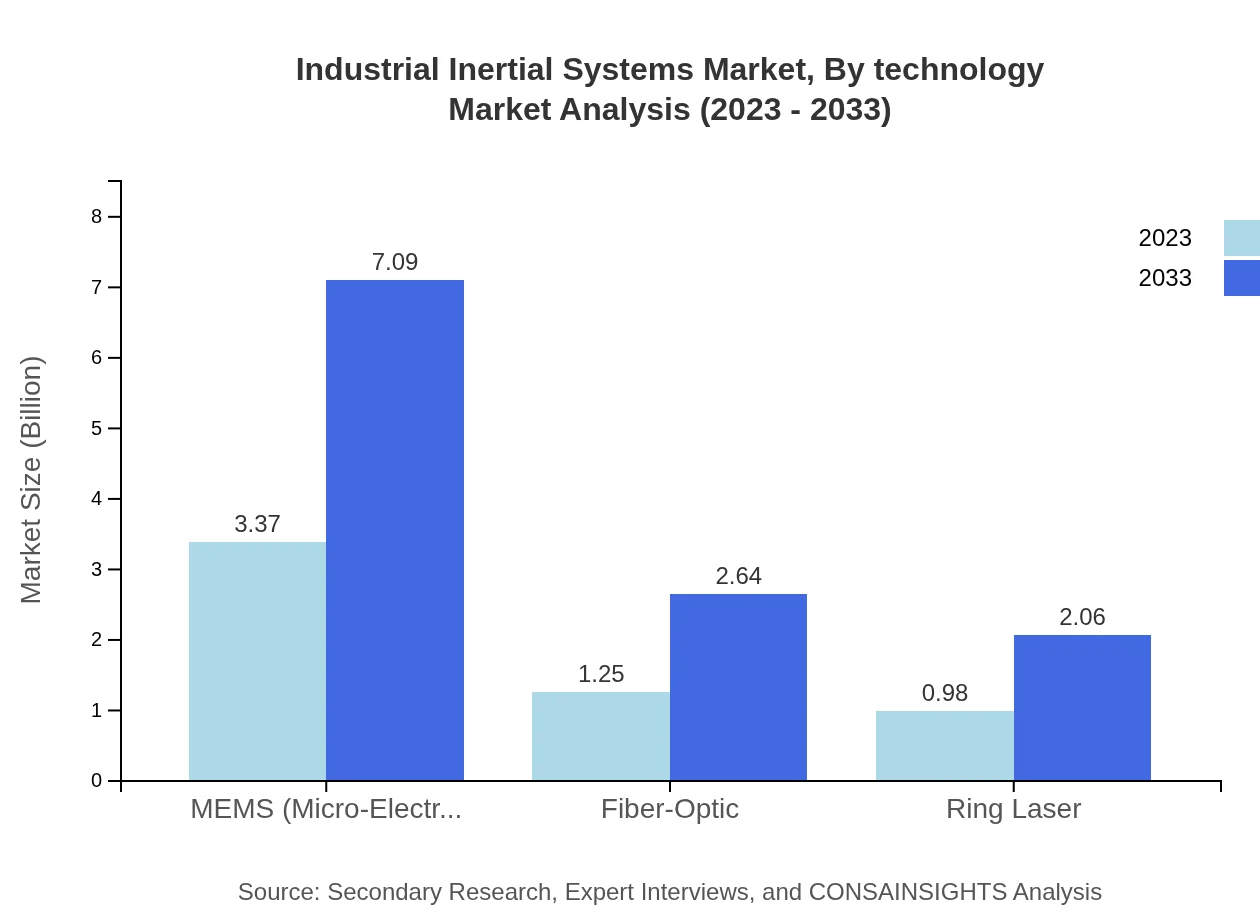

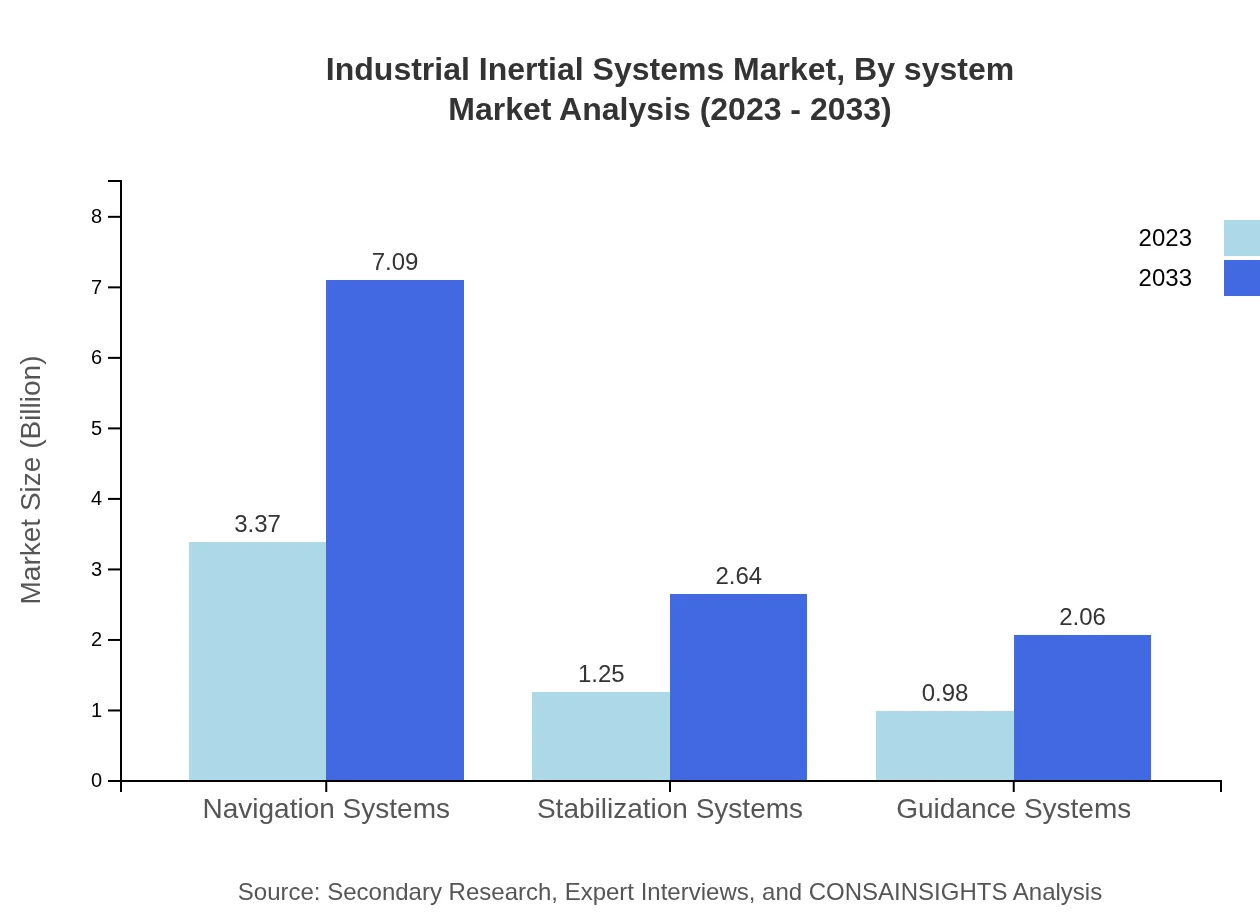

Industrial Inertial Systems Market Analysis By Technology

The market, segmented by technology, highlights 'Navigation Systems' with a market size of $3.37 billion in 2023, expected to grow to $7.09 billion by 2033, reflecting a 60.16% market share. Other noteworthy technologies include 'Stabilization Systems' ($1.25 billion, growing to $2.64 billion) and 'Guidance Systems' ($0.98 billion, growing to $2.06 billion), showcasing their critical roles in aerospace and defense applications.

