Industrial Metrology Market Report

Published Date: 22 January 2026 | Report Code: industrial-metrology

Industrial Metrology Market Size, Share, Industry Trends and Forecast to 2033

This report provides comprehensive insights into the Industrial Metrology market, covering market dynamics, segmentation, regional analysis, and forecasts from 2023 to 2033. The insights aim to guide stakeholders in making informed decisions in this evolving industry.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

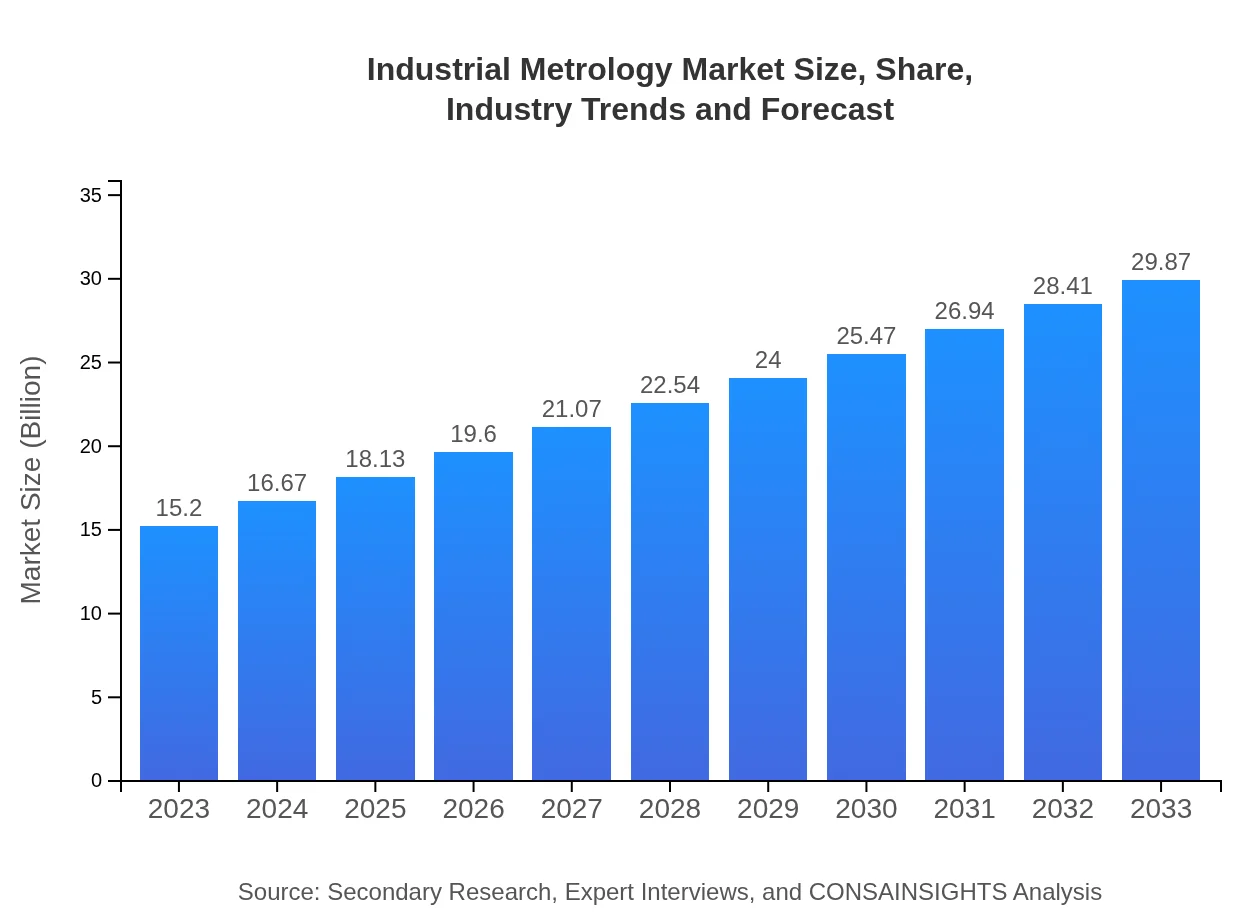

| 2023 Market Size | $15.20 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $29.87 Billion |

| Top Companies | Hexagon AB, Carl Zeiss AG, Mitutoyo Corporation, Renishaw plc |

| Last Modified Date | 22 January 2026 |

Industrial Metrology Market Overview

Customize Industrial Metrology Market Report market research report

- ✔ Get in-depth analysis of Industrial Metrology market size, growth, and forecasts.

