Inline Metrology Market Report

Published Date: 22 January 2026 | Report Code: inline-metrology

Inline Metrology Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Inline Metrology market from 2023 to 2033. It includes insights on market size, growth forecasts, industry trends, regional dynamics, and key players, offering valuable information for businesses and stakeholders in this field.

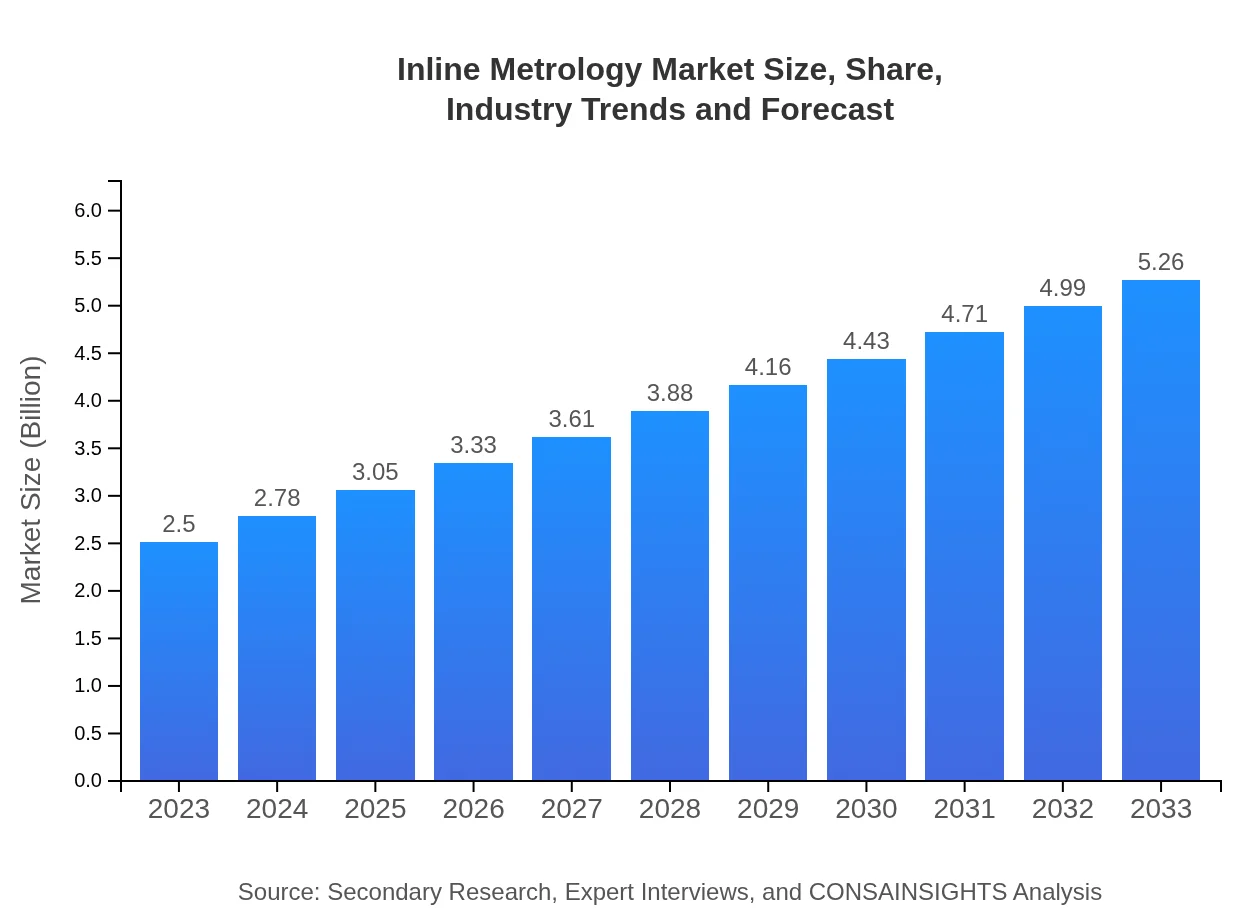

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $2.50 Billion |

| CAGR (2023-2033) | 7.5% |

| 2033 Market Size | $5.26 Billion |

| Top Companies | Hexagon AB, Zeiss Group, Mitutoyo Corporation, Faro Technologies Inc. |

| Last Modified Date | 22 January 2026 |

Inline Metrology Market Overview

Customize Inline Metrology Market Report market research report

- ✔ Get in-depth analysis of Inline Metrology market size, growth, and forecasts.

