Injectable Drug Delivery Devices Market Report

Published Date: 31 January 2026 | Report Code: injectable-drug-delivery-devices

Injectable Drug Delivery Devices Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Injectable Drug Delivery Devices market, focusing on its growth from 2023 to 2033. It includes insights on market size, trends, technologies, regional performance, and key industry players.

| Metric | Value |

|---|---|

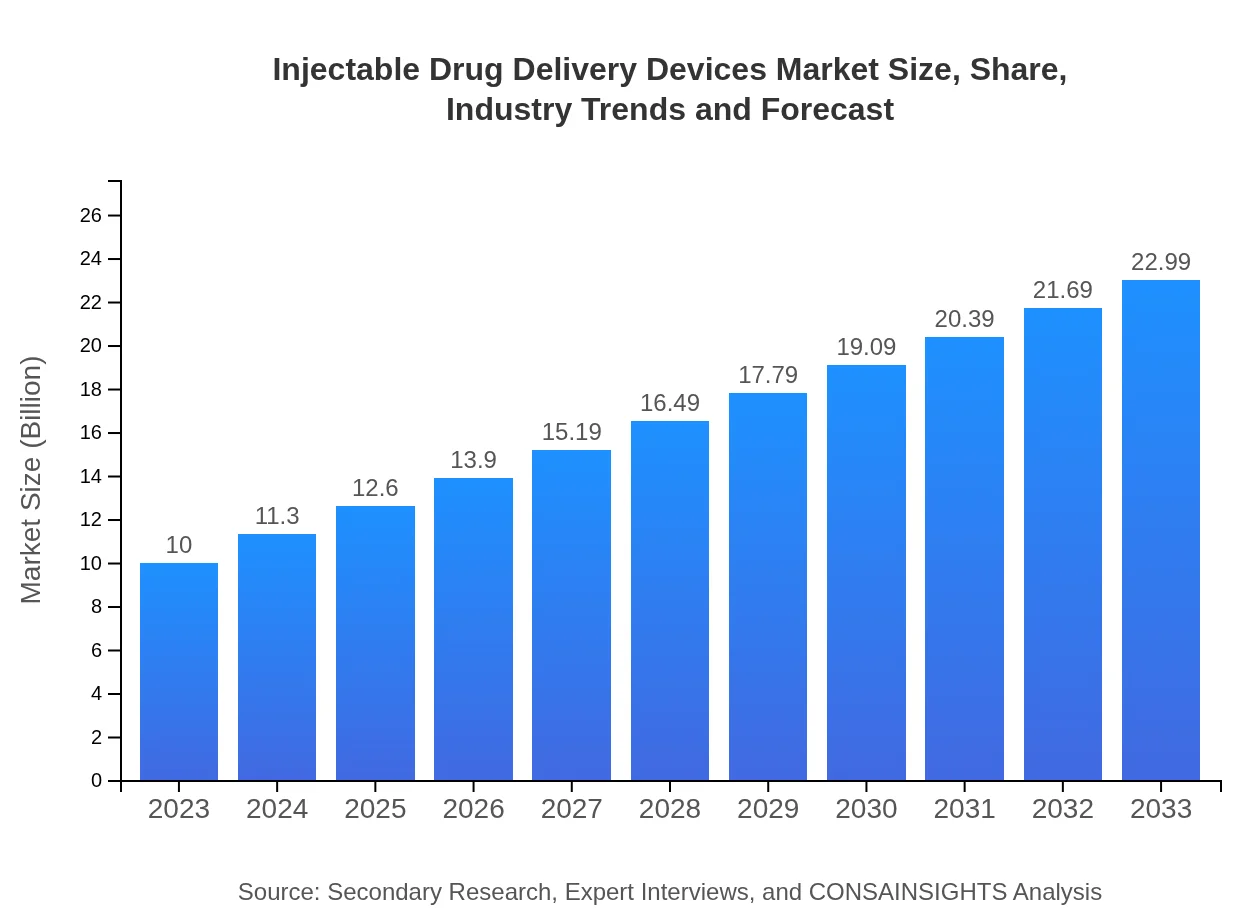

| Study Period | 2023 - 2033 |

| 2023 Market Size | $10.00 Billion |

| CAGR (2023-2033) | 8.4% |

| 2033 Market Size | $22.99 Billion |

| Top Companies | BD (Becton, Dickinson and Company), AbbVie Inc., Medtronic , Pfizer Inc., Roche |

| Last Modified Date | 31 January 2026 |

Injectable Drug Delivery Devices Market Overview

Customize Injectable Drug Delivery Devices Market Report market research report

- ✔ Get in-depth analysis of Injectable Drug Delivery Devices market size, growth, and forecasts.