- ✔ Understand Industrial Metrology's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Industrial Metrology

What is the Market Size & CAGR of Industrial Metrology market in 2023 and 2033?

Industrial Metrology Industry Analysis

Industrial Metrology Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Industrial Metrology Market Analysis Report by Region

Europe Industrial Metrology Market Report:

Europe is anticipated to see its market size increase from $5.03 billion in 2023 to $9.89 billion by 2033. The region's strong focus on innovation, supported by stringent regulations and standards for quality assurance, further enhances the need for sophisticated metrology solutions.Asia Pacific Industrial Metrology Market Report:

In the Asia Pacific region, the market was valued at $2.88 billion in 2023 and is expected to reach $5.66 billion by 2033. The region’s rapid industrialization and expanding manufacturing sector contribute to this growth. Additionally, rising investments in smart factory technology and automation are further propelling the demand for advanced metrology solutions in countries like China, Japan, and India.North America Industrial Metrology Market Report:

North America’s Industrial Metrology market is projected to grow from $5.01 billion in 2023 to $9.85 billion by 2033. This growth is fueled by the dominance of the automotive and aerospace industries, which emphasize stringent quality standards and advanced manufacturing processes.South America Industrial Metrology Market Report:

For South America, the market size is projected to grow from $1.37 billion in 2023 to $2.70 billion by 2033. Despite economic challenges, there is a growing recognition of the importance of quality control and precision measurement in local manufacturing processes, driven by both domestic production and exports.Middle East & Africa Industrial Metrology Market Report:

In the Middle East and Africa, the Industrial Metrology market is expected to grow from $0.90 billion in 2023 to $1.77 billion by 2033. Although currently smaller, the region is increasingly recognizing the importance of quality control in various sectors, including oil and gas, construction, and manufacturing.Tell us your focus area and get a customized research report.

