Inhalation And Nasal Spray Generic Drugs Market Report

Published Date: 31 January 2026 | Report Code: inhalation-and-nasal-spray-generic-drugs

Inhalation And Nasal Spray Generic Drugs Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Inhalation and Nasal Spray Generic Drugs market from 2023 to 2033. It encompasses detailed insights into market size, growth patterns, segmentation, regional dynamics, industry players, and future trends.

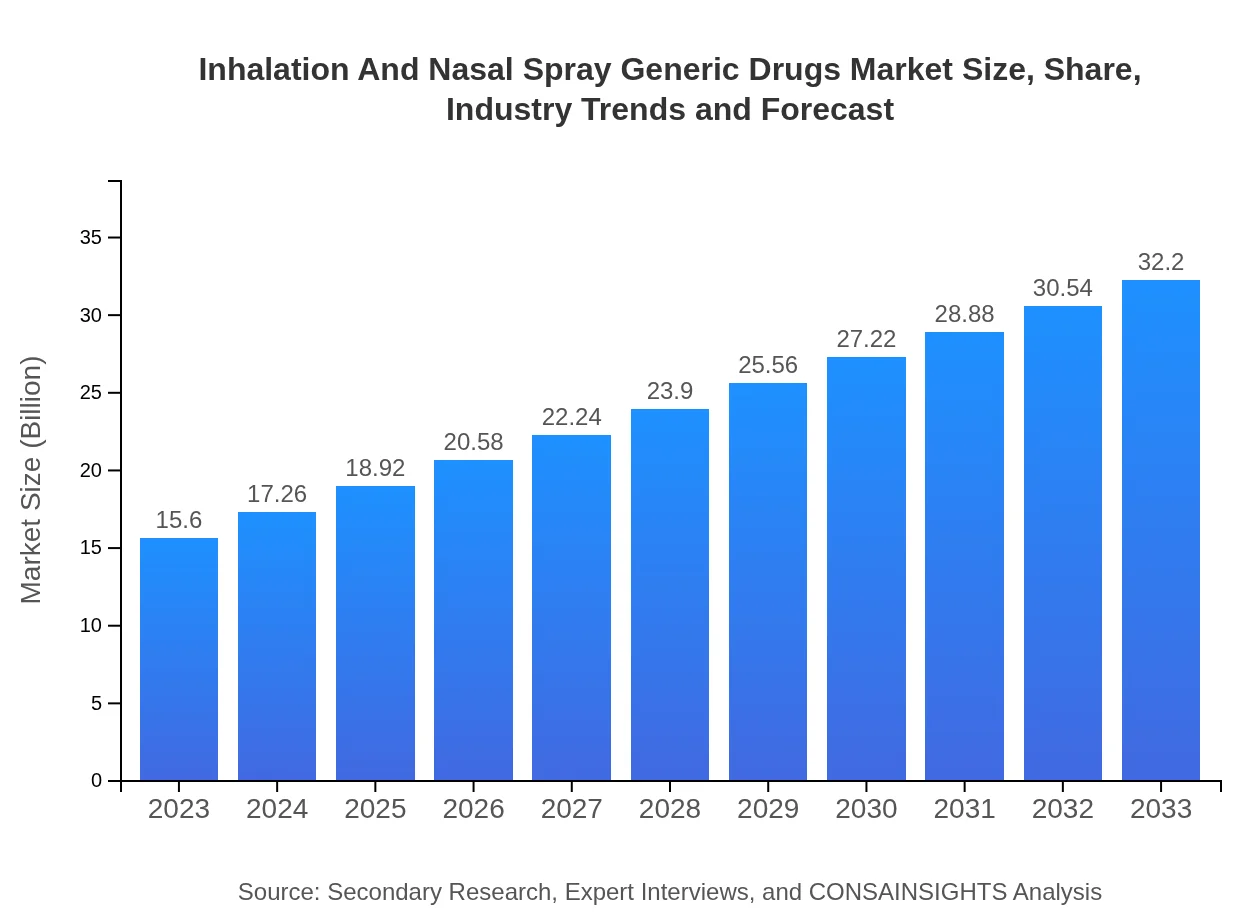

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $15.60 Billion |

| CAGR (2023-2033) | 7.3% |

| 2033 Market Size | $32.20 Billion |

| Top Companies | Teva Pharmaceutical Industries Ltd., Mylan N.V., Roche, Sandoz (a Novartis division) |

| Last Modified Date | 31 January 2026 |

Inhalation And Nasal Spray Generic Drugs Market Overview

Customize Inhalation And Nasal Spray Generic Drugs Market Report market research report

- ✔ Get in-depth analysis of Inhalation And Nasal Spray Generic Drugs market size, growth, and forecasts.

