Industrial Wireless Transmitter Market Report

Published Date: 31 January 2026 | Report Code: industrial-wireless-transmitter

Industrial Wireless Transmitter Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Industrial Wireless Transmitter market, including key insights, trends, and forecasts for the period 2023 to 2033. It covers critical market segments, regional analysis, and leading players shaping the industry's future.

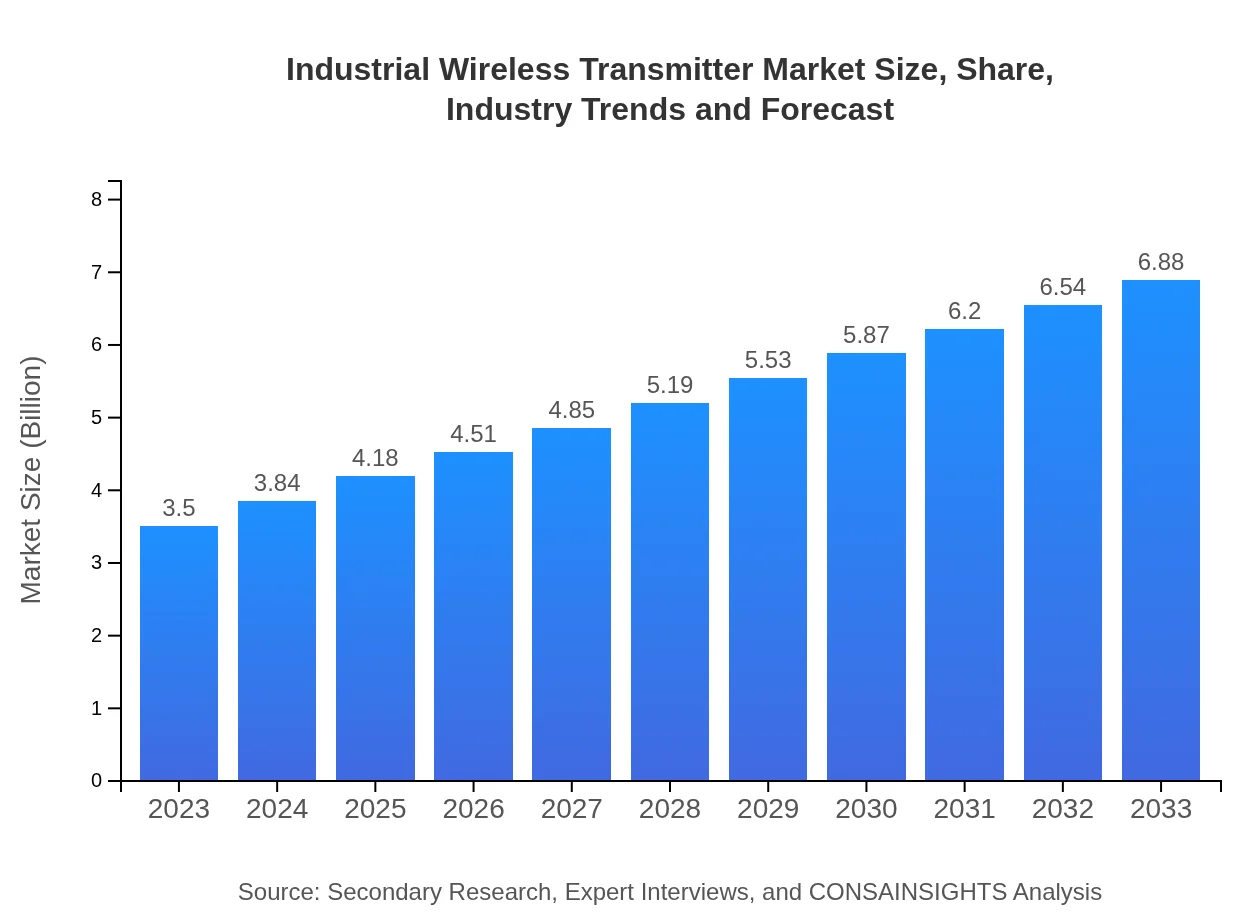

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $3.50 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $6.88 Billion |

| Top Companies | Honeywell International Inc., Siemens AG, Emerson Electric Co., Schneider Electric, ABB Ltd. |

| Last Modified Date | 31 January 2026 |

Industrial Wireless Transmitter Market Overview

Customize Industrial Wireless Transmitter Market Report market research report

- ✔ Get in-depth analysis of Industrial Wireless Transmitter market size, growth, and forecasts.

