Influenza Medications Market Report

Published Date: 31 January 2026 | Report Code: influenza-medications

Influenza Medications Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Influenza Medications market, including market size, growth forecasts, regional insights, and industry trends from 2023 to 2033. It offers deep insights into market dynamics, segmentation, and key players shaping the influeza medication landscape.

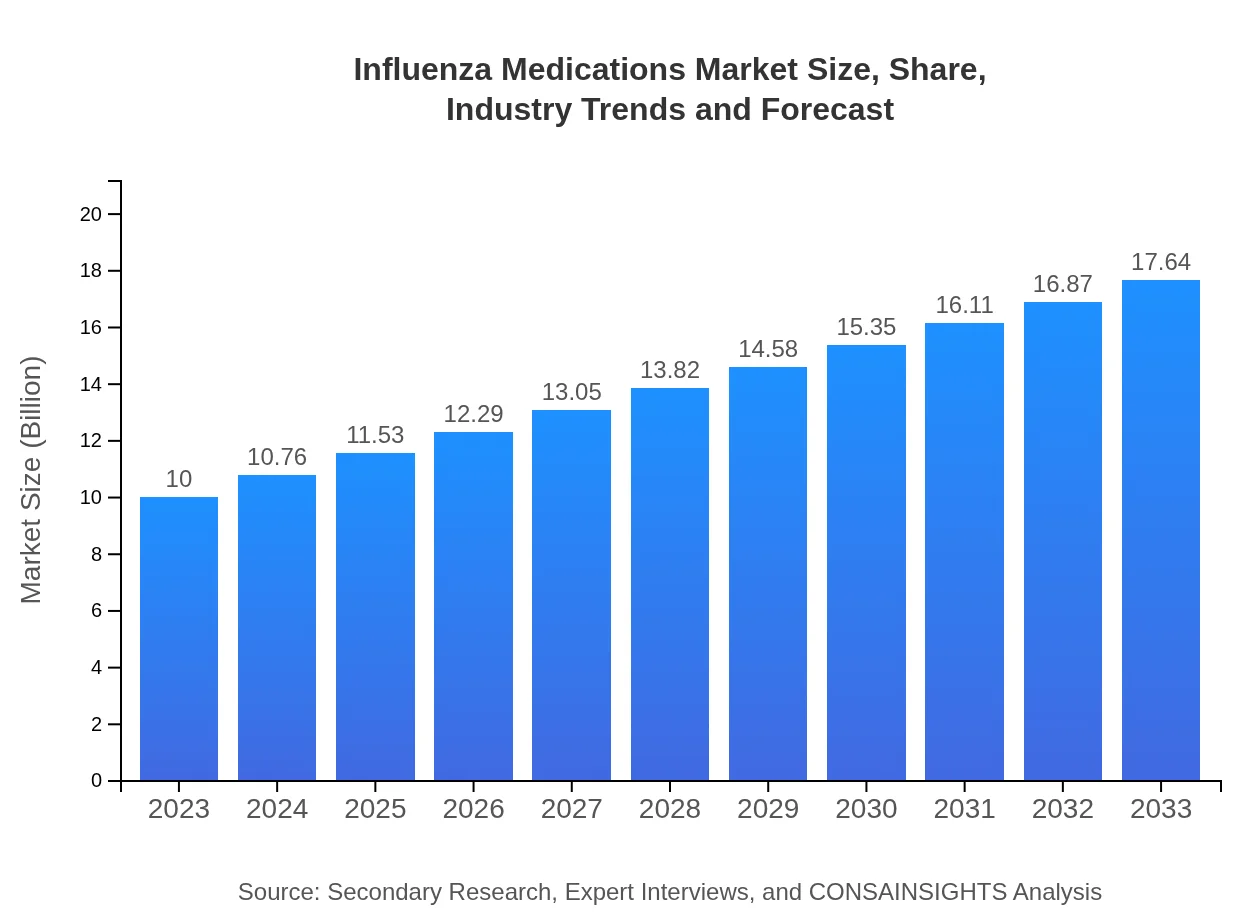

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $10.00 Billion |

| CAGR (2023-2033) | 5.7% |

| 2033 Market Size | $17.64 Billion |

| Top Companies | Roche, GlaxoSmithKline, AbbVie, Sanofi |

| Last Modified Date | 31 January 2026 |

Influenza Medications Market Overview

Customize Influenza Medications Market Report market research report

- ✔ Get in-depth analysis of Influenza Medications market size, growth, and forecasts.