- ✔ Understand Inhalation And Nasal Spray Generic Drugs's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Inhalation And Nasal Spray Generic Drugs

What is the Market Size & CAGR of Inhalation And Nasal Spray Generic Drugs market in 2023?

Inhalation And Nasal Spray Generic Drugs Industry Analysis

Inhalation And Nasal Spray Generic Drugs Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Inhalation And Nasal Spray Generic Drugs Market Analysis Report by Region

Europe Inhalation And Nasal Spray Generic Drugs Market Report:

The European market will grow from $4.14 billion in 2023 to around $8.55 billion by 2033. Key factors include the ongoing healthcare reforms, a strong presence of generic manufacturers, and a rising focus on respiratory disease management.Asia Pacific Inhalation And Nasal Spray Generic Drugs Market Report:

In the Asia Pacific region, the inhalation and nasal spray generic drugs market is expected to expand from $3.04 billion in 2023 to approximately $6.28 billion by 2033. This growth is fueled by increasing healthcare access, rising awareness of respiratory health, and a growing elderly population seeking effective treatment options.North America Inhalation And Nasal Spray Generic Drugs Market Report:

North America currently holds the largest market share, with a valuation of $5.23 billion in 2023, expected to rise to $10.79 billion by 2033. The robust demand for affordable healthcare solutions and the prevalence of chronic respiratory conditions drive this growth.South America Inhalation And Nasal Spray Generic Drugs Market Report:

South America is projected to grow from $1.36 billion in 2023 to $2.80 billion by 2033. Market growth in this region is supported by government initiatives aimed at enhancing healthcare infrastructure and increasing access to generic drugs.Middle East & Africa Inhalation And Nasal Spray Generic Drugs Market Report:

The inhalation and nasal spray generic drugs market in the Middle East and Africa is expected to increase from $1.84 billion in 2023 to $3.79 billion by 2033. This growth is reflecting improvements in healthcare policies and rising awareness of respiratory health issues.Tell us your focus area and get a customized research report.

