Infusion Pumps And Accessories Market Report

Published Date: 31 January 2026 | Report Code: infusion-pumps-and-accessories

Infusion Pumps And Accessories Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the infusion pumps and accessories market, examining current trends, forecasts through 2033, size and growth potential across various regions and segments.

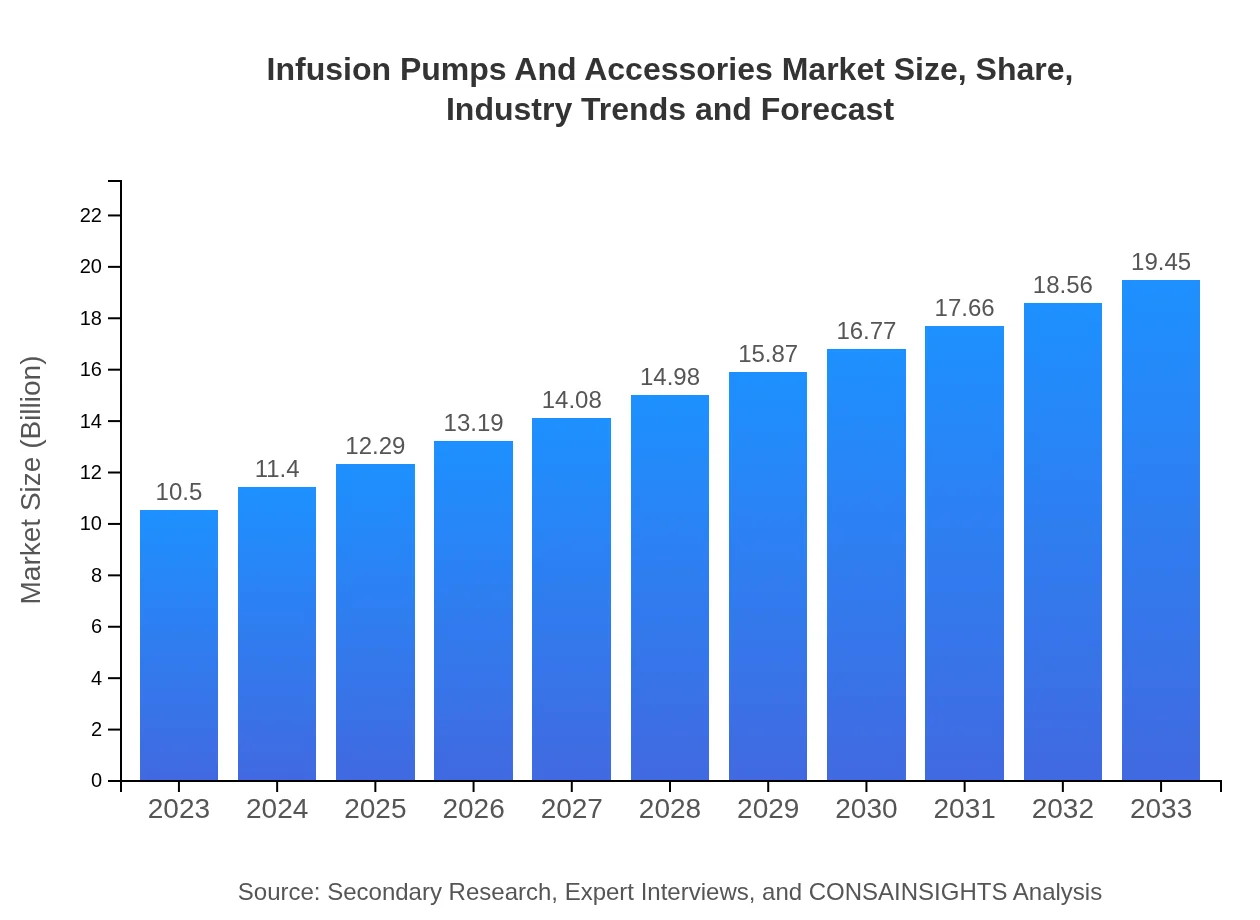

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $10.50 Billion |

| CAGR (2023-2033) | 6.2% |

| 2033 Market Size | $19.45 Billion |

| Top Companies | Baxter International Inc., B. Braun Melsungen AG, Medtronic Plc., Terumo Corporation, Smiths Medical |

| Last Modified Date | 31 January 2026 |

Infusion Pumps And Accessories Market Overview

Customize Infusion Pumps And Accessories Market Report market research report

- ✔ Get in-depth analysis of Infusion Pumps And Accessories market size, growth, and forecasts.

