Infectious Disease Diagnostics Market Report

Published Date: 31 January 2026 | Report Code: infectious-disease-diagnostics

Infectious Disease Diagnostics Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Infectious Disease Diagnostics market, including market size, growth forecasts, industry trends, and key player insights from 2023 to 2033.

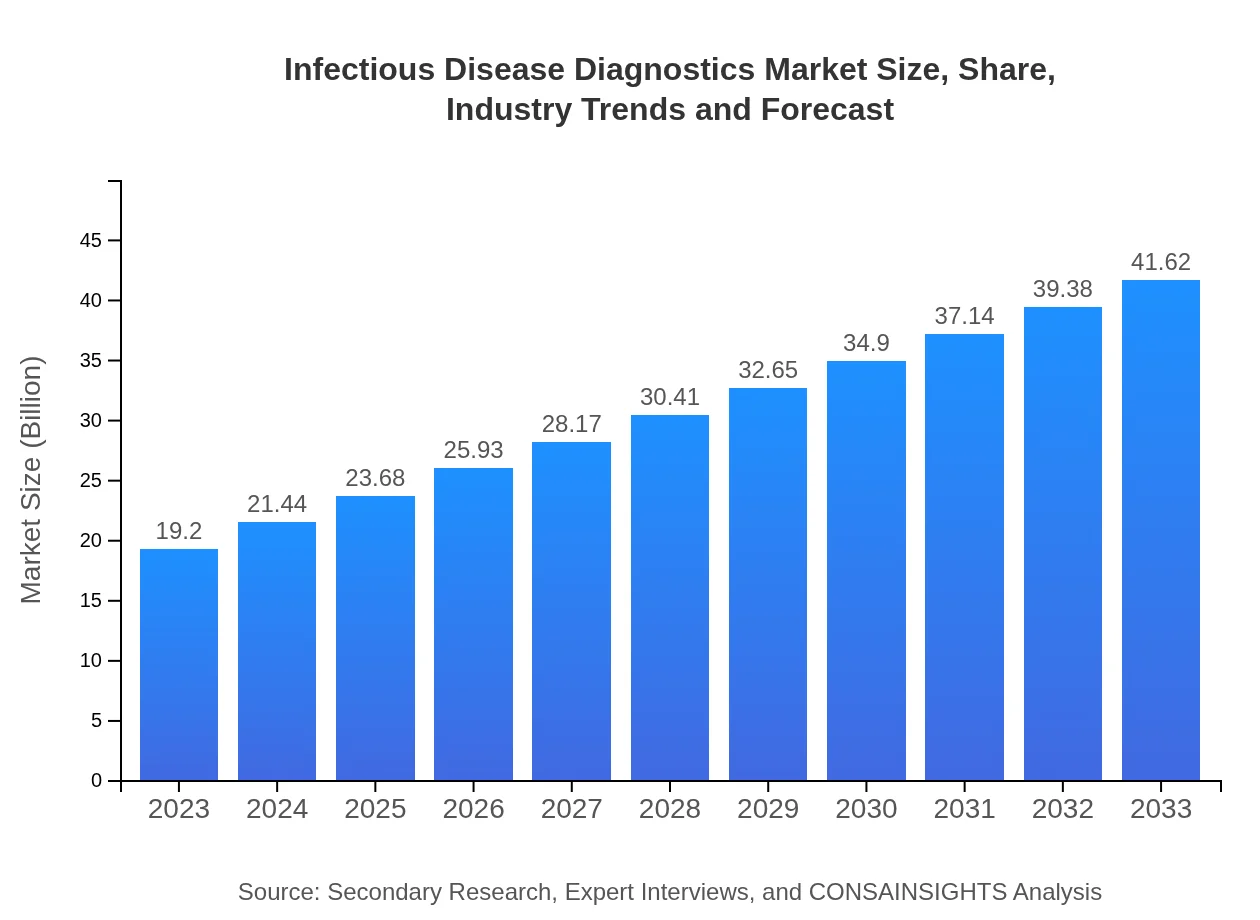

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $19.20 Billion |

| CAGR (2023-2033) | 7.8% |

| 2033 Market Size | $41.62 Billion |

| Top Companies | Roche Diagnostics, Abbott Laboratories, Thermo Fisher Scientific, Siemens Healthineers |

| Last Modified Date | 31 January 2026 |

Infectious Disease Diagnostics Market Overview

Customize Infectious Disease Diagnostics Market Report market research report

- ✔ Get in-depth analysis of Infectious Disease Diagnostics market size, growth, and forecasts.

