Infertility Drugs Market Report

Published Date: 31 January 2026 | Report Code: infertility-drugs

Infertility Drugs Market Size, Share, Industry Trends and Forecast to 2033

This report explores the Infertility Drugs market, providing insights into its size, growth trends, and forecasts from 2023 to 2033, along with analyses of industry performance and leading players.

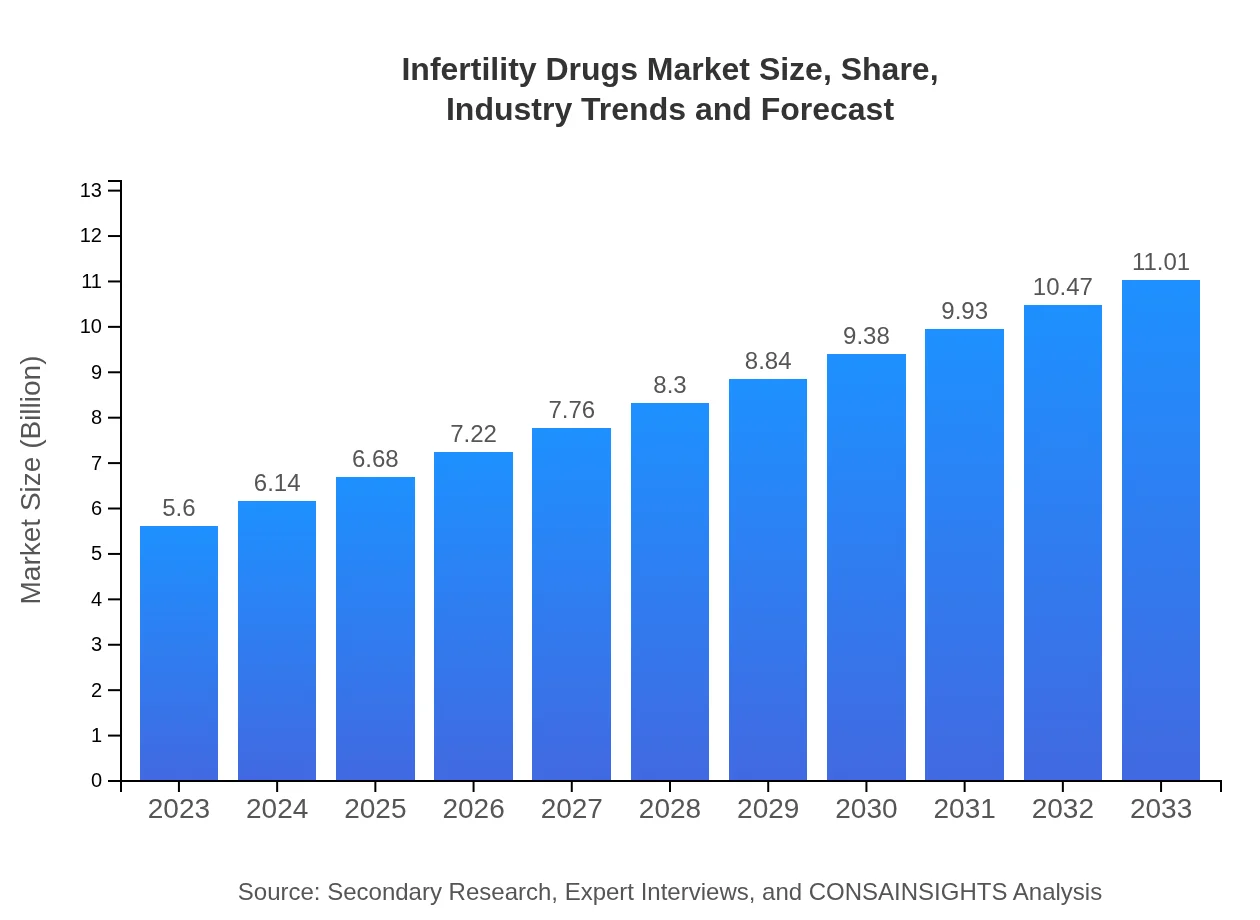

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.60 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $11.01 Billion |

| Top Companies | Merck KGaA, Ferring Pharmaceuticals, Bristol-Myers Squibb, Teva Pharmaceuticals, AbbVie |

| Last Modified Date | 31 January 2026 |

Infertility Drugs Market Overview

Customize Infertility Drugs Market Report market research report

- ✔ Get in-depth analysis of Infertility Drugs market size, growth, and forecasts.