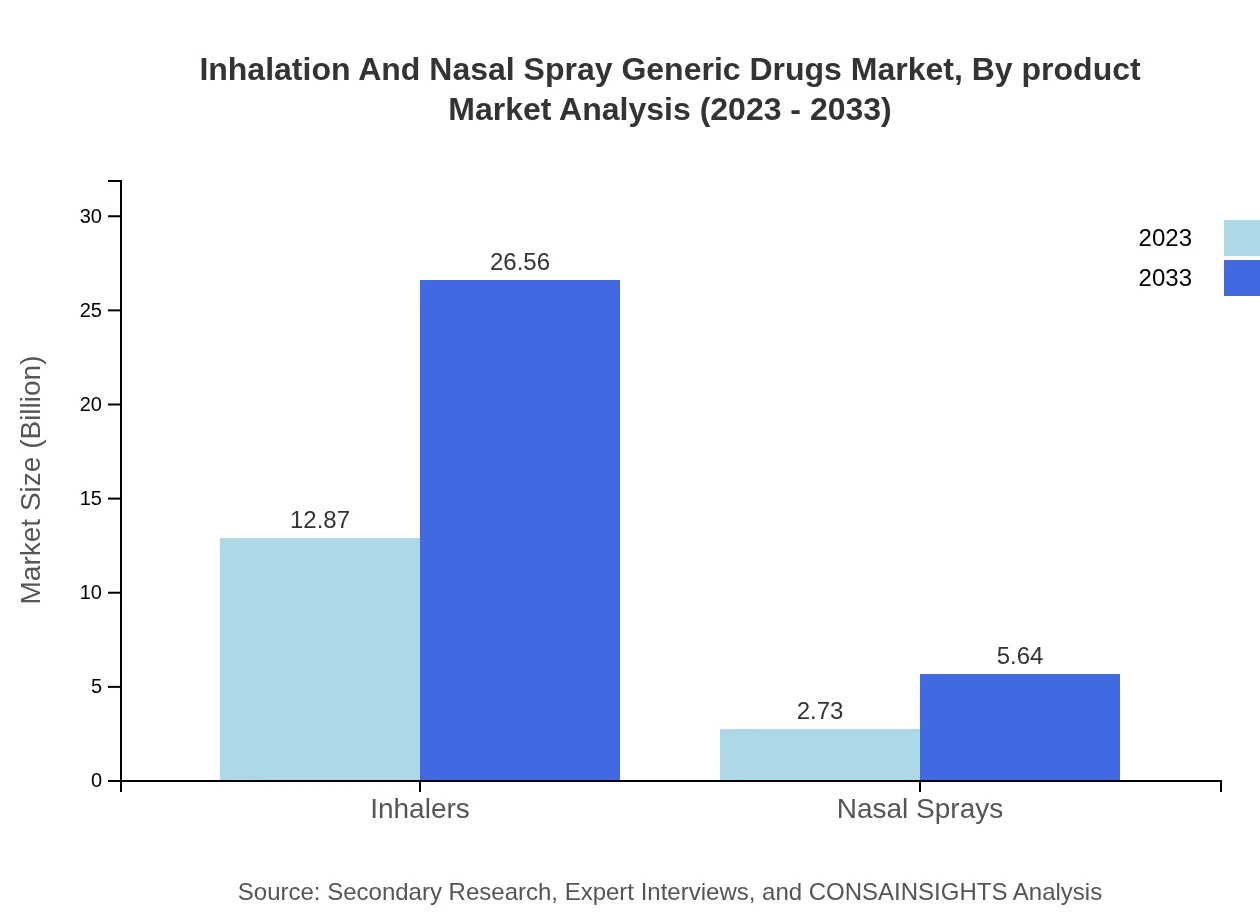

Inhalation And Nasal Spray Generic Drugs Market Analysis By Product

By product type, Inhalation products dominate the market with a size of $12.87 billion in 2023, expected to grow to $26.56 billion by 2033, maintaining an 82.48% market share throughout the analysis period. Nasal sprays, although smaller, show potential growth from $2.73 billion in 2023 to $5.64 billion by 2033, representing 17.52% of the market.

