Infant Formula Milk Powder Market Report

Published Date: 31 January 2026 | Report Code: infant-formula-milk-powder

Infant Formula Milk Powder Market Size, Share, Industry Trends and Forecast to 2033

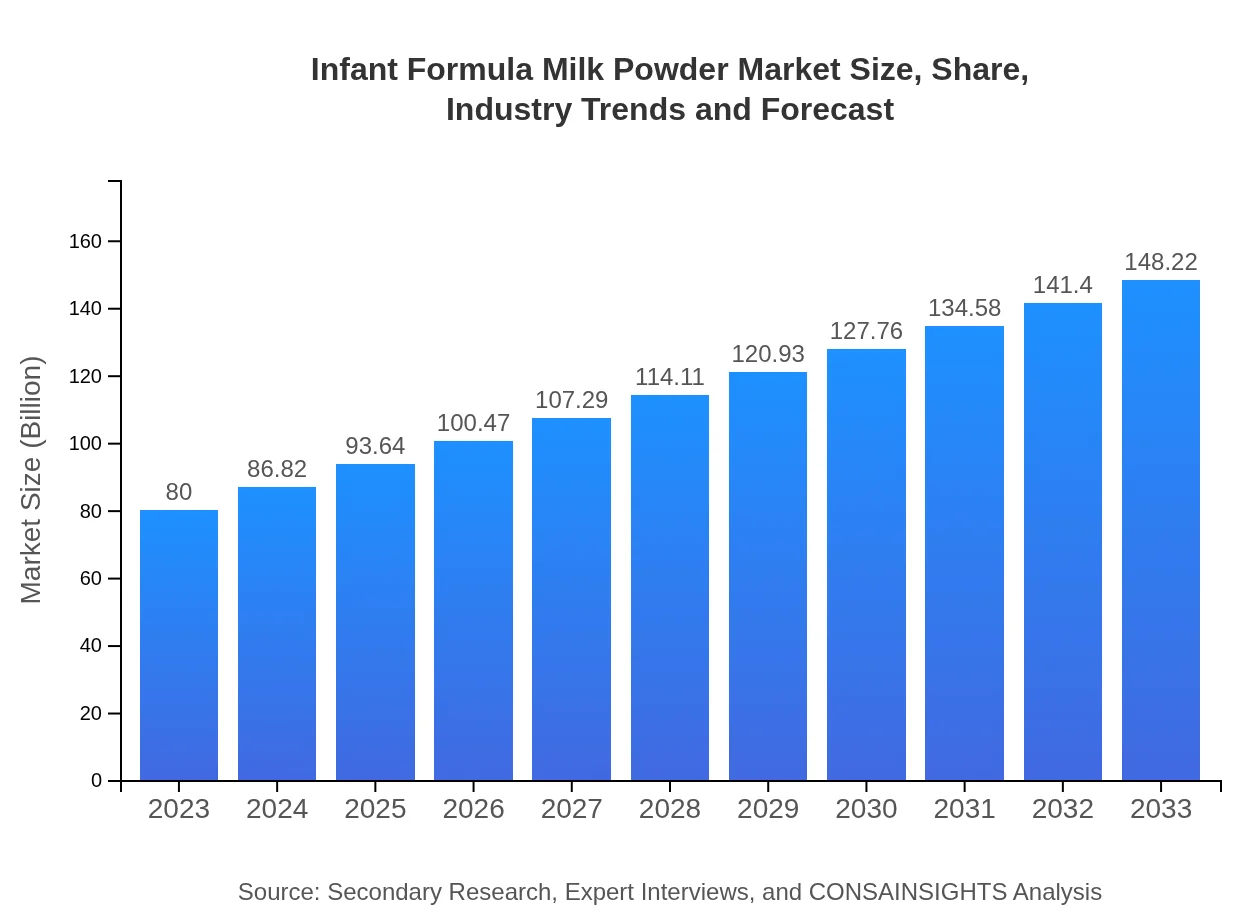

This report covers the Infant Formula Milk Powder market, providing insights and data on market size, CAGR, and trends from 2023 to 2033.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $80.00 Billion |

| CAGR (2023-2033) | 6.2% |

| 2033 Market Size | $148.22 Billion |

| Top Companies | Nestlé S.A., Danone S.A., Abbott Laboratories, Mead Johnson Nutrition Company |

| Last Modified Date | 31 January 2026 |

Infant Formula Milk Powder Market Overview

Customize Infant Formula Milk Powder Market Report market research report

- ✔ Get in-depth analysis of Infant Formula Milk Powder market size, growth, and forecasts.

