Inertial Navigation System Market Report

Published Date: 03 February 2026 | Report Code: inertial-navigation-system

Inertial Navigation System Market Size, Share, Industry Trends and Forecast to 2033

This comprehensive report delves into the Inertial Navigation System market from 2023 to 2033, providing vital insights into market dynamics, size, competitive landscape, and regional analyses, designed to support stakeholders in strategic planning and decision-making.

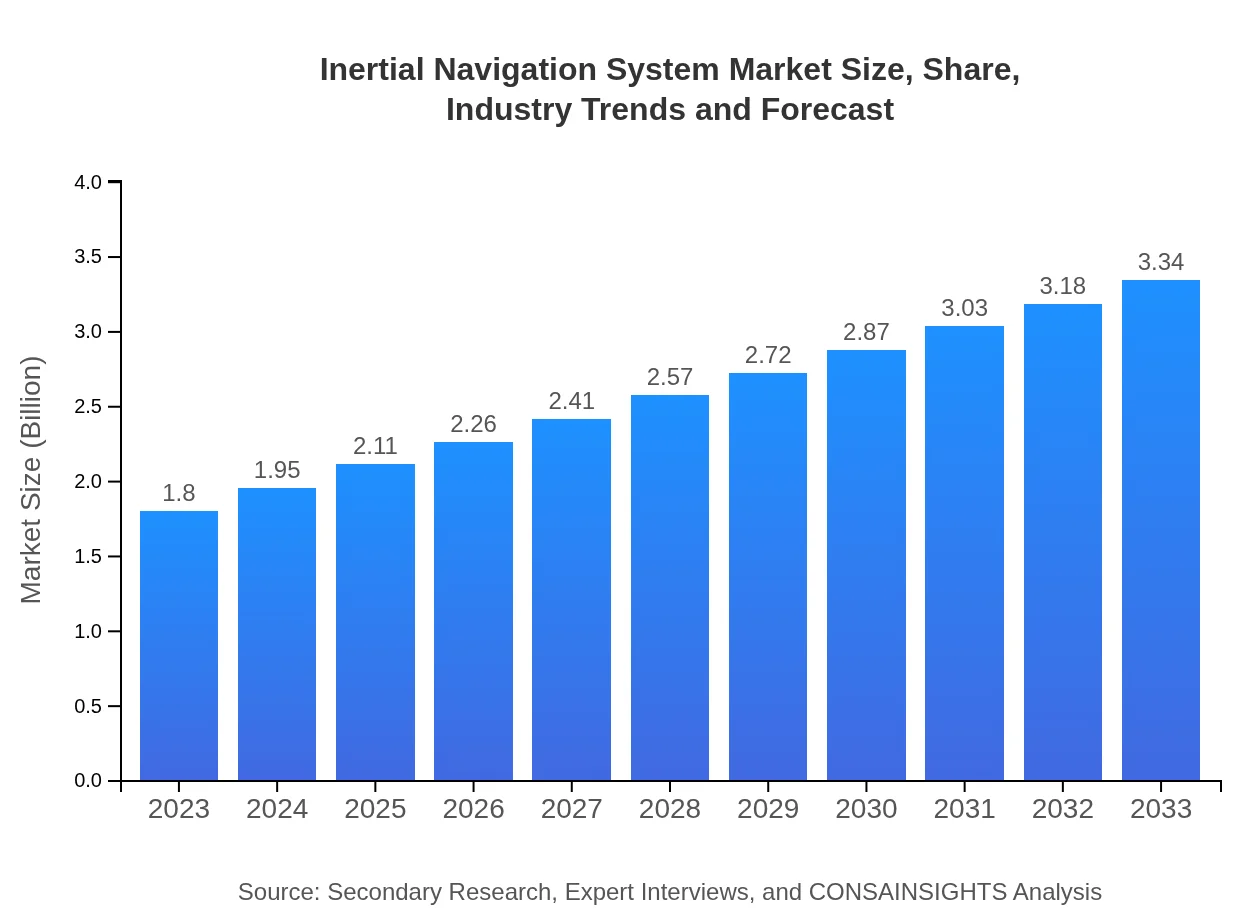

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $1.80 Billion |

| CAGR (2023-2033) | 6.2% |

| 2033 Market Size | $3.34 Billion |

| Top Companies | Honeywell International Inc., Northrop Grumman Corporation, Thales Group, Raytheon Technologies Corporation, BAE Systems |

| Last Modified Date | 03 February 2026 |

Inertial Navigation System Market Overview

Customize Inertial Navigation System Market Report market research report

- ✔ Get in-depth analysis of Inertial Navigation System market size, growth, and forecasts.

