Infusion Pump Software Market Report

Published Date: 31 January 2026 | Report Code: infusion-pump-software

Infusion Pump Software Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Infusion Pump Software market from 2023 to 2033, highlighting market trends, size, and regional insights. It aims to offer valuable insights into technology adoption and future growth opportunities.

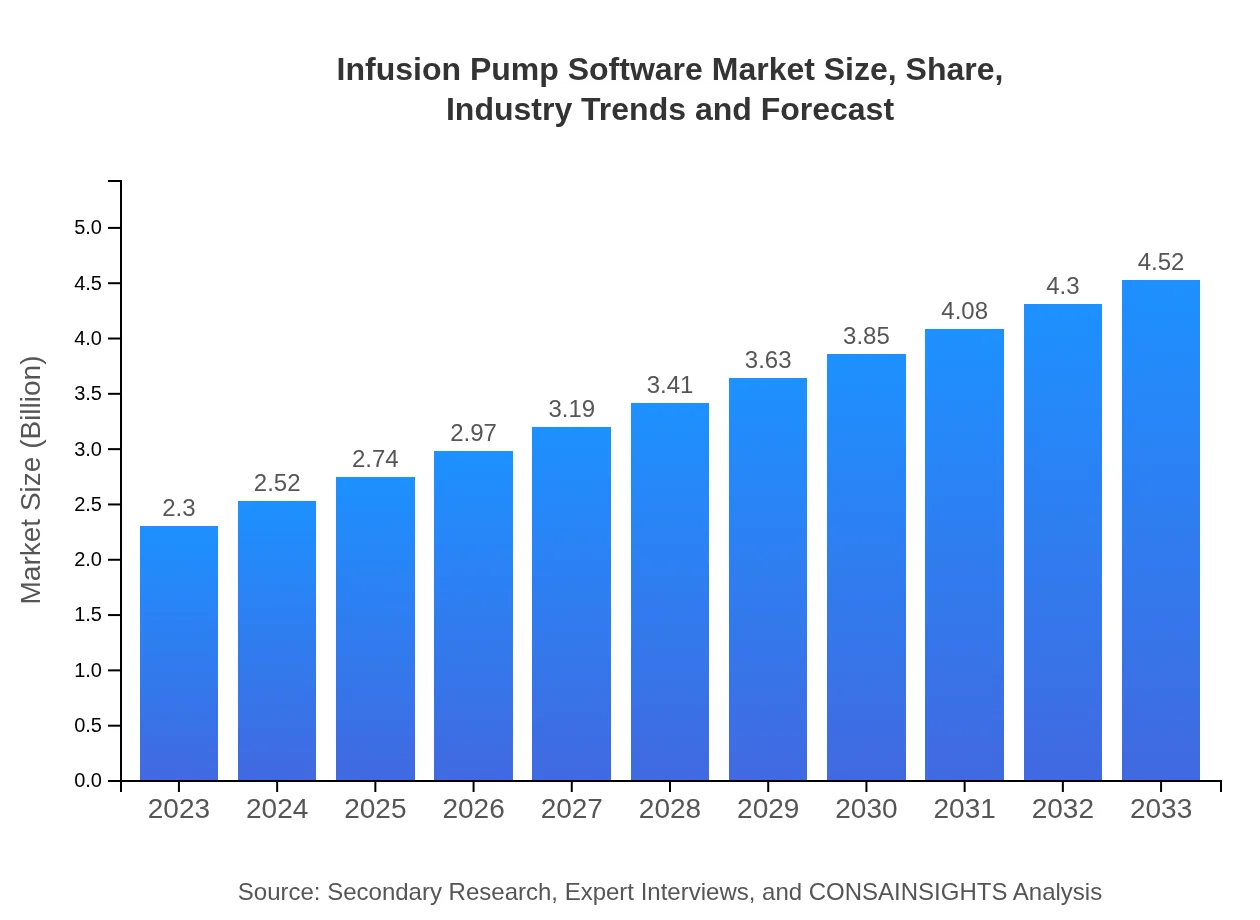

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $2.30 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $4.52 Billion |

| Top Companies | Becton Dickinson and Company, Medtronic , Baxter International Inc., Fresenius Kabi, Smiths Medical |

| Last Modified Date | 31 January 2026 |

Infusion Pump Software Market Overview

Customize Infusion Pump Software Market Report market research report

- ✔ Get in-depth analysis of Infusion Pump Software market size, growth, and forecasts.