- ✔ Understand Infant Formula Milk Powder's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Infant Formula Milk Powder

What is the Market Size & CAGR of Infant Formula Milk Powder market in 2023?

Infant Formula Milk Powder Industry Analysis

Infant Formula Milk Powder Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Infant Formula Milk Powder Market Analysis Report by Region

Europe Infant Formula Milk Powder Market Report:

Europe's market stood at $22.90 billion in 2023 and is projected to reach $42.44 billion by 2033. The inclination towards organic products and stringent regulations ensure a robust market environment for responsible consumption.Asia Pacific Infant Formula Milk Powder Market Report:

The Asia Pacific region held a market value of $15.38 billion in 2023, projected to reach $28.49 billion by 2033. Growing economies, high birth rates, and increased health awareness are key growth drivers. Countries like China and India are witnessing a surge in demand for premium products.North America Infant Formula Milk Powder Market Report:

North America exhibited a market size of $28.78 billion in 2023, with forecasts indicating growth to $53.32 billion by 2033. The region is characterized by high disposable incomes and sophisticated distribution channels, driving demand for premium infant formulas.South America Infant Formula Milk Powder Market Report:

In South America, the market size in 2023 was approximately $5.47 billion, with expectations of growth to $10.14 billion by 2033. Economic improvements and rising health consciousness among parents are propelling market expansion.Middle East & Africa Infant Formula Milk Powder Market Report:

The Middle East and Africa's Infant Formula Milk Powder market was valued at $7.47 billion in 2023, anticipated to grow to $13.84 billion by 2033. Increased birth rates coupled with an expanding middle class contribute to this growth outlook.Tell us your focus area and get a customized research report.

