Industrial Machine Vision Market Report

Published Date: 22 January 2026 | Report Code: industrial-machine-vision

Industrial Machine Vision Market Size, Share, Industry Trends and Forecast to 2033

This comprehensive report provides a detailed analysis of the Industrial Machine Vision market, offering insights on market size, trends, technological advancements, and forecasts for the period from 2023 to 2033.

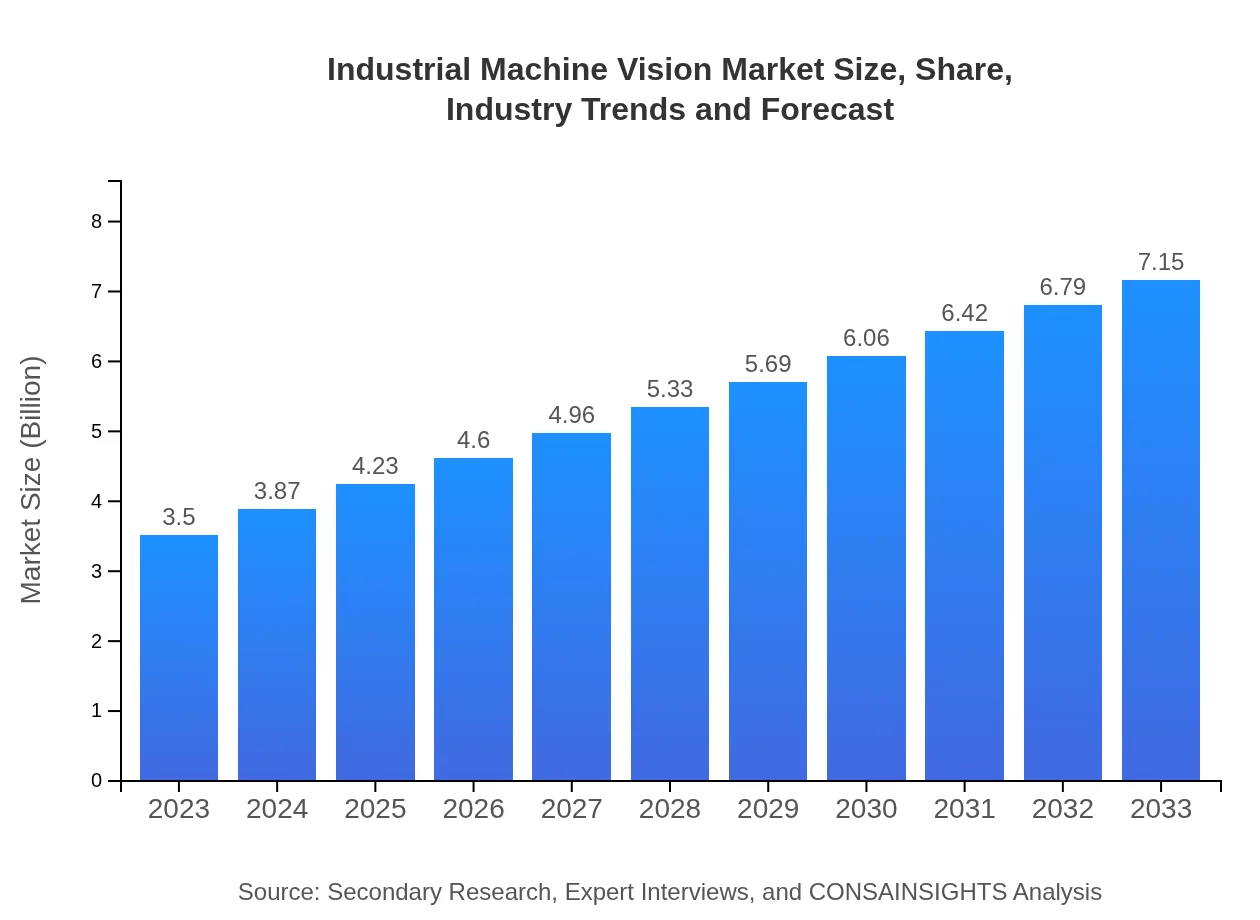

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $3.50 Billion |

| CAGR (2023-2033) | 7.2% |

| 2033 Market Size | $7.15 Billion |

| Top Companies | Cognex Corporation, Keyence Corporation, Basler AG, Teledyne Technologies Inc. |

| Last Modified Date | 22 January 2026 |

Industrial Machine Vision Market Overview

Customize Industrial Machine Vision Market Report market research report

- ✔ Get in-depth analysis of Industrial Machine Vision market size, growth, and forecasts.

