Industrial Services Market Report

Published Date: 22 January 2026 | Report Code: industrial-services

Industrial Services Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Industrial Services market, encompassing market dynamics, segmentation, regional insights, and future trends from 2023 to 2033. It aims to deliver actionable insights and quantitative data for stakeholders looking to navigate this evolving landscape.

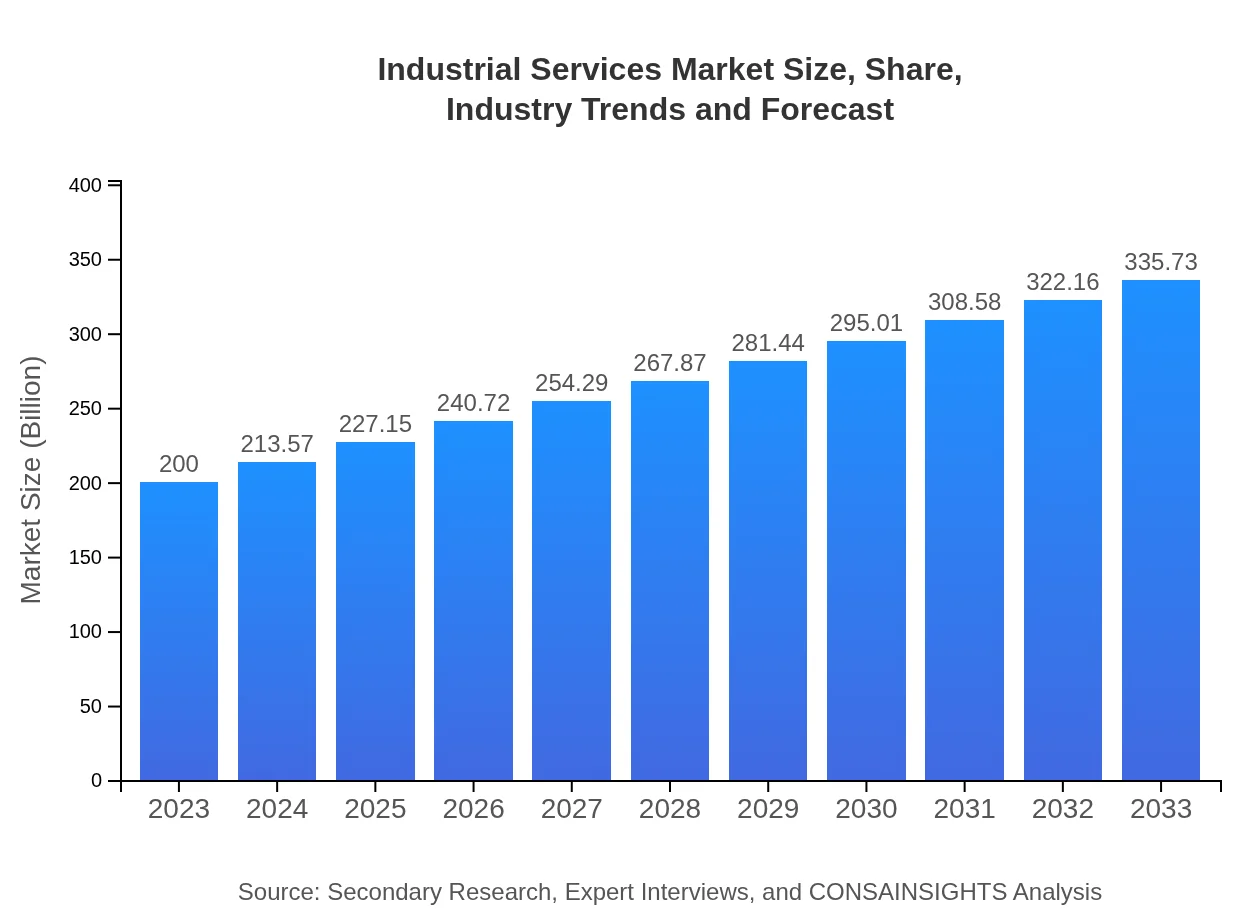

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $200.00 Billion |

| CAGR (2023-2033) | 5.2% |

| 2033 Market Size | $335.73 Billion |

| Top Companies | General Electric, Siemens AG, Honeywell International Inc., Schneider Electric, ABB Ltd. |

| Last Modified Date | 22 January 2026 |

Industrial Services Market Overview

Customize Industrial Services Market Report market research report

- ✔ Get in-depth analysis of Industrial Services market size, growth, and forecasts.

