Infection Surveillance Solutions Market Report

Published Date: 31 January 2026 | Report Code: infection-surveillance-solutions

Infection Surveillance Solutions Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Infection Surveillance Solutions market from 2023 to 2033, covering market size, growth trends, regional insights, industry dynamics, and key players in the industry.

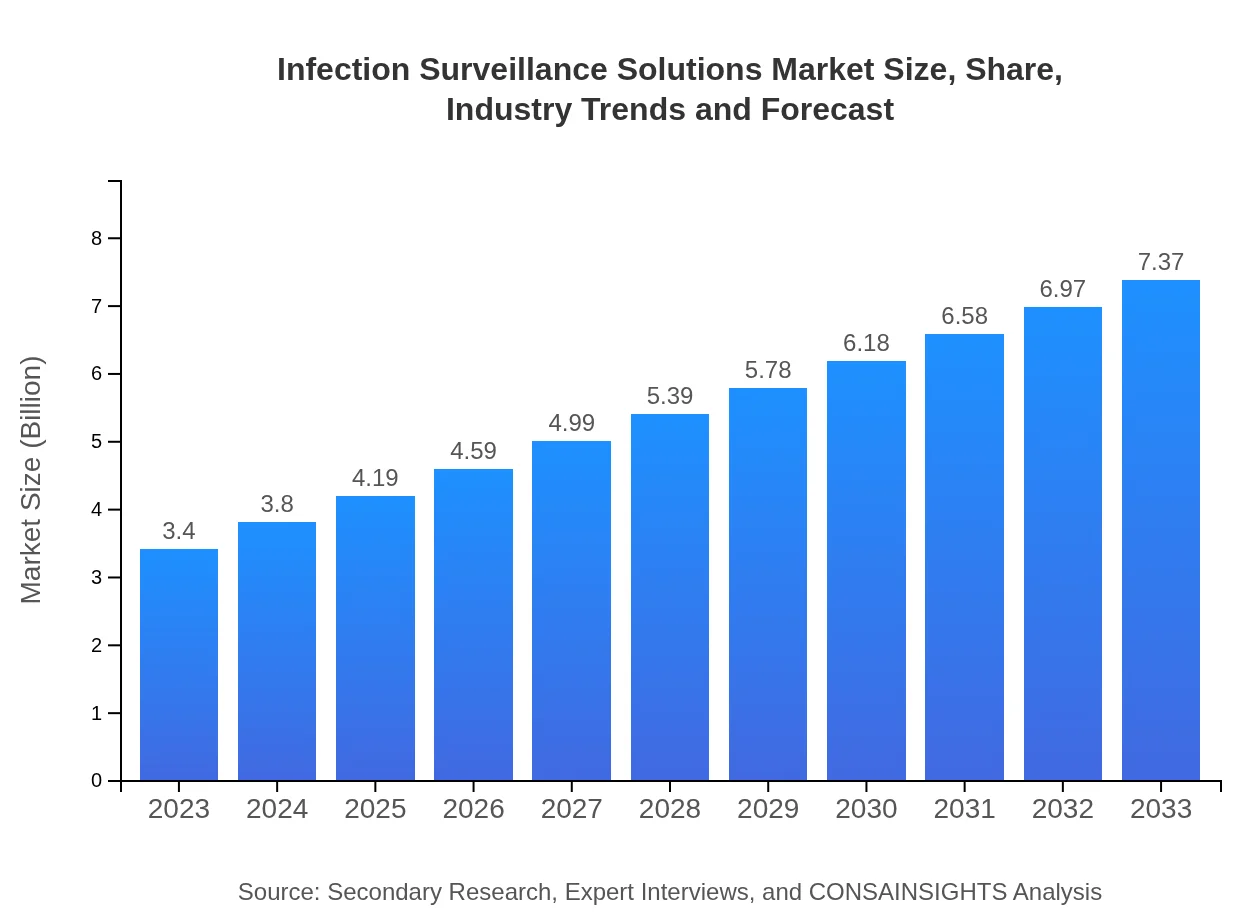

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $3.40 Billion |

| CAGR (2023-2033) | 7.8% |

| 2033 Market Size | $7.37 Billion |

| Top Companies | Cerner Corporation, Mediware Information Systems, Inc., Johnson & Johnson, Premier, Inc. |

| Last Modified Date | 31 January 2026 |

Infection Surveillance Solutions Market Overview

Customize Infection Surveillance Solutions Market Report market research report

- ✔ Get in-depth analysis of Infection Surveillance Solutions market size, growth, and forecasts.

