Industrial Radiography Testing Market Report

Published Date: 31 January 2026 | Report Code: industrial-radiography-testing

Industrial Radiography Testing Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Industrial Radiography Testing market, focusing on insights and trends from 2023 to 2033. It covers market size, growth rates, segment analysis, regional insights, key players, and future forecasts to guide stakeholders in strategic planning.

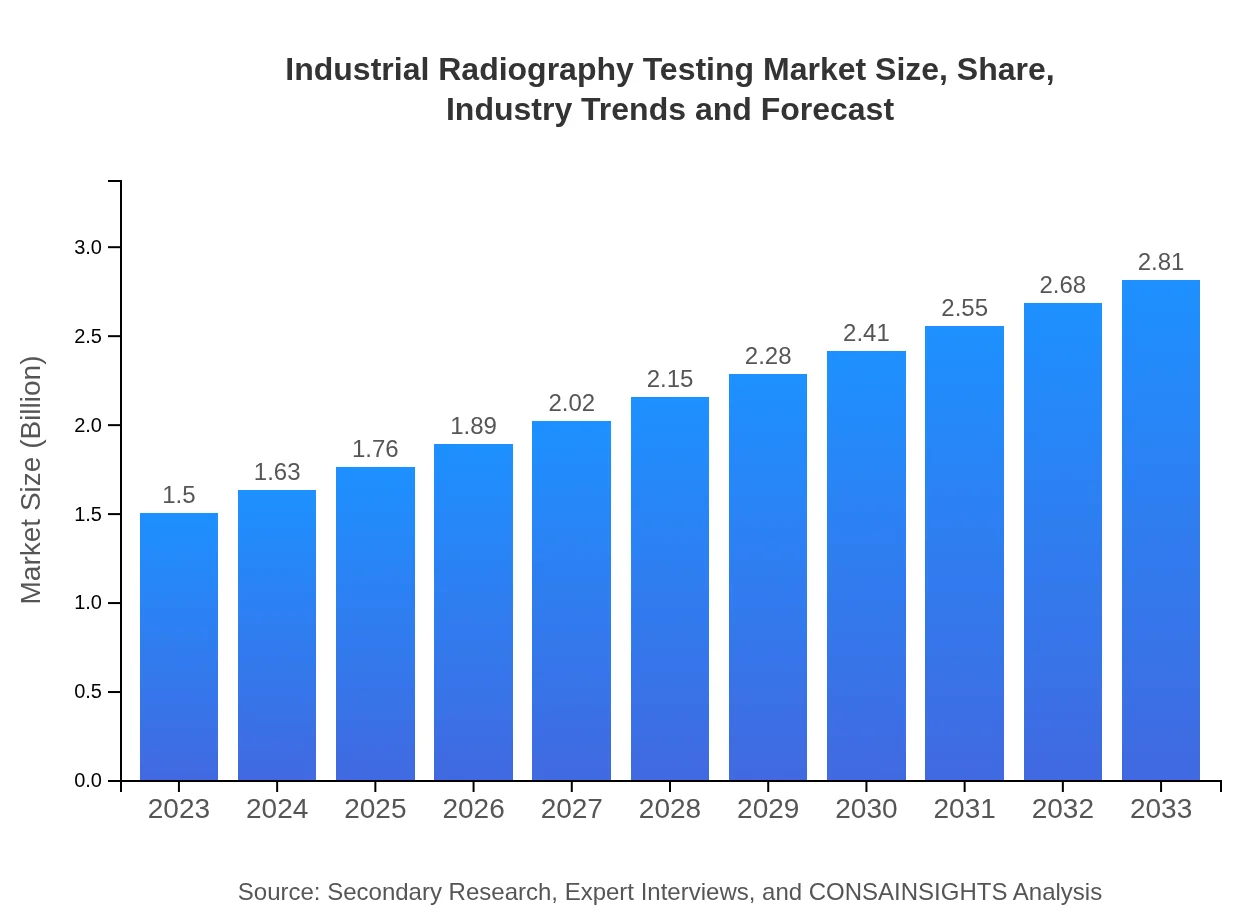

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $1.50 Billion |

| CAGR (2023-2033) | 6.3% |

| 2033 Market Size | $2.81 Billion |

| Top Companies | General Electric Co., Francesco C. V. Piazzoli, Olympus Corporation, Intertek Group plc, Bureau Veritas |

| Last Modified Date | 31 January 2026 |

Industrial Radiography Testing Market Overview

Customize Industrial Radiography Testing Market Report market research report

- ✔ Get in-depth analysis of Industrial Radiography Testing market size, growth, and forecasts.