- ✔ Understand Infectious Disease Diagnostics's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Infectious Disease Diagnostics

What is the Market Size & CAGR of Infectious Disease Diagnostics market in 2023?

Infectious Disease Diagnostics Industry Analysis

Infectious Disease Diagnostics Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Infectious Disease Diagnostics Market Analysis Report by Region

Europe Infectious Disease Diagnostics Market Report:

Europe's market is estimated to grow from $5.45 billion in 2023 to $11.82 billion in 2033, facilitated by robust regulatory frameworks and a heightened focus on disease surveillance and control.Asia Pacific Infectious Disease Diagnostics Market Report:

In Asia Pacific, the market size is projected to reach $8.49 billion by 2033 from $3.91 billion in 2023, driven by rising healthcare expenditure and technological innovations in diagnostics.North America Infectious Disease Diagnostics Market Report:

North America held a market size of $6.80 billion in 2023, anticipated to increase to $14.74 billion by 2033, as a result of advanced healthcare systems and significant investments in research and development.South America Infectious Disease Diagnostics Market Report:

The South American market is expected to grow from $0.43 billion in 2023 to $0.92 billion by 2033, supported by increasing awareness of infectious diseases and improvements in healthcare infrastructure.Middle East & Africa Infectious Disease Diagnostics Market Report:

The Middle East and Africa market is poised to increase from $2.61 billion in 2023 to $5.65 billion by 2033, driven by rising awareness of infectious diseases and expanded access to diagnostic technologies.Tell us your focus area and get a customized research report.