- ✔ Understand Infection Surveillance Solutions's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Infection Surveillance Solutions

What is the Market Size & CAGR of Infection Surveillance Solutions market in 2023?

Infection Surveillance Solutions Industry Analysis

Infection Surveillance Solutions Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Infection Surveillance Solutions Market Analysis Report by Region

Europe Infection Surveillance Solutions Market Report:

In Europe, the market is anticipated to grow from $1.06 billion in 2023 to $2.30 billion by 2033. The focus on enhancing healthcare quality and patient safety through effective infection control policies is driving this growth, coupled with a supportive regulatory environment.Asia Pacific Infection Surveillance Solutions Market Report:

The Asia Pacific region is experiencing notable growth with a market size expected to increase from $0.70 billion in 2023 to $1.53 billion by 2033. Factors such as rising healthcare expenditures, an increase in awareness of infection control measures, and growing investments in healthcare infrastructure are propelling this growth.North America Infection Surveillance Solutions Market Report:

North America holds a significant share of the Infection Surveillance Solutions market, with its size projected to expand from $1.11 billion in 2023 to $2.40 billion in 2033. This growth is largely fueled by stringent regulations regarding infection control and a high prevalence of HAIs, along with advanced technological adoption in healthcare facilities.South America Infection Surveillance Solutions Market Report:

In South America, the Infection Surveillance Solutions market is forecasted to grow from $0.27 billion in 2023 to $0.60 billion by 2033. Increased healthcare budgets and initiatives to improve public health systems are driving the market, though challenges such as economic instability may temper growth rates.Middle East & Africa Infection Surveillance Solutions Market Report:

The Middle East and Africa region is expected to see growth from $0.25 billion in 2023 to $0.55 billion by 2033. Factors such as rising healthcare investments, governmental support for healthcare technology, and increased awareness surrounding infection management contribute to this growth, despite existing socio-economic challenges.Tell us your focus area and get a customized research report.