- ✔ Understand Infertility Drugs's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Infertility Drugs

What is the Market Size & CAGR of the Infertility Drugs market in 2023?

Infertility Drugs Industry Analysis

Infertility Drugs Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Infertility Drugs Market Analysis Report by Region

Europe Infertility Drugs Market Report:

In Europe, the market is expected to increase from 1.96 billion USD in 2023 to 3.85 billion USD by 2033. The region's established healthcare systems and increased investments in reproductive health solutions are pivotal drivers for this growth.Asia Pacific Infertility Drugs Market Report:

In the Asia Pacific region, the infertility drugs market is projected to grow from 0.96 billion USD in 2023 to 1.89 billion USD by 2033, driven by rising awareness of reproductive health and improving healthcare infrastructure. The increasing prevalence of lifestyle-related infertility is expected to further boost demand for infertility treatments.North America Infertility Drugs Market Report:

North America is set to see its market grow from 1.92 billion USD in 2023 to 3.76 billion USD by 2033. This growth is projected due to the high adoption rate of advanced IVF technologies, significant investment in healthcare research, and higher awareness of fertility treatments among the population.South America Infertility Drugs Market Report:

The South American market is forecasted to increase from 0.52 billion USD in 2023 to 1.03 billion USD in 2033, owing to enhanced access to healthcare facilities and a growing focus on reproductive health initiatives by both governments and private organizations.Middle East & Africa Infertility Drugs Market Report:

The Middle East and Africa region's market, though smaller, is anticipated to grow from 0.24 billion USD in 2023 to 0.47 billion USD by 2033, supported by improving healthcare access and rising awareness about infertility solutions.Tell us your focus area and get a customized research report.