- ✔ Understand Industrial Services's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Industrial Services

What is the Market Size & CAGR of Industrial Services market in 2023?

Industrial Services Industry Analysis

Industrial Services Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Industrial Services Market Analysis Report by Region

Europe Industrial Services Market Report:

The European market for Industrial Services had an estimated size of $57.44 billion in 2023, projected to grow to $96.42 billion by 2033. A strong focus on sustainability and environmental regulations is influencing service provision, with increased demand for consulting and maintenance services that contribute to efficient resource usage.Asia Pacific Industrial Services Market Report:

The Asia Pacific region represents a significant portion of the global Industrial Services market, with an estimated size of $38.72 billion in 2023, projected to grow to $65.00 billion by 2033. Rapid industrialization, increased manufacturing capabilities, and a focus on automation are driving factors in this market expansion. Countries like China and India are at the forefront, investing in smart manufacturing technologies and logistics solutions.North America Industrial Services Market Report:

North America leads the market with a significant size of $73.66 billion in 2023, anticipated to expand to $123.65 billion by 2033. The region is characterized by advanced technological development, a strong emphasis on innovation, and heightened adoption of IoT and AI solutions. Industries such as manufacturing, energy & utilities are significant contributors to this growth.South America Industrial Services Market Report:

In South America, the Industrial Services market was valued at $12.68 billion in 2023 and is expected to reach $21.29 billion by 2033. Key growth drivers include infrastructure development projects, enhancing operational capabilities in manufacturing and energy sectors, and a growing reliance on outsourcing services as companies aim to improve efficiency.Middle East & Africa Industrial Services Market Report:

The Middle East and Africa region is expected to show considerable growth, from $17.50 billion in 2023 to $29.38 billion by 2033. The region’s economic diversification efforts, coupled with investments in infrastructure and energy sectors, are driving the growth of industrial services. Emerging technologies and skilled workforce development are key to supporting these initiatives.Tell us your focus area and get a customized research report.

