Industrial Robotics Market Report

Published Date: 22 January 2026 | Report Code: industrial-robotics

Industrial Robotics Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Industrial Robotics market, covering trends, growth forecasts, and market dynamics from 2023 to 2033, offering valuable insights for industry stakeholders.

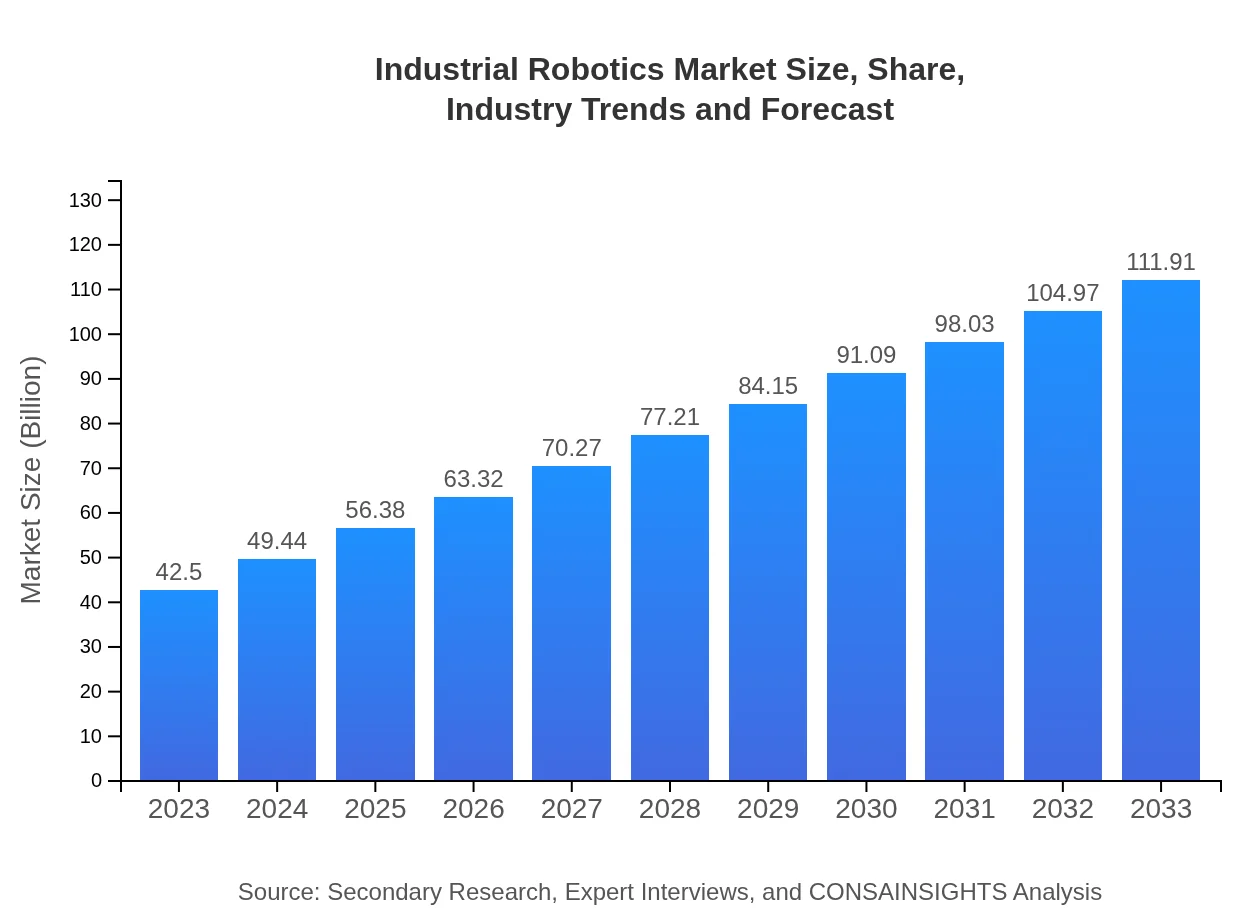

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $42.50 Billion |

| CAGR (2023-2033) | 9.8% |

| 2033 Market Size | $111.91 Billion |

| Top Companies | ABB Ltd., KUKA AG, FANUC Corporation, Yaskawa Electric Corporation, Universal Robots |

| Last Modified Date | 22 January 2026 |

Industrial Robotics Market Overview

Customize Industrial Robotics Market Report market research report

- ✔ Get in-depth analysis of Industrial Robotics market size, growth, and forecasts.