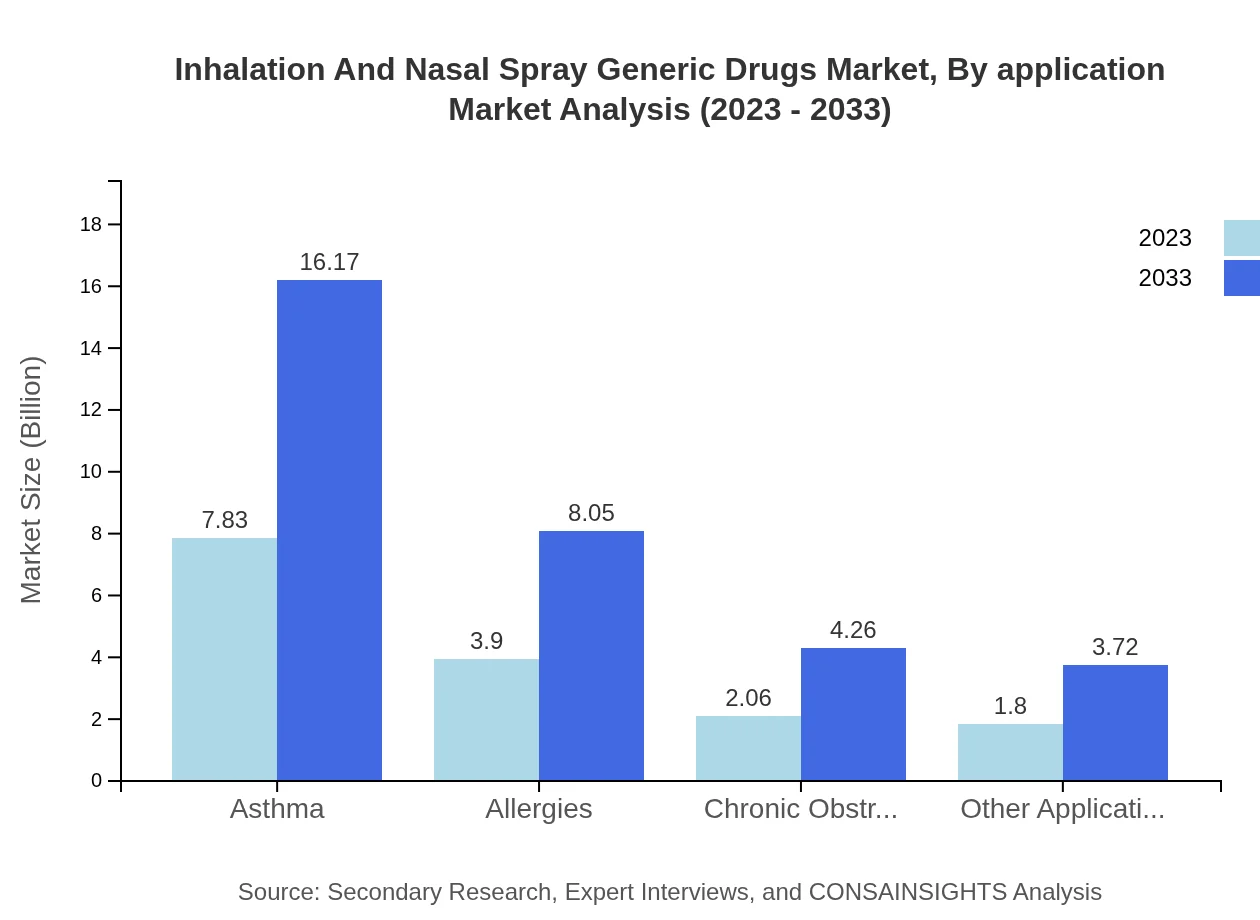

Inhalation And Nasal Spray Generic Drugs Market Analysis By Application

Asthma applications account for the largest share, with a market size of $7.83 billion in 2023, projected to grow to $16.17 billion by 2033. Allergy treatments follow with a size increase from $3.90 billion to $8.05 billion during the same period, while COPD applications will experience growth from $2.06 billion to $4.26 billion.

