Inorganic Scintillators Market Report

Published Date: 31 January 2026 | Report Code: inorganic-scintillators

Inorganic Scintillators Market Size, Share, Industry Trends and Forecast to 2033

This report presents a comprehensive analysis of the Inorganic Scintillators market, focusing on key insights, trends, and forecasts from 2023 to 2033. It includes data on market size, growth rates, regional dynamics, and significant players within the industry.

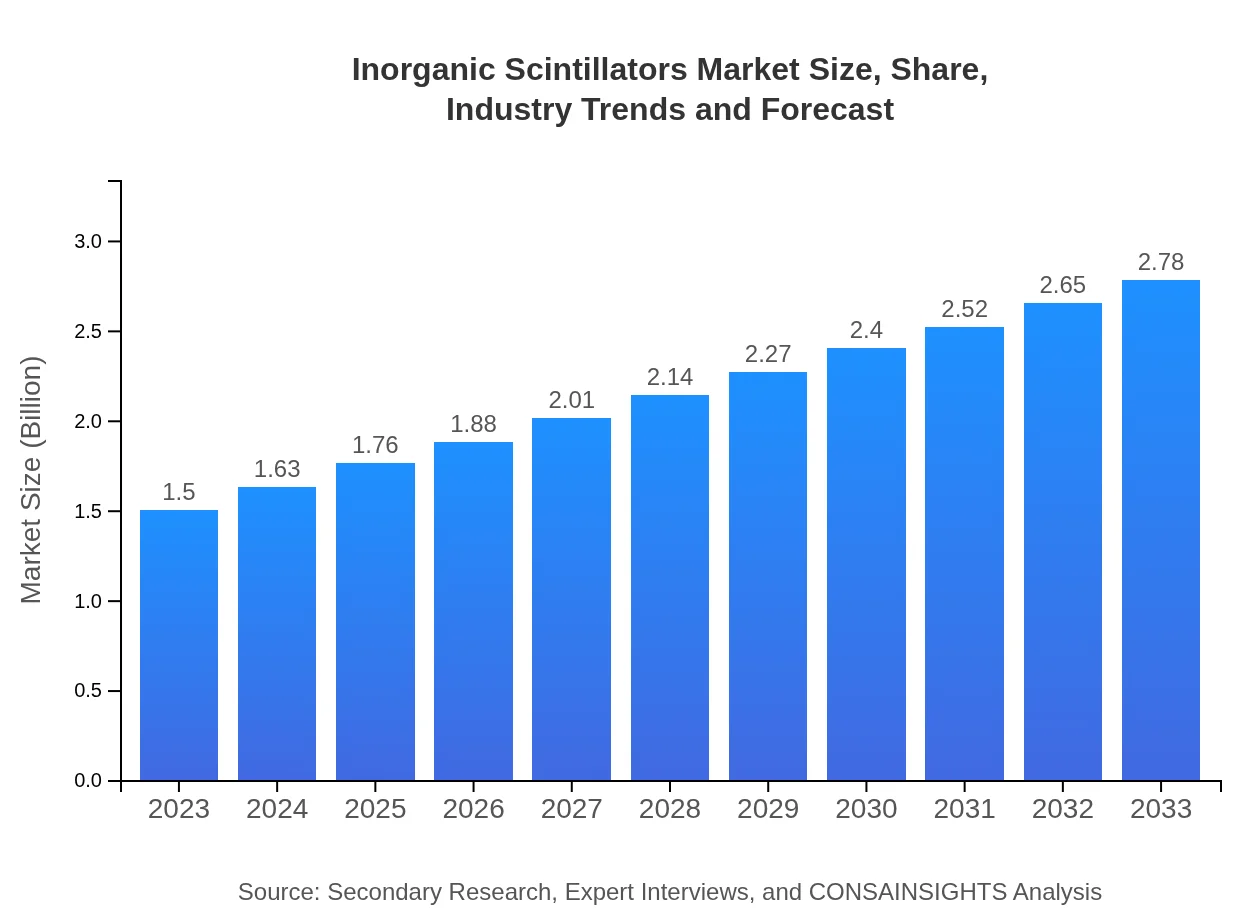

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $1.50 Billion |

| CAGR (2023-2033) | 6.2% |

| 2033 Market Size | $2.78 Billion |

| Top Companies | Thallium Bromide (TlBr), Saint-Gobain, Bicron (a subsidiary of Kuraray), Hitachi Metals |

| Last Modified Date | 31 January 2026 |

Inorganic Scintillators Market Overview

Customize Inorganic Scintillators Market Report market research report

- ✔ Get in-depth analysis of Inorganic Scintillators market size, growth, and forecasts.

- ✔ Understand Inorganic Scintillators's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Inorganic Scintillators

What is the Market Size & CAGR of Inorganic Scintillators market in 2023?