- ✔ Understand Industrial Radiography Testing's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Industrial Radiography Testing

What is the Market Size & CAGR of the Industrial Radiography Testing market in 2023?

Industrial Radiography Testing Industry Analysis

Industrial Radiography Testing Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Industrial Radiography Testing Market Analysis Report by Region

Europe Industrial Radiography Testing Market Report:

In Europe, the market size is expected to increase from USD 0.50 billion in 2023 to USD 0.94 billion by 2033, owing to advancements in industrial testing processes and significant investments in sectors such as aerospace and energy.Asia Pacific Industrial Radiography Testing Market Report:

In the Asia Pacific region, the Industrial Radiography Testing market is expected to grow from USD 0.28 billion in 2023 to USD 0.52 billion by 2033, driven by increasing industrialization and stringent safety regulations. Countries like China and India are major contributors owing to their expanding manufacturing sectors and investments in infrastructure.North America Industrial Radiography Testing Market Report:

The North American market, particularly the United States, is projected to expand from USD 0.53 billion in 2023 to USD 0.99 billion by 2033. The presence of advanced testing technologies and strict regulatory frameworks supporting safety standards are key market drivers.South America Industrial Radiography Testing Market Report:

South America is anticipated to witness growth from USD 0.14 billion in 2023 to USD 0.26 billion by 2033. The rising demand for industrial radiography in the oil and gas sector, coupled with improving economic conditions, is likely to boost market activities in this region.Middle East & Africa Industrial Radiography Testing Market Report:

The Middle East and Africa market is projected to grow from USD 0.05 billion in 2023 to USD 0.10 billion by 2033. The growth is fueled by the expansion of the oil and gas sector and the need for enhanced quality control in various industries.Tell us your focus area and get a customized research report.