- ✔ Understand Influenza Medications's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Influenza Medications

What is the Market Size & CAGR of Influenza Medications market in 2023?

Influenza Medications Industry Analysis

Influenza Medications Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Influenza Medications Market Analysis Report by Region

Europe Influenza Medications Market Report:

Europe's market for influenza medications was valued at $3.53 billion in 2023, with projections reaching $6.22 billion by 2033. Increased vaccination campaigns and public health policies focusing on influenza prevention are major factors driving this growth.Asia Pacific Influenza Medications Market Report:

The Asia Pacific region, with a market value of $1.89 billion in 2023, is expected to reach $3.33 billion by 2033. The growth is driven by increasing healthcare expenditure, expanding access to medications, and rising awareness about seasonal flu vaccinations amidst outbreaks.North America Influenza Medications Market Report:

North America holds a significant share with a market size of $3.20 billion in 2023, expected to grow to $5.65 billion by 2033. This growth can be attributed to established healthcare infrastructure, advanced research capabilities, and a high uptake of vaccination.South America Influenza Medications Market Report:

In South America, the market is projected to grow modestly from $0.02 billion in 2023 to $0.04 billion by 2033. Access to medications remains limited in some areas, but initiatives to enhance healthcare systems broaden the reach of influenza medications.Middle East & Africa Influenza Medications Market Report:

The Middle East and Africa region is anticipated to grow from $1.36 billion in 2023 to $2.40 billion by 2033. The increasing prevalence of influenza virus outbreaks and investment in healthcare infrastructure contribute to this growth.Tell us your focus area and get a customized research report.