- ✔ Understand Industrial Robotics's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Industrial Robotics

What is the Market Size & CAGR of Industrial Robotics market in 2023 and 2033?

Industrial Robotics Industry Analysis

Industrial Robotics Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Industrial Robotics Market Analysis Report by Region

Europe Industrial Robotics Market Report:

Europe's Industrial Robotics market is projected to grow from $10.51 billion in 2023 to $27.69 billion by 2033, driven by advancements in technology and a strong automotive manufacturing base in countries like Germany and France.Asia Pacific Industrial Robotics Market Report:

In 2023, the Asia-Pacific Industrial Robotics market is estimated to be valued at $8.46 billion, projected to grow to $22.27 billion by 2033. Japan, China, and South Korea are the leading countries in robotics adoption, driven by manufacturing output and government support for automation technologies.North America Industrial Robotics Market Report:

North America holds a significant share of the market, with a value of $14.52 billion in 2023, set to reach $38.24 billion by 2033. The U.S. is the largest market in the region, where industries are heavily investing in automation and robotics to enhance productivity.South America Industrial Robotics Market Report:

The South American market was valued at $3.75 billion in 2023 and is expected to reach $9.87 billion by 2033. The region's growth is propelled by increased investments in automation technologies and efforts to modernize the manufacturing sector.Middle East & Africa Industrial Robotics Market Report:

The Middle East and Africa market was valued at $5.26 billion in 2023, expected to grow to $13.84 billion by 2033, as countries in the region begin investing more in automation to diversify their economies away from oil dependence.Tell us your focus area and get a customized research report.

