Industrial Labels Market Report

Published Date: 02 February 2026 | Report Code: industrial-labels

Industrial Labels Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Industrial Labels market, covering key insights, market size, growth forecasts, and industry trends from 2023 to 2033. It offers a detailed overview of market segmentation, regional analyses, and profiles of leading companies.

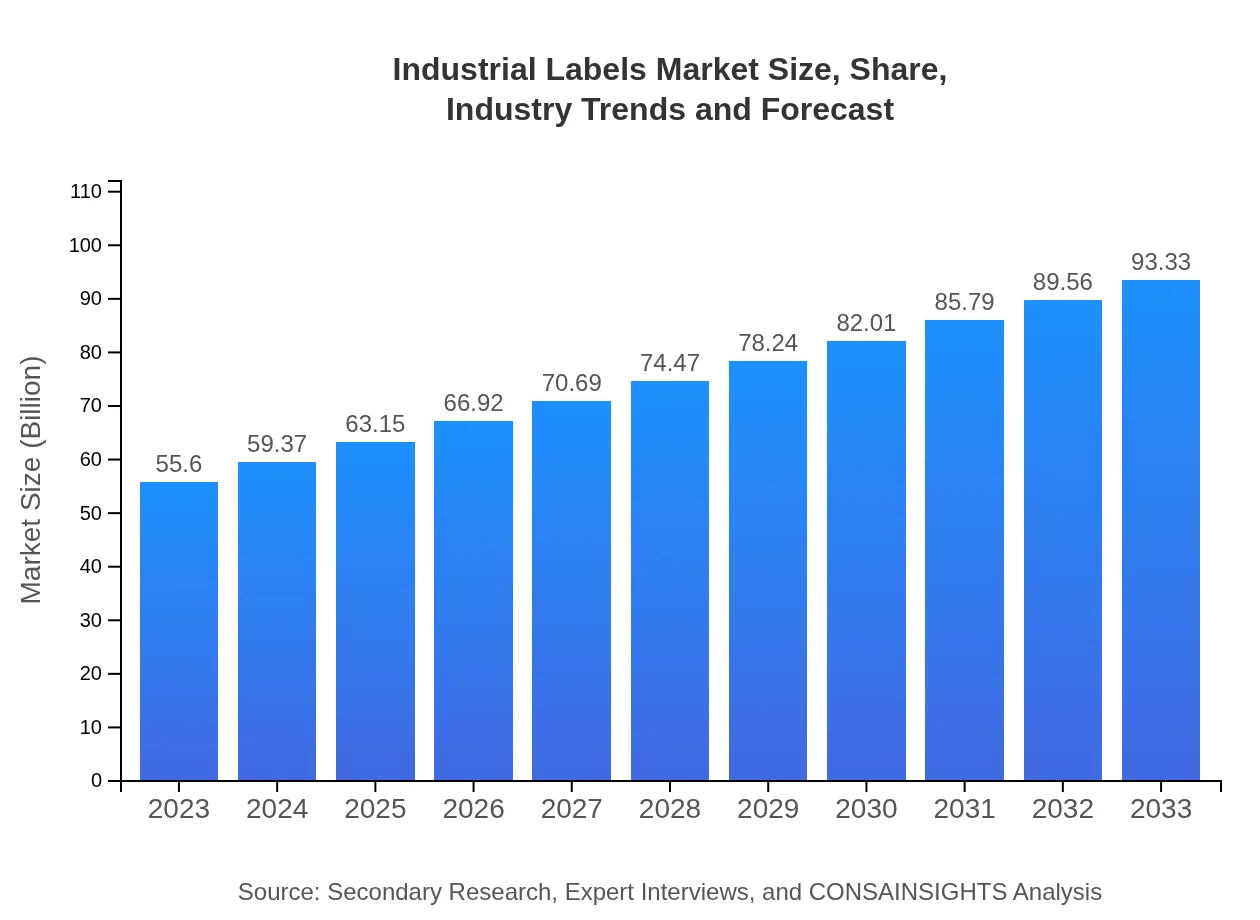

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $55.60 Billion |

| CAGR (2023-2033) | 5.2% |

| 2033 Market Size | $93.33 Billion |

| Top Companies | Avery Dennison Corporation, Brady Corporation, Smart Packaging Solutions, 3M Company |

| Last Modified Date | 02 February 2026 |

Industrial Labels Market Overview

Customize Industrial Labels Market Report market research report

- ✔ Get in-depth analysis of Industrial Labels market size, growth, and forecasts.