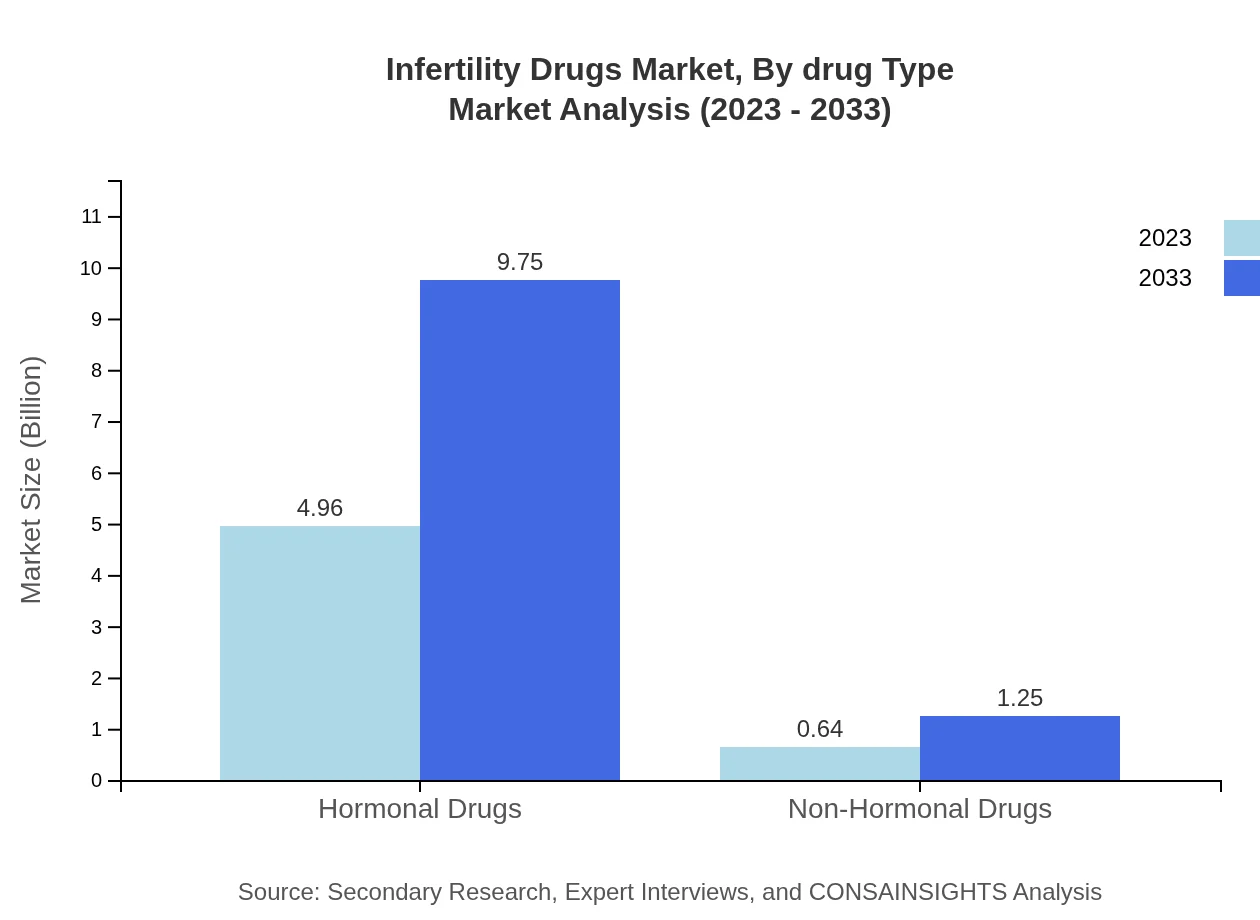

Infertility Drugs Market Analysis By Drug Type

The infertility drugs are primarily segmented into hormonal and non-hormonal types. Hormonal drugs represent a significant share, poised to grow from 4.96 billion USD in 2023 to 9.75 billion USD by 2033, accounting for 88.61% of the market share. Non-hormonal drugs are also gaining traction, with their market size expected to increase from 0.64 billion USD to 1.25 billion USD over the same period, representing 11.39% market share.