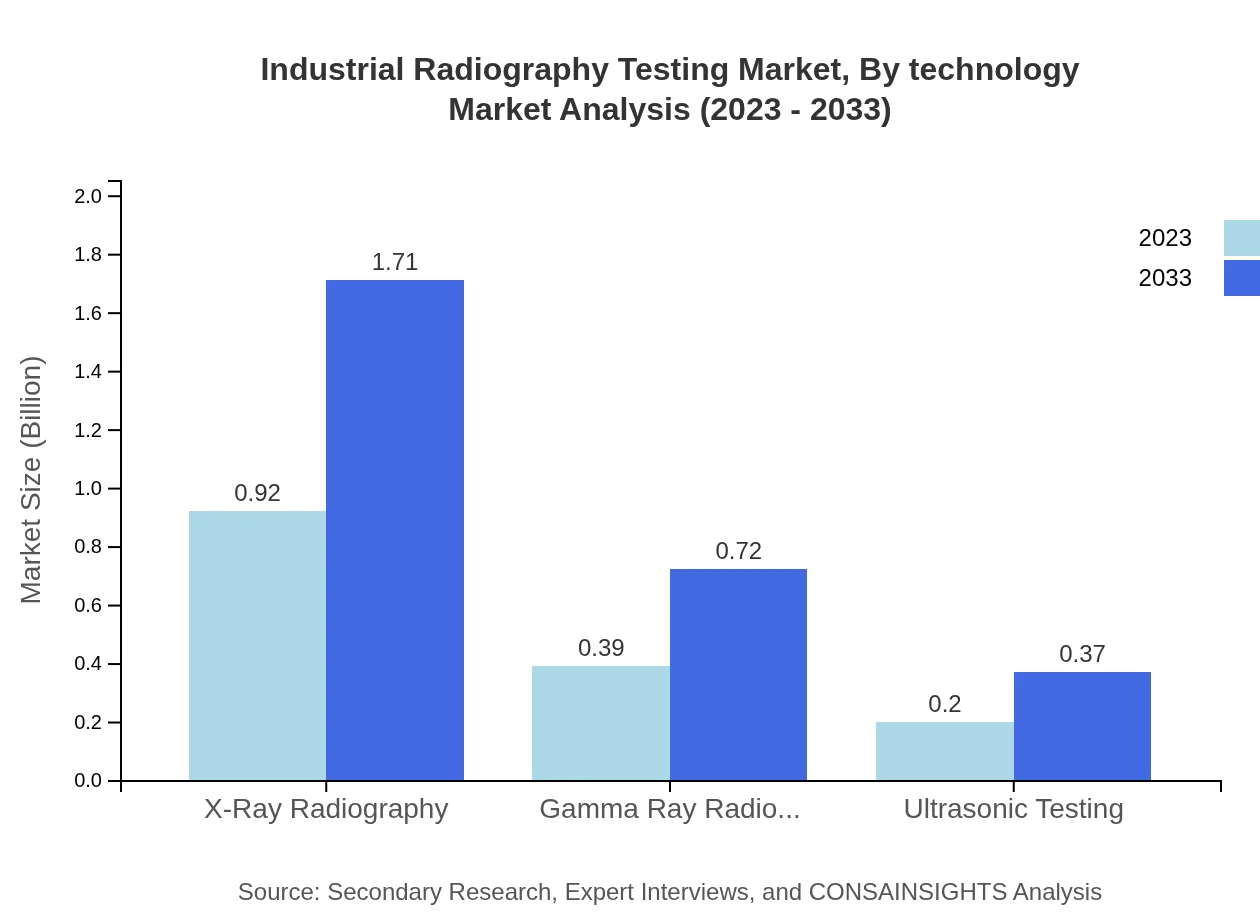

Industrial Radiography Testing Market Analysis By Technology

The Industrial Radiography Testing market analysis by technology indicates that X-ray radiography continues to dominate the market, with a size of USD 0.92 billion in 2023 and expected to grow to USD 1.71 billion by 2033, maintaining a market share of 61.08%. Gamma ray radiography follows with USD 0.39 billion in 2023, projected to reach USD 0.72 billion by 2033, holding a 25.77% market share.