- ✔ Understand Industrial Labels's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Industrial Labels

What is the Market Size & CAGR of Industrial Labels market in 2023?

Industrial Labels Industry Analysis

Industrial Labels Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Industrial Labels Market Analysis Report by Region

Europe Industrial Labels Market Report:

Europe's Industrial Labels market is set to grow from USD 16.23 billion in 2023 to USD 27.24 billion by 2033. Here, the emphasis on compliance and sustainability impacts labeling demand substantially, alongside a strong packaging industry that necessitates innovative labeling solutions for various products.Asia Pacific Industrial Labels Market Report:

The Asia-Pacific region holds a significant share of the Industrial Labels market, with an estimated market size of USD 10.51 billion in 2023, projected to reach USD 17.64 billion by 2033. The growth is driven by rapid industrialization, particularly in countries like China and India, alongside increasing consumer demand for packaged goods and labeling compliance.North America Industrial Labels Market Report:

North America is anticipated to experience robust growth, expanding from USD 20.55 billion in 2023 to USD 34.50 billion by 2033. The region's advancements in technology, stringent regulatory requirements, and the presence of major label manufacturers drive this market growth. Innovations in smart labeling technologies will also contribute significantly.South America Industrial Labels Market Report:

In South America, the Industrial Labels market is expected to grow from USD 4.87 billion in 2023 to USD 8.18 billion by 2033. Factors such as expanding manufacturing sectors and rising retail activity contribute to this growth, while the preference for sustainable and informative labeling solutions is becoming increasingly important.Middle East & Africa Industrial Labels Market Report:

The Middle East and Africa region is forecasted to grow from USD 3.44 billion in 2023 to USD 5.78 billion by 2033. This growth is largely driven by the expansion of the logistics and retail sectors, and increasing investments in manufacturing capabilities, combined with growing awareness of safety and product labeling regulations.Tell us your focus area and get a customized research report.