- ✔ Understand Industrial Machine Vision's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Industrial Machine Vision

What is the Market Size & CAGR of Industrial Machine Vision market in 2023?

Industrial Machine Vision Industry Analysis

Industrial Machine Vision Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Industrial Machine Vision Market Analysis Report by Region

Europe Industrial Machine Vision Market Report:

Europe is projected to witness substantial market growth, moving from $1.15 billion in 2023 to $2.35 billion by 2033. The focus on quality manufacturing and stringent regulatory standards in industries such as automotive and electronics significantly drives demand in this region.Asia Pacific Industrial Machine Vision Market Report:

In the Asia-Pacific region, the Industrial Machine Vision market is expected to grow from $0.62 billion in 2023 to $1.27 billion by 2033. This growth is driven by rapid industrialization, especially in manufacturing sectors in countries like China and India, where the adoption of smart factory technologies is escalating significantly.North America Industrial Machine Vision Market Report:

North America, led by the United States, exhibits a robust market growth, increasing from $1.24 billion in 2023 to $2.53 billion in 2033. The region's advanced technological infrastructure and the presence of key players enhance the adoption of machine vision systems across various sectors.South America Industrial Machine Vision Market Report:

The South American market for Industrial Machine Vision is anticipated to grow from $0.16 billion in 2023 to $0.32 billion by 2033. Brazil and Argentina are key contributors, fostering growth through the modernization of manufacturing practices and adoption of advanced imaging technologies.Middle East & Africa Industrial Machine Vision Market Report:

The Middle East and Africa market is set to expand from $0.34 billion in 2023 to $0.69 billion by 2033, with countries like South Africa and the UAE leading growth through increased investments in automation and manufacturing technologies.Tell us your focus area and get a customized research report.