- ✔ Understand Industrial Wireless Transmitter's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Industrial Wireless Transmitter

What is the Market Size & CAGR of the Industrial Wireless Transmitter market in 2023?

Industrial Wireless Transmitter Industry Analysis

Industrial Wireless Transmitter Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Industrial Wireless Transmitter Market Analysis Report by Region

Europe Industrial Wireless Transmitter Market Report:

In Europe, the market for Industrial Wireless Transmitters is projected to increase from $0.85 billion in 2023 to $1.67 billion by 2033. The region is witnessing a major focus on digital transformation in industries coupled with stringent regulatory standards driving the adoption of advanced control systems and monitoring solutions. Countries in Western Europe, particularly Germany and the UK, are at the forefront of this transition.Asia Pacific Industrial Wireless Transmitter Market Report:

In the Asia Pacific region, the Industrial Wireless Transmitter market is projected to grow from $0.76 billion in 2023 to $1.49 billion by 2033. This growth is driven by rapid industrialization, increasing urbanization, and a significant rise in manufacturing activities across countries like China and India. The push towards smart cities and the adoption of IoT solutions further enhance demand for advanced wireless transmitters in this region.North America Industrial Wireless Transmitter Market Report:

North America holds a considerable share of the market with a valuation of $1.31 billion in 2023, anticipating growth to $2.57 billion by 2033. The region's extensive investments in technology development and automation across manufacturing and utility sectors significantly contribute to this growth. Moreover, the presence of leading market players and advancements in IoT and wireless solutions enhance the demand for industrial wireless transmitters.South America Industrial Wireless Transmitter Market Report:

In South America, the market is expected to grow from $0.18 billion in 2023 to $0.36 billion by 2033. Countries like Brazil and Argentina are investing in modernization of their industrial infrastructure, driven by the need for improved efficiency and sustainability. Government initiatives aimed at promoting the adoption of smart technologies also play a crucial role.Middle East & Africa Industrial Wireless Transmitter Market Report:

The Middle East and Africa market for Industrial Wireless Transmitters is expected to grow from $0.40 billion in 2023 to $0.79 billion by 2033, driven by increasing investments in infrastructure projects and the adoption of smart grid technologies. The oil and gas sector's emphasis on automation enhances demand in this region, as stakeholders look to improve operational efficiency and safety.Tell us your focus area and get a customized research report.