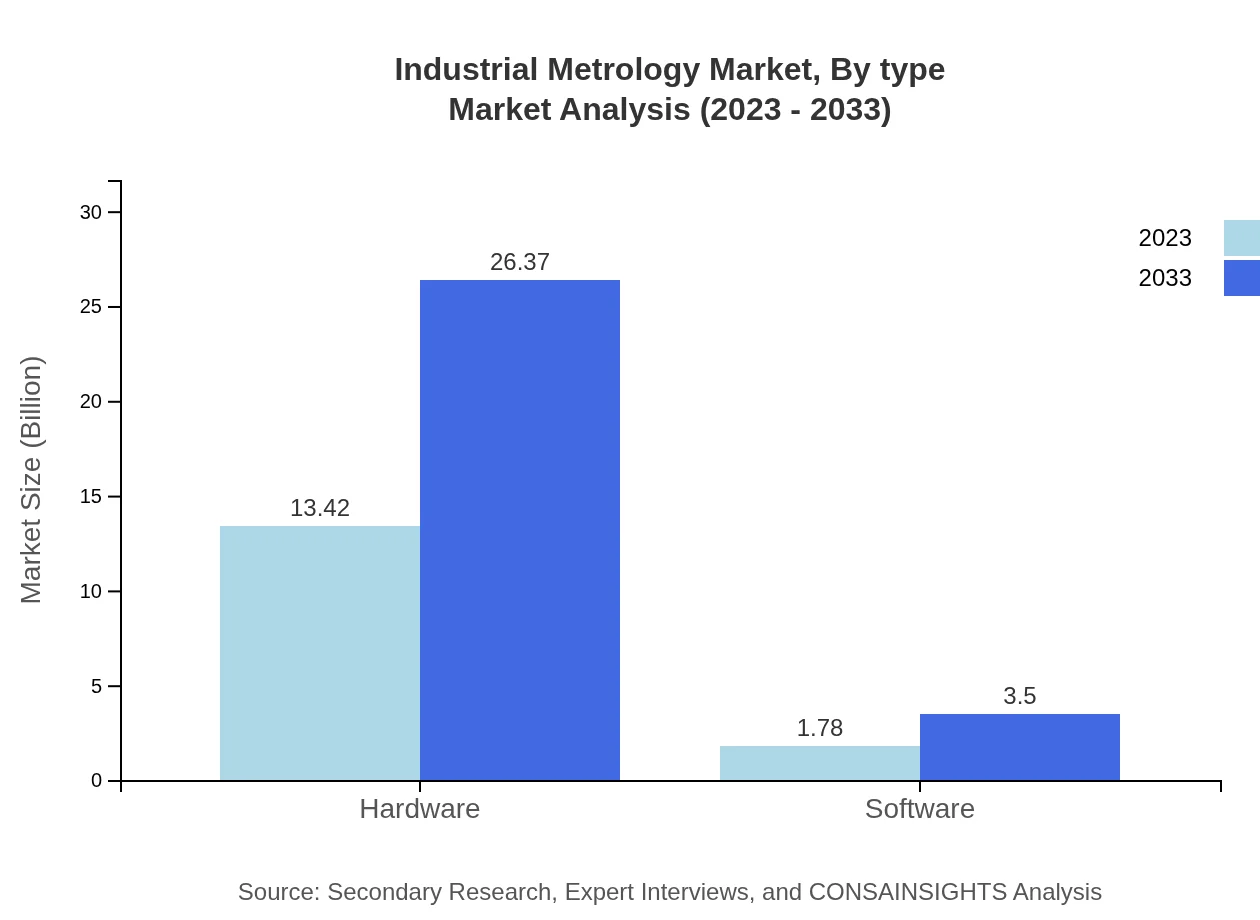

Industrial Metrology Market Analysis By Technology

The Industrial Metrology market by technology is primarily segmented into hardware and software. The hardware segment stands at $13.42 billion in 2023, expecting growth to $26.37 billion by 2033. Software solutions, meanwhile, show a value of $1.78 billion in 2023, growing to $3.50 billion by 2033 as companies increasingly adopt data analytics and management systems to optimize their measurement processes.