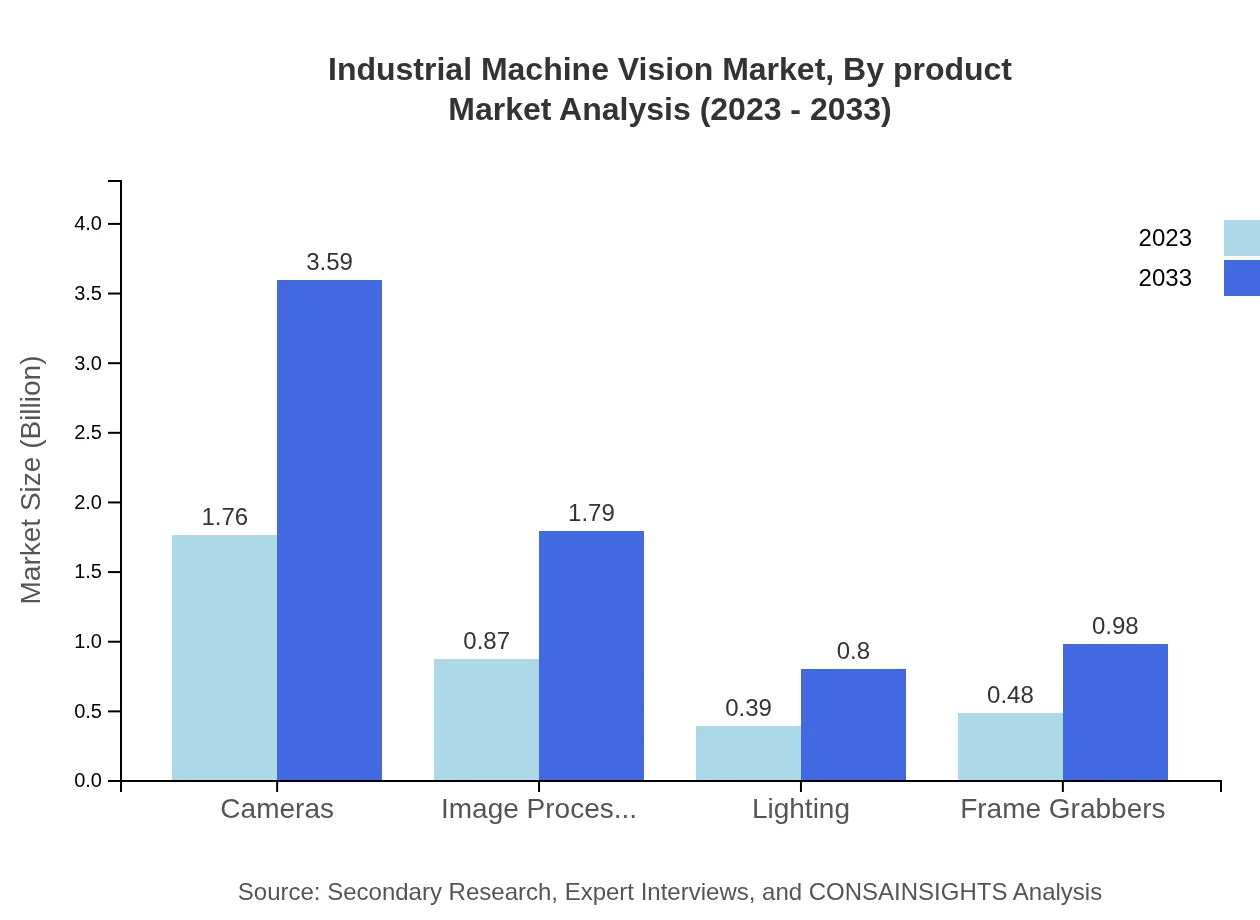

Industrial Machine Vision Market Analysis By Product

The product segmentation of the Industrial Machine Vision market reveals that cameras dominate the segment, projected to grow from $1.76 billion in 2023 to $3.59 billion by 2033. They hold a significant market share of 50.17% in 2023, remaining stable throughout the forecast period. Image processing software and lighting are also critical, with expected growth of $0.87 billion to $1.79 billion and $0.39 billion to $0.80 billion, respectively. Frame grabbers are projected to grow steadily from $0.48 billion to $0.98 billion.