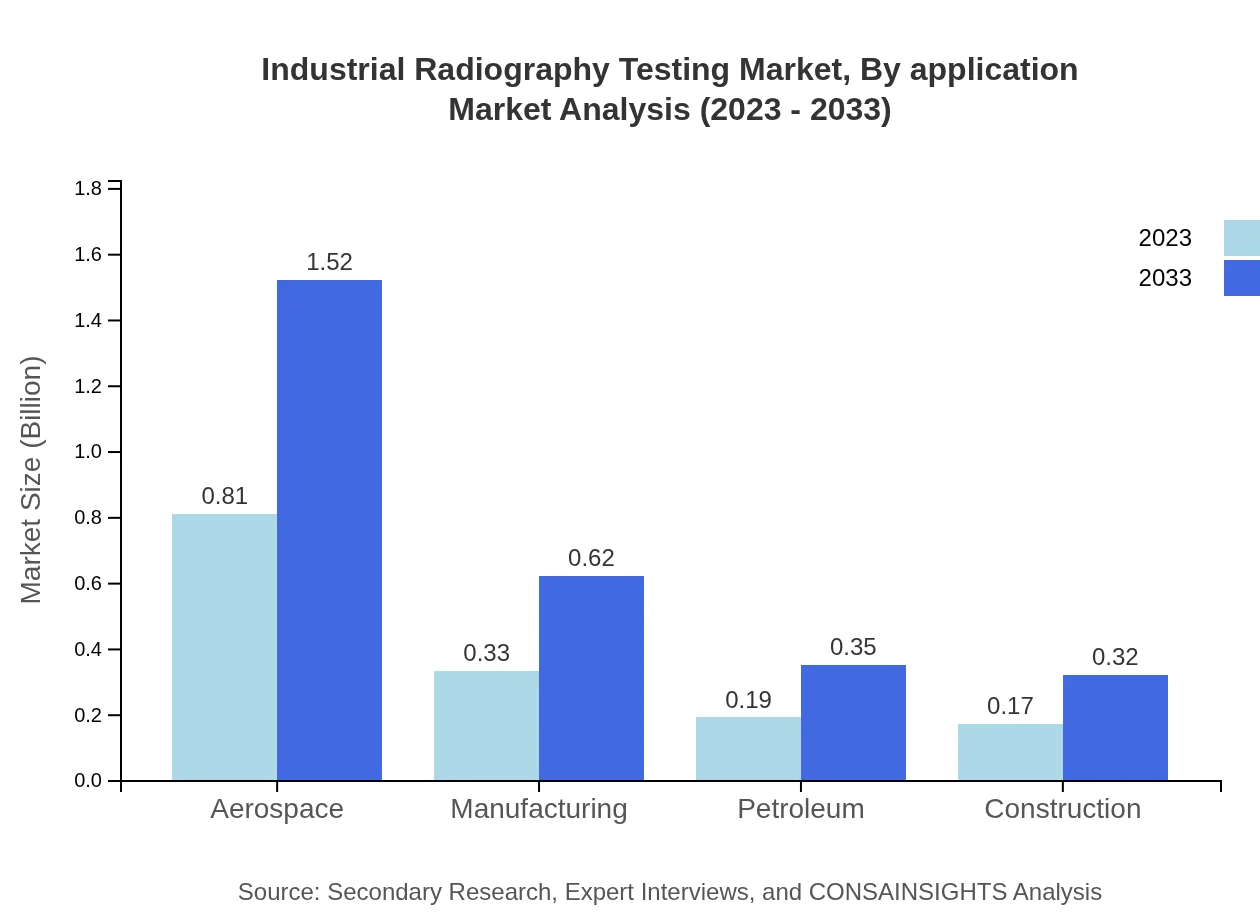

Industrial Radiography Testing Market Analysis By Application

In application analysis, the oil and gas sector leads with a size of USD 0.92 billion in 2023, expected to reach USD 1.71 billion by 2033, capturing 61.08% of the market. Automotive and aerospace sectors also contribute significantly, with respective sizes of 0.39 billion and 0.81 billion in 2023.

