Industrial Rt For Nondestructive Testing Market Report

Published Date: 31 January 2026 | Report Code: industrial-rt-for-nondestructive-testing

Industrial Rt For Nondestructive Testing Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Industrial RT for Nondestructive Testing market from 2023 to 2033, covering market size, growth trends, technology advancements, and regional insights to aid stakeholders in decision-making.

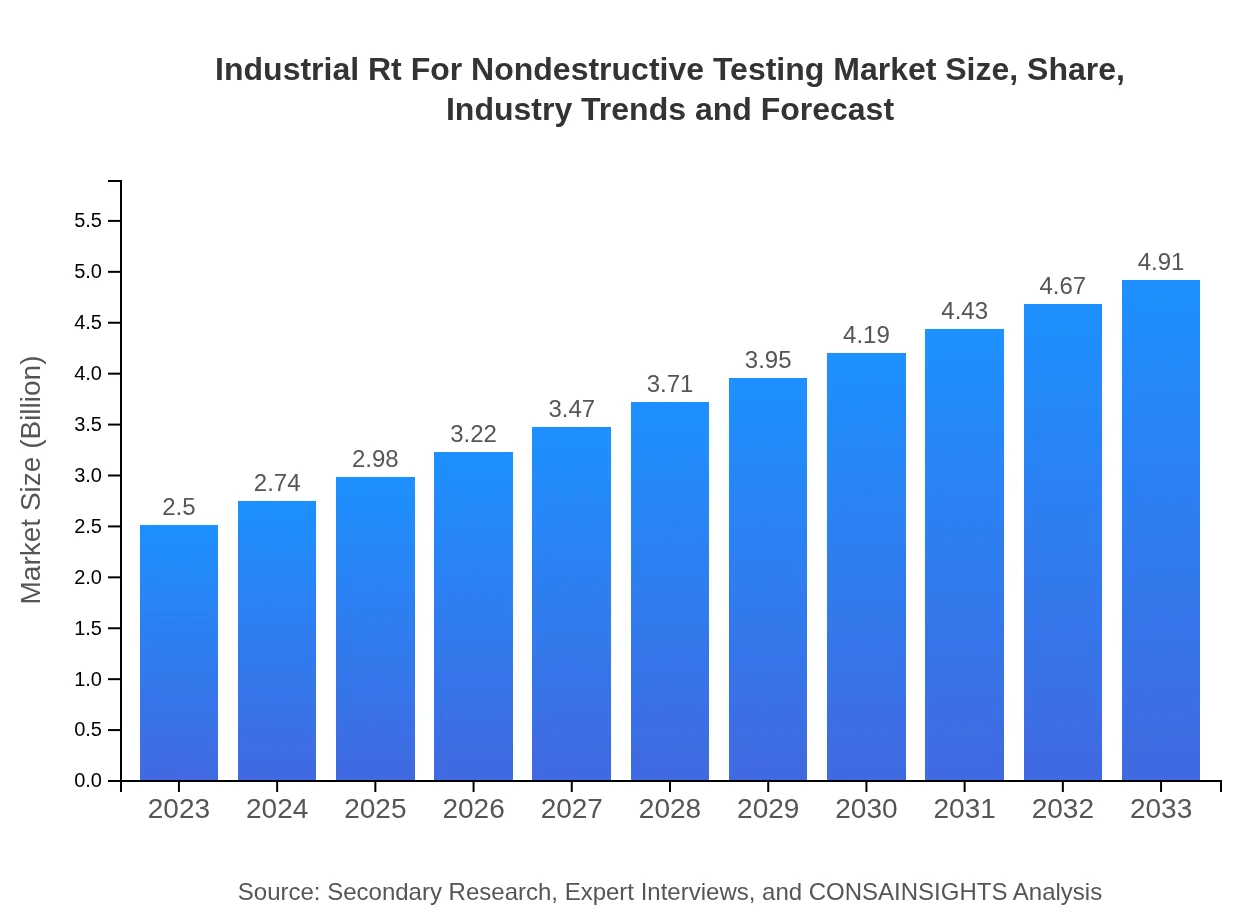

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $2.50 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $4.91 Billion |

| Top Companies | GE Inspection Technologies, Fujifilm, Olympus Corporation, Mistras Group, Inc. |

| Last Modified Date | 31 January 2026 |

Industrial Rt For Nondestructive Testing Market Overview

Customize Industrial Rt For Nondestructive Testing Market Report market research report

- ✔ Get in-depth analysis of Industrial Rt For Nondestructive Testing market size, growth, and forecasts.