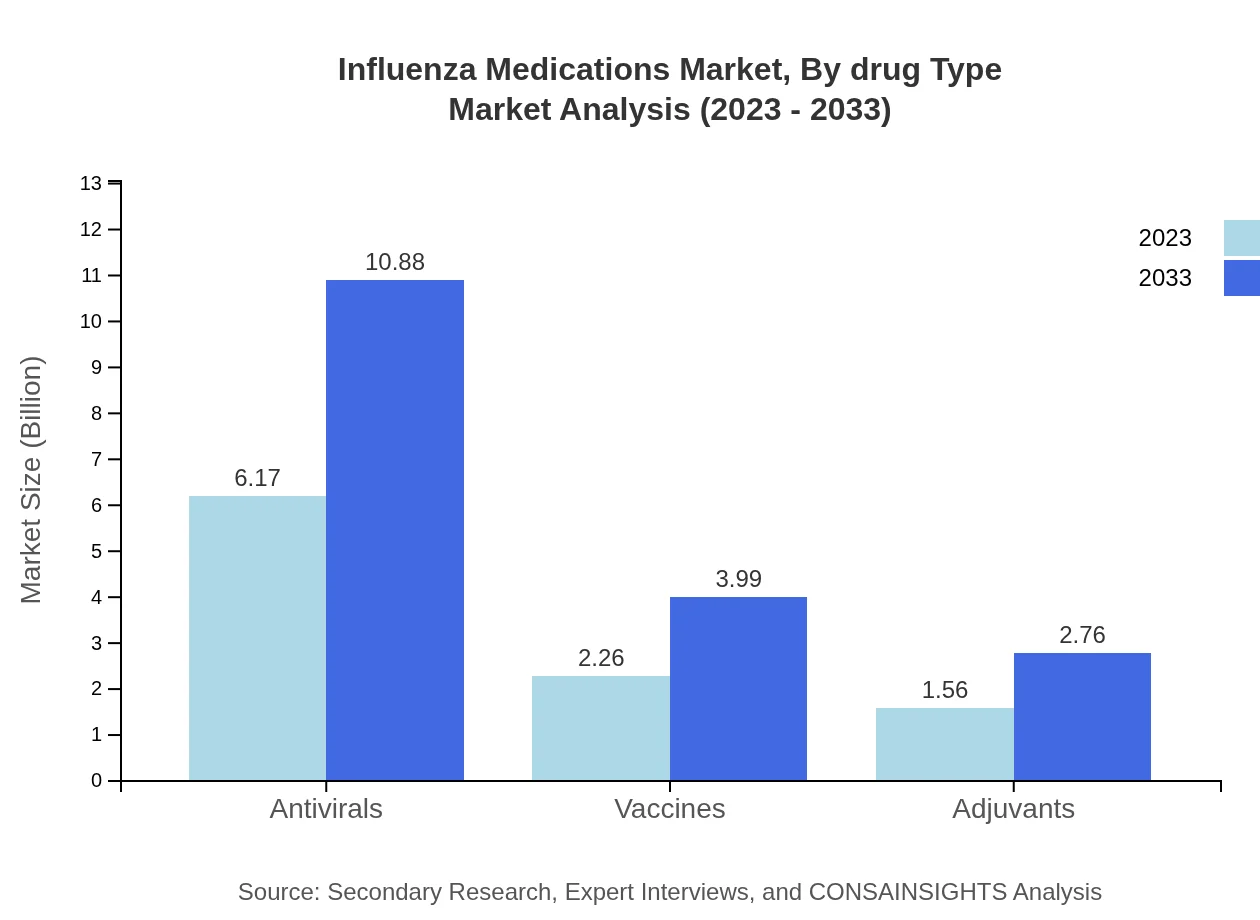

Influenza Medications Market Analysis By Drug Type

Antivirals dominate the Influenza Medications market due to their efficacy in treating patients during outbreaks. With revenues projected to grow from $6.17 billion in 2023 to $10.88 billion by 2033, they represent approximately 61.7% market share. Vaccines are also vital, with growth from $2.26 billion to $3.99 billion, holding a 22.65% share.