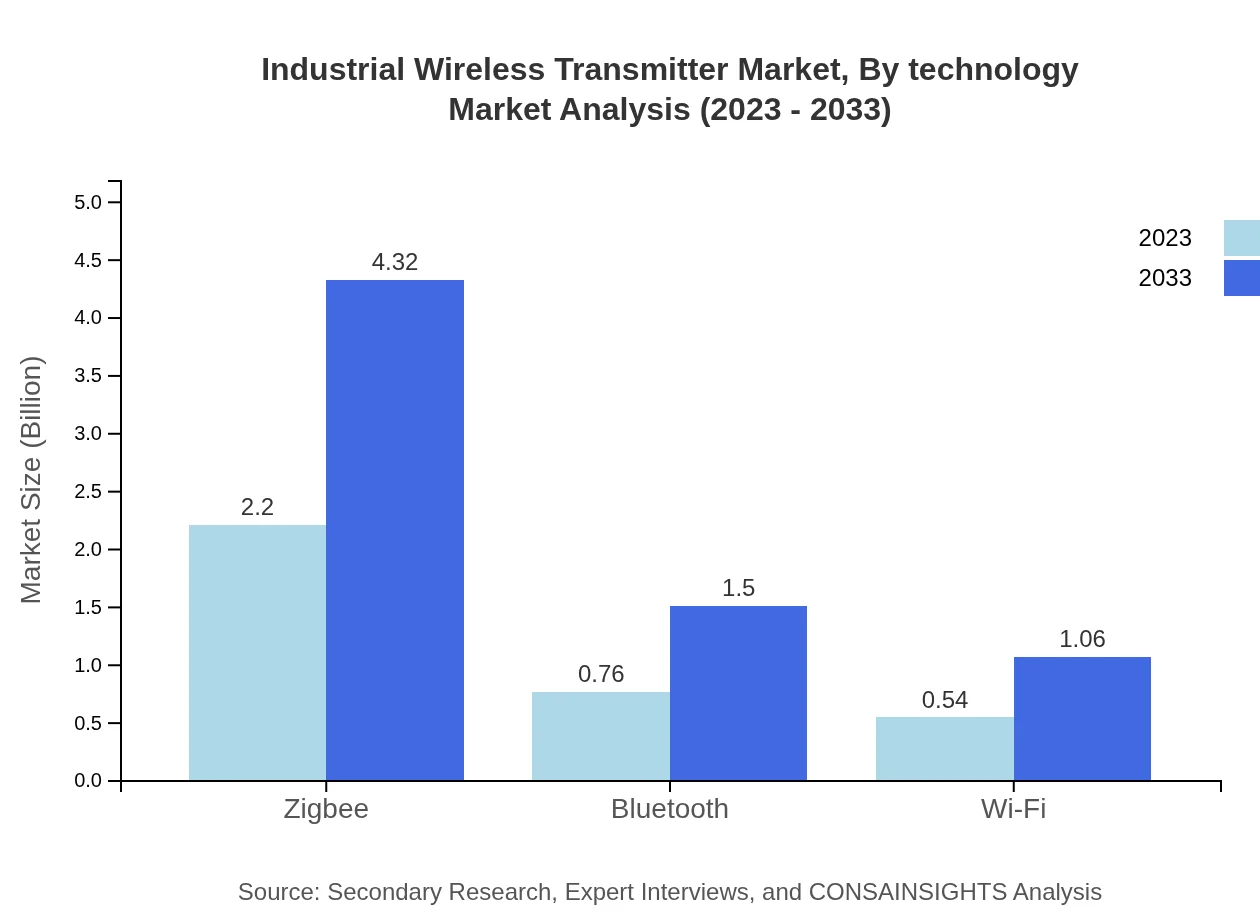

Industrial Wireless Transmitter Market Analysis By Technology

In 2023, the Zigbee technology segment leads the market with a size of $2.20 billion, expected to grow to $4.32 billion by 2033, maintaining around 62.79% market share. Bluetooth follows with a market size of $0.76 billion in 2023, doubling to $1.50 billion in 2033, representing a market share of 21.75%. Wi-Fi technology also shows growth, from $0.54 billion to $1.06 billion, holding 15.46% of the share.

