Industrial Networking Solutions Market Report

Published Date: 31 January 2026 | Report Code: industrial-networking-solutions

Industrial Networking Solutions Market Size, Share, Industry Trends and Forecast to 2033

This report examines the Industrial Networking Solutions market, providing insights on market size, forecasts for 2023 to 2033, and trends shaping the industry. It discusses segmentation, regional analysis, technology advancements, and the profiles of key market players.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

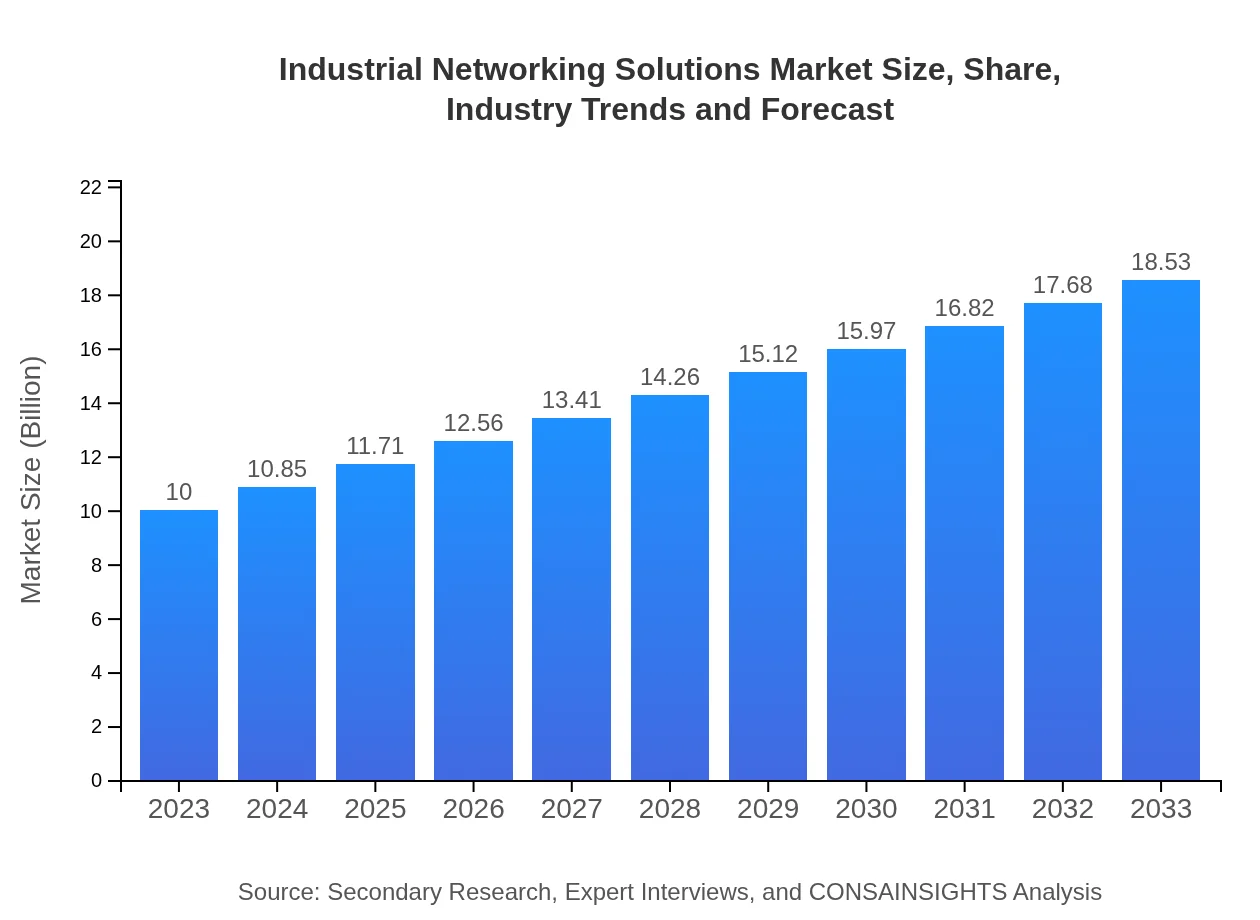

| 2023 Market Size | $10.00 Billion |

| CAGR (2023-2033) | 6.2% |

| 2033 Market Size | $18.53 Billion |

| Top Companies | Cisco Systems, Inc., Siemens AG, Rockwell Automation, Inc., Honeywell International Inc. |

| Last Modified Date | 31 January 2026 |

Industrial Networking Solutions Market Overview

Customize Industrial Networking Solutions Market Report market research report

- ✔ Get in-depth analysis of Industrial Networking Solutions market size, growth, and forecasts.

- ✔ Understand Industrial Networking Solutions's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Industrial Networking Solutions

What is the Market Size & CAGR of Industrial Networking Solutions market in 2023?

Industrial Networking Solutions Industry Analysis

Industrial Networking Solutions Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Industrial Networking Solutions Market Analysis Report by Region

Europe Industrial Networking Solutions Market Report:

Europe's market is forecasted to grow from $3.15 billion in 2023 to $5.83 billion by 2033. The region's focus on Industry 4.0 and smart manufacturing is propelling the demand for advanced networking solutions.Asia Pacific Industrial Networking Solutions Market Report:

The Asia Pacific region is projected to see significant growth, with the market size expected to increase from $1.68 billion in 2023 to $3.12 billion by 2033. Key factors include rapid industrialization, technological advancements, and rising demand for connected devices across major economies like China and India.North America Industrial Networking Solutions Market Report:

In North America, the market size is anticipated to rise from $3.75 billion in 2023 to $6.96 billion in 2033, driven by strong demand for automation and IoT technologies. The region is home to many leading technology firms, facilitating innovation.South America Industrial Networking Solutions Market Report:

The South American market is estimated to grow from $0.92 billion in 2023 to $1.70 billion by 2033. Growing investments in infrastructure and emphasis on smart city initiatives are driving the adoption of industrial networking solutions in this region.Middle East & Africa Industrial Networking Solutions Market Report:

In the Middle East and Africa, the market is projected to grow from $0.50 billion in 2023 to $0.93 billion in 2033, as countries increase investment in digital infrastructure and smart technologies in industrial sectors.Tell us your focus area and get a customized research report.

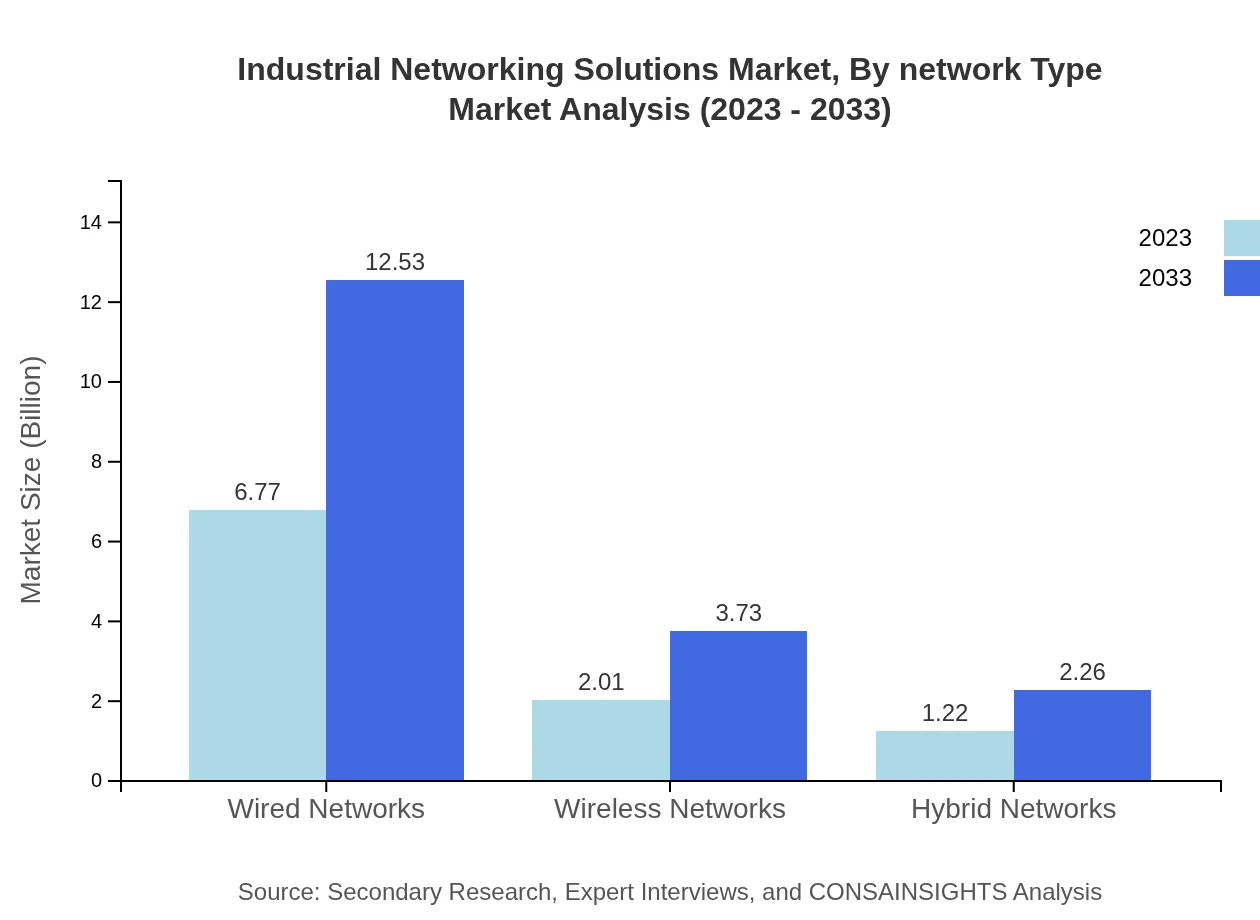

Industrial Networking Solutions Market Analysis By Network Type

The Industrial Networking Solutions market by network type comprises wired, wireless, and hybrid networks. Wired networks, valued at $6.77 billion in 2023, dominate the market due to their reliability and security, maintaining a 67.65% share. Wireless networks are growing in popularity, projected to reach $3.73 billion by 2033, primarily driven by the demand for flexibility and ease of installation. Hybrid networks, combining both wired and wireless solutions, are also gaining traction.

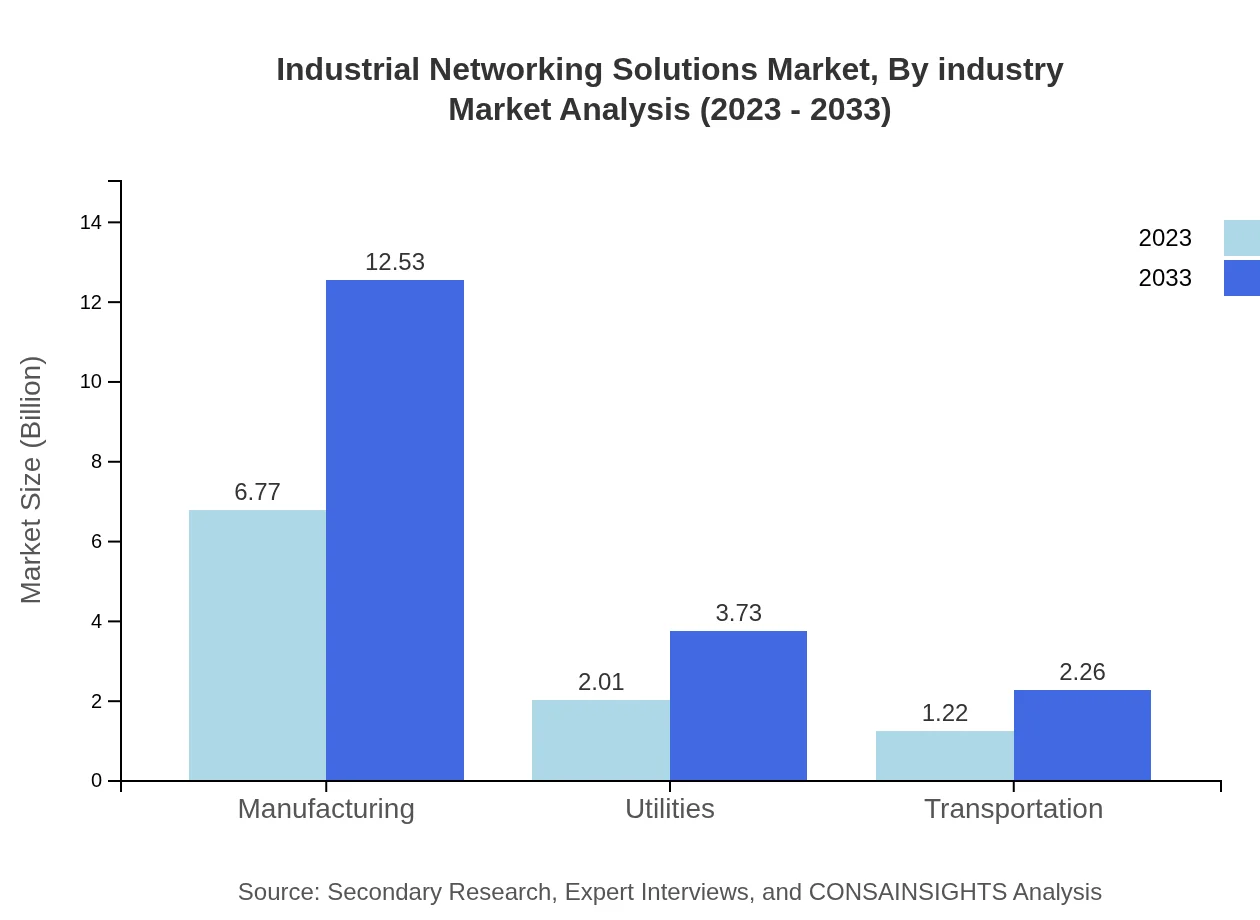

Industrial Networking Solutions Market Analysis By Industry

The market by industry primarily includes manufacturing, utilities, and transportation. Manufacturing leads with a market size of $6.77 billion in 2023, maintaining a 67.65% market share, with a projected growth to $12.53 billion by 2033. Utilities and transportation segments are also growing, with sizes of $2.01 billion and $1.22 billion in 2023, respectively, each expected to see healthy growth.

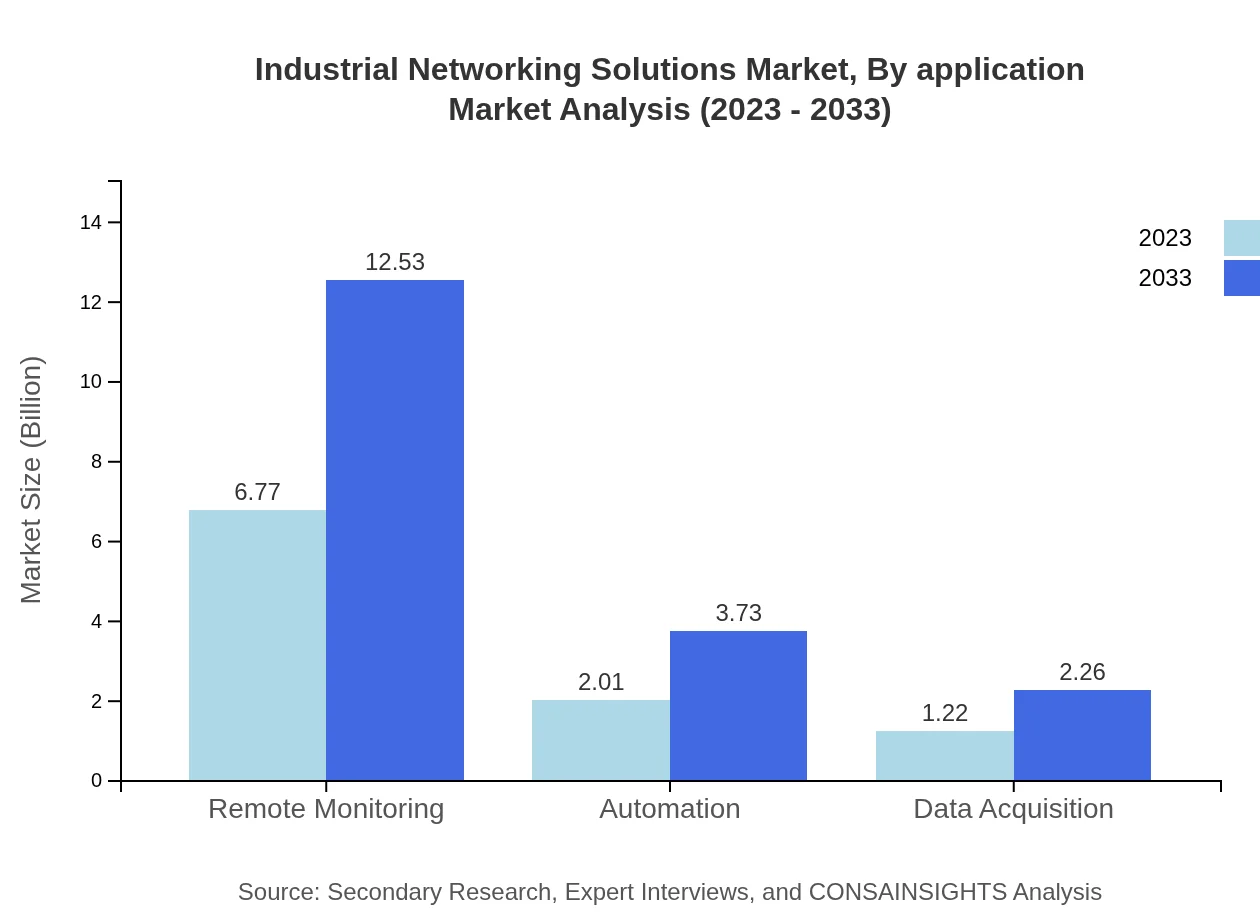

Industrial Networking Solutions Market Analysis By Application

Applications of Industrial Networking Solutions are expanding to include smart manufacturing, utility monitoring, and transportation logistics. The smart manufacturing segment significantly drives growth, reflecting increased investment in automation and IoT technologies within diverse industrial settings, which enhances operational efficiency and productivity.

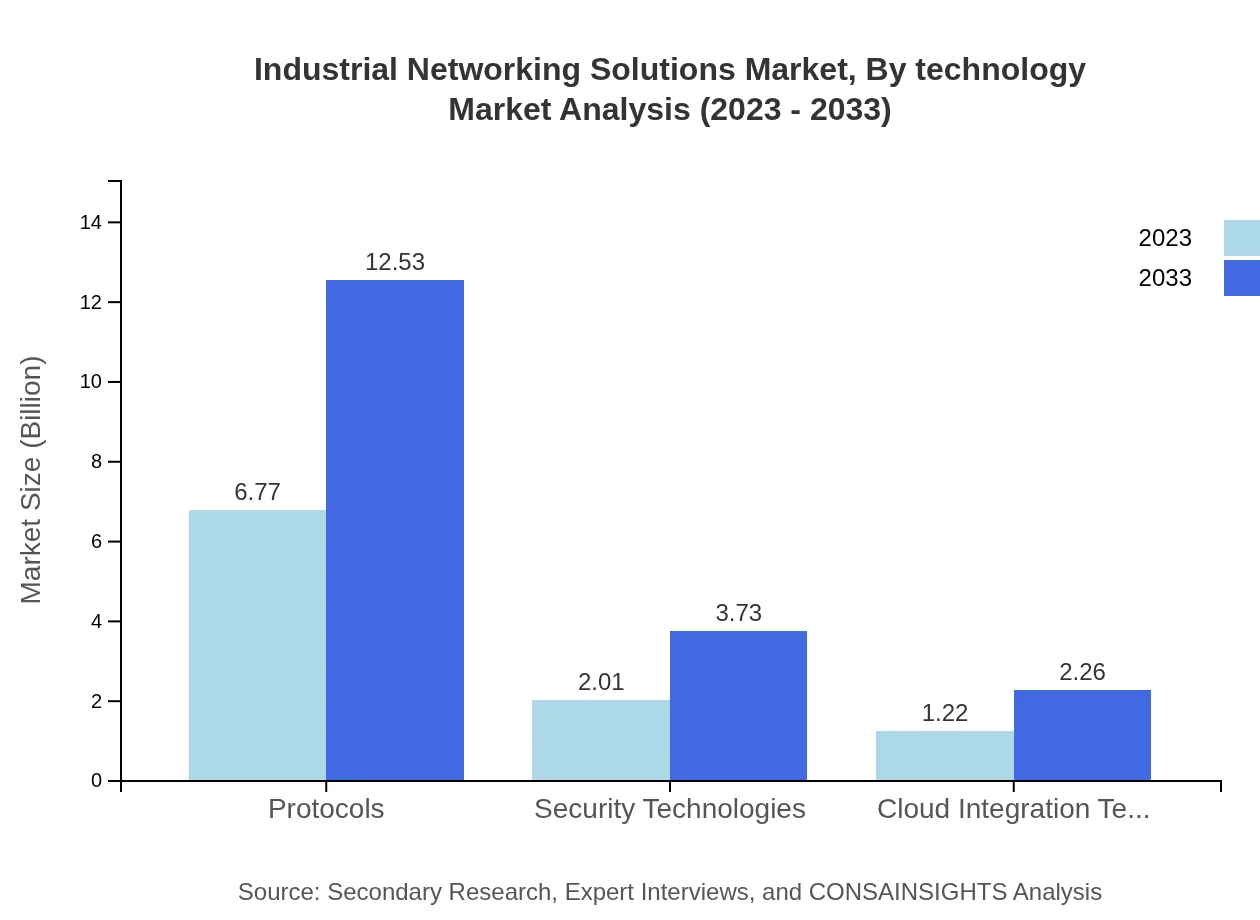

Industrial Networking Solutions Market Analysis By Technology

Technologies shaping the Industrial Networking Solutions market include protocols, security technologies, and cloud integration. Protocols dominate the market, valued at $6.77 billion in 2023, representing a 67.65% share. Security technologies, essential for safeguarding network integrity, and cloud integration for flexible data handling, are expected to grow substantially in the coming years.

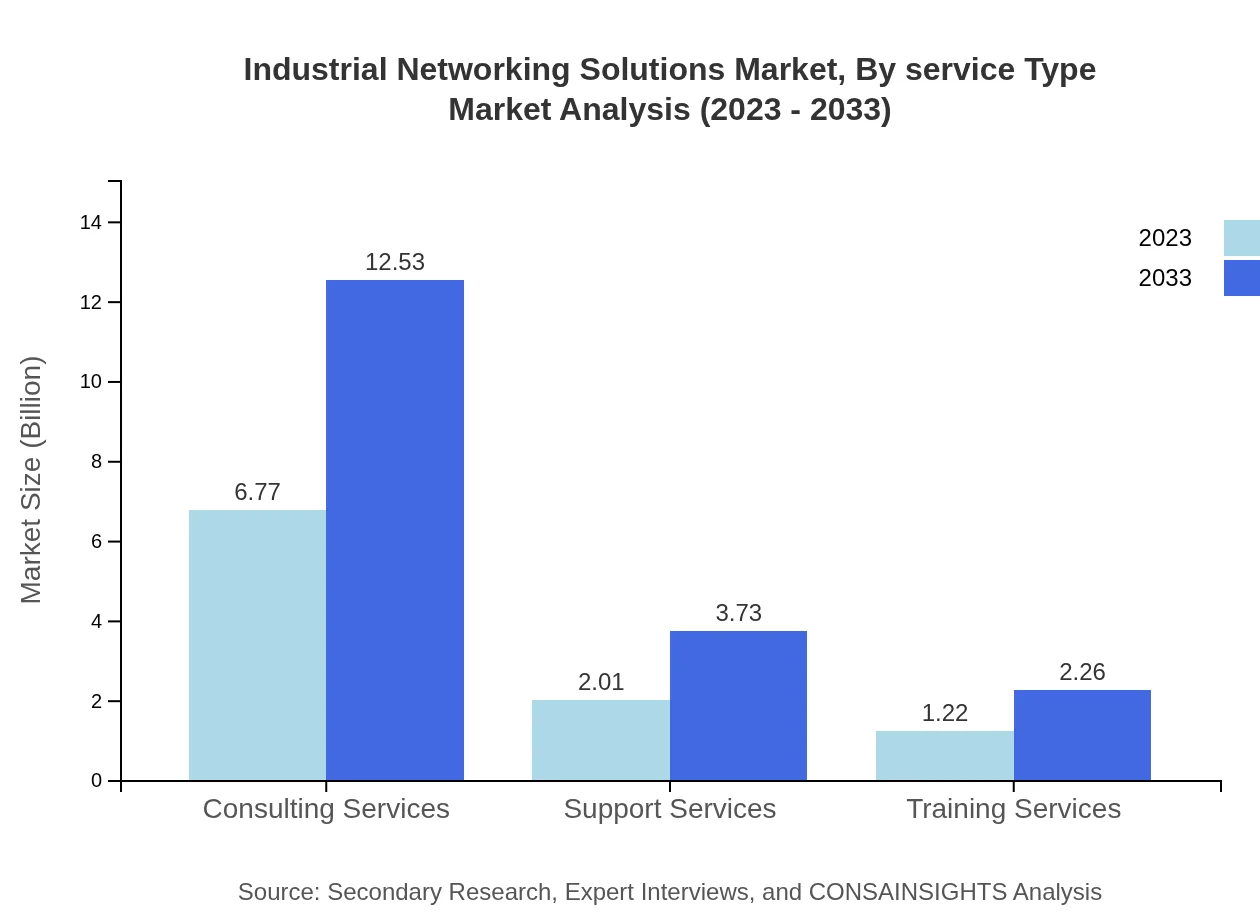

Industrial Networking Solutions Market Analysis By Service Type

Service types include consulting services, support services, and training services. Consulting services lead the way, accounting for $6.77 billion in 2023, with a 67.65% market share. The increasing complexity of industrial operations necessitates expert consulting to guide organizations in effectively implementing networking solutions to foster efficiency and security.

Industrial Networking Solutions Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Industrial Networking Solutions Industry

Cisco Systems, Inc.:

Cisco leads in providing networking solutions with a strong focus on cybersecurity and IoT, ensuring reliable industrial communication and data exchange.Siemens AG:

Siemens excels in industrial automation and drives the adoption of innovative networking technologies for smart manufacturing solutions.Rockwell Automation, Inc.:

Rockwell specializes in automation technologies and integrates advanced networking solutions to enhance industrial operations.Honeywell International Inc.:

Honeywell provides robust industrial networking solutions focused on improving operational efficiencies across various sectors.We're grateful to work with incredible clients.

FAQs

What is the market size of industrial Networking Solutions?

The global industrial networking solutions market was valued at approximately $10 billion in 2023 and is projected to grow at a CAGR of 6.2%, reaching around $18 billion by 2033.

What are the key market players or companies in this industrial Networking Solutions industry?

Key players include Cisco Systems, Siemens, Rockwell Automation, Schneider Electric, and Honeywell, with significant contributions from firms specializing in industrial networking technologies and solutions.

What are the primary factors driving the growth in the industrial Networking Solutions industry?

Key growth drivers include increasing automation in industries, the rising adoption of IoT, enhanced connectivity, and the growing need for secure and efficient networking solutions in manufacturing and utilities.

Which region is the fastest Growing in the industrial Networking Solutions?

The North American region is the fastest-growing, projected to expand from $3.75 billion in 2023 to $6.96 billion by 2033, driven by technology advancements and increased industrial digitization.

Does ConsaInsights provide customized market report data for the industrial Networking Solutions industry?

Yes, ConsaInsights offers tailored market report data to meet specific client needs in the industrial networking solutions sector, providing detailed insights and analysis.

What deliverables can I expect from this industrial Networking Solutions market research project?

Deliverables include comprehensive market analysis, segmented data, growth forecasts, competitive landscape assessments, and insights into market trends and regional performances.

What are the market trends of industrial Networking Solutions?

Key market trends include the rise of smart manufacturing, increasing demand for secure remote access solutions, and the integration of advanced technologies such as AI and machine learning in industrial networks.