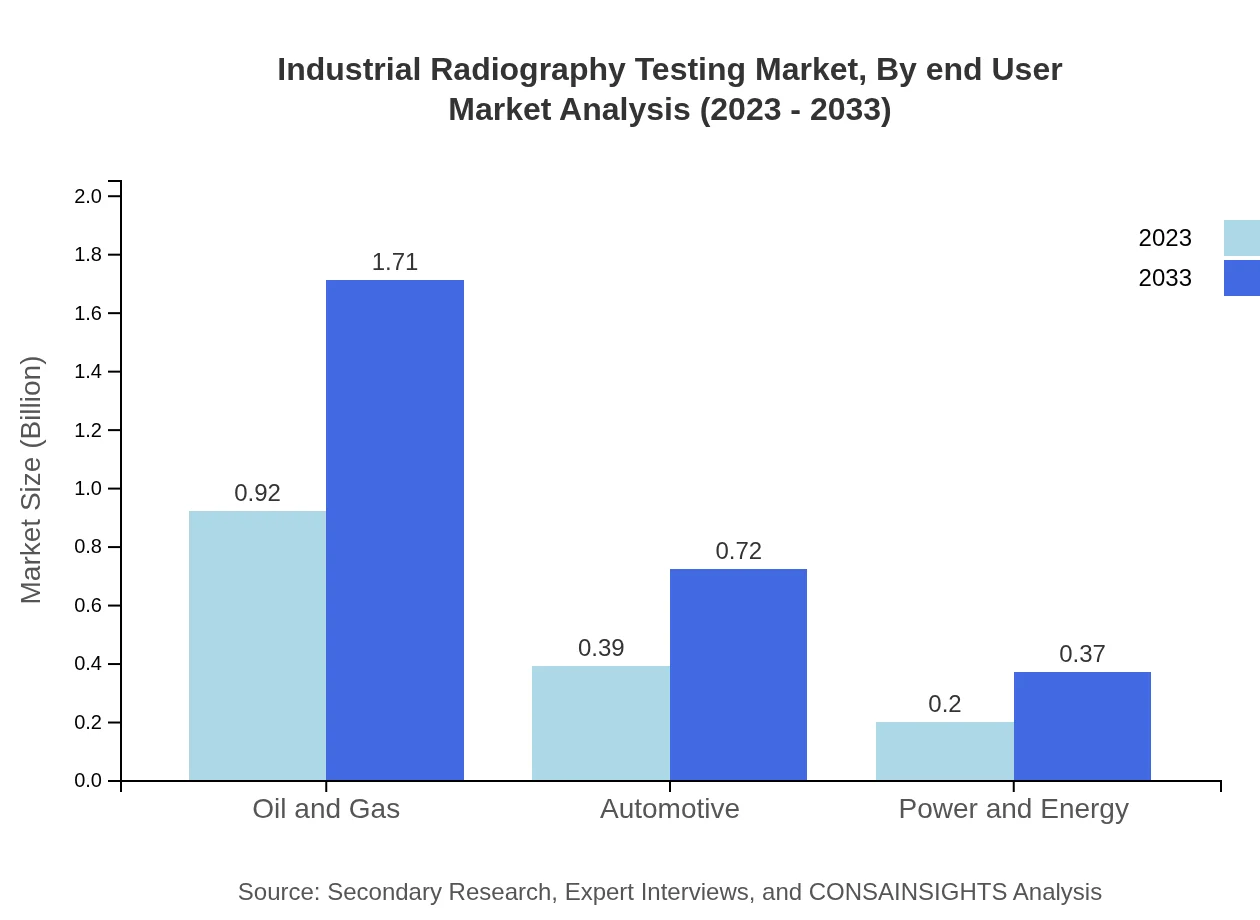

Industrial Radiography Testing Market Analysis By End User

Market analysis by end-user highlights the strongest demand from sectors like oil and gas, aerospace, and manufacturing. The oil and gas industry alone represents 61.08% of the market share, while manufacturing and construction sectors significantly contribute to the total market growth.

