Infrastructure As A Service Market Report

Published Date: 31 January 2026 | Report Code: infrastructure-as-a-service

Infrastructure As A Service Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Infrastructure as a Service (IaaS) market, examining key trends, market size, growth rates, and competitive landscape from 2023 to 2033. Insights on regional coverage, technology advancements, and market segmentation are also included.

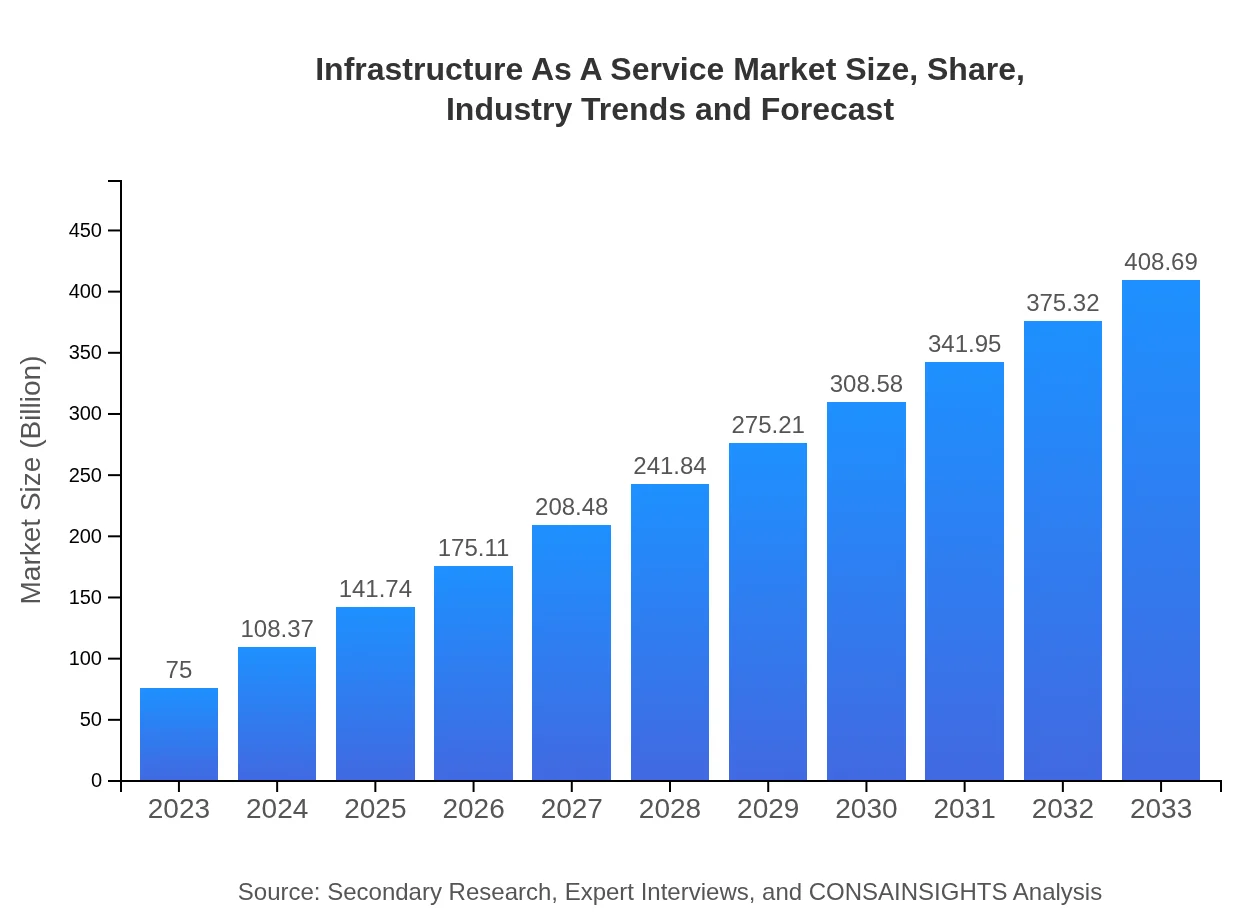

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $75.00 Billion |

| CAGR (2023-2033) | 17.5% |

| 2033 Market Size | $408.69 Billion |

| Top Companies | Amazon Web Services (AWS), Microsoft Azure, Google Cloud Platform, IBM Cloud, Alibaba Cloud |

| Last Modified Date | 31 January 2026 |

Infrastructure As A Service Market Overview

Customize Infrastructure As A Service Market Report market research report

- ✔ Get in-depth analysis of Infrastructure As A Service market size, growth, and forecasts.