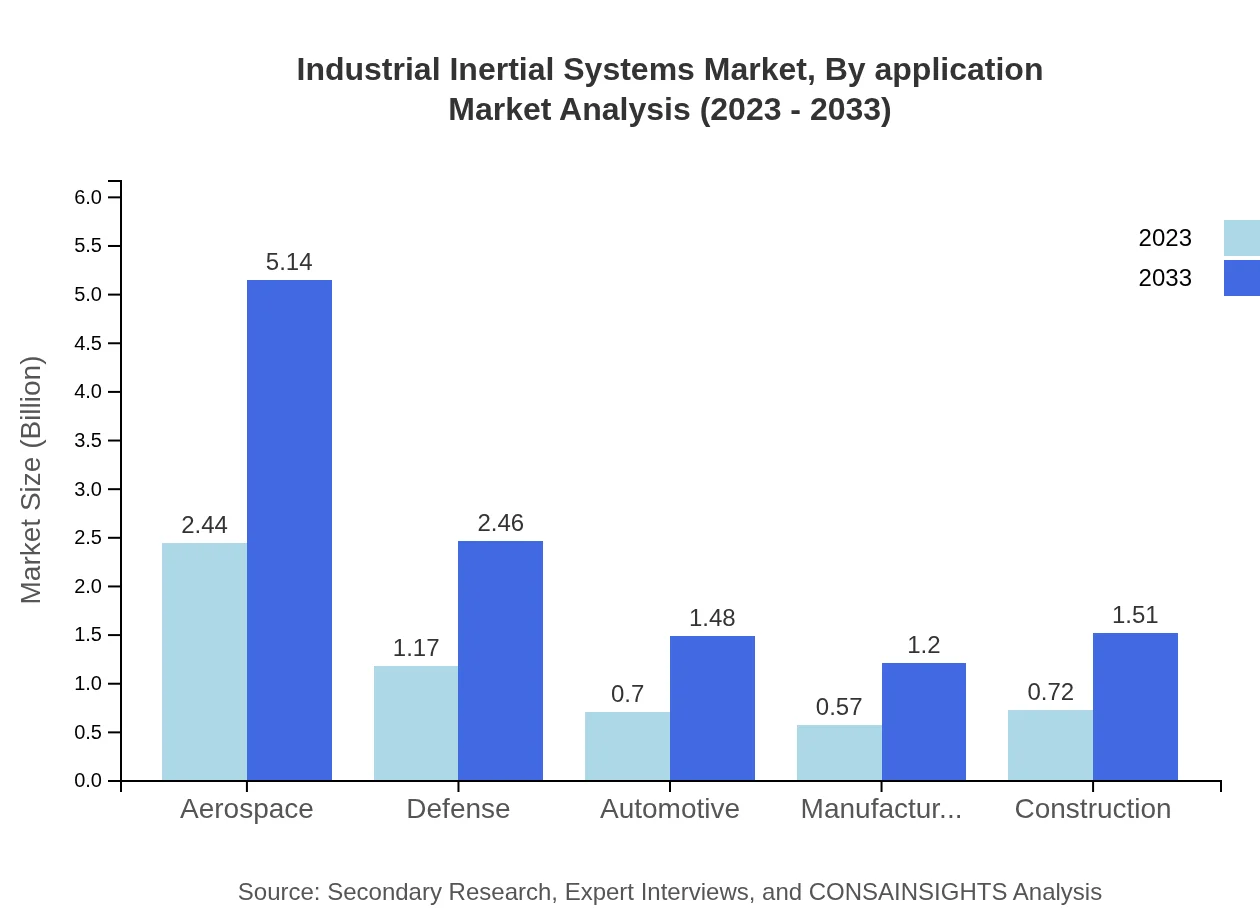

Industrial Inertial Systems Market Analysis By Application

This segment illustrates significant applications across various fields, with the 'Aerospace and Defense' category dominating at $3.19 billion in 2023 to $6.71 billion by 2033, indicating a 56.91% market share. Other sectors include 'Automotive' ($0.70 billion to $1.48 billion) and 'Manufacturing' ($0.57 billion to $1.20 billion), which are also experiencing robust growth due to increased reliance on inertial systems.