- ✔ Understand Injectable Drug Delivery Devices's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Injectable Drug Delivery Devices

What is the Market Size & CAGR of Injectable Drug Delivery Devices market in 2023?

Injectable Drug Delivery Devices Industry Analysis

Injectable Drug Delivery Devices Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Injectable Drug Delivery Devices Market Analysis Report by Region

Europe Injectable Drug Delivery Devices Market Report:

Europe's market is set to grow from $3.57 billion in 2023 to $8.21 billion by 2033, supported by a well-established healthcare framework, increasing prevalence of chronic diseases, and strong presence of leading market players.Asia Pacific Injectable Drug Delivery Devices Market Report:

The Asia Pacific region is projected to experience substantial growth, with the market anticipated to expand from $1.61 billion in 2023 to $3.70 billion by 2033. Increasing investments in healthcare infrastructure and a growing population are key drivers behind this growth.North America Injectable Drug Delivery Devices Market Report:

North America remains the largest market for Injectable Drug Delivery Devices, valued at $3.42 billion in 2023 and reaching an estimated $7.86 billion by 2033. Factors contributing to this growth include high healthcare expenditures, advanced healthcare systems, and robust R&D activities.South America Injectable Drug Delivery Devices Market Report:

In South America, the market is expected to grow from $0.60 billion in 2023 to $1.37 billion by 2033, driven by rising healthcare awareness and government initiatives aimed at improving disease management.Middle East & Africa Injectable Drug Delivery Devices Market Report:

The Middle East and Africa region is poised for growth, with projections indicating an increase from $0.81 billion in 2023 to $1.85 billion by 2033. The rise of healthcare investment and improvement of supply chain infrastructures are pivotal for market expansion.Tell us your focus area and get a customized research report.