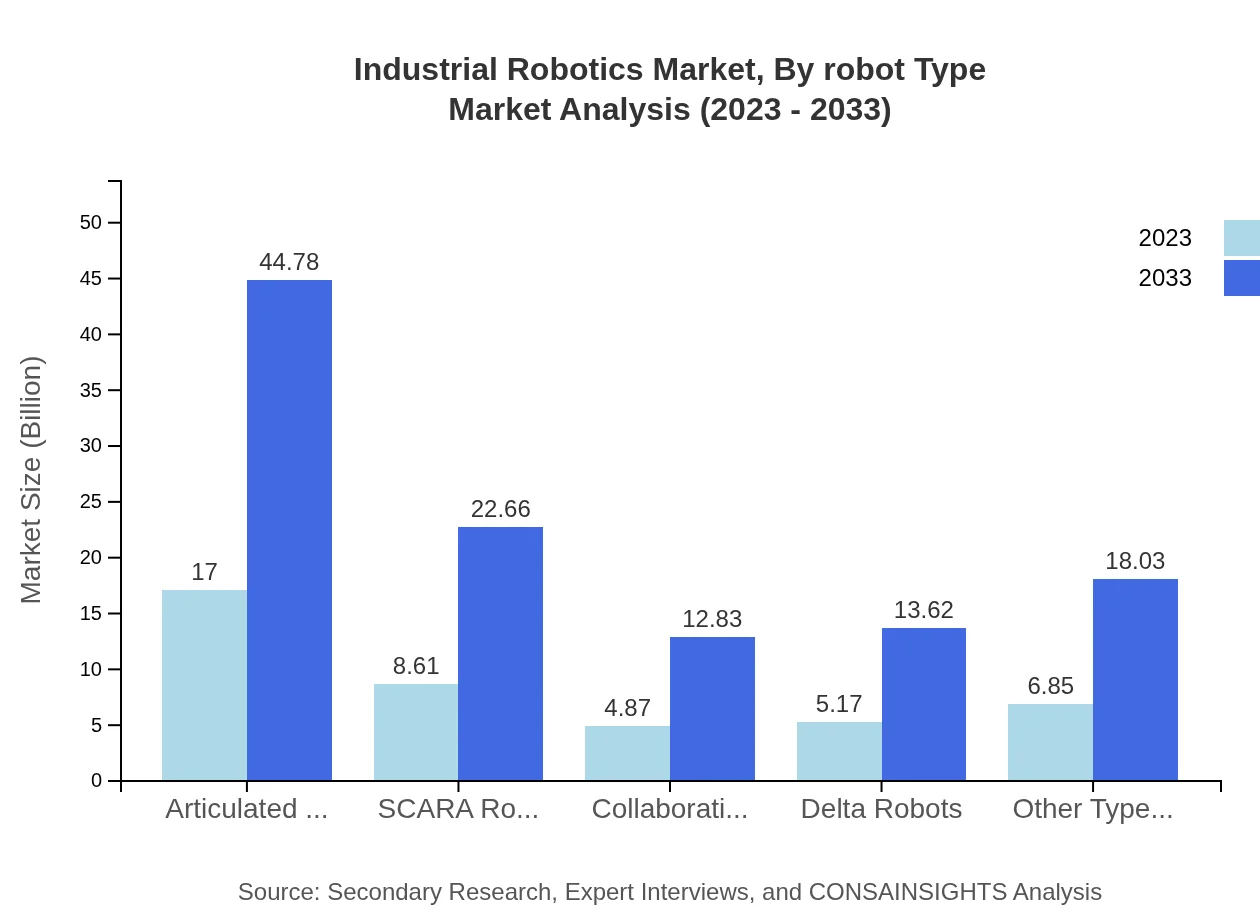

Industrial Robotics Market Analysis By Robot Type

Articulated Robots lead the market with a size of $17.00 billion in 2023, anticipated to grow to $44.78 billion by 2033, accounting for 40.01% market share. SCARA Robots are projected to grow from $8.61 billion to $22.66 billion, holding a 20.25% share, while Collaborative Robots are expected to increase from $4.87 billion to $12.83 billion, with an 11.46% share.