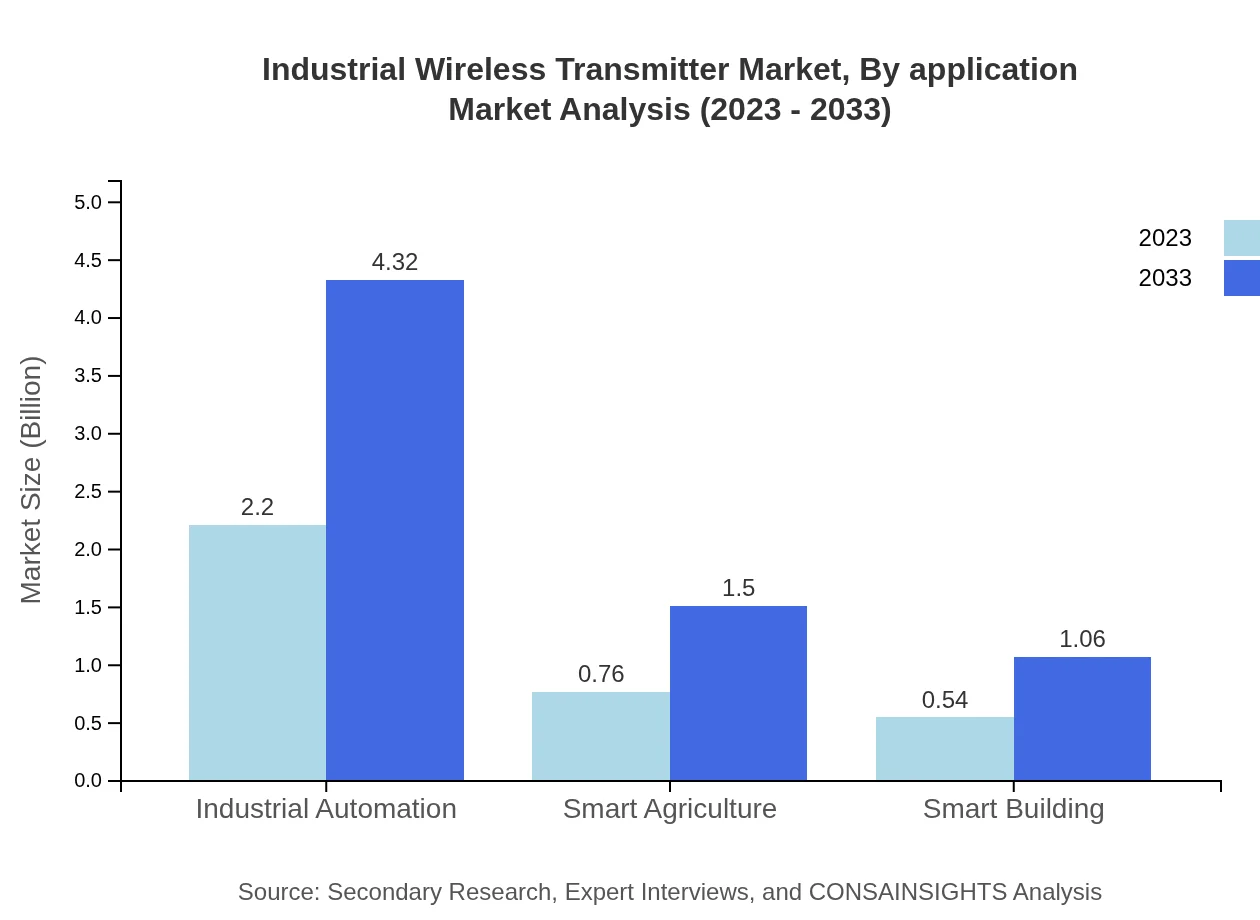

Industrial Wireless Transmitter Market Analysis By Application

The industrial automation segment dominates with a market size of $2.20 billion in 2023 and a forecast growth to $4.32 billion by 2033, representing a 62.79% share. The smart agriculture application follows with an initial size of $0.76 billion, projected to reach $1.50 billion by 2033, accounting for 21.75%, while smart buildings show potential growth from $0.54 billion to $1.06 billion, holding 15.46%.