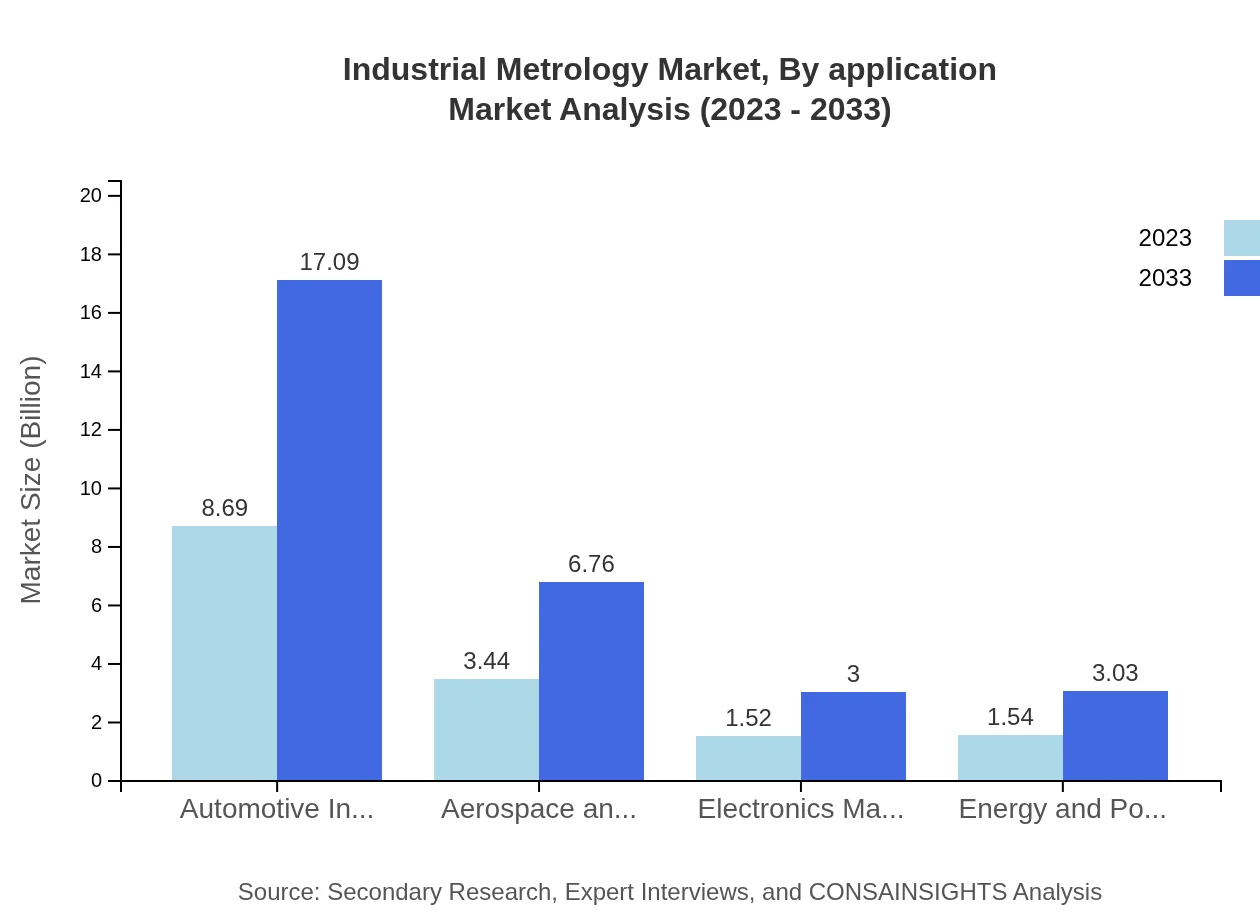

Industrial Metrology Market Analysis By Application

Market applications include automotive, aerospace, electronics, and energy sectors. The automotive sector leads, valued at $8.69 billion in 2023, projected to climb to $17.09 billion by 2033. The aerospace and defense sector follows, growing from $3.44 billion in 2023 to $6.76 billion by 2033, driven by technological advancements and stringent safety regulations.

