Industrial Turbocharger Market Report

Published Date: 22 January 2026 | Report Code: industrial-turbocharger

Industrial Turbocharger Market Size, Share, Industry Trends and Forecast to 2033

This report offers a comprehensive analysis of the Industrial Turbocharger market, including insights on market size, industry dynamics, segmentation, and forecasts through 2033. It covers trends, technology insights, regional performances, and key players in the sector.

| Metric | Value |

|---|---|

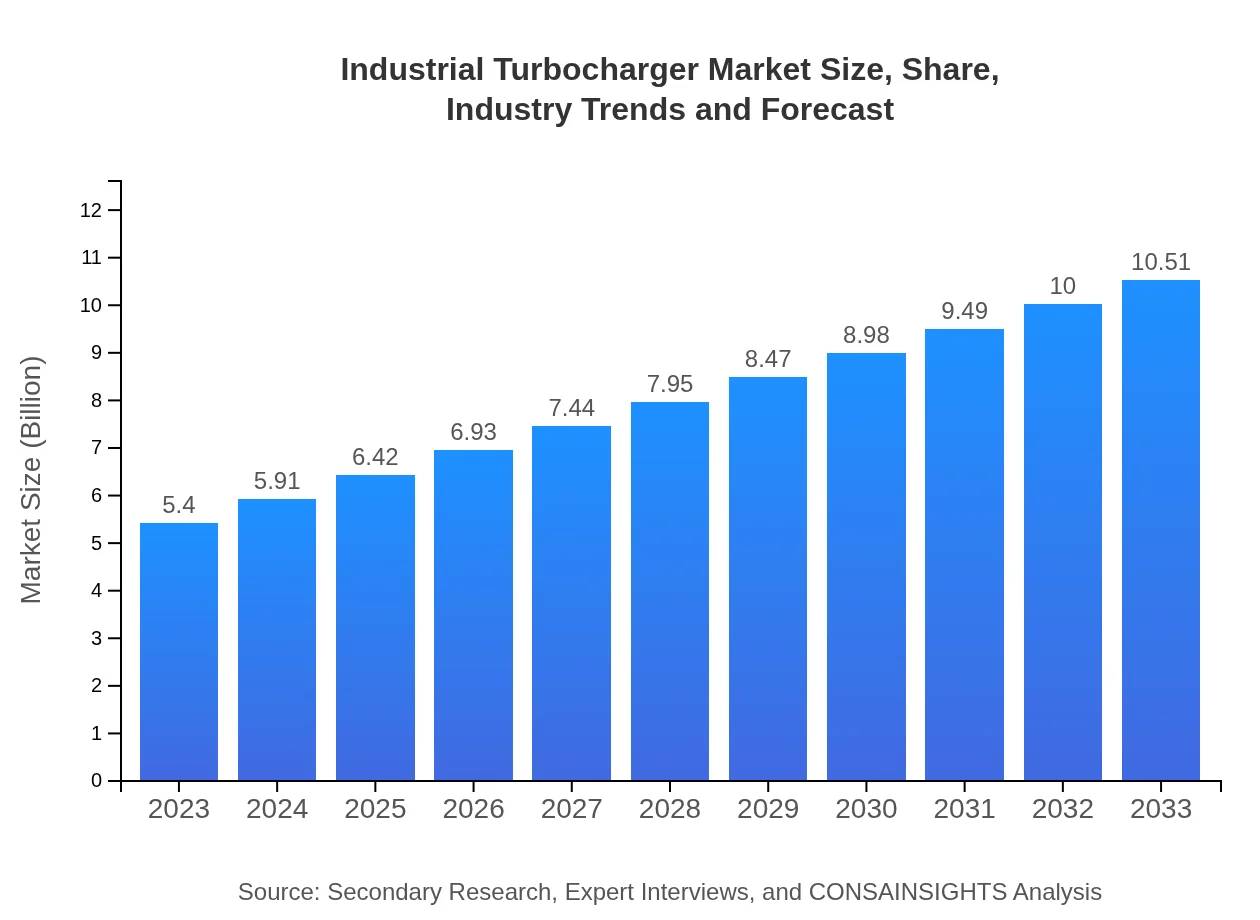

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.40 Billion |

| CAGR (2023-2033) | 6.7% |

| 2033 Market Size | $10.51 Billion |

| Top Companies | General Electric, Honeywell International Inc., BorgWarner Inc., Cummins Inc. |

| Last Modified Date | 22 January 2026 |

Industrial Turbocharger Market Overview

Customize Industrial Turbocharger Market Report market research report

- ✔ Get in-depth analysis of Industrial Turbocharger market size, growth, and forecasts.