- ✔ Understand Infrastructure As A Service's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Infrastructure As A Service

What is the Market Size & CAGR of Infrastructure As A Service market in 2023?

Infrastructure As A Service Industry Analysis

Infrastructure As A Service Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Infrastructure As A Service Market Analysis Report by Region

Europe Infrastructure As A Service Market Report:

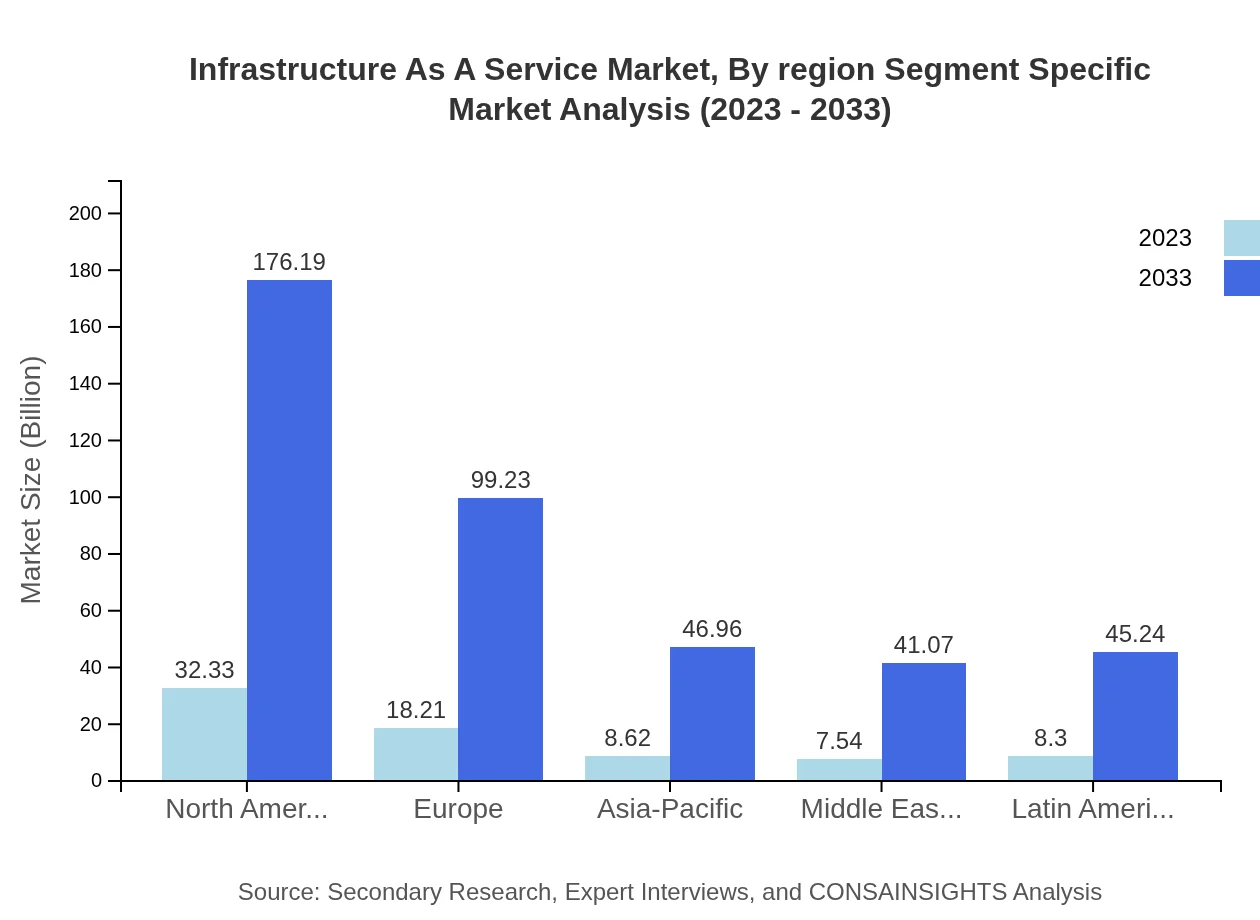

Europe's IaaS market is forecast to expand from $21.67 billion in 2023 to $118.07 billion by 2033, fueled by regulatory compliance requirements and demands for data security, which are prompting businesses to shift towards cloud solutions for better risk management.Asia Pacific Infrastructure As A Service Market Report:

The IaaS market in the Asia Pacific region is anticipated to grow significantly, reaching $83.74 billion by 2033 from $15.37 billion in 2023. Factors driving this growth include the burgeoning IT sector in countries like India and China, increasing investments in digital infrastructure, and a rising number of startups benefiting from cloud solutions.North America Infrastructure As A Service Market Report:

North America holds one of the largest shares of the IaaS market, projected to reach $139.12 billion by 2033 from $25.53 billion in 2023. This growth is driven by the high adoption rate of cloud technologies and significant investments in digital transformation efforts among enterprises across various sectors.South America Infrastructure As A Service Market Report:

In South America, the market is expected to grow from $6.10 billion in 2023 to $33.23 billion by 2033. The increasing focus on improving infrastructure capabilities within the region, coupled with economic growth and digitalization, is driving this demand in several industries.Middle East & Africa Infrastructure As A Service Market Report:

The Middle East and Africa region is set to see growth from $6.34 billion in 2023 to $34.53 billion by 2033. Factors such as increasing smartphone penetration, burgeoning internet access, and government initiatives towards building digital economies are key growth drivers in the region.Tell us your focus area and get a customized research report.

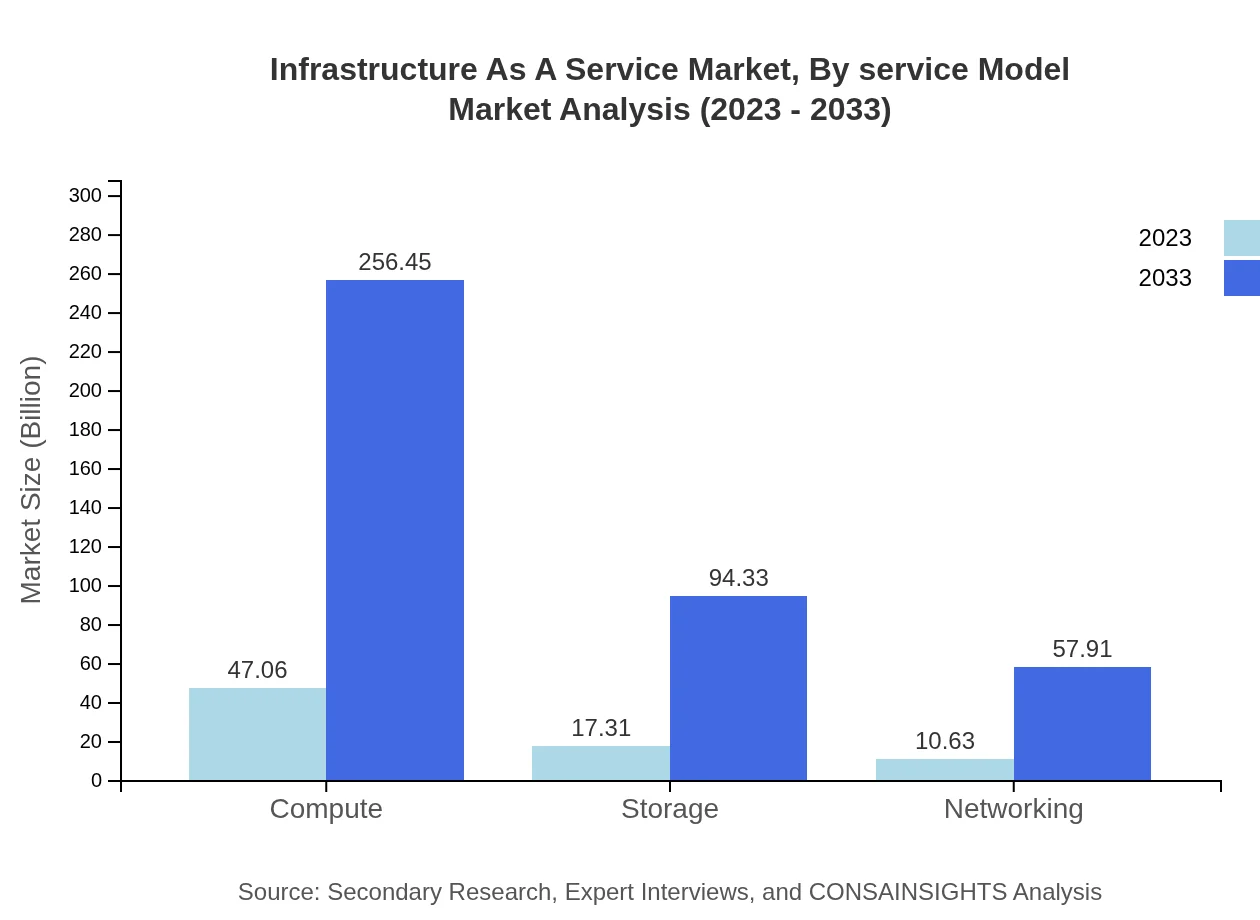

Infrastructure As A Service Market Analysis By Service Model

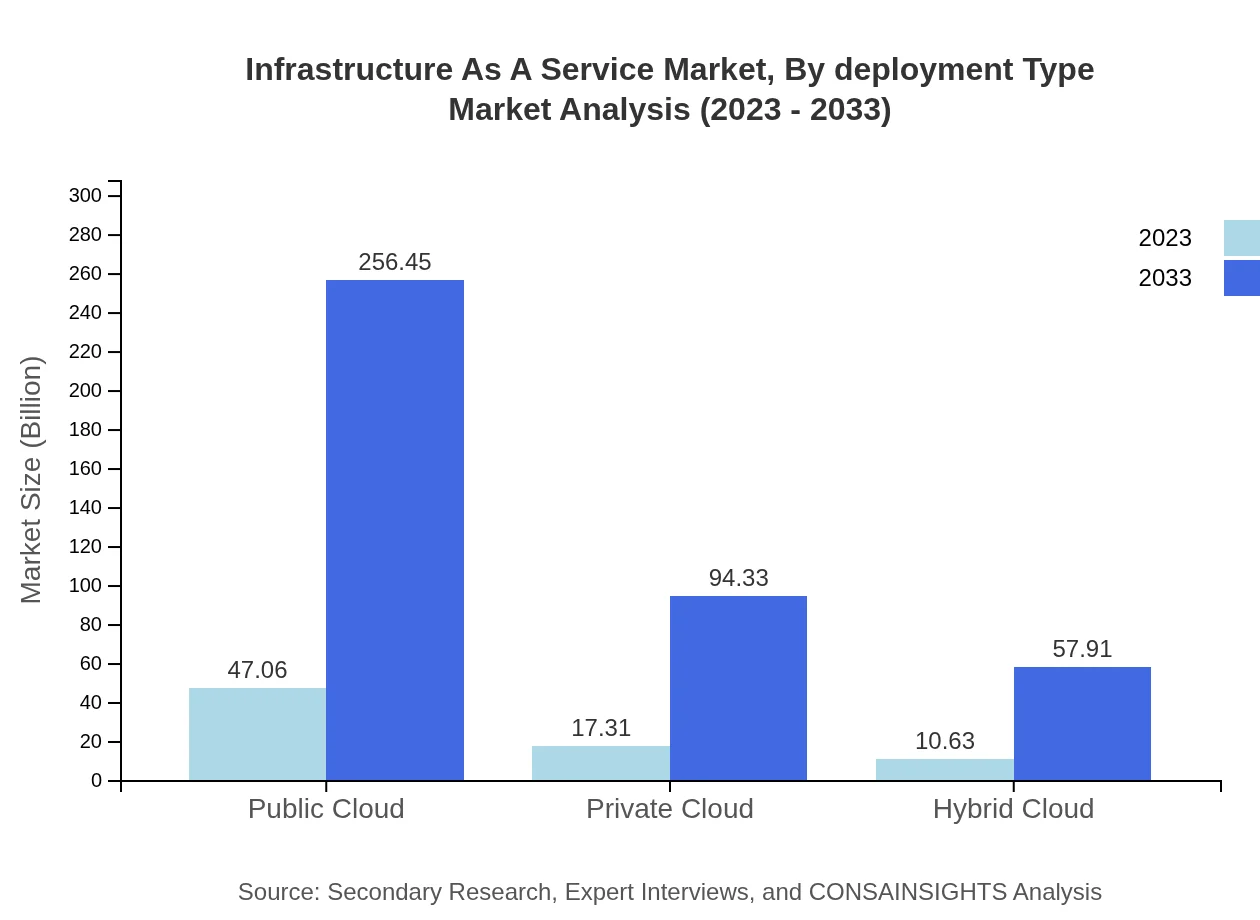

IaaS can be segmented into public cloud, private cloud, and hybrid cloud service models. Public cloud holds the largest market share at 62.75% in 2023, growing to a projected 62.75% by 2033. Private cloud is expected to expand as organizations emphasize security and compliance, with a growth from $17.31 billion to $94.33 billion, maintaining a share of 23.08%. Hybrid cloud is also gaining traction, predicted to grow substantially as businesses seek flexibility.