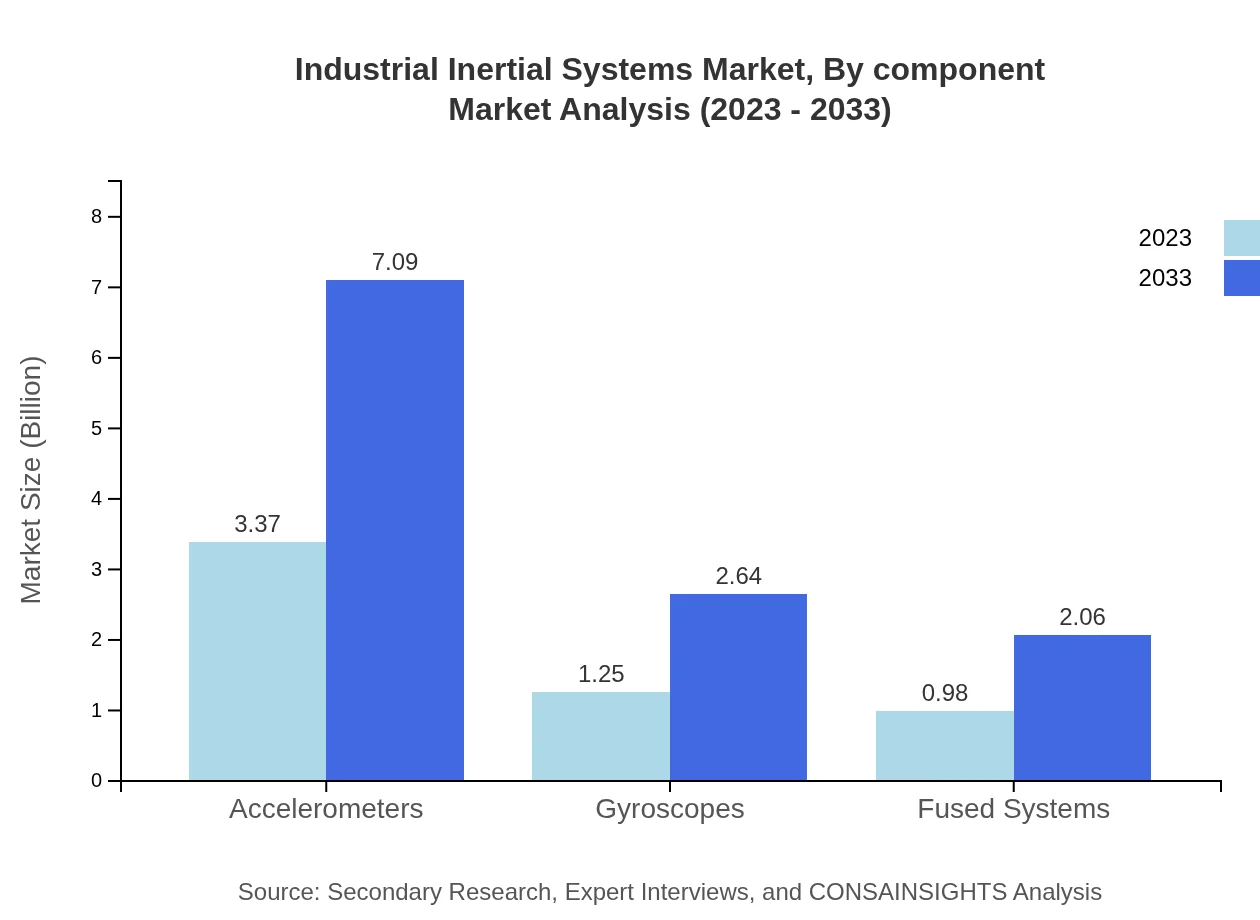

Industrial Inertial Systems Market Analysis By Component

Among components, 'Accelerometers' and 'Gyroscopes' are leading, with sizes of $3.37 billion and $1.25 billion respectively in 2023. 'Fused Systems' are slated for growth from $0.98 billion to $2.06 billion by 2033, gaining traction due to their precision in motion detection.