- ✔ Understand Infusion Pump Software's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Infusion Pump Software

What is the Market Size & CAGR of Infusion Pump Software market in 2023?

Infusion Pump Software Industry Analysis

Infusion Pump Software Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Infusion Pump Software Market Analysis Report by Region

Europe Infusion Pump Software Market Report:

Europe's Infusion Pump Software market held a value of $0.72 billion in 2023 and is projected to reach $1.41 billion by 2033. The demand in this region is driven by increasing regulatory compliance requirements and a growing elderly population requiring long-term care.Asia Pacific Infusion Pump Software Market Report:

In the Asia Pacific region, the Infusion Pump Software market was valued at $0.45 billion in 2023 and is expected to grow to $0.88 billion by 2033. The growth in this region is driven by the rising healthcare infrastructure investments and increasing chronic disease prevalence, particularly diabetes and cardiovascular diseases.North America Infusion Pump Software Market Report:

North America represents the largest market, valued at $0.78 billion in 2023, with growth expected to reach $1.54 billion by 2033. The dominance of this region can be attributed to advanced healthcare infrastructure, higher adoption rates of technology in healthcare, and significant investment in research and development.South America Infusion Pump Software Market Report:

The South American market for Infusion Pump Software was approximately $0.21 billion in 2023, projected to grow to $0.41 billion by 2033. The region's growth potential lies in the expansion of healthcare facilities and increased demand for advanced medical technologies.Middle East & Africa Infusion Pump Software Market Report:

The Middle East and Africa market had a valuation of $0.14 billion in 2023, expected to rise to $0.27 billion by 2033. Growth factors include expanding healthcare facilities, government initiatives to improve healthcare standards, and the increasing prevalence of diseases requiring infusion therapies.Tell us your focus area and get a customized research report.