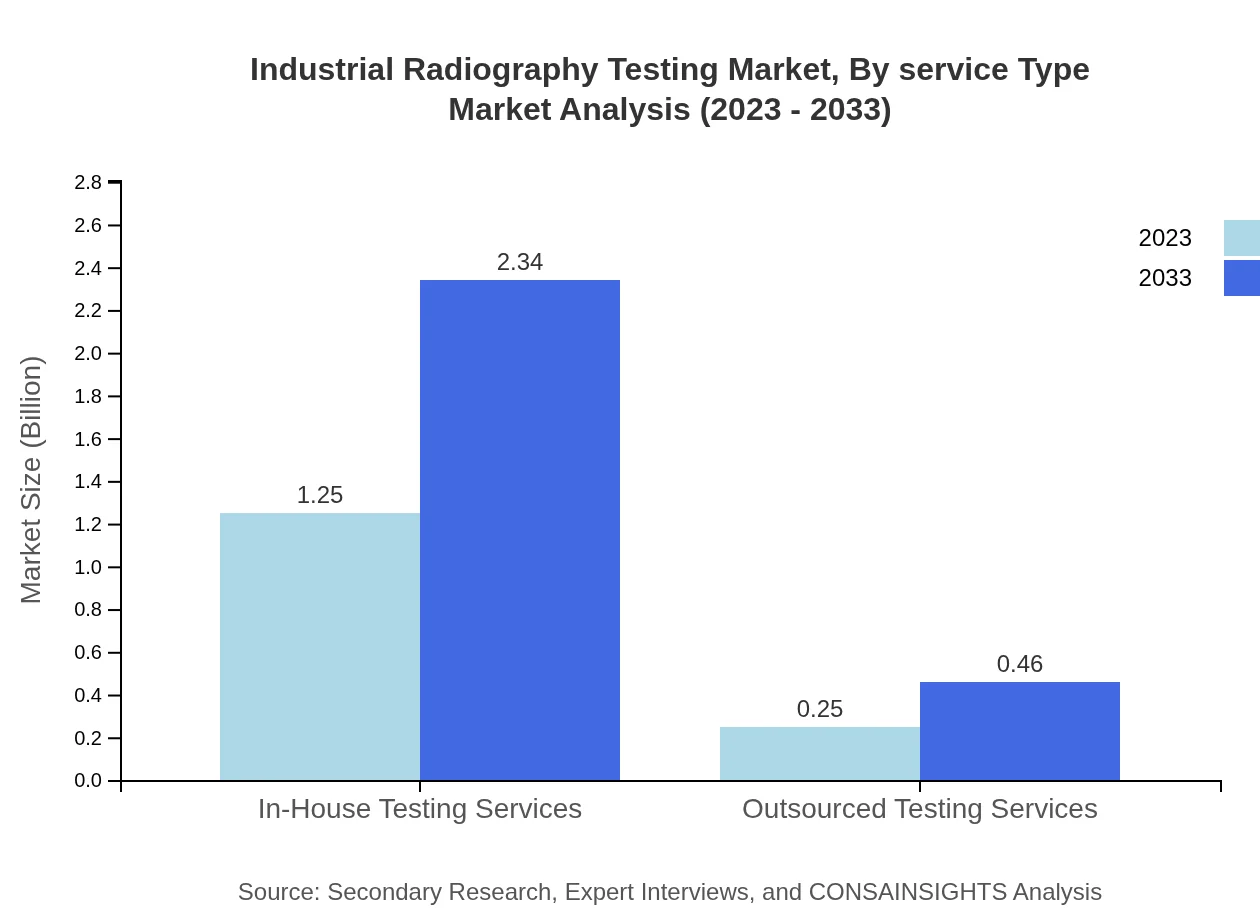

Industrial Radiography Testing Market Analysis By Service Type

This segment differentiates between in-house and outsourced testing services. In-house testing services make up 83.5% of the market share, amounting to USD 1.25 billion in 2023, while outsourced services are projected to grow from USD 0.25 billion to USD 0.46 billion by 2033, maintaining 16.5% share.