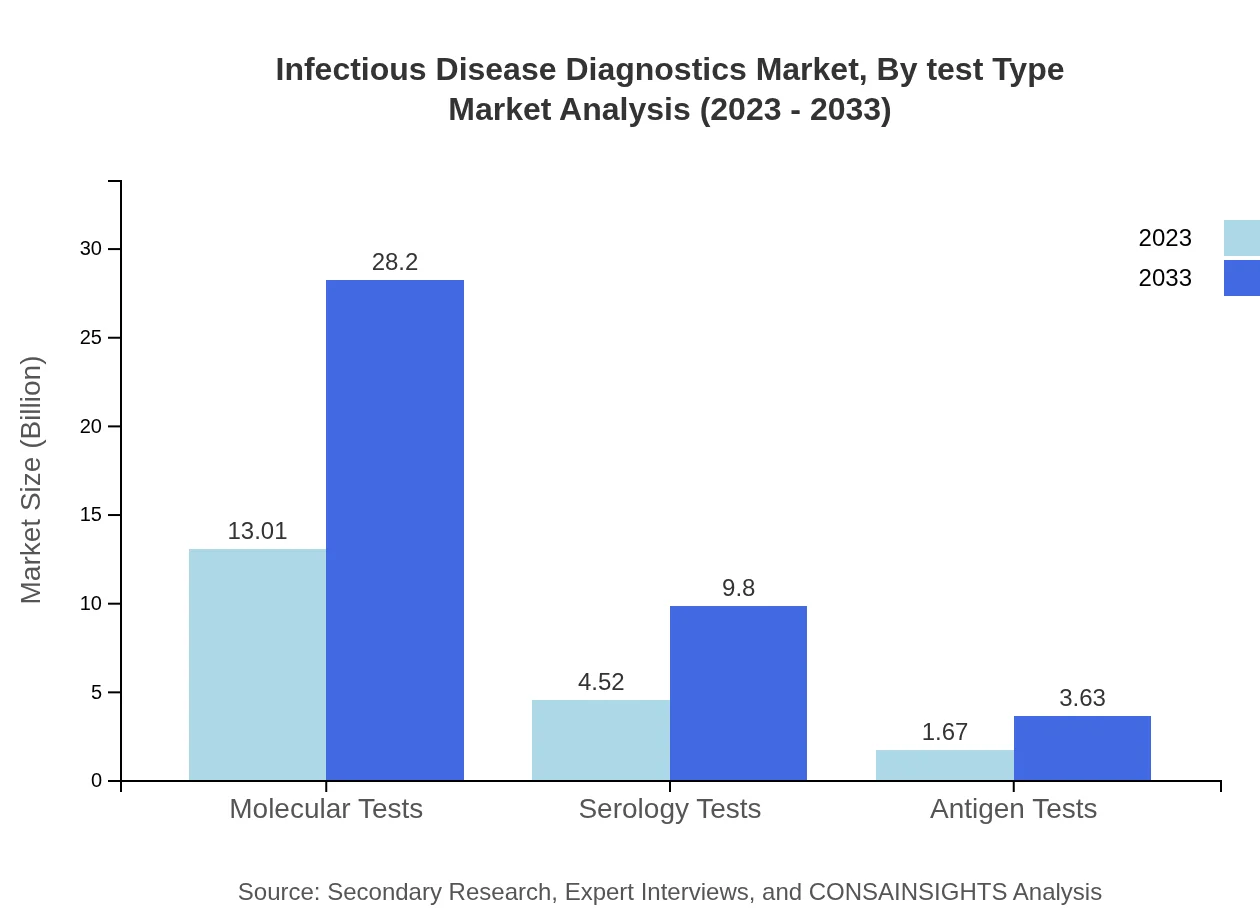

Infectious Disease Diagnostics Market Analysis By Test Type

The Infectious Disease Diagnostics Market, By Test Type, illustrates a significant emphasis on molecular tests, accounting for $13.01 billion in 2023 and forecasted to double to $28.20 billion by 2033. Serology tests will also see growth from $4.52 billion to $9.80 billion, indicating a steady reliance on both molecular diagnostics and immunoassays.