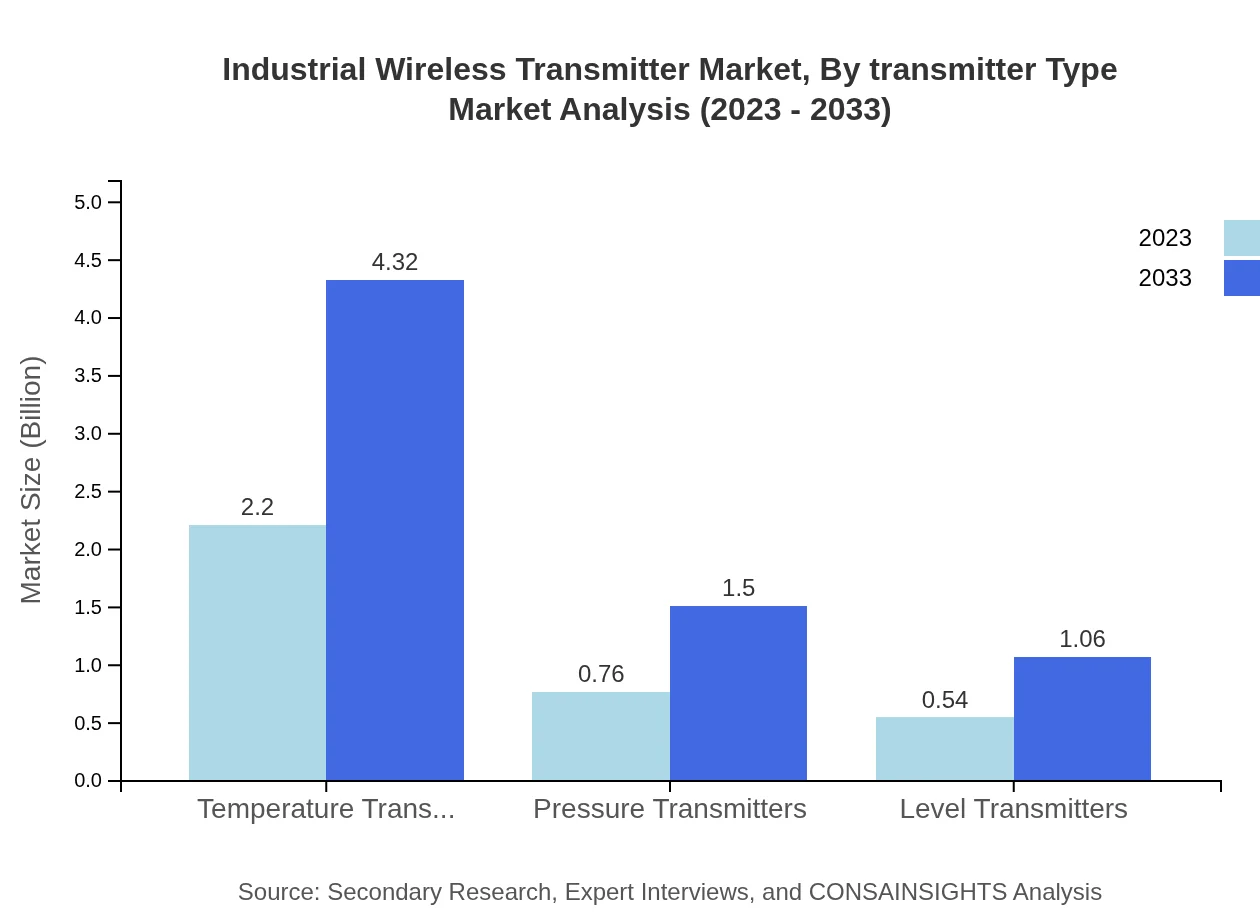

Industrial Wireless Transmitter Market Analysis By Transmitter Type

Temperature transmitters lead the market with a size of $2.20 billion in 2023, growing to $4.32 billion by 2033, capturing 62.79% share. Pressure transmitters, with a size of $0.76 billion, are expected to hit $1.50 billion by 2033, maintaining a 21.75% share. Level transmitters are projected to rise from $0.54 billion to $1.06 billion, holding 15.46% share.

