Industrial Refrigeration Systems Market Report

Published Date: 22 January 2026 | Report Code: industrial-refrigeration-systems

Industrial Refrigeration Systems Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Industrial Refrigeration Systems market, including market size, growth projections, segmentation, and insights into prevailing trends up to the year 2033.

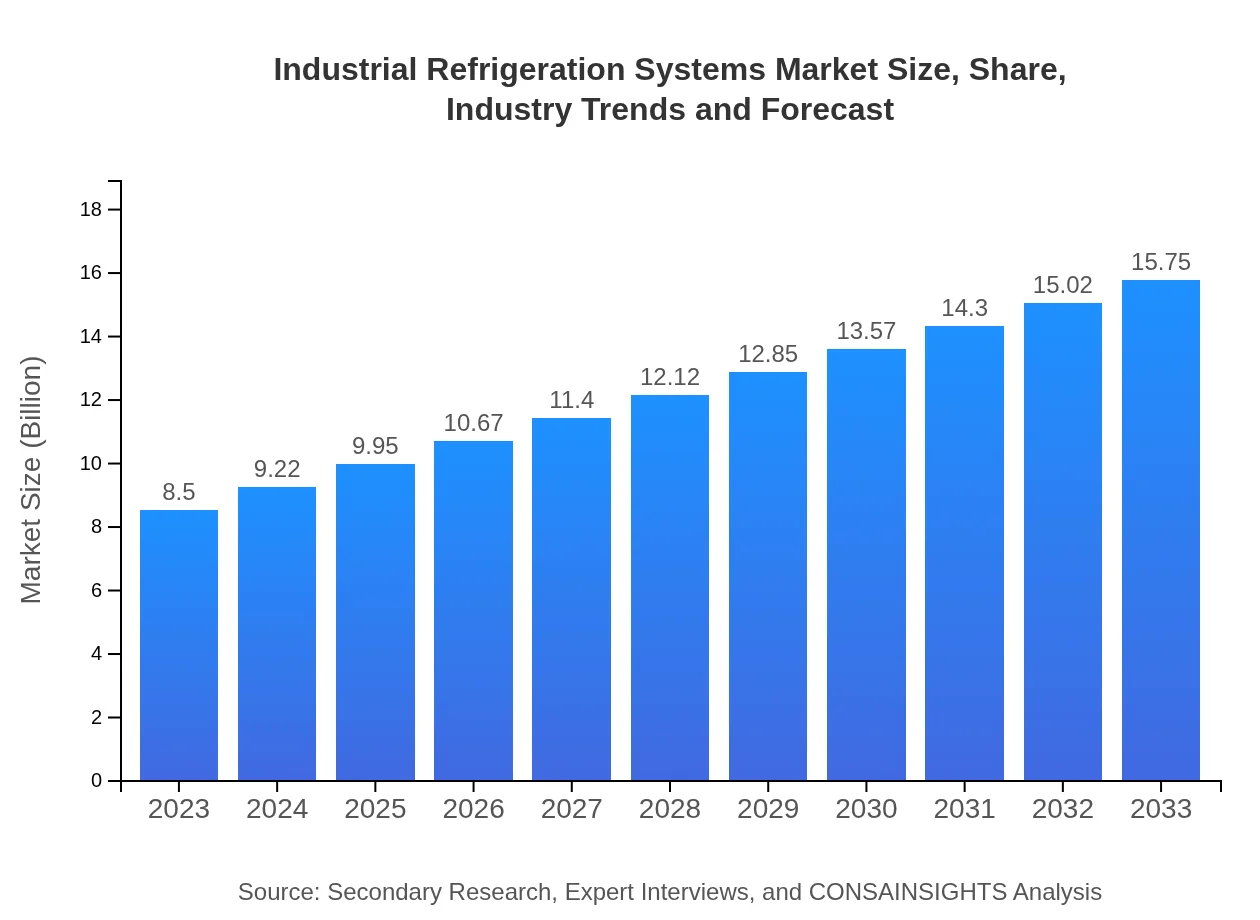

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $8.50 Billion |

| CAGR (2023-2033) | 6.2% |

| 2033 Market Size | $15.75 Billion |

| Top Companies | Honeywell International Inc., Carrier Global Corporation, Emerson Electric Co., Lennox International Inc., Daikin Industries, Ltd. |

| Last Modified Date | 22 January 2026 |

Industrial Refrigeration Systems Market Overview

Customize Industrial Refrigeration Systems Market Report market research report

- ✔ Get in-depth analysis of Industrial Refrigeration Systems market size, growth, and forecasts.