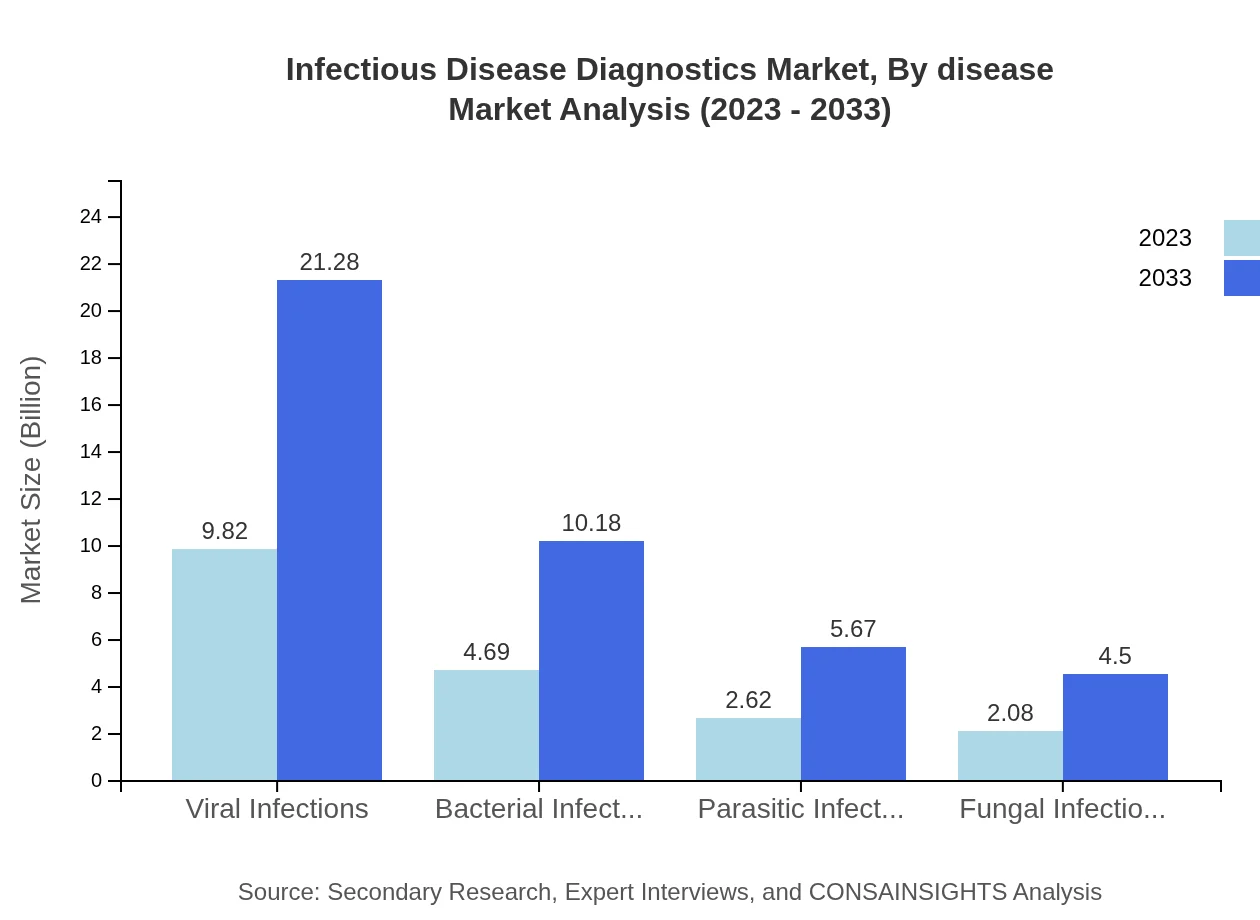

Infectious Disease Diagnostics Market Analysis By Disease

The market size for viral infections is expected to grow from $9.82 billion in 2023 to $21.28 billion by 2033. Bacterial infections and parasitic infections are predicted to follow suit, with market sizes increasing from $4.69 billion to $10.18 billion and from $2.62 billion to $5.67 billion respectively.

