Industrial Sensors Market Report

Published Date: 31 January 2026 | Report Code: industrial-sensors

Industrial Sensors Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Industrial Sensors market from 2023 to 2033. It covers market size, growth trends, regional insights, and competitive landscape to equip stakeholders with essential data for informed decision-making.

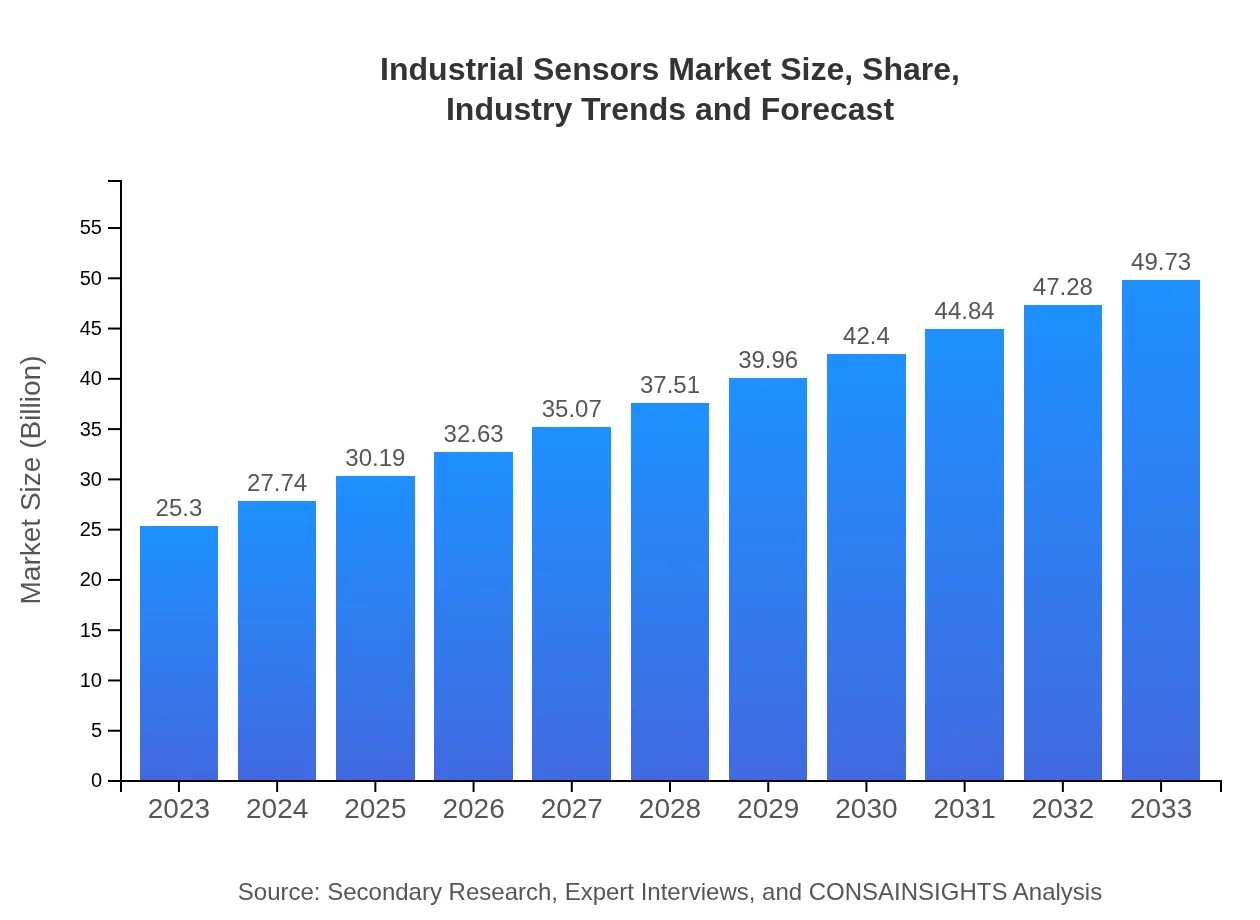

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $25.30 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $49.73 Billion |

| Top Companies | Siemens AG, Honeywell International Inc., Emerson Electric Co., Rockwell Automation, Inc., TE Connectivity Ltd. |

| Last Modified Date | 31 January 2026 |

Industrial Sensors Market Overview

Customize Industrial Sensors Market Report market research report

- ✔ Get in-depth analysis of Industrial Sensors market size, growth, and forecasts.