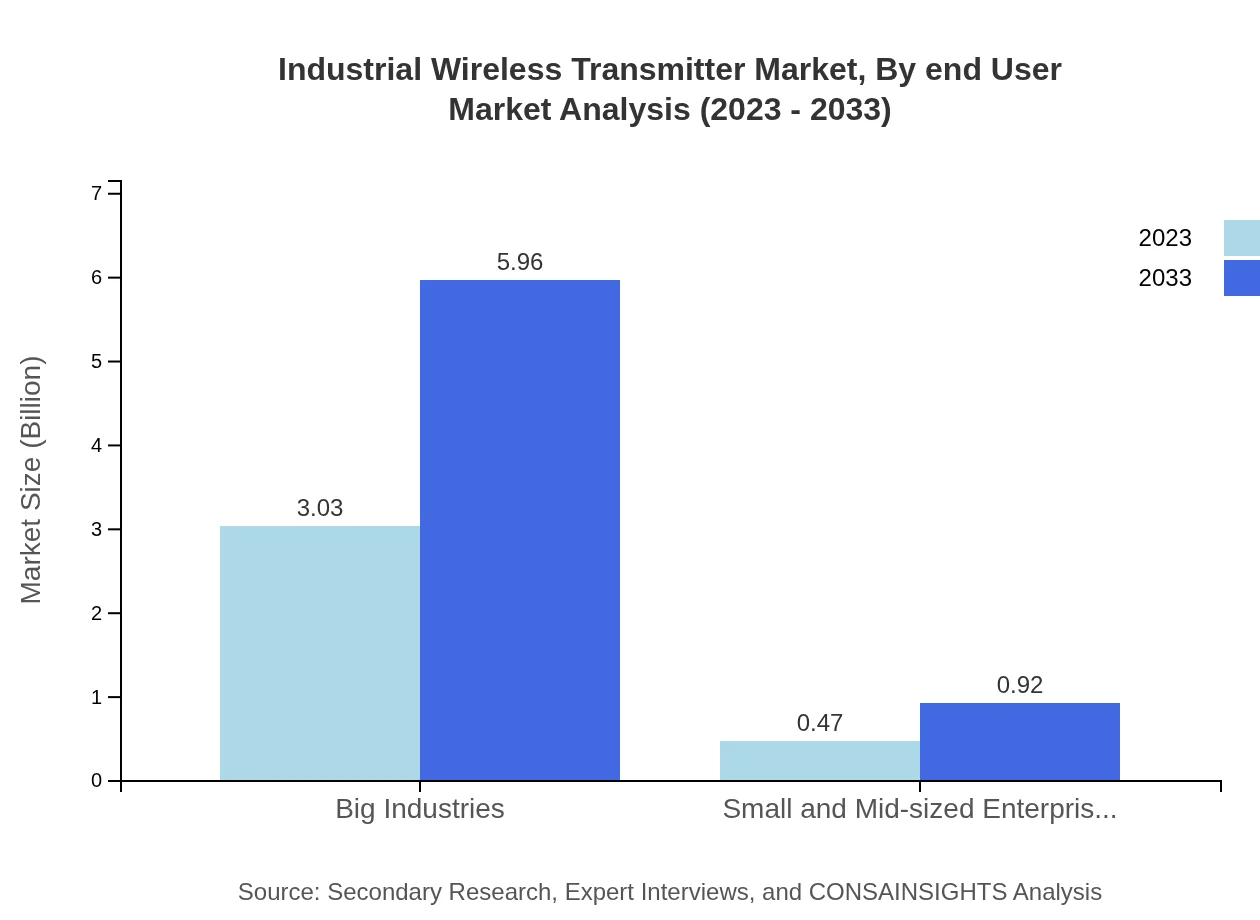

Industrial Wireless Transmitter Market Analysis By Industry

The big industries sector dominates the market with a size of $3.03 billion in 2023, expected to rise to $5.96 billion by 2033, holding a significant 86.58% share. Small and mid-sized businesses are also notable, starting at $0.47 billion and forecasting a growth to $0.92 billion, capturing a share of 13.42%.