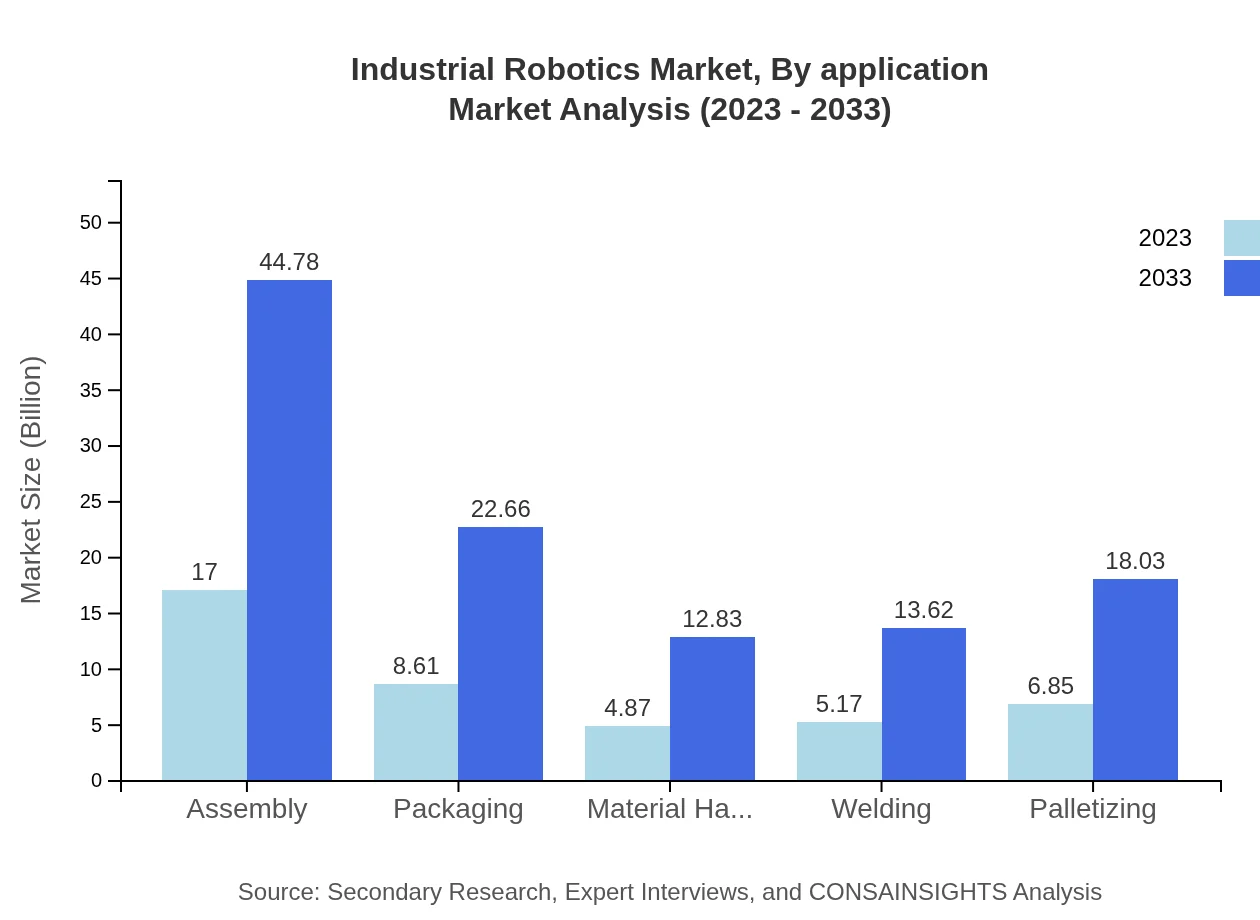

Industrial Robotics Market Analysis By Application

Assembly applications represent a significant market size of $17.00 billion in 2023, projected to reach $44.78 billion by 2033. Packaging and material handling applications follow with market sizes of $8.61 billion and $4.87 billion in 2023, expected to grow respectively.