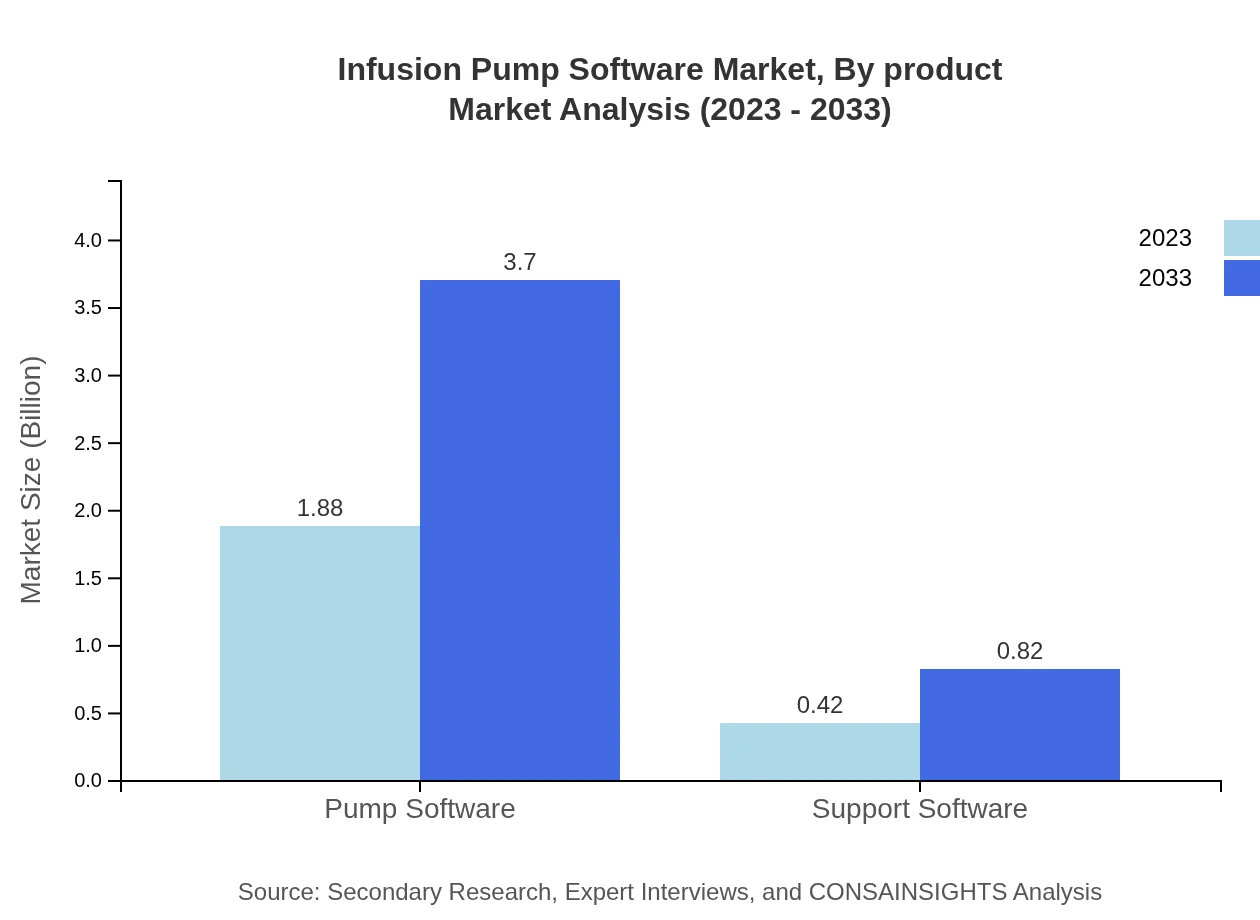

Infusion Pump Software Market Analysis By Product

In 2023, the Infusion Pump Software segment was valued at $1.88 billion and is forecasted to grow to $3.70 billion by 2033, maintaining the majority share in the market due to its crucial role in medication delivery.