- ✔ Understand Infusion Pumps And Accessories's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Infusion Pumps And Accessories

What is the Market Size & CAGR of Infusion Pumps And Accessories market in 2023?

Infusion Pumps And Accessories Industry Analysis

Infusion Pumps And Accessories Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Infusion Pumps And Accessories Market Analysis Report by Region

Europe Infusion Pumps And Accessories Market Report:

Europe's market size is estimated to increase from USD 3.14 billion in 2023 to USD 5.81 billion in 2033. The adoption of smart technologies and regulatory support for innovative devices drives this expansion directly.Asia Pacific Infusion Pumps And Accessories Market Report:

In the Asia Pacific, the infusion pumps and accessories market is projected to expand from USD 1.91 billion in 2023 to USD 3.54 billion by 2033, attributed to rising healthcare expenditure, increased prevalence of chronic diseases, and growing awareness of advanced healthcare facilities among patients.North America Infusion Pumps And Accessories Market Report:

The North American market is the largest, expected to grow from USD 4.00 billion in 2023 to USD 7.41 billion by 2033. Factors such as a strong presence of leading manufacturers, a highly developed healthcare system, and rising demand for efficient patient management systems drive this growth.South America Infusion Pumps And Accessories Market Report:

South America accounts for a smaller segment of the market, growing from USD 0.33 billion in 2023 to USD 0.62 billion in 2033. The growth is supported by improving healthcare infrastructure and increased governmental investments in medical technologies.Middle East & Africa Infusion Pumps And Accessories Market Report:

The market in the Middle East and Africa is anticipated to grow from USD 1.12 billion in 2023 to USD 2.08 billion in 2033. The factors contributing to growth include increasing healthcare access and government health initiatives aimed at combating various diseases.Tell us your focus area and get a customized research report.