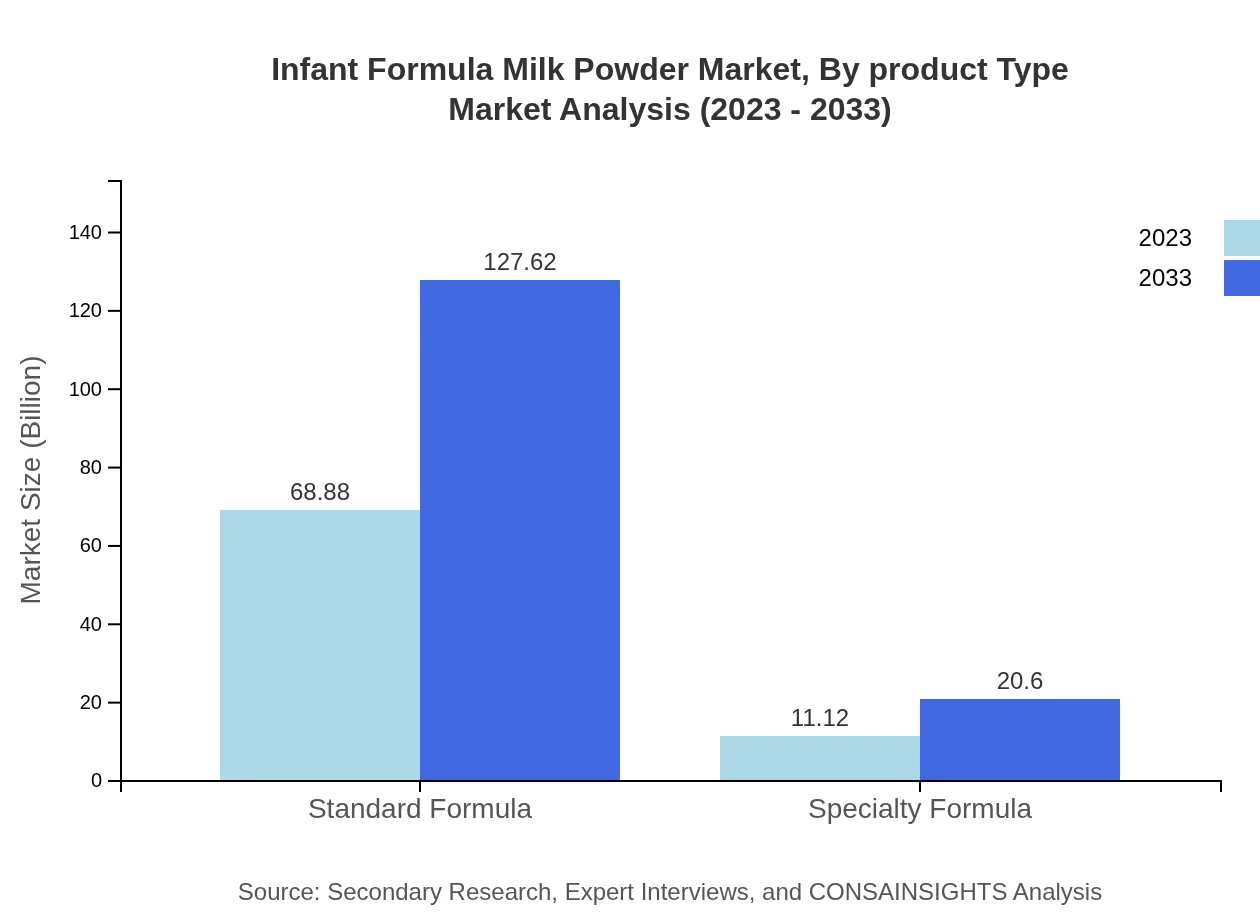

Infant Formula Milk Powder Market Analysis By Product Type

The Infant Formula Milk Powder market is majorly segmented into standard formula, specialty formula, and organic formula. Standard formulas captured around 86.1% market share in 2023, amounting to approximately $68.88 billion, with projections to reach $127.62 billion by 2033. Specialty formulas accounted for 13.9% of the market share, valued at $11.12 billion in 2023, expected to double to approximately $20.60 billion by 2033.