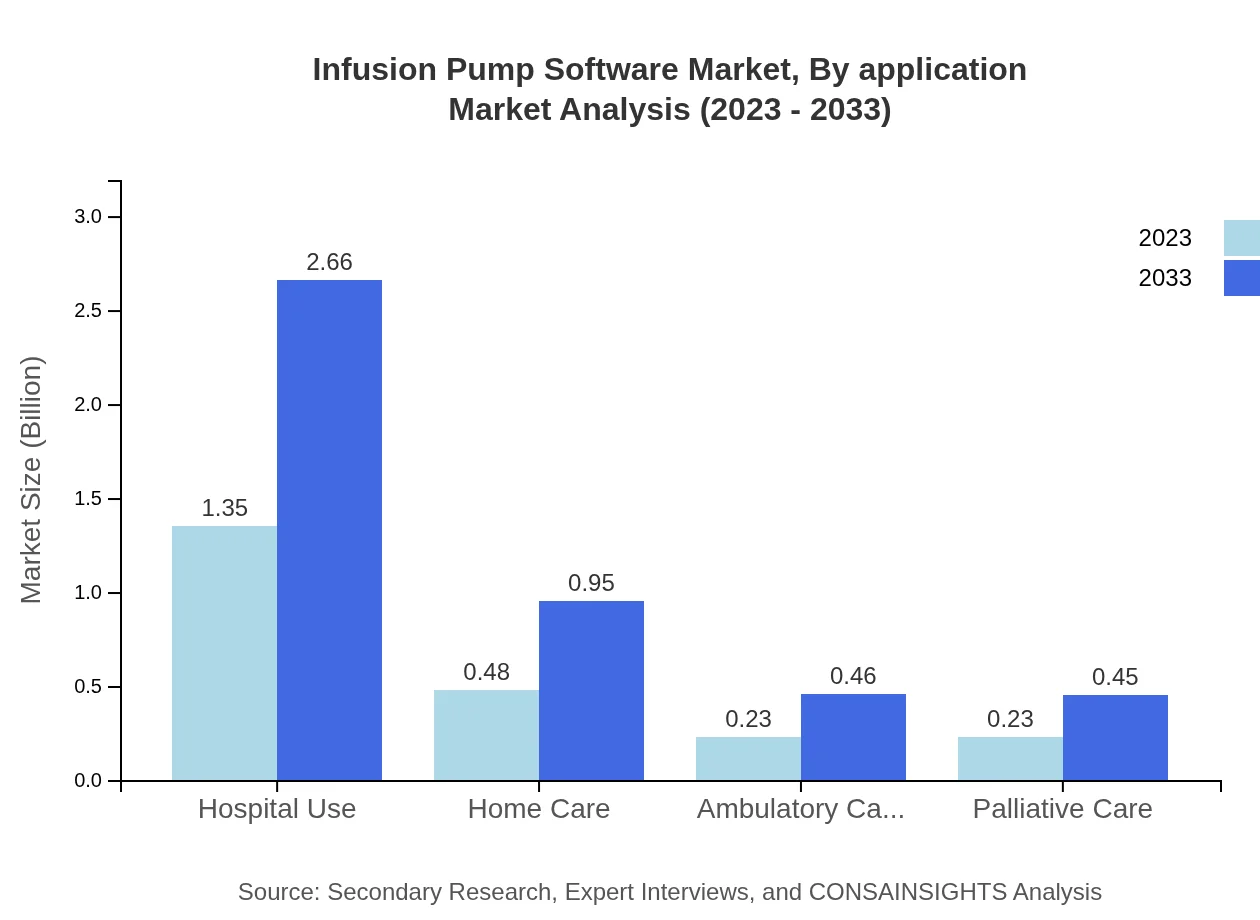

Infusion Pump Software Market Analysis By Application

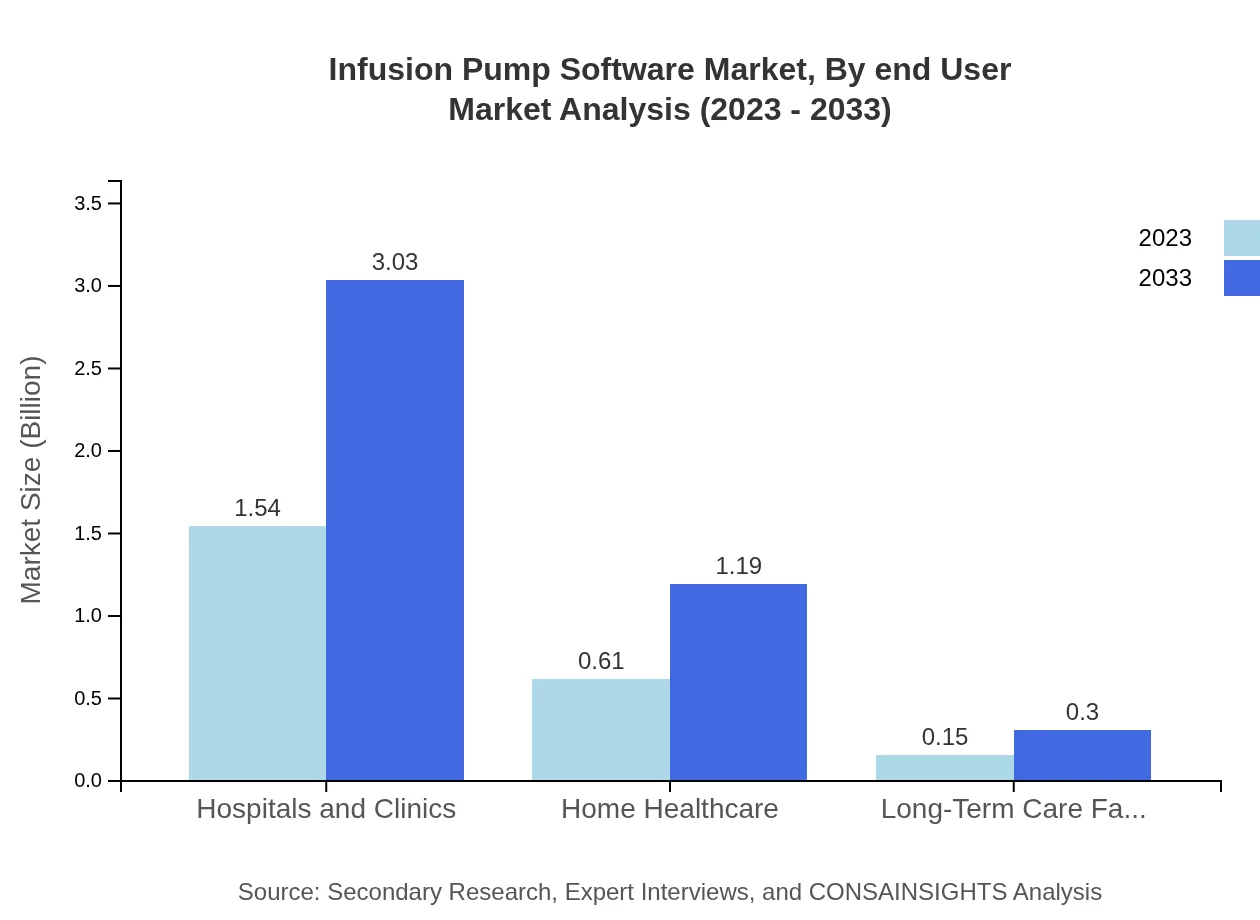

The application segment for hospitals and clinics accounted for $1.54 billion in 2023, projected to reach $3.03 billion by 2033, emphasizing the reliance of healthcare institutions on infusion pump software for precise medication administration.

Infusion Pump Software Market Analysis By End User

In 2023, the hospital use accounted for approximately $1.35 billion, growing to $2.66 billion by 2033, confirming the sectors' substantial reliance on infusion technologies.