- ✔ Understand Industrial Sensors's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Industrial Sensors

What is the Market Size & CAGR of Industrial Sensors market in 2023?

Industrial Sensors Industry Analysis

Industrial Sensors Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Industrial Sensors Market Analysis Report by Region

Europe Industrial Sensors Market Report:

Europe's Industrial Sensors market will expand from $7.21 billion in 2023 to $14.17 billion by 2033. The region’s stringent regulations aimed at enhancing industrial safety and efficiency will further bolster sensor adoption.Asia Pacific Industrial Sensors Market Report:

In the Asia Pacific region, the Industrial Sensors market is projected to grow from $5.24 billion in 2023 to $10.29 billion by 2033, fueled by rapid industrialization and increasing investments in automation and smart manufacturing technologies.North America Industrial Sensors Market Report:

The North American market will grow significantly, reaching $15.97 billion by 2033 from $8.13 billion in 2023, supported by advancements in IoT technologies and a strong demand for reliability in industrial processes.South America Industrial Sensors Market Report:

The South American market is expected to increase from $1.88 billion in 2023 to $3.69 billion by 2033, driven by a rising focus on energy efficiency and the expansion of manufacturing capabilities.Middle East & Africa Industrial Sensors Market Report:

The Middle East and Africa market will see an increase from $2.85 billion in 2023 to $5.60 billion by 2033, aided by growing infrastructure projects and a push toward digital transformation.Tell us your focus area and get a customized research report.