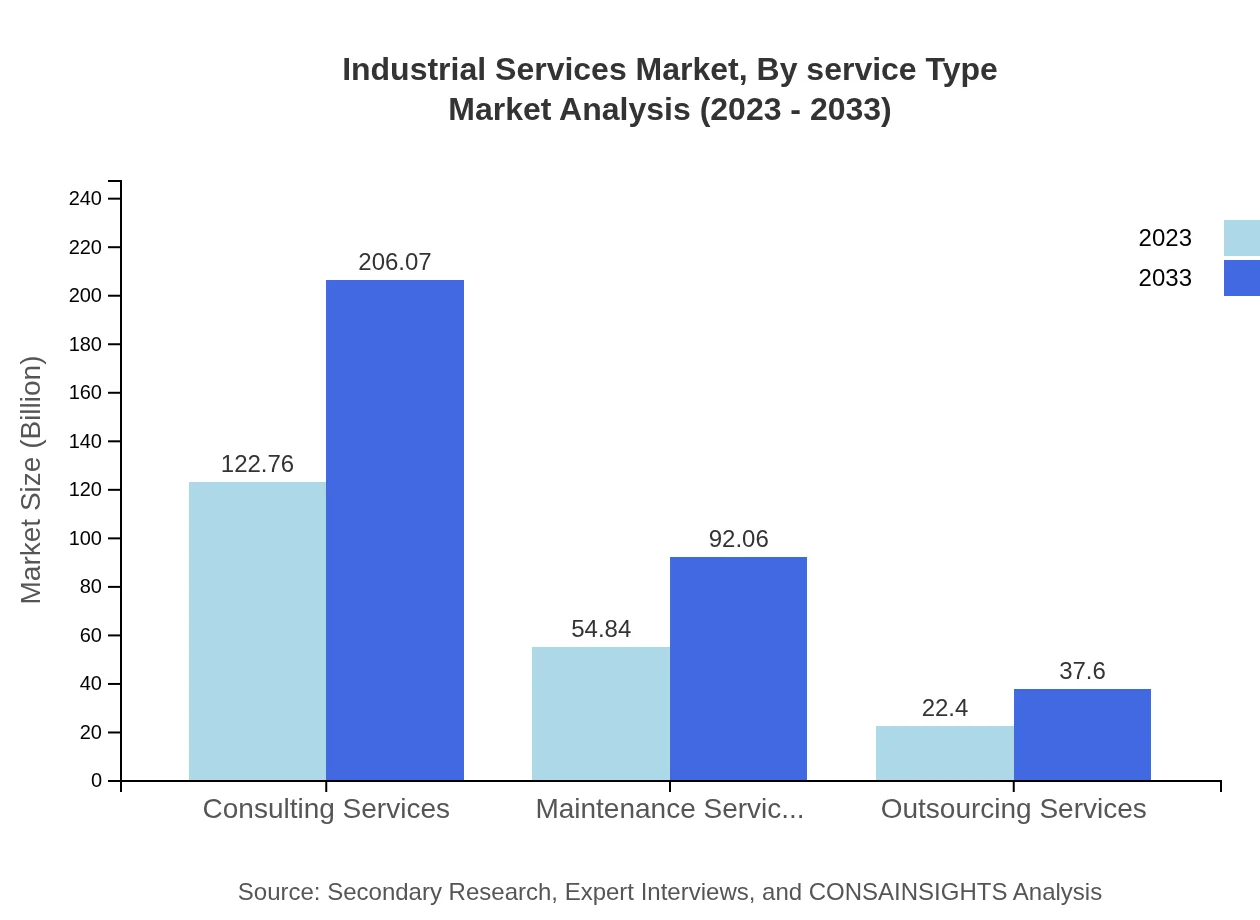

Industrial Services Market Analysis By Service Type

The service type segment of the Industrial Services market showcases significant growth across various services. As of 2023, Maintenance Services lead the market with a size of $54.84 billion and a market share of 27.42%. Consulting Services, also valued at $122.76 billion, represent 61.38% of the market. Automation Solutions constitute a crucial area, aimed at enhancing productivity with a projected size of $122.76 billion. Other notable services include Logistics and Outsourcing, with substantial growth prospects.

