Industrial Margarine Market Report

Published Date: 31 January 2026 | Report Code: industrial-margarine

Industrial Margarine Market Size, Share, Industry Trends and Forecast to 2033

This report delves into the Industrial Margarine market, exploring key insights, data, and trends from 2023 to 2033, including market size, regional dynamics, technology advancements, and future forecasts.

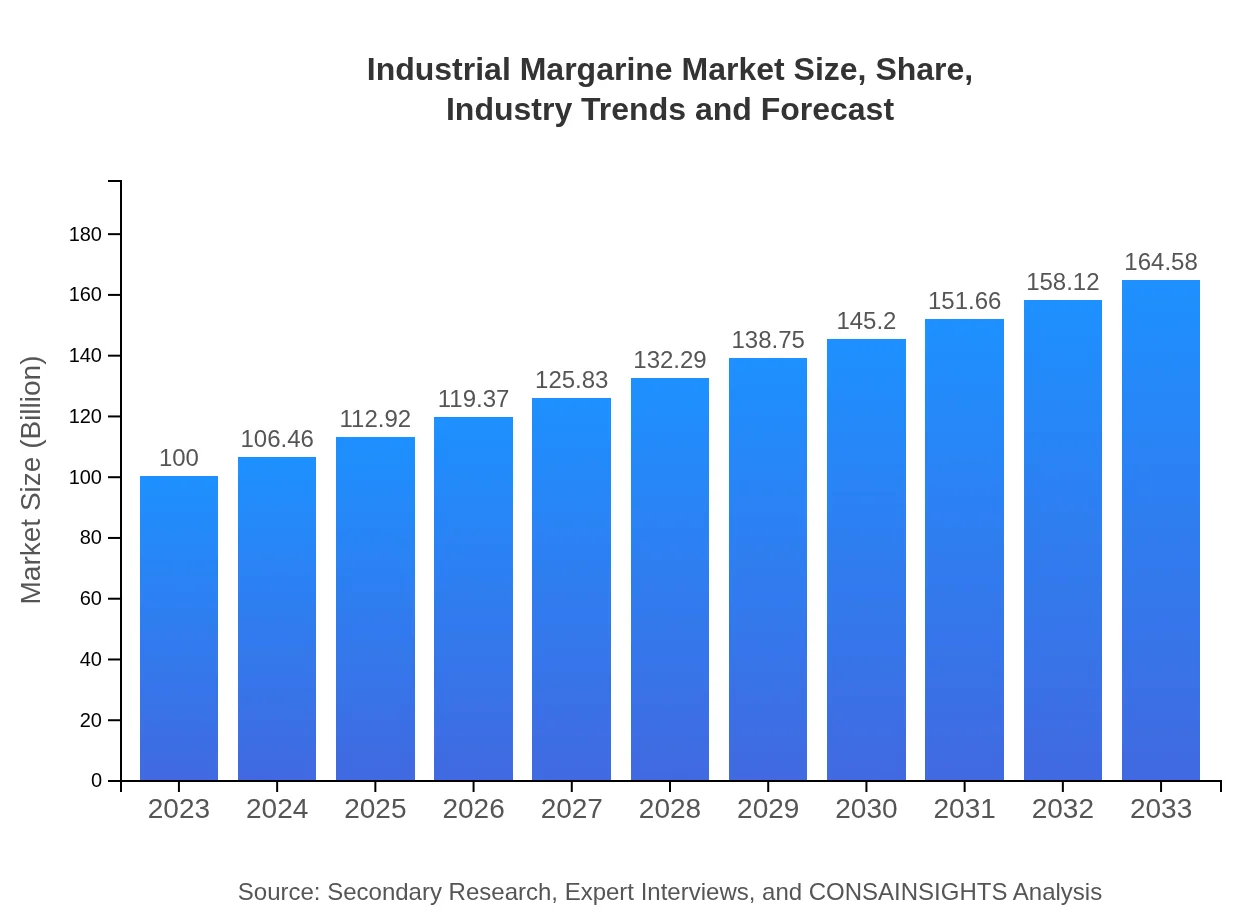

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $100.00 Million |

| CAGR (2023-2033) | 5% |

| 2033 Market Size | $164.58 Million |

| Top Companies | Unilever, Cargill , Bunge Limited, Kraft Heinz |

| Last Modified Date | 31 January 2026 |

Industrial Margarine Market Overview

Customize Industrial Margarine Market Report market research report

- ✔ Get in-depth analysis of Industrial Margarine market size, growth, and forecasts.