- ✔ Understand Inline Metrology's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Inline Metrology

What is the Market Size & CAGR of Inline Metrology market in 2023?

Inline Metrology Industry Analysis

Inline Metrology Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Inline Metrology Market Analysis Report by Region

Europe Inline Metrology Market Report:

Europe's market is expected to witness substantial growth from $0.65 billion in 2023 to $1.36 billion in 2033. The region's demand is fueled by rigorous manufacturing standards and a shift towards Industry 4.0. Additionally, European manufacturers are increasingly investing in innovative metrology technologies to maintain competitiveness in a global marketplace.Asia Pacific Inline Metrology Market Report:

In 2023, the Inline Metrology market in Asia Pacific is valued at $0.52 billion, expected to reach $1.10 billion by 2033, propelled by rapid industrialization and investments in manufacturing technologies across countries like China and India. The region's growth is supported by increasing adoption of automation in manufacturing processes, enhancing the demand for efficient measurement systems.North America Inline Metrology Market Report:

The North America Inline Metrology market is projected to grow from $0.95 billion in 2023 to $2.00 billion by 2033, driven largely by technological advancements in the automotive and aerospace sectors. A strong focus on quality control, supported by stringent regulations, is resulting in higher adoption of inline measurement solutions.South America Inline Metrology Market Report:

South America shows a smaller Inline Metrology market starting at $0.06 billion in 2023 and projected to grow to $0.12 billion by 2033. Contributing factors to this growth include modernization initiatives in the manufacturing sector and gradual adoption of advanced measurement technologies, although growth pace remains slower compared to other regions.Middle East & Africa Inline Metrology Market Report:

In the Middle East and Africa, the Inline Metrology market is valued at $0.32 billion in 2023, predicted to double to $0.68 billion by 2033. The growth is driven by expanding manufacturing capabilities and initiatives to enhance operational efficiency, particularly in the automotive and oil & gas sectors.Tell us your focus area and get a customized research report.