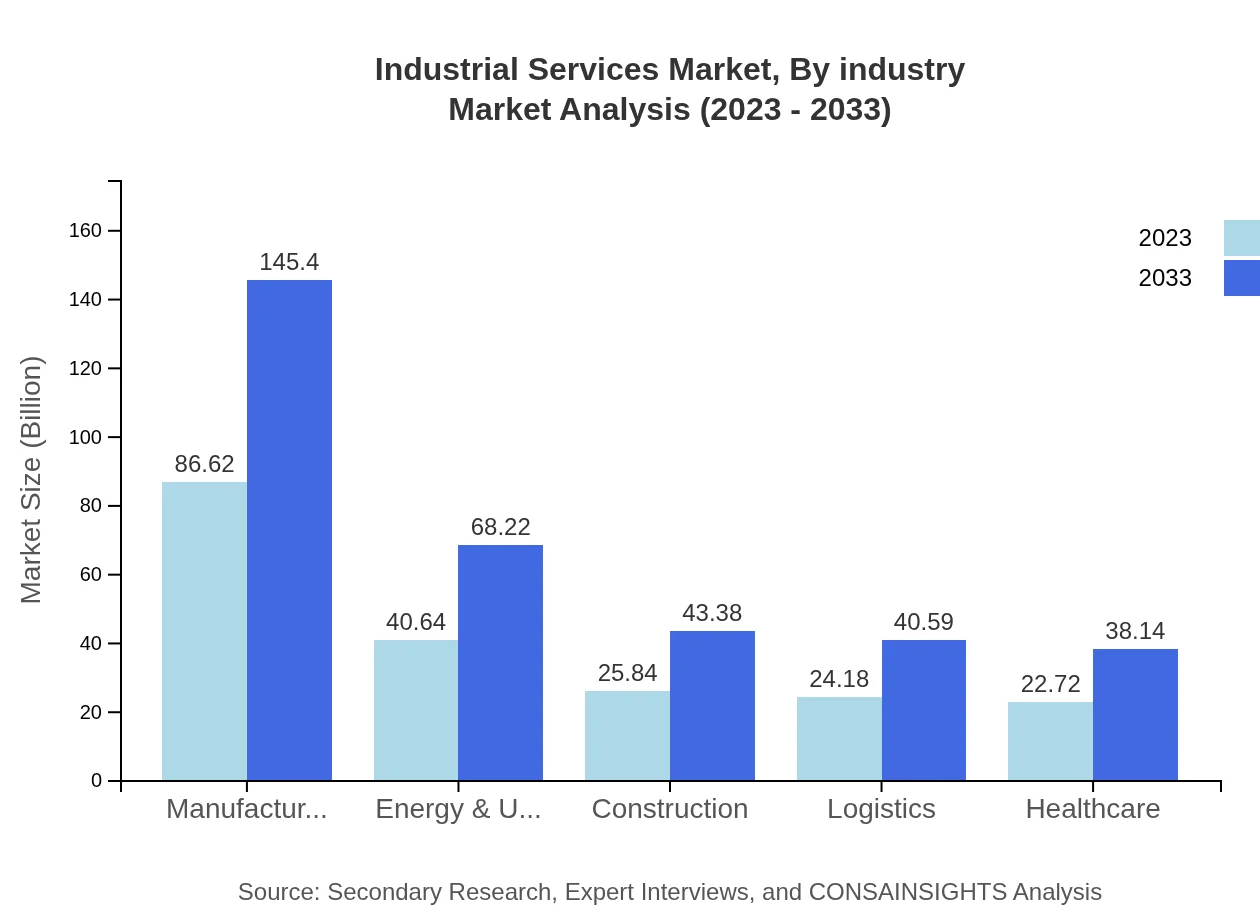

Industrial Services Market Analysis By Industry

In terms of industry segmentation, the Manufacturing sector leads with a market size of $86.62 billion and 43.31% market share in 2023. The Energy & Utilities sector follows closely with $40.64 billion (20.32% share). The growing importance of services across the Construction and Healthcare industries is notable, reflecting the increasing complexity of projects and the demand for tailored solutions.