- ✔ Understand Industrial Margarine's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Industrial Margarine

What is the Market Size & CAGR of the Industrial Margarine market in 2023?

Industrial Margarine Industry Analysis

Industrial Margarine Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Industrial Margarine Market Analysis Report by Region

Europe Industrial Margarine Market Report:

The European Industrial Margarine market, currently valued at $31.36 billion in 2023, is expected to surge to $51.61 billion by 2033. The region's growth is supported by stringent regulatory frameworks on trans fat usage and increasing production of health-oriented margarine variants.Asia Pacific Industrial Margarine Market Report:

The Asia-Pacific Industrial Margarine market is estimated at $19.77 billion in 2023, expected to grow to $32.54 billion by 2033, driven by rising urbanization and the growing food processing industry. The presence of key manufacturing hubs in countries like India and China further enhances market growth.North America Industrial Margarine Market Report:

North America is poised to maintain its substantial market share with a valuation of $33.49 billion in 2023, growing to $55.12 billion by 2033. The prevalence of health-conscious consumers and innovation in product offerings drive significant growth.South America Industrial Margarine Market Report:

In South America, the market for Industrial Margarine is valued at $6.05 billion in 2023 and is projected to reach $9.96 billion by 2033. This growth is bolstered by the increasing demand for bakery products in local cuisines, particularly in Brazil and Argentina.Middle East & Africa Industrial Margarine Market Report:

The Middle East and Africa market for Industrial Margarine stands at $9.33 billion in 2023, expected to grow to $15.35 billion by 2033. The increasing food service and hospitality industry in the UAE and South Africa are key contributors to this growth.Tell us your focus area and get a customized research report.