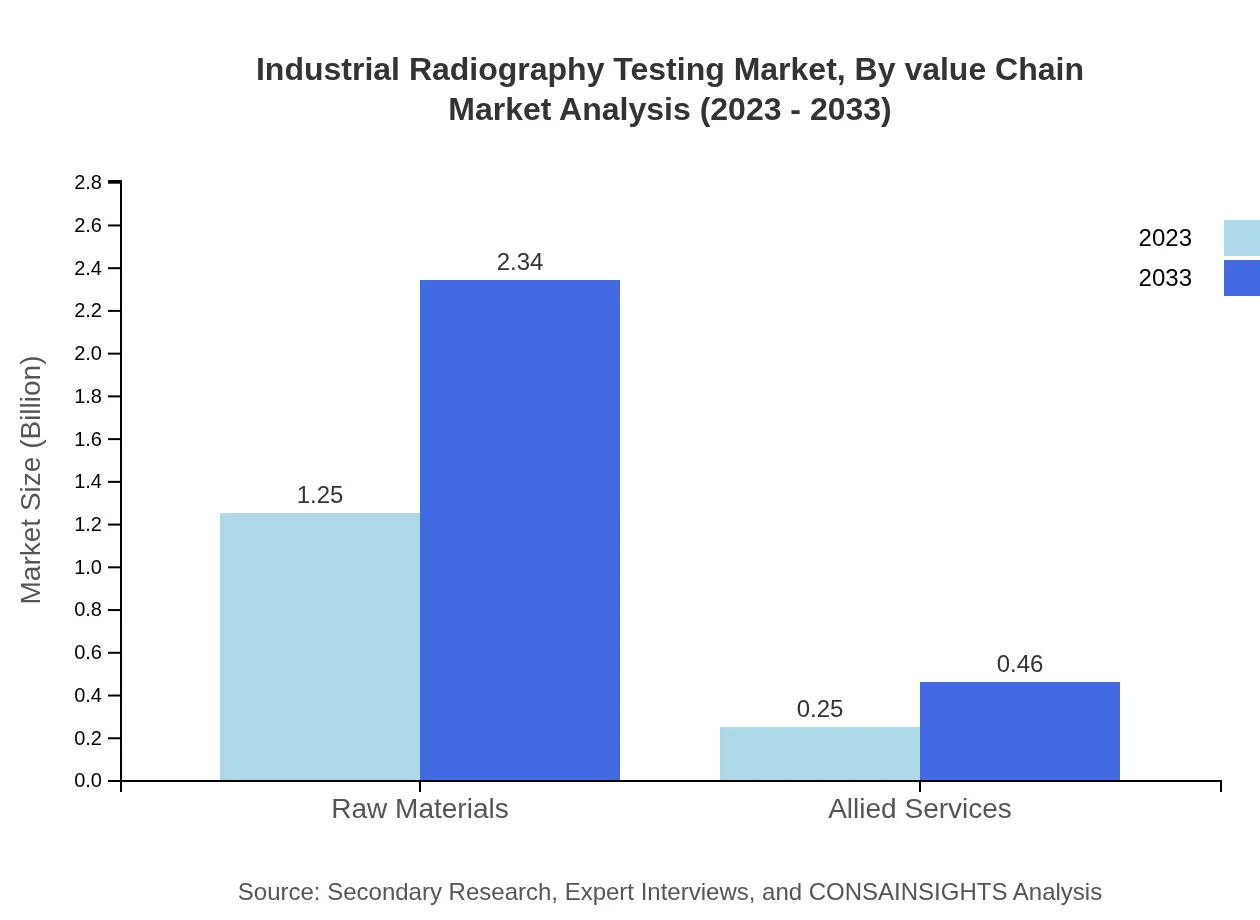

Industrial Radiography Testing Market Analysis By Value Chain

The analysis of the value chain in the Industrial Radiography Testing sector shows that raw materials, equipment, and testing services are crucial components. Raw materials significantly influence market dynamics, representing 83.5% of market share in 2023, underscoring their importance in the overall operations of the industry.

Industrial Radiography Testing Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in the Industrial Radiography Testing Industry

General Electric Co.:

An industry leader known for its advanced industrial imaging solutions that utilize both X-ray and gamma-ray technologies.Francesco C. V. Piazzoli:

Specializes in innovative radiographic testing services and has a strong presence in the aerospace and automotive sectors.Olympus Corporation:

Provides a wide range of inspection equipment and solutions, with a focus on digital radiography technologies.Intertek Group plc:

Known for its comprehensive testing and certification services across various industries, including high-quality radiographic evaluations.Bureau Veritas:

A global leader in testing, inspection, and certification services, recognized for its robust radiography testing solutions.We're grateful to work with incredible clients.

FAQs

What is the market size of industrial Radiography Testing?

The global market size for industrial radiography testing is projected to reach $1.5 billion by 2033, with a compound annual growth rate (CAGR) of 6.3%. This growth reflects increased applications in various industrial sectors.

What are the key market players or companies in the industrial Radiography Testing industry?

Key players in the industrial radiography testing market include major companies involved in providing testing services. These companies continuously innovate their technologies to stay competitive and meet the growing demand for quality assurance in various industries.

What are the primary factors driving the growth in the industrial Radiography Testing industry?

Growth in the industrial radiography testing industry is driven by rising quality assurance needs, technological advancements in imaging techniques, and the expansion of critical sectors like oil and gas, manufacturing, and aerospace, fostering a consistent market demand.

Which region is the fastest Growing in the industrial Radiography Testing?

The fastest-growing region in industrial radiography testing is North America, projected to grow from $0.53 billion in 2023 to $0.99 billion by 2033, highlighting increasing investment in infrastructure and industrial applications.

Does ConsaInsights provide customized market report data for the industrial Radiography Testing industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs in the industrial radiography testing industry, allowing clients to access insights relevant to their strategic business objectives.

What deliverables can I expect from this industrial Radiography Testing market research project?

From the industrial radiography testing market research project, clients can expect detailed reports, data-driven insights, analysis of market trends, forecasts, and a comprehensive overview of competitive landscapes tailored to various business requirements.

What are the market trends of industrial Radiography Testing?

Current market trends in industrial radiography testing include an increasing reliance on advanced imaging technologies, growing demand in the aerospace and oil sectors, and a shift towards automation in testing processes to enhance efficiency and reduce costs.