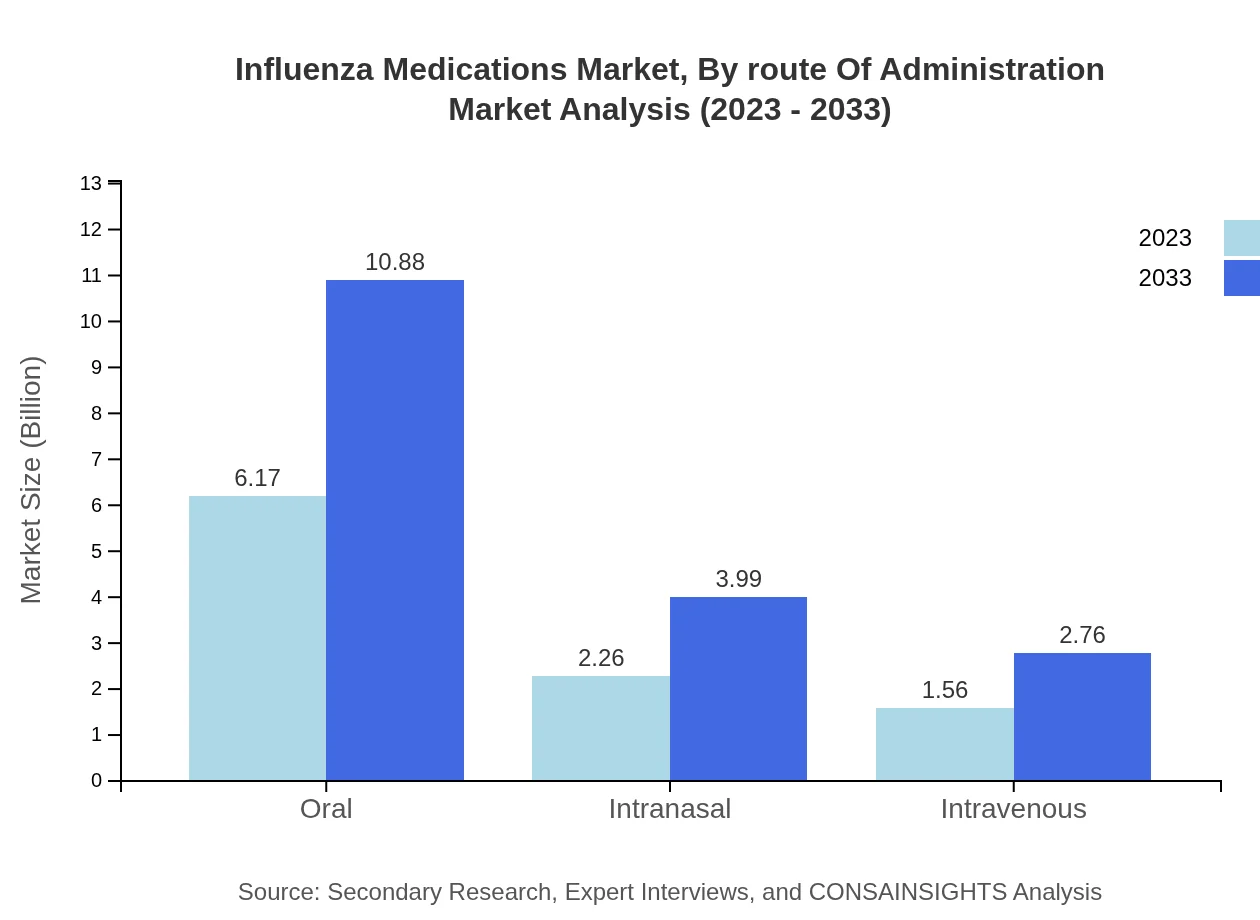

Influenza Medications Market Analysis By Route Of Administration

The Oral route is the most prominent, with a market size of $6.17 billion anticipated to grow to $10.88 billion by 2033. Intranasal and intravenous routes together represent significant market shares, appealing to specific patient needs.