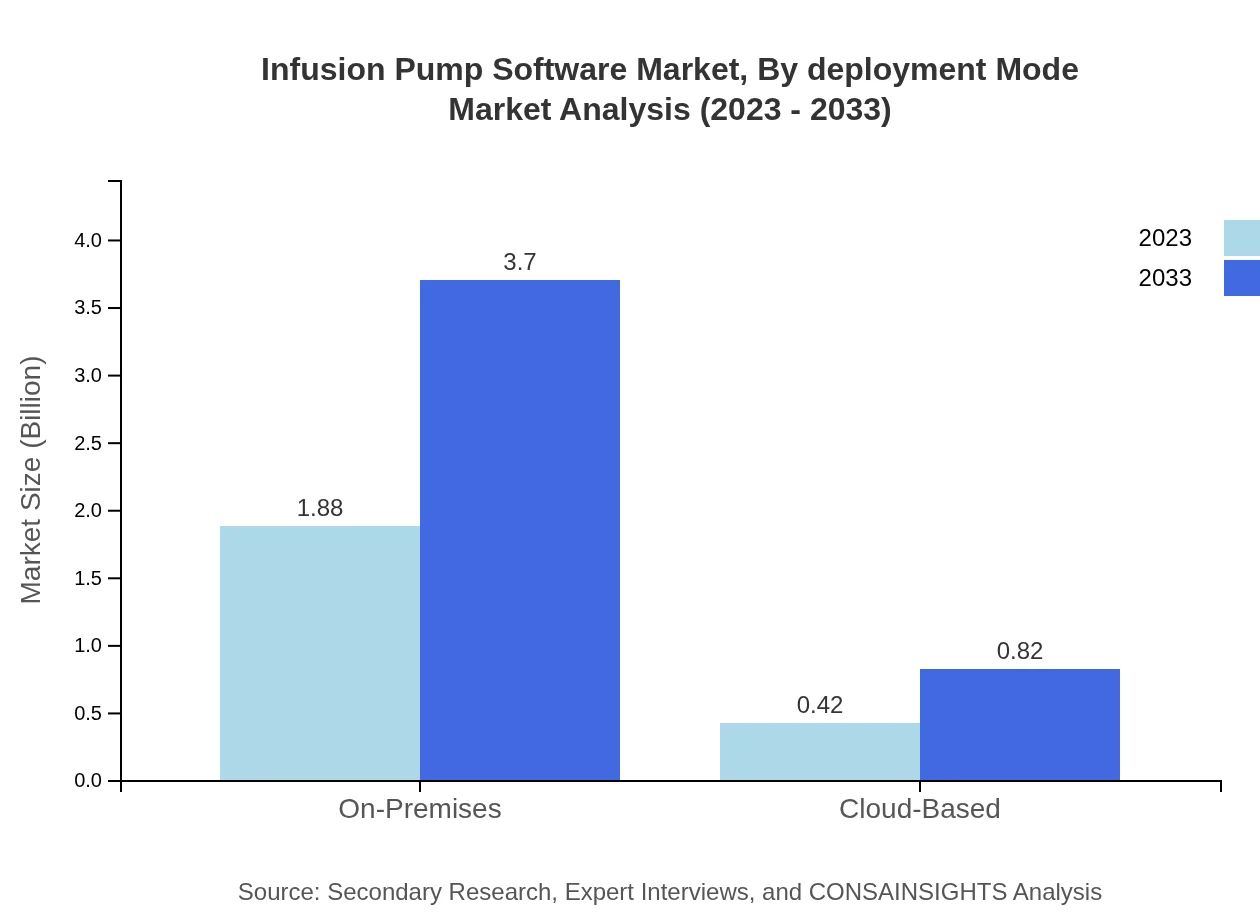

Infusion Pump Software Market Analysis By Deployment Mode

In 2023, the on-premises deployment segment was valued at $1.88 billion and is expected to maintain its share at $3.70 billion by 2033 due to the clinical settings’ preference for data control.