- ✔ Understand Inertial Navigation System's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Inertial Navigation System

What is the Market Size & CAGR of Inertial Navigation System market in 2023?

Inertial Navigation System Industry Analysis

Inertial Navigation System Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Inertial Navigation System Market Analysis Report by Region

Europe Inertial Navigation System Market Report:

In Europe, the market will likely grow from $0.43 billion in 2023 to $0.80 billion by 2033, with increasing adoption of INS in civilian aerospace and automotive applications propelled by regulations pushing for enhanced safety systems.Asia Pacific Inertial Navigation System Market Report:

In the Asia Pacific region, the market is expected to grow from $0.39 billion in 2023 to $0.72 billion by 2033, driven by rising defense budgets and expanding aerospace industries in countries like China, India, and Japan.North America Inertial Navigation System Market Report:

North America is anticipated to maintain a dominant market position, growing from $0.61 billion in 2023 to $1.13 billion by 2033. The US military’s significant investments in advanced technologies and the booming aerospace industry are key drivers.South America Inertial Navigation System Market Report:

The South American market is projected to increase from $0.15 billion in 2023 to $0.29 billion by 2033. Growth is predominantly seen in Brazil and Argentina due to rising investments in infrastructure and automotive sectors.Middle East & Africa Inertial Navigation System Market Report:

The Middle East and Africa region are projected to see growth from $0.21 billion in 2023 to $0.39 billion by 2033, driven mainly by investments in defense and infrastructure development initiatives across the region.Tell us your focus area and get a customized research report.