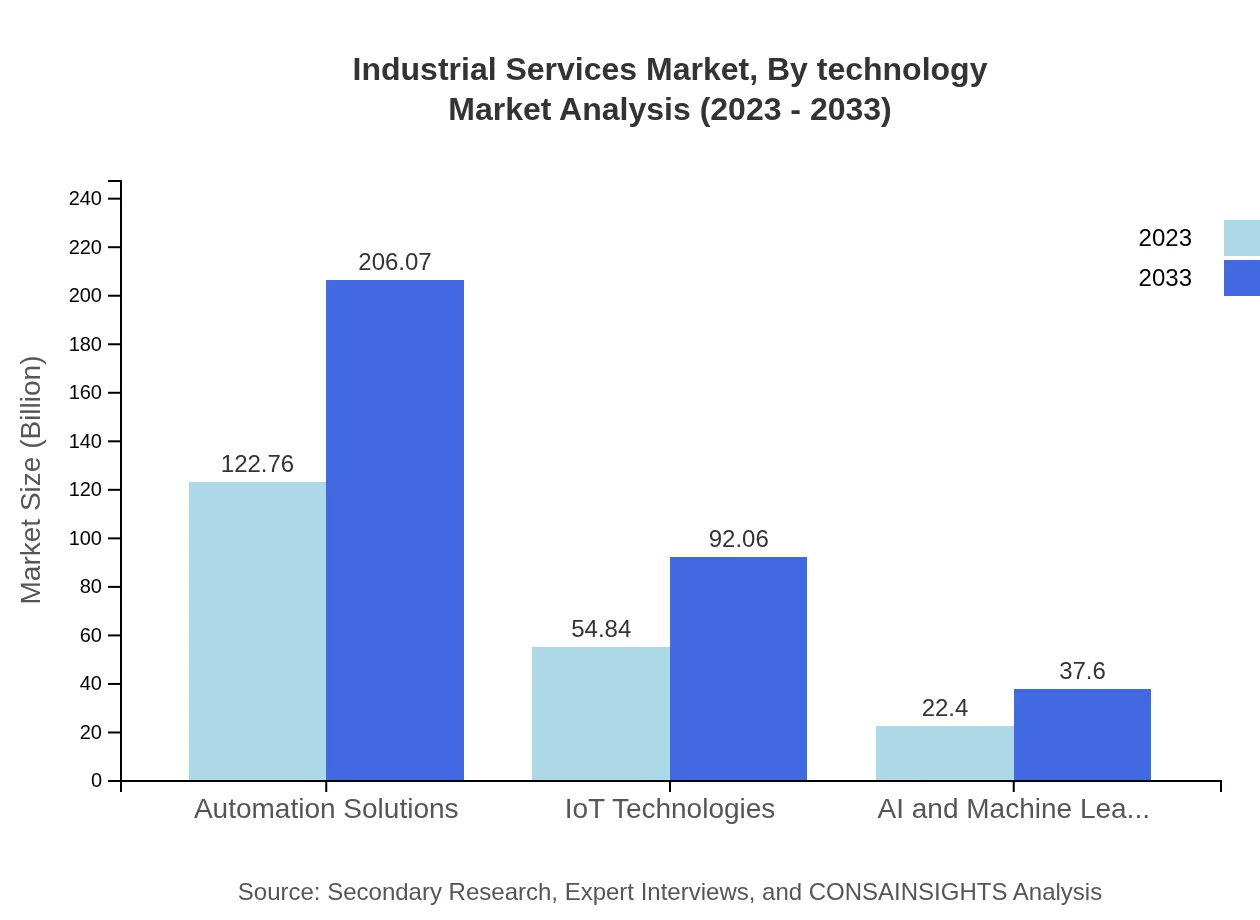

Industrial Services Market Analysis By Technology

The technology segment is witnessing rapid advancements with IoT Technologies sized at $54.84 billion in 2023 and expected to increase significantly. AI and Machine Learning services are also gaining traction, projected to have a market size of $22.40 billion. Automation Technologies are central to enhancing operational efficiency, contributing remarkably to the market’s overall growth. The integration of digital tools within these technologies is reshaping operational frameworks.