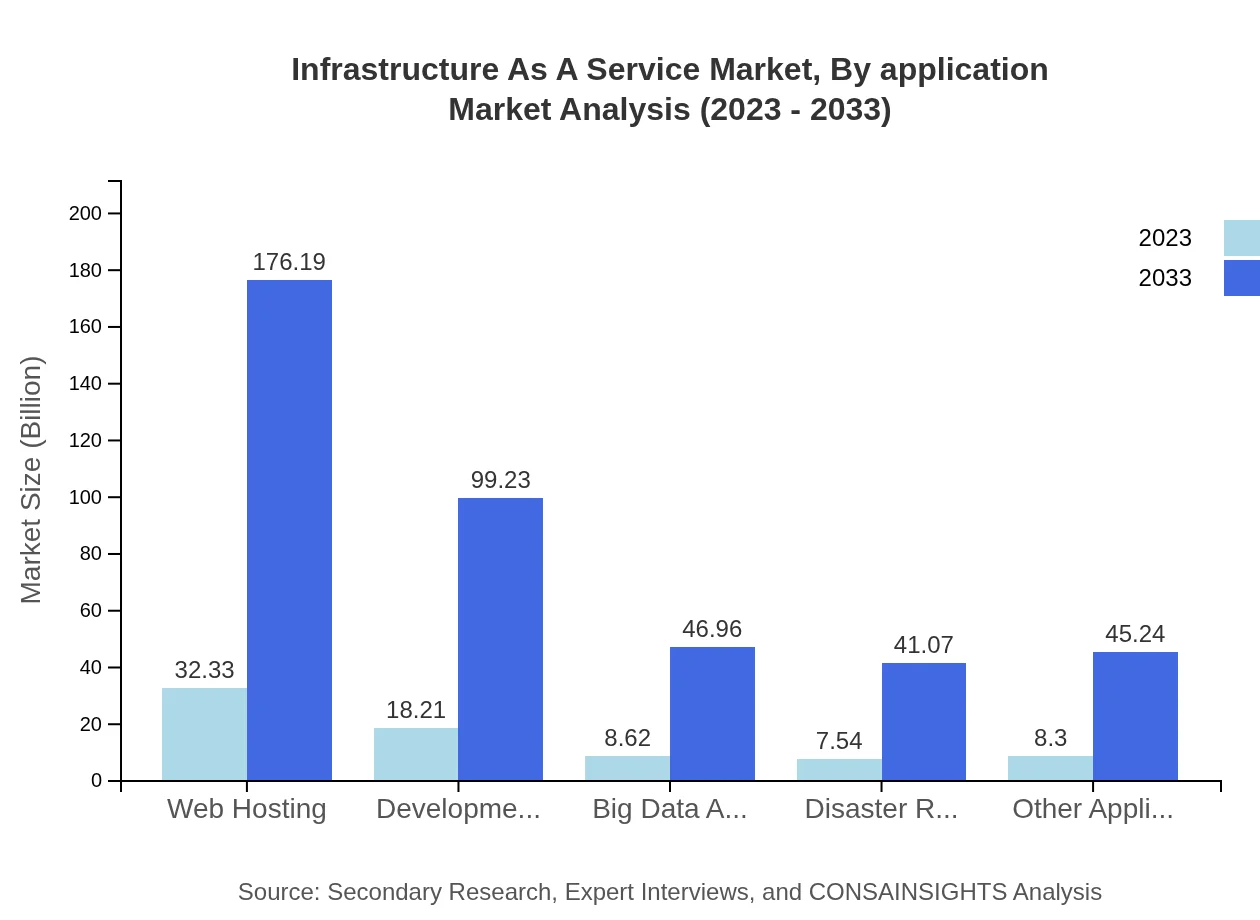

Infrastructure As A Service Market Analysis By Application

The market is further segmented by application areas such as web hosting, development and testing, big data analytics, and disaster recovery. Web hosting is the largest segment, with expected growth from $32.33 billion in 2023 to $176.19 billion by 2033, holding a significant 43.11% market share.

Infrastructure As A Service Market Analysis By Deployment Type

IaaS deployment types include on-premise and cloud-based solutions. The shift towards cloud-based solutions is prevalent, particularly among SMEs looking for cost-effective IT infrastructure. Organizations are increasingly adopting hybrid deployment models for better flexibility and resource management.