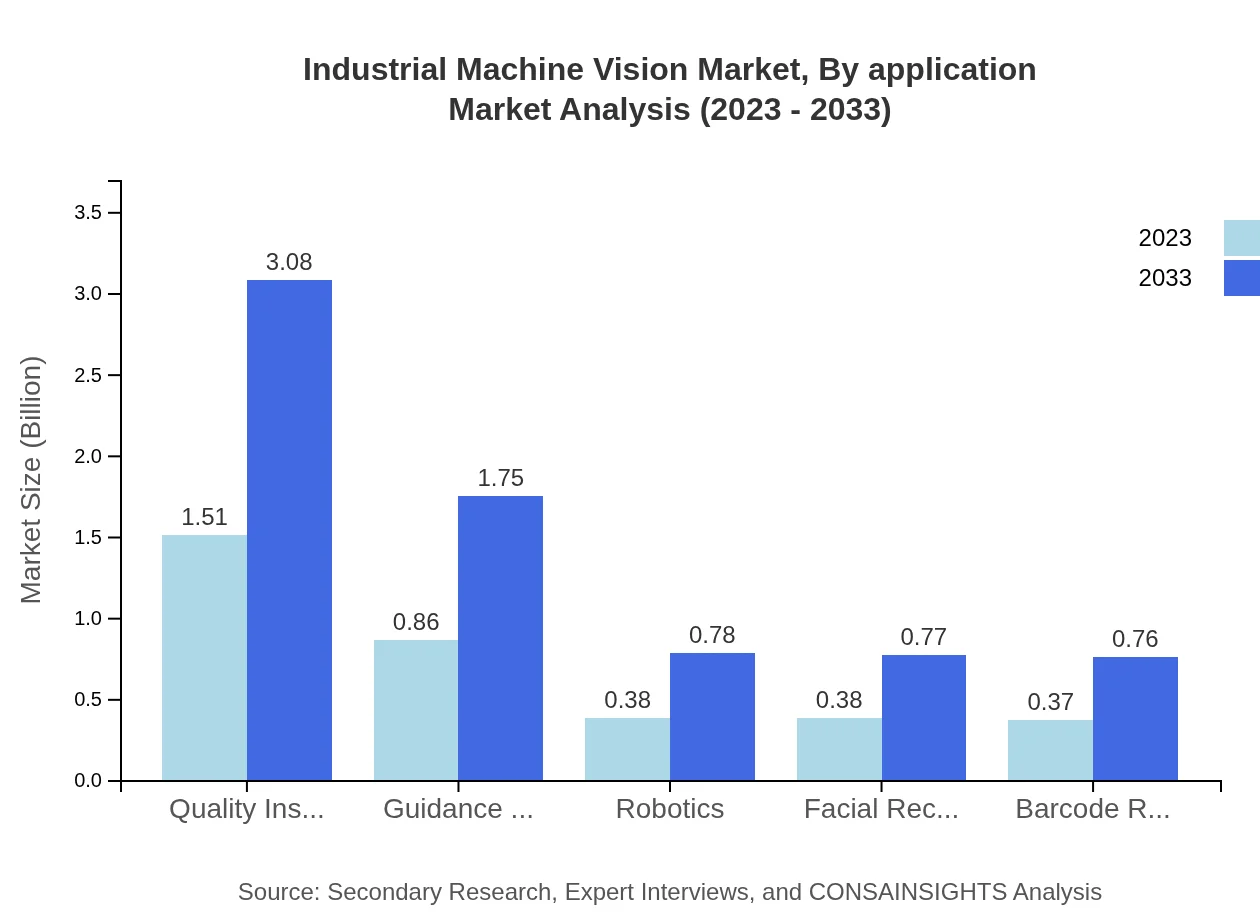

Industrial Machine Vision Market Analysis By Application

Applications within the Industrial Machine Vision market highlight quality inspection as a critical component, anticipated to increase from $1.51 billion in 2023 to $3.08 billion by 2033, maintaining a market share of 43.12%. Other applications, including guidance systems and robotics, will grow in significance as more sectors adopt automation solutions to enhance operational efficiency.