- ✔ Understand Industrial Rt For Nondestructive Testing's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Industrial Rt For Nondestructive Testing

What is the Market Size & CAGR of Industrial Rt For Nondestructive Testing market in 2023?

Industrial Rt For Nondestructive Testing Industry Analysis

Industrial Rt For Nondestructive Testing Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Industrial Rt For Nondestructive Testing Market Analysis Report by Region

Europe Industrial Rt For Nondestructive Testing Market Report:

Europe accounted for a market size of $0.71 billion in 2023, with projections reaching $1.39 billion by 2033. The region is witnessing a rise in demand for NDT services driven by safety standards and technological innovations in industries such as automotive and construction.Asia Pacific Industrial Rt For Nondestructive Testing Market Report:

The Asia Pacific region held a market size of $0.48 billion in 2023 and is projected to reach $0.94 billion by 2033, driven by rapid industrialization and increasing investments in infrastructure. Countries like China and India are witnessing high demand for NDT services due to their expansive manufacturing and construction sectors.North America Industrial Rt For Nondestructive Testing Market Report:

The North American market was valued at $0.85 billion in 2023, expected to expand to $1.68 billion by 2033. The region's growth is primarily driven by stringent industrial regulations, the presence of key players, and advancements in NDT technologies across industries such as aerospace and automotive.South America Industrial Rt For Nondestructive Testing Market Report:

In South America, the Industrial RT for Nondestructive Testing market size was $0.12 billion in 2023, with expectations to grow to $0.23 billion by 2033. Growth in this region is fueled by increasing infrastructure development and regulatory compliance across various industries, including oil & gas.Middle East & Africa Industrial Rt For Nondestructive Testing Market Report:

The Middle East and Africa region showed a market size of $0.35 billion in 2023, projected to reach $0.68 billion by 2033. Robust growth in oil & gas and mining industries is contributing to increased demand for nondestructive testing solutions.Tell us your focus area and get a customized research report.

