Inertial Measurement Unit Market Report

Published Date: 03 February 2026 | Report Code: inertial-measurement-unit

Inertial Measurement Unit Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Inertial Measurement Unit (IMU) market, covering market trends, size, growth forecasts from 2023 to 2033, and key regional insights. It addresses the technological advancements and market segmentation that are shaping the future of the IMU industry.

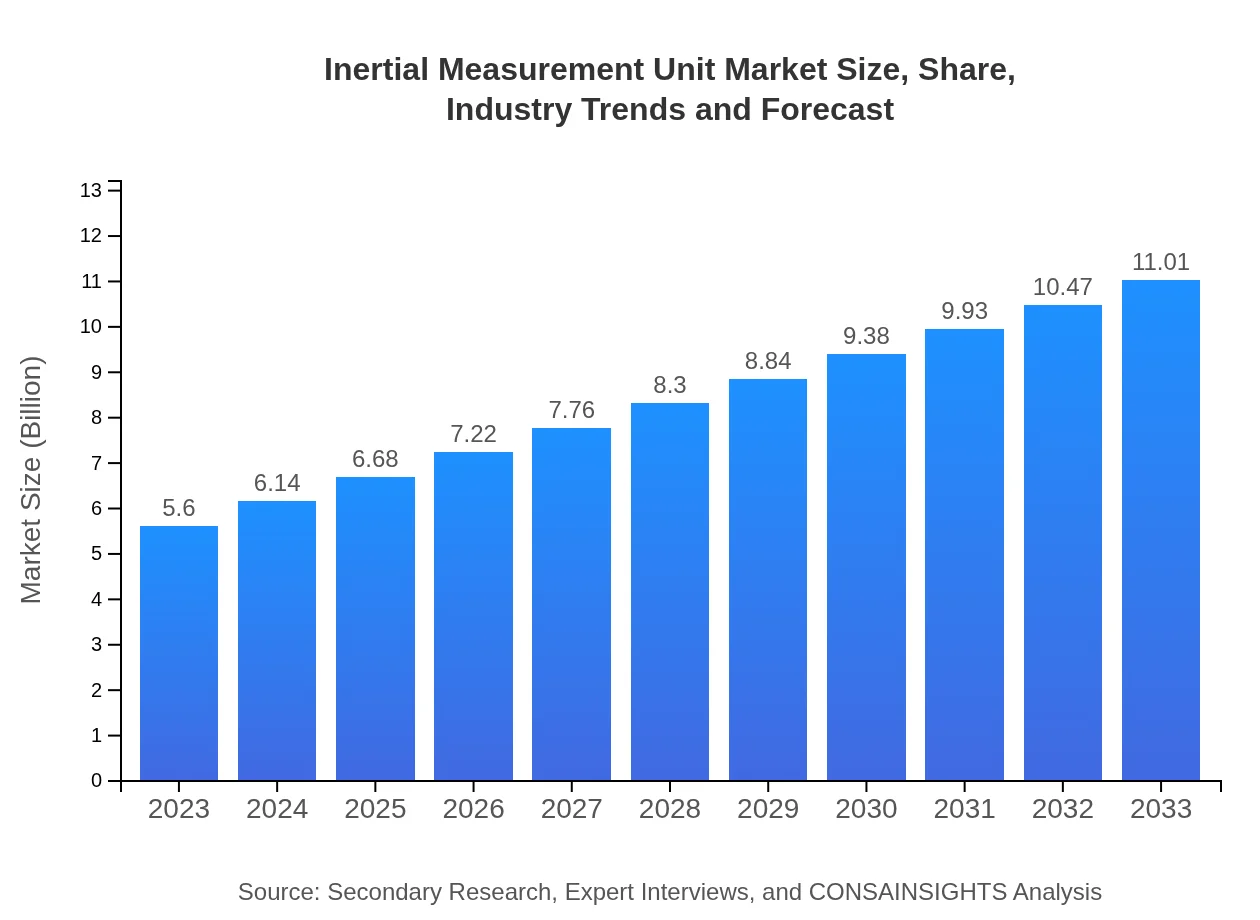

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.60 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $11.01 Billion |

| Top Companies | Honeywell International Inc., Northrop Grumman Corporation, STMicroelectronics, Bosch Sensortec, Texas Instruments |

| Last Modified Date | 03 February 2026 |

Inertial Measurement Unit Market Overview

Customize Inertial Measurement Unit Market Report market research report

- ✔ Get in-depth analysis of Inertial Measurement Unit market size, growth, and forecasts.