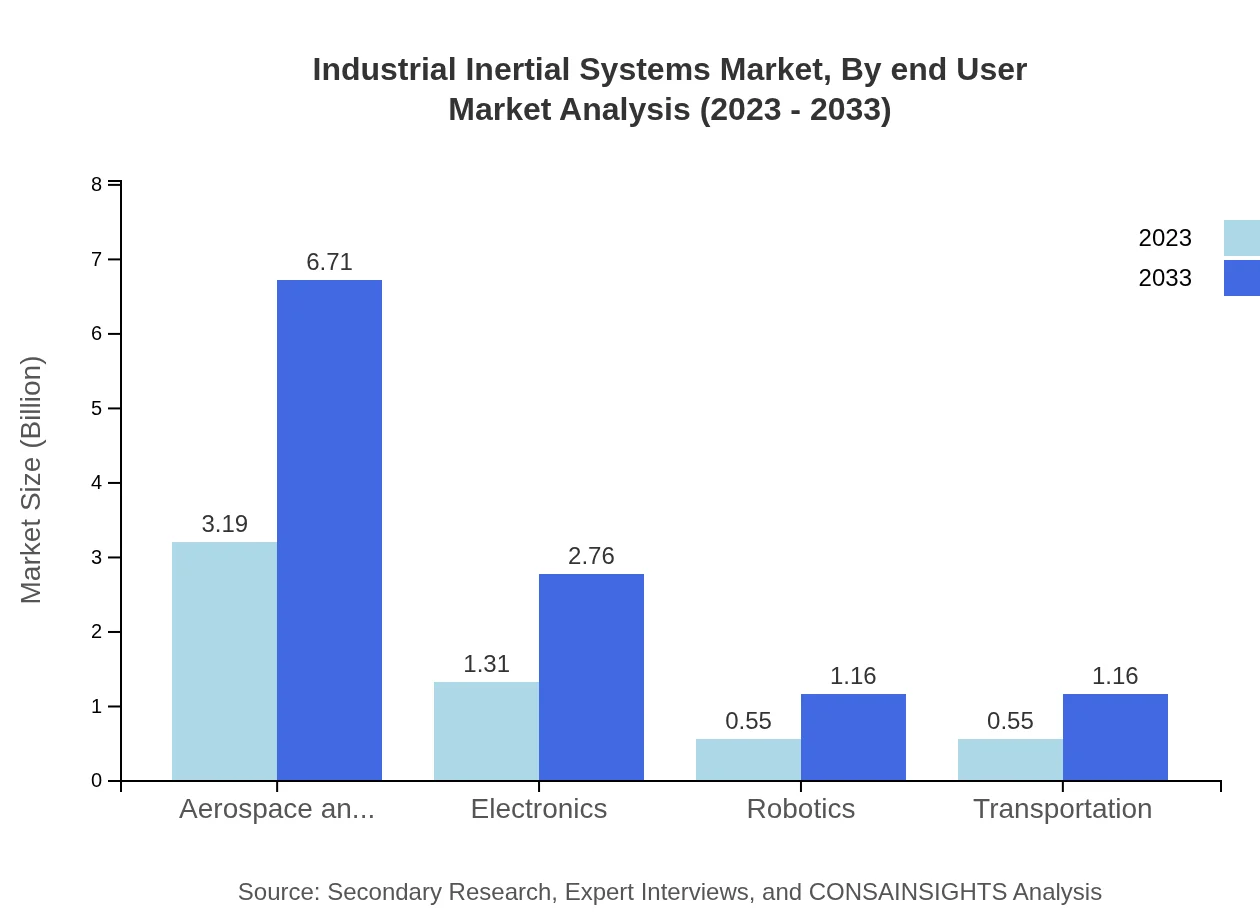

Industrial Inertial Systems Market Analysis By End User

End-user segmentation reveals an increasing dependency on inertial systems in 'Aerospace,' expected to grow from $2.44 billion to $5.14 billion by 2033. 'Robotics' and 'Transportation' also highlight growth potential due to advancements in these fields.

Industrial Inertial Systems Market Analysis By System

The market by system indicates notable prospects for growth in applications across new technologies, critical for sectors like manufacturing, where streamlined processes are pivotal for operational success. Insights into ongoing R&D efforts highlight an urgent need for adaptability in industrial systems.

Industrial Inertial Systems Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Industrial Inertial Systems Industry

Honeywell International Inc.:

A leader in the aerospace sector, Honeywell provides innovative inertial sensing solutions emphasizing advanced navigation and stabilization systems.Northrop Grumman Corporation:

Renowned for its defense technologies, Northrop Grumman plays a pivotal role in providing high-performance inertial systems for military and aerospace applications.Thankar:

As a key player in the MEMS sector, Thankar focuses on developing miniature inertial sensors that are utilized in various automated applications.Bosch Sensortec:

Bosch enhances the consumer electronics market with inertial sensors primarily in mobile devices, demonstrating versatility and advanced technology applications.We're grateful to work with incredible clients.

FAQs

What is the market size of industrial Inertial Systems?

The industrial inertial systems market is currently valued at approximately USD 5.6 billion, with a projected growth rate of 7.5% CAGR through 2033. This indicates robust growth as applications in various sectors expand.

What are the key market players or companies in this industrial Inertial Systems industry?

Key players in the industrial inertial systems market include leading technology companies and specialized manufacturers engaged in developing advanced inertial measurement units (IMUs), accelerometers, gyroscopes, and navigation systems, driving innovation and competition.

What are the primary factors driving the growth in the industrial Inertial Systems industry?

Major growth drivers include the increasing demand for automation in manufacturing, advancements in navigation and guidance technologies, and the growth of the aerospace and defense sectors, which heavily rely on precise inertial measurement solutions for operational efficiency.

Which region is the fastest Growing in the industrial Inertial Systems?

The fastest-growing region in the industrial-inertial systems market is North America, expected to expand from USD 1.95 billion in 2023 to USD 4.10 billion by 2033, showcasing significant opportunities across technological innovations and industrial applications.

Does ConsaInsights provide customized market report data for the industrial Inertial Systems industry?

Yes, ConsaInsights offers customized market report data tailored to the specific needs of clients in the industrial-inertial systems sector, allowing for in-depth analysis and insights based on unique business requirements and market conditions.

What deliverables can I expect from this industrial Inertial Systems market research project?

Deliverables typically include comprehensive market analysis reports, forecast data, segment insights, competitive landscape evaluations, and actionable recommendations tailored to inform business strategies and decision-making in the industrial inertial systems industry.

What are the market trends of industrial Inertial Systems?

Current market trends include the integration of advanced sensor technologies, increased investments in automation, the rise of AI and machine learning applications, and growing demand for MEMS-based solutions, all contributing to enhanced operational capabilities in industrial applications.