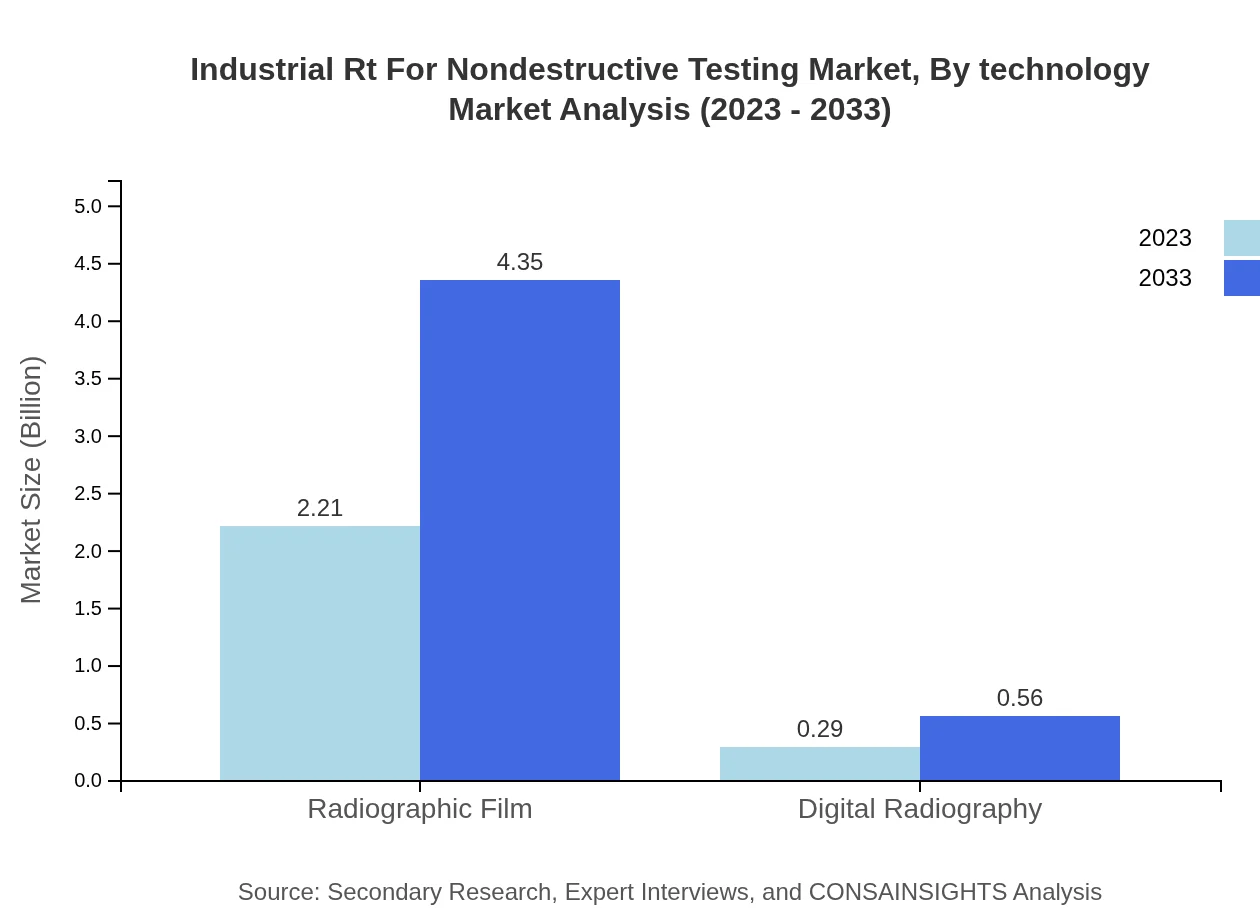

Industrial Rt For Nondestructive Testing Market Analysis By Technology

The market is dominated by Radiographic Film technology, representing 88.54% of the market share in 2023, projected to maintain this prominence with a value of $2.21 billion. Digital Radiography, while smaller, is growing as industries transition towards digital solutions, expected to increase from $0.29 billion in 2023 to $0.56 billion by 2033.