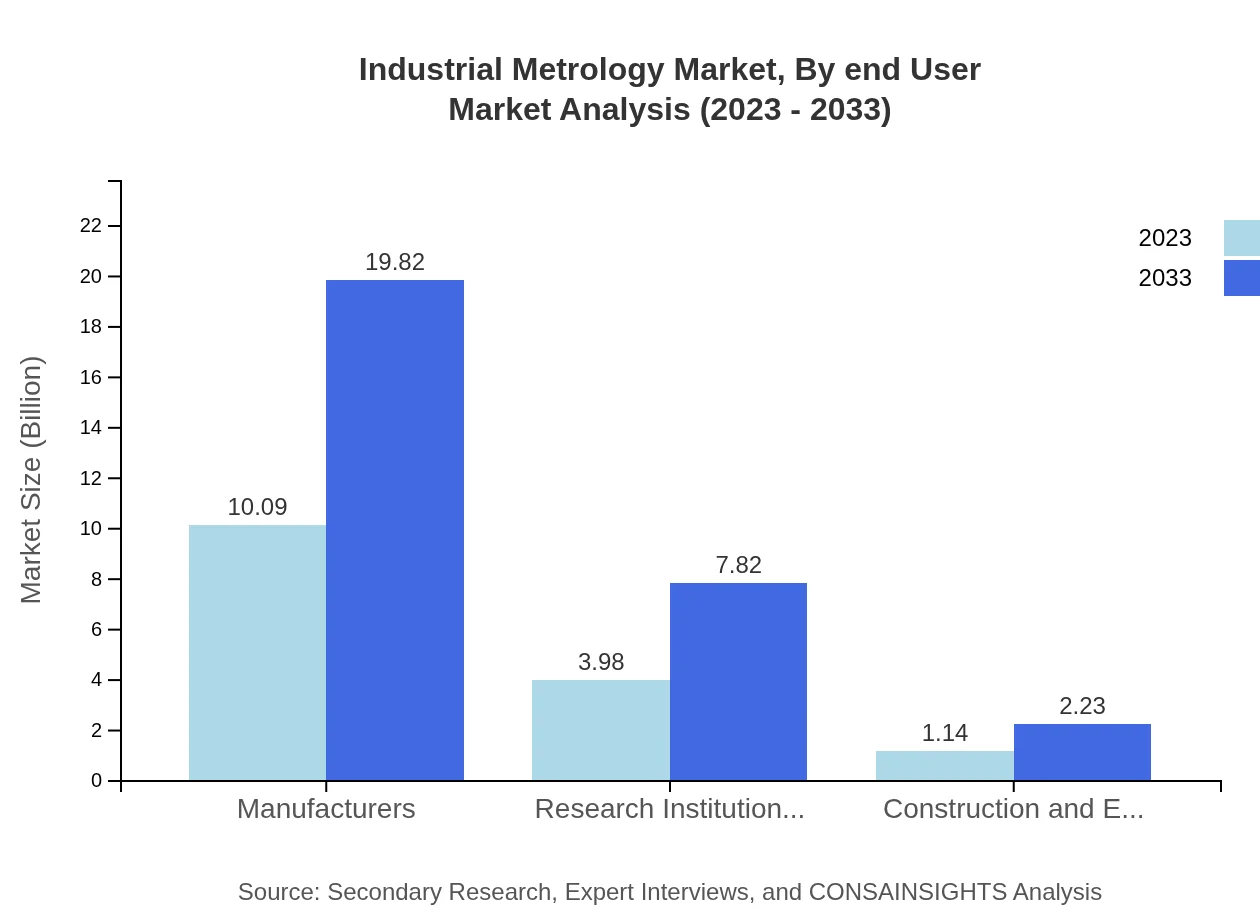

Industrial Metrology Market Analysis By End User

End-user segments include manufacturers, research institutions, and construction firms. Manufacturers represent a significant market share at $10.09 billion in 2023, anticipating an increase to $19.82 billion by 2033. Research institutions also play a vital role, with a market value expected to grow from $3.98 billion to $7.82 billion in the same timeframe.