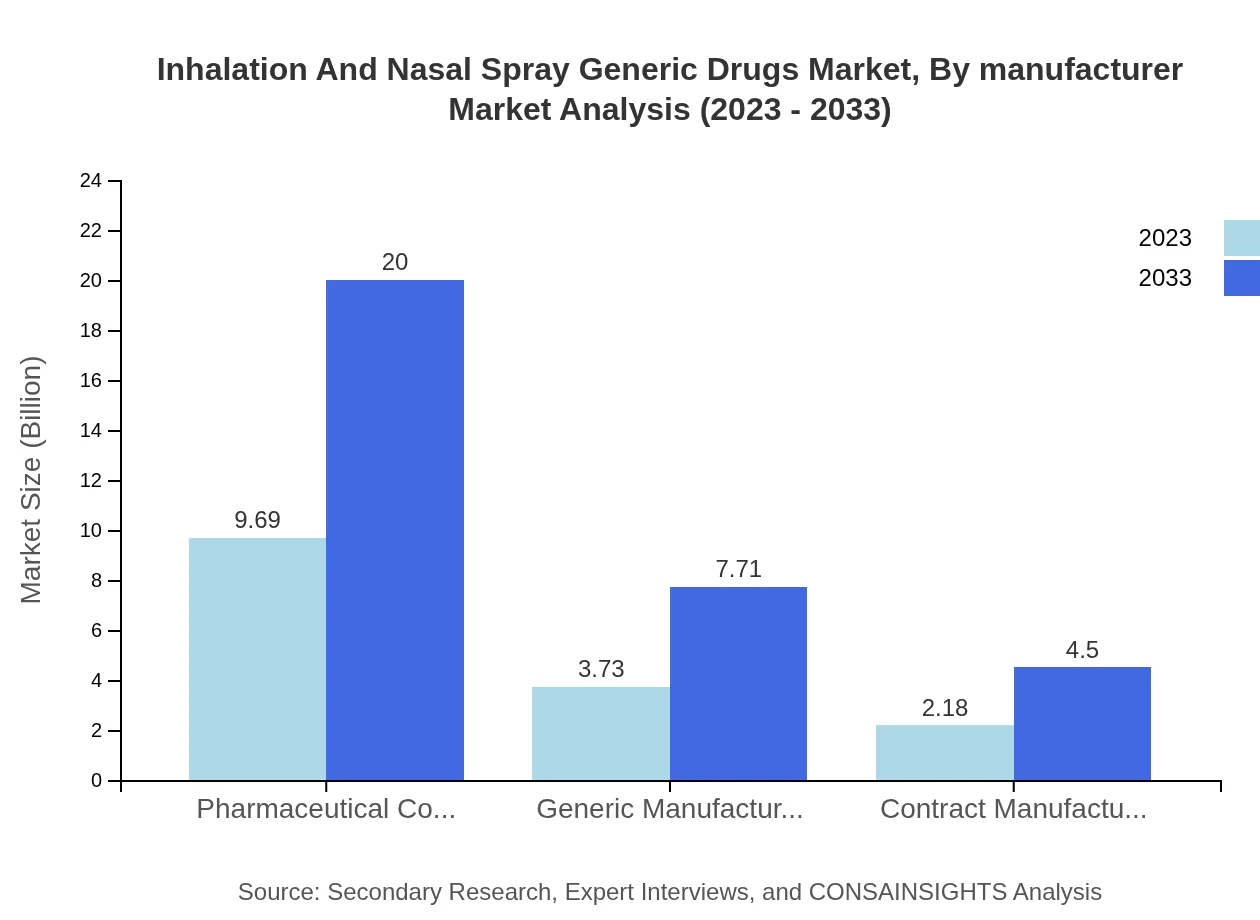

Inhalation And Nasal Spray Generic Drugs Market Analysis By Manufacturer

Pharmaceutical companies will continue to lead, controlling 62.1% of the market share in 2023, with a market size of $9.69 billion, growing to $20 billion by 2033. Generic manufacturers contribute with growth from $3.73 billion to $7.71 billion and contract manufacturers show an increase from $2.18 billion to $4.50 billion.