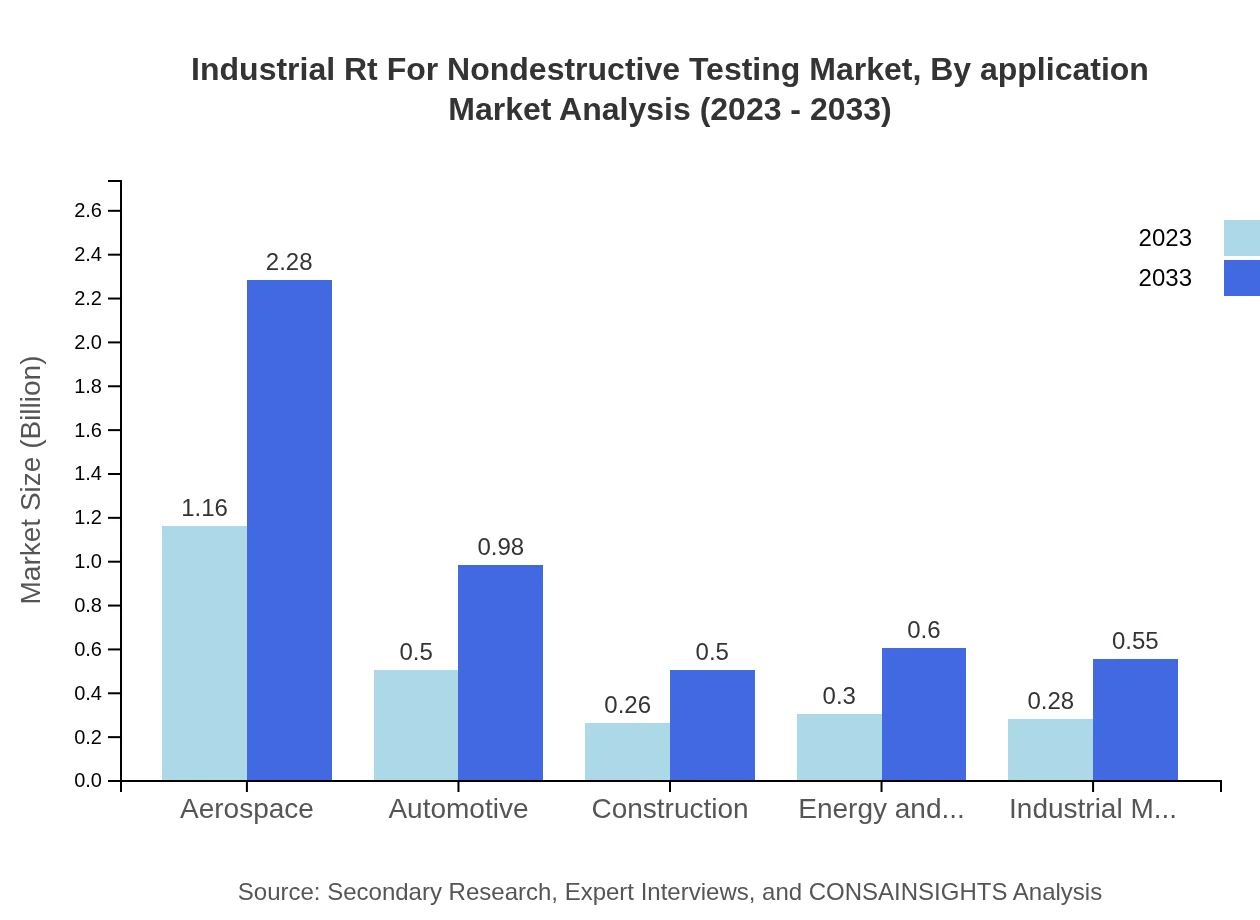

Industrial Rt For Nondestructive Testing Market Analysis By Application

Aerospace remains a vital application sector, projected to grow from $1.16 billion in 2023 to $2.28 billion by 2033, representing 46.33% market share. Other key applications, such as automotive and construction, are also expected to experience growth, aligning with global trends toward enhanced safety and reliability.