- ✔ Understand Industrial Turbocharger's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Industrial Turbocharger

What is the Market Size & CAGR of Industrial Turbocharger market in 2023?

Industrial Turbocharger Industry Analysis

Industrial Turbocharger Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Industrial Turbocharger Market Analysis Report by Region

Europe Industrial Turbocharger Market Report:

Europe's industrial turbocharger market is forecasted to grow from $1.52 billion in 2023 to $2.95 billion by 2033. Stringent emission regulations and a focus on sustainable energy significantly influence this growth, fostering innovation in turbocharger technology.Asia Pacific Industrial Turbocharger Market Report:

The Asia-Pacific region is poised for significant growth in the Industrial Turbocharger market, projected to reach $2.01 billion by 2033 from $1.03 billion in 2023. The increasing industrialization, coupled with a focus on efficient energy solutions, drives demand, particularly in countries like China and India, where infrastructure development is a priority.North America Industrial Turbocharger Market Report:

North America leads the market with a valuation projected to grow from $1.86 billion in 2023 to $3.62 billion in 2033. The region is characterized by advanced technological development and a shift towards cleaner energy solutions, pushing for the adoption of industrial turbochargers in various applications.South America Industrial Turbocharger Market Report:

In South America, the market is expected to grow from $0.36 billion in 2023 to $0.70 billion by 2033. Factors such as the expansion of the agriculture and mining sectors contribute to this growth, alongside investments in renewable energy projects.Middle East & Africa Industrial Turbocharger Market Report:

The Middle East and Africa region is anticipated to grow from $0.63 billion in 2023 to $1.22 billion by 2033, driven by rising demand for industrial infrastructure and energy solutions as economies continue to diversify.Tell us your focus area and get a customized research report.