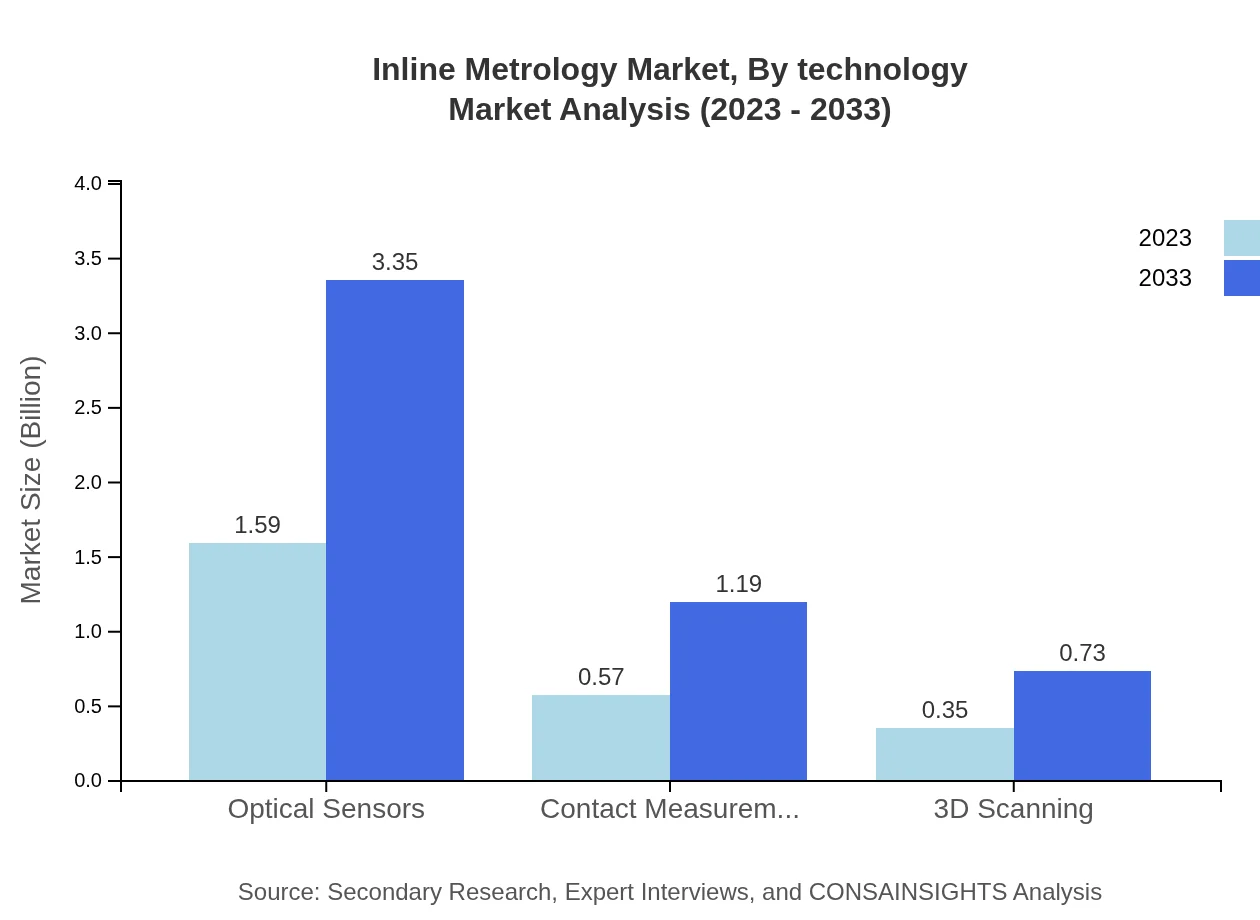

Inline Metrology Market Analysis By Technology

The technology segment of the Inline Metrology market includes optical sensors, contact measurement, and 3D scanning technologies, with each ensuring accuracy and efficiency in different applications. Optical sensors hold a significant market share at 63.56% in 2023, projected to sustain this position through 2033. Contact measurement systems, constituting 22.61% market share, focus on applications that require physical touch and precision.