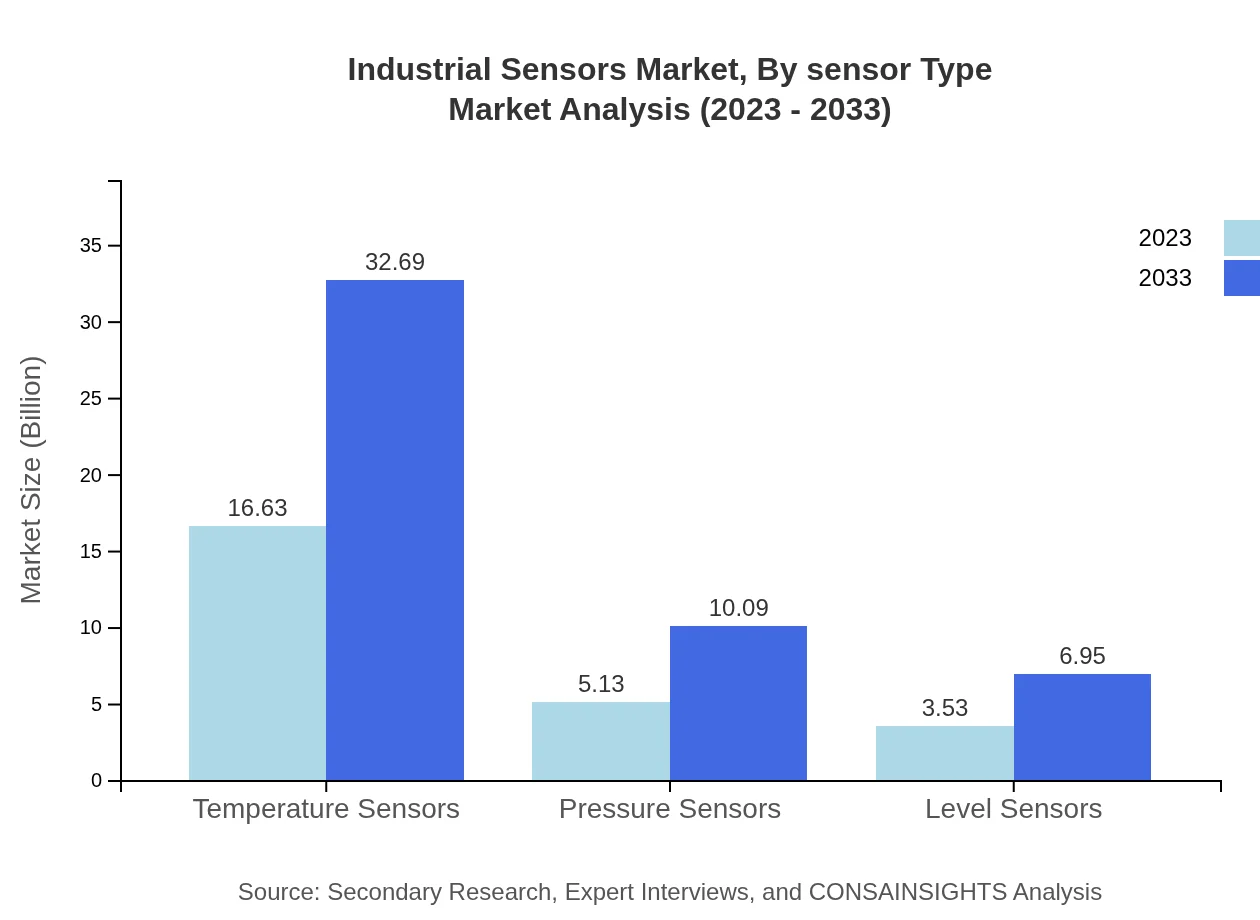

Industrial Sensors Market Analysis By Sensor Type

The market for sensors is projected to grow from $16.63 billion in 2023 to $32.69 billion in 2033, representing a critical segment of the industrial sensors ecosystem. Temperature sensors dominate, owing to their widespread necessity in various applications, followed by pressure and level sensors which play essential roles in monitoring and control processes across industries.