Inorganic Scintillators Industry Analysis

Inorganic Scintillators Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Inorganic Scintillators Market Analysis Report by Region

Europe Inorganic Scintillators Market Report:

In Europe, the market is expected to grow from USD 0.48 billion in 2023 to USD 0.89 billion by 2033. Factors driving this growth include an aging population, increased healthcare activities, and advanced research initiatives in nuclear physics and healthcare applications. Countries like Germany, France, and the UK are leading in adopting new scintillation technologies.Asia Pacific Inorganic Scintillators Market Report:

The Asia Pacific region holds a significant share in the Inorganic Scintillators market, with a projected market size of USD 0.24 billion in 2023 and USD 0.45 billion by 2033. The growth here is driven by increasing healthcare investments and a growing nuclear sector in countries like China and India. Rising adoption of advanced medical technologies and radiation detection applications are prominent factors boosting demand.North America Inorganic Scintillators Market Report:

North America dominates the Inorganic Scintillators market, with a projected size of USD 0.56 billion in 2023, growing to USD 1.04 billion by 2033. The region's growth is fueled by a robust healthcare system, significant investments in nuclear technology, and strong regulatory frameworks promoting radiation safety in various sectors, enhancing the demand for advanced scintillation materials.South America Inorganic Scintillators Market Report:

In South America, the Inorganic Scintillators market is smaller but growing, with a market size of USD 0.06 billion in 2023, expected to reach USD 0.11 billion by 2033. Brazil and Argentina lead the market with their increasing focus on nuclear safety and medical imaging applications, although growth is tempered by economic fluctuations.Middle East & Africa Inorganic Scintillators Market Report:

The Middle East and Africa region is projected to grow from USD 0.16 billion in 2023 to USD 0.29 billion by 2033. The growth in this region is primarily due to increasing nuclear power plant projects and heightened efforts in radiation safety protocols in healthcare and industrial sectors. However, the market faces challenges related to economic conditions and regulatory environments.Tell us your focus area and get a customized research report.

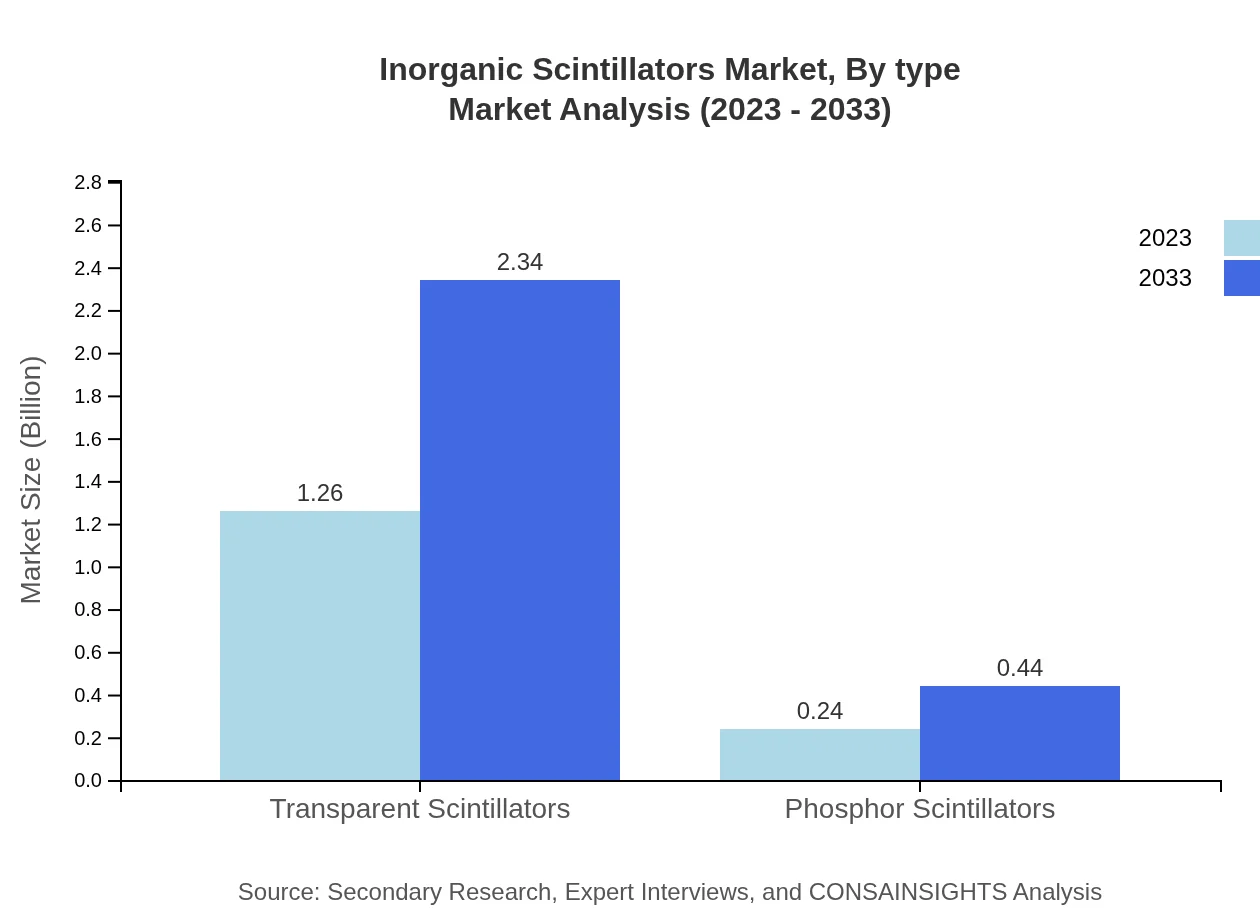