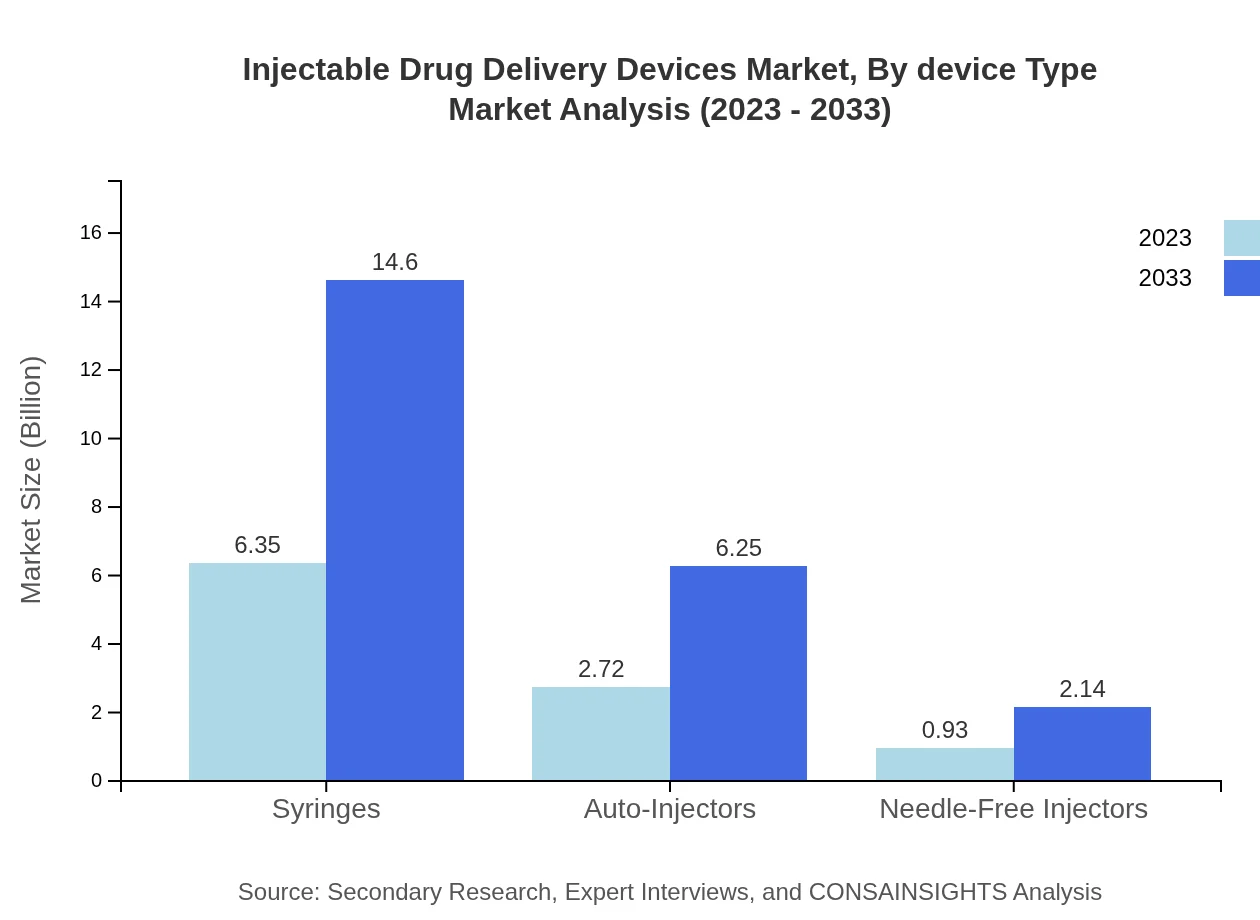

Injectable Drug Delivery Devices Market Analysis By Device Type

In terms of device type, syringes accounted for the majority market share at 63.5% in 2023, valued at $6.35 billion, and projected to reach $14.60 billion by 2033. Auto-injectors represent a significant portion as well, with a market size of $2.72 billion in 2023, expected to grow at the same rate, maintaining a share of 27.2%. Needle-free injectors are anticipated to increase from $0.93 billion to $2.14 billion during the forecast period.