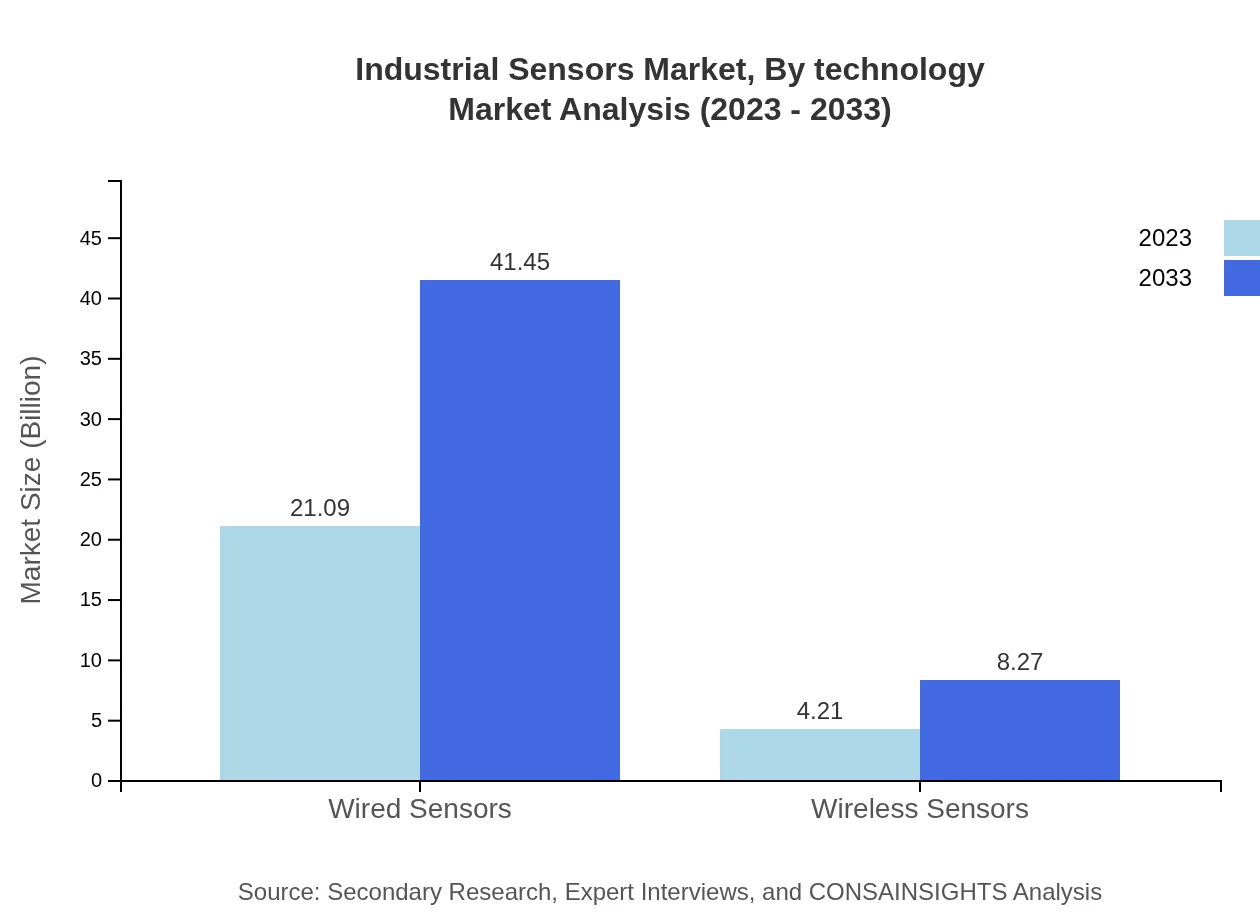

Industrial Sensors Market Analysis By Technology

Wired sensors accounted for a major market share of 83.36% in 2023, valued at $21.09 billion. These sensors are preferred for their reliability and ease of integration into existing systems. Conversely, wireless sensors, although smaller in market size at $4.21 billion, are projected to gain traction as connectivity technologies improve.

Industrial Sensors Market Analysis By Application

The manufacturing sector took the largest portion of the market, accounting for 48.02% in 2023, showing its significance in sensor technology adoption amidst increased automation strategies. Other notable applications include oil and gas, and food and beverage, demonstrating diverse utilizations of industrial sensors across sectors.