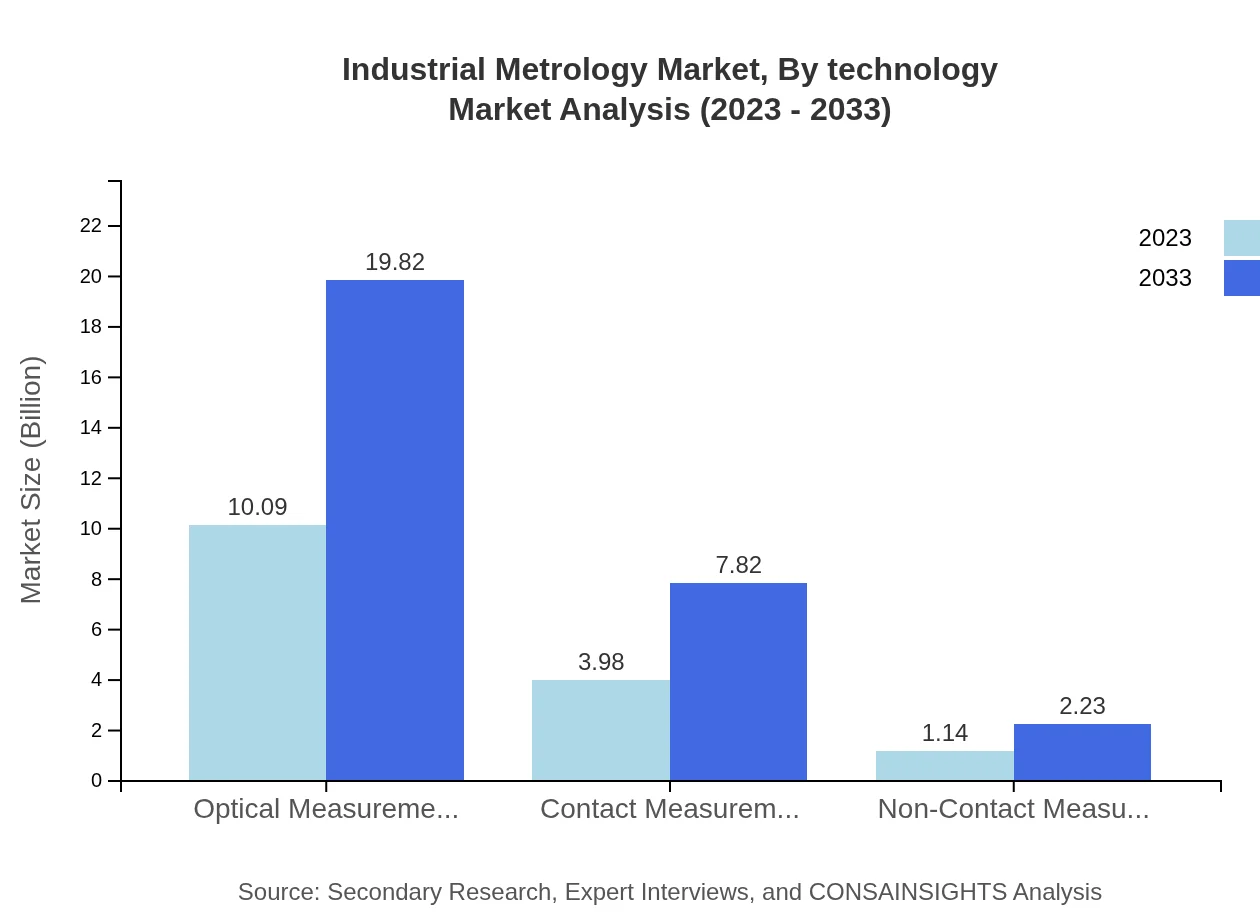

Industrial Metrology Market Analysis By Type

The market includes contact (growing from $3.98 billion to $7.82 billion) and non-contact measurements (increasing from $1.14 billion to $2.23 billion by 2033). Optical measurement remains a predominant technology with significant market share, emphasizing the ongoing demand for precision in manufacturing.