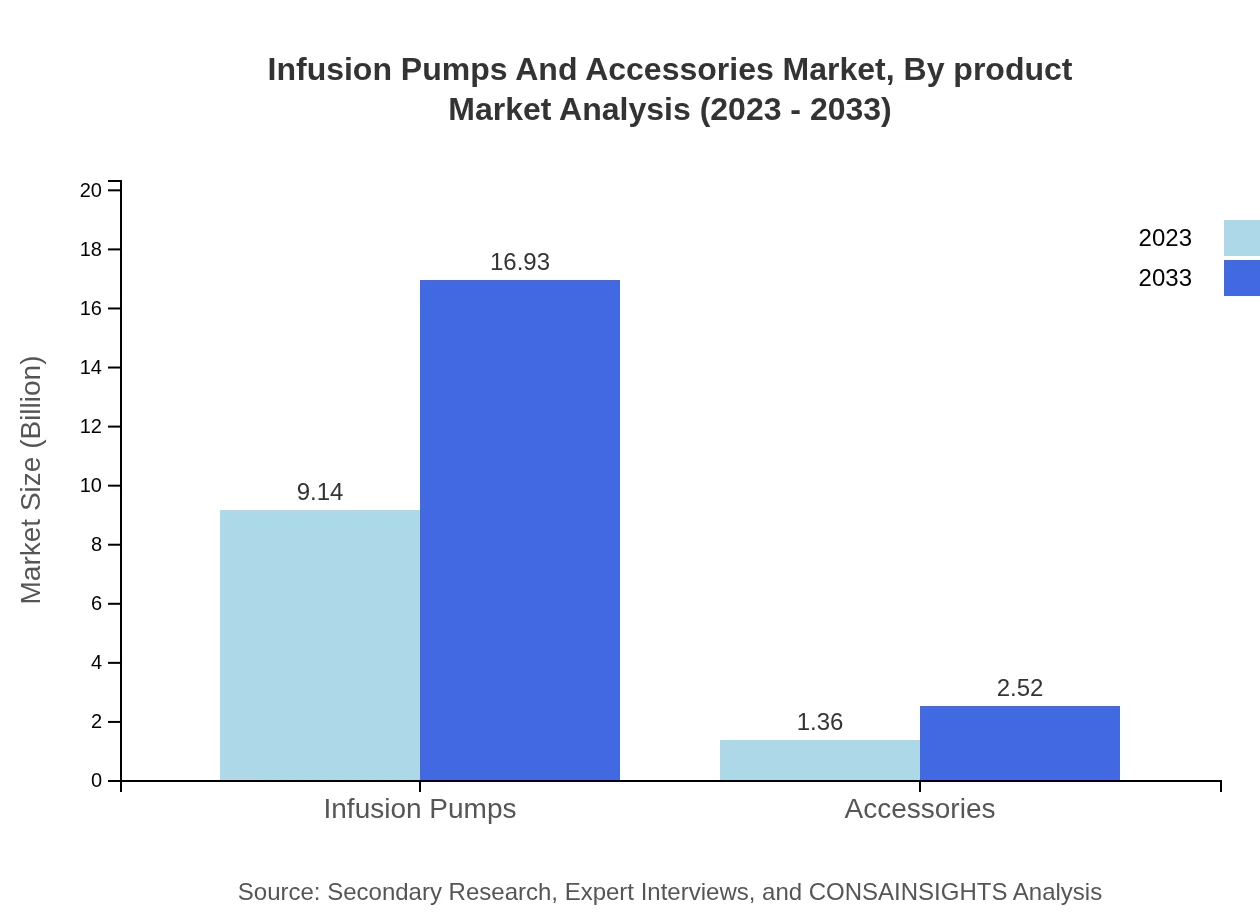

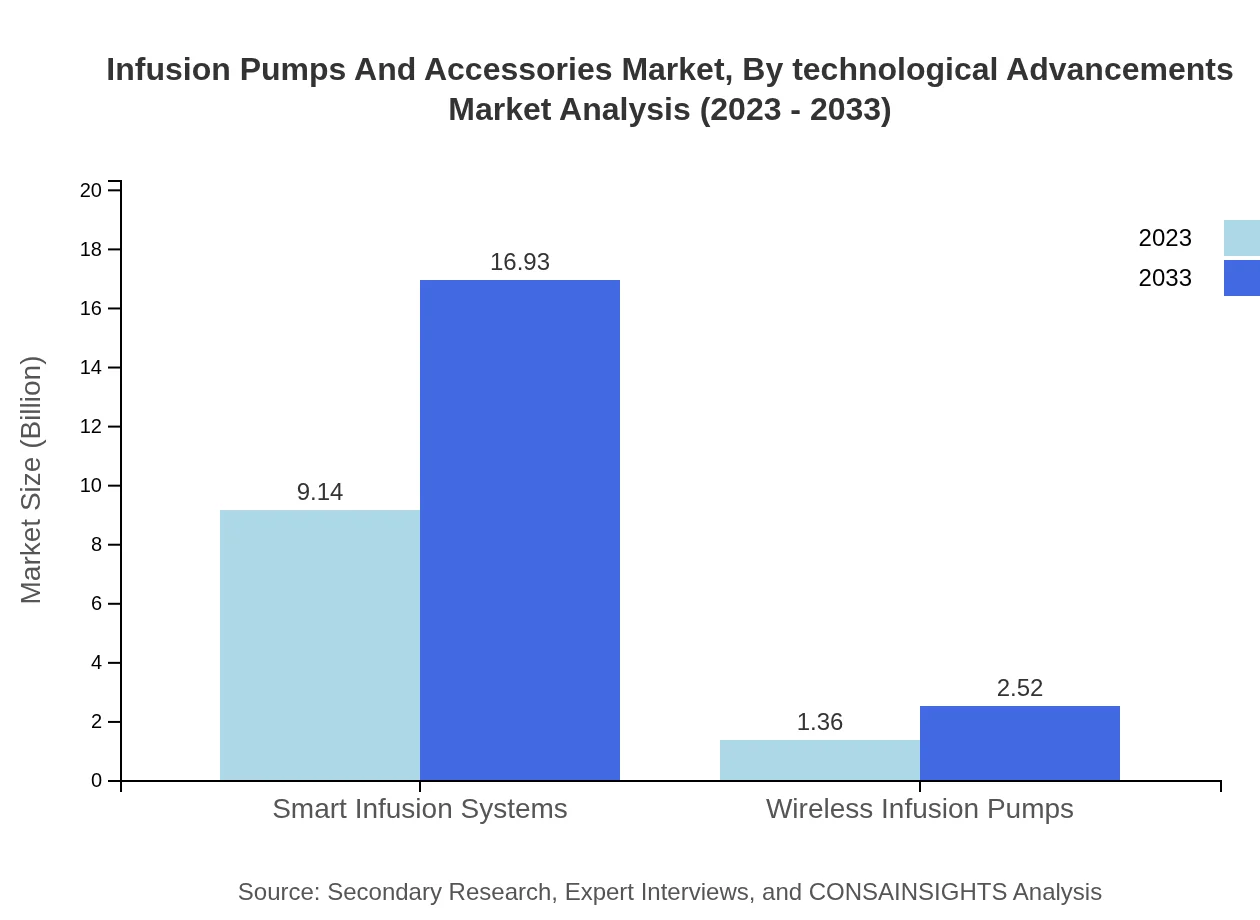

Infusion Pumps And Accessories Market Analysis By Product

The global market for infusion pumps is forecasted to grow from USD 9.14 billion in 2023 to USD 16.93 billion by 2033. This segment holds a market share of 87.05% in 2023 and is expected to maintain this share through 2033. The infusion accessories segment is much smaller, forecasted to increase from USD 1.36 billion in 2023 to USD 2.52 billion in 2033, reflecting its importance in ensuring safety and precision in infusion therapies.