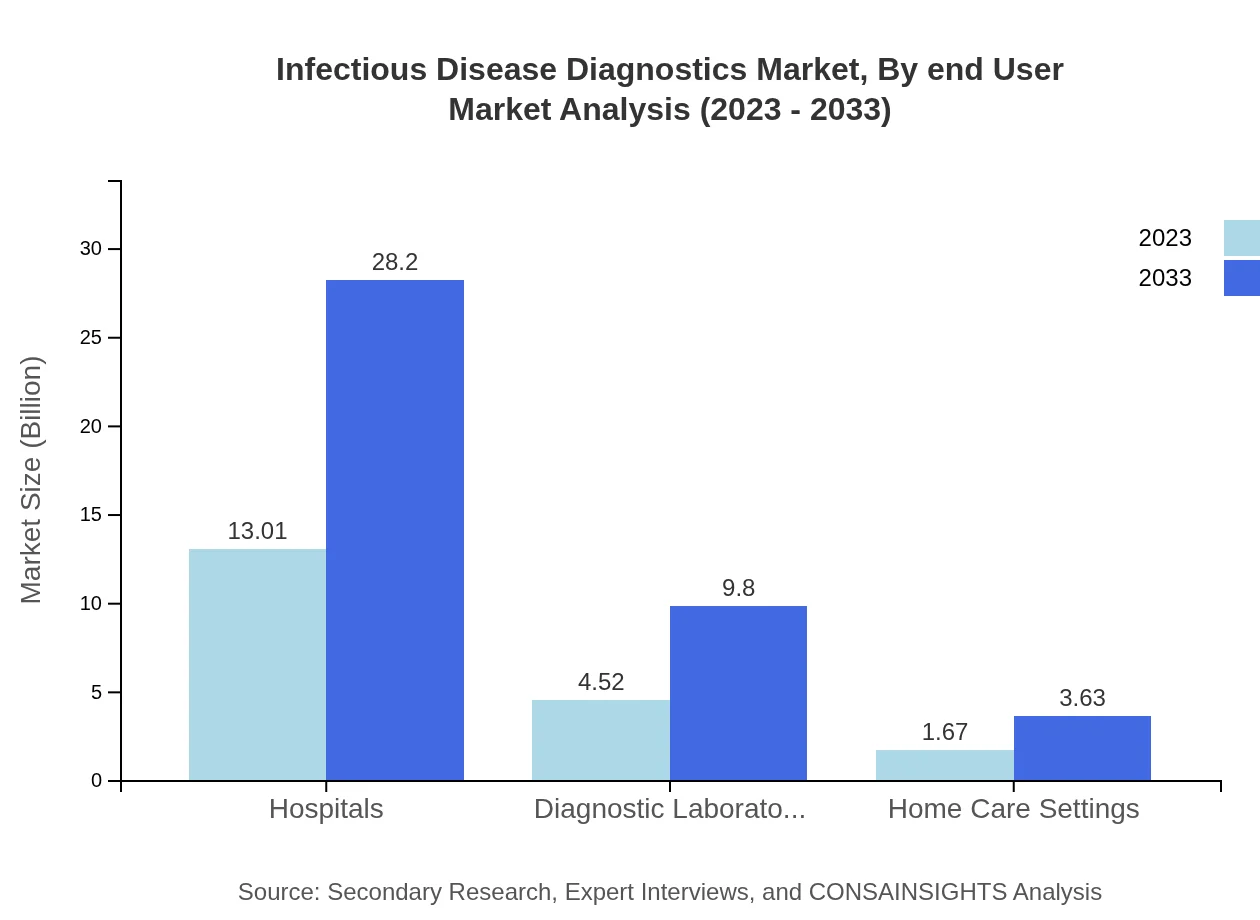

Infectious Disease Diagnostics Market Analysis By End User

Hospitals dominate the market with a size of $13.01 billion in 2023 and are projected to grow to $28.20 billion by 2033. Diagnostic laboratories are also significant players, growing from $4.52 billion to $9.80 billion, showcasing the importance of laboratory services in disease diagnostics.

