Infrastructure Sector Overview Of Trends Industry Competitiveness Forecasts To-2024 Market Report

Published Date: 22 January 2026 | Report Code: infrastructure-sector-overview-of-trends-industry-competitiveness-forecasts-to-2024

Infrastructure Sector Overview Of Trends Industry Competitiveness Forecasts To-2024 Market Size, Share, Industry Trends and Forecast to 2033

This report explores the current state and projected growth of the infrastructure sector from 2023 to 2033. It provides insights into market trends, size, competitive landscape, and forecasts, offering a comprehensive look at the evolving infrastructure landscape.

| Metric | Value |

|---|---|

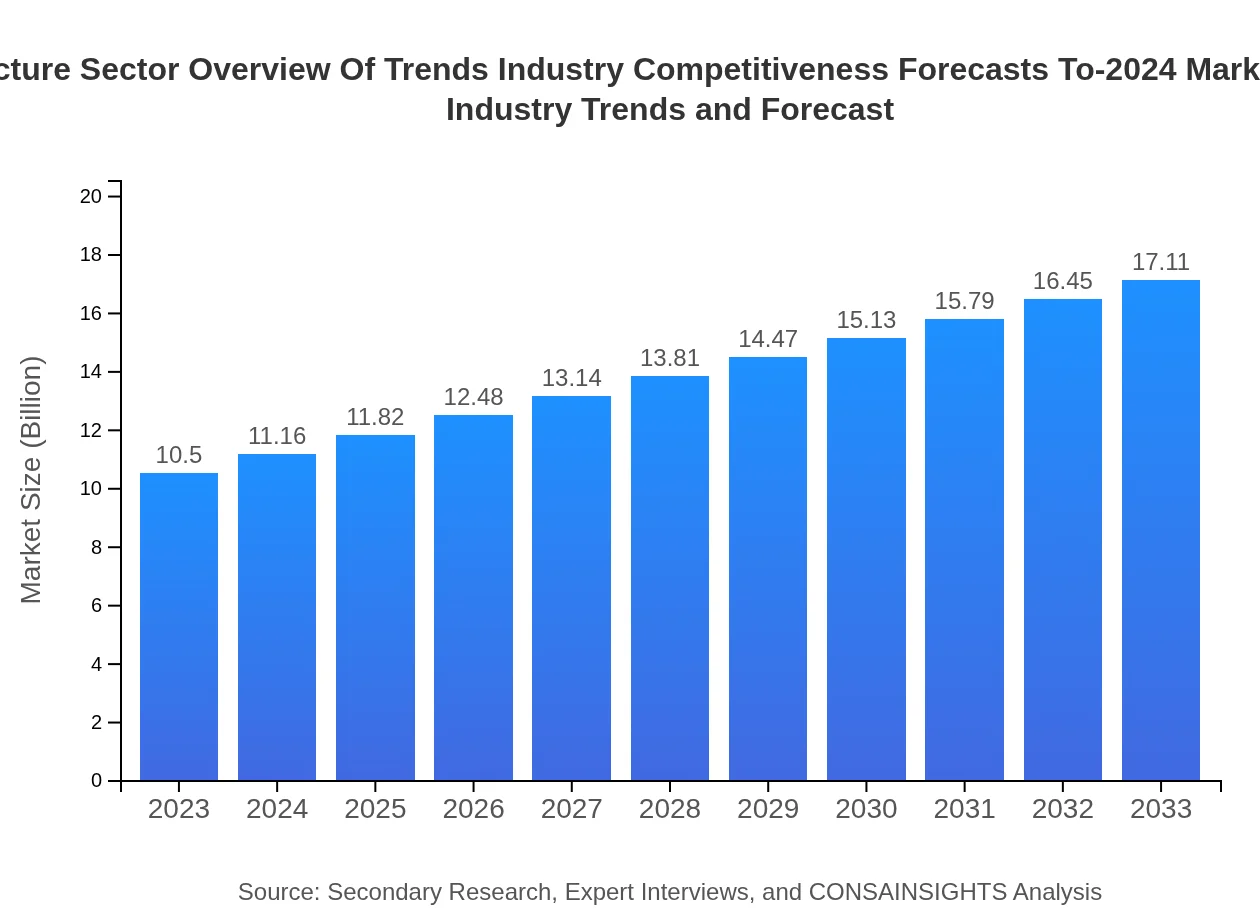

| Study Period | 2023 - 2033 |

| 2023 Market Size | $10.50 Trillion |

| CAGR (2023-2033) | 4.9% |

| 2033 Market Size | $17.11 Trillion |

| Top Companies | Bechtel, Fluor Corporation, Jacobs Engineering Group, AECOM |

| Last Modified Date | 22 January 2026 |

Infrastructure Sector Overview Of Trends Industry Competitiveness Forecasts To-2024 Market Overview

Customize Infrastructure Sector Overview Of Trends Industry Competitiveness Forecasts To-2024 Market Report market research report

- ✔ Get in-depth analysis of Infrastructure Sector Overview Of Trends Industry Competitiveness Forecasts To-2024 market size, growth, and forecasts.