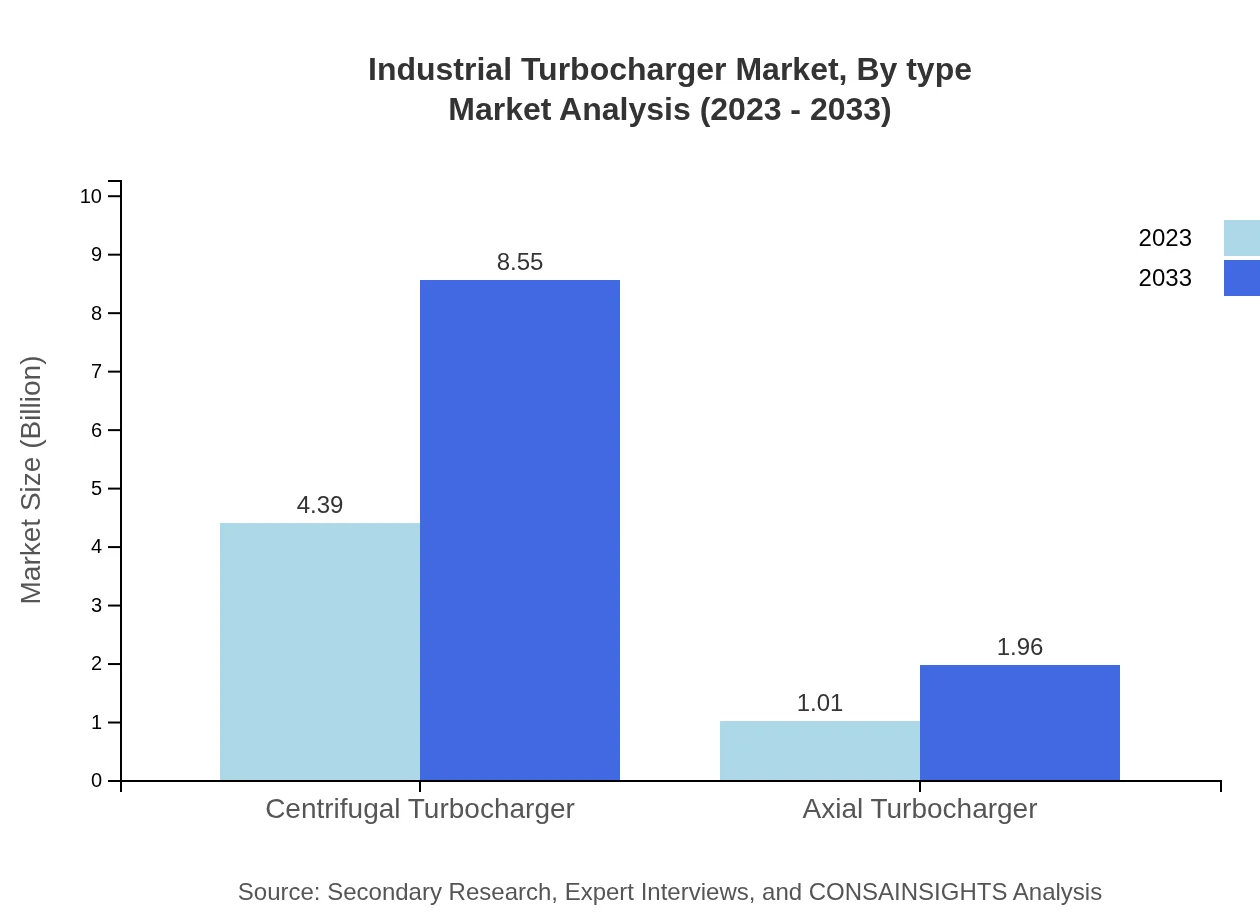

Industrial Turbocharger Market Analysis By Type

Centrifugal turbochargers hold a substantial market share at 81.36% in 2023 and are projected to maintain growth from $4.39 billion in 2023 to $8.55 billion in 2033. In contrast, axial turbochargers account for 18.64% of the market, anticipated to grow from $1.01 billion in 2023 to $1.96 billion by 2033.