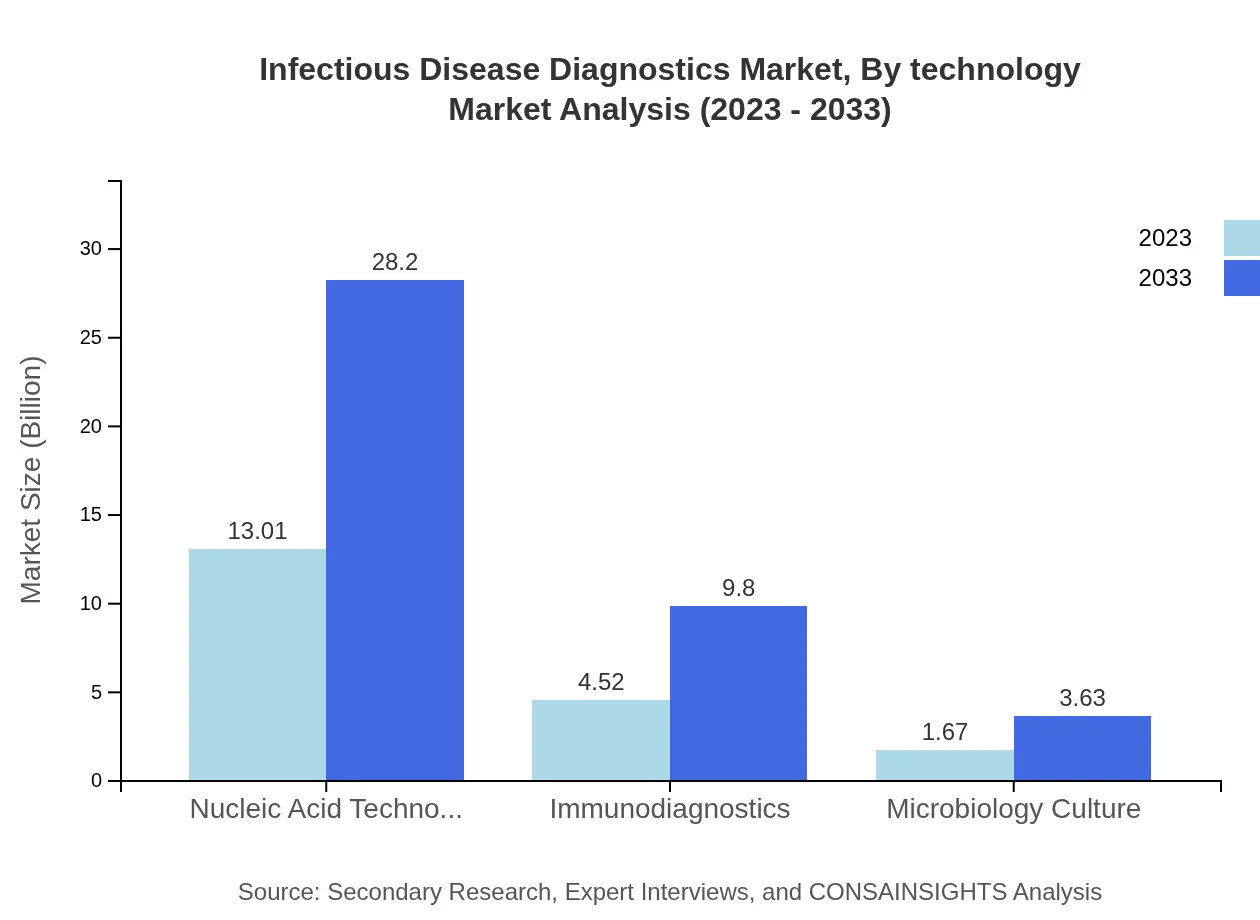

Infectious Disease Diagnostics Market Analysis By Technology

Nucleic acid technology leads the market with a size expected to rise from $13.01 billion in 2023 to $28.20 billion in 2033. Meanwhile, immunodiagnostics will significantly contribute, expanding from $4.52 billion to $9.80 billion.