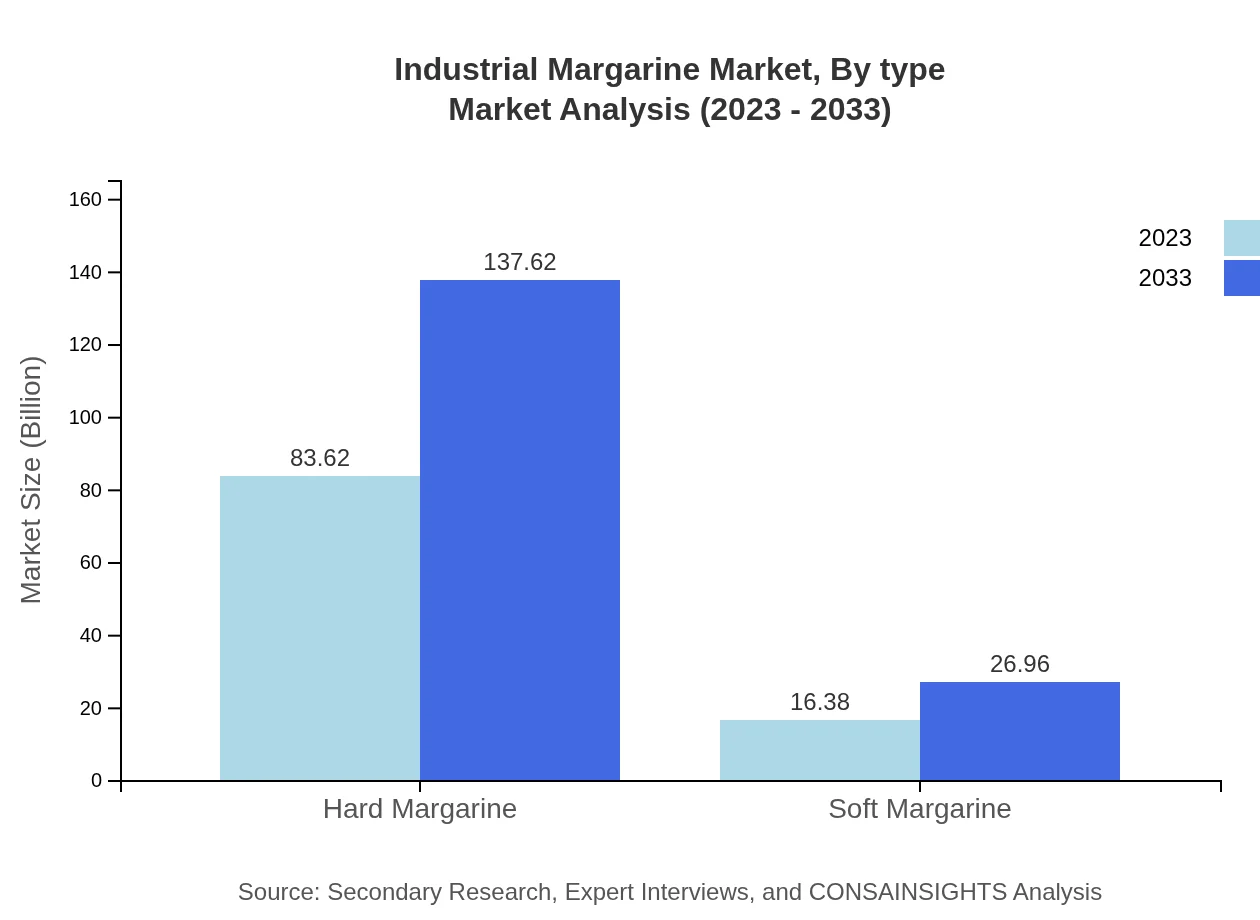

Industrial Margarine Market Analysis By Type

In 2023, Hard Margarine dominates the market with a size of $83.62 billion, projected to grow to $137.62 billion by 2033. Soft Margarine, although smaller, is also expected to rise from $16.38 billion to $26.96 billion. Hard Margarine's stability and ease of use in various applications make it highly favored within the industry.