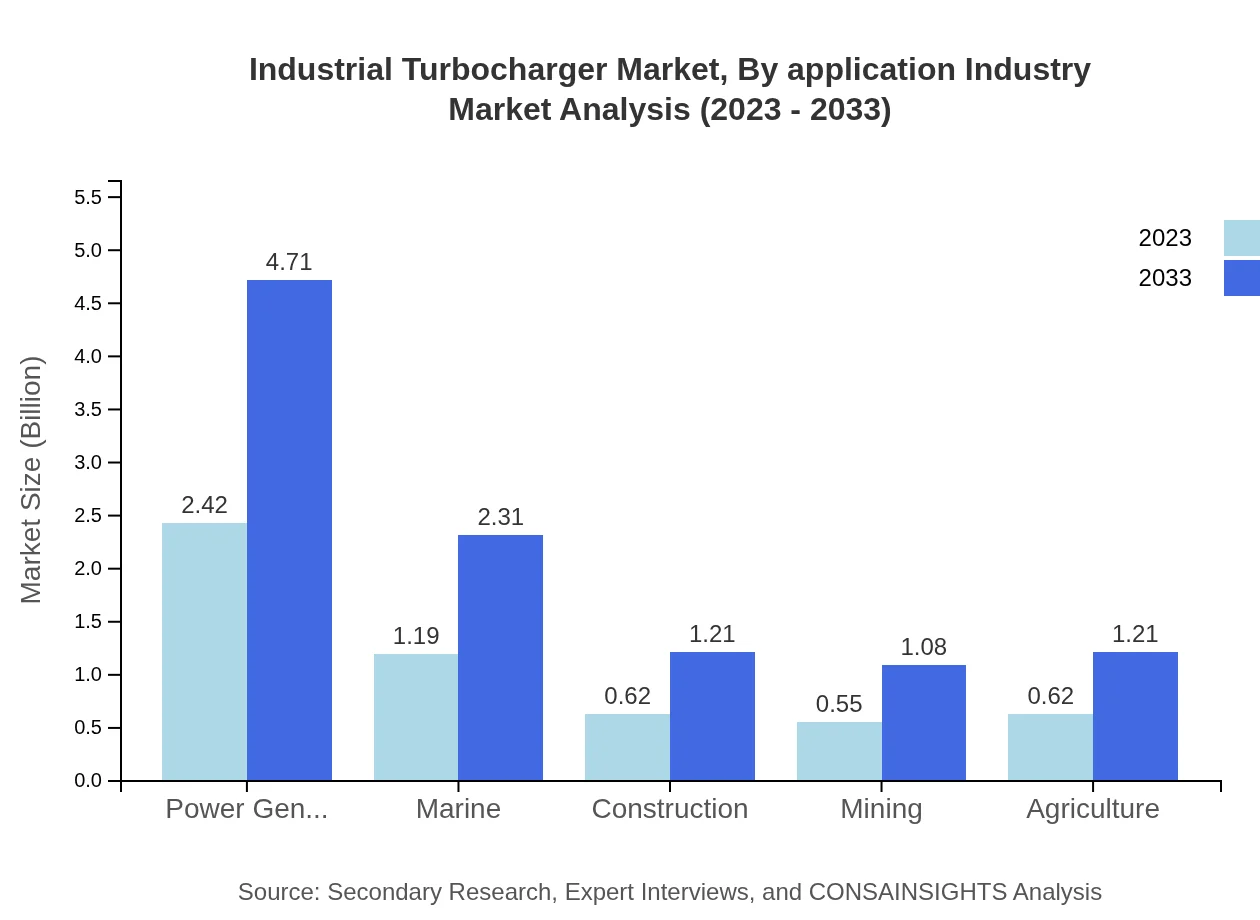

Industrial Turbocharger Market Analysis By Application Industry

The power generation sector is the largest segment, expected to grow from $2.42 billion in 2023 to $4.71 billion in 2033, which represents a 44.79% market share. Marine, construction, and mining sectors follow suit, indicating a broad range of applications tapping into turbocharging technology's efficiency.