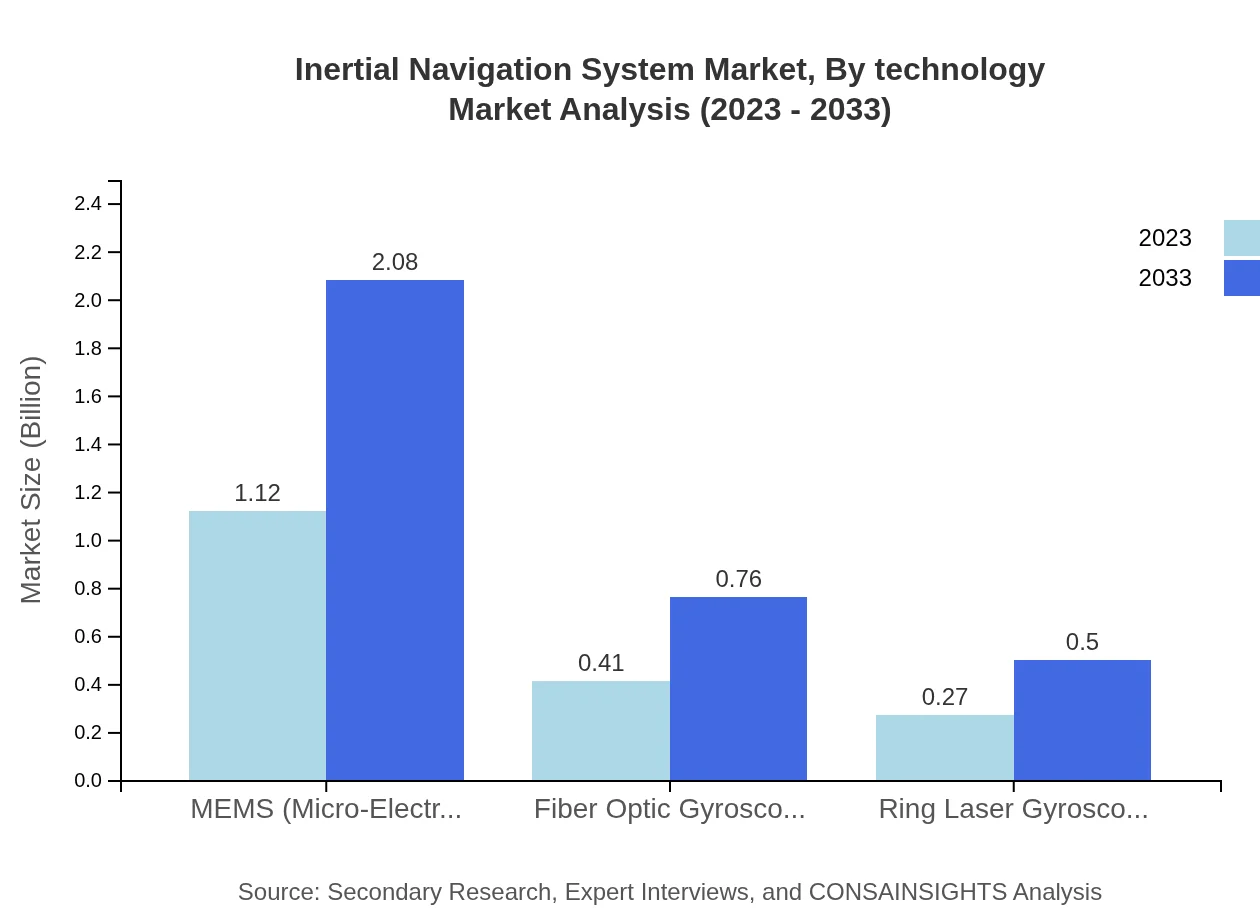

Inertial Navigation System Market Analysis By Technology

The segment comprises various technologies such as MEMS, FOGs, and RLGs. MEMS technology captures a significant market share, reflecting advancements in miniaturization. In 2023, the MEMS market was valued at $1.12 billion, projected to reach $2.08 billion by 2033, signifying a 7.5% CAGR. FOGs and RLGs also see steady growth due to their critical applications in aerospace and defense.