- ✔ Understand Industrial Refrigeration Systems's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Industrial Refrigeration Systems

What is the Market Size & CAGR of Industrial Refrigeration Systems market in 2023 and 2033?

Industrial Refrigeration Systems Industry Analysis

Industrial Refrigeration Systems Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Industrial Refrigeration Systems Market Analysis Report by Region

Europe Industrial Refrigeration Systems Market Report:

Europe is projected to see the market grow from $2.28 billion in 2023 to $4.22 billion by 2033. Due to increased environmental regulations and a strong push towards energy-efficient solutions, European countries are moving towards adopting natural refrigerants extensively.Asia Pacific Industrial Refrigeration Systems Market Report:

The Asia Pacific region is projected to witness significant growth, with the market size anticipated to grow from $1.69 billion in 2023 to approximately $3.13 billion in 2033. This growth is driven by robust industrialization, increasing demand for processed food, and expansion in the cold chain logistics sector.North America Industrial Refrigeration Systems Market Report:

The North American market is among the largest, estimated to grow from $3.14 billion in 2023 to $5.83 billion in 2033, driven by stringent safety regulations and high standards for food quality in the food and beverage industries.South America Industrial Refrigeration Systems Market Report:

In South America, the Industrial Refrigeration Systems market is expected to reach $1.45 billion by 2033, increasing from $0.78 billion in 2023. Growth in the region is attributed to rising food and beverage sectors and evolving consumer preferences for sustainable refrigeration technologies.Middle East & Africa Industrial Refrigeration Systems Market Report:

In the Middle East and Africa, the market size is expected to rise from $0.61 billion in 2023 to $1.13 billion in 2033. This growth is largely due to infrastructural development and increasing investments in the food processing industry.Tell us your focus area and get a customized research report.