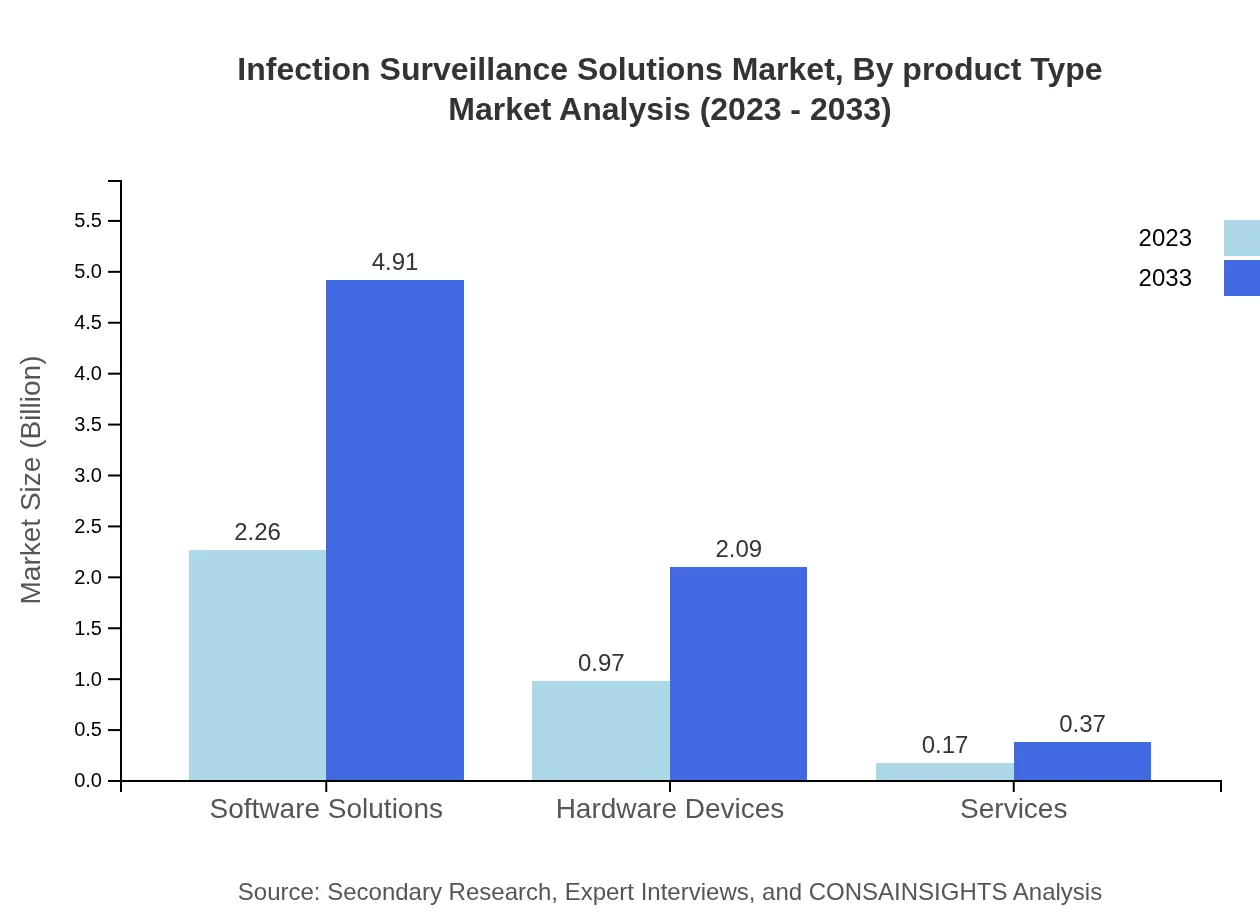

Infection Surveillance Solutions Market Analysis By Product Type

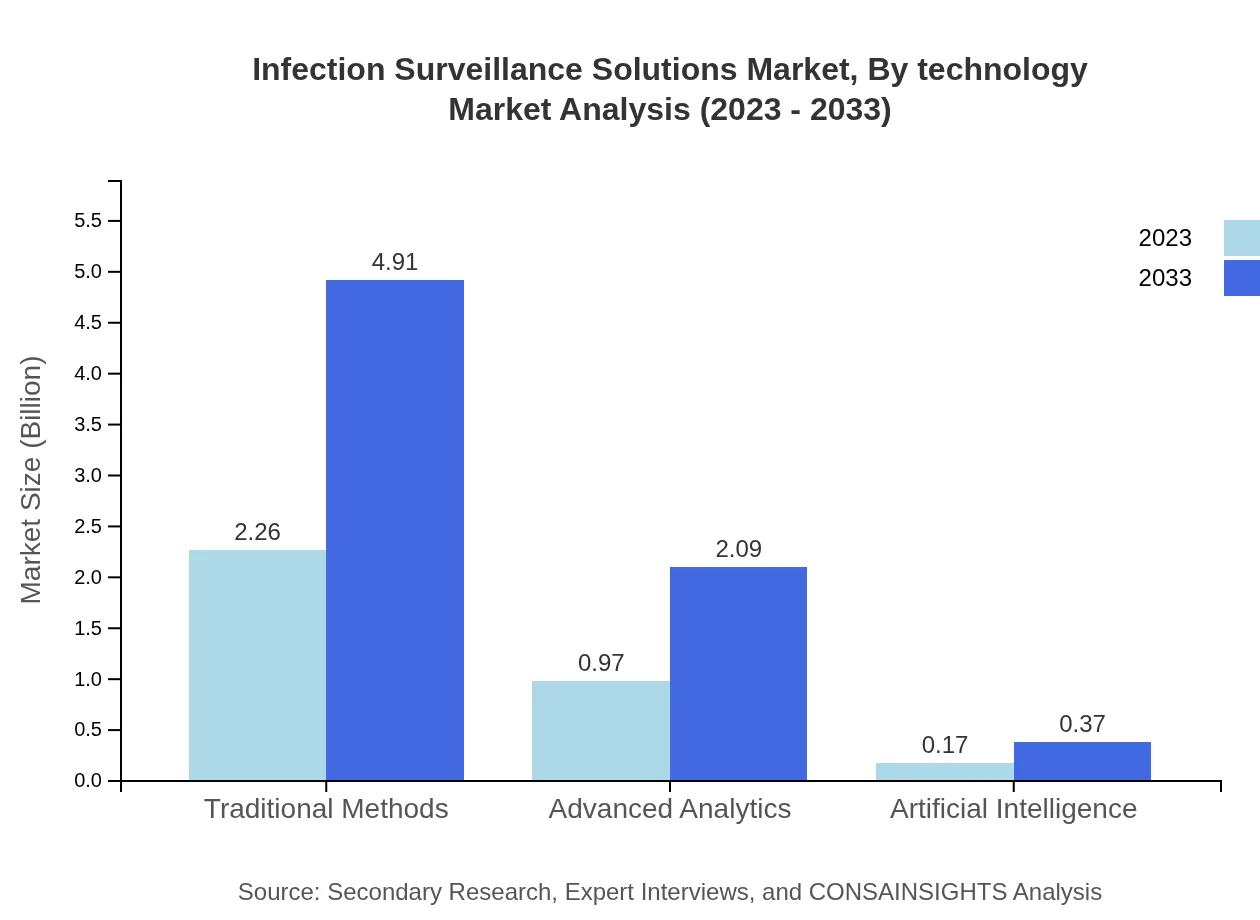

The product type segment reveals dominance in software solutions, representing $2.26 billion in 2023 and maintaining a market share of 66.58% through 2033. Hardware devices and services also share the spotlight, with expected revenues of $0.97 billion and $0.17 billion, respectively. Software solutions provide essential analytics and reporting features that are crucial for effective infection surveillance.