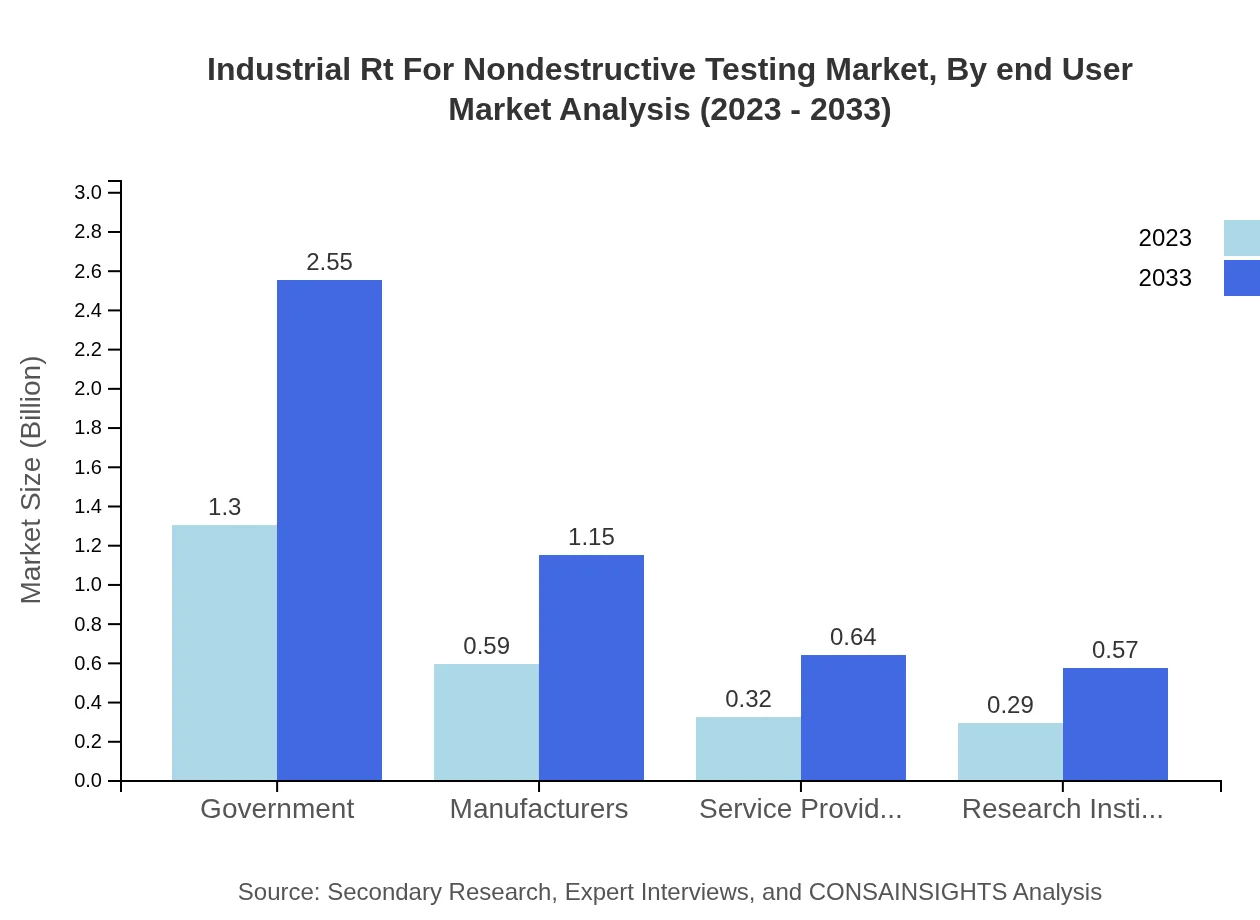

Industrial Rt For Nondestructive Testing Market Analysis By End User

Key end-users include government bodies, manufacturers, and service providers, with government agencies commanding a 51.92% market share in 2023. The share is expected to remain stable, reflecting ongoing compliance and regulatory needs, while manufacturers and service providers also demonstrate significant growth potential.