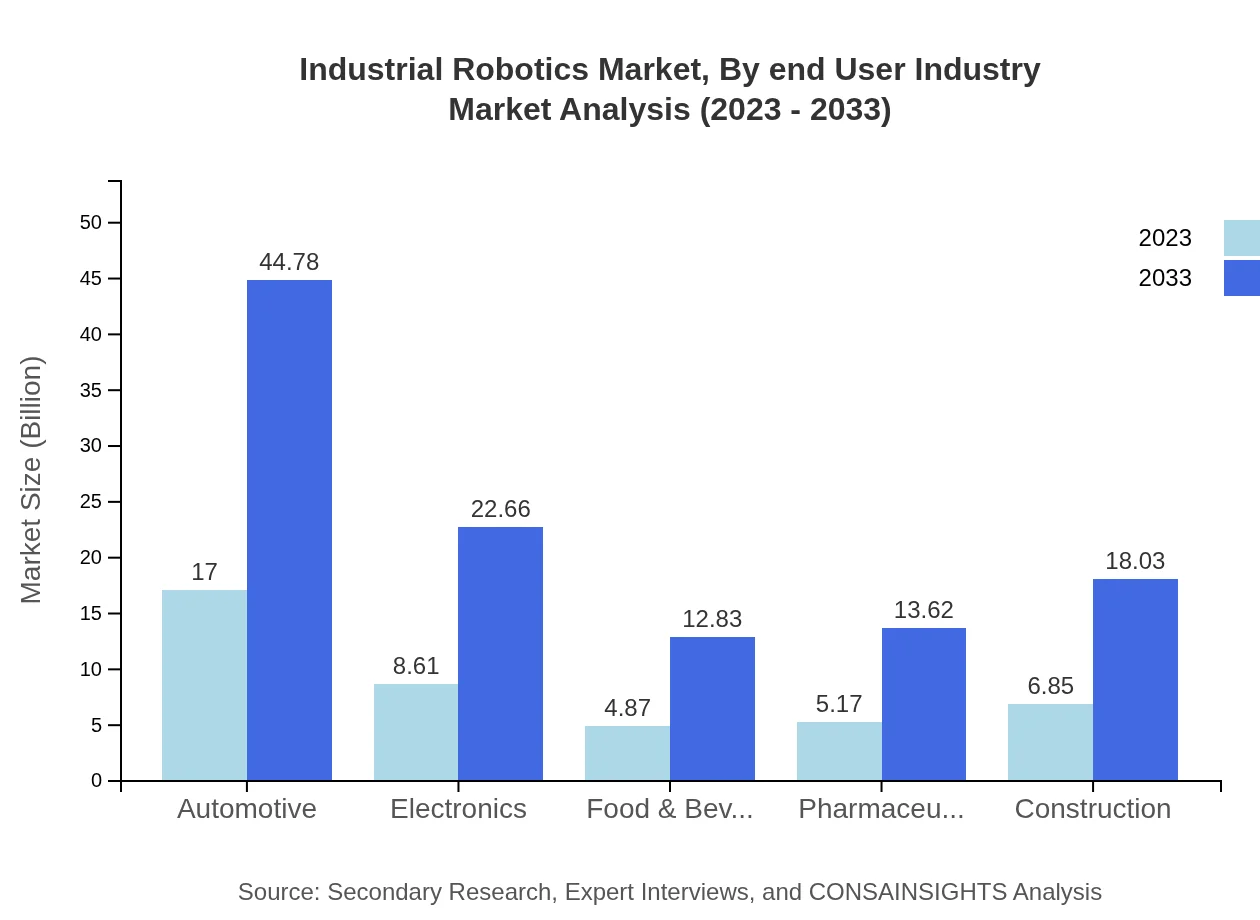

Industrial Robotics Market Analysis By End User Industry

The automotive industry leads in robotics integration, projected to achieve a market size of $17.00 billion in 2023. Following closely, the electronics and food & beverage industries are also seeing substantial growth due to increasing automation.