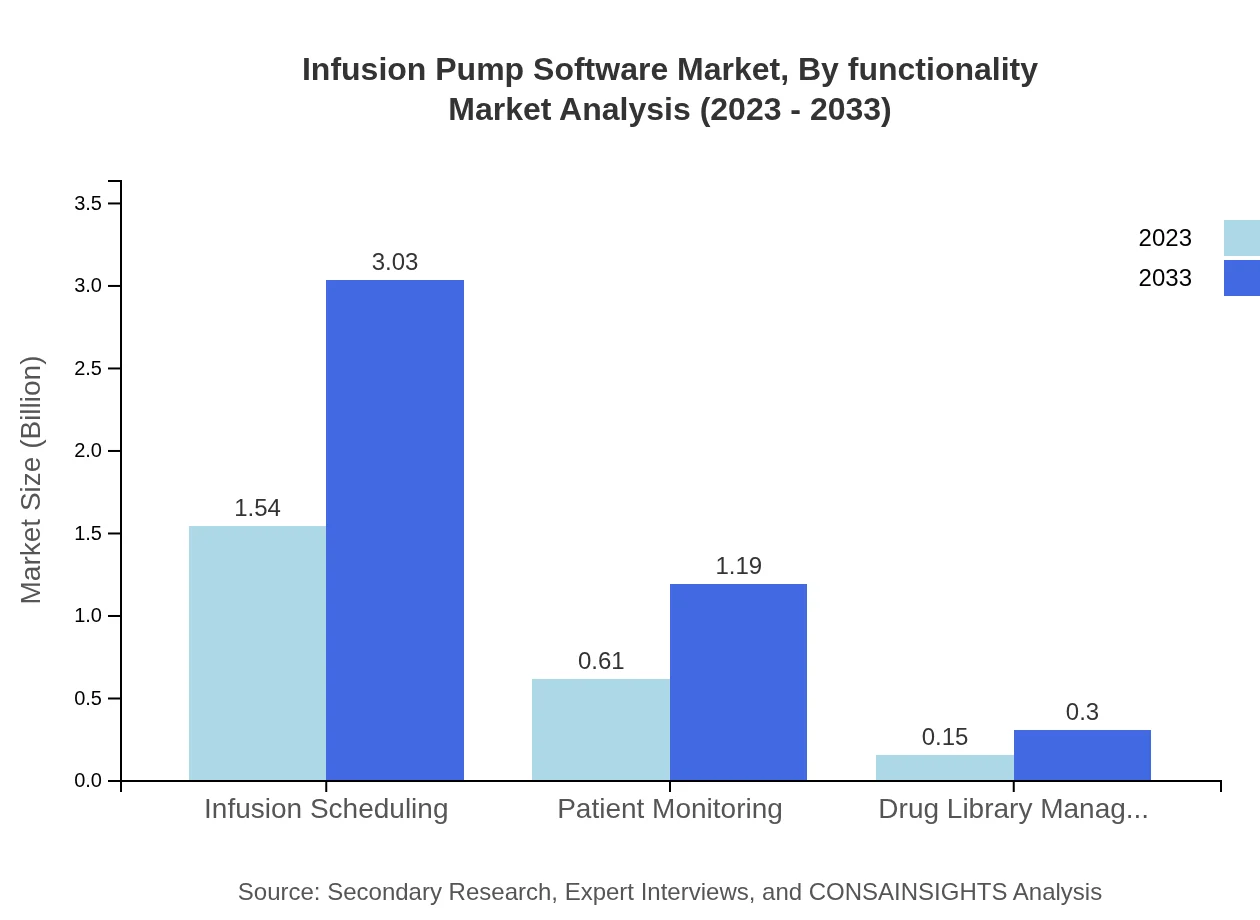

Infusion Pump Software Market Analysis By Functionality

Infusion Scheduling, which stood at $1.54 billion in 2023, is projected to maintain its significance in patient care and projected to reach $3.03 billion by 2033.

Infusion Pump Software Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Infusion Pump Software Industry

Becton Dickinson and Company:

A major medical technology company that provides innovative infusion solutions, focusing on patient safety and outcomes.Medtronic :

A global leader in medical technology, offering advanced infusion systems that integrate with digital healthcare solutions.Baxter International Inc.:

This firm specializes in critical care medications and infusion technologies that enhance care delivery.Fresenius Kabi:

Known for its infusion systems and technology that bolster patient safety and efficacy in infusions.Smiths Medical:

A leading medical device manufacturer providing a range of infusion therapy solutions and innovative software for clinicians.We're grateful to work with incredible clients.

FAQs

What is the market size of infusion Pump Software?

The infusion pump software market is currently valued at approximately $2.3 billion with a projected CAGR of 6.8% from 2023 to 2033. This growth indicates significant advancements and increasing adoption in healthcare settings globally.

What are the key market players or companies in the infusion Pump Software industry?

Key players in the infusion pump software market include Medtronic, Baxter International, B. Braun, and Cerner Corporation. These companies lead with innovative solutions and comprehensive software offerings, catering to diverse healthcare needs across various segments.

What are the primary factors driving the growth in the infusion Pump Software industry?

Growth drivers include increased prevalence of chronic diseases requiring infusion therapies, technological advancements in pump software, and a rise in home healthcare settings. Additionally, regulatory support for safety standards accelerates market expansion.

Which region is the fastest Growing in the infusion Pump Software market?

North America is currently the fastest-growing region, projected to increase from $0.78 billion in 2023 to $1.54 billion by 2033. Europe and Asia-Pacific also show significant growth potential, reflecting rising healthcare investments.

Does ConsaInsights provide customized market report data for the infusion Pump Software industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the infusion pump software industry. Clients can access detailed insights based on particular demographics, regions, or market segments to drive informed decision-making.

What deliverables can I expect from this infusion Pump Software market research project?

Deliverables include comprehensive market analysis reports, segmentation data, regional insights, competitive landscape overviews, and future growth forecasts. These reports are designed to help stakeholders identify opportunities and make strategic decisions.

What are the market trends of infusion Pump Software?

Trends include increasing adoption of cloud-based software solutions, integration of artificial intelligence for patient monitoring, and a shift towards patient-centric care models. Growth in telehealth services is also shaping the future of infusion pump software.