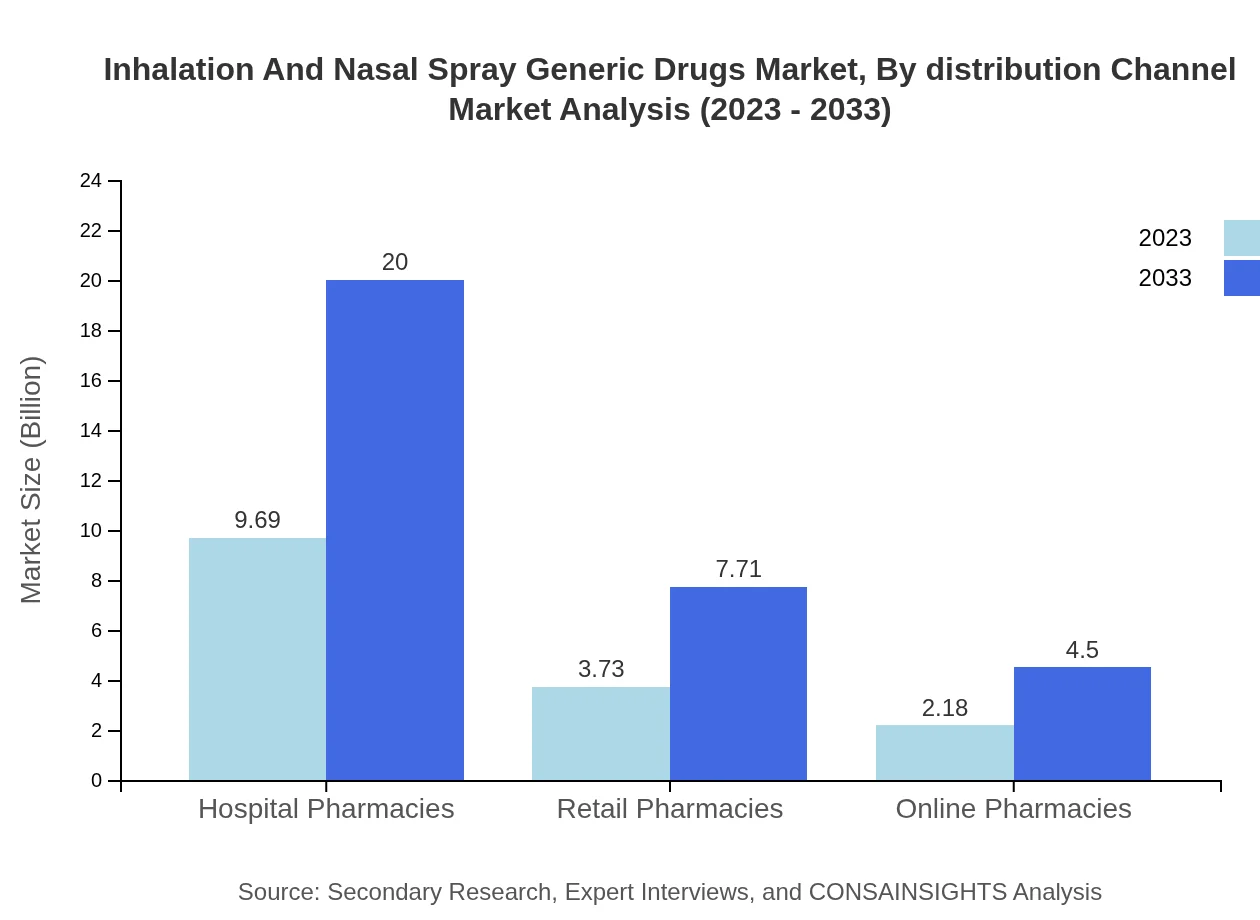

Inhalation And Nasal Spray Generic Drugs Market Analysis By Distribution Channel

Hospital pharmacies dominate with a market size of $9.69 billion in 2023, projected to reach $20 billion by 2033, while retail and online pharmacies will grow significantly as well, indicating a shift in distribution strategies in favor of digital platforms.