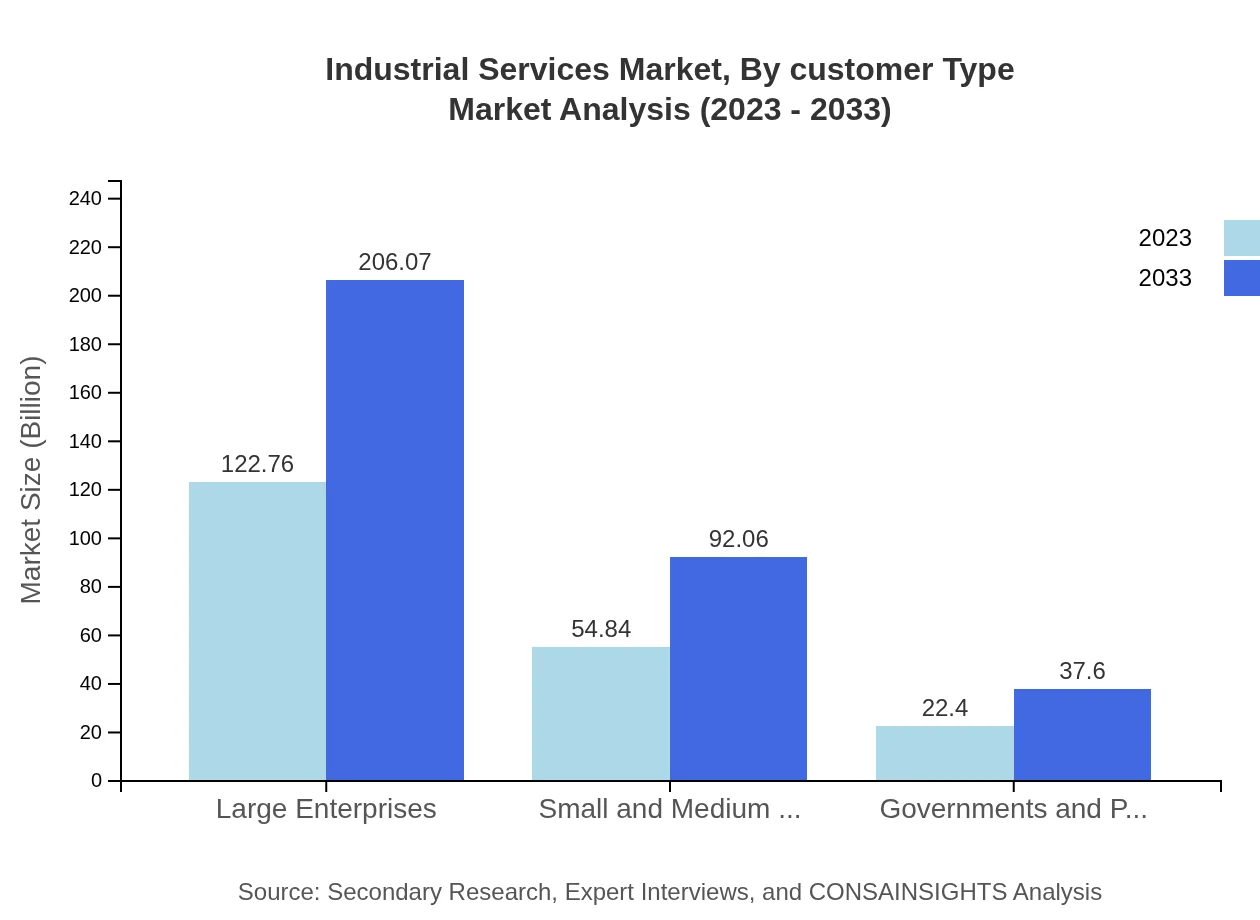

Industrial Services Market Analysis By Customer Type

The customer type analysis identifies Large Enterprises leading with a market size of $122.76 billion. Small and Medium Enterprises also represent a crucial segment with $54.84 billion, demonstrating their increasing need for efficient service solutions. Governments and the Public Sector contribute a significant portion with services designed to enhance public infrastructure and operations.

Industrial Services Market Analysis By Region Type

Global Industrial Services Market, By Regions (excluding detailed analysis) Market Analysis (2023 - 2033)

The regional analysis indicates that North America, followed by Europe and Asia Pacific, forms the backbone of the Industrial Services market. Increased focus on technology adoption and sustainability across regions reflects growing demand for specialized services, catering to industry-specific needs.

Industrial Services Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Industrial Services Industry

General Electric:

A multinational conglomerate known for providing technology and services across various sectors, including energy, aviation, and manufacturing. GE plays a significant role in industrial services through its consultation and automation technologies.Siemens AG:

A global leader in engineering and technology, Siemens is recognized for its advanced solutions in automation and digitalization which significantly enhance industrial processes.Honeywell International Inc.:

Specializing in technology and manufacturing, Honeywell delivers a wide range of industrial services focusing on innovation and sustainability within the sector.Schneider Electric:

Focusing on energy management and automation solutions, Schneider Electric is pivotal in the adoption of sustainable practices and efficient service delivery.ABB Ltd.:

Known for its robotics, power, and automation technologies, ABB is instrumental in driving digital transformation across the industrial services landscape.We're grateful to work with incredible clients.

FAQs

What is the market size of industrial services?

The global industrial services market is valued at approximately $200 billion in 2023, with a projected CAGR of 5.2% over the next decade, indicating robust growth and significant potential opportunities in various sectors.

What are the key market players or companies in this industrial services industry?

Key players in the industrial services market include leading firms specializing in automation, consulting, maintenance, and logistics. Major companies are consistently focusing on innovation to enhance service offerings and improve operational efficiency.

What are the primary factors driving the growth in the industrial services industry?

Primary growth drivers include advancements in automation technologies, increasing demand for IoT solutions, rising operational efficiency needs, and the growing emphasis on sustainability and cost reduction across industrial sectors.

Which region is the fastest Growing in the industrial services?

The Asia-Pacific region is expected to witness significant growth, with market size projected to rise from $38.72 billion in 2023 to $65 billion by 2033, underscoring increased industrial activities and investments in technology.

Does ConsaInsights provide customized market report data for the industrial services industry?

Yes, ConsaInsights offers tailored market reports for the industrial services industry, allowing clients to access specific insights and data that meet their unique business requirements and strategic goals.

What deliverables can I expect from this industrial services market research project?

Deliverables include comprehensive market analysis reports, growth forecasts, competitive landscape assessments, and detailed insights into regional and segment-specific trends to inform strategic decision-making.

What are the market trends of industrial services?

Current trends include increased adoption of AI and machine learning, a shift towards automation, growing interest in sustainability, and the rising significance of data analytics in operational strategies across industries.