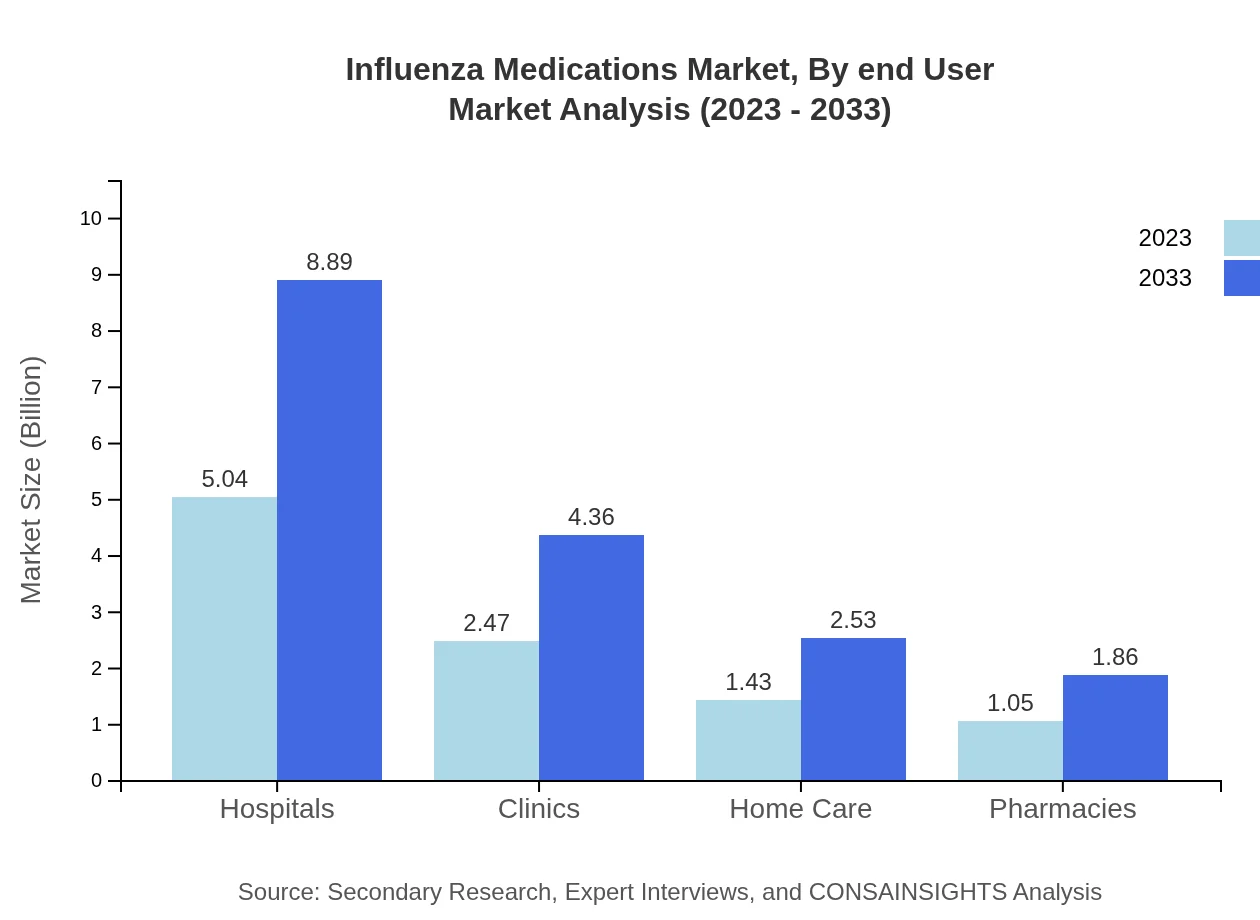

Influenza Medications Market Analysis By End User

Hospitals lead the market with a size of $5.04 billion in 2023, projected to expand to $8.89 billion by 2033, maintaining a 50.39% market share. Clinics and pharmacies also play substantial roles, particularly for outpatient treatment.