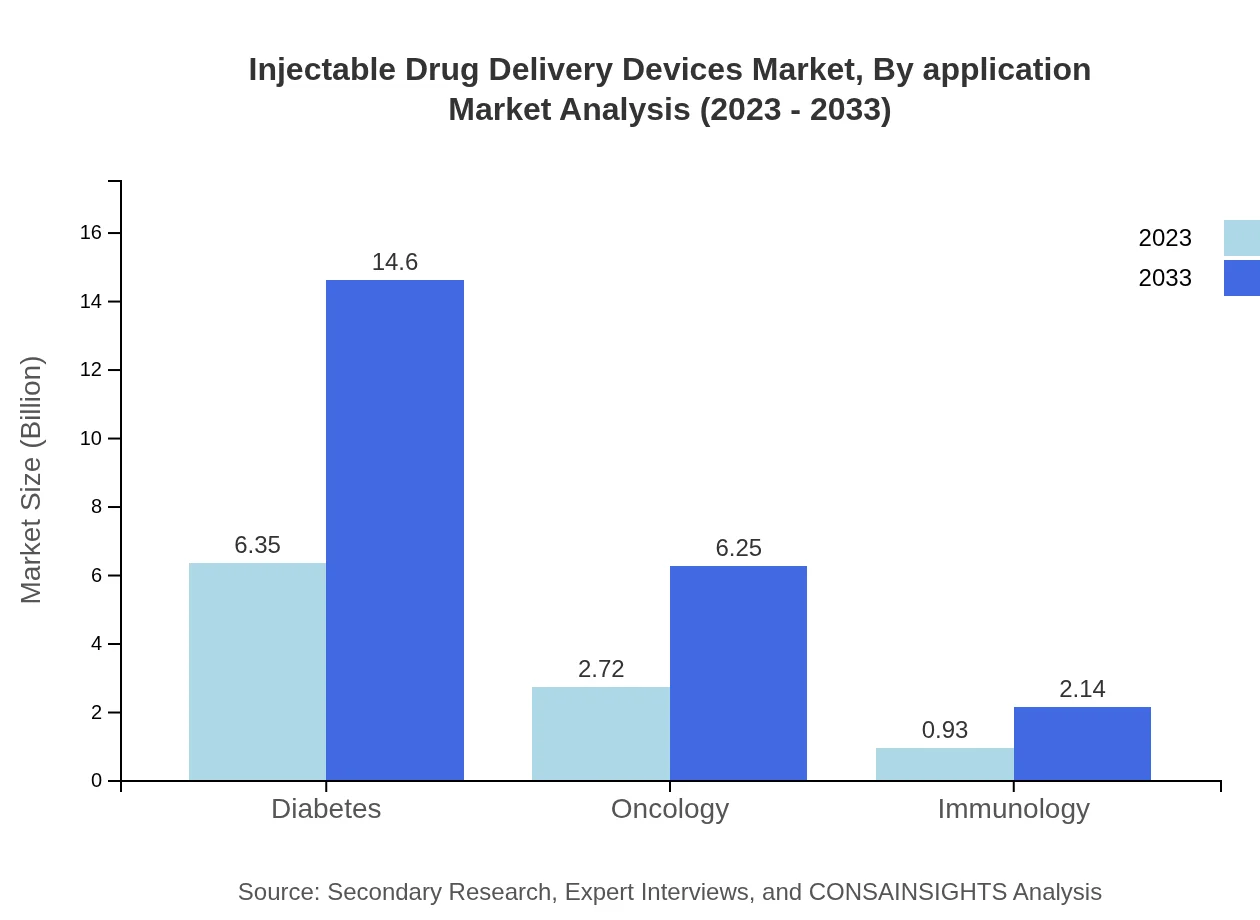

Injectable Drug Delivery Devices Market Analysis By Application

By application, the diabetes segment dominates with a market share of 63.5% and a size of $6.35 billion in 2023, growing to $14.60 billion by 2033. Oncology and immunology also present significant growth opportunities, with respective shares of 27.2% and 9.3%. Their respective markets are expected to grow from $2.72 billion to $6.25 billion for oncology, and from $0.93 billion to $2.14 billion for immunology within the forecast period.