- ✔ Understand Infrastructure Sector Overview Of Trends Industry Competitiveness Forecasts To-2024's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Infrastructure Sector Overview Of Trends Industry Competitiveness Forecasts To-2024

What is the Market Size & CAGR of Infrastructure Sector Overview Of Trends Industry Competitiveness Forecasts To-2024 market in 2023?

Infrastructure Sector Overview Of Trends Industry Competitiveness Forecasts To-2024 Industry Analysis

Infrastructure Sector Overview Of Trends Industry Competitiveness Forecasts To-2024 Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Infrastructure Sector Overview Of Trends Industry Competitiveness Forecasts To-2024 Market Analysis Report by Region

Europe Infrastructure Sector Overview Of Trends Industry Competitiveness Forecasts To-2024 Market Report:

The European infrastructure market is projected to grow from $3.52 trillion in 2023 to $5.73 trillion by 2033. Ongoing investments in green technology and sustainable practices are shaping the market. The EU’s commitment to reducing carbon emissions influences large-scale projects across member countries.Asia Pacific Infrastructure Sector Overview Of Trends Industry Competitiveness Forecasts To-2024 Market Report:

In Asia Pacific, the market size is projected to grow from $1.85 trillion in 2023 to $3.01 trillion by 2033. Countries like India and China are leading infrastructure investments driven by urbanization and economic growth. Technological advancements and public initiatives support this expansion, particularly in sustainable projects.North America Infrastructure Sector Overview Of Trends Industry Competitiveness Forecasts To-2024 Market Report:

North America shows a substantial increase in infrastructure investment from $3.77 trillion in 2023 to $6.15 trillion by 2033. The U.S. government has pushed for infrastructure upgrades and modernization. Smart infrastructure and sustainability are key focus areas, alongside the need for resilient systems against extreme weather.South America Infrastructure Sector Overview Of Trends Industry Competitiveness Forecasts To-2024 Market Report:

South America is expected to see growth from $0.70 trillion in 2023 to $1.15 trillion by 2033. The region is focusing on improving transportation and utility infrastructure, supported by both local and international investments. Renewable energy projects are gaining traction as countries aim for sustainable development.Middle East & Africa Infrastructure Sector Overview Of Trends Industry Competitiveness Forecasts To-2024 Market Report:

Middle East and Africa are set to increase market size from $0.66 trillion in 2023 to $1.07 trillion by 2033. The region’s infrastructure projects are largely fueled by oil revenue; however, there is increasing diversification into renewable projects and smart city developments.Tell us your focus area and get a customized research report.