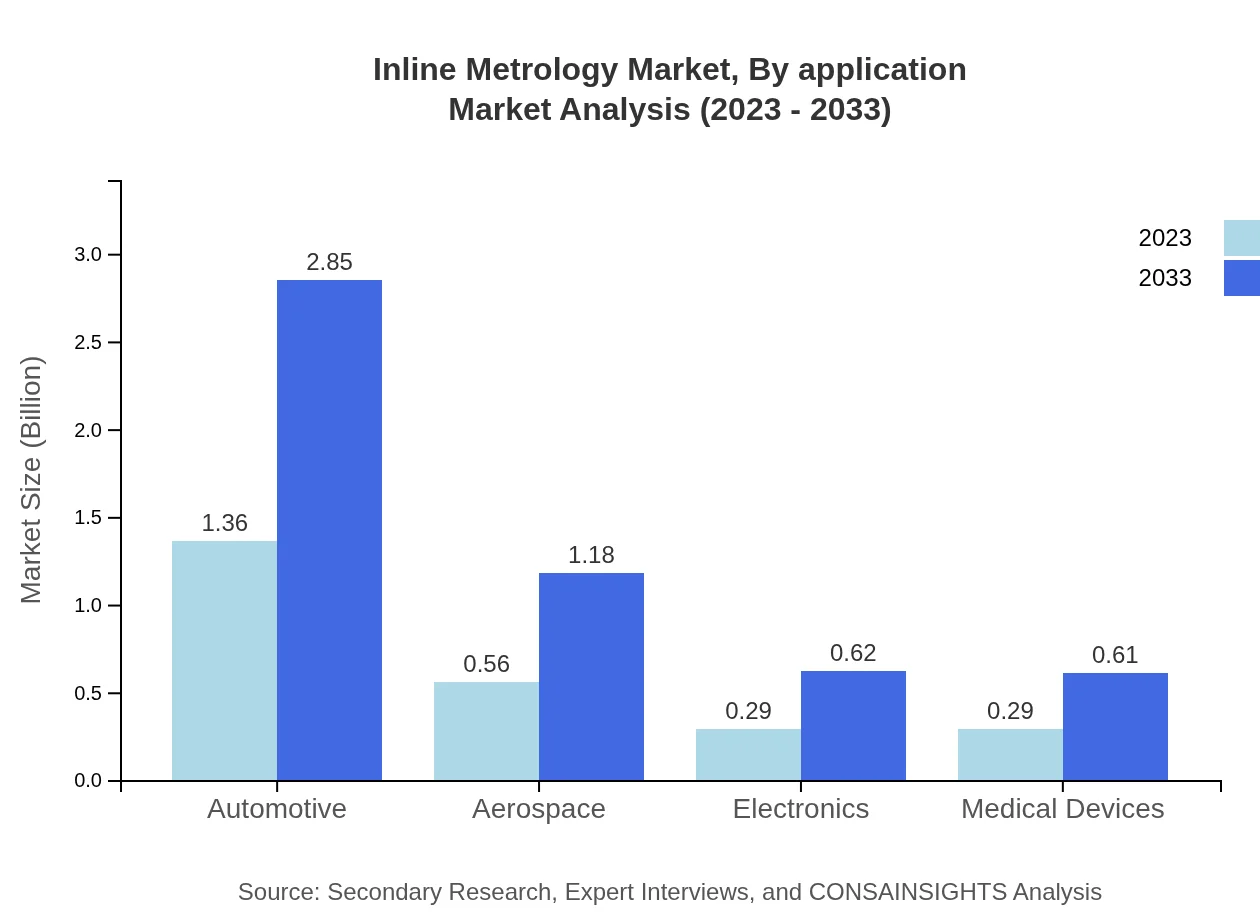

Inline Metrology Market Analysis By Application

Key applications of Inline Metrology include automotive, aerospace, electronics, and medical devices. The automotive sector accounts for 54.23% of market share in 2023, with projections indicating continuous growth as vehicle manufacturers prioritize precision engineering and quality assurance.