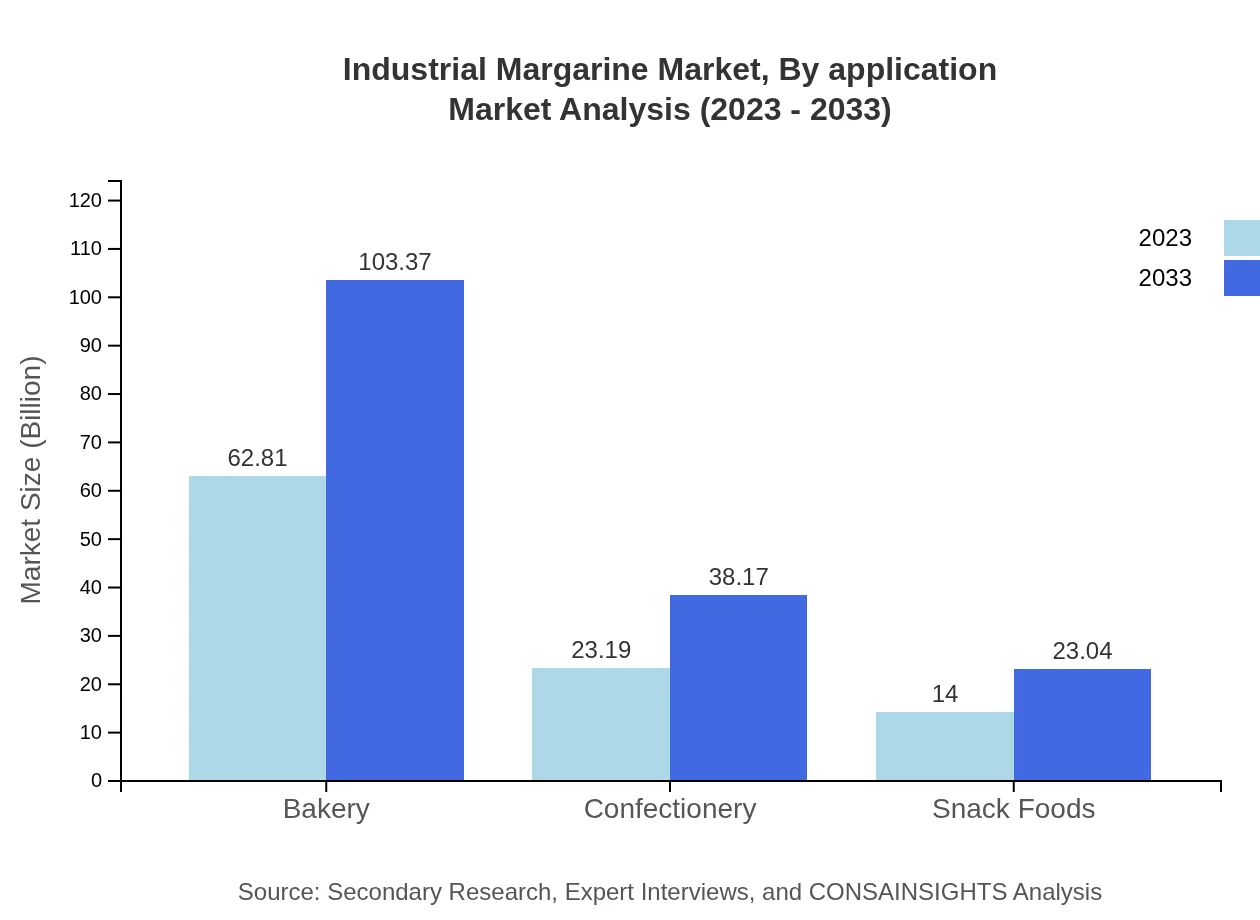

Industrial Margarine Market Analysis By Application

The Bakery sector leads the application market with a size of $62.81 billion in 2023, anticipated to reach $103.37 billion by 2033. Confectionery follows at $23.19 billion, growing to $38.17 billion, while Snack Foods are expected to expand from $14.00 billion to $23.04 billion during the same period.