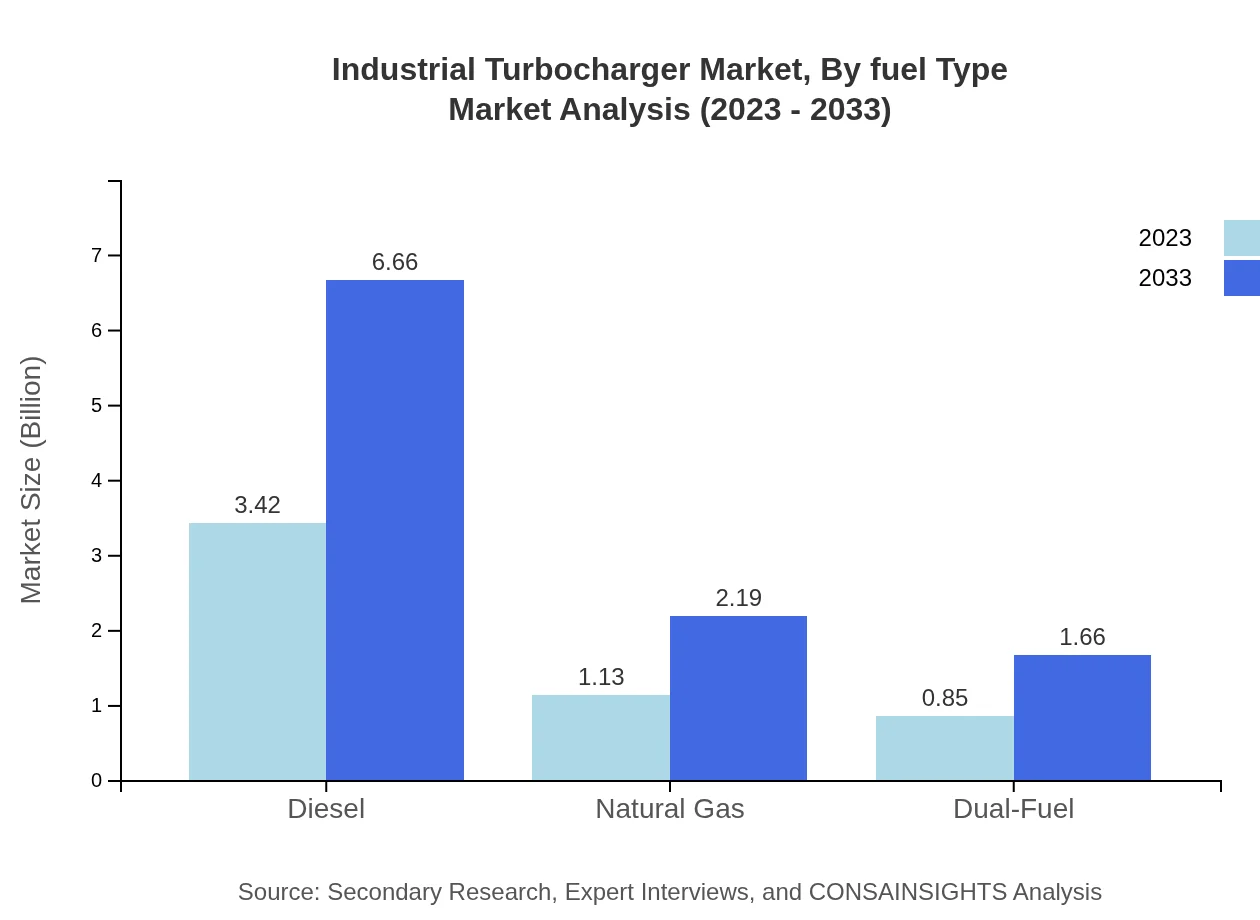

Industrial Turbocharger Market Analysis By Fuel Type

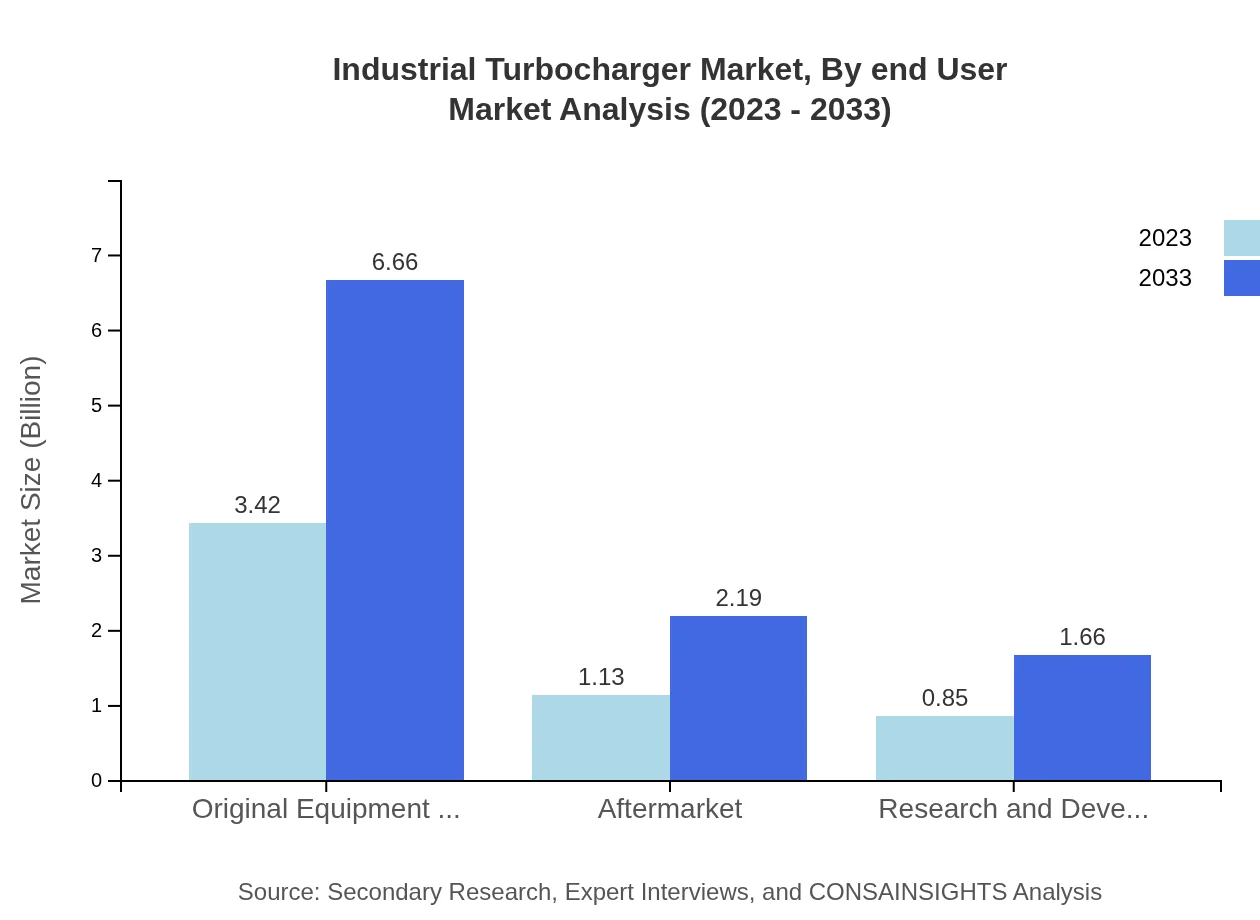

Diesel-powered turbochargers dominate with a market share of 63.37%, expanding from $3.42 billion in 2023 to $6.66 billion in 2033. Natural gas and dual-fuel systems are also growing, showcasing the industry's adaptation to diverse fuel resources.