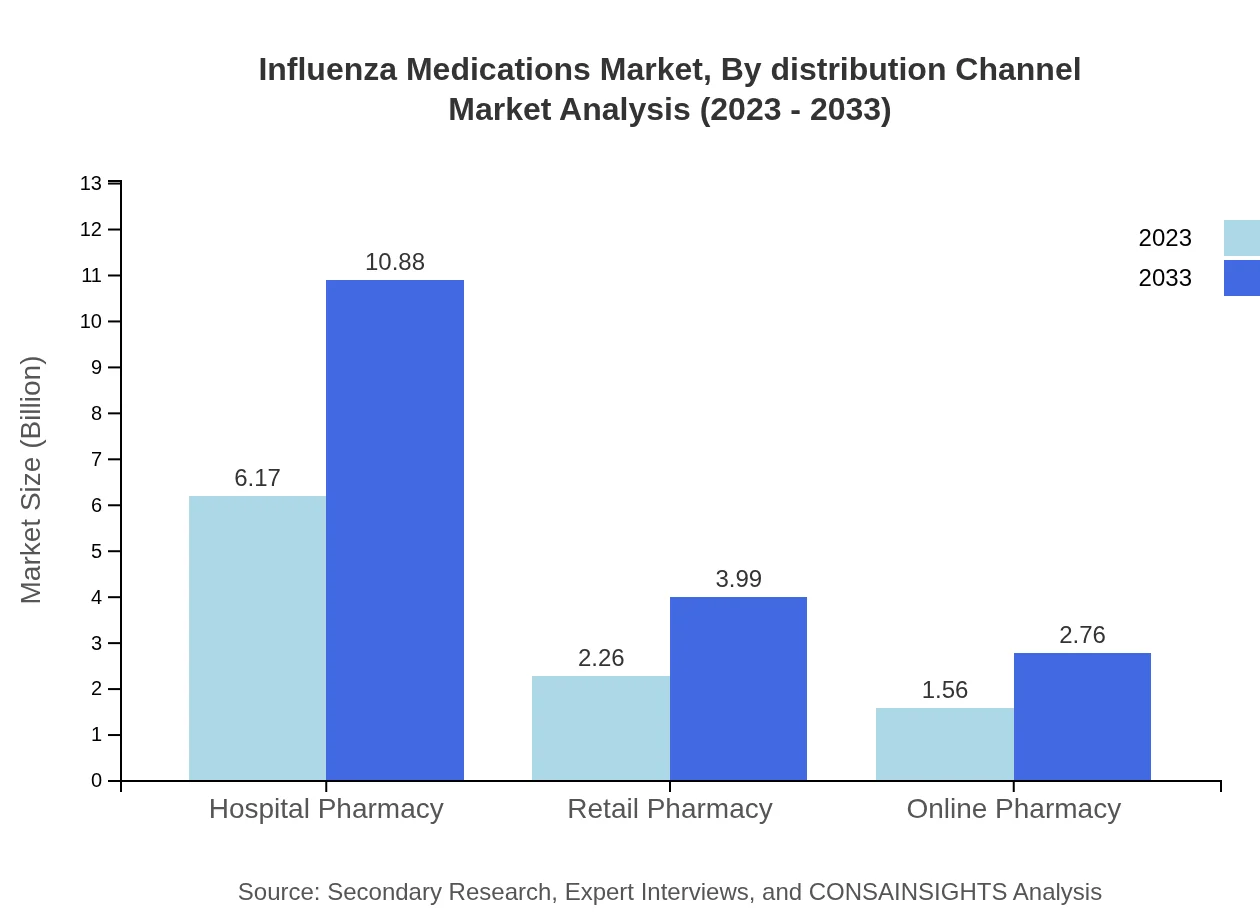

Influenza Medications Market Analysis By Distribution Channel

Hospitals and pharmacies dominate the distribution landscape, accounting for 61.7% of the market. Online pharmacies are emerging, offering convenience and accessibility, significantly impacting how patients access Influenza Medications.