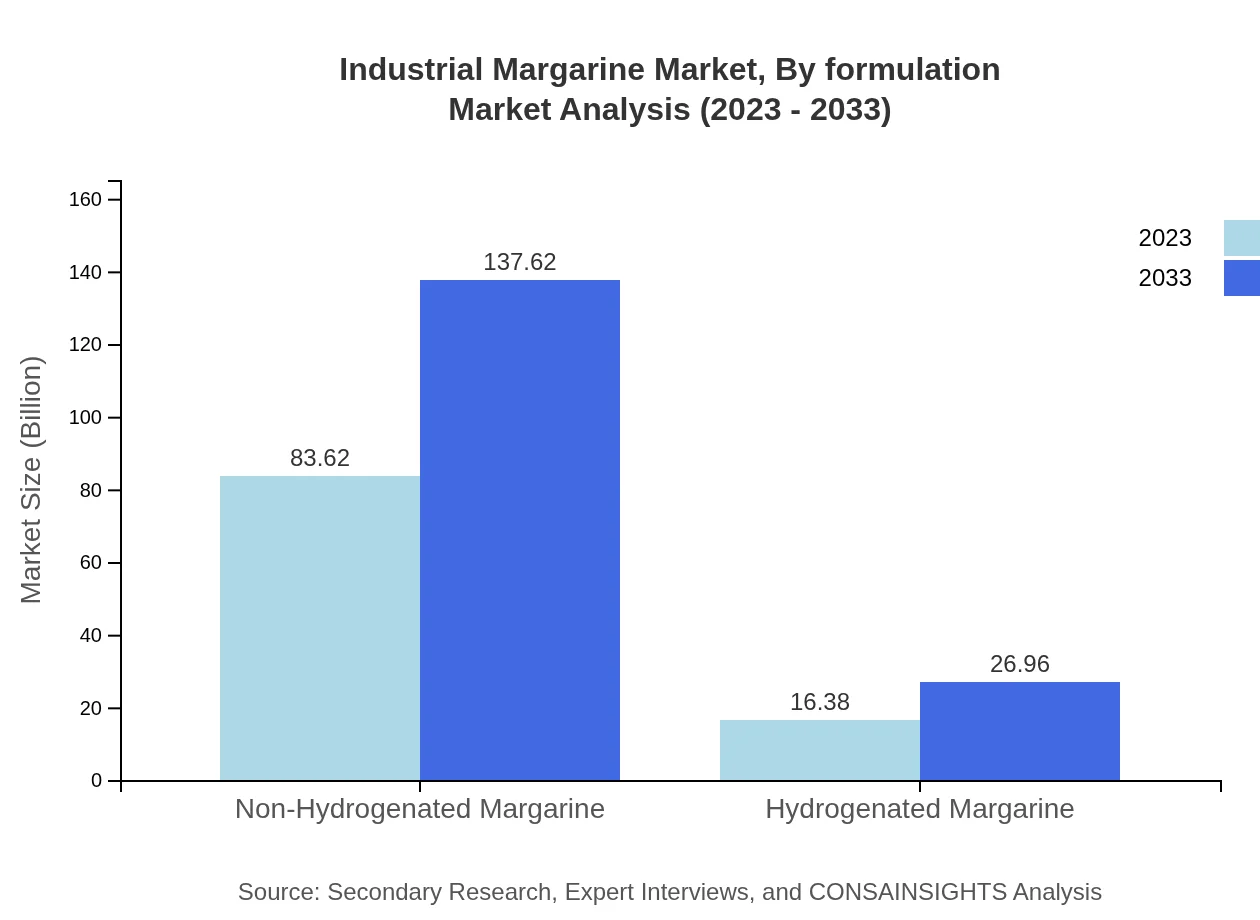

Industrial Margarine Market Analysis By Formulation

Non-Hydrogenated Margarine represents a significant portion of the market at $83.62 billion in 2023, continuing to grow to $137.62 billion by 2033. Hydrogenated Margarine, despite facing scrutiny, maintains an important share, expected to rise from $16.38 billion to $26.96 billion.