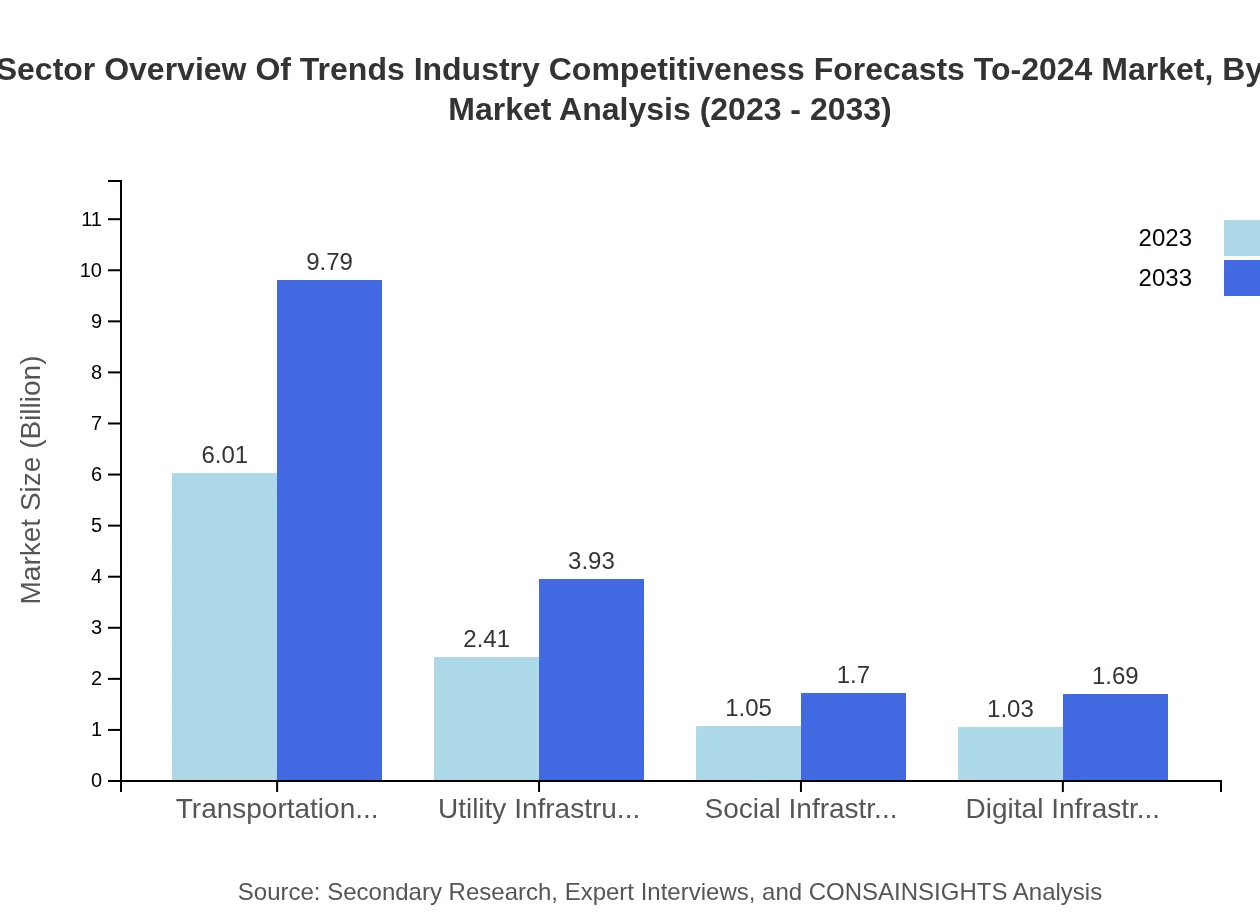

Infrastructure Sector Overview Of Trends Industry Competitiveness Forecasts To-2024 Market Analysis By Infrastructure Type