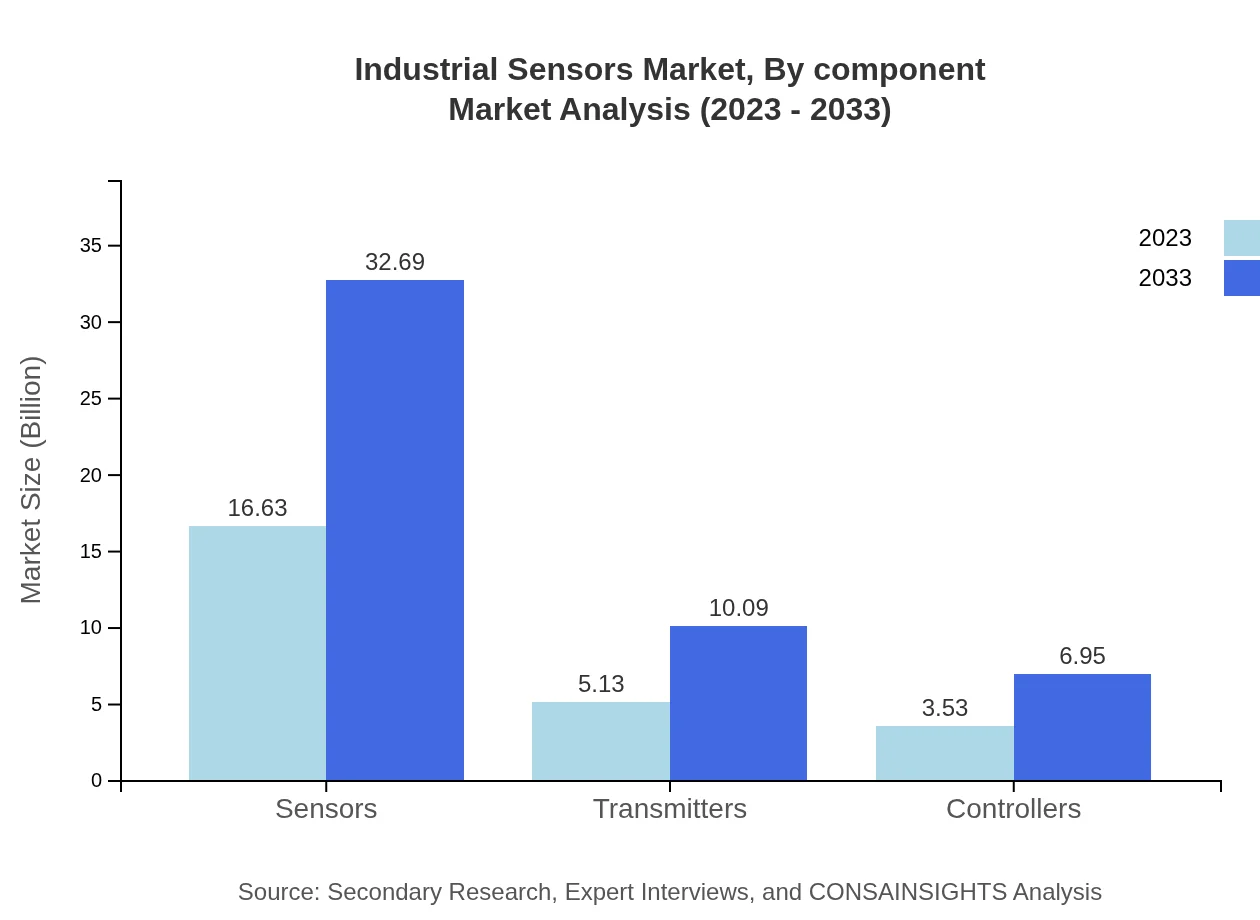

Industrial Sensors Market Analysis By Component

The market is segmented into sensors, transmitters, and controllers, with sensors leading the chart. Transmitters hold a 20.29% market share, showing their importance in signal processing and communication, while controllers is key to system automation and control.