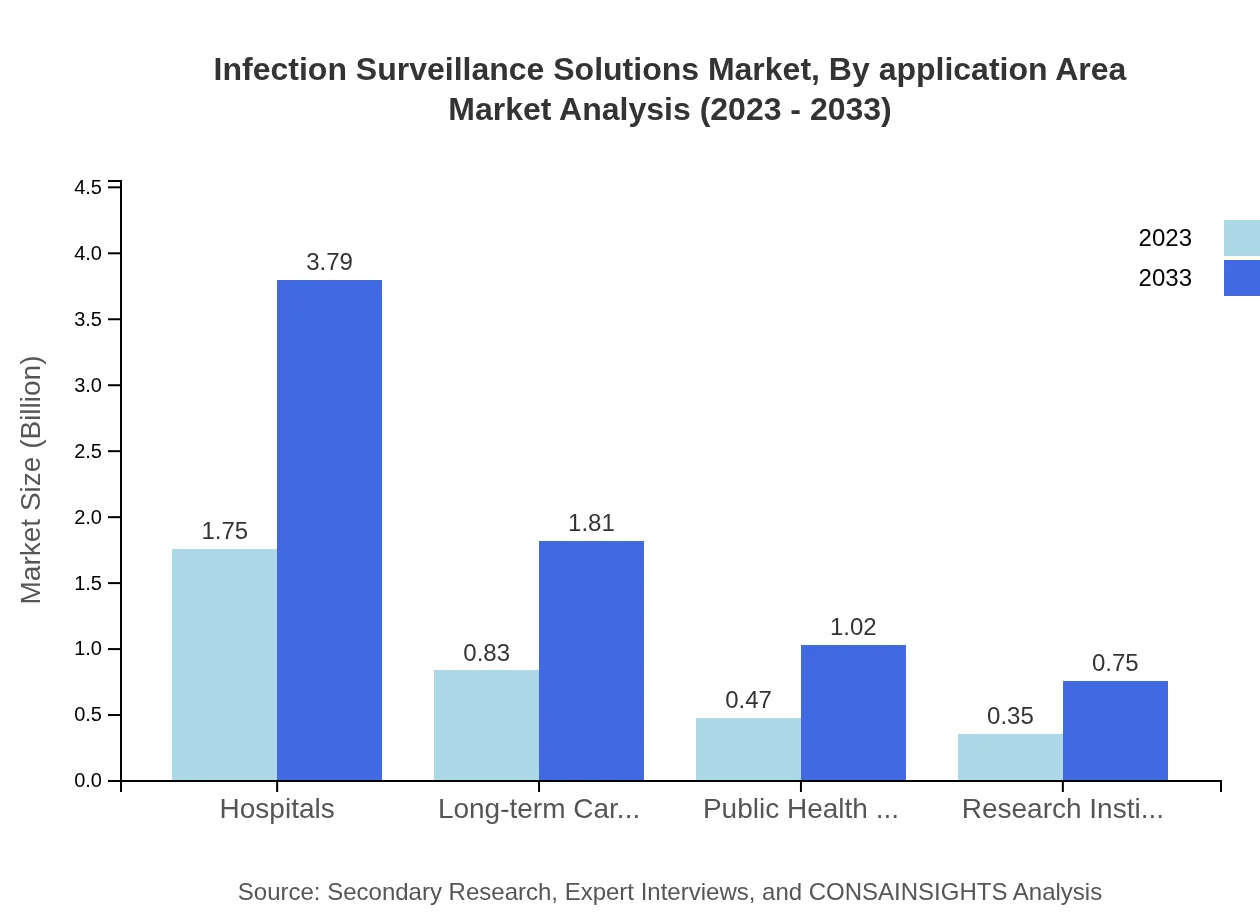

Infection Surveillance Solutions Market Analysis By Application Area

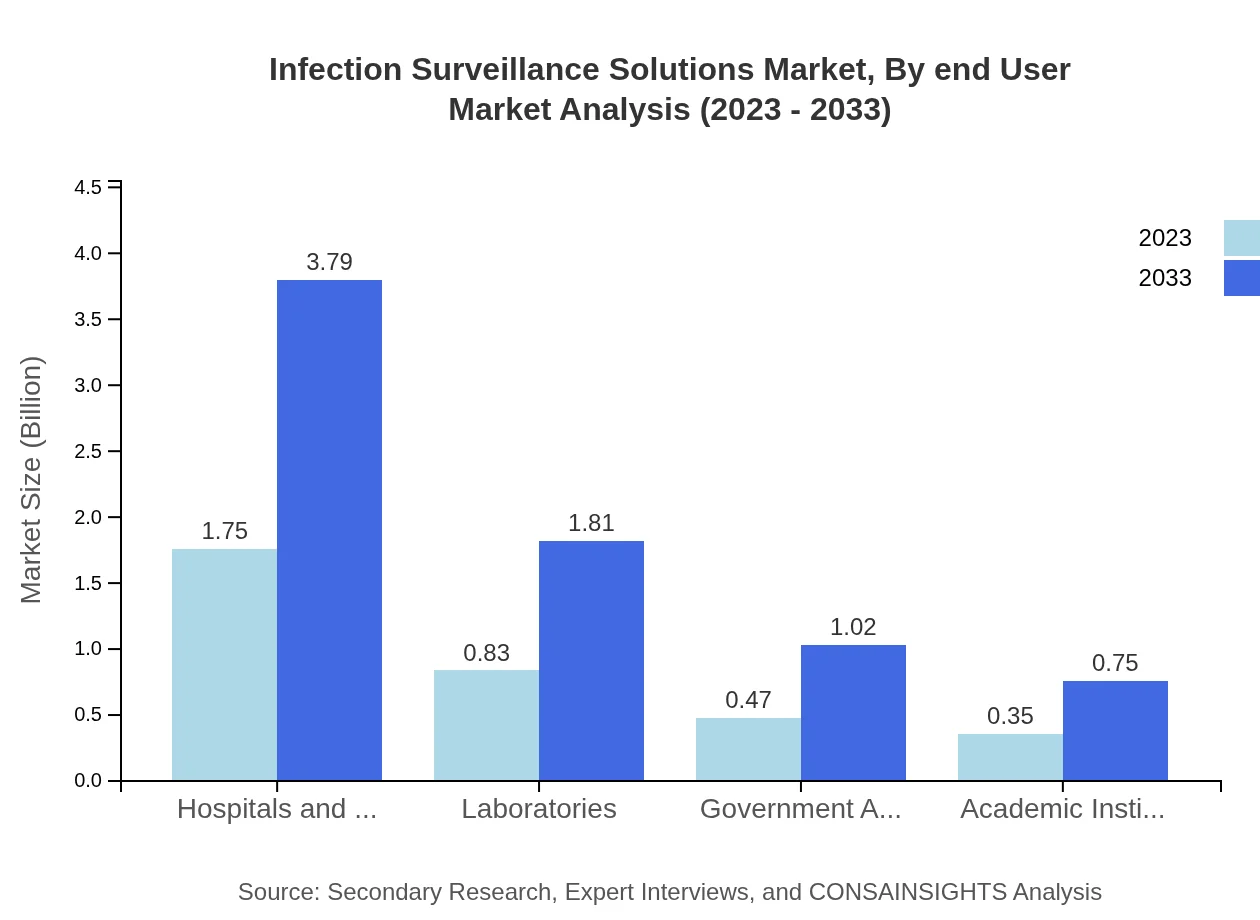

Hospitals and clinics are the primary users of infection surveillance solutions, with growth from $1.75 billion in 2023 to $3.79 billion by 2033. Long-term care facilities and public health agencies are also notable segments, aiming to enhance their infection control protocols and patient safety measures.