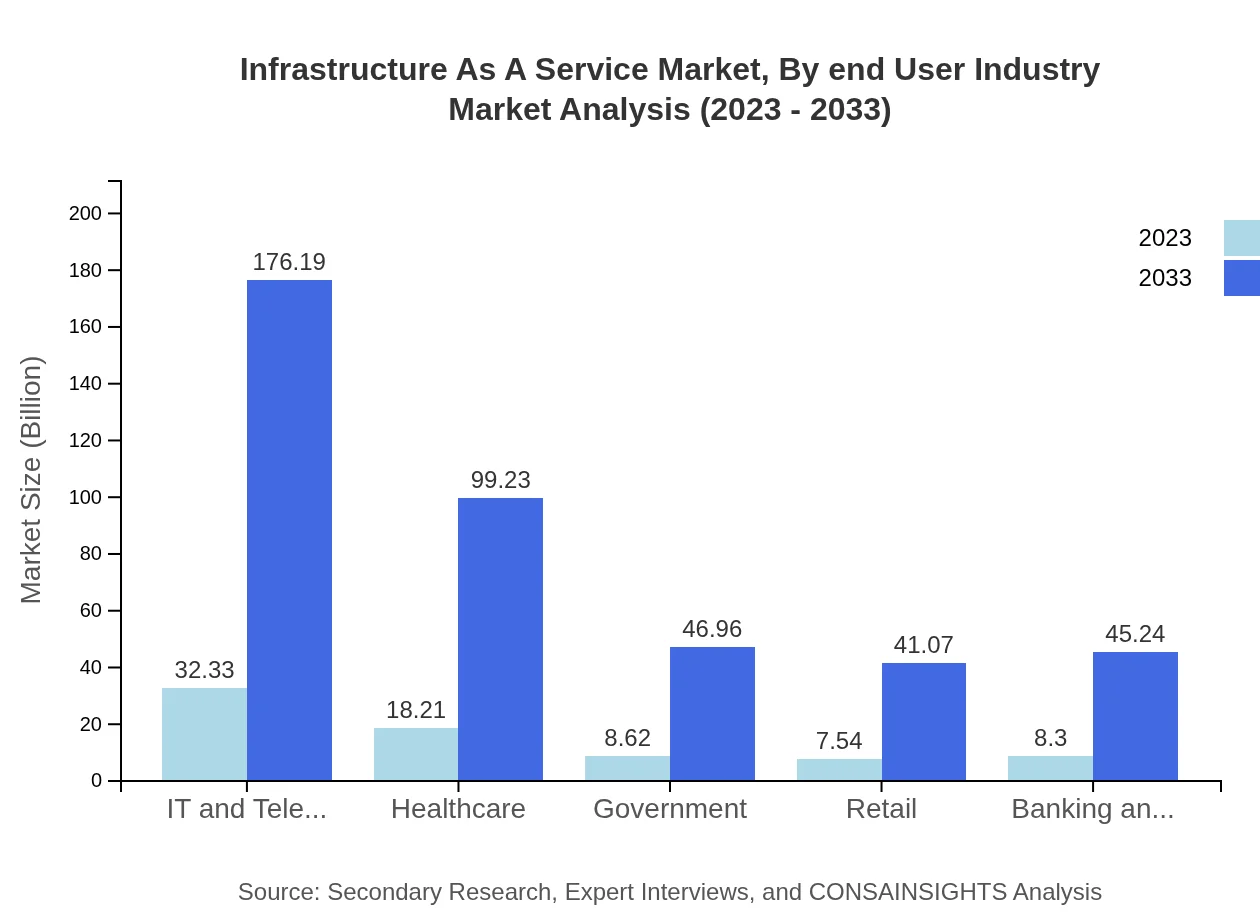

Infrastructure As A Service Market Analysis By End User Industry

The end-user segments include IT and telecom, healthcare, government, retail, and banking and financial services. IT and telecom display a notable size increase, with market forecasts rising from $32.33 billion in 2023 to $176.19 billion by 2033. Healthcare also shows significant growth, reflecting its critical need for data management and secure applications.

Infrastructure As A Service Market Analysis By Region Segment Specific

Regional analysis highlights varying growth rates, with North America leading, but Asia Pacific also rising rapidly due to digital transformation strategies being implemented by significant economies. Other regions like Europe and Latin America are experiencing gradual shifts towards cloud solutions, thereby increasing their market footprints.

Infrastructure As A Service Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Infrastructure As A Service Industry

Amazon Web Services (AWS):

The leading provider of cloud computing services, AWS offers a comprehensive suite of IaaS solutions catering to businesses of all sizes, characterized by its vast service offerings and global infrastructure.Microsoft Azure:

With a robust portfolio of IaaS solutions, Microsoft Azure focuses on hybrid cloud and enterprise-level offerings, making it a popular choice among large corporations.Google Cloud Platform:

Google Cloud provides a flexible IaaS offering with innovative services, especially in data analytics, appealing to tech-savvy businesses and startups.IBM Cloud:

IBM Cloud emphasizes hybrid cloud solutions and has deep integration with AI and data analytics, catering to a wide range of industry needs.Alibaba Cloud:

As Asia's leading provider, Alibaba Cloud offers robust IaaS solutions with a significant focus on the APAC region, driving adoption among businesses looking to scale operations digitally.We're grateful to work with incredible clients.

FAQs

What is the market size of Infrastructure As A-Service?