Infertility Drugs Market Analysis By Treatment Type

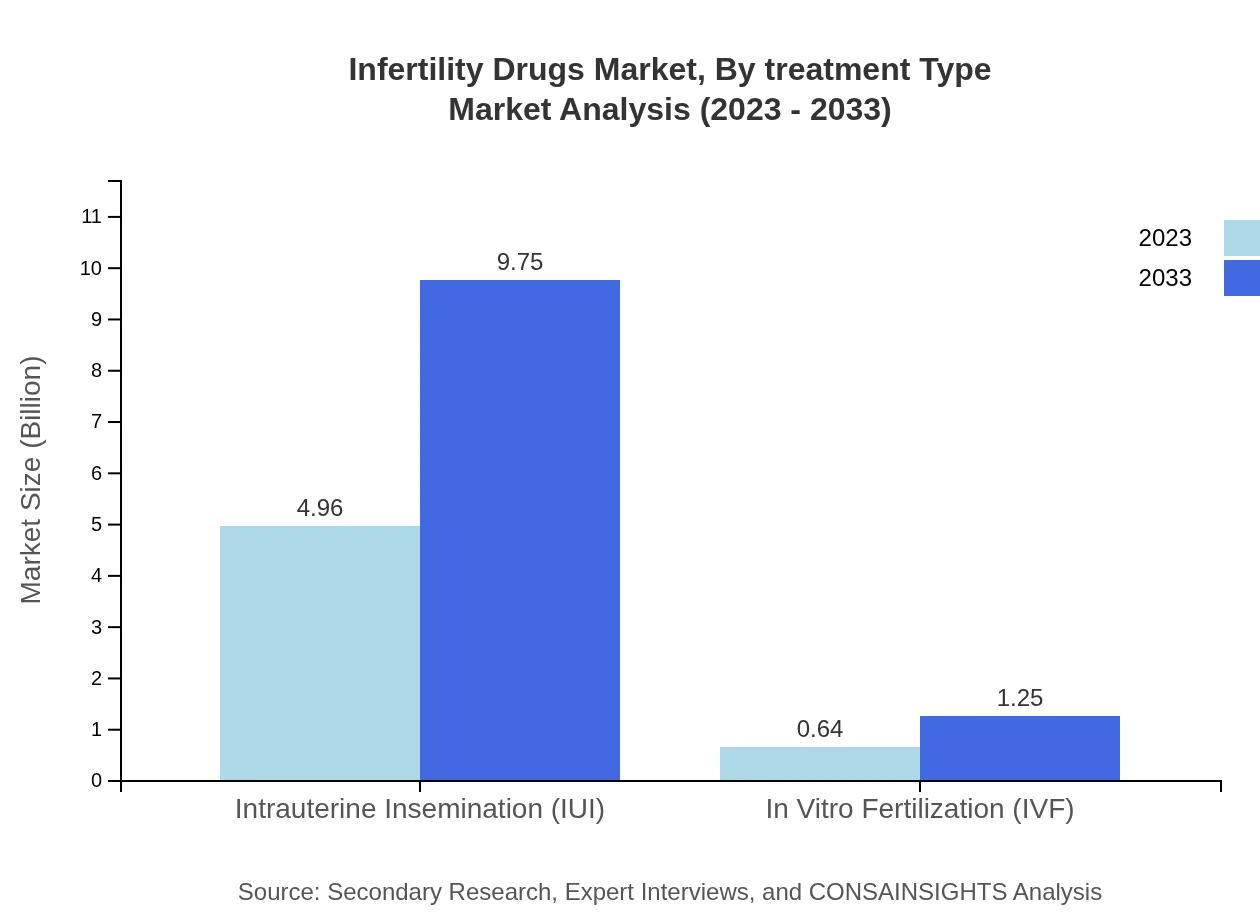

Intrauterine Insemination (IUI) will continue to dominate the market, moving from 4.96 billion USD in 2023 to 9.75 billion USD by 2033, capturing 88.61% of the treatment share. In Vitro Fertilization (IVF) treatment, although smaller, is emerging, with projections of growth from 0.64 billion USD to 1.25 billion USD, accounting for 11.39% share.