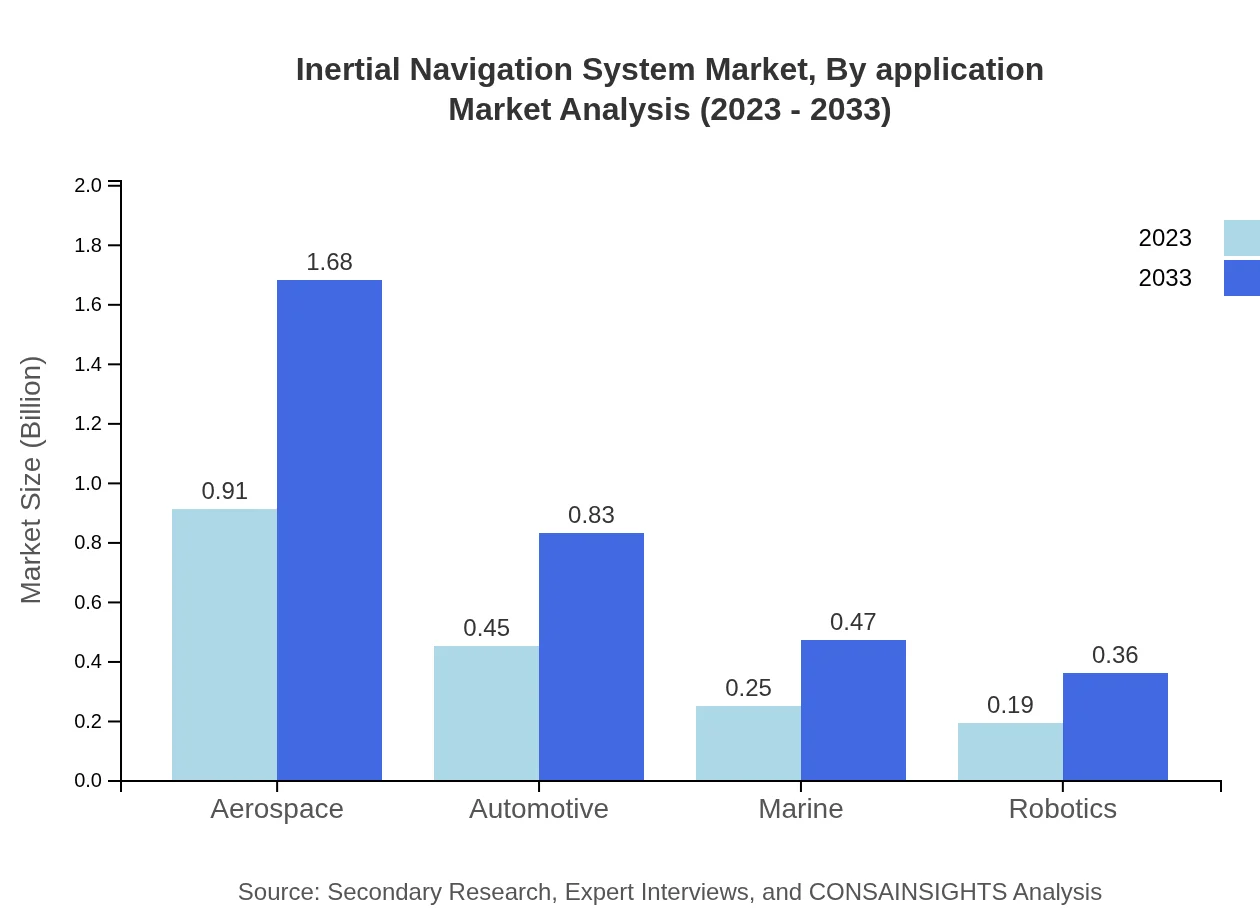

Inertial Navigation System Market Analysis By Application

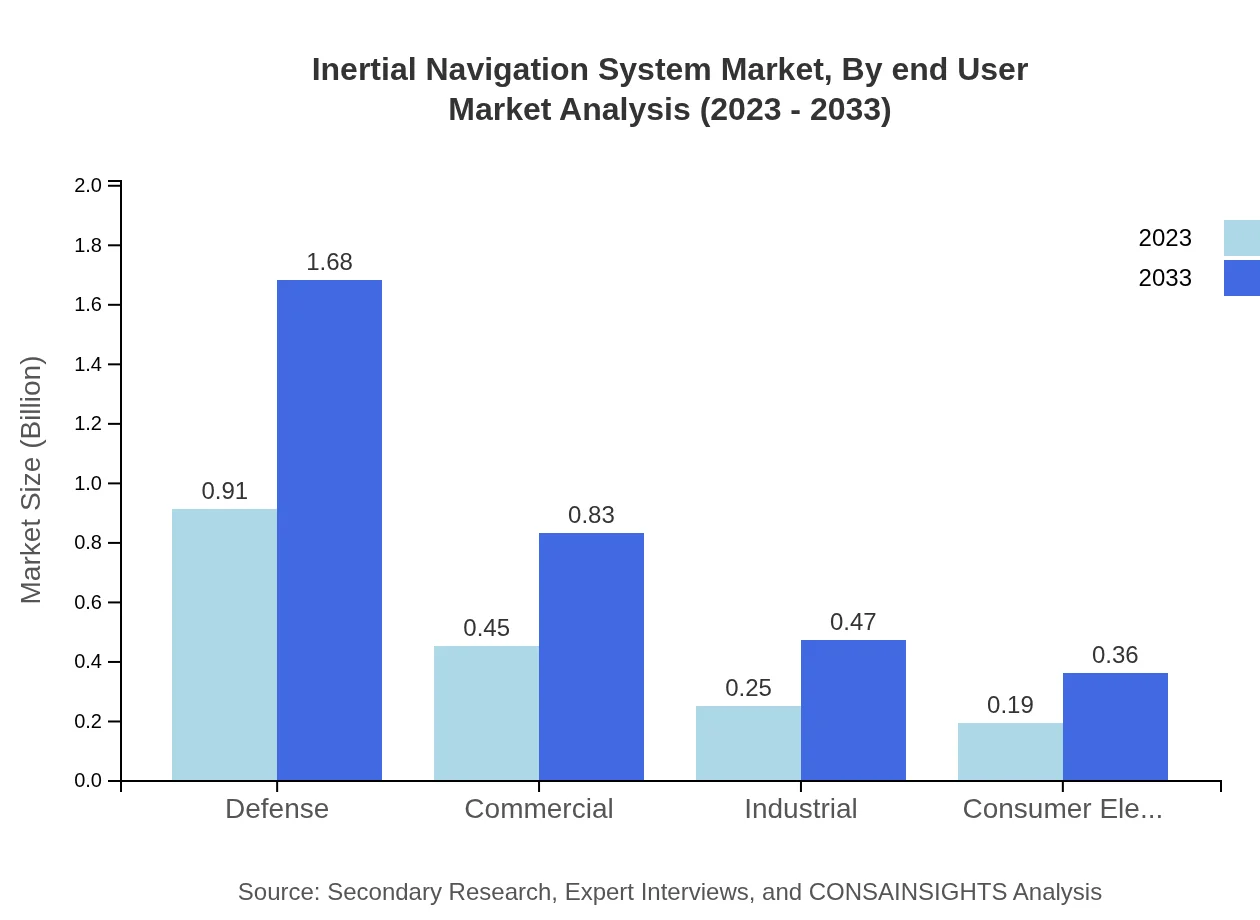

Application sectors illustrate diverse adoption trends. The defense segment leads with a market size of $0.91 billion in 2023, growing to $1.68 billion by 2033, reflecting its essential position in national security frameworks. Aerospace follows closely, also showing significant growth driven by the expansion of commercial aviation.