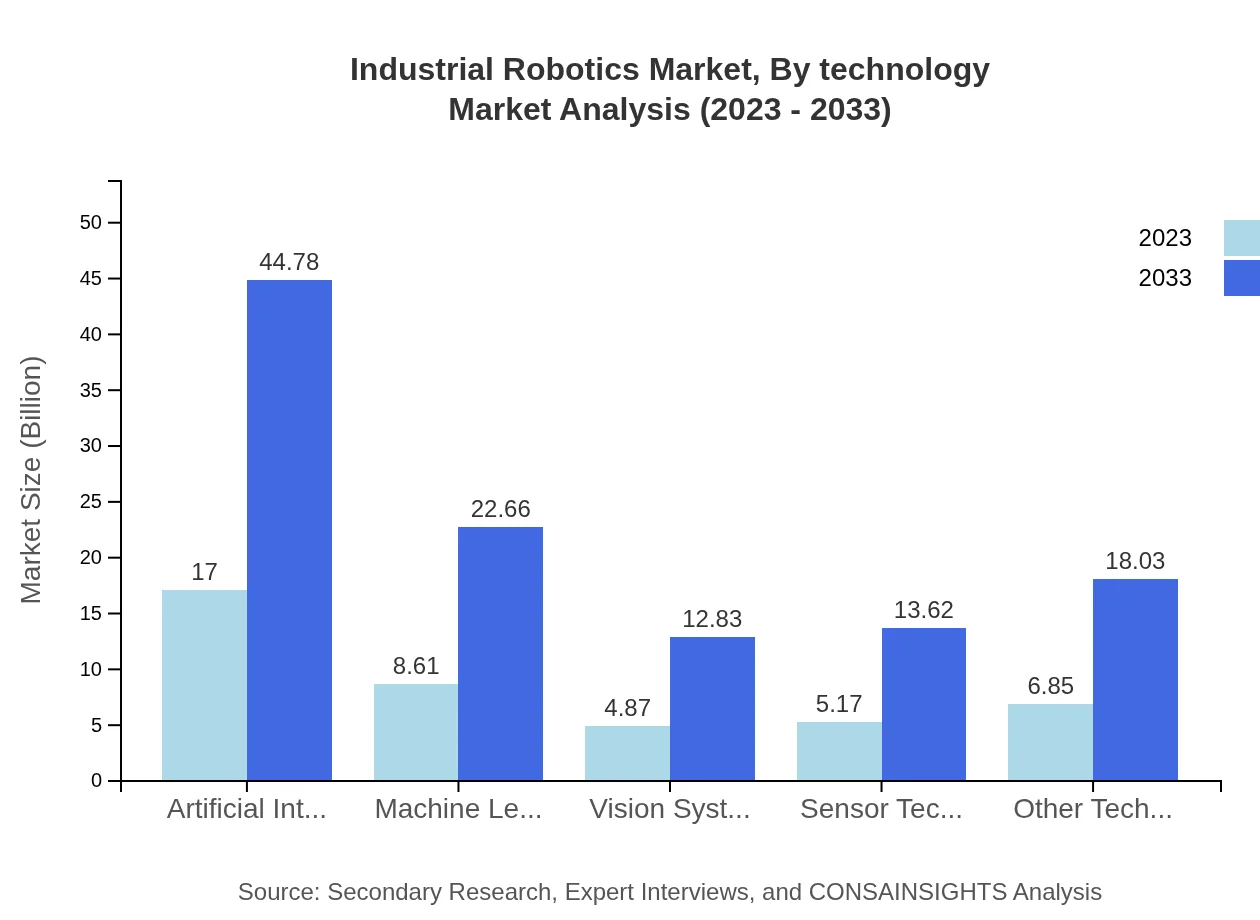

Industrial Robotics Market Analysis By Technology

Integration of Artificial Intelligence in industrial robotics is driving growth, with a market size projected to move from $17.00 billion to $44.78 billion. Machine Learning and Sensor Technology are also critical, with growth expectations closely paralleling AI advancements.