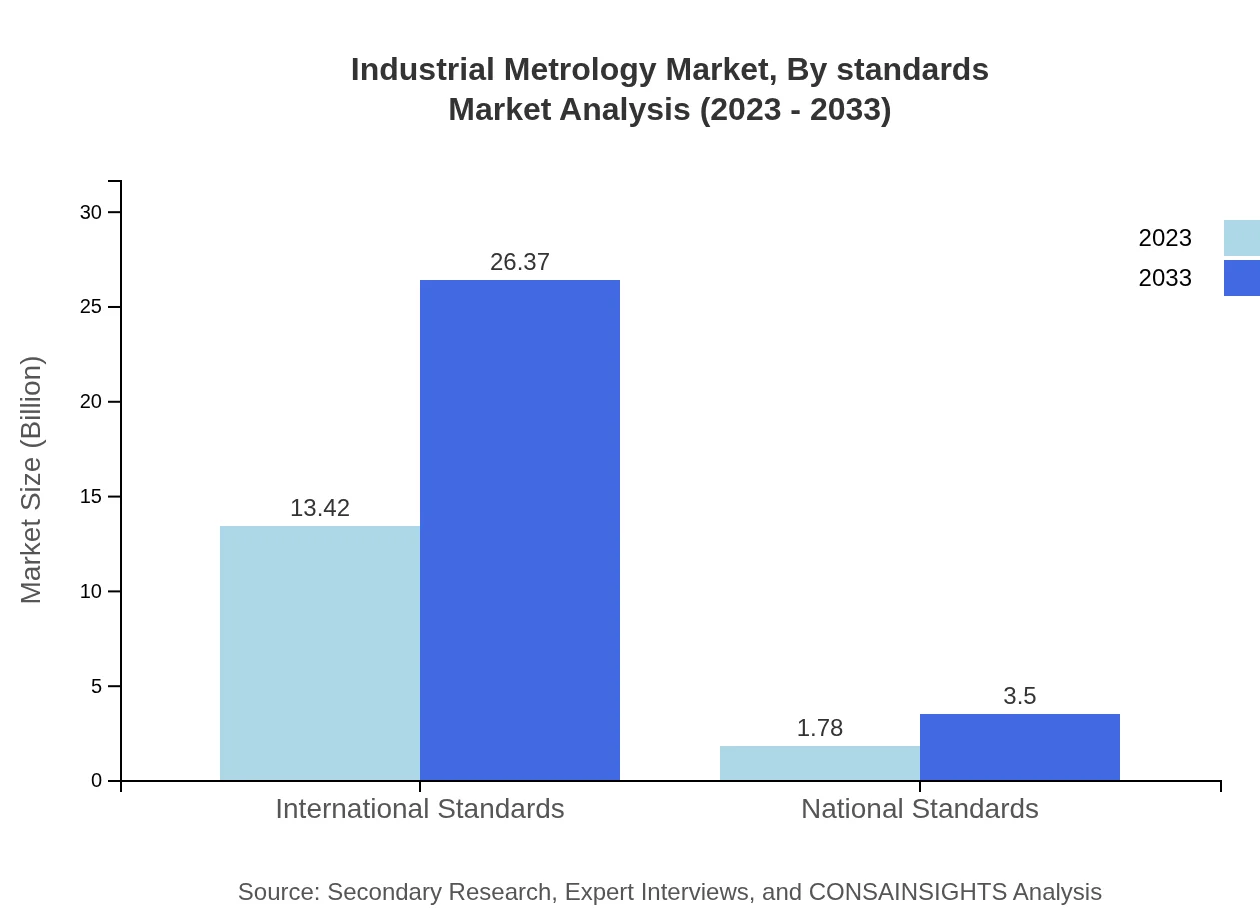

Industrial Metrology Market Analysis By Standards

Standards are categorized into international and national standards, both crucial for compliance and quality assurance. International standards dominate, holding a share valued at $13.42 billion in 2023, expected to grow to $26.37 billion by 2033, while national standards follow, showing growth from $1.78 billion to $3.50 billion.

Industrial Metrology Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Industrial Metrology Industry

Hexagon AB:

Hexagon AB is a global leader in digital solutions for smart manufacturing and metrology, offering advanced measurement technologies.Carl Zeiss AG:

Carl Zeiss AG specializes in optics and optoelectronics, providing high precision metrology solutions widely used in manufacturing.Mitutoyo Corporation:

Mitutoyo Corporation is renowned for its precision measuring tools and systems, addressing diverse applications in industrial metrology.Renishaw plc:

Renishaw plc focuses on engineering technology, with a strong emphasis on precision measurement and scanning systems.We're grateful to work with incredible clients.

FAQs

What is the market size of industrial Metrology?

The industrial metrology market is valued at approximately $15.2 billion in 2023, with a projected CAGR of 6.8% through 2033, indicating robust growth driven by advancements in technology and increasing demand for precision measurement.

What are the key market players or companies in this industrial Metrology industry?

Key players in the industrial metrology industry include renowned companies engaged in manufacturing precision measurement devices, software solutions, and advanced instrumentation technologies. These entities are instrumental in setting standards and driving innovation in measurement practices.

What are the primary factors driving the growth in the industrial Metrology industry?

Factors fueling growth include advancements in measurement technologies, increasing demand for automation in manufacturing, stringent quality control measures, and the rise of IoT applications that enhance precision and efficiency in measurements.

Which region is the fastest Growing in the industrial Metrology?

Europe is the fastest-growing region in the industrial metrology market, expanding from $5.03 billion in 2023 to $9.89 billion by 2033. Asia Pacific also showcases rapid growth, projected to reach $5.66 billion, highlighting emerging markets' potential.

Does ConsaInsights provide customized market report data for the industrial Metrology industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the industrial metrology sector, enabling clients to receive insights specific to their business goals and market challenges.

What deliverables can I expect from this industrial Metrology market research project?

Clients can expect comprehensive deliverables including detailed market analysis, trend reports, competitive landscape assessments, regional insights, and forecasts, all tailored to enhance strategic decision-making and investment planning.

What are the market trends of industrial metrology?

Current trends indicate a shift towards digitalization, increased integration of AI in measurement systems, growing importance of compliance with international standards, and rising applications in industries like automotive, aerospace, and electronics manufacturing.