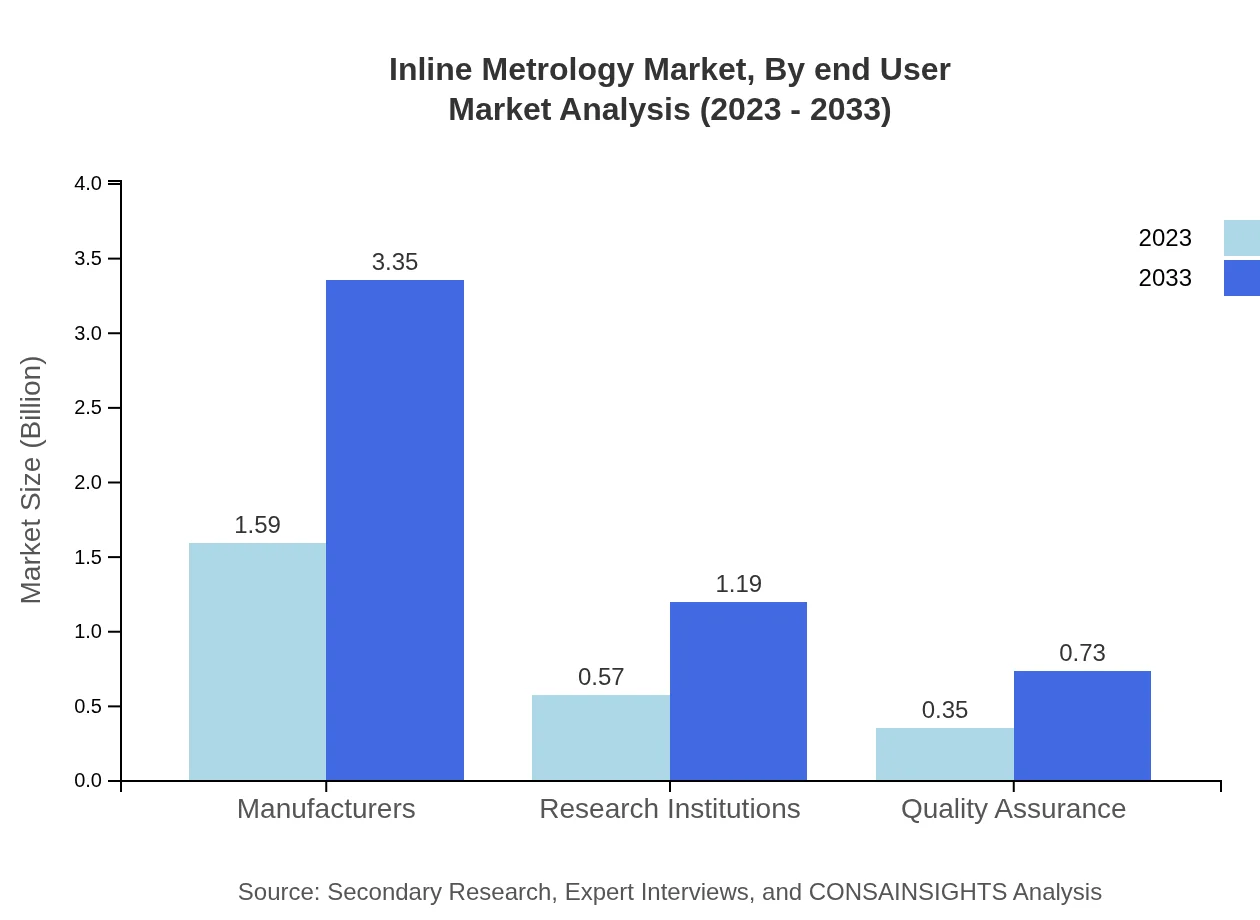

Inline Metrology Market Analysis By End User

End-user analysis reveals significant demand from automotive, aerospace, electronics, and medical devices sectors. The automotive industry takes the lead, accounting for a considerable portion of market engagement and pushing technological adoption as companies seek to optimize production efficiency.