The global Infrastructure-as-a-Service (IaaS) market is projected to grow from $75 billion in 2023 to significantly higher in the coming years. The market is expected to achieve a compound annual growth rate (CAGR) of 17.5%, indicating robust growth in demand.

What are the key market players or companies in the Infrastructure As A-Service industry?

Leading companies in the IaaS sector include major players such as Amazon Web Services (AWS), Microsoft Azure, Google Cloud Platform (GCP), IBM Cloud, and Oracle Cloud. These firms dominate the market due to their extensive service offerings and robust infrastructure.

What are the primary factors driving the growth in the Infrastructure As A-Service industry?

Key growth drivers for the IaaS market include the increasing adoption of cloud-based solutions, growing demand for scalable infrastructure, cost-efficiency, and the rise of remote work trends, leading to higher reliance on cloud storage and processing capabilities.

Which region is the fastest Growing in the Infrastructure As A-Service market?

The fastest-growing region in the IaaS market is North America, with the market expected to expand from $25.53 billion in 2023 to $139.12 billion by 2033. Following closely is Europe and Asia-Pacific, reflecting strong growth potential.

Does ConsaInsights provide customized market report data for the IaaS industry?

Yes, ConsaInsights offers customized market report data tailored to the specific needs of clients in the IaaS industry. This includes detailed insights based on unique business models, regional focuses, and emerging trends.

What deliverables can I expect from this Infrastructure As A-Service market research project?

Clients can expect comprehensive market analysis reports, trend forecasting, competitive landscape assessments, and segment-specific insights. Detailed data visualizations and actionable recommendations will also be provided.

What are the market trends of Infrastructure As A-Service?

Current IaaS market trends include a surge in hybrid cloud adoption, increased focus on data security, and advancements in automated management tools. The rise in big data analytics and disaster recovery services is also notable.