- ✔ Understand Inertial Measurement Unit's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Inertial Measurement Unit

What is the Market Size & CAGR of Inertial Measurement Unit market in 2023?

Inertial Measurement Unit Industry Analysis

Inertial Measurement Unit Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Inertial Measurement Unit Market Analysis Report by Region

Europe Inertial Measurement Unit Market Report:

In Europe, the market size is forecasted to grow from $1.57 billion in 2023 to $3.08 billion by 2033. Government initiatives to adopt advanced automotive technologies and the rise of aviation standards are pivotal in driving this growth.Asia Pacific Inertial Measurement Unit Market Report:

In the Asia Pacific region, the IMU market size reached approximately $1.06 billion in 2023, with expectations of doubling to $2.08 billion by 2033. The growth is driven by rising consumer electronics demand, increased automotive manufacturing, and advancements in robotics across major economies such as Japan, China, and South Korea.North America Inertial Measurement Unit Market Report:

North America's IMU market stood at $2.14 billion in 2023, anticipated to reach $4.20 billion by 2033. The region benefits from strong automotive and aerospace sectors, alongside investments in defense technologies, making it a critical market for advanced navigation solutions.South America Inertial Measurement Unit Market Report:

The South American IMU market is projected to grow from $0.52 billion in 2023 to $1.02 billion by 2033. The expansion is supported largely by aerospace growth and increasing investments in autonomous vehicles, with countries like Brazil and Argentina leading in adoption.Middle East & Africa Inertial Measurement Unit Market Report:

The Middle East and Africa region has a smaller IMU market, valued at $0.32 billion in 2023, with projections rising to $0.63 billion by 2033. Growth is anticipated through increased military spending and infrastructure projects necessitating advanced navigation systems.Tell us your focus area and get a customized research report.