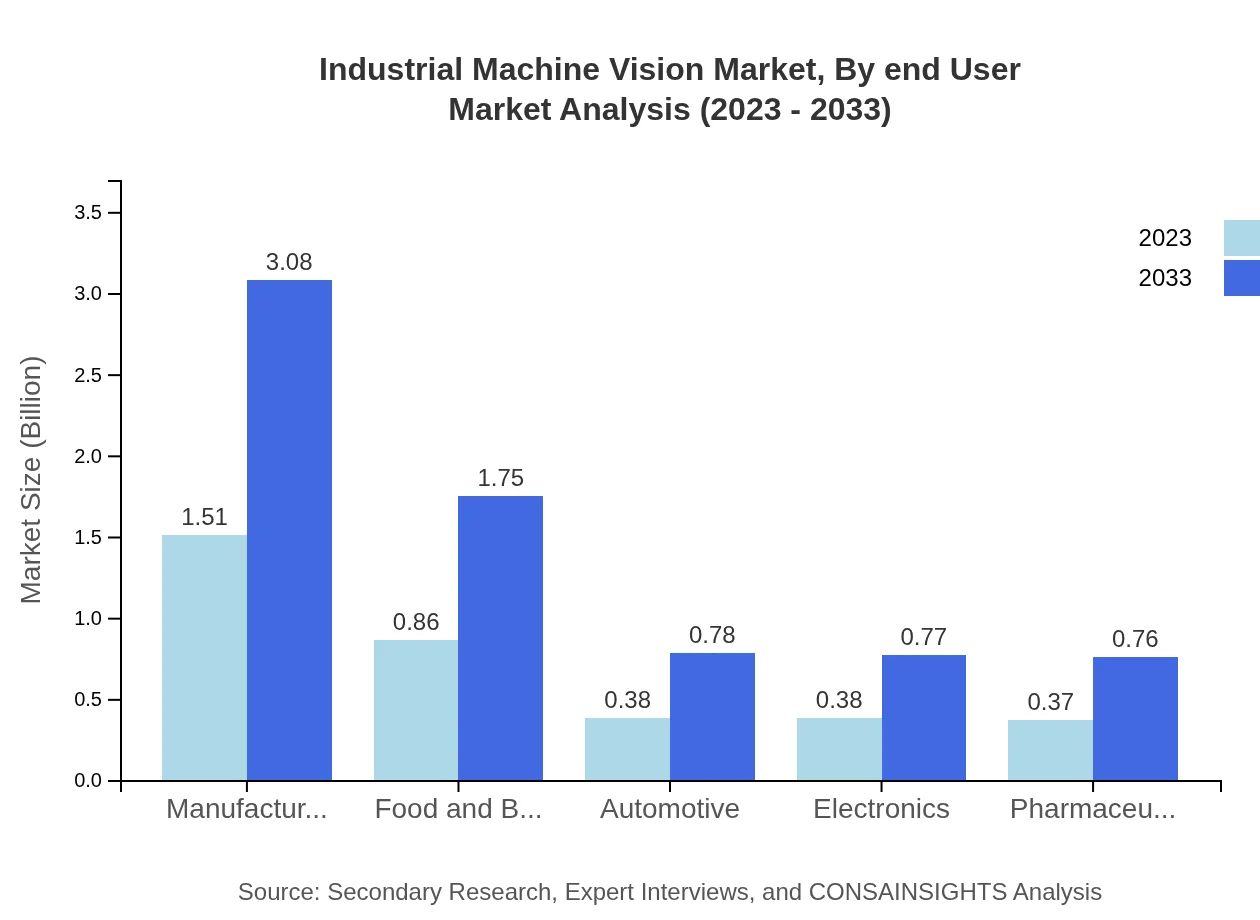

Industrial Machine Vision Market Analysis By End User

The end-user market demonstrates that manufacturing leads the sector, with growth forecast from $1.51 billion to $3.08 billion by 2033, holding a steady share of 43.12%. The automotive and food & beverage industries also play a vital role, expected to contribute with a shift towards automated and quality-focused operations.