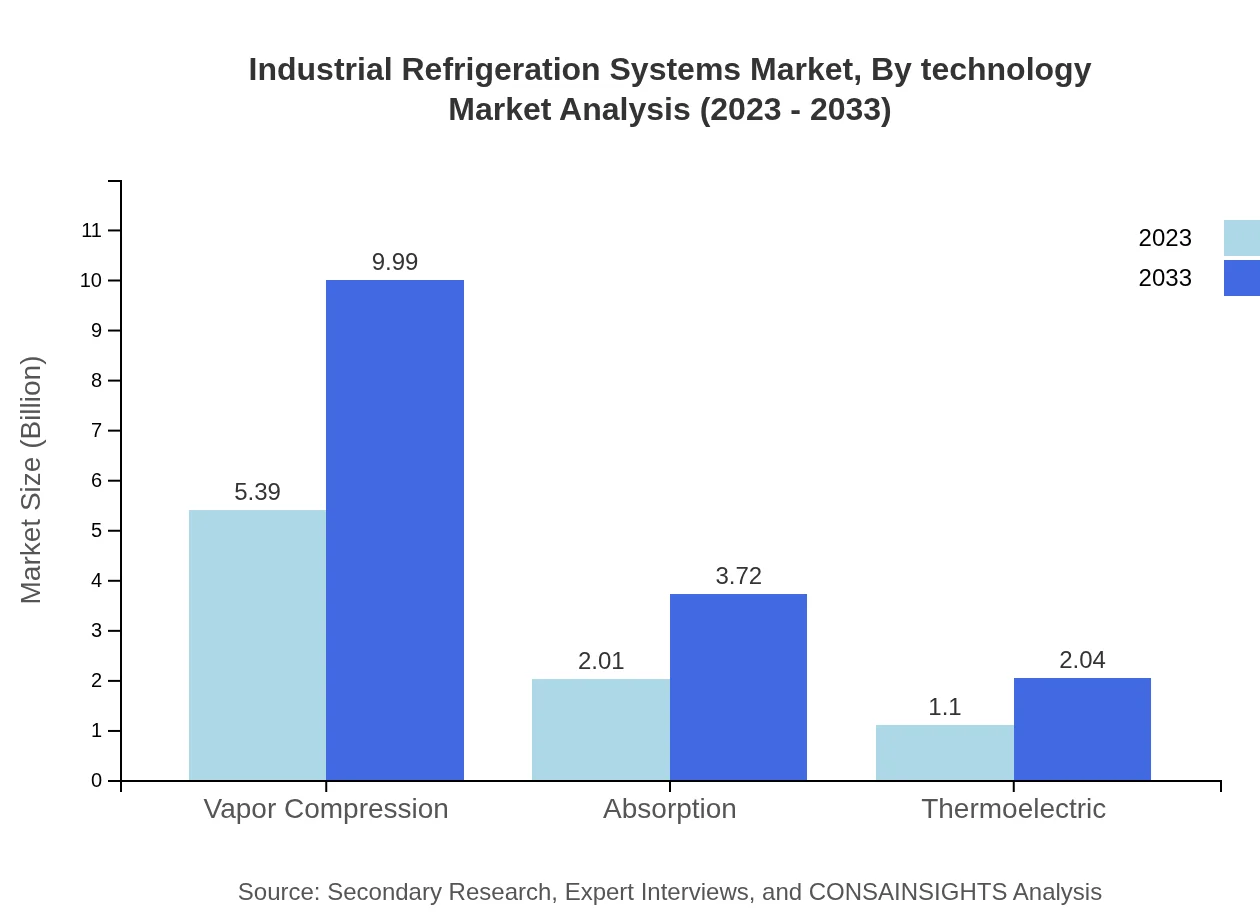

Industrial Refrigeration Systems Market Analysis By Technology

The Industrial Refrigeration Systems market by technology showcases significant contributions from vapor compression systems, which account for approximately 63.45% of the market share in 2023. The absorption and thermoelectric technologies also have notable segments, holding 23.62% and 12.93% respectively, reflecting the growing adoption of energy-efficient solutions.