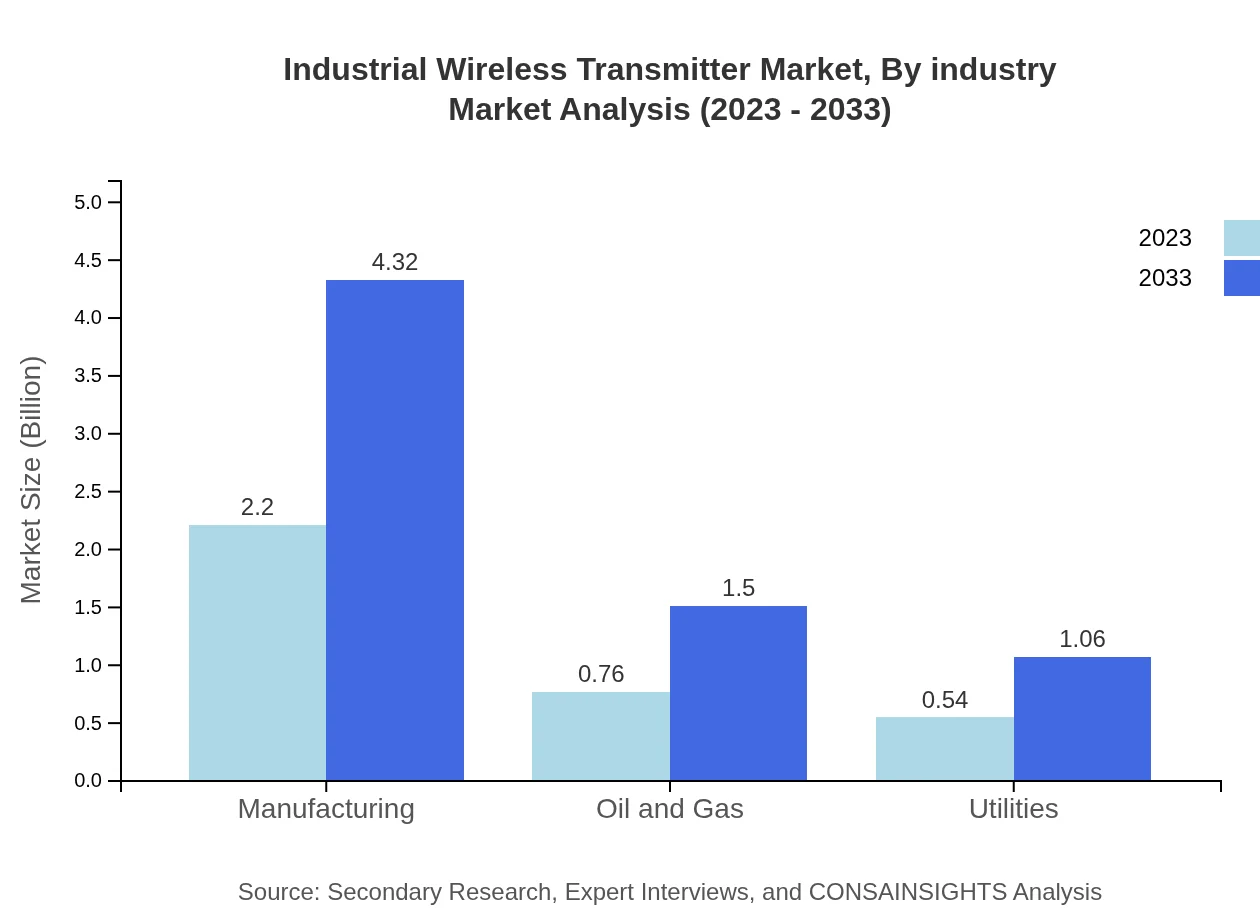

Industrial Wireless Transmitter Market Analysis By End User

End users from the manufacturing sector hold the largest share, with the market size at $2.20 billion in 2023 and projected to grow to $4.32 billion by 2033, representing 62.79%. The oil and gas sector shows promising growth, with size increasing from $0.76 billion to $1.50 billion, accounting for 21.75% share while utilities segment grows from $0.54 billion to $1.06 billion, maintaining a 15.46% share.

Industrial Wireless Transmitter Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Industrial Wireless Transmitter Industry

Honeywell International Inc.:

A leading provider of industrial automation solutions, Honeywell offers a comprehensive range of wireless transmitters known for their high accuracy and reliability.Siemens AG:

Siemens is at the forefront of innovation in industrial wireless transmitters, focusing on integrating IoT and automation in its offerings to enhance operational efficiency.Emerson Electric Co.:

Emerson is a powerhouse in process automation and offers robust wireless solutions, particularly in the oil and gas sector, driving efficiency and safety.Schneider Electric:

Schneider is known for its commitment to sustainable technologies and offers a range of wireless transmitters that cater to modern industrial applications.ABB Ltd.:

ABB specializes in electrification and automation, providing advanced wireless transmitter technologies that support critical process management across industries.We're grateful to work with incredible clients.

FAQs

What is the market size of industrial wireless transmitter?

The industrial wireless transmitter market is valued at approximately $3.5 billion in 2023, with a projected CAGR of 6.8% up to 2033. This growth reflects the increasing demand for wireless communication solutions in industrial applications.

What are the key market players or companies in the industrial wireless transmitter industry?

The industrial wireless transmitter market includes prominent players such as Siemens, Honeywell, Emerson Electric, and Yokogawa. These companies drive innovation through the development of advanced wireless technologies and systems to enhance operational efficiency.

What are the primary factors driving the growth in the industrial wireless transmitter industry?

Key factors driving growth in the industrial wireless transmitter market include the increasing adoption of automation in industries, the demand for real-time monitoring, and improvements in wireless technology that reduce costs and enhance reliability.

Which region is the fastest Growing in the industrial wireless transmitter market?

Asia Pacific is the fastest-growing region for industrial wireless transmitters, with a market value expected to rise from $0.76 billion in 2023 to $1.49 billion by 2033, indicating significant growth due to industrialization and technological advancements in the region.

Does ConsaInsights provide customized market report data for the industrial wireless transmitter industry?

Yes, ConsaInsights offers customized market report data for the industrial wireless transmitter industry, tailored to meet specific client needs, including detailed insights, competitive analysis, and market forecasts.

What deliverables can I expect from this industrial wireless transmitter market research project?

From the industrial wireless transmitter market research project, you can expect deliverables including comprehensive market analysis, regional insights, competitive landscape evaluations, and detailed projections segmented by end-user application and technology.

What are the market trends of industrial wireless transmitter?

Growing trends in the industrial wireless transmitter market include the rise of smart factories, increasing investments in IoT applications, and the development of low-power wide-area networks (LPWAN) to optimize connectivity and performance in industrial processes.