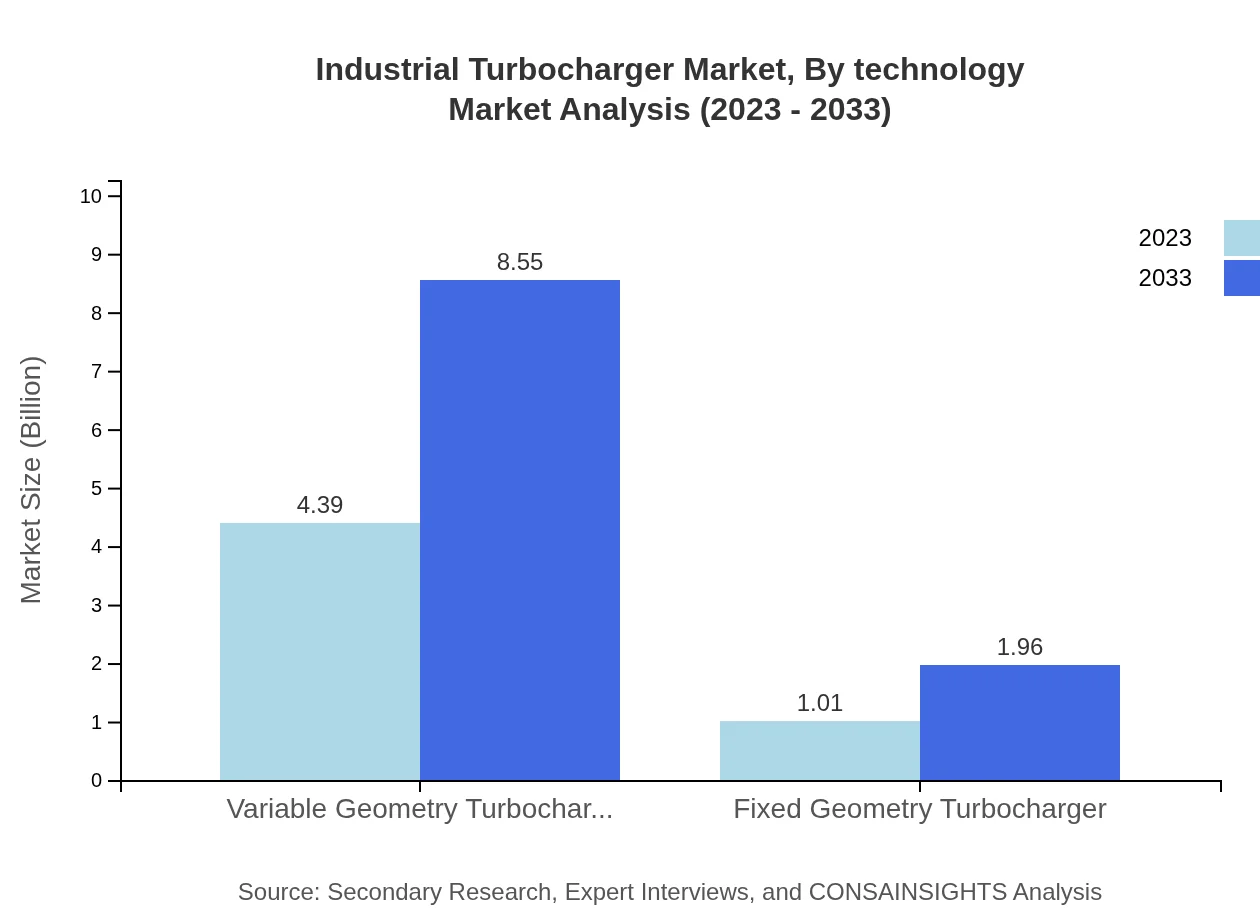

Industrial Turbocharger Market Analysis By Technology

Variable geometry turbochargers (VGT) are becoming increasingly popular due to their enhanced performance, maintaining a high market share of 81.36%. Fixed geometry turbochargers, while smaller in share at 18.64%, continue to see significant advancements.

Industrial Turbocharger Market Analysis By End User

Key end-users in this market include Original Equipment Manufacturers (OEMs) and aftermarket suppliers. OEMs constitute around 63.37% of the market, with aftermarket solutions growing significantly due to increased demand for maintenance and replacement parts.

Industrial Turbocharger Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Industrial Turbocharger Industry

General Electric:

A leading player in energy technologies, offering innovative turbocharging solutions for power generation and industrial applications.Honeywell International Inc.:

Renowned for its extensive range of turbocharger products, focusing on performance efficiency and environmental solutions.BorgWarner Inc.:

A key innovator in automotive and industrial turbocharger technologies, known for high-performance systems and sustainability efforts.Cummins Inc.:

Provides a diverse portfolio of turbocharging solutions, emphasizing cleaner and more efficient engine technology.We're grateful to work with incredible clients.

FAQs

What is the market size of industrial Turbocharger?

The global industrial turbocharger market is projected to reach approximately $5.4 billion by 2033, growing at a CAGR of 6.7% from current market estimates. This growth indicates an increasing demand for turbocharging technology across various industrial applications.

What are the key market players or companies in the industrial turbocharger industry?

Key players in the industrial turbocharger market include Honeywell, Mitsubishi Heavy Industries, BorgWarner, and Mercedes. These companies lead the market with innovative technologies, reliable products, and extensive service networks catering to a variety of industrial applications.

What are the primary factors driving the growth in the industrial turbocharger industry?

Growth in the industrial turbocharger market is primarily driven by the rising demand for fuel-efficient and high-performance engines, regulatory pressures for reduced emissions, and the growing industrial sector, particularly in Asia-Pacific and North America.

Which region is the fastest Growing in the industrial turbocharger?

The Asia-Pacific region is the fastest-growing market for industrial turbochargers, expected to grow from $1.03 billion in 2023 to $2.01 billion by 2033. This growth is fueled by industrial expansion and increasing investments in infrastructure and manufacturing.

Does ConsaInsights provide customized market report data for the industrial turbocharger industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs in the industrial turbocharger industry. Clients can request detailed analyses, forecasts, and insights based on unique business requirements and market conditions.

What deliverables can I expect from this industrial turbocharger market research project?

Clients can expect a comprehensive report including market size and forecasts, competitive landscape analysis, segmentation by type and region, trend analyses, and strategic recommendations specifically tailored to the industrial turbocharger market.

What are the market trends of industrial turbocharger?

Current trends in the industrial turbocharger market include an increasing focus on variable geometry turbochargers, advancements in digital monitoring technologies, and a shift towards more sustainable solutions to meet legislations on emissions and energy efficiency.