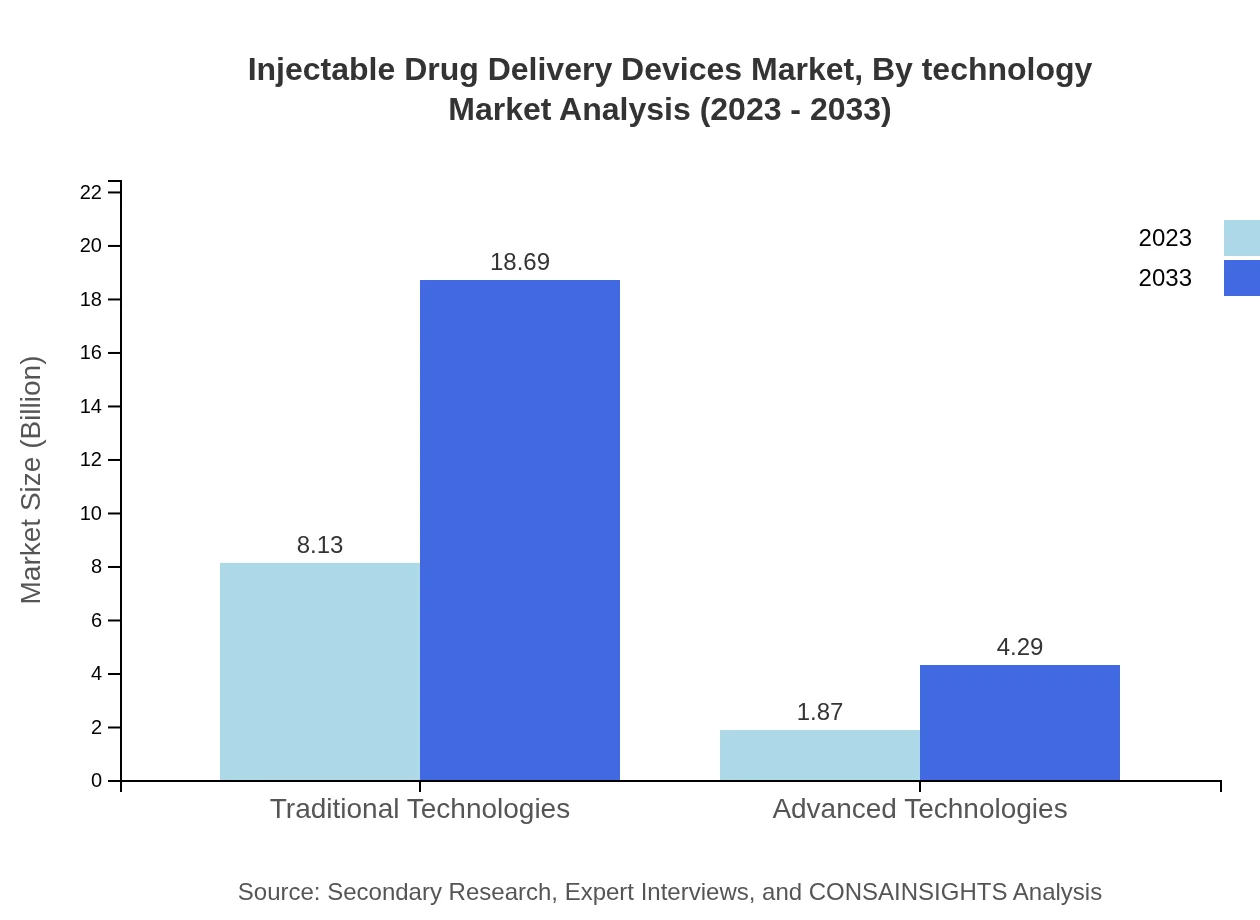

Injectable Drug Delivery Devices Market Analysis By Technology

The technology segment reflects a strong preference for traditional technologies, which hold an 81.33% market share, growing from $8.13 billion to $18.69 billion by 2033. Advanced technologies, while representing a smaller share at 18.67%, show promising growth from $1.87 billion to $4.29 billion, indicating a shift towards modernity in drug delivery.