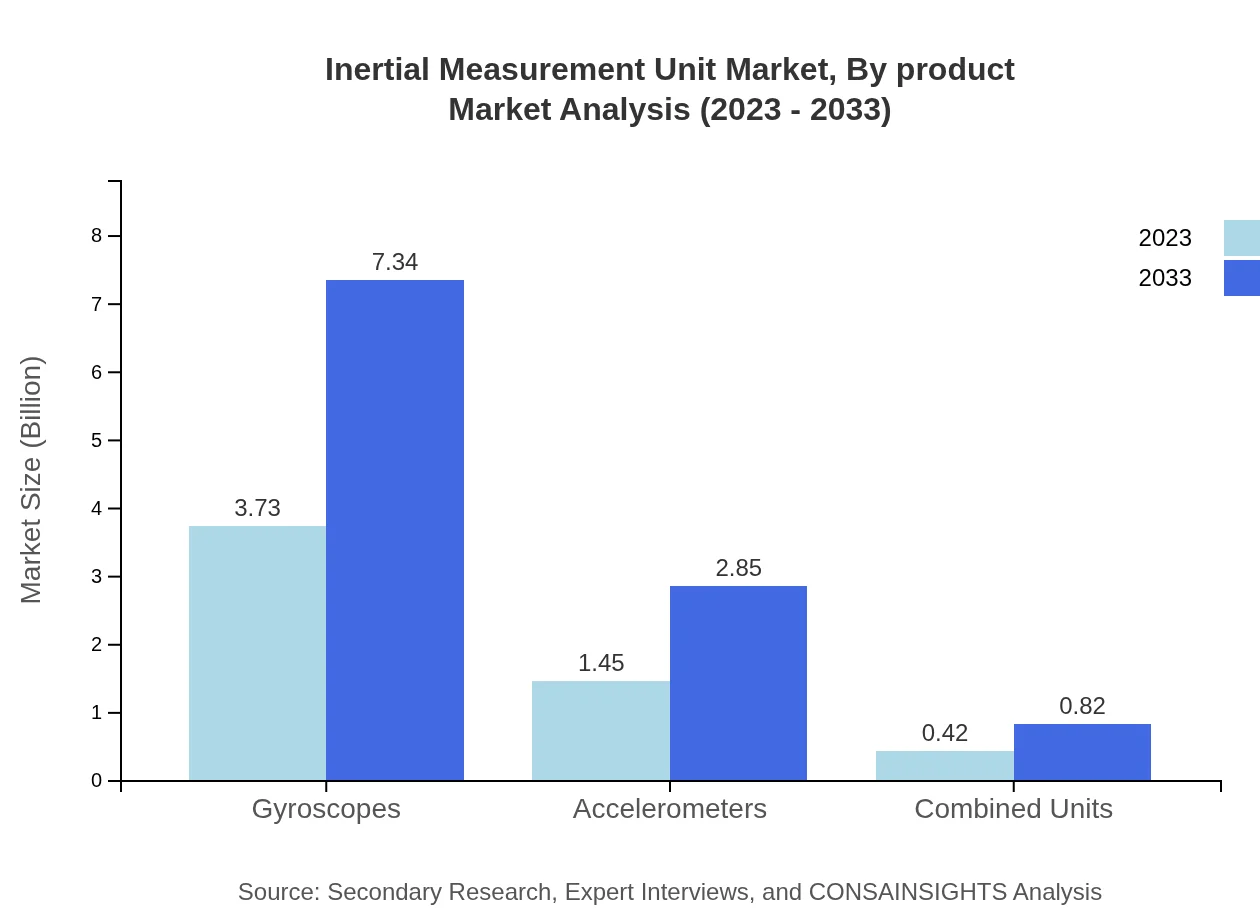

Inertial Measurement Unit Market Analysis By Product

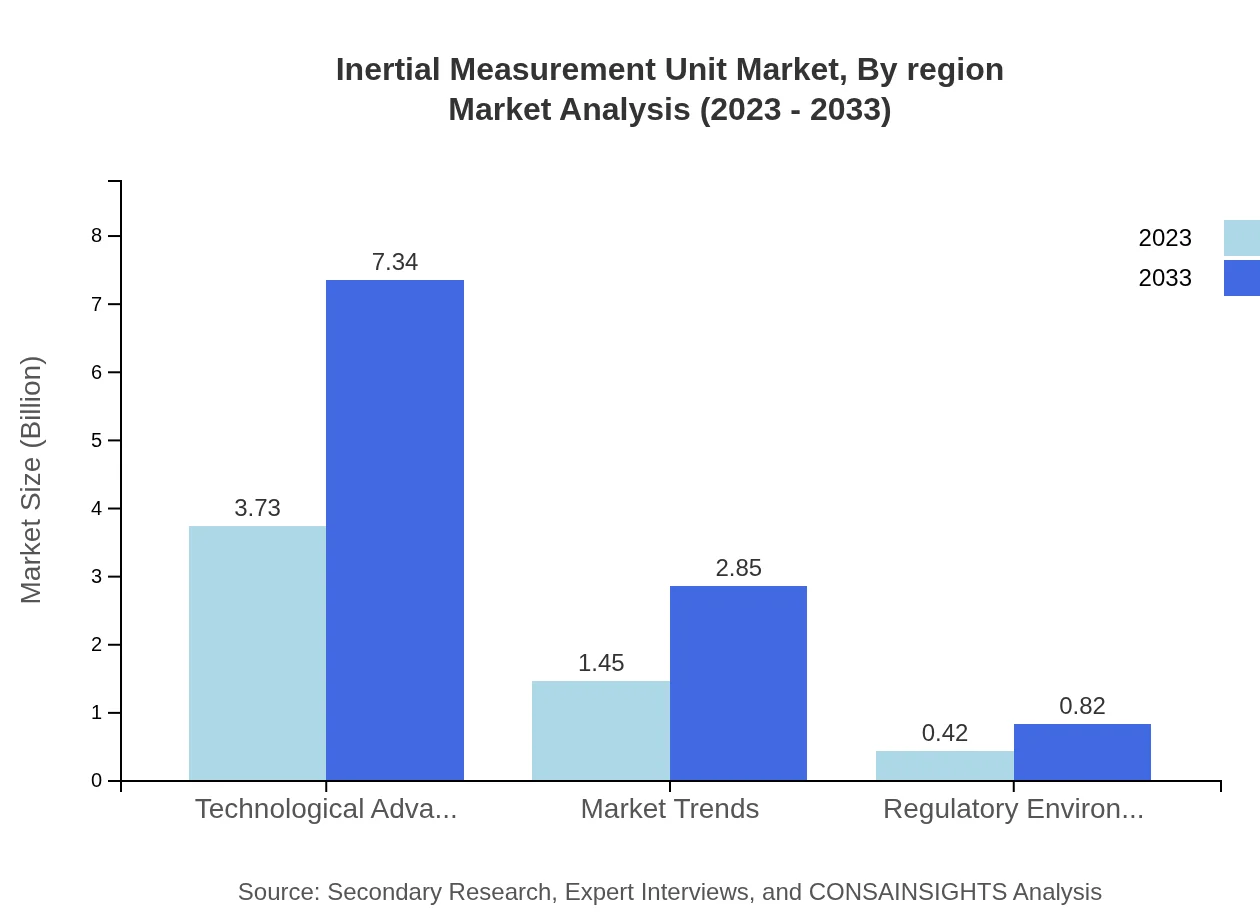

In 2023, gyroscopes account for 66.67% of the IMU market share, equating to a size of $3.73 billion, with growth expected to maintain this share through 2033. Accelerometers, representing 25.88% with a size of $1.45 billion in 2023, are also crucial, especially in consumer electronics applications. Combined units are emerging, projected to grow from $0.42 billion to $0.82 billion, with a share of 7.45%.