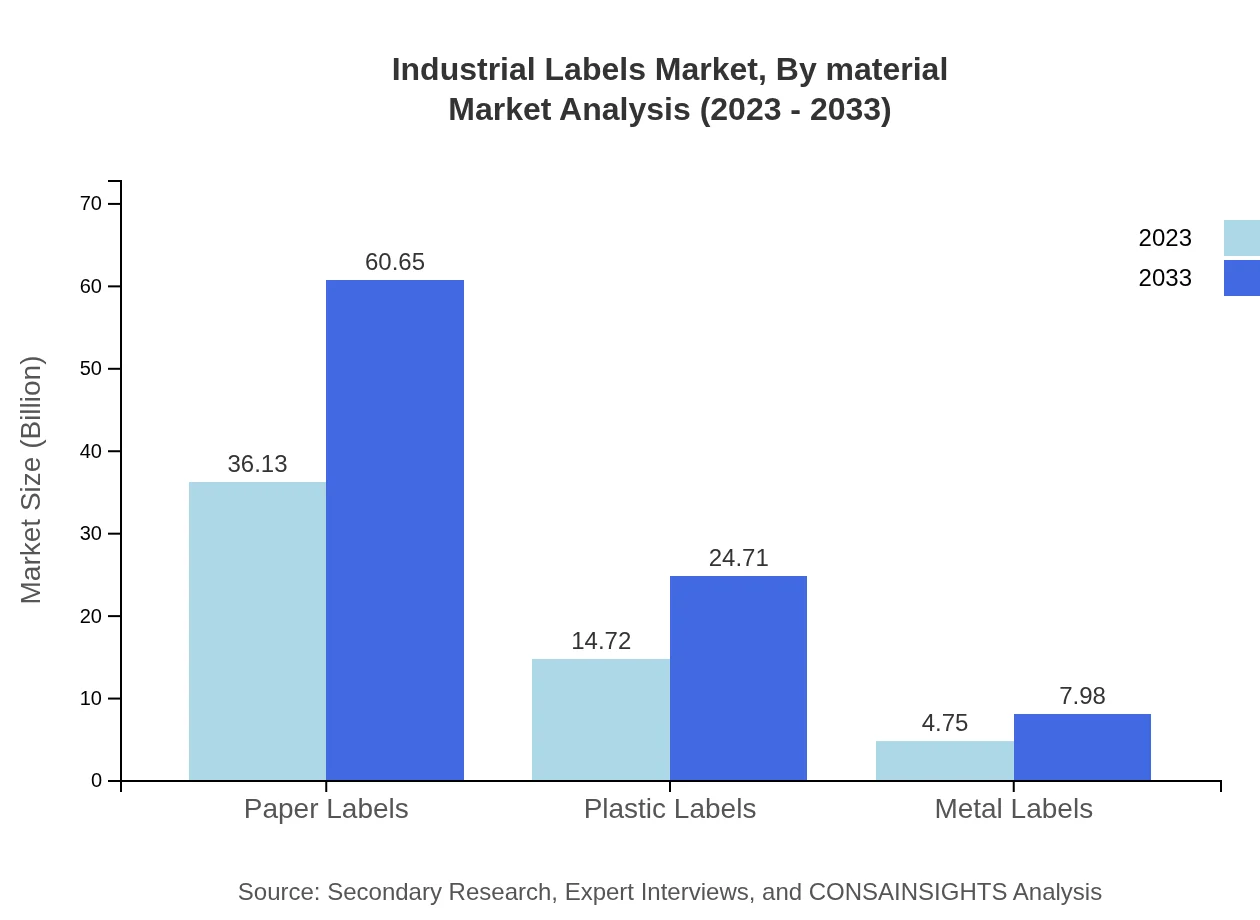

Industrial Labels Market Analysis By Material

The Industrial Labels Market is categorized into various materials such as paper, plastic, and metal. In terms of size, paper labels dominate the market, projected to grow from USD 36.13 billion in 2023 to USD 60.65 billion by 2033, accounting for 64.98% share. Plastic labels, on the other hand, are expected to increase from USD 14.72 billion to USD 24.71 billion, claiming 26.47% share of the market by 2033. Metal labels, although smaller, show suitable growth from USD 4.75 billion to USD 7.98 billion with an 8.55% share.