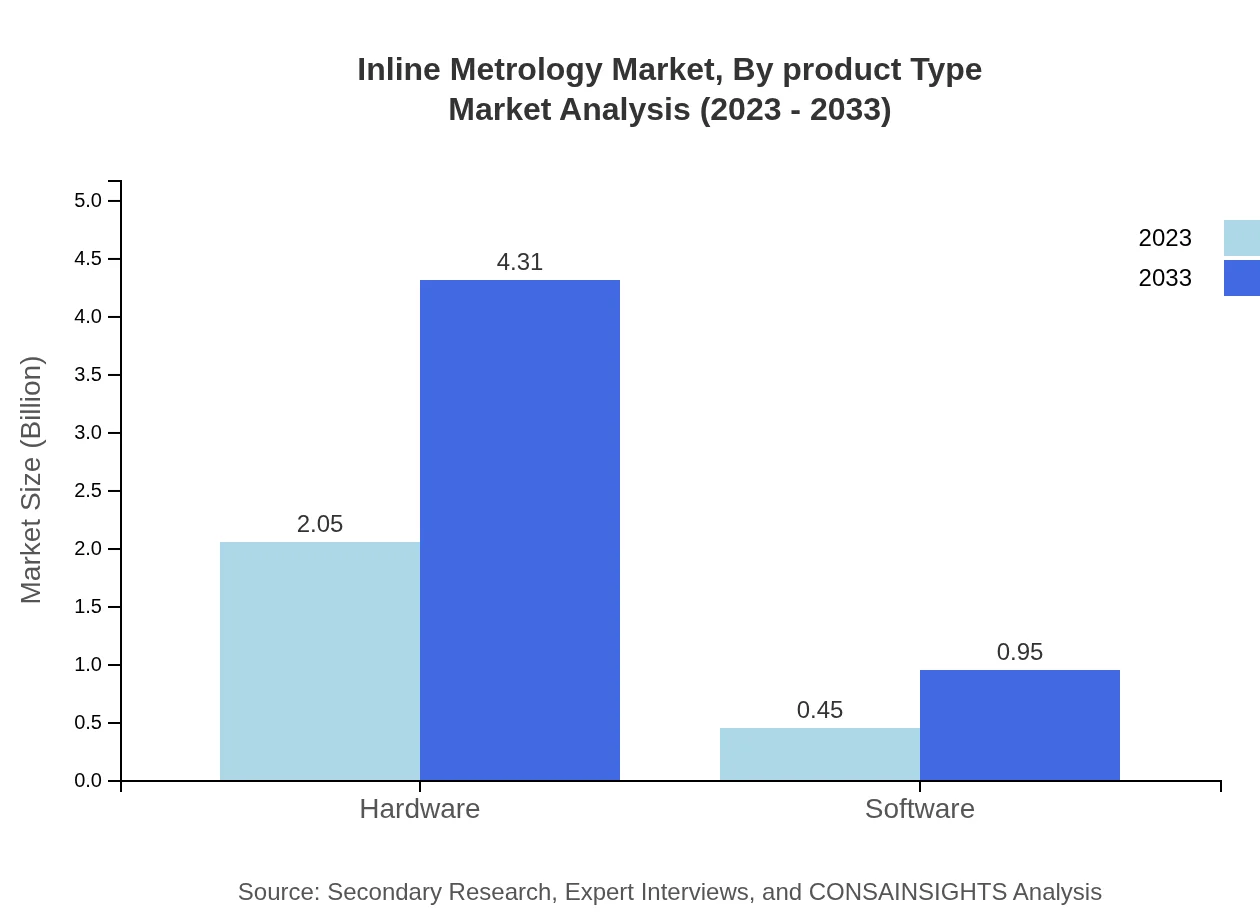

Inline Metrology Market Analysis By Product Type

With hardware comprising 81.93% of the Inline Metrology market in 2023, manufacturers heavily invest in integrated systems. This category primarily influences market dynamics, determining competitive strategies across sectors and promoting innovation in measurement solutions.

