Inflight Entertainment And Connectivity Market Report

Published Date: 31 January 2026 | Report Code: inflight-entertainment-and-connectivity

Inflight Entertainment And Connectivity Market Size, Share, Industry Trends and Forecast to 2033

This report analyzes the Inflight Entertainment and Connectivity market from 2023 to 2033, providing insights into market trends, size, growth rates, segmentation, and regional dynamics, catering to industry stakeholders and decision-makers.

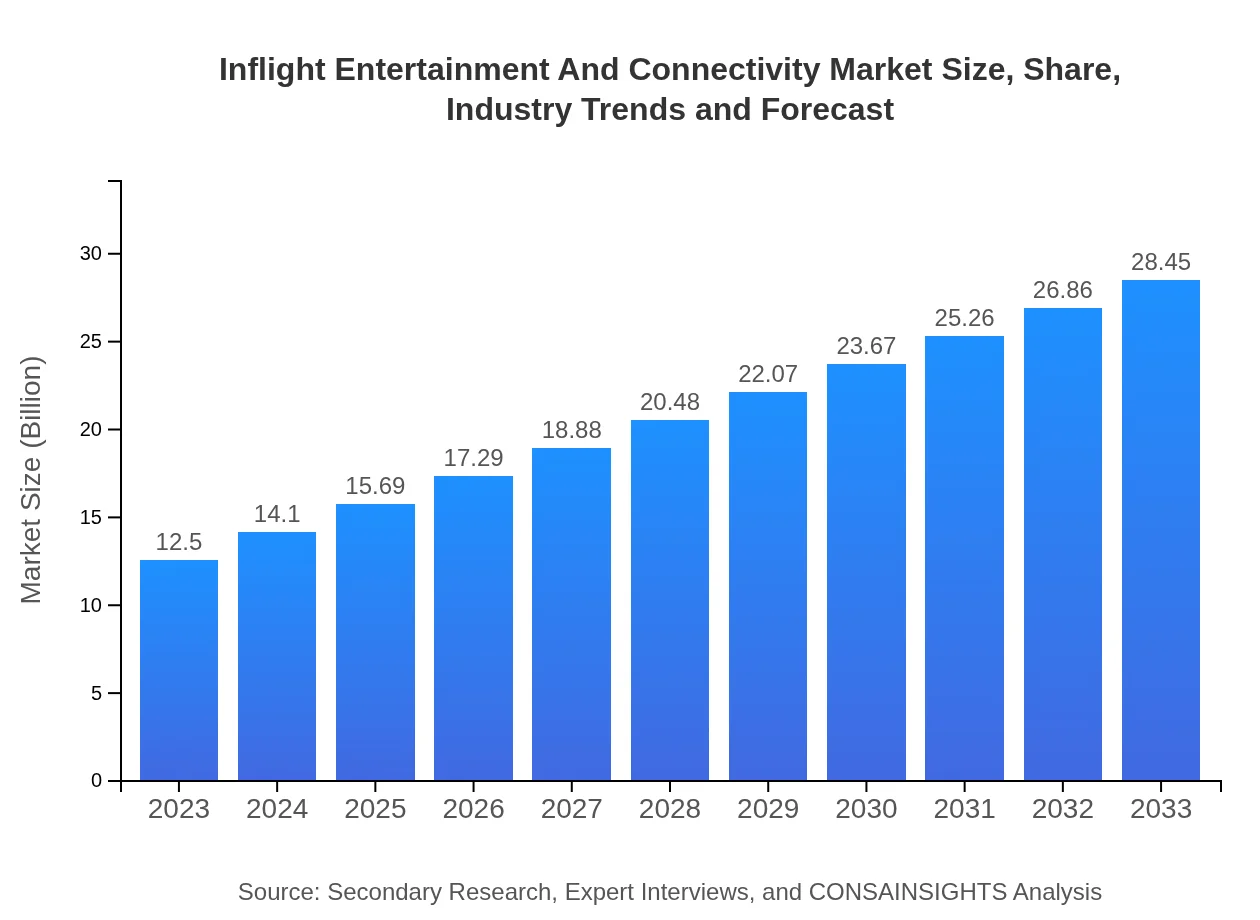

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $12.50 Billion |

| CAGR (2023-2033) | 8.3% |

| 2033 Market Size | $28.45 Billion |

| Top Companies | Thales Group, Panasonic Avionics Corporation, Gogo Inc., Viasat Inc. |

| Last Modified Date | 31 January 2026 |

Inflight Entertainment And Connectivity Market Overview

Customize Inflight Entertainment And Connectivity Market Report market research report

- ✔ Get in-depth analysis of Inflight Entertainment And Connectivity market size, growth, and forecasts.