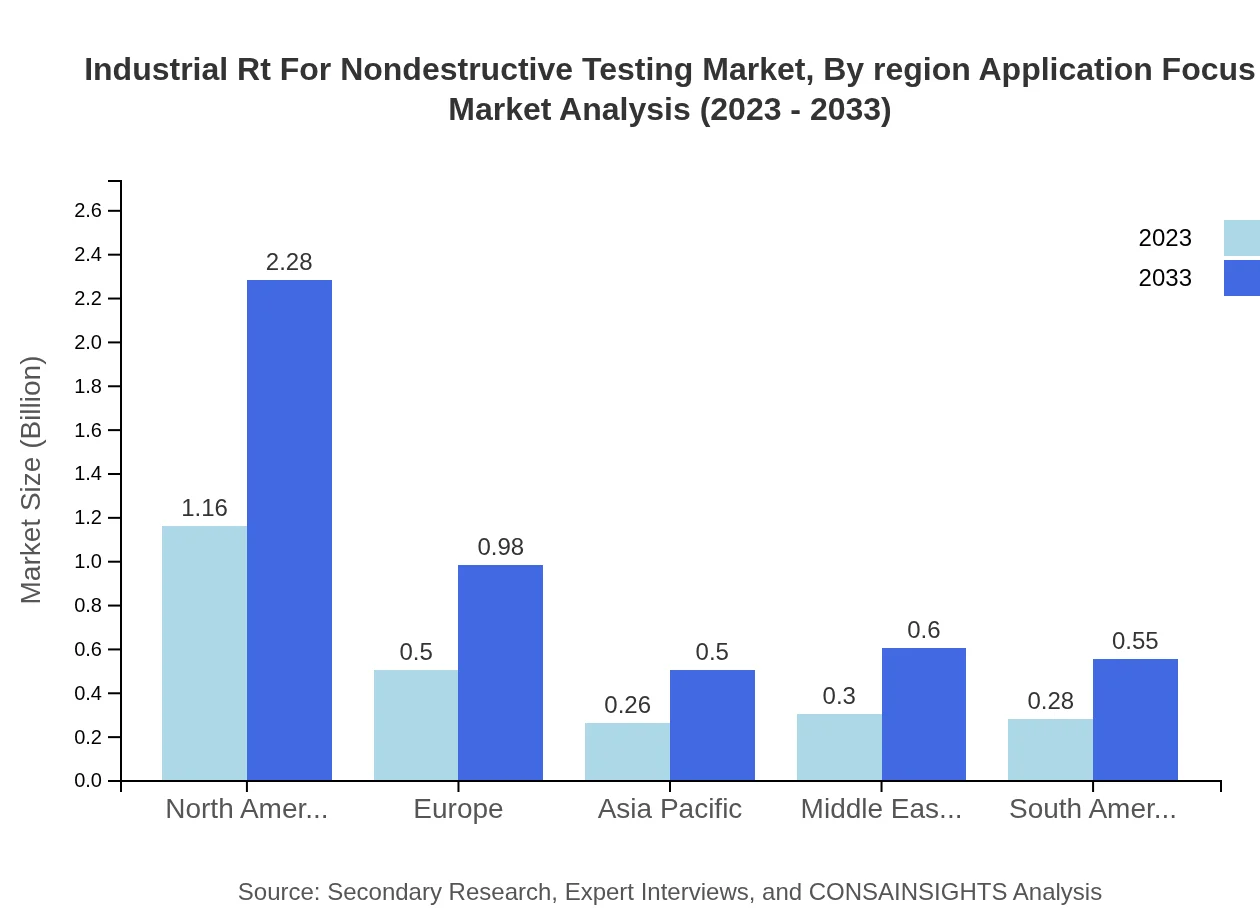

Industrial Rt For Nondestructive Testing Market Analysis By Region Application Focus

Regional focus varies, with North America, Europe, and Asia Pacific leading in application focus, particularly within the aerospace and automotive sectors. The integration of advanced technologies is cultivating new opportunities and enhancing the effectiveness of nondestructive testing procedures.

Industrial Rt For Nondestructive Testing Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Industrial Rt For Nondestructive Testing Industry

GE Inspection Technologies:

A leading provider of nondestructive testing solutions, GE offers advanced technologies and analytics to enhance inspection efficiency and effectiveness.Fujifilm:

Fujifilm holds a strong position in NDT with its innovative radiography products, focusing on digital solutions and imaging technologies.Olympus Corporation:

Olympus is renowned for its range of NDT equipment, particularly in ultrasonic testing, complementing its RT offerings.Mistras Group, Inc.:

Mistras provides comprehensive asset protection solutions, including diverse NDT methodologies, aiming to enhance safety and reliability in industrial applications.We're grateful to work with incredible clients.

FAQs

What is the market size of industrial Rt For Nondestructive Testing?

The industrial radiographic testing market size is projected to reach $2.5 billion by 2033, experiencing a CAGR of 6.8%. This growth indicates a strong demand for nondestructive testing solutions across various industries.

What are the key market players or companies in this industrial Rt For Nondestructive Testing industry?

Key players in the industrial radiographic testing market include major companies like ASNT, GE Inspection Technologies, and Siemens. Their innovations and extensive product offerings drive the competitive landscape and market growth.

What are the primary factors driving the growth in the industrial Rt For Nondestructive Testing industry?

Growth in the industrial radiographic testing sector is driven by increased demand for inspection services, advancements in testing technologies, and the need for safety and compliance in industries such as aerospace and automotive.

Which region is the fastest Growing in the industrial Rt For Nondestructive Testing?

The fastest-growing region in the industrial radiographic testing market is North America. Market size is projected to increase from $0.85 billion in 2023 to $1.68 billion by 2033, reflecting a significant growth opportunity.

Does ConsaInsights provide customized market report data for the industrial Rt For Nondestructive Testing industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs in the industrial radiographic testing industry. Clients can request personalized insights and analytics based on their requirements.

What deliverables can I expect from this industrial Rt For Nondestructive Testing market research project?

Deliverables from the industrial radiographic testing market research project include detailed market analysis, growth forecasts, competitive landscape overview, and insights on regional and segment performance.

What are the market trends of industrial Rt For Nondestructive Testing?

Current market trends in industrial radiographic testing include increased automation in testing processes, the rise of digital radiography, and a growing emphasis on environmentally friendly inspection methods.