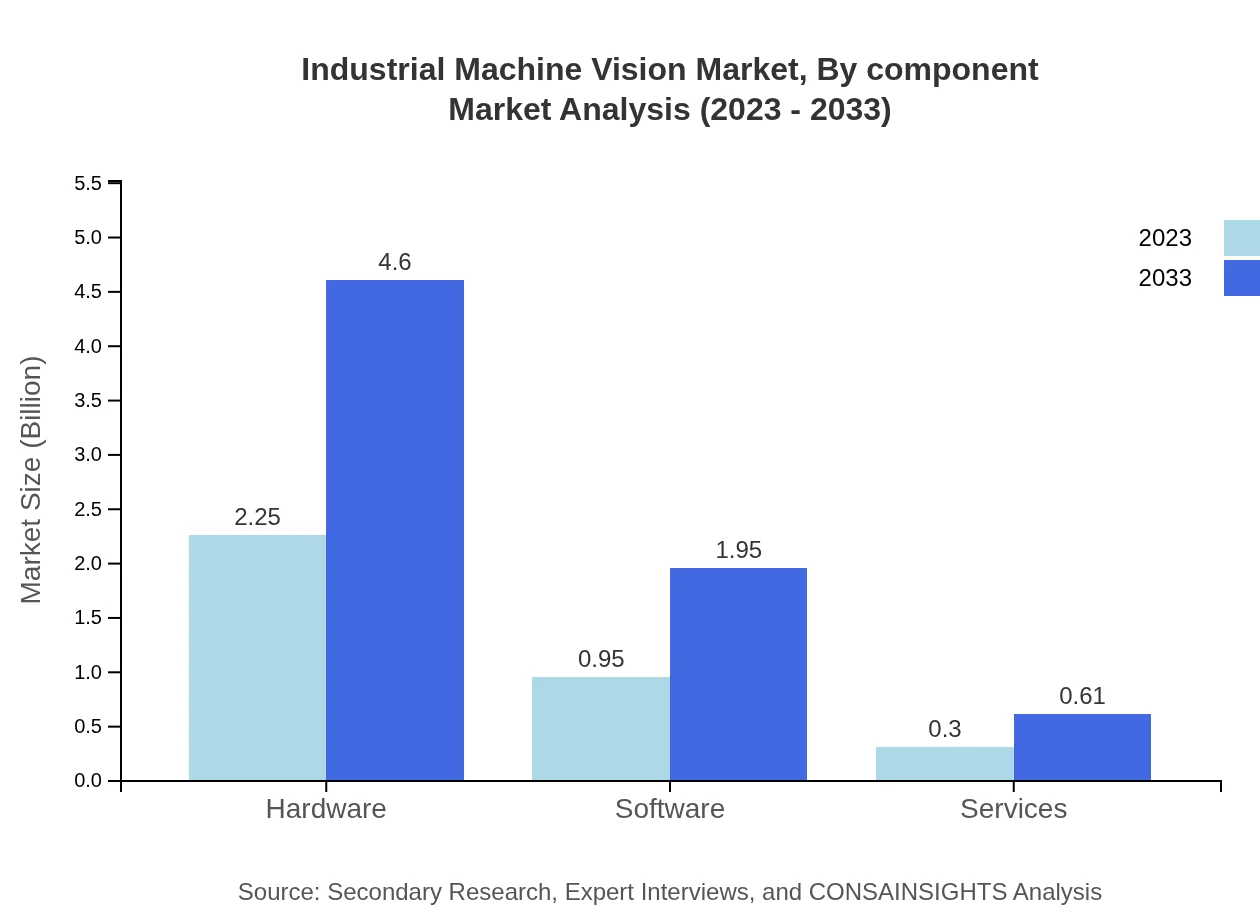

Industrial Machine Vision Market Analysis By Component

In terms of components, hardware leads the segment with a market size of $2.25 billion expected to grow to $4.60 billion by 2033, capturing a substantial share of 64.25%. Software follows, playing an essential role in data processing and analysis, growing to $1.95 billion, while services are also an integral part, albeit at a smaller scale.

Industrial Machine Vision Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Industrial Machine Vision Industry

Cognex Corporation:

Cognex is a leading provider of machine vision and industrial barcode reading technologies, offering innovative solutions that enhance productivity and quality in manufacturing.Keyence Corporation:

Keyence specializes in automation and inspection technologies, providing advanced machine vision systems designed to improve quality control and operational efficiency across various industries.Basler AG:

Basler is a well-known developer of high-quality cameras and image processing software, focusing on machine vision applications for different sectors including electronics and automotive.Teledyne Technologies Inc.:

Teledyne is a diversified technology company that offers advanced imaging solutions for machine vision applications, known for their technological innovations in cameras and sensor products.We're grateful to work with incredible clients.

FAQs

What is the market size of industrial machine vision?

The global industrial machine vision market is valued at $3.5 billion in 2023, with a projected CAGR of 7.2%, indicating a strong growth trajectory as businesses increasingly adopt automation and innovation in their processes.

What are the key market players or companies in the industrial machine vision industry?

Key players in the industrial machine vision market include companies specializing in imaging systems, software development, and hardware manufacturing. They are pivotal in advancing technology and meeting varying industry standards across global markets.

What are the primary factors driving the growth in the industrial machine vision industry?

Growth is driven by the rising demand for automation in manufacturing, increased quality control requirements, and advancements in AI and machine learning, contributing to enhanced imaging capabilities and data processing.

Which region is the fastest Growing in the industrial machine vision?

Asia Pacific is currently the fastest-growing region for industrial machine vision, projected to grow from $0.62 billion in 2023 to $1.27 billion by 2033, reflecting strong demand for automation and technology adoption.

Does ConsaInsights provide customized market report data for the industrial machine vision industry?

Yes, ConsaInsights offers customized market report data, allowing clients to tailor research to specific segments or regions in the industrial machine vision industry for more precise insights.

What deliverables can I expect from this industrial machine vision market research project?

Deliverables include comprehensive market analysis reports, segmentation data, competitive landscape insights, regional performance analysis, and tailored recommendations based on your business needs and objectives.

What are the market trends of industrial machine vision?

Current trends include increasing integration of machine learning algorithms in imaging, rising adoption in sectors like food and beverage, automotive, and pharmaceutical, and a shift towards smart manufacturing solutions.