Infertility Drugs Market Analysis By Route Of Administration

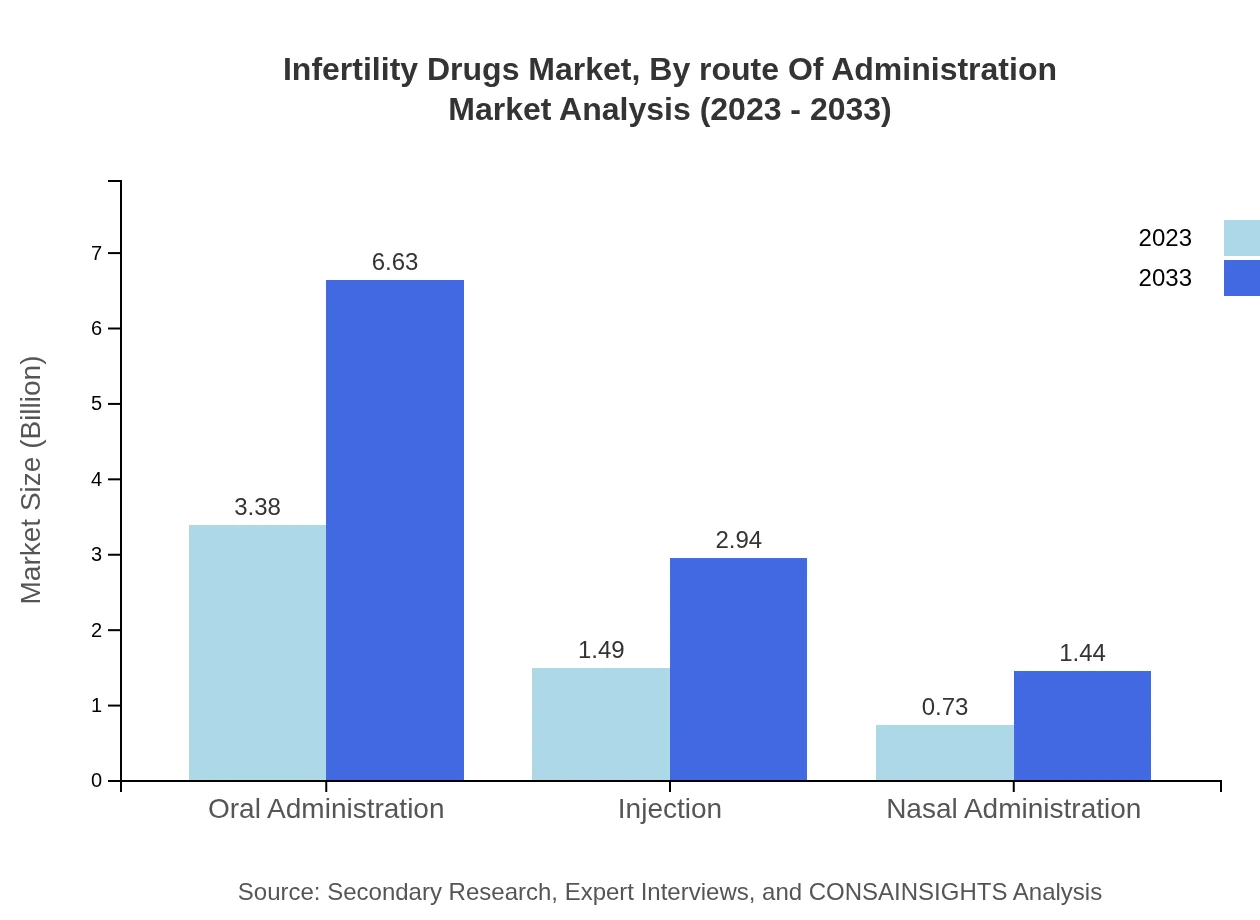

The oral administration route is expected to maintain its lead, growing from 3.38 billion USD in 2023 to 6.63 billion USD in 2033, representing a 60.27% market share. The injection route is anticipated to grow moderately, projected to rise from 1.49 billion USD to 2.94 billion USD, accounting for 26.68% share. Nasal administration is growing steadily, from 0.73 billion USD to 1.44 billion USD, encompassing 13.05% of the market.