- ✔ Understand Inflight Entertainment And Connectivity's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Inflight Entertainment And Connectivity

What is the Market Size & CAGR of Inflight Entertainment And Connectivity market in 2023?

Inflight Entertainment And Connectivity Industry Analysis

Inflight Entertainment And Connectivity Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Inflight Entertainment And Connectivity Market Analysis Report by Region

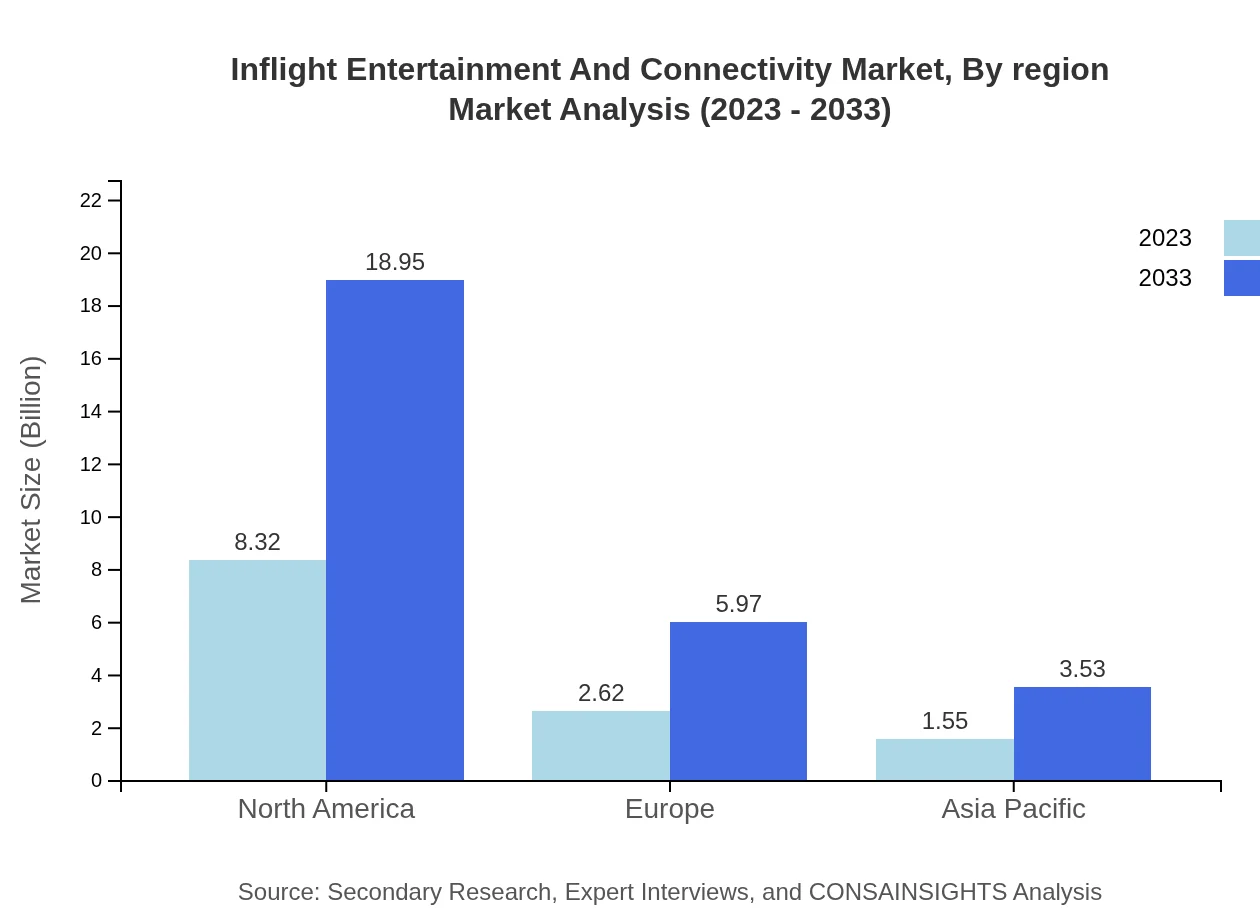

Europe Inflight Entertainment And Connectivity Market Report:

The European inflight entertainment and connectivity market is anticipated to increase from $4.10 billion in 2023 to $9.34 billion by 2033. The focus on passenger welfare and experience, coupled with stringent regulations regarding onboard services, drives investments in enhanced IFEC systems.Asia Pacific Inflight Entertainment And Connectivity Market Report:

The Asia Pacific region is projected to show significant growth from $2.17 billion in 2023 to approximately $4.95 billion by 2033. Increasing air travel demand, rising middle-class incomes, and competitive airline offerings contribute to this growth. Countries like China, India, and Japan are leading investments in enhancing inflight services.North America Inflight Entertainment And Connectivity Market Report:

North America remains a leader in the IFEC market, valued at $4.36 billion in 2023 and projected to reach $9.91 billion by 2033. The region's advanced infrastructure, high consumer expectations, and commitment to flight experience enhancements by major airlines solidify its dominance.South America Inflight Entertainment And Connectivity Market Report:

In South America, the market is expected to grow from $0.70 billion in 2023 to $1.60 billion by 2033. The growth is driven by the expansion of low-cost carriers and improvements in air travel accessibility, coupled with a growing interest in passenger comfort and entertainment.Middle East & Africa Inflight Entertainment And Connectivity Market Report:

The Middle East and Africa's market is projected to grow from $1.17 billion in 2023 to $2.66 billion by 2033. Factors contributing to this growth include increased connectivity initiatives and the expansion of airline fleets in emerging economies.Tell us your focus area and get a customized research report.