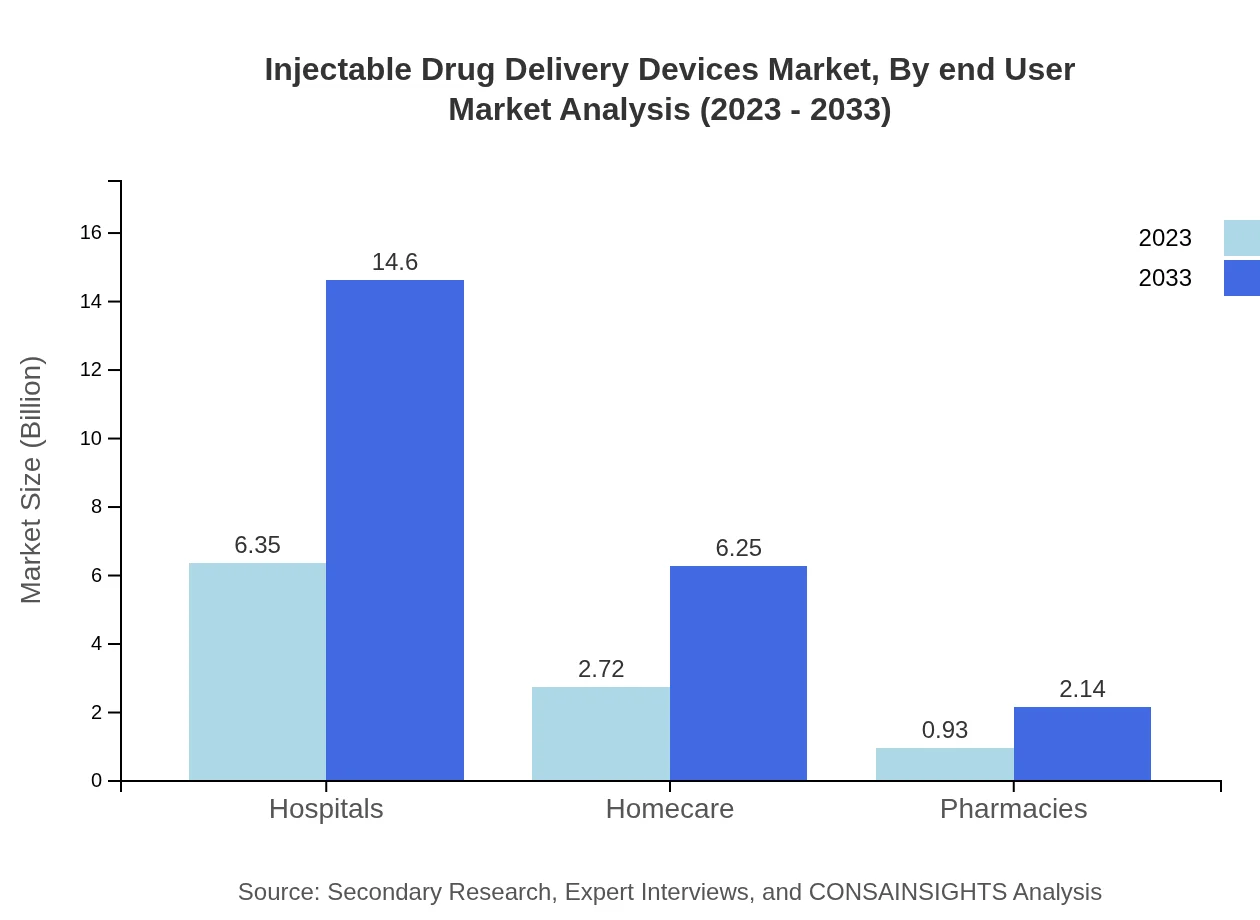

Injectable Drug Delivery Devices Market Analysis By End User

Hospitals constitute the largest end-user segment, with a market value of $6.35 billion in 2023, projected to reach $14.60 billion by 2033, reflecting a share of 63.5%. Homecare and pharmacies are also important segments, showcasing a size of $2.72 billion and $0.93 billion respectively in 2023, and anticipated to grow to $6.25 billion and $2.14 billion in 2033.