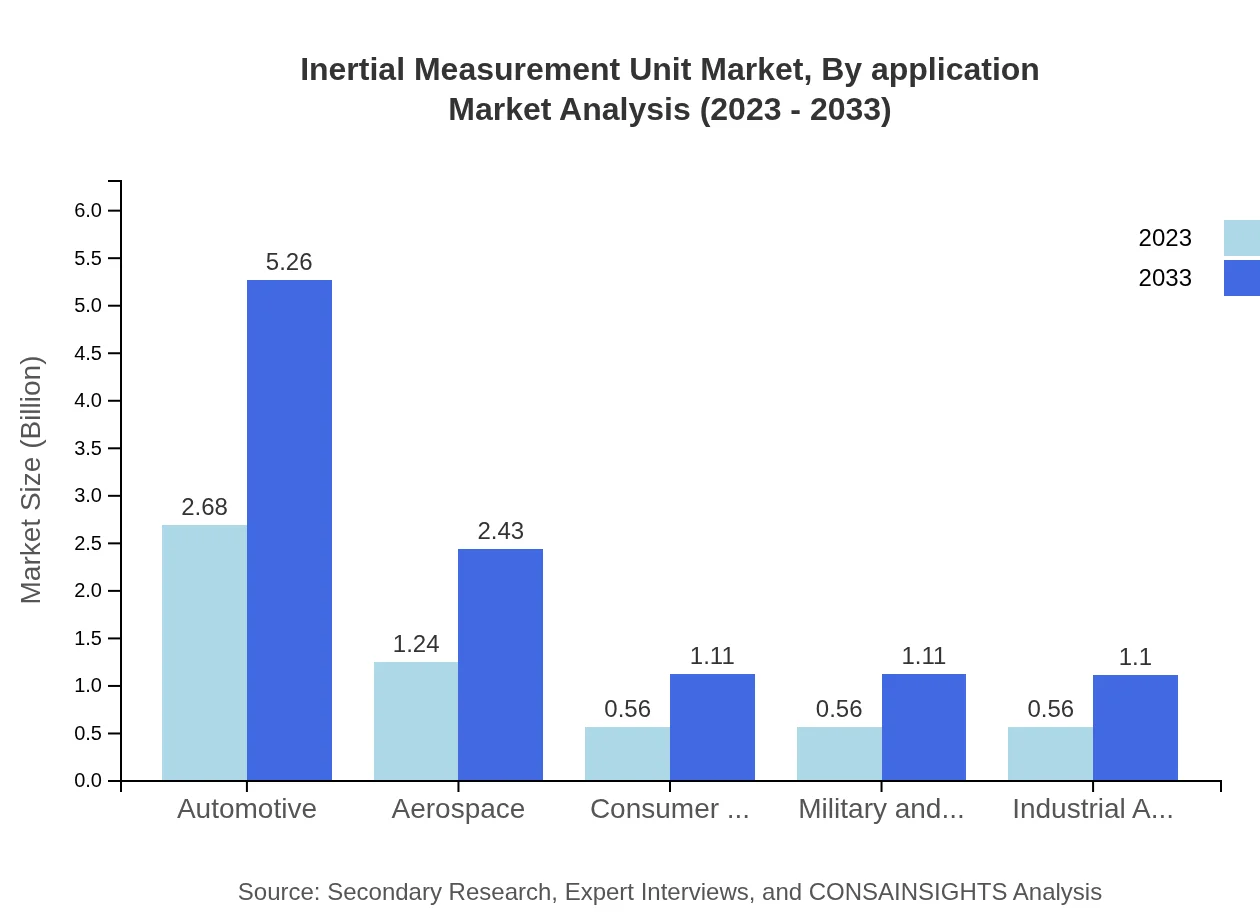

Inertial Measurement Unit Market Analysis By Application

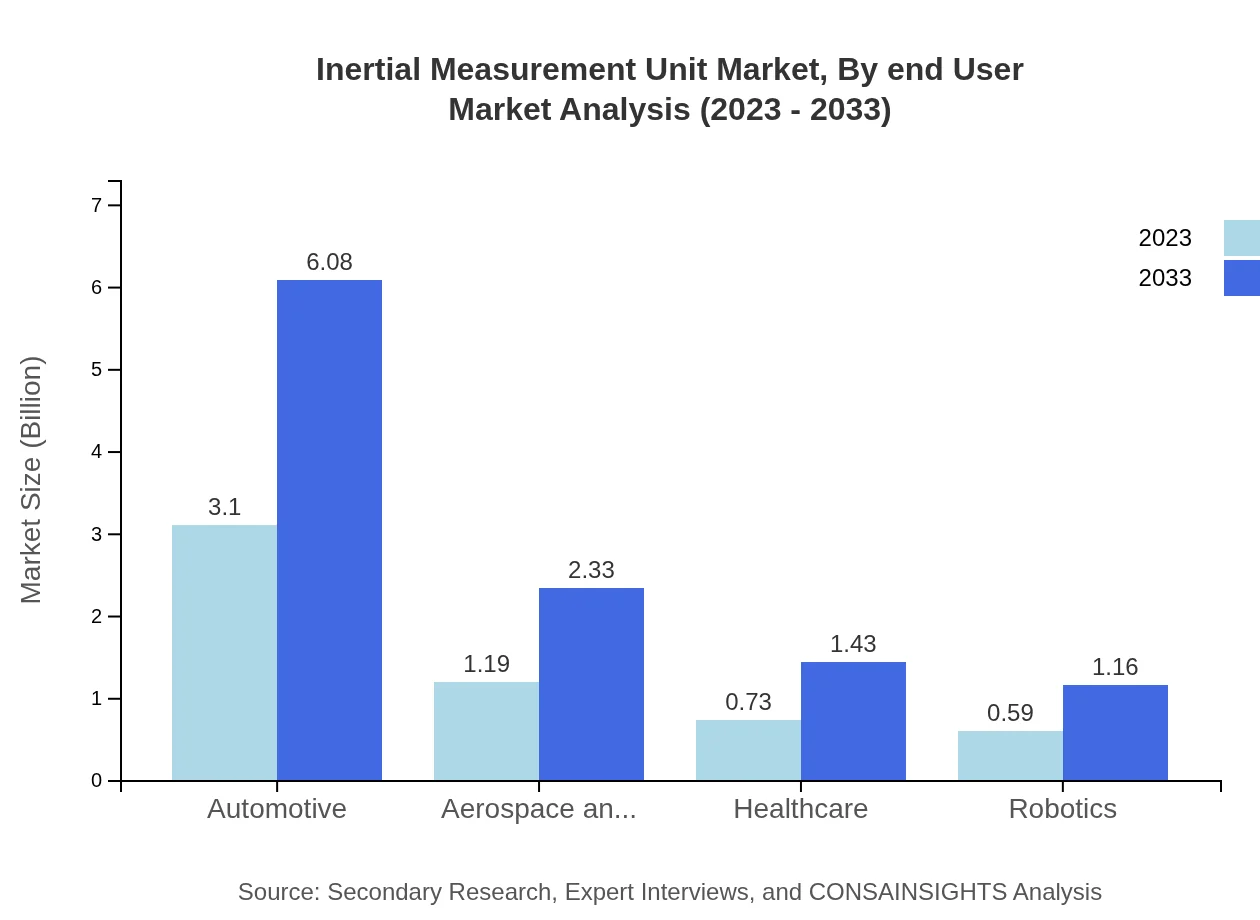

The automotive sector dominates the applications segment, holding 55.27% of the market in 2023, translating to $3.10 billion in value. Aerospace and defense segments account for 21.2% of the market, emphasizing precision navigation. Significant growth is also seen in healthcare and robotics, with increasing applications in telehealth and automation.