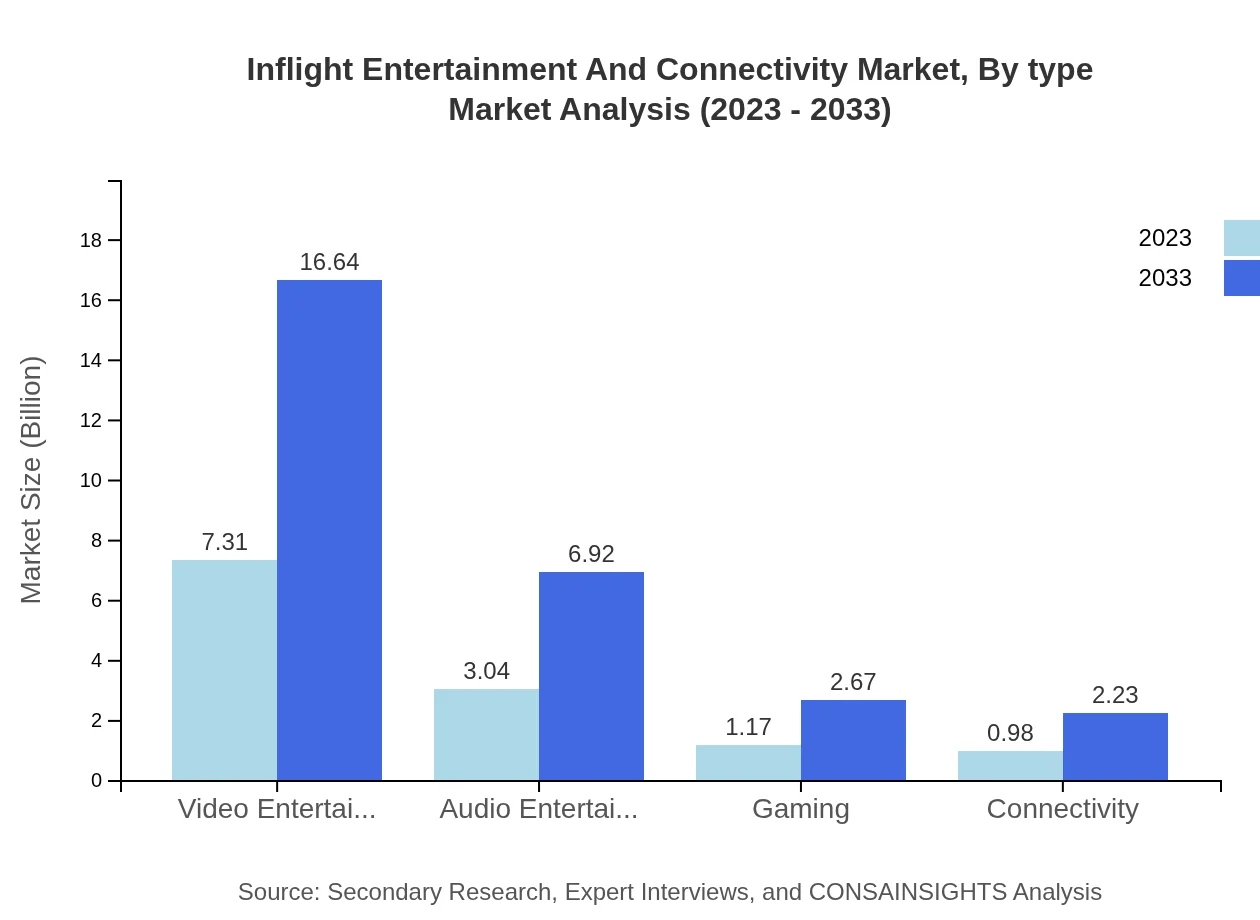

Inflight Entertainment And Connectivity Market Analysis By Type

The inflight entertainment component leads the market, showcasing a size of $7.31 billion in 2023 and projected to rise to $16.64 billion by 2033. This segment represents 58.47% of the market share in 2023, remaining stable, while audio and gaming segments are also significant, with audio entertainment valued at $3.04 billion and gaming at $1.17 billion in 2023.