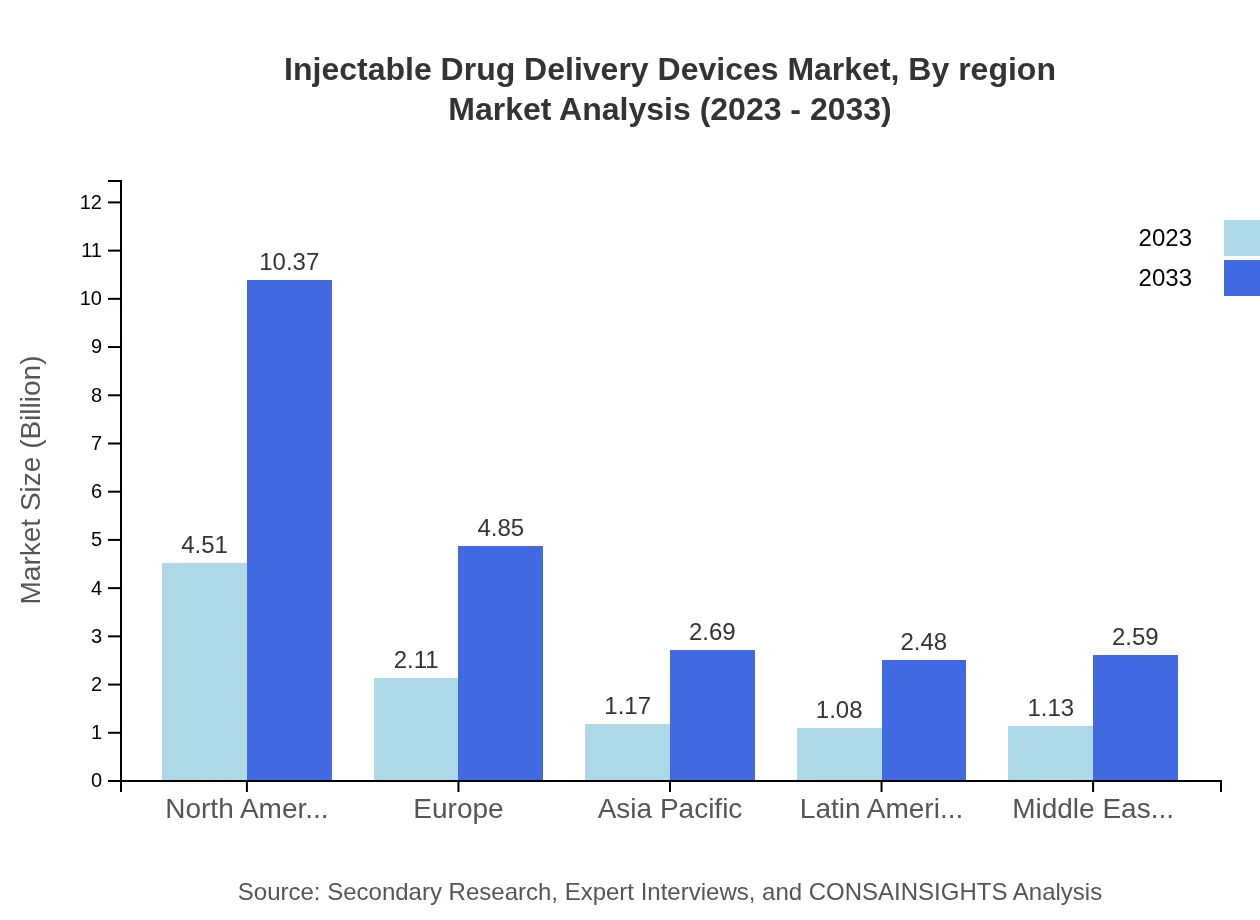

Injectable Drug Delivery Devices Market Analysis By Region

The by-region analysis emphasizes that North America, Europe, and Asia Pacific collectively represent the vast majority of the market share. North America accounts for 45.11% share in both years under review, while Europe maintains a stable share of 21.11%. Asia Pacific, expected to grow its share from 11.72% in 2023 to 11.72% in 2033, signifies emerging markets gaining traction.

Injectable Drug Delivery Devices Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Injectable Drug Delivery Devices Industry

BD (Becton, Dickinson and Company):

A leading global medical technology company, BD specializes in the development and manufacturing of medical supplies, devices, laboratory equipment, and diagnostic products, including syringes and drug delivery devices.AbbVie Inc.:

AbbVie is a global biopharmaceutical company known for its innovative drugs and therapies, including advanced drug delivery systems to improve patient experiences.Medtronic :

Medtronic offers a wide range of medical technology and services, including advanced injector technologies that provide solutions for chronic diseases.Pfizer Inc.:

Pfizer is a research-based global biopharmaceutical company creating medicines and vaccines, focusing on self-injection devices for patients.Roche:

Roche develops targeted therapies tailored to patient needs, including innovative delivery systems that support better therapeutic doses.We're grateful to work with incredible clients.

FAQs

What is the market size of injectable drug delivery devices?

The global market size for injectable drug delivery devices is projected at $10 billion in 2023. With a compound annual growth rate (CAGR) of 8.4%, it is expected to continue growing significantly over the next decade.

What are the key market players or companies in the injectable drug delivery devices industry?

Key players in the injectable drug delivery devices market include major pharmaceutical and biotechnology companies, specialized device manufacturers, and contract manufacturers. These companies focus on innovation, quality, and expanding their product portfolios to capture market share.

What are the primary factors driving the growth in the injectable drug delivery devices industry?

Growth in the injectable drug delivery devices market is driven by increasing prevalence of chronic diseases, technological advancements in drug delivery systems, and a rising preference for self-administration of medications. These factors are significantly enhancing market demand.

Which region is the fastest Growing in the injectable drug delivery devices?

The Asia-Pacific region is the fastest-growing market for injectable drug delivery devices, with an increase from $1.61 billion in 2023 to $3.70 billion by 2033. This growth is fueled by expanding healthcare access and increasing investments in health infrastructure.

Does ConsaInsights provide customized market report data for the injectable drug delivery devices industry?

Yes, ConsaInsights offers customized market report data tailored to the specific needs of clients in the injectable drug delivery devices industry. This includes detailed insights on market trends, forecasts, and competitive analysis.

What deliverables can I expect from this injectable drug delivery devices market research project?

Clients can expect comprehensive deliverables including market size analysis, growth forecasts, segmentation data, competitive landscape insights, and regional market assessments. These reports will aid in strategic decision-making.

What are the market trends of injectable drug delivery devices?

Current trends in the injectable drug delivery devices market include the rise of advanced technologies, increasing demand for auto-injectors, and a push towards integrated drug delivery systems for chronic disease management. These trends are shaping the future of the market.