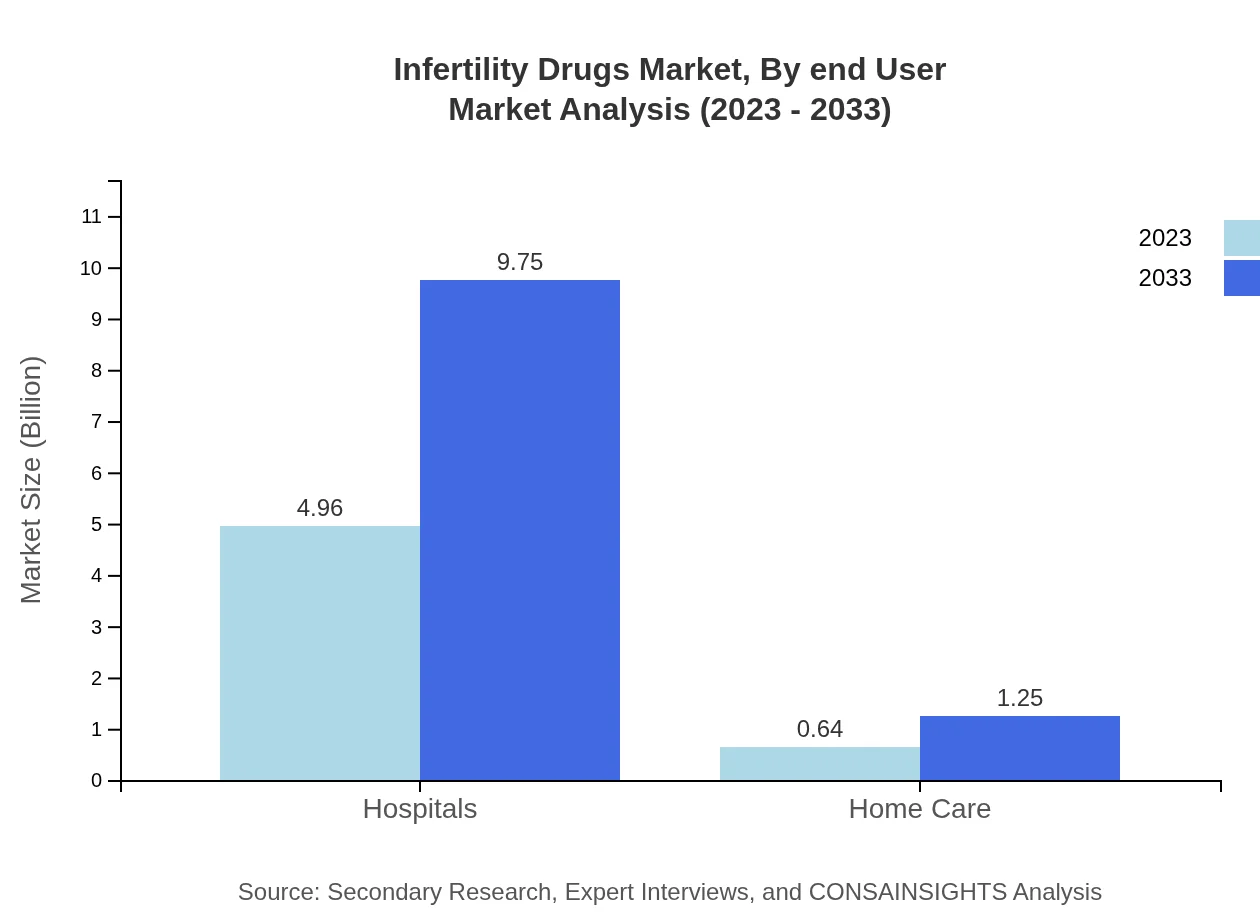

Infertility Drugs Market Analysis By End User

Hospitals are the leading end-users, with market sizes expected to rise from 4.96 billion USD in 2023 to 9.75 billion USD by 2033, maintaining 88.61% share. Home care settings are also anticipated to grow, with projected revenue increases from 0.64 billion USD to 1.25 billion USD, holding a share of 11.39%.