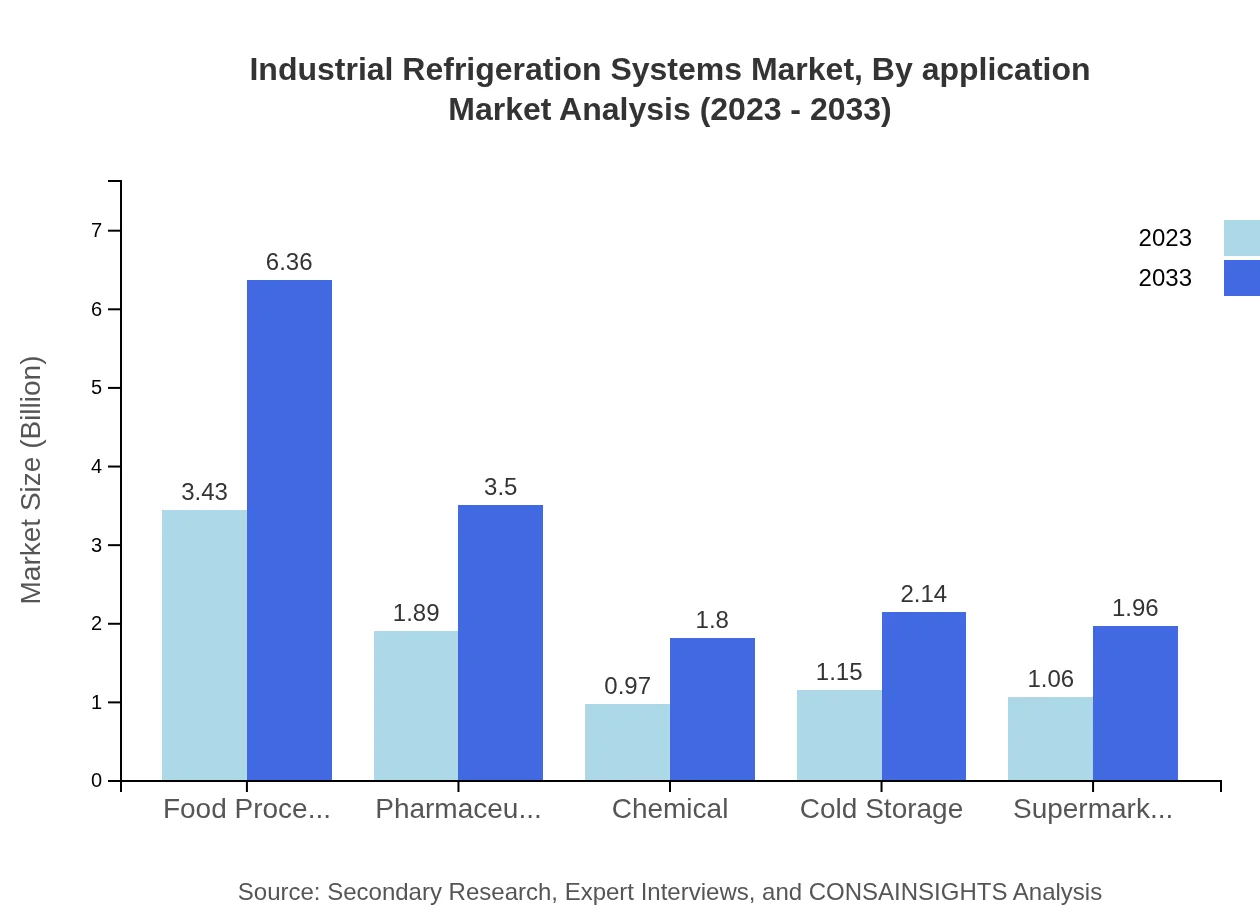

Industrial Refrigeration Systems Market Analysis By Application

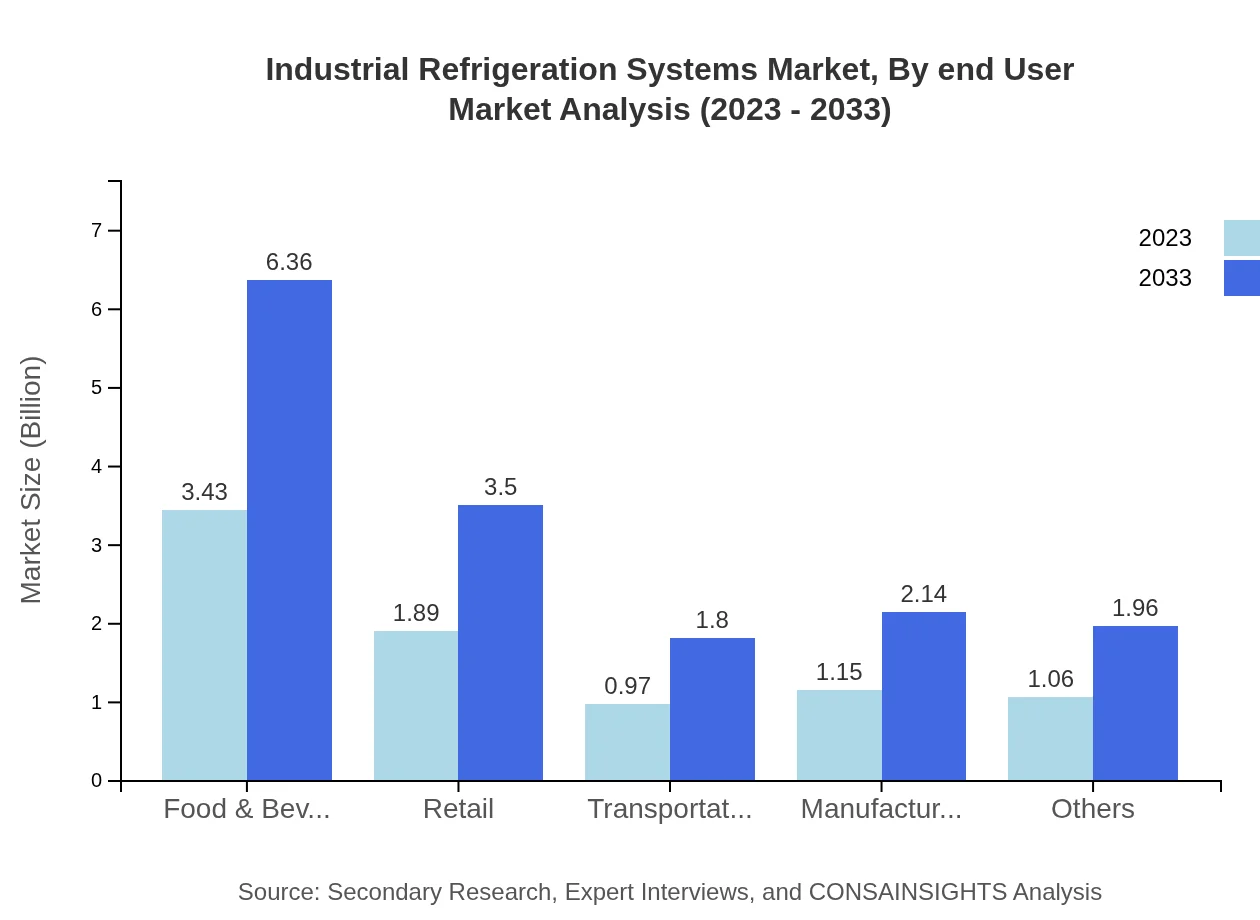

In terms of application, the food and beverage sector dominates the market with a share of 40.41% in 2023, translating to a market size of $3.43 billion, expected to rise to $6.36 billion by 2033. Retail and pharmaceutical applications are also significant, emphasizing the sector’s broad applicability.