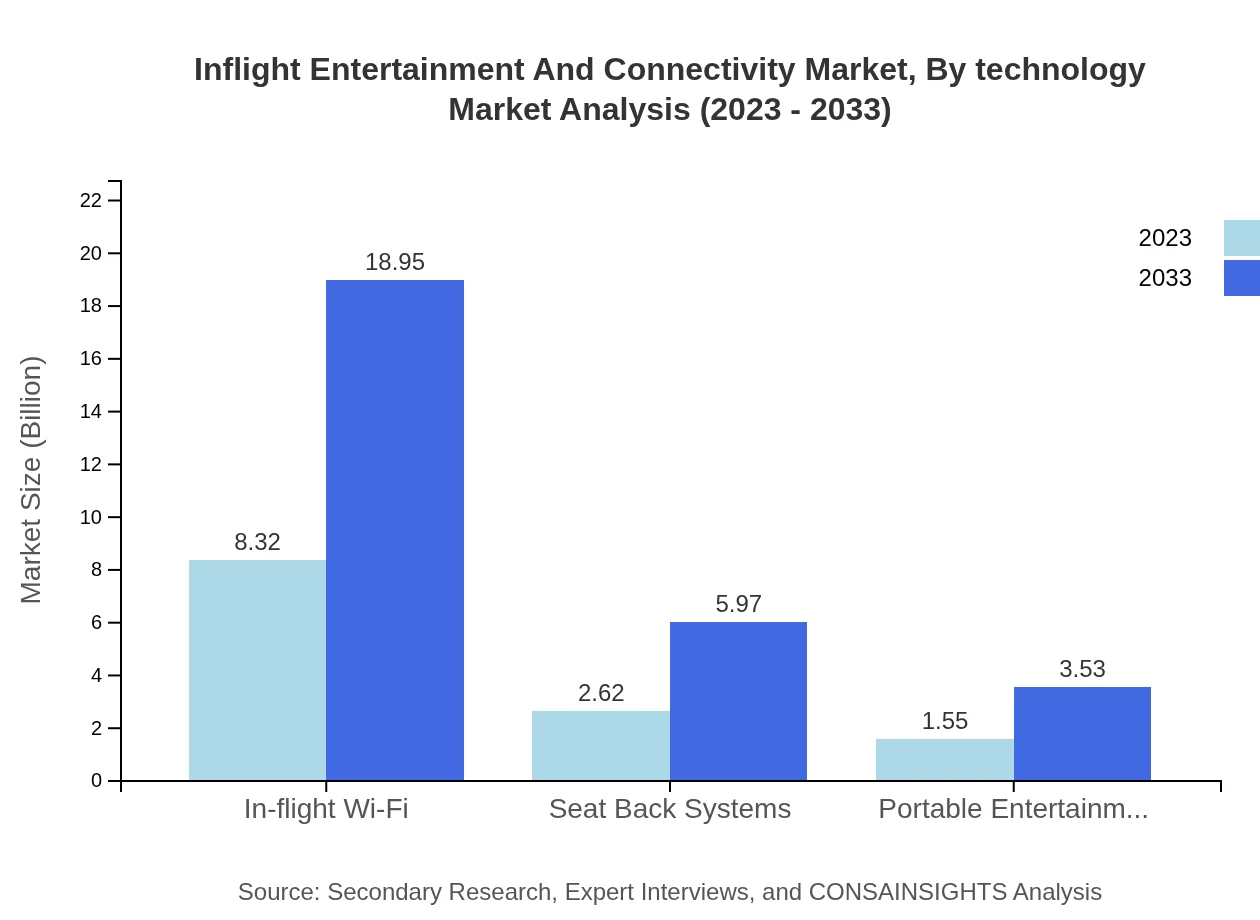

Inflight Entertainment And Connectivity Market Analysis By Technology

Current technological advancements include satellite communication and wireless solutions, which are critical to increasing inflight connectivity efficiency. The sector is experiencing a shift towards integrated platforms that offer seamless content delivery and accessibility, with technologies like 5G being progressively rolled out to enhance user experience.