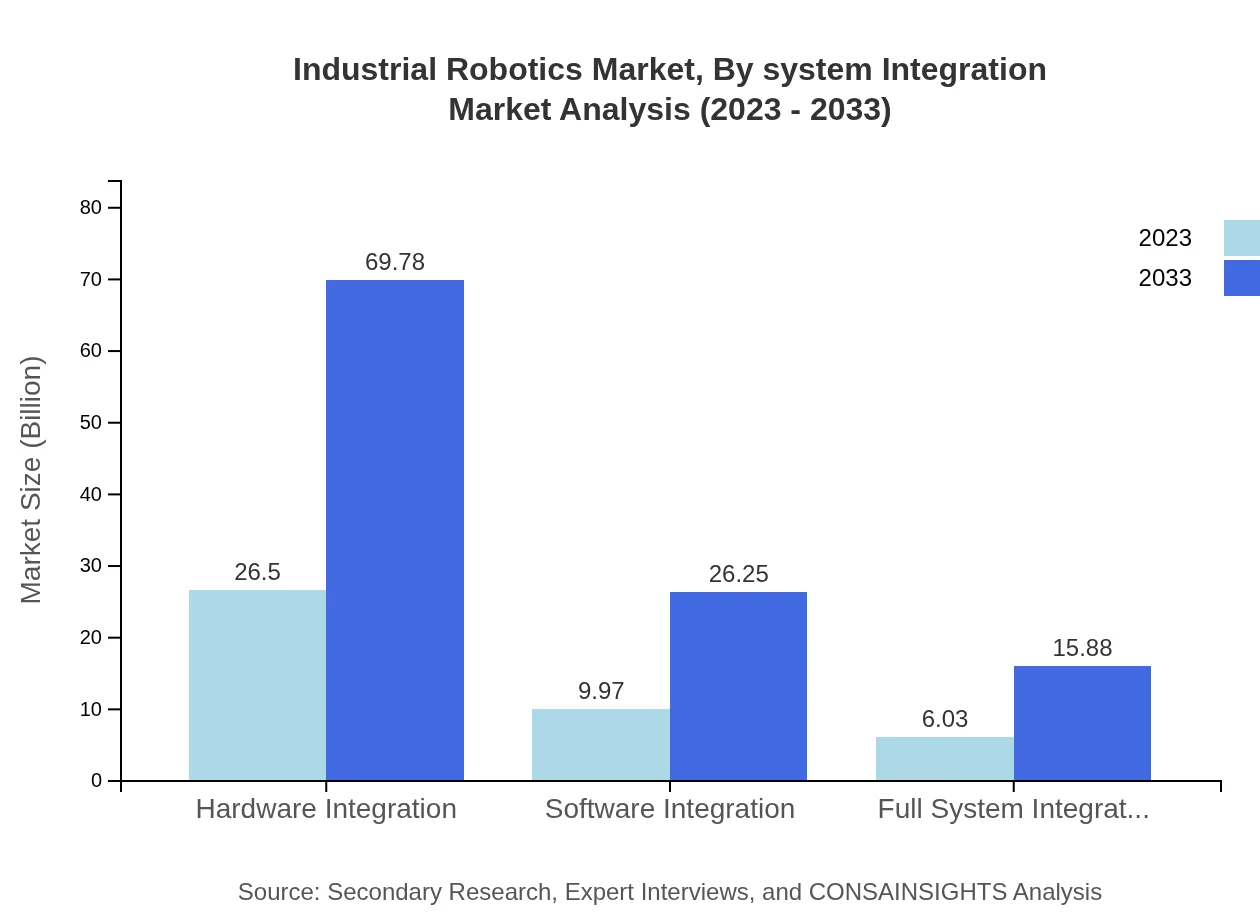

Industrial Robotics Market Analysis By System Integration

Hardware Integration leads with an anticipated growth from $26.50 billion to $69.78 billion. Software integration is also witnessing remarkable growth, signaling a move towards comprehensive robotic solutions rather than standalone systems.

Industrial Robotics Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Industrial Robotics Industry

ABB Ltd.:

A global leader in robotics and automation technologies, ABB provides a wide range of industrial robots and solutions globally, supporting industries with upgrades in manufacturing processes.KUKA AG:

Known for its innovative industrial robots and automation solutions, KUKA is a strong player in sectors like automotive assembly and logistics.FANUC Corporation:

FANUC is renowned for its advanced robotics technology and factory automation solutions, leading the global market with its wide array of robotic arms and manufacturing systems.Yaskawa Electric Corporation:

Yaskawa specializes in industrial robots and automation equipment, making significant contributions to manufacturing efficiency and quality enhancement.Universal Robots:

A pioneer in collaborative robot technology, Universal Robots is transforming automation with its user-friendly and versatile robots designed for small and medium-sized enterprises.We're grateful to work with incredible clients.

FAQs

What is the market size of industrial robotics?

The industrial robotics market is projected to reach approximately $42.5 billion by 2033, growing at a CAGR of 9.8% from its current size. This growth reflects increasing automation and robotics applications across various industries.

What are the key market players or companies in the industrial robotics industry?

Key players in the industrial robotics sector include major companies such as ABB, KUKA, FANUC, and Yaskawa. These companies are at the forefront, offering innovative solutions to enhance automation processes.

What are the primary factors driving the growth in the industrial robotics industry?

Factors fueling the growth of the industrial robotics industry include technological advancements, rising labor costs, demand for higher productivity, and increased focus on workplace safety through automation.

Which region is the fastest Growing in the industrial robotics?

Asia-Pacific is the fastest-growing region in the industrial robotics market, projected to expand from $8.46 billion in 2023 to $22.27 billion by 2033, driven by manufacturing growth and increased investment in automation.

Does Consainsights provide customized market report data for the industrial robotics industry?

Yes, Consainsights offers customized market report data tailored to specific needs within the industrial robotics industry, enabling clients to gain detailed insights that align with their strategic objectives.

What deliverables can I expect from this industrial robotics market research project?

Deliverables from the industrial robotics market research project typically include a comprehensive report, key market trends, detailed segmentation data, and insights into competitive landscape and growth opportunities.

What are the market trends of industrial robotics?

Current trends in the industrial robotics market include an increase in collaborative robots (cobots), integration of AI and machine learning, and a growing emphasis on flexible automation solutions across various industrial sectors.