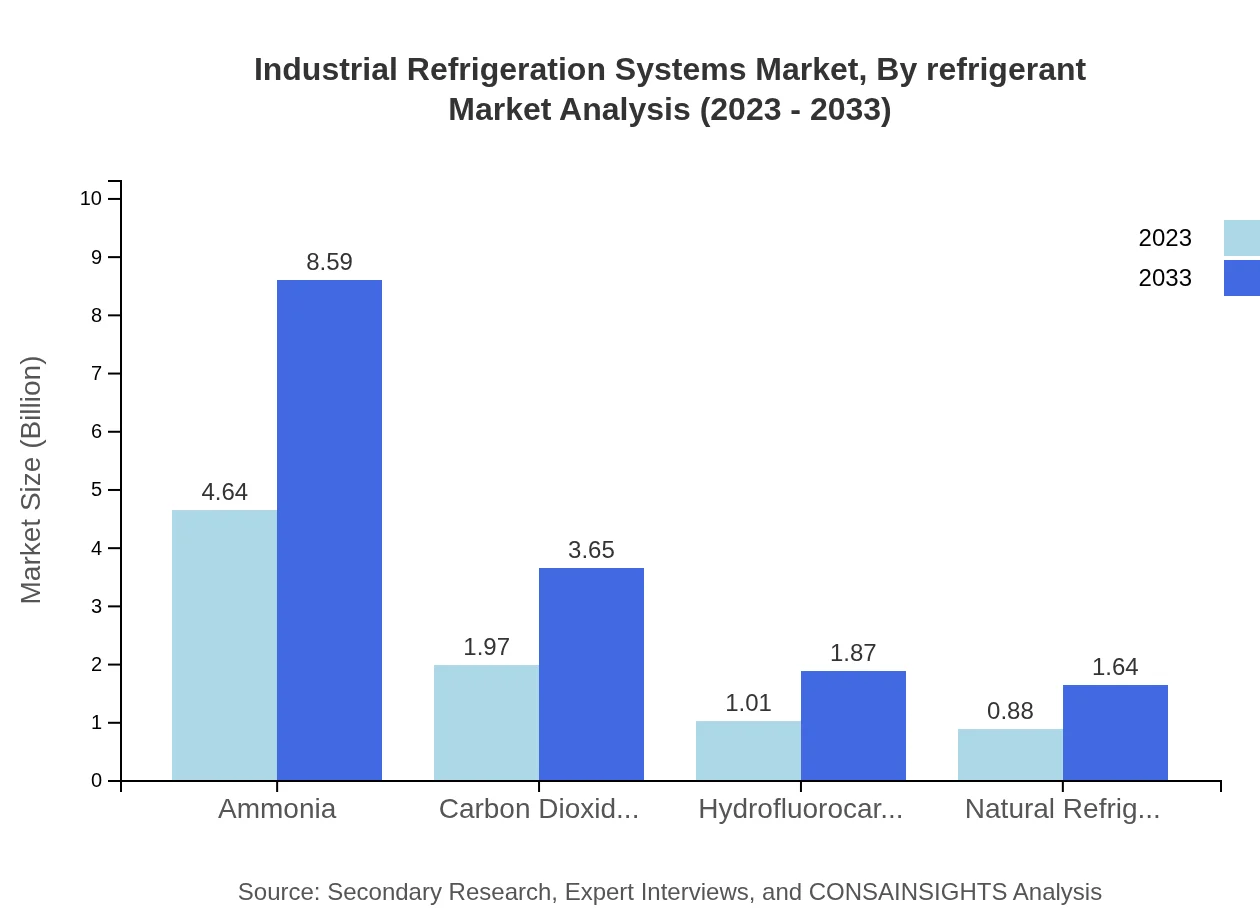

Industrial Refrigeration Systems Market Analysis By Refrigerant

The refrigerant types include ammonia, which leads the market with a 54.56% share in 2023, and is projected to rise significantly. Carbon Dioxide and Hydrofluorocarbons make up 23.16% and 11.89% respectively, each catering to specific needs within the industry, as regulations push for lower Global Warming Potential (GWP) options.

Industrial Refrigeration Systems Market Analysis By End User

The market segmentation by end-user highlights the food processing industry as a key player, representing a significant portion of the market. With the increasing focus on safety and sustainability, industries such as pharmaceuticals and chemicals are also investing heavily in refrigeration systems.