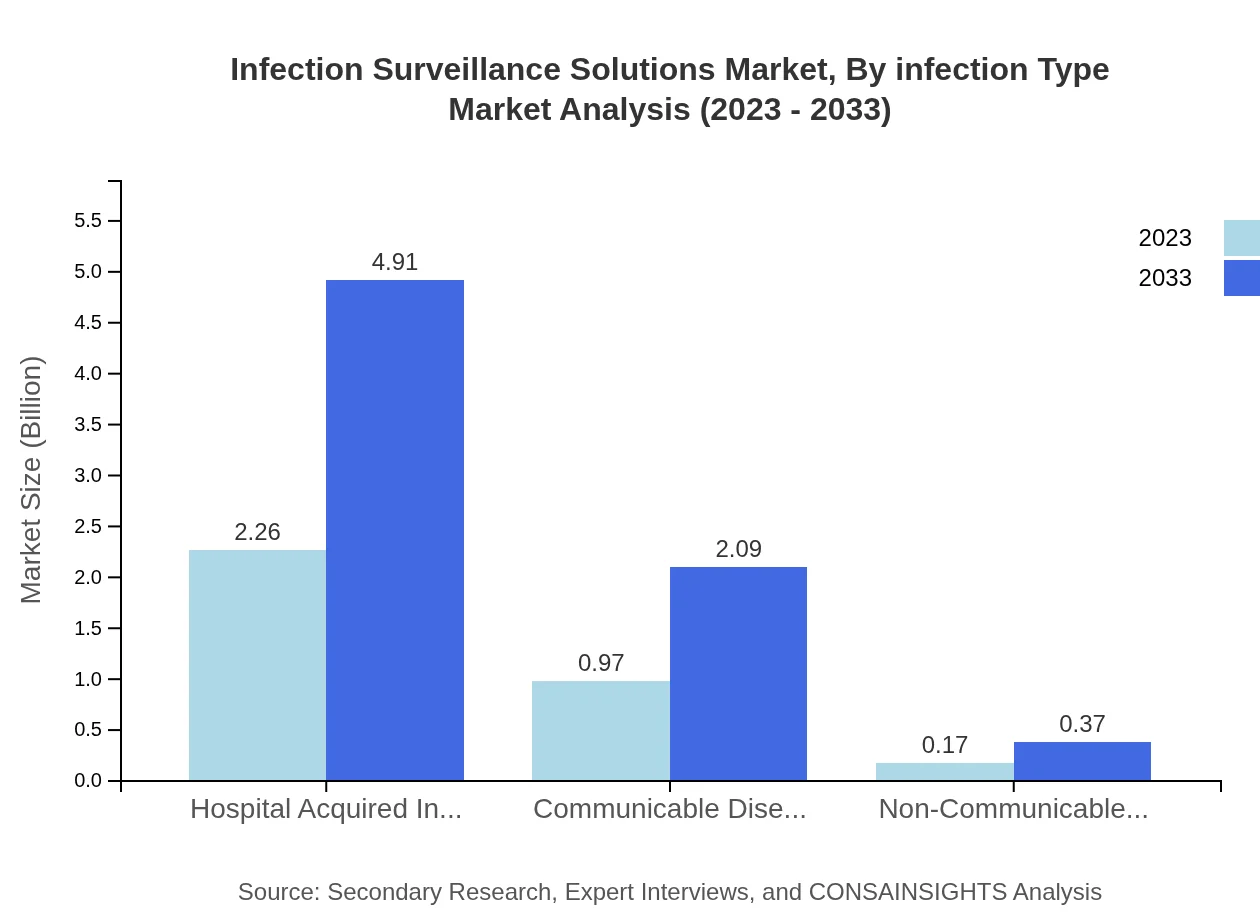

Infection Surveillance Solutions Market Analysis By Infection Type

The market reveals significant attention to hospital-acquired infections (HAIs), projected to reach $2.26 billion by 2033, maintaining a substantial market share. Communicable diseases and non-communicable infections also require tailored surveillance measures, reflecting the diverse applications of these solutions.

Infection Surveillance Solutions Market Analysis By End User

Hospitals are the largest end-users of infection surveillance solutions, with a forecasted market value of $3.79 billion by 2033. Engagement from laboratories and academic institutions is also crucial, gradually increasing their roles in facilitating advanced infection monitoring techniques.

Infection Surveillance Solutions Market Analysis By Technology

The integration of advanced analytics holds a significant share, expected to grow from $0.97 billion in 2023 to $2.09 billion by 2033. Traditional methods still play a role but are eclipsed by tech-driven innovations, indicating a shift towards more efficient, data-driven solutions in infection surveillance.

Infection Surveillance Solutions Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Infection Surveillance Solutions Industry

Cerner Corporation:

A leading health information technology company that provides innovative solutions for hospitals and healthcare providers to enhance infection control and management.Mediware Information Systems, Inc.:

Specializes in healthcare software solutions, including infection surveillance tools that help healthcare organizations to monitor and prevent infections effectively.Johnson & Johnson:

A global leader in medical devices, pharmaceuticals, and consumer health products, recognized for its contributions to infection prevention through various training programs and products.Premier, Inc.:

A healthcare improvement company that provides solutions and data analytics to enhance infection control and mitigation in hospital settings.We're grateful to work with incredible clients.

FAQs

What is the market size of infection Surveillance Solutions?

The infection surveillance solutions market is projected to reach $3.4 billion by 2033, growing at a CAGR of 7.8% from 2023. This growth reflects rising healthcare needs and advancements in surveillance technology.

What are the key market players or companies in this infection Surveillance Solutions industry?

Key players in the infection surveillance solutions market include established health technology firms, software developers, and analytics companies. Prominent names in this sector enhance their offerings through innovative solutions tailored for hospitals and healthcare providers.

What are the primary factors driving the growth in the infection Surveillance Solutions industry?

Growth in the infection surveillance solutions industry is driven by increasing incidences of hospital-acquired infections, regulatory pressures for healthcare standards, and technological advancements. Enhanced data reporting and analytics capabilities are also contributing significantly to market expansion.

Which region is the fastest Growing in the infection Surveillance Solutions?

Asia Pacific is the fastest-growing region in the infection surveillance solutions market, expanding from $0.70 billion in 2023 to $1.53 billion by 2033. The region's focus on improving healthcare and infection control practices fuels this rapid growth.

Does ConsaInsights provide customized market report data for the infection Surveillance Solutions industry?

Yes, ConsaInsights offers customized market report data tailored to client specifications. Clients can request specific insights, segmentations, and regional analyses, ensuring they receive the relevant information to support decision-making.

What deliverables can I expect from this infection Surveillance Solutions market research project?

Clients can expect detailed market analyses, segmentation reports, competitive landscapes, and regional growth forecasts as deliverables. These insights are designed for strategic planning and understanding market dynamics within the infection surveillance sector.

What are the market trends of infection Surveillance Solutions?

Market trends include a shift towards advanced analytics, integration of AI technologies, and a growing preference for software solutions in infection control. Moreover, investment in healthcare infrastructure is fostering innovation in surveillance practices.