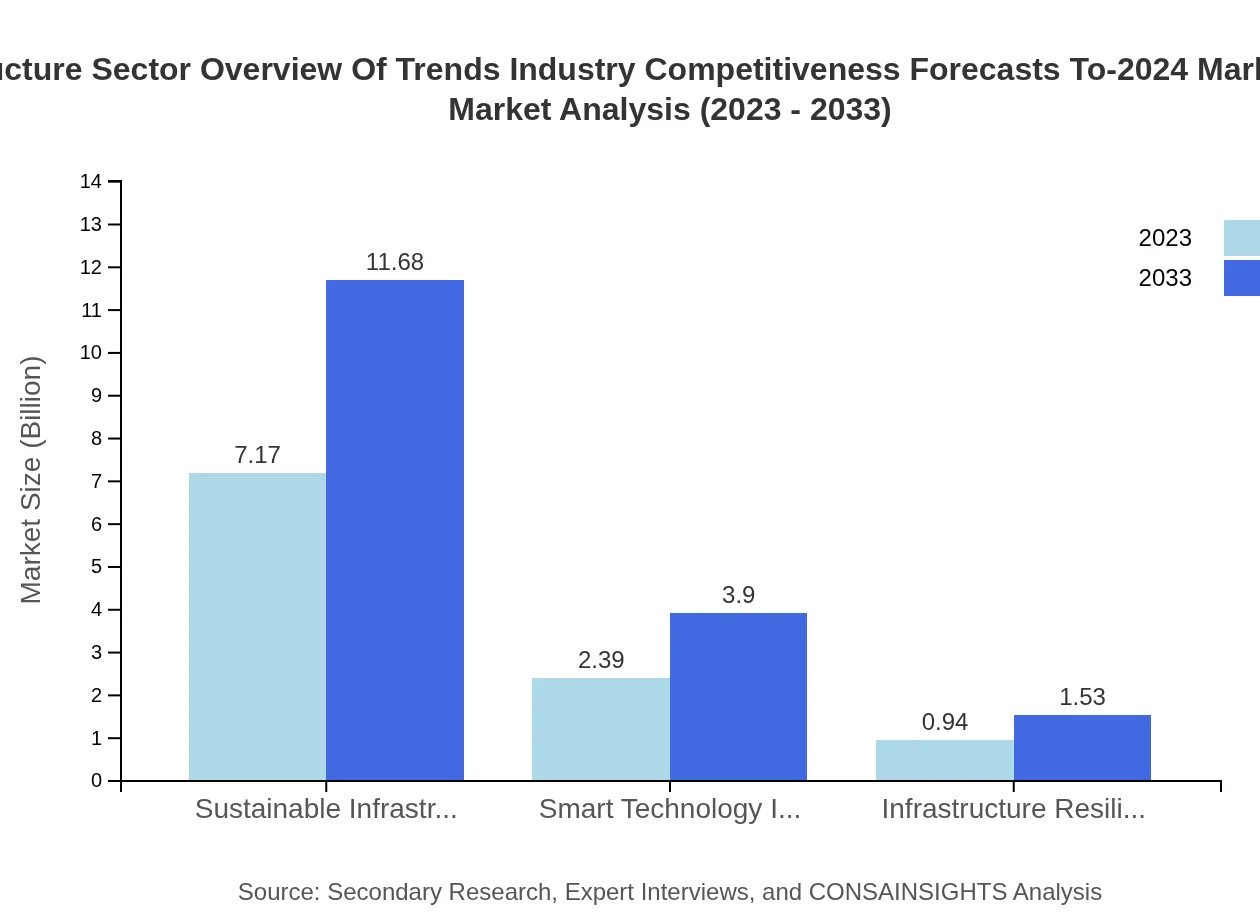

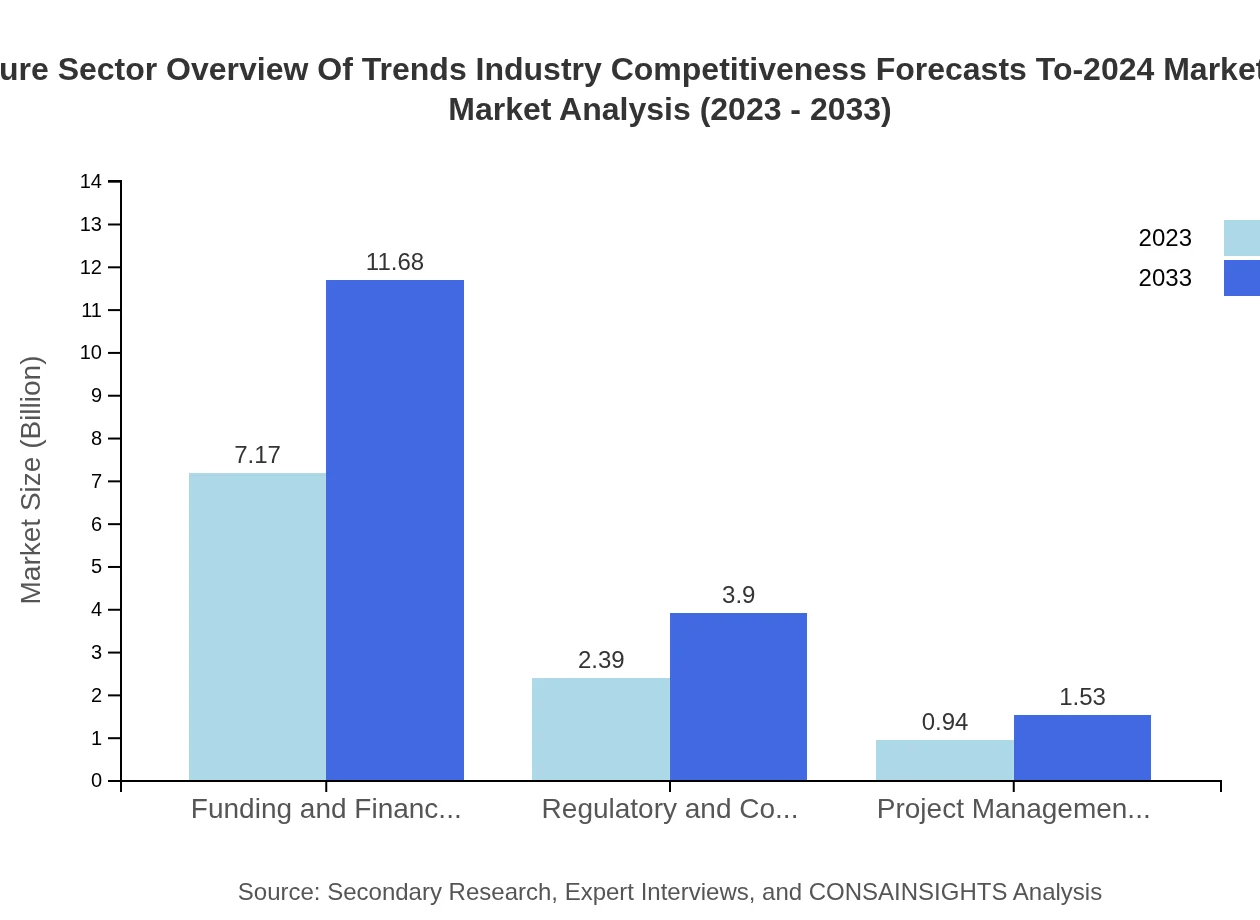

In 2023, sustainable infrastructure, with a market size of about $7.17 trillion, is anticipated to grow to $11.68 trillion by 2033, showcasing its significant share of 68.24% in the overall infrastructure market. Smart technology integration is another critical segment, growing from $2.39 trillion to $3.90 trillion, representing a share of 22.79%. Furthermore, transportation infrastructure leads in size with $6.01 trillion, indicating its essential role in economic connectivity.