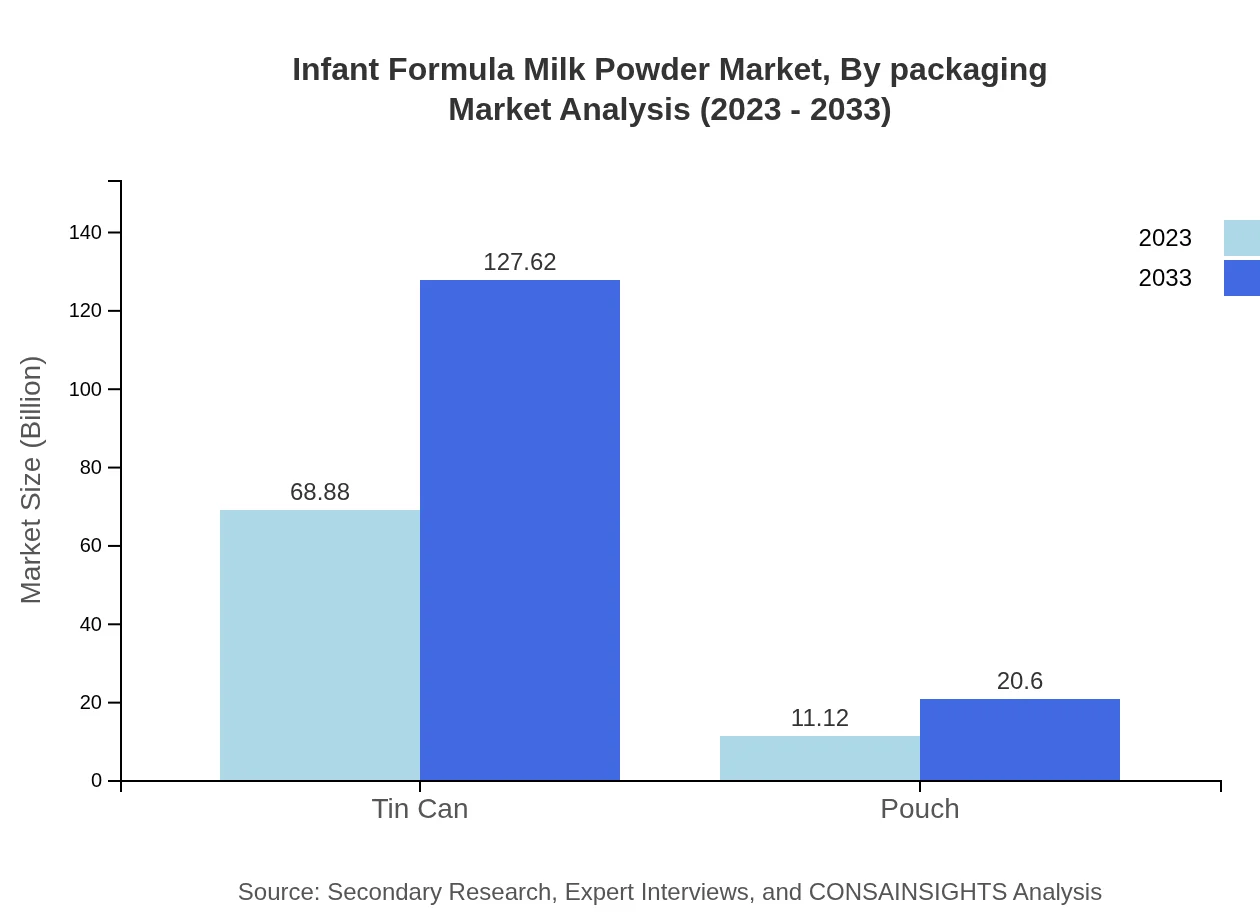

Infant Formula Milk Powder Market Analysis By Packaging

Packaging significantly influences consumer choice within the Infant Formula Milk Powder market. Tin cans dominated the market with a size of $68.88 billion and a steady share of 86.1% in 2023, projected to rise to $127.62 billion by 2033. Pouches represent a growing alternative, holding a 13.9% share, with a market size of $11.12 billion anticipated to grow to $20.60 billion by 2033.