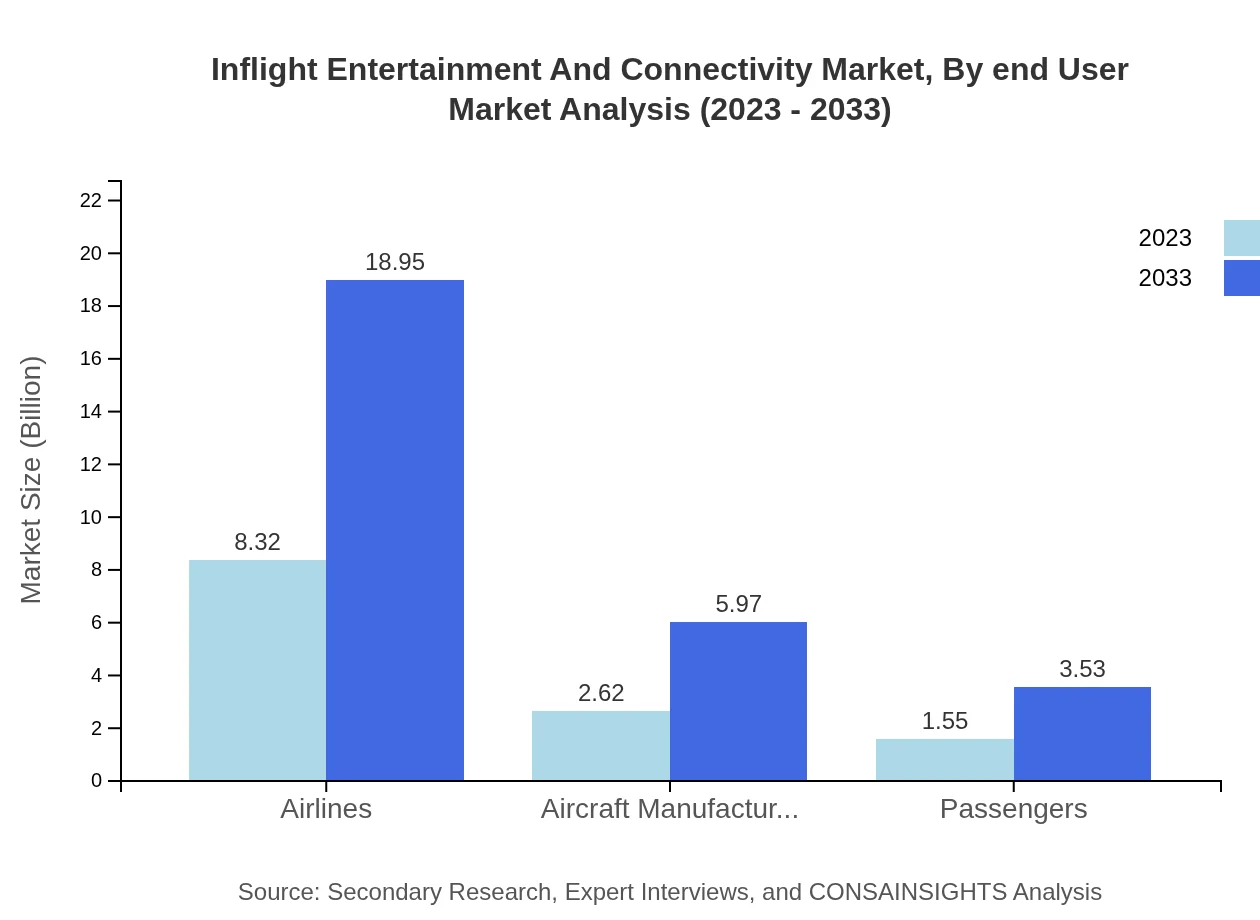

Inflight Entertainment And Connectivity Market Analysis By End User

Key end-users include airlines, aircraft manufacturers, and passengers. Airlines dominate the market share due to their direct investment in entertainment systems, expected to reach $8.32 billion by 2033. Aircraft manufacturers also greatly influence market growth by integrating advanced systems into new aircraft designs.