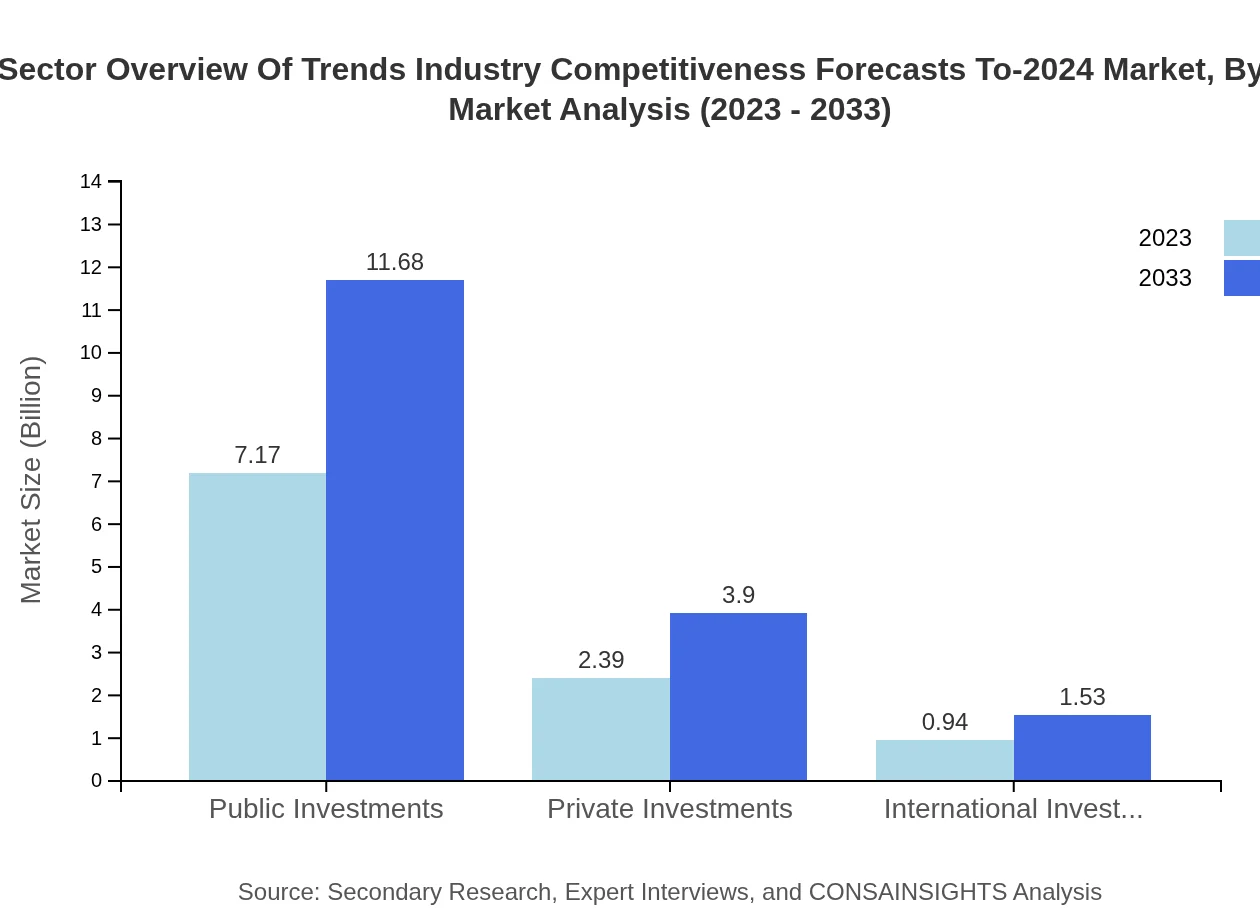

Infrastructure Sector Overview Of Trends Industry Competitiveness Forecasts To-2024 Market Analysis By Investment Source

Public investments dominate the infrastructure financing landscape, accounting for $7.17 trillion in 2023 and expected to reach $11.68 trillion by 2033. Private and international investments are also growing, though they share a smaller pie of 22.79% and 8.97%, respectively. The blend of funding sources is crucial to address the significant financing needs in this sector.

Infrastructure Sector Overview Of Trends Industry Competitiveness Forecasts To-2024 Market Analysis By Trends

Current trends emphasize sustainability, smart technology integration, and resilience against climate change. With increasing investments in green infrastructure and the adoption of smart technologies, the sector is evolving. Challenges in funding, regulatory compliance, and project management are being addressed through innovative solutions, reinforcing market growth.

Infrastructure Sector Overview Of Trends Industry Competitiveness Forecasts To-2024 Market Analysis By Challenges

The infrastructure sector faces several challenges, including funding shortages, regulatory complexities, and management inefficiencies. Navigating compliance with evolving regulations can be daunting, while securing consistent funding for large projects remains a significant hurdle. Addressing these challenges is vital for the sector’s growth and overall effectiveness.

Infrastructure Sector Overview Of Trends Industry Competitiveness Forecasts To-2024 Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Infrastructure Sector Overview Of Trends Industry Competitiveness Forecasts To-2024 Industry

Bechtel:

A leading construction and project management company, Bechtel delivers critical infrastructure projects around the world, focusing on sustainability and innovation.Fluor Corporation:

Fluor provides engineering, procurement, construction, and maintenance services for various industries, contributing significantly to infrastructure development globally.Jacobs Engineering Group:

Jacobs offers a full spectrum of infrastructure solutions and is focused on integrating smart technologies to enhance efficiency and sustainability.AECOM:

AECOM is a global infrastructure firm involved in planning, designing, and managing infrastructure projects, emphasizing sustainability and community impact.We're grateful to work with incredible clients.

FAQs

What is the market size of Infrastructure Sector Overview Of Trends Industry Competitiveness Forecasts To 2024?

The market size for the Infrastructure Sector is projected to reach $10.5 Trillion by 2024, with a compound annual growth rate (CAGR) of 4.9%. This growth reflects increasing investments in infrastructure across various regions and sectors.

What are the key market players or companies in this Infrastructure Sector industry?

Key market players in the Infrastructure Sector include major construction firms, engineering companies, and project management consultancies, which lead in innovation and project execution. They often collaborate with governments and private sector organizations.

What are the primary factors driving the growth in the Infrastructure Sector industry?

Growth in the Infrastructure Sector is primarily driven by urbanization, increasing population, investments in smart technology integration, and government spending on public infrastructure projects aimed at economic development and sustainability.

Which region is the fastest Growing in the Infrastructure Sector?

The fastest-growing region in the Infrastructure Sector is expected to be North America, with a market size projected to increase from $3.77 Trillion in 2023 to $6.15 Trillion by 2033, reflecting accelerated development initiatives.

Does ConsaInsights provide customized market report data for the Infrastructure Sector industry?

Yes, ConsaInsights offers customized market report data tailored to the unique needs of clients in the Infrastructure Sector. This includes in-depth analyses and insights specific to various sub-segments.

What deliverables can I expect from this Infrastructure Sector market research project?

Deliverables from the Infrastructure Sector market research project include comprehensive reports, trend analyses, forecasts, market segmentation data, competitive landscape evaluations, and actionable insights for strategic decision-making.

What are the market trends of Infrastructure Sector?

Key trends in the Infrastructure Sector include the rise of sustainable infrastructure, smart technology integration, and a focus on resilience. Increased public and private investments are shaping future developments and enhancing operational efficiencies.