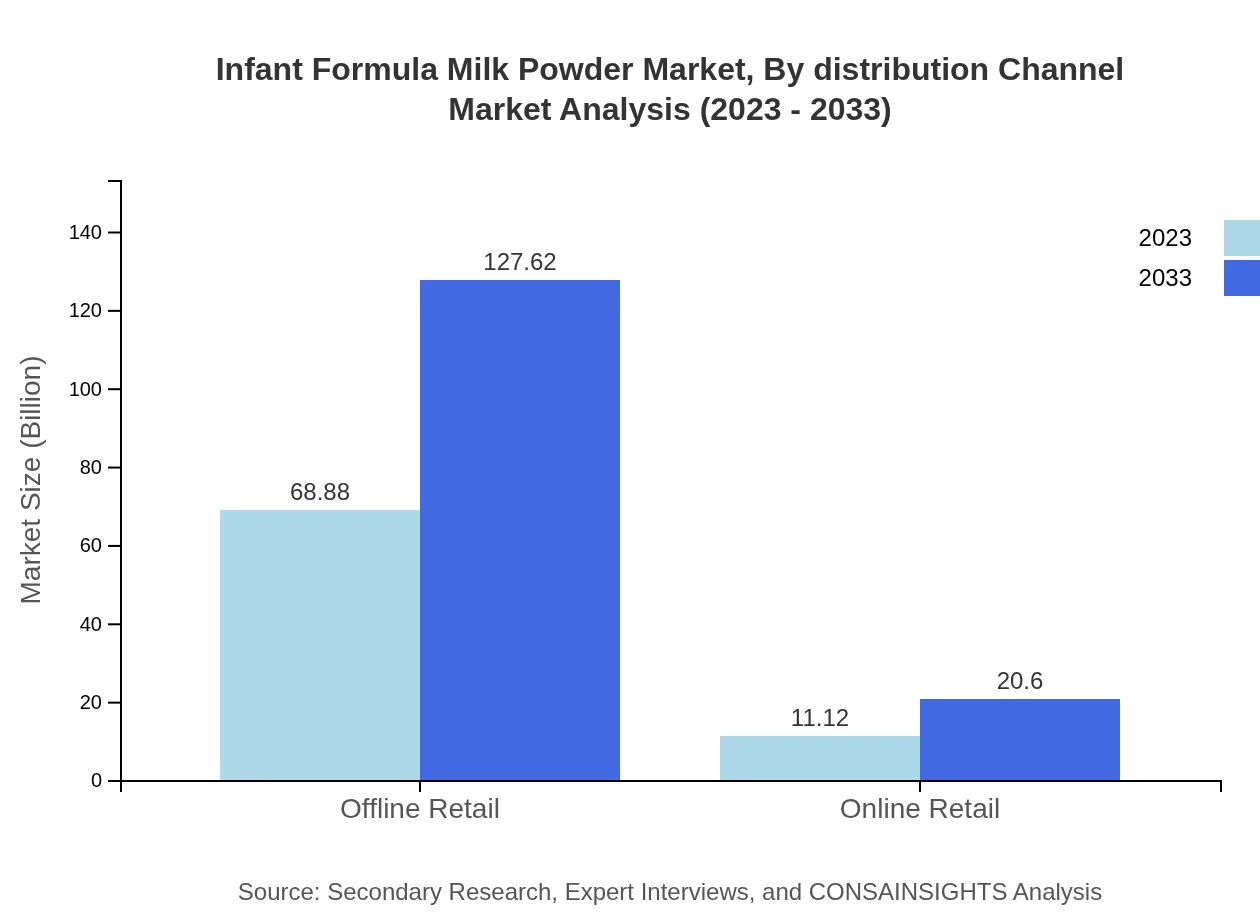

Infant Formula Milk Powder Market Analysis By Distribution Channel

Distribution channels segmentation shows a preference for offline retail which dominated the market at $68.88 billion and held an 86.1% share in 2023. Conversely, online retail is gaining traction, currently valued at $11.12 billion (13.9% share) and expected to grow to $20.60 billion by 2033, emphasizing the shift in consumer shopping behavior.