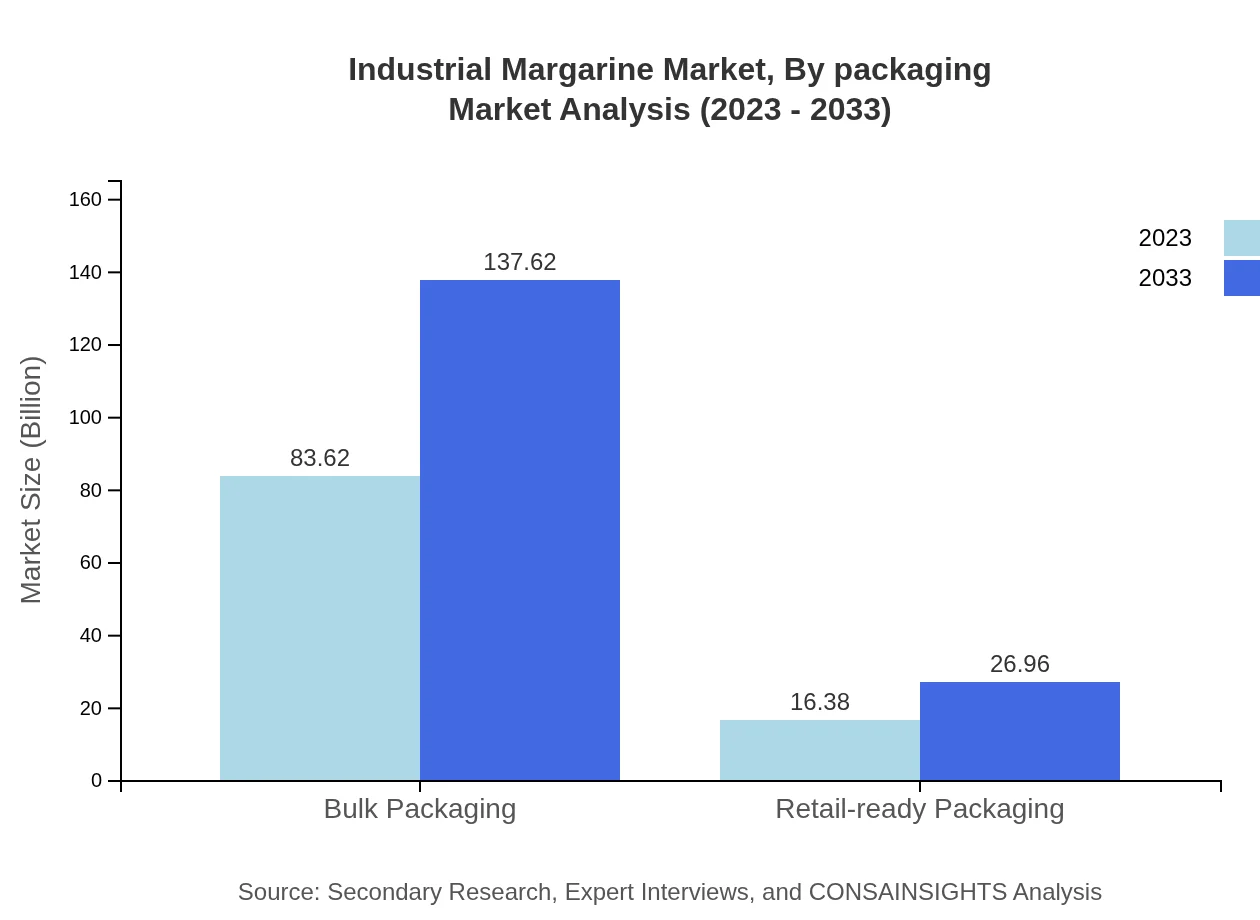

Industrial Margarine Market Analysis By Packaging

Bulk Packaging leads with a size of $83.62 billion in 2023, growing to $137.62 billion by 2033, catering primarily to industrial bakeries and food manufacturers. Retail-ready Packaging is set to increase from $16.38 billion to $26.96 billion, reflecting consumer access trends.