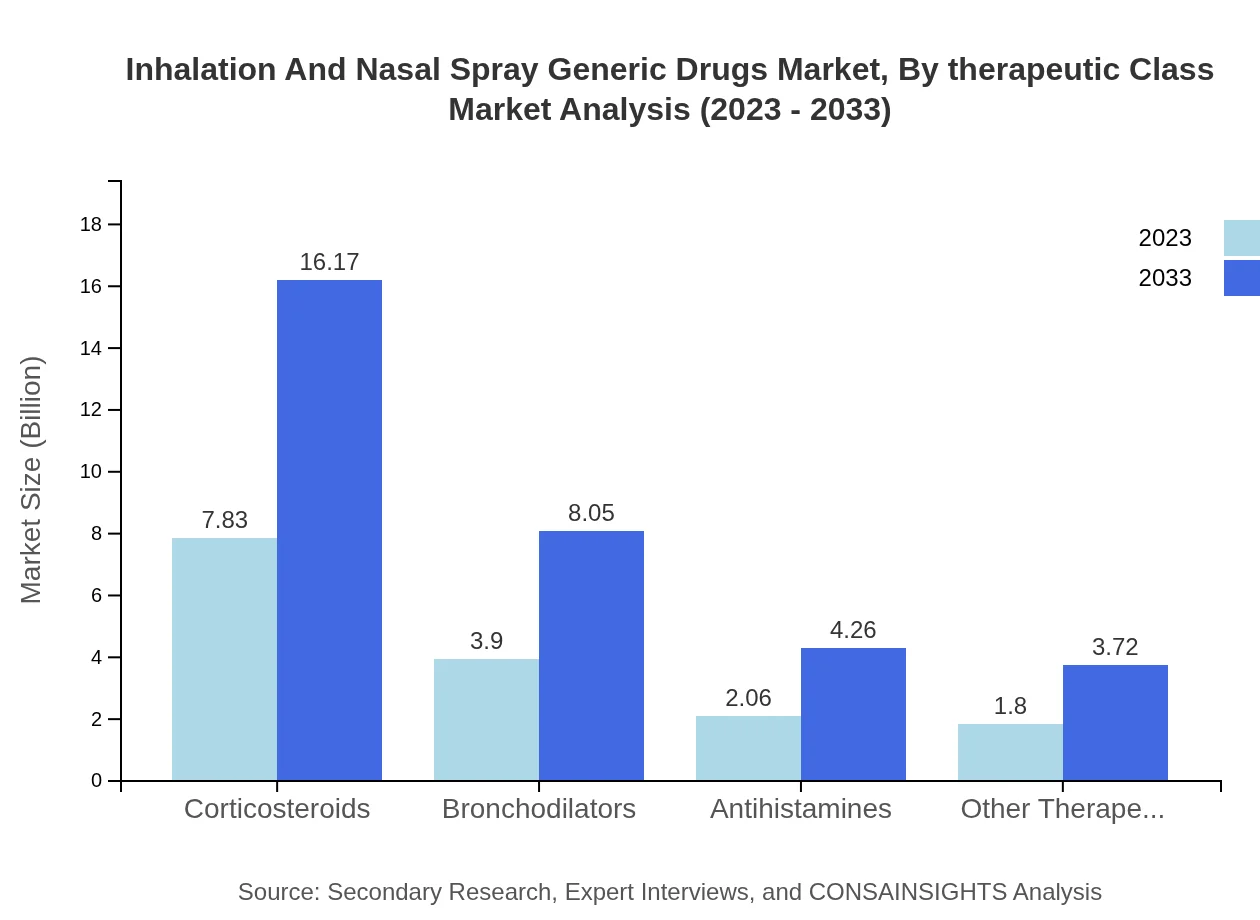

Inhalation And Nasal Spray Generic Drugs Market Analysis By Therapeutic Class

Corticosteroids lead the therapeutic class with a market size of $7.83 billion in 2023, increasing to $16.17 billion by 2033, while bronchodilators and antihistamines exhibit potential growth as patients shift towards preventative treatments.

Inhalation And Nasal Spray Generic Drugs Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Inhalation And Nasal Spray Generic Drugs Industry

Teva Pharmaceutical Industries Ltd.:

Teva is a leading generic drug manufacturer with a robust portfolio in inhalation therapies, offering affordable alternatives to branded products.Mylan N.V.:

Mylan, now part of Viatris, is a key player providing a wide range of inhalation and nasal spray products, committed to improving patient access to essential medication.Roche:

Roche is known for its strong pipeline of inhalation drugs, focusing on innovative solutions for respiratory diseases while also providing a significant share of generic options.Sandoz (a Novartis division):

Sandoz specializes in generic pharmaceuticals and biosimilars, with a diverse and expanding range of inhalation products catering to various therapeutic needs.We're grateful to work with incredible clients.

FAQs

What is the market size of inhalation And Nasal Spray Generic Drugs?

The inhalation and nasal spray generic drugs market is projected to reach $15.6 billion by 2033, growing at a CAGR of 7.3%. The 2023 market stands at $11.54 billion, indicating substantial growth potential in this sector.

What are the key market players or companies in the inhalation And Nasal Spray Generic Drugs industry?

Key players in the inhalation and nasal spray generic drugs sector include leading pharmaceutical companies and dedicated generic drug manufacturers. Notable players also encompass contract manufacturers and hospitals using these products in treatment protocols.

What are the primary factors driving the growth in the inhalation And Nasal Spray Generic Drugs industry?

Growth is primarily driven by an increasing prevalence of respiratory diseases, expanding aging population, innovations in drug delivery systems, and rising adoption of generic medications due to their affordability.

Which region is the fastest Growing in the inhalation And Nasal Spray Generic Drugs?

The fastest-growing region is Asia Pacific, with the market projected to grow from $3.04 billion in 2023 to $6.28 billion by 2033. Other significant markets include North America and Europe, seeing strong growth rates as well.

Does ConsaInsights provide customized market report data for the inhalation And Nasal Spray Generic Drugs industry?

Yes, ConsaInsights offers customized market reports tailored to specific stakeholder needs in the inhalation and nasal spray generic drugs sector, ensuring that relevant insights and data are delivered.

What deliverables can I expect from this inhalation And Nasal Spray Generic Drugs market research project?

Deliverables from this project include comprehensive market analysis, growth forecasts, trend reports, competitor analysis, and actionable insights, helping stakeholders make informed decisions.

What are the market trends of inhalation And Nasal Spray Generic Drugs?

Current trends include rising demand for combination therapies, advancements in inhalation technology, preference for self-administration devices, and increasing focus on patient-centric drug delivery systems.