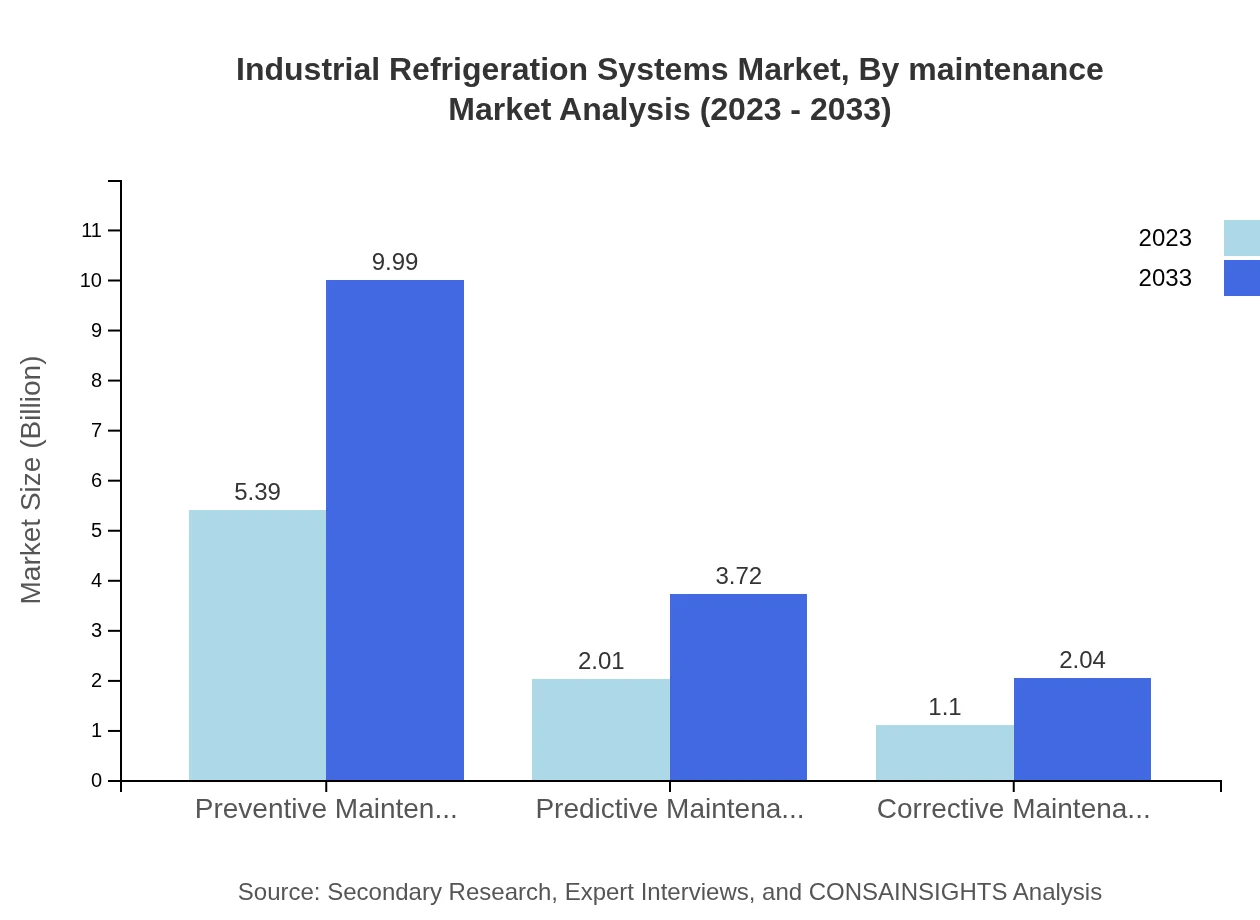

Industrial Refrigeration Systems Market Analysis By Maintenance

Maintenance strategies within the Industrial Refrigeration Systems market are critical, with preventive maintenance dominating at 63.45%. Predictive maintenance is also gaining traction as technology evolves, providing companies with smarter solutions for system management and efficiency.

Industrial Refrigeration Systems Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Industrial Refrigeration Systems Industry

Honeywell International Inc.:

A leading provider of advanced refrigeration solutions that focus on energy efficiency and sustainable practices.Carrier Global Corporation:

Renowned for its cutting-edge HVAC systems, Carrier is instrumental in setting industry standards for refrigeration systems.Emerson Electric Co.:

Emerson is known for its technological innovations in refrigeration, emphasizing reliability and sustainability.Lennox International Inc.:

Lennox focuses on both residential and commercial refrigeration solutions with advancements in energy efficiency.Daikin Industries, Ltd.:

A global leader in heating and cooling solutions, Daikin emphasizes sustainable and environmentally friendly refrigerants in its products.We're grateful to work with incredible clients.

FAQs

What is the market size of industrial refrigeration systems?

The industrial refrigeration systems market is valued at approximately $8.5 billion in 2023, with a projected compound annual growth rate (CAGR) of 6.2% expected to drive substantial growth through 2033.

What are the key market players or companies in the industrial refrigeration systems industry?

Key players in the industrial refrigeration systems market include Emerson Electric Co., Danfoss, Carrier Global Corporation, and Johnson Controls International, among others, who lead in technology innovation and market share.

What are the primary factors driving the growth in the industrial refrigeration systems industry?

Growth in the industrial refrigeration systems industry is driven by increasing demand for food preservation, advancements in technology, regulatory push for energy-efficient systems, and the rising trend in cold chain logistics.

Which region is the fastest Growing in the industrial refrigeration systems?

Asia Pacific represents the fastest-growing region in the industrial refrigeration systems market, projected to expand from $1.69 billion in 2023 to $3.13 billion by 2033, primarily due to urbanization and industrial growth.

Does ConsaInsights provide customized market report data for the industrial refrigeration systems industry?

Yes, ConsaInsights offers customized market report data tailored to the industrial refrigeration systems industry, allowing clients to receive insights specific to their needs and strategic interests.

What deliverables can I expect from this industrial refrigeration systems market research project?

Deliverables from the industrial refrigeration systems market research project typically include comprehensive reports, market forecasts, segmentation analysis, competitive landscape assessments, and actionable insights.

What are the market trends of industrial refrigeration systems?

Key trends in the industrial refrigeration systems market include the shift towards natural refrigerants, increased automation in cold storage solutions, greater focus on energy efficiency, and expansion of online grocery services driving demand.