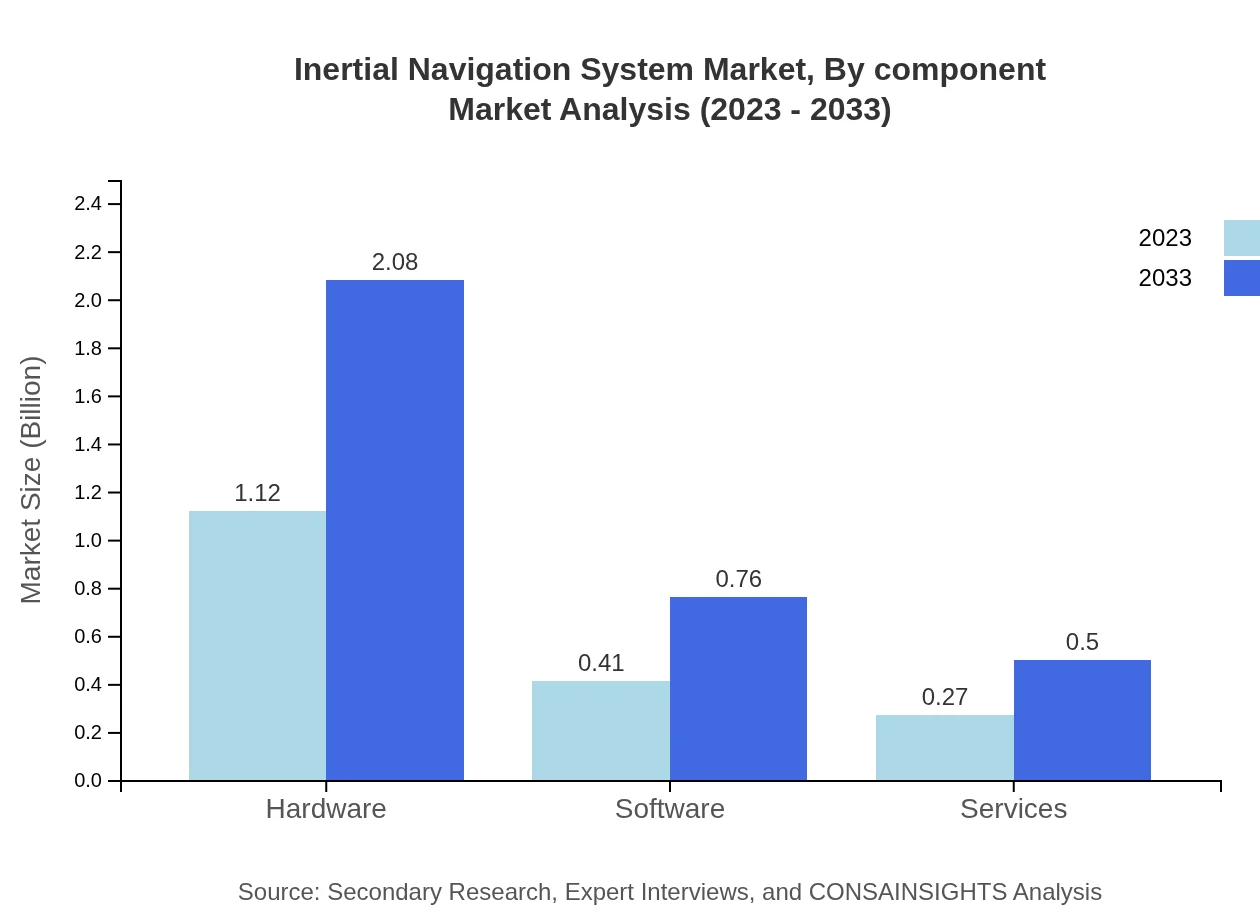

Inertial Navigation System Market Analysis By Component

The market is segmented further into hardware (leading at $1.12 billion in 2023) and software/services. The hardware segment reflects advancements in sensor technology and dominates overall revenues due to increased demand in various applications, expected to maintain a majority share of the market.

Inertial Navigation System Market Analysis By End User

Key end-user segments include aerospace, automotive, and industrial sectors. Aerospace remains a dominant force, driven by regulatory demands and technological advancements. The automotive sector shows promising growth attributable to the rise of autonomous vehicle technologies.

Inertial Navigation System Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Inertial Navigation System Industry

Honeywell International Inc.:

A leading player in the aerospace and industrial markets, known for their advanced inertial sensors and navigation technologies.Northrop Grumman Corporation:

Specializes in defense technologies, providing state-of-the-art inertial navigation systems for various military applications.Thales Group:

A prominent player in defense electronics, delivering integrated navigation solutions utilizing inertial technology for both civil and military sectors.Raytheon Technologies Corporation:

A global leader in aerospace and defense, recognized for innovative navigation and guidance systems.BAE Systems:

Focuses on advanced defense and aerospace technologies, developing sophisticated inertial navigation systems for a range of applications.We're grateful to work with incredible clients.

FAQs

What is the market size of Inertial Navigation System?

The global inertial navigation system (INS) market is currently valued at $1.8 billion, with an expected growth at a CAGR of 6.2%. The market is projected to expand significantly by 2033.

What are the key market players or companies in the Inertial Navigation System industry?

The INS industry consists of major players such as Northrop Grumman, Honeywell International, and Thales Group, which are known for their technological advancements and comprehensive product portfolios that cater to various sectors.

What are the primary factors driving the growth in the Inertial Navigation System industry?

Key growth drivers include increased demand for precision navigation in defense applications, advancements in MEMS technology, and the rising adoption of autonomous systems across various industries.

Which region is the fastest Growing in the Inertial Navigation System?

North America is the fastest-growing region for the INS market, expected to reach $1.13 billion by 2033. Meanwhile, Europe and Asia Pacific are also experiencing robust growth rates.

Does ConsaInsights provide customized market report data for the Inertial Navigation System industry?

Yes, Consainsights offers tailored market reports for the inertial navigation system sector, accommodating specific client needs and detailed insights relevant to their unique market interests.

What deliverables can I expect from this Inertial Navigation System market research project?

Expected deliverables include comprehensive market analysis reports, segmentation data, growth forecasts, and competitive landscape assessments, providing valuable insights for informed decision-making.

What are the market trends of Inertial Navigation System?

Current trends in the INS market include increasing integration of advanced sensor technologies, growing emphasis on automation across industries, and expanding applications in consumer electronics and automotive sectors.