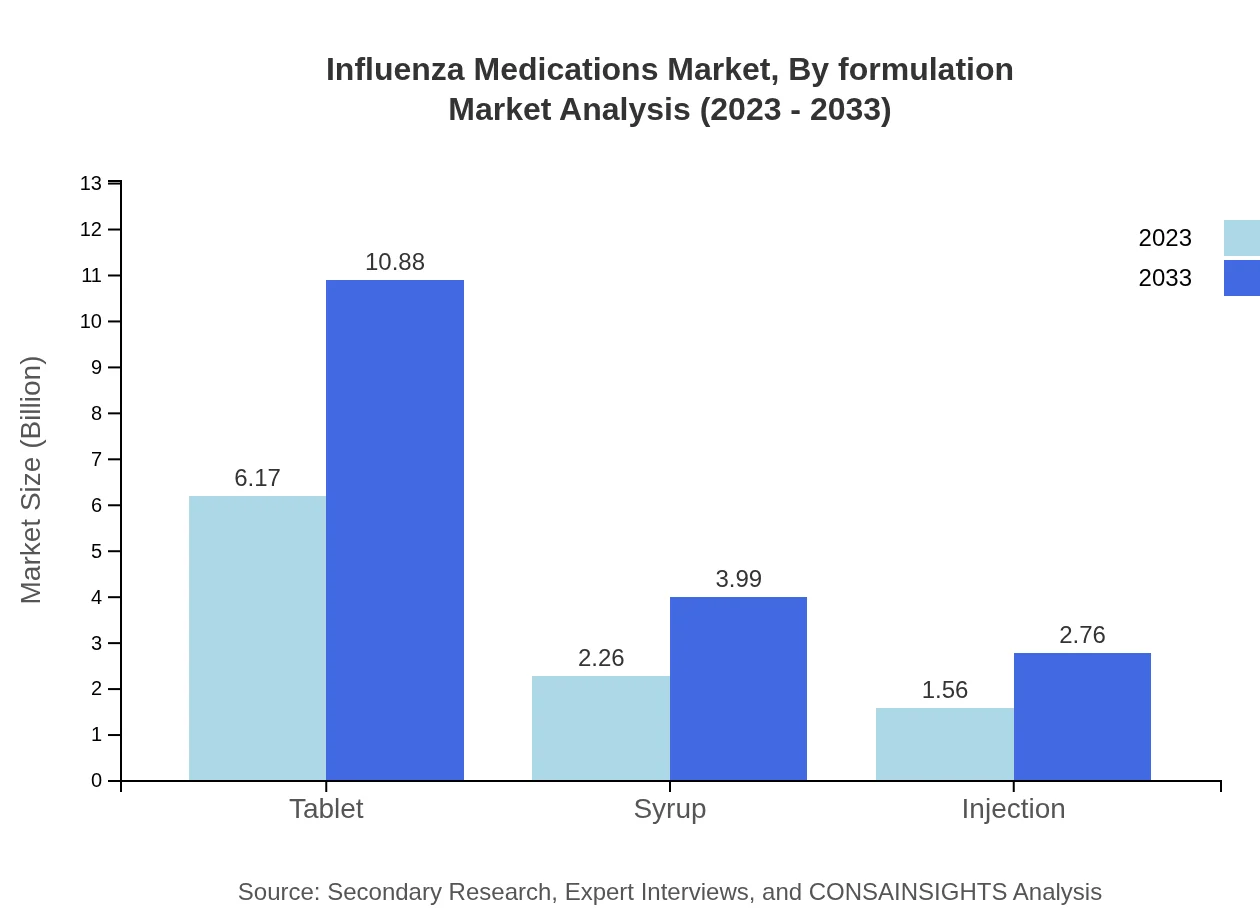

Influenza Medications Market Analysis By Formulation

Tablets represent key formulations in the market, expected to grow from $6.17 billion in 2023 to $10.88 billion by 2033, while syrups and injections also contribute positively to the segment’s growth.

Influenza Medications Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Influenza Medications Industry

Roche:

A leading player known for its antiviral medication, Tamiflu, which effectively treats influenza and significantly contributes to the market.GlaxoSmithKline:

Well renowned for its influenza vaccines and antiviral therapies, focusing on innovative solutions for flu prevention and management.AbbVie:

Known for its strong portfolio of antiviral medications that address various strains of influenza, enhancing its market presence.Sanofi:

Focuses on vaccine development, contributing significantly to global vaccination campaigns against influenza.We're grateful to work with incredible clients.

FAQs

What is the market size of influenza Medications?

The influenza medications market is valued at $10 billion in 2023, with a projected CAGR of 5.7%. This growth reflects the increasing demand for effective influenza treatments and preventative measures across healthcare settings.

What are the key market players or companies in the influenza Medications industry?

Key players in the influenza medications market include major pharmaceutical companies focusing on antiviral drugs and vaccines, with ongoing investments in R&D to enhance product efficacy and expand their market reach.

What are the primary factors driving the growth in the influenza medications industry?

Key drivers include rising influenza incidences, advancements in drug formulations, increased government funding for healthcare, and a growing emphasis on preventive healthcare solutions through vaccinations.

Which region is the fastest Growing in the influenza medications market?

The Asia-Pacific region is emerging as the fastest-growing market, estimated to reach $3.33 billion by 2033, driven by increasing healthcare access and rising public health awareness regarding influenza prevention.

Does ConsaInsights provide customized market report data for the influenza medications industry?

Yes, ConsaInsights offers customized market reports tailored to specific business needs in the influenza medications industry, ensuring clients receive relevant, actionable insights to drive decision-making.

What deliverables can I expect from this influenza medications market research project?

Deliverables include a comprehensive market analysis report, competitive landscape overview, segmented market data, and insights on emerging trends, helping to inform strategic business decisions.

What are the market trends of influenza medications?

Trends include a shift towards personalized medicine, increased demand for antiviral treatments, and the integration of digital health tools in managing influenza outbreaks, indicating a dynamic market evolution.