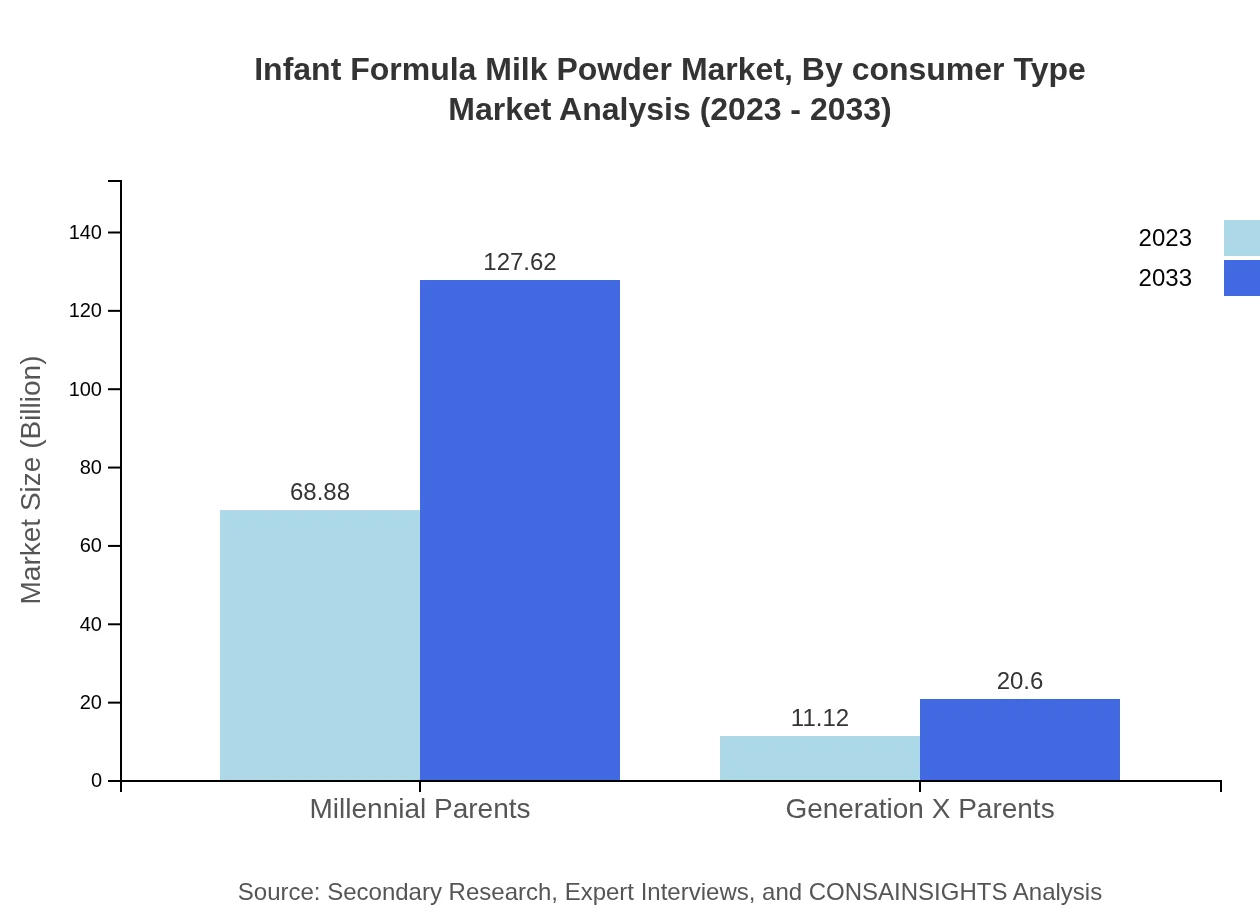

Infant Formula Milk Powder Market Analysis By Consumer Type

Consumer demographics reveal significant insights; millennial parents comprised 86.1% share of the market, valued at $68.88 billion in 2023, forecasted to soar to $127.62 billion by 2033. Generation X parents accounted for a smaller 13.9% share, generating revenue of $11.12 billion, projected to increase to $20.60 billion by 2033.

Infant Formula Milk Powder Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Infant Formula Milk Powder Industry

Nestlé S.A.:

One of the largest food and beverage companies globally, Nestlé offers a wide range of infant formula products focusing on quality and nutritional value.Danone S.A.:

A multinational food-products corporation, Danone specializes in dairy and provides various infant feeding solutions focusing on organic and specialized formulas.Abbott Laboratories:

Abbott is a global healthcare company that produces a variety of nutritional products, including popular infant formulas that cater to health-conscious consumers.Mead Johnson Nutrition Company:

Known for its Enfamil product line, Mead Johnson is a leading provider focusing on scientific research to advance infant nutrition.We're grateful to work with incredible clients.

FAQs

What is the market size of infant Formula Milk Powder?

The global infant formula milk powder market is expected to reach $80 billion by 2033, growing at a CAGR of 6.2%. This growth is fueled by rising birth rates and increased awareness of nutrition.

What are the key market players or companies in this infant formula milk powder industry?

Key players in the infant formula milk powder market include Nestlé, Abbott Laboratories, Danone, and Mead Johnson. These companies dominate due to their established brands, extensive distribution networks, and diverse product offerings.

What are the primary factors driving the growth in the infant formula milk powder industry?

Factors driving growth include increasing consumer preference for formula due to working parents, rising disposable incomes, and growing awareness of nutrient content in infant nutrition. Additionally, innovations in formulations are also contributing to market expansion.

Which region is the fastest Growing in the infant formula milk powder market?

The North America region is the fastest-growing area in the infant formula milk powder market, with projected growth from $28.78 billion in 2023 to $53.32 billion by 2033, driven by strong demand in the U.S. and Canada.

Does ConsaInsights provide customized market report data for the infant formula milk powder industry?

Yes, ConsaInsights offers customized market report data tailored to specific client requirements in the infant formula milk powder industry. This includes insights on market size, trends, and competitive analysis.

What deliverables can I expect from this infant formula milk powder market research project?

Deliverables from this market research project include a comprehensive report, detailed market analysis, segment data, growth forecasts, competitive landscape assessment, and tailored recommendations for strategy development.

What are the market trends of infant formula milk powder?

Current trends in the infant formula milk powder market include an increase in organic product offerings, heightened focus on sustainability, and technological advancements in product formulation, alongside greater transparency in ingredient sourcing.