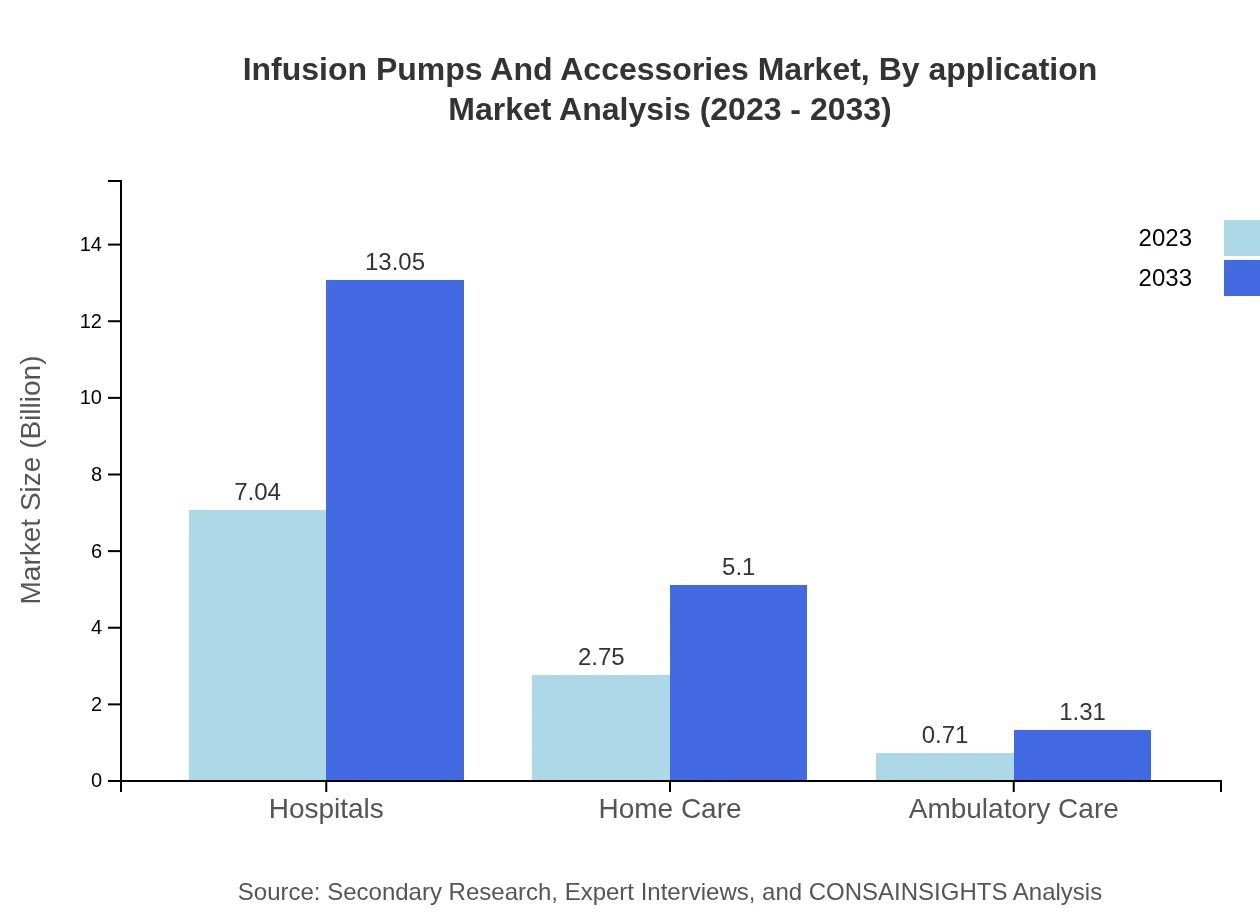

Infusion Pumps And Accessories Market Analysis By Application

The hospital segment is dominant, with a market size expected to rise from USD 7.04 billion in 2023 to USD 13.05 billion by 2033, capturing about 67.07% of the market share. Home care services are also significant, projected to grow from USD 2.75 billion in 2023 to USD 5.10 billion in 2033, indicating a trend towards patient-centered home healthcare.