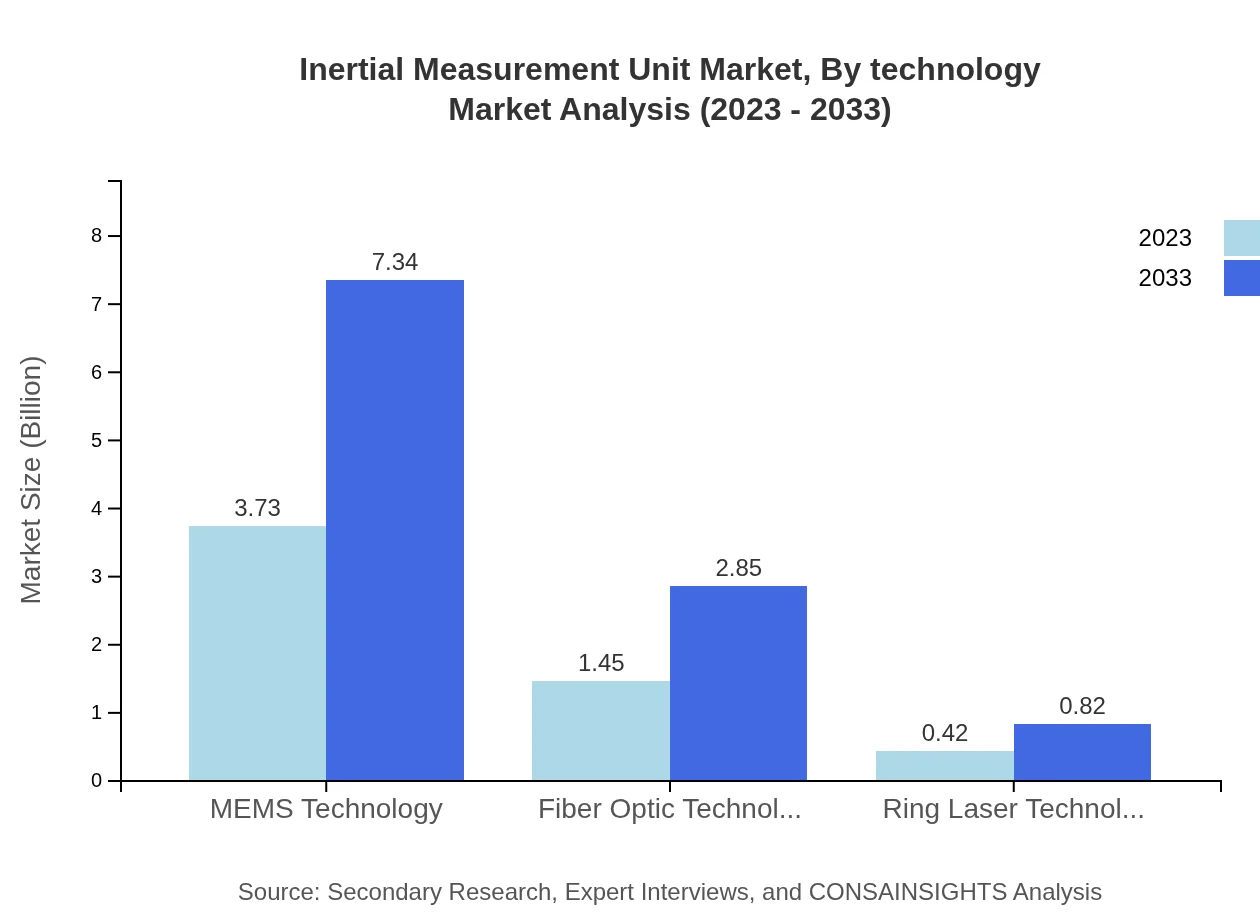

Inertial Measurement Unit Market Analysis By Technology

MEMS technology holds a substantial 66.67% market share in 2023, translating to $3.73 billion, due to its wide adoption in mobile devices and automotive applications. Fiber optic technology and ring laser technology are also present, making up 25.88% and 7.45% respectively, with specific applications in aerospace and precision instruments.

Inertial Measurement Unit Market Analysis By End User

The automotive industry's demand for IMUs is robust, with a share of 47.77% in 2023, while military and defense sectors closely follow. The consumer electronics sector is emerging as a critical end-user, particularly with the growth of smart devices requiring integrated IMUs.

Inertial Measurement Unit Market Analysis By Region

Current trends in the IMU market highlight a significant shift towards miniaturization and technological integration. The growth of IoT devices and autonomous vehicles is propelling demand, while regulatory challenges in various regions are shaping compliance standards for new technologies.

Inertial Measurement Unit Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Inertial Measurement Unit Industry

Honeywell International Inc.:

A key player in the aerospace and defense sectors, Honeywell specializes in IMU technology for navigation and control systems.Northrop Grumman Corporation:

This company provides advanced IMU solutions for military and aeronautical applications, known for high-precision gyroscopes.STMicroelectronics:

A major manufacturer of MEMS-based sensors, STMicroelectronics plays a crucial role in consumer electronics and automotive IMU markets.Bosch Sensortec:

Leading in MEMS technology, Bosch Sensortec designs compact IMUs for a variety of applications, driving innovation in consumer electronics.Texas Instruments:

Offers a range of IMU products, focusing on applications in automotive and industrial sectors.We're grateful to work with incredible clients.

FAQs

What is the market size of inertial Measurement Unit?

The inertial measurement unit market is projected to reach $5.6 billion by 2033, growing at a CAGR of 6.8%. The growth reflects increased adoption across various sectors, particularly in automotive and aerospace applications.

What are the key market players or companies in the inertial Measurement Unit industry?

Key players include Honeywell International Inc., Northrop Grumman Corporation, and STMicroelectronics N.V. These companies dominate through innovative technologies, strategic partnerships, and expansive product portfolios in the inertial measurement space.

What are the primary factors driving the growth in the inertial Measurement Unit industry?

Key growth drivers include increasing demand for precision navigation in automotive and aerospace sectors, advancements in MEMS technology that enhance performance, and rising applications in consumer electronics and industrial automation.

Which region is the fastest Growing in inertial Measurement Unit?

Asia Pacific is the fastest-growing region, expected to grow from $1.06 billion in 2023 to $2.08 billion by 2033. North America follows closely, increasing from $2.14 billion to $4.20 billion over the same period.

Does ConsaInsights provide customized market report data for the inertial Measurement Unit industry?

Yes, ConsaInsights offers customized market reports tailored to specific needs and queries about the inertial measurement unit industry, ensuring clients receive relevant data and insights for strategic decision-making.

What deliverables can I expect from this inertial Measurement Unit market research project?

Expect comprehensive market analysis, trends identification, competitive landscape summaries, regional growth insights, and segmentation data. Reports also include forecasts, market size estimates, and insights into emerging technologies.

What are the market trends of inertial Measurement Unit?

Current trends include the increasing adoption of MEMS technology, growth of automotive applications for navigation, and advancements in fiber optic technology enhancing unit performance. There is a rising focus on integration with IoT solutions as well.