Industrial Margarine Market Analysis By Distribution Channel

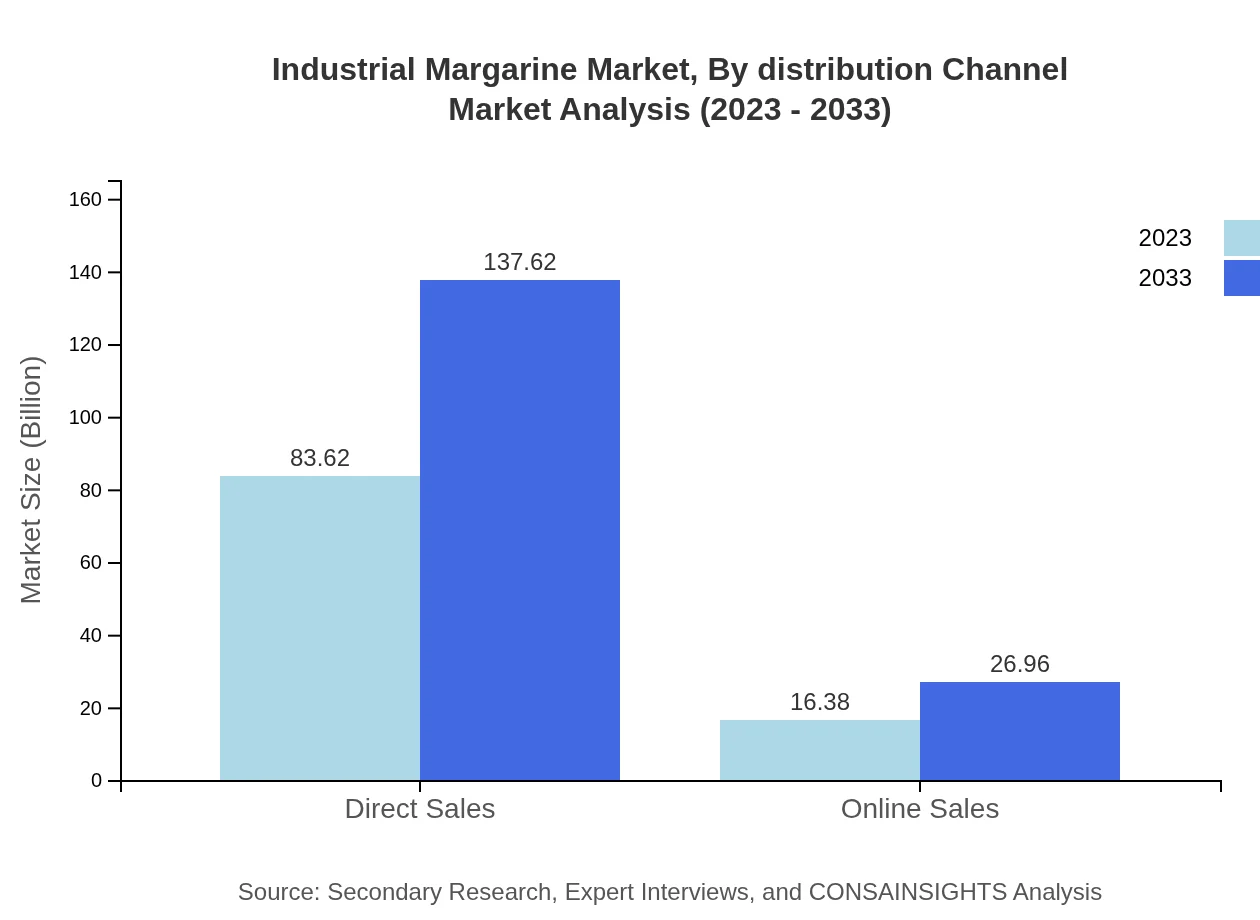

Direct Sales dominate with $83.62 billion in 2023, projected to remain strong at $137.62 billion by 2033. Online Sales, while smaller at $16.38 billion, are anticipated to grow to $26.96 billion, reflecting the shift towards e-commerce and online grocery shopping.

Industrial Margarine Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in the Industrial Margarine Industry

Unilever:

A leading global food company known for its Margarine brands like Flora, which focuses on health and wholesome ingredients.Cargill :

A major player in the global margarine market, producing a variety of margarine for both wholesale and retail sectors.Bunge Limited:

A global agribusiness and food company, Bunge is known for its strong presence in the margarine market, leveraging its vast supply chain.Kraft Heinz:

Offers a variety of margarine products under various brands, leveraging their extensive distribution channels and marketing capabilities.We're grateful to work with incredible clients.

FAQs

What is the market size of industrial margarine?

The industrial margarine market is valued at approximately $100 million in 2023. This market is projected to grow at a CAGR of 5% through 2033, indicating a positive growth trajectory for the upcoming decade.

What are the key market players or companies in the industrial margarine industry?

Key players in the industrial margarine market include major food manufacturers and margarine suppliers. These companies often leverage innovative production techniques and robust distribution networks to enhance their market presence.

What are the primary factors driving the growth in the industrial margarine industry?

Growth in the industrial margarine industry is driven by rising demand in the bakery and confectionery sectors, along with an increasing preference for healthier fat alternatives, making margarine a suitable choice for many consumers.

Which region is the fastest Growing in the industrial margarine?

The North American region exhibits the fastest growth in the industrial margarine market, projected to increase from $33.49 million in 2023 to $55.12 million by 2033, reflecting robust demand and market expansion.

Does ConsaInsights provide customized market report data for the industrial margarine industry?

Yes, ConsaInsights offers customized market reports tailored to the specific needs of clients in the industrial margarine industry, allowing for a detailed analysis based on precise parameters and market conditions.

What deliverables can I expect from this industrial margarine market research project?

You can expect comprehensive market analysis, including detailed reports on market size, trends, segment performance, regional data, and forecasts. Additionally, insights into competitive landscape and consumer behavior will be provided.

What are the market trends of industrial margarine?

Current market trends in industrial margarine include an increasing focus on non-hydrogenated options, growing demand for vegan products, and innovations in packaging that cater to sustainability. These trends highlight evolving consumer preferences.