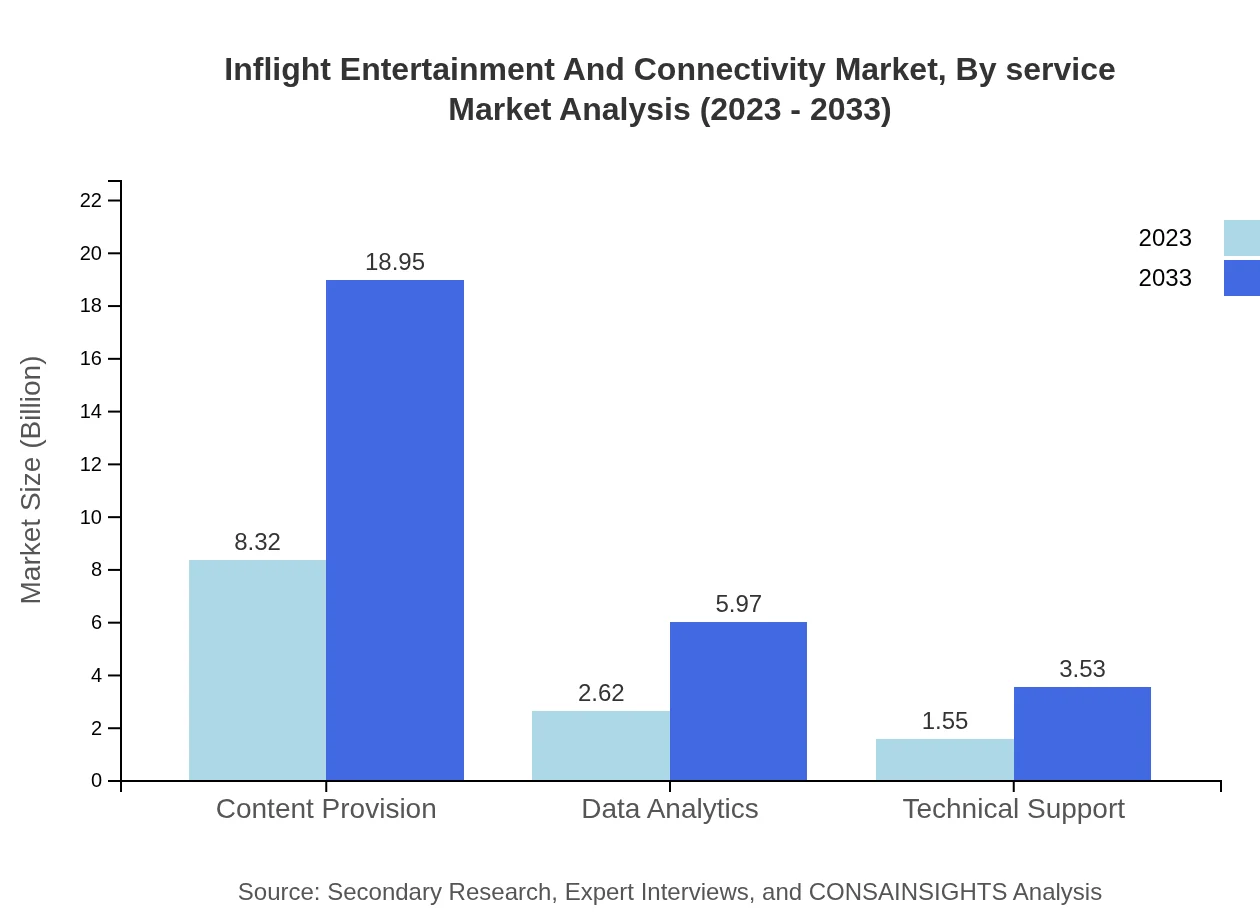

Inflight Entertainment And Connectivity Market Analysis By Service

Various services, such as in-flight Wi-Fi and technical support, are integral to the IFEC market. In-flight Wi-Fi services alone are projected to grow from $8.32 billion in 2023 to $18.95 billion by 2033, reflecting increasing demand for high-speed connectivity among passengers.

Inflight Entertainment And Connectivity Market Analysis By Region

As analyzed previously, regions such as North America and Europe lead in market size and investment in inflight entertainment and connectivity advancements, while Asia Pacific and South America present significant growth opportunities.

Inflight Entertainment And Connectivity Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Inflight Entertainment And Connectivity Industry

Thales Group:

Thales is a global leader in aerospace and defense, providing advanced inflight entertainment and connectivity technologies that enhance passenger experiences.Panasonic Avionics Corporation:

Panasonic Avionics offers global solutions for inflight entertainment, focusing on passenger experience and connectivity through innovative technology.Gogo Inc.:

A major player in inflight Wi-Fi solutions, Gogo provides extensive products and services aimed at improving connectivity for commercial and business aviation.Viasat Inc.:

Viasat specializes in satellite and secure networking technology, delivering high-speed inflight connectivity services and inflight entertainment.We're grateful to work with incredible clients.

FAQs

What is the market size of inflight entertainment and connectivity?

The global inflight entertainment and connectivity market is valued at approximately $12.5 billion in 2023 with a projected CAGR of 8.3%, indicating substantial growth in demand for enhanced passenger experiences through advanced technology.

What are the key market players or companies in the inflight entertainment and connectivity industry?

Key players in the inflight entertainment and connectivity industry include major airlines, technology providers, and content creators, which significantly impact growth by supplying innovative solutions and managing distribution networks for in-flight services.

What are the primary factors driving the growth in the inflight entertainment and connectivity industry?

Growth in the inflight entertainment and connectivity market is primarily driven by increased passenger demand for connectivity, technological advancements in communication systems, and the evolving expectations for on-board entertainment options.

Which region is the fastest Growing in the inflight entertainment and connectivity market?

The North American region stands out as the fastest-growing market with an increase from $4.36 billion in 2023 to $9.91 billion by 2033, fueled by high passenger traffic and advancements in inflight services.

Does ConsInsights provide customized market report data for the inflight entertainment and connectivity industry?

Yes, ConsInsights offers customized market report data for the inflight entertainment and connectivity industry, tailored to specific client needs, including detailed analysis and insights based on regional and segment data.

What deliverables can I expect from this inflight entertainment and connectivity market research project?

Deliverables from this market research project typically include comprehensive reports on market trends, forecasts, competitive analysis, and detailed segment data, providing valuable insights for strategic decision-making.

What are the market trends of inflight entertainment and connectivity?

Current market trends in inflight entertainment and connectivity include increasing reliance on streaming services, the rise of wireless connectivity options, and a growing emphasis on data analytics for personalized passenger experiences.