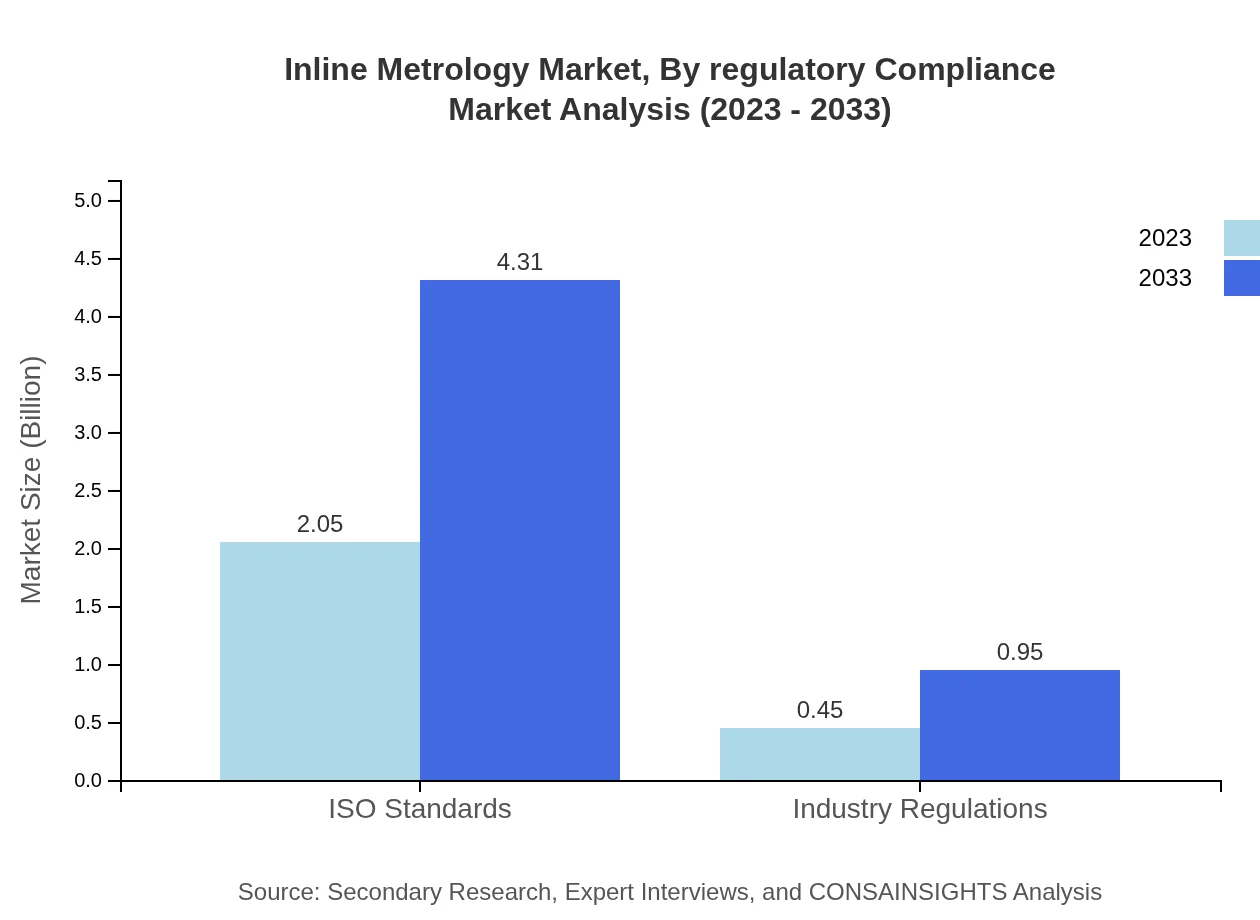

Inline Metrology Market Analysis By Regulatory Compliance

Regulatory compliance is essential in the Inline Metrology market, as industries must adhere to ISO standards and industry regulations to ensure quality. The market share attributed to ISO standards stands at 81.93%, reflecting the importance placed on quality and compliance across sectors.

Inline Metrology Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Inline Metrology Industry

Hexagon AB:

A leading global provider of information technologies that drive productivity and quality across geospatial and industrial manufacturing applications. Known for its innovative metrology solutions.Zeiss Group:

Zeiss is renowned for its precision measurement solutions and optical products, heavily impacting the Inline Metrology sector with cutting-edge technology and research initiatives.Mitutoyo Corporation:

A provider of measuring instruments, Mitutoyo focuses on high-precision equipment, contributing significantly to the Inline Metrology landscape with a diverse product portfolio.Faro Technologies Inc.:

Faro specializes in 3D measurement and imaging solutions and has established a strong presence in the Inline Metrology sector through continuous product development and innovation.We're grateful to work with incredible clients.

FAQs

What is the market size of inline Metrology?

The inline-measurement market is projected to reach approximately $2.5 billion by 2033, growing at a CAGR of 7.5%. This indicates significant growth potential as companies increasingly prioritize precision and efficiency in their production processes.

What are the key market players or companies in this inline Metrology industry?

Key players in the inline-measuring market include major manufacturing firms and technology providers specializing in precision measurement solutions. They drive innovation and competition, enhancing product offerings and market presence.

What are the primary factors driving the growth in the inline Metrology industry?

The growth in the inline-metrology industry is primarily driven by advancements in technology, increasing demand for quality assurance in manufacturing, and the need for real-time measurements to enhance operational efficiency and reduce waste.

Which region is the fastest Growing in the inline Metrology?

The fastest-growing region in the inline-metrology market is North America, projected to grow from $0.95 billion in 2023 to $2.00 billion by 2033. This growth is fueled by technological advancements and increased automation across industries.

Does ConsaInsights provide customized market report data for the inline Metrology industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs in the inline-metrology industry, providing clients with detailed insights and analyses that align with their business objectives.

What deliverables can I expect from this inline Metrology market research project?

From the inline-metrology market research project, clients can expect comprehensive reports, detailed data analyses, market forecasts, and strategic recommendations for growth and investment opportunities tailored to their unique market situation.

What are the market trends of inline Metrology?

Key market trends in inline-metrology include the increasing adoption of automated measurement systems, integration of AI for data analysis, and growing regulatory compliance requirements, driving the demand for real-time quality assurance solutions.