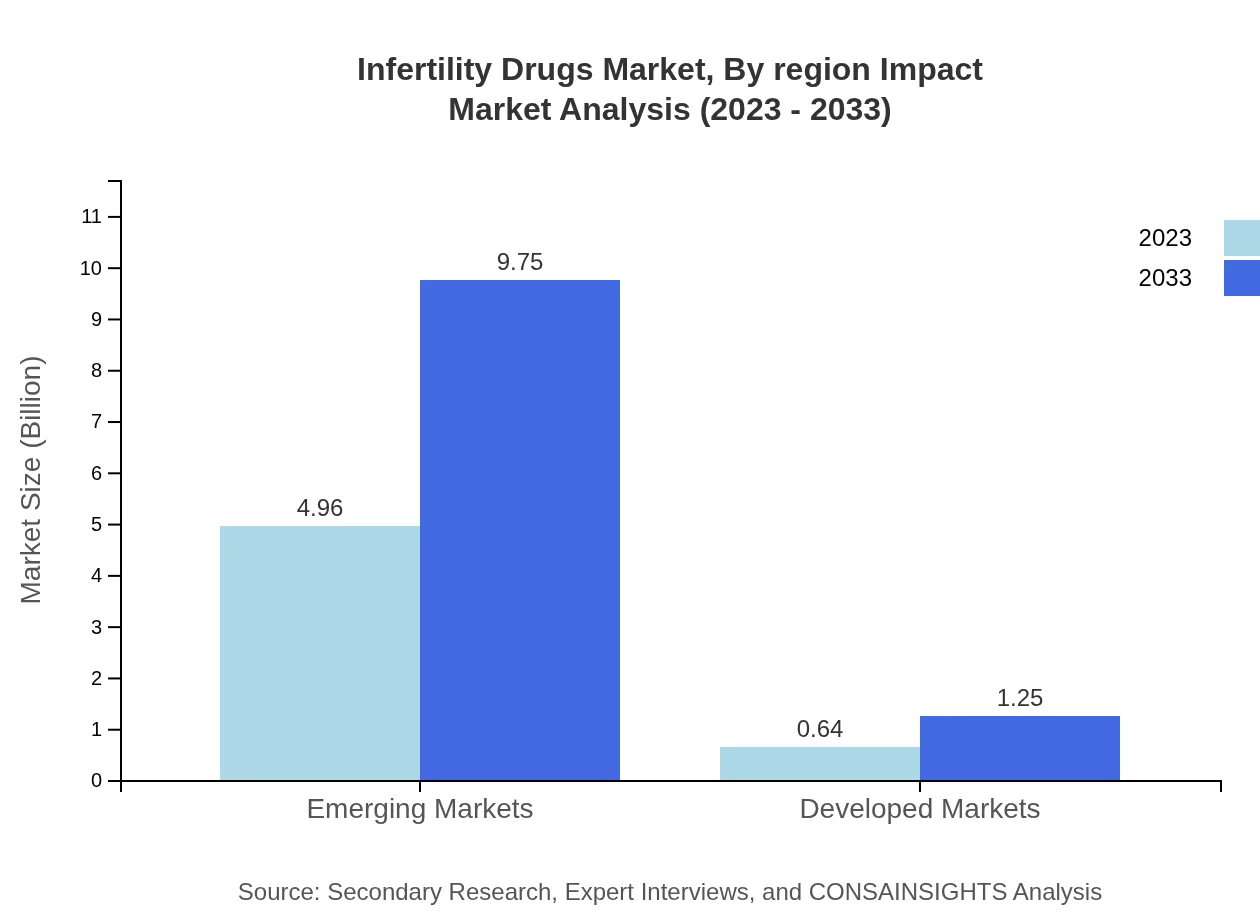

Infertility Drugs Market Analysis By Region Impact

The regional impact on the infertility drugs market varies significantly, influenced by factors such as socio-cultural attitudes towards fertility, healthcare policy, availability of advanced reproductive technologies, and economic conditions. North America and Europe lead due to advanced health infrastructure, while regions like Asia Pacific are rapidly catching up due to improved access and growing awareness.

Infertility Drugs Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Infertility Drugs Industry

Merck KGaA:

A leading global player in reproductive health, offering a range of fertility medications and innovative solutions to enhance fertility treatments.Ferring Pharmaceuticals:

Specializes in reproductive medicine and women’s health, committed to improving treatment for infertility through research and extensive product offerings.Bristol-Myers Squibb:

Develops a range of infertility drugs, focusing on emerging therapies that address major causes of infertility.Teva Pharmaceuticals:

Notable for their extensive portfolio in hormonal treatments, Teva is a prominent supplier in the infertility drug market.AbbVie:

Offers unique solutions in fertility treatments and continues to invest in R&D to provide innovative therapies.We're grateful to work with incredible clients.

FAQs

What is the market size of infertility drugs?

The global infertility drugs market is valued at approximately $5.6 billion in 2023 and is projected to grow at a CAGR of 6.8%, reaching around $11.6 billion by 2033, reflecting increasing demand for fertility treatments.

What are the key market players or companies in the infertility drugs industry?

Key market players in the infertility drugs industry include major pharmaceutical companies that specialize in reproductive health, such as Merck KGaA, Ferring Pharmaceuticals, and Teva Pharmaceuticals, which lead the market with innovative fertility therapies.

What are the primary factors driving the growth in the infertility drugs industry?

Growth in the infertility drugs market is driven by rising infertility rates, increasing awareness about reproductive health, advancements in pharmaceutical technologies, and greater accessibility to assisted reproductive technologies.

Which region is the fastest Growing in the infertility drugs market?

The fastest-growing region in the infertility drugs market is Europe, expected to rise from $1.96 billion in 2023 to $3.85 billion in 2033, reflecting a strong emphasis on reproductive health services and solutions in this region.

Does ConsaInsights provide customized market report data for the infertility drugs industry?

Yes, ConsaInsights offers customized market report data tailored to meet specific client needs across the infertility drugs industry, enabling businesses to make data-driven decisions.

What deliverables can I expect from this infertility drugs market research project?

From this market research project, you can expect comprehensive reports including market size analysis, growth forecasts, competitive landscapes, regional insights, and segmentation data for informed decision-making.

What are the market trends of infertility drugs?

Current market trends include a shift towards personalized treatment options, increased investment in research and development for new therapies, and a growing focus on affordability and accessibility of infertility treatments.