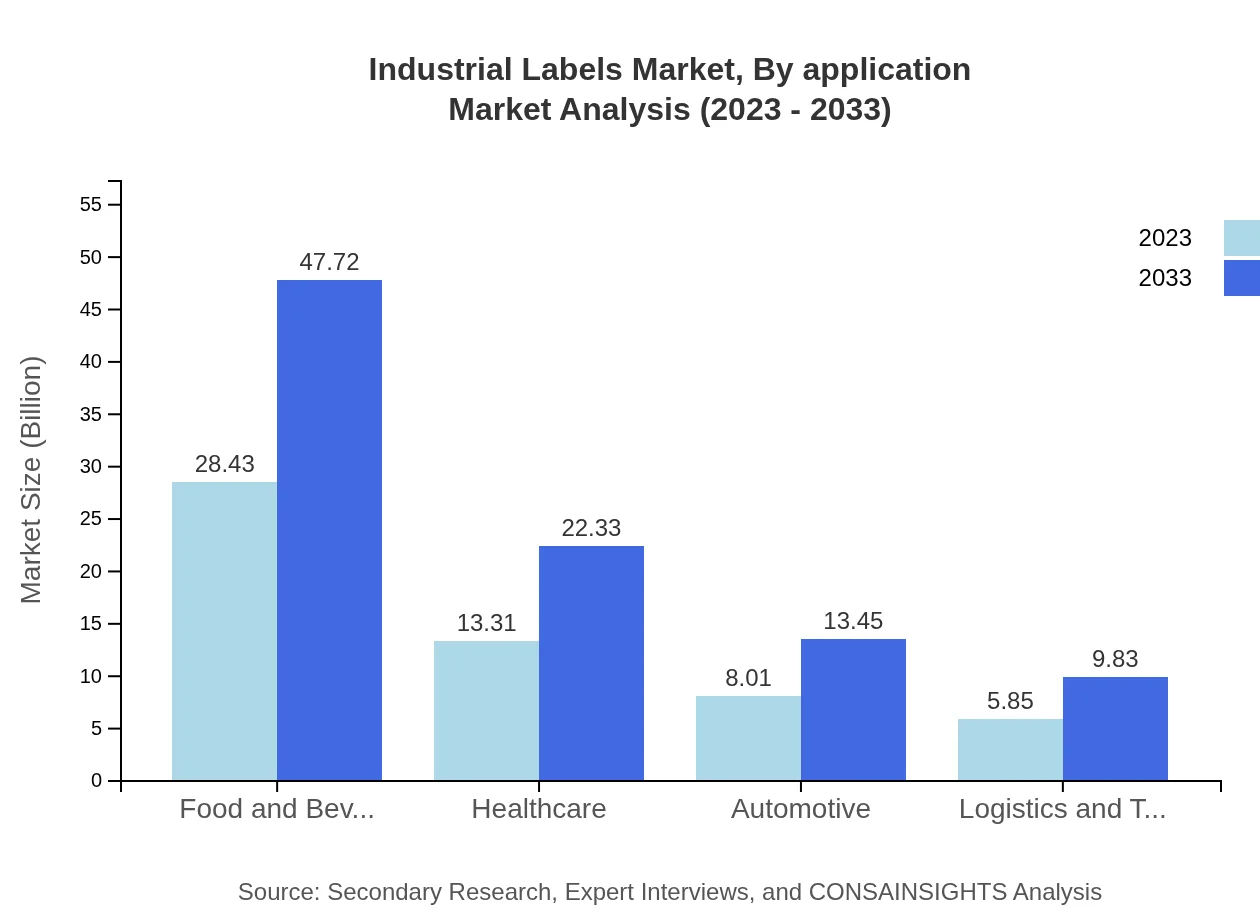

Industrial Labels Market Analysis By Application

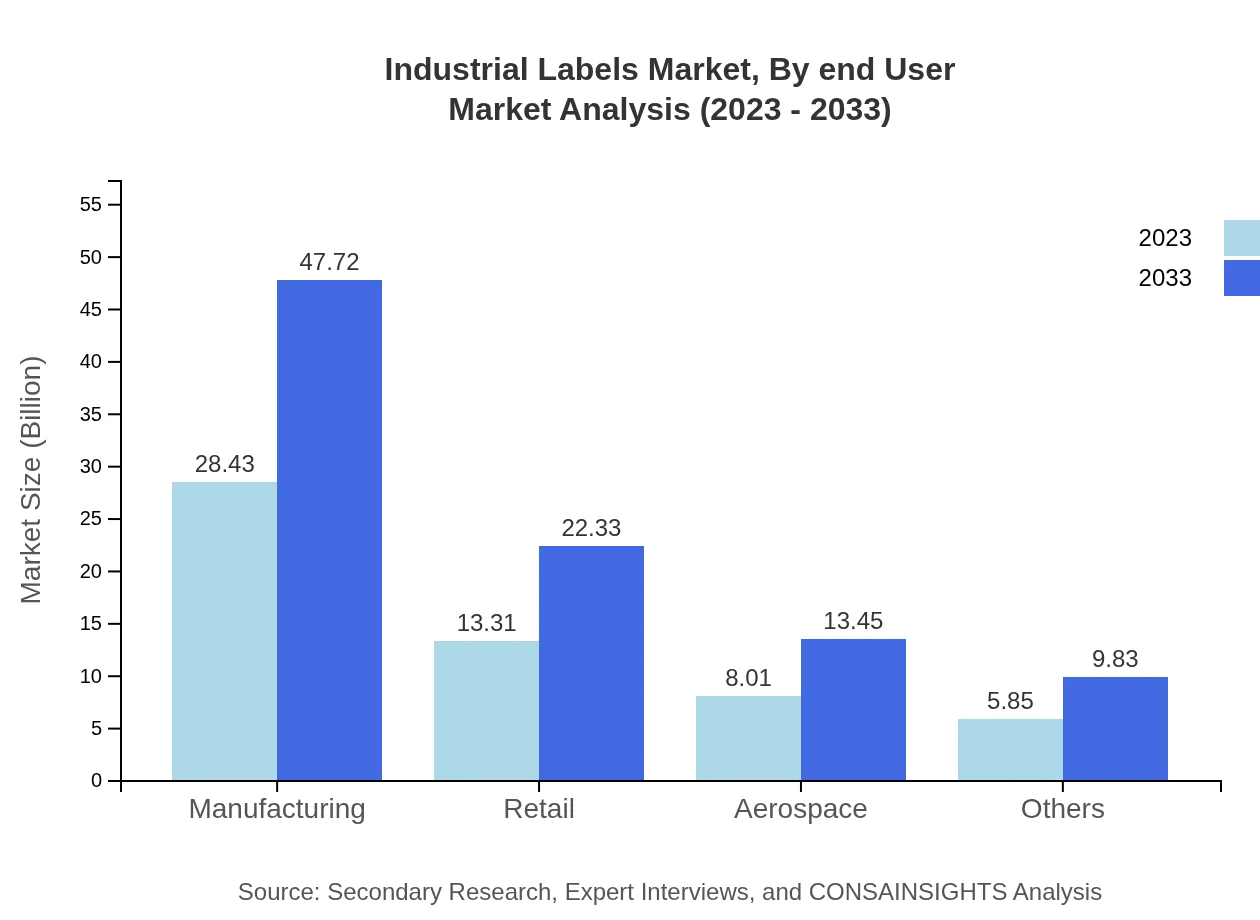

Within the market segments by application, manufacturing holds substantial dominance, with forecasts indicating growth from USD 28.43 billion in 2023 to USD 47.72 billion by 2033, reflecting a 51.13% share. The food & beverage sector is also prominent, expanding from USD 28.43 billion to USD 47.72 billion (51.13% share). Growth within healthcare will see an increase from USD 13.31 billion to USD 22.33 billion, maintaining a 23.93% share throughout, while retail and aerospace applications will witness similar growth trajectories.