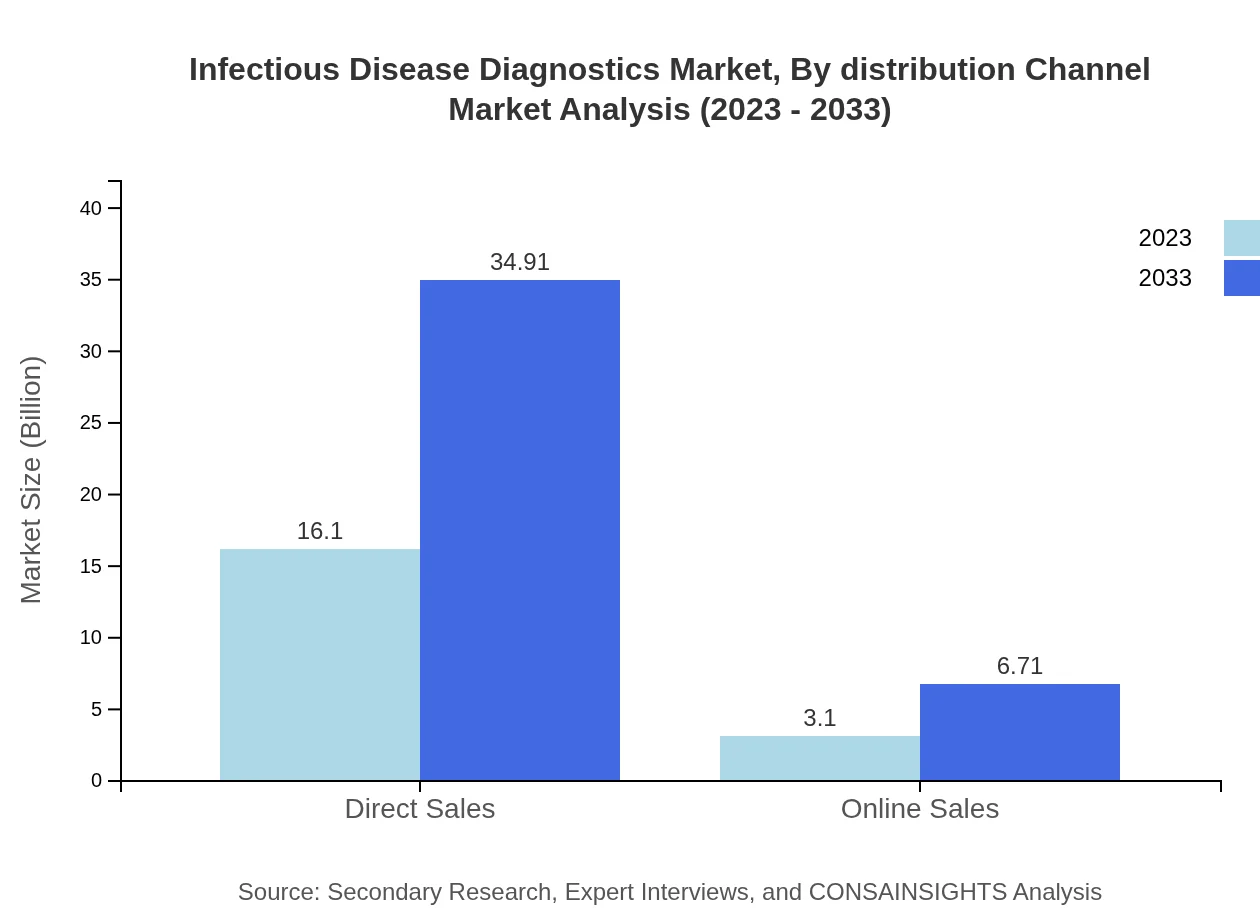

Infectious Disease Diagnostics Market Analysis By Distribution Channel

Direct sales account for a significant market share, increasing from $16.10 billion in 2023 to $34.91 billion by 2033. Online sales are also expected to climb from $3.10 billion to $6.71 billion, reflecting shifting consumer preferences towards online purchasing.

Infectious Disease Diagnostics Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Infectious Disease Diagnostics Industry

Roche Diagnostics:

A leader in diagnostic solutions, Roche offers an extensive range of tests and procedures for infectious diseases, focusing on rapid diagnostics.Abbott Laboratories:

Known for innovative diagnostic products, Abbott focuses on providing advanced molecular diagnostics and serological tests for a wide range of infectious diseases.Thermo Fisher Scientific:

Provides a broad portfolio of diagnostic solutions emphasizing advanced and comprehensive testing technologies in infectious disease diagnostics.Siemens Healthineers:

Specializes in integrated diagnostics solutions, offering an array of testing technologies and analytics for better patient outcomes.We're grateful to work with incredible clients.

FAQs

What is the market size of infectious Disease Diagnostics?

The infectious disease diagnostics market is valued at approximately $19.2 billion in 2023, with a projected CAGR of 7.8% from 2023 to 2033, highlighting significant growth in this crucial healthcare segment.

What are the key market players or companies in this infectious Disease Diagnostics industry?

Key players in the infectious disease diagnostics market include leading companies like Abbott Laboratories, Roche Diagnostics, Siemens Healthineers, Danaher Corporation, and Becton Dickinson. These firms drive innovation and market expansion, contributing significantly to the industry's growth.

What are the primary factors driving the growth in the infectious Disease Diagnostics industry?

Growth in this market is driven by factors including the rising prevalence of infectious diseases, advancements in diagnostic technologies, increased healthcare expenditure, and growing awareness of early detection methodologies, fostering a robust demand for effective diagnostics.

Which region is the fastest Growing in the infectious Disease Diagnostics?

The Asia Pacific region is forecasted to be the fastest-growing market for infectious disease diagnostics, with an increase from $3.91 billion in 2023 to $8.49 billion by 2033, driven by improving healthcare infrastructure and rising disease prevalence.

Does ConsaInsights provide customized market report data for the infectious Disease Diagnostics industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs in the infectious disease diagnostics industry, enabling clients to access detailed insights that meet their unique research requirements.

What deliverables can I expect from this infectious Disease Diagnostics market research project?

From this market research project, clients can expect comprehensive deliverables such as detailed market analysis reports, regional growth assessments, competitive landscape insights, segment-wise data breakdowns, and actionable business recommendations.

What are the market trends of infectious Disease Diagnostics?

Market trends include a shift towards molecular diagnostics, growth in point-of-care testing, increasing adoption of automation in laboratories, and a focus on rapid testing methods, significantly influencing the infectious disease diagnostics landscape.