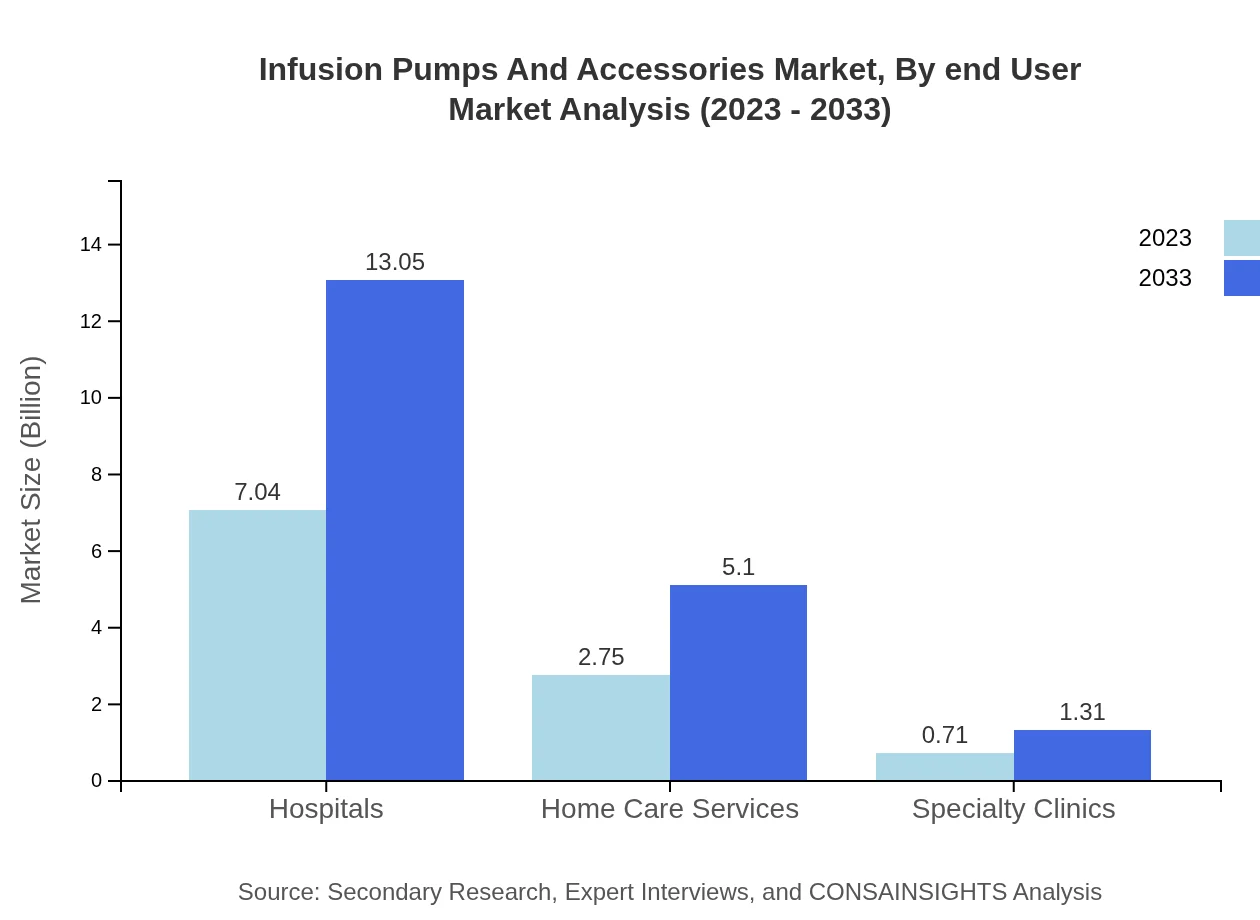

Infusion Pumps And Accessories Market Analysis By End User

In terms of end-users, hospitals are the leading users of infusion pumps and accessories, with the segment projected to expand significantly. Specialty clinics and ambulatory care are also notable end-users indicating a rising trend towards outpatient therapies.

Infusion Pumps And Accessories Market Analysis By Technological Advancements

Technological advancements are crucial in shaping the infusion pumps and accessories market. Smart infusion pumps, featuring programmable settings and wireless connectivity for better monitoring, are increasingly gaining traction. The rise of Health IT and patient monitoring technologies reflects a shift towards integrated healthcare models, enhancing the overall patient care experience.

Infusion Pumps And Accessories Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Infusion Pumps And Accessories Industry

Baxter International Inc.:

Baxter is a leading global medical device company that specializes in infusion systems for various healthcare environments. Their innovative products have set standards in improving patient safety and efficacy.B. Braun Melsungen AG:

B. Braun is well-known for its comprehensive range of infusion systems and solutions tailored for hospitals and outpatient settings, focusing on quality and safety.Medtronic Plc.:

Medtronic is a paramount player in medical technology, providing advanced infusion systems that enable better patient management and streamlined clinical workflows.Terumo Corporation:

Terumo is recognized for delivering innovative infusion devices that enhance patient care, focusing on safety and user-friendliness.Smiths Medical:

Smiths Medical specializes in infusion devices, offering a wide range of products designed for the accuracy and safety of drug delivery.We're grateful to work with incredible clients.

FAQs

What is the market size of infusion pumps and accessories?

The global market size for infusion pumps and accessories is estimated at USD 10.5 billion in 2023, with a projected CAGR of 6.2% until 2033. This growth indicates a robust increase in demand for these essential medical devices.

What are the key market players or companies in the infusion pumps and accessories industry?

Key players in the infusion pumps and accessories industry include prominent medical device manufacturers like Baxter International, Becton Dickinson, and Medtronic, which are significant for their innovative product development and extensive market reach.

What are the primary factors driving the growth in the infusion pumps and accessories industry?

Driving factors include the rising prevalence of chronic diseases, increasing surgical procedures, technological advancements in pump devices, and the growing preference for home and outpatient care services, which enhance accessibility to treatment.

Which region is the fastest Growing in the infusion pumps and accessories market?

North America is the fastest-growing region, with an estimated market size of USD 4.00 billion in 2023, projected to rise to USD 7.41 billion by 2033, attributed to advanced healthcare infrastructure and high demand for quality patient care.

Does ConsaInsights provide customized market report data for the infusion pumps and accessories industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the infusion pumps and accessories sector, ensuring clients receive relevant insights tailored to their strategic objectives.

What deliverables can I expect from this infusion pumps and accessories market research project?

Deliverables include comprehensive market analysis reports, detailed segmentation data, competitive landscapes, trend analysis, forecasts, and actionable insights to inform decision-making and strategic planning.

What are the market trends of infusion pumps and accessories?

Current market trends indicate a growing shift towards wireless infusion pumps, smart infusion systems, and an increasing focus on home care services, reflecting the ongoing transformation in patient care approaches.