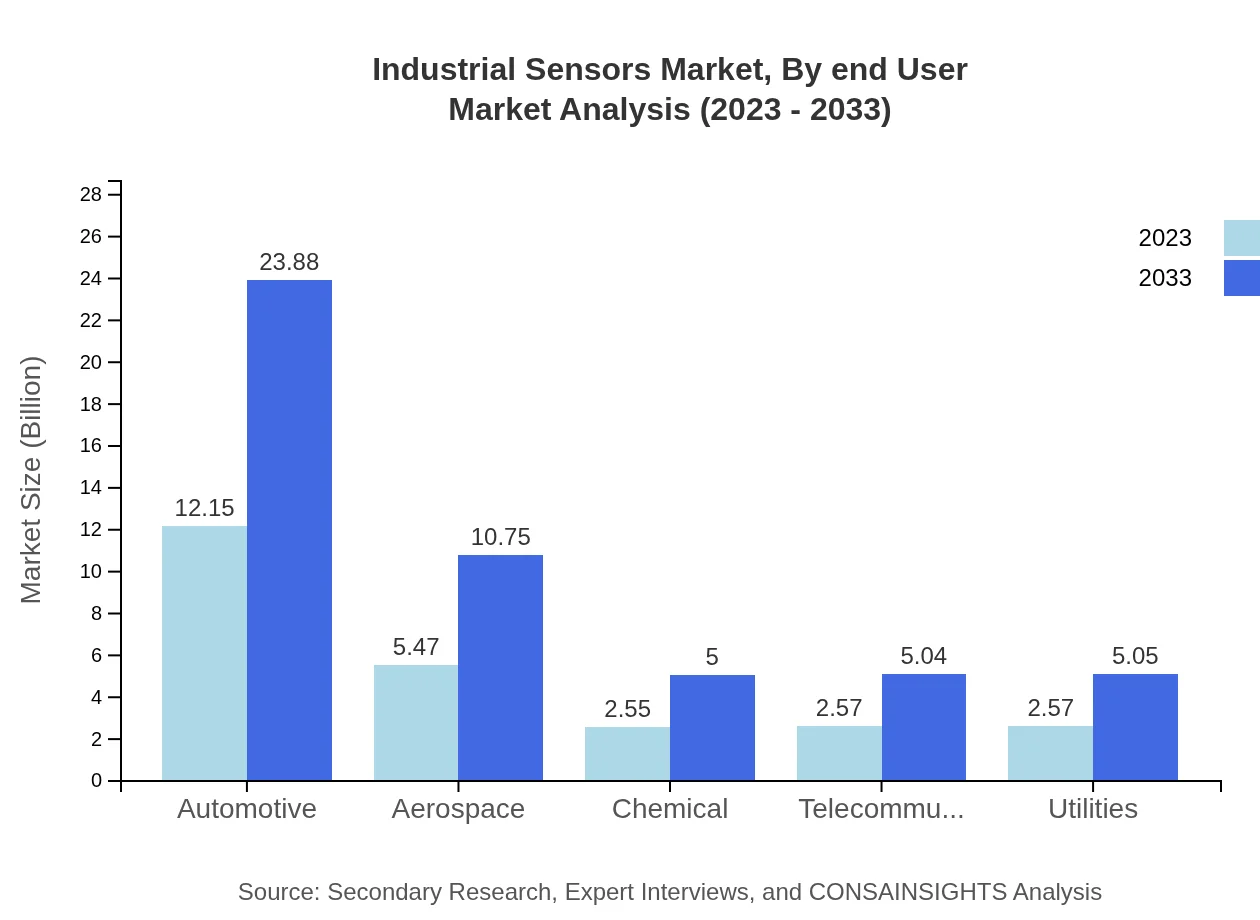

Industrial Sensors Market Analysis By End User

End-users are primarily categorized into utilities, manufacturing, and other sectors. Utilities will witness significant growth due to increasing investments in smart grids, while the manufacturing sector will remain the largest consumer due to its direct reliance on sensor technologies for process improvement and operational efficiency.

Industrial Sensors Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Industrial Sensors Industry

Siemens AG:

A global leader in automation and digitalization in industrial sectors, Siemens provides innovative sensor technology that supports Industry 4.0 initiatives.Honeywell International Inc.:

Honeywell is renowned for its advanced sensor solutions across various sectors, specializing in safety and operational efficiencies in industrial applications.Emerson Electric Co.:

Emerson is a significant player in industrial automation technology, offering a broad array of sensors that promote process optimization and monitoring.Rockwell Automation, Inc.:

Rockwell specializes in industrial automation solutions, providing cutting-edge sensors integral to smart manufacturing practices.TE Connectivity Ltd.:

TE Connectivity leads in sensor connectivity solutions, enhancing sensor performance in demanding industrial environments.We're grateful to work with incredible clients.

FAQs

What is the market size of industrial sensors?

The industrial sensors market is projected to reach approximately $25.3 billion by 2033, growing at a CAGR of 6.8% from its current valuation. This growth indicates a strong demand for advanced sensing technologies across various industries.

What are the key market players or companies in the industrial sensors industry?

Key players in the industrial sensors market include leaders in technology such as Siemens AG, Honeywell International Inc., and Emerson Electric Co. These companies contribute significantly to market innovations and advancements in sensor technology.

What are the primary factors driving the growth in the industrial sensors industry?

The growth in the industrial sensors industry is primarily driven by the increasing automation in manufacturing processes, the rising demand for IoT, and regulatory requirements for safety and efficiency in industrial operations. Additionally, advancements in sensor technologies are bolstering this growth.

Which region is the fastest Growing in the industrial sensors market?

The Asia Pacific region is projected to be the fastest-growing market for industrial sensors, expanding from $5.24 billion in 2023 to $10.29 billion by 2033, fueled by rapid industrialization and increased adoption of smart technologies.

Does ConsaInsights provide customized market report data for the industrial sensors industry?

Yes, ConsaInsights offers customized market report data tailored to client needs in the industrial sensors sector. This includes detailed analyses and insights specific to various segments and regions, enhancing strategic decision-making.

What deliverables can I expect from this industrial sensors market research project?

Expect comprehensive reports detailing market size, trends, segmented data, growth forecasts, and regional analyses. The deliverables will also include insights on competitive landscapes and strategic recommendations for market positioning.

What are the market trends of industrial sensors?

Current trends in the industrial sensors market include the rise of wireless sensor networks, increasing use of AI in data analysis, and greater integration of sensors in smart manufacturing systems, reflecting a shift towards more advanced industrial processes.