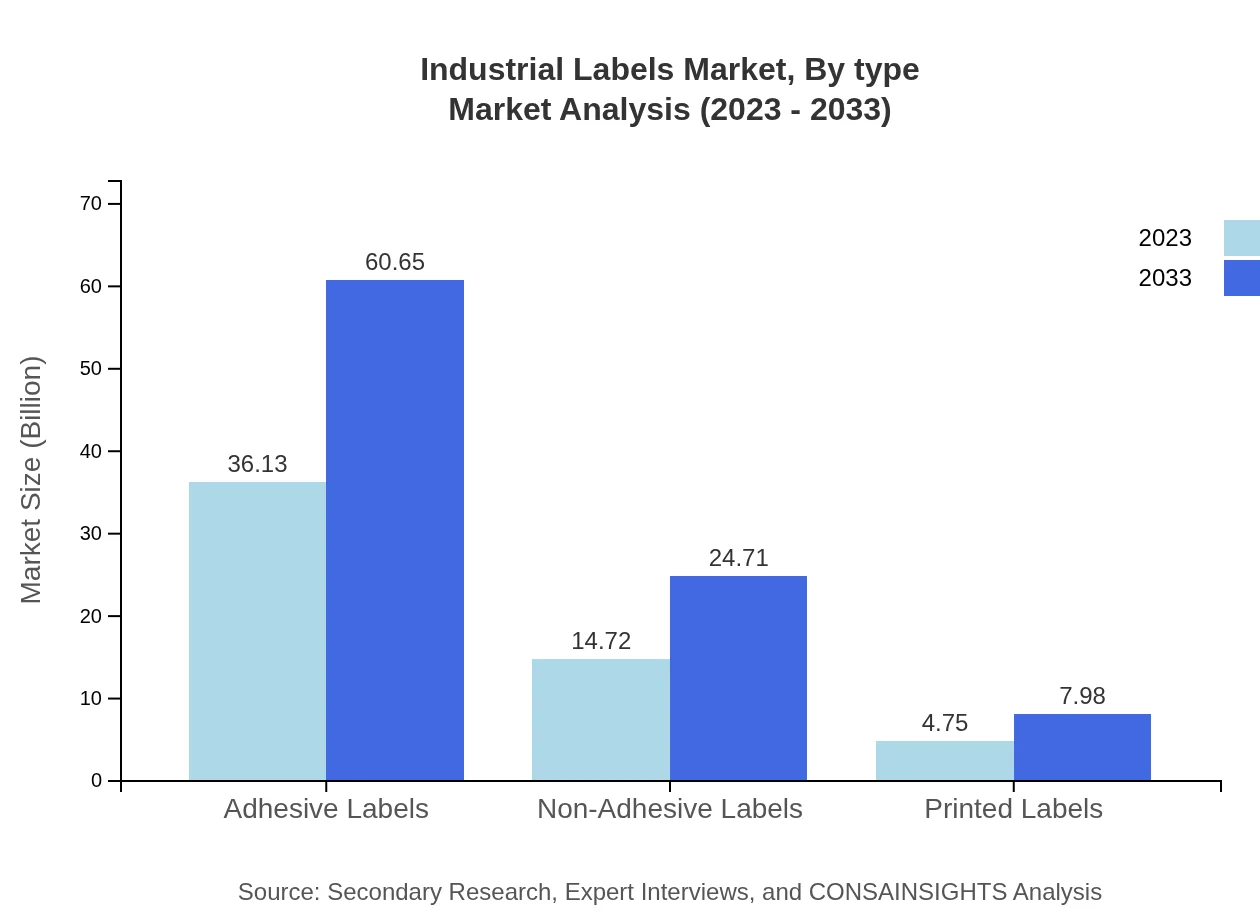

Industrial Labels Market Analysis By Type

The market is further segmented by types of labels including adhesive, non-adhesive, and printed labels. Adhesive labels dominate the segment with a size of USD 36.13 billion in 2023 growing to USD 60.65 billion by 2033, representing a 64.98% market share. Non-adhesive labels are expected to grow from USD 14.72 billion to USD 24.71 billion (26.47%) and printed labels from USD 4.75 billion to USD 7.98 billion (8.55%).

Industrial Labels Market Analysis By End User

The market segmentation by end-user indicates that the manufacturing sector and food & beverage are the leading consumers of industrial labels, collectively accounting for significant growth and shares. Sectors such as logistics and transportation and healthcare are emerging segments that show potential for growth as they adapt to newer labeling technologies.

Industrial Labels Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Industrial Labels Industry

Avery Dennison Corporation:

Avery Dennison is a global leader in material science and manufacturing of labeling and packaging solutions, offering a range of innovative products that aid in the tracking and identification of goods.Brady Corporation:

Brady Corporation specializes in identification and safety solutions, providing high-quality industrial labels used in various sectors including manufacturing and logistics.Smart Packaging Solutions:

Smart Packaging Solutions is known for pioneering RFID-based labels and smart tags that enhance product traceability and supply chain efficiency.3M Company:

3M offers a wide array of labeling solutions that emphasize innovation and sustainability, catering to various sectors across the globe.We're grateful to work with incredible clients.

FAQs

What is the market size of industrial Labels?

The global industrial labels market is projected to grow from $55.6 billion in 2023 to approximately $90.3 billion by 2033, achieving a CAGR of 5.2% during this period. This growth is buoyed by increased demand across various industries.

What are the key market players or companies in this industrial Labels industry?

Key players include Avery Dennison Corporation, CCL Industries, Brady Corporation, 3M, and Multicolor Corporation. These companies are recognized for their innovative solutions and robust distribution networks, playing significant roles in the industrial labels market.

What are the primary factors driving the growth in the industrial Labels industry?

Key growth drivers include the rising focus on product safety and quality, regulatory requirements, increased automation in manufacturing, and the growing e-commerce sector which demands efficient labeling solutions for logistics.

Which region is the fastest Growing in the industrial Labels?

The Asia Pacific region is anticipated to witness substantial growth in the industrial labels sector, projected to increase from $10.51 billion in 2023 to $17.64 billion by 2033, signifying a blossoming market driven by industrial expansion.

Does ConsaInsights provide customized market report data for the industrial Labels industry?

Yes, ConsaInsights specializes in offering customized market report data tailored to specific client needs, ensuring that insights are relevant and actionable for strategic decision-making in the industrial labels sector.

What deliverables can I expect from this industrial Labels market research project?

Expect comprehensive reports, market analysis, competitive landscape reviews, future forecasts, and segmented data insights spanning regions and product types, equipping you with critical information for informed decision-making.

What are the market trends of industrial Labels?

Current trends include the shift towards sustainable label materials, the integration of smart technologies like QR codes, and the increasing need for customizable labeling solutions driven by e-commerce and retail demands.