Industrial Pc Market Report

Published Date: 31 January 2026 | Report Code: industrial-pc

Industrial Pc Market Size, Share, Industry Trends and Forecast to 2033

This market report provides a comprehensive analysis of the Industrial PC industry, covering market size, growth trends, segment insights, and regional developments from 2023 to 2033. The report highlights key insights and forecasts for stakeholders to make informed business decisions.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

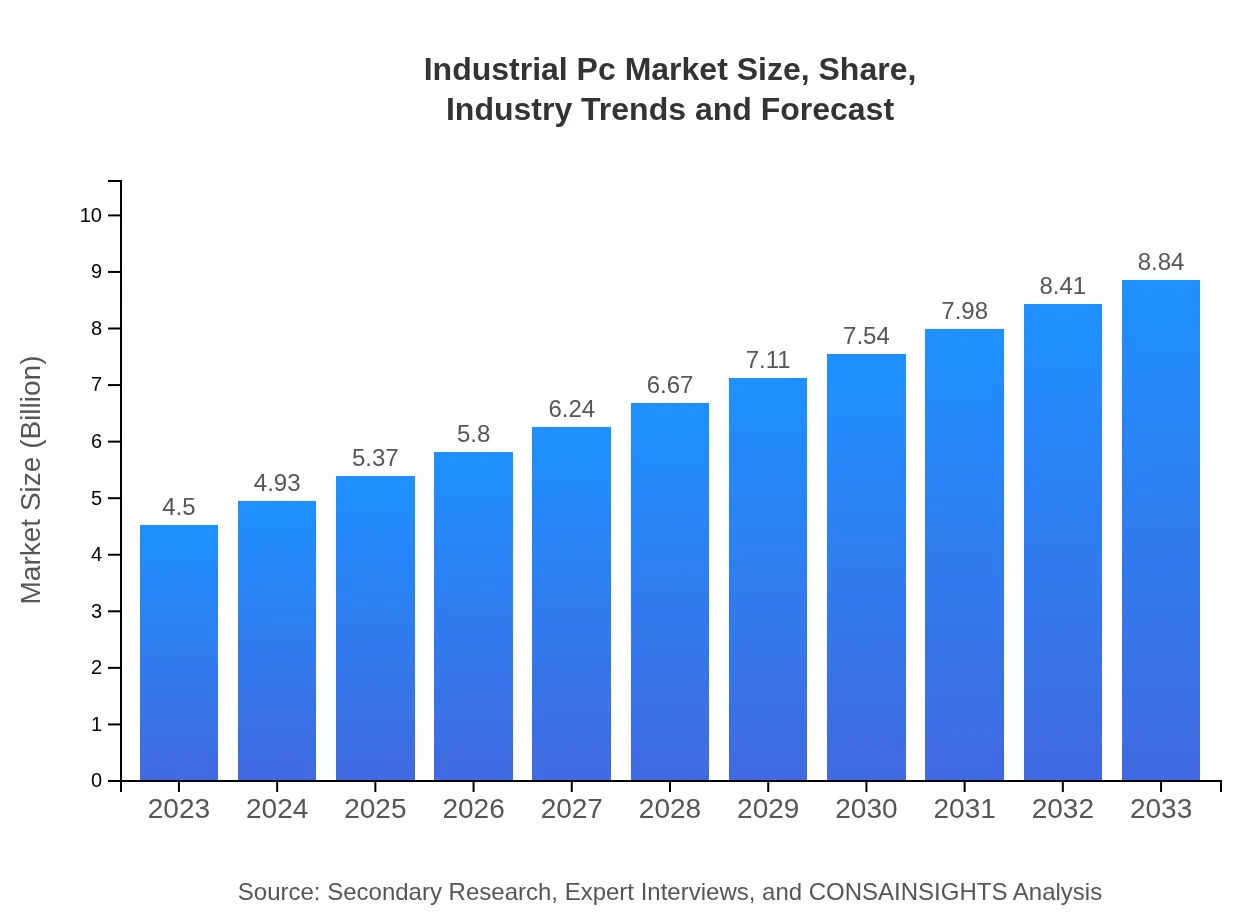

| 2023 Market Size | $4.50 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $8.84 Billion |

| Top Companies | Siemens AG, Advantech Co., Ltd., Beckhoff Automation GmbH, Aaeon Technology Inc., Rockwell Automation, Inc. |

| Last Modified Date | 31 January 2026 |

Industrial PC Market Overview

Customize Industrial Pc Market Report market research report

- ✔ Get in-depth analysis of Industrial Pc market size, growth, and forecasts.

- ✔ Understand Industrial Pc's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Industrial Pc

What is the Market Size & CAGR of Industrial PC market in 2023?

Industrial PC Industry Analysis

Industrial PC Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Industrial PC Market Analysis Report by Region

Europe Industrial Pc Market Report:

In Europe, the market for Industrial PCs was around $1.25 billion in 2023 and is projected to grow to $2.45 billion by 2033. The region benefits from stringent regulations promoting automation and efficiency, pushing industries towards adopting state-of-the-art Industrial PC solutions.Asia Pacific Industrial Pc Market Report:

In the Asia-Pacific region, the Industrial PC market was valued at $0.91 billion in 2023 and is expected to grow to $1.79 billion by 2033, driven by the rapid industrialization in countries like China and India. The increasing focus on smart manufacturing and automation technologies is further propelling market growth.North America Industrial Pc Market Report:

North America holds a substantial share of the Industrial PC market, valued at $1.44 billion in 2023, with expectations to reach $2.84 billion by 2033. The adoption of advanced manufacturing technologies and the presence of key market players in the US and Canada fuel this growth.South America Industrial Pc Market Report:

The South American market for Industrial PCs was valued at $0.40 billion in 2023, projected to reach $0.78 billion by 2033. The growth is attributed to ongoing improvements in industrial infrastructure and rising investments in automation technologies across Brazil and Argentina.Middle East & Africa Industrial Pc Market Report:

For the Middle East and Africa, the Industrial PC market was valued at $0.50 billion in 2023 and is expected to grow to $0.99 billion by 2033. The increased investment in oil & gas and utility sectors, coupled with emerging technology adoption, is encouraging growth.Tell us your focus area and get a customized research report.

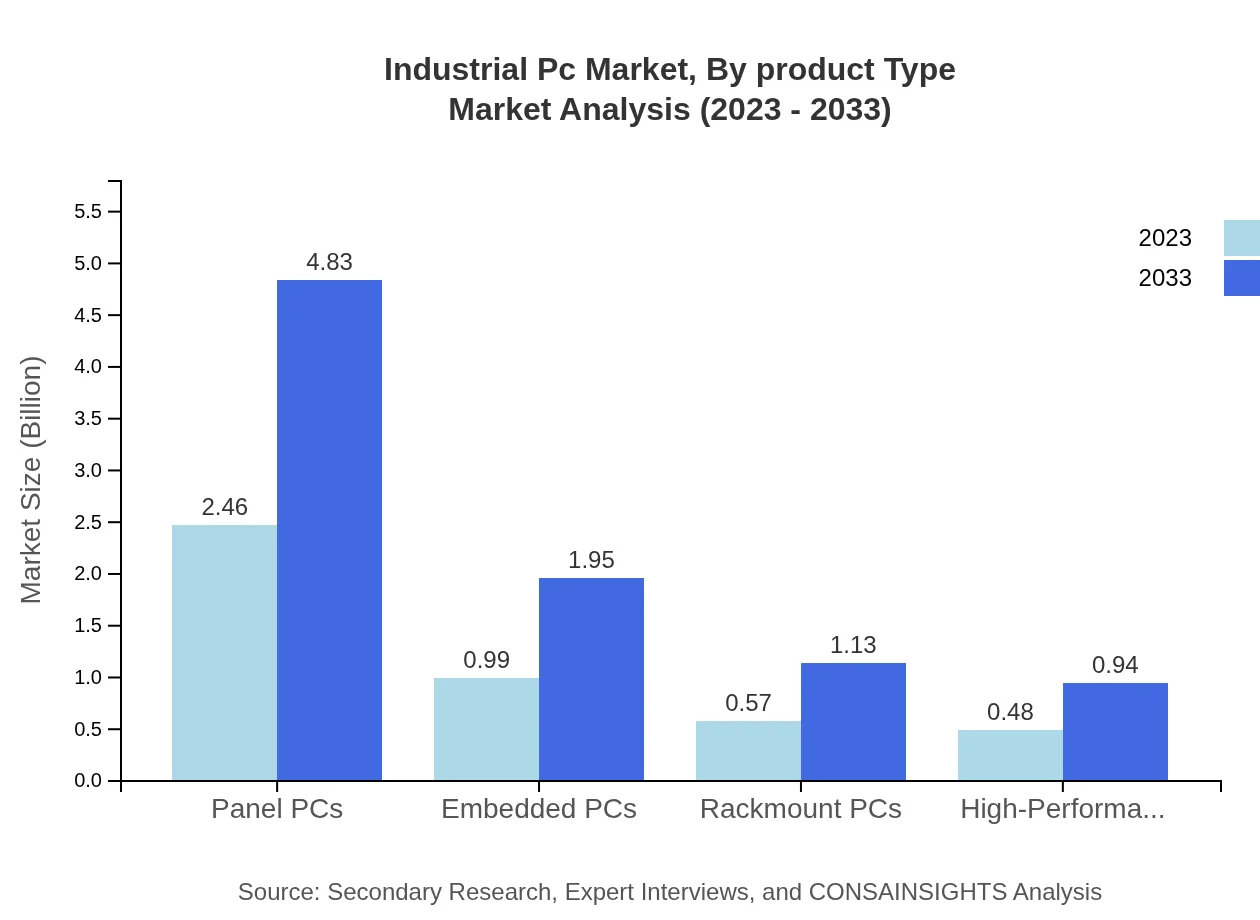

Industrial Pc Market Analysis By Product Type

The Industrial PC market by product type indicates significant shifts, with panel PCs leading the market due to their versatility and ease of use in multiple environments. Panel PCs accounted for a market size of $2.46 billion in 2023 and are expected to reach $4.83 billion by 2033, maintaining a share of 54.56%. Embedded PCs and rackmount PCs also show promising growth, attributed to their robust performance in specialized applications.

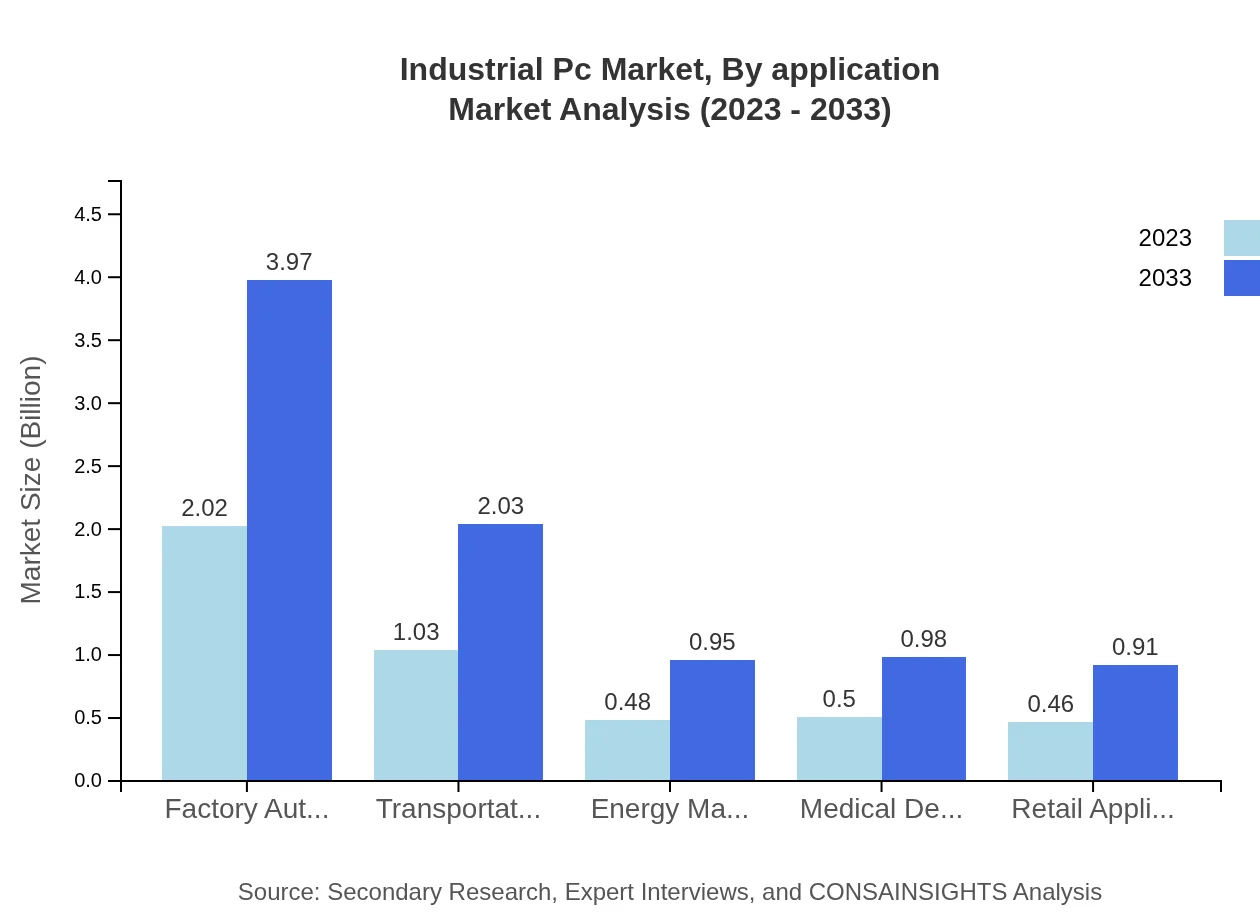

Industrial Pc Market Analysis By Application

Across applications, the manufacturing sector dominates the Industrial PC market with a size of $2.02 billion in 2023 and projected growth to $3.97 billion by 2033, holding a market share of 44.94%. Other significant applications include oil & gas and healthcare, where robust PCs are increasingly required for real-time data processing and operational reliability.

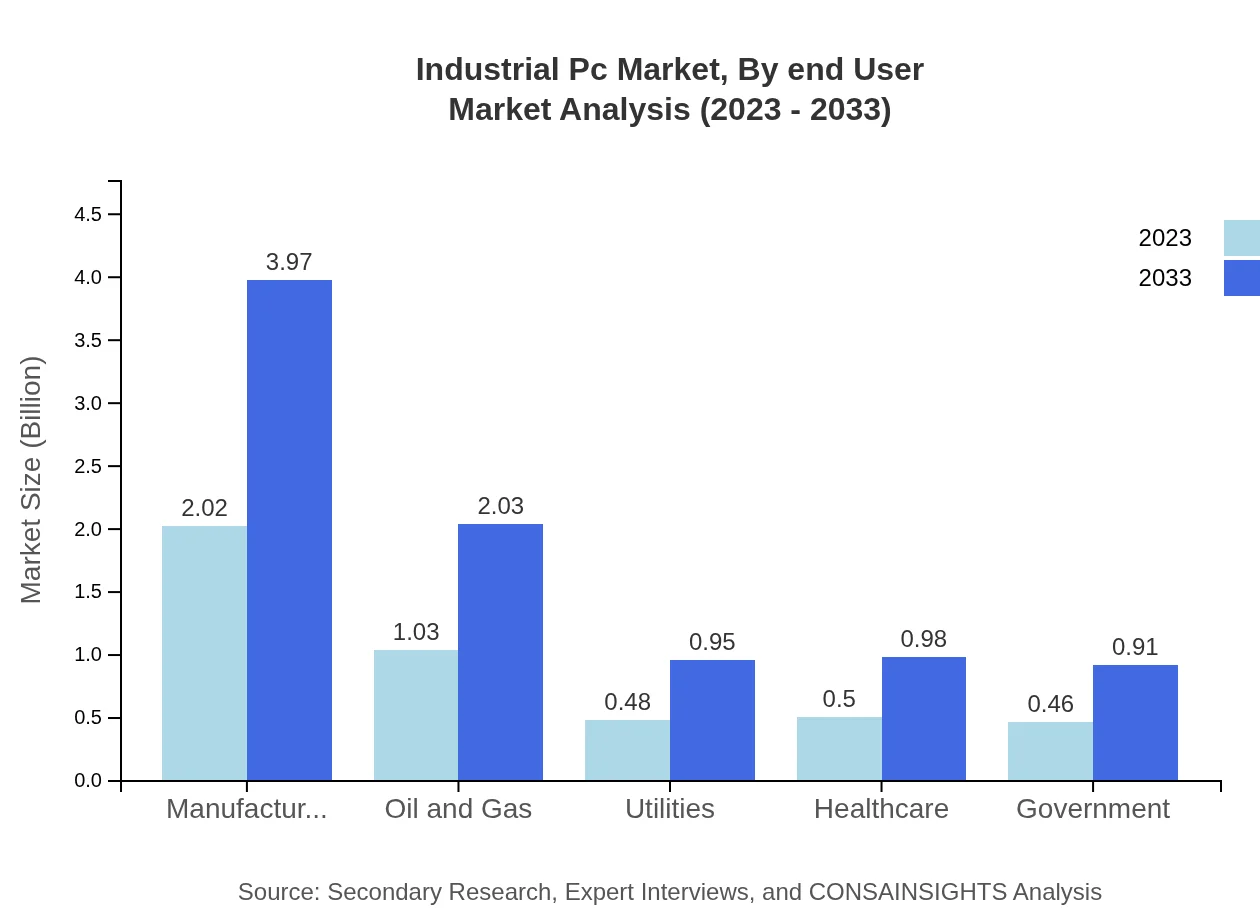

Industrial Pc Market Analysis By End User

End-user segmentation reveals that the manufacturing sector leads in the uptake of Industrial PCs, accounting for a significant market size. As industries automate processes for improved efficiency, the role of Industrial PCs becomes increasingly vital across various operational settings. Healthcare applications are also seeing increased adoption due to the need for reliable data processing and monitoring systems.

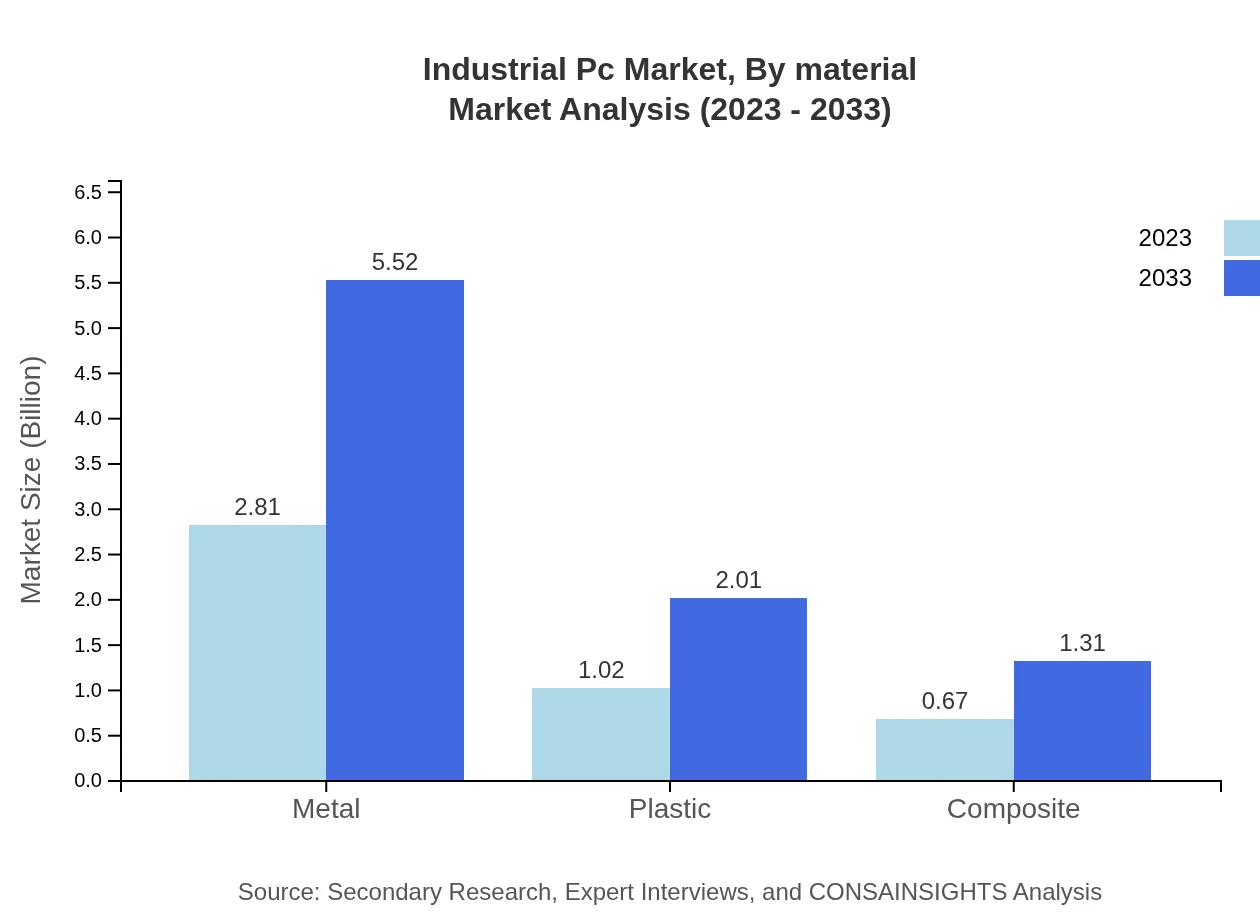

Industrial Pc Market Analysis By Material

Market analysis by materials used in Industrial PCs shows that metal casing is predominant, reflecting 62.38% of market share in 2023 with a size of $2.81 billion, expected to reach $5.52 billion by 2033. This is due to its durability and reliability in rugged environments where Industrial PCs are typically deployed.

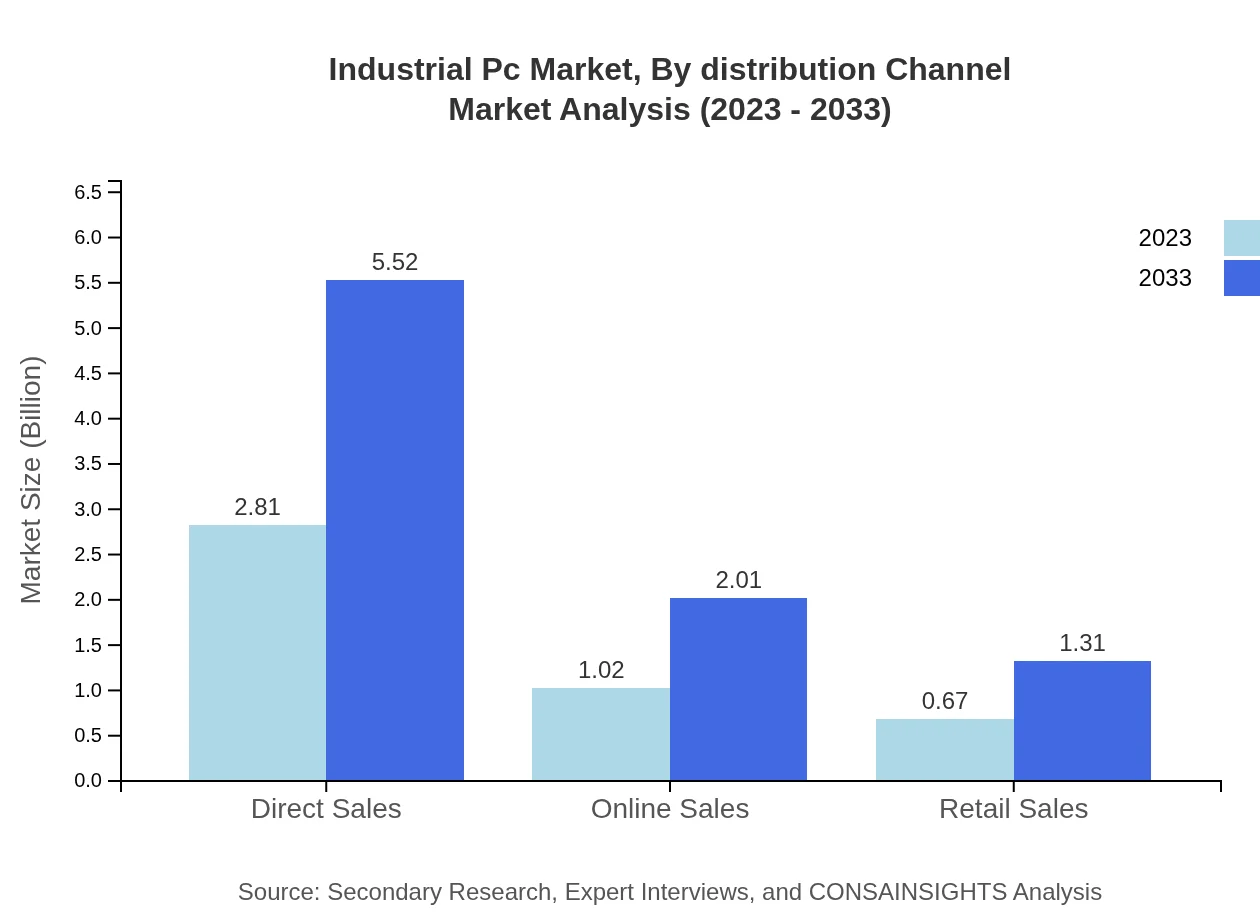

Industrial Pc Market Analysis By Distribution Channel

The distribution channel analysis shows that direct sales dominate the Industrial PC market, holding a substantial share of 62.38% in 2023 with a market size of $2.81 billion, rising to $5.52 billion by 2033. Online sales are also growing, demonstrating a shift towards e-commerce in the Industrial PC sector.

Industrial PC Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Industrial PC Industry

Siemens AG:

Siemens operates in multiple industrial sectors and is a leading manufacturer of Industrial PCs. Their innovation in industrial automation and digitalization is pivotal for enhancing manufacturing processes worldwide.Advantech Co., Ltd.:

Advantech specializes in embedded and automation solutions, providing a wide range of Industrial PCs. Their products are integral to developing smart cities and Industrial IoT ecosystems.Beckhoff Automation GmbH:

Beckhoff is recognized for its PC-based control technology, providing versatile and powerful Industrial PCs suited for various applications, considerably impacting factory automation.Aaeon Technology Inc.:

Aaeon focuses on advanced industrial computing and embedded systems. Their continuous commitment to quality ensures robust performance in demanding environments.Rockwell Automation, Inc.:

Rockwell Automation is a key player in the automation solutions market, recognized for its innovative products that enhance Industrial PC performance and efficiency in manufacturing.We're grateful to work with incredible clients.

FAQs

What is the market size of Industrial PC?

The global Industrial PC market is currently valued at approximately $4.5 billion and is projected to grow at a CAGR of 6.8% through 2033, reflecting robust adoption across various sectors.

What are the key market players or companies in the Industrial PC industry?

Key players in the Industrial PC market include Advantech, Siemens, Cisco Systems, and Beckhoff Automation, among others, playing crucial roles in innovation and market growth.

What are the primary factors driving the growth in the Industrial PC industry?

Growth drivers in the Industrial PC industry include increased automation, the rise of the IoT, and the need for ruggedized computing solutions in harsh environments, supporting efficiency and productivity.

Which region is the fastest Growing in the Industrial PC?

The fastest-growing region in the Industrial PC market is Europe, expected to expand from $1.25 billion in 2023 to $2.45 billion by 2033, driven by increasing investments in automation.

Does ConsaInsights provide customized market report data for the Industrial PC industry?

Yes, ConsaInsights offers customized market report data tailored to the specific needs of clients in the Industrial PC industry, ensuring relevant and actionable insights.

What deliverables can I expect from this Industrial PC market research project?

Deliverables from the Industrial PC market research project typically include detailed market analysis, trend forecasts, competitive landscape evaluations, and actionable insights tailored to your needs.

What are the market trends of Industrial PC?

Current trends in the Industrial PC market include the shift towards more powerful computing technologies, integration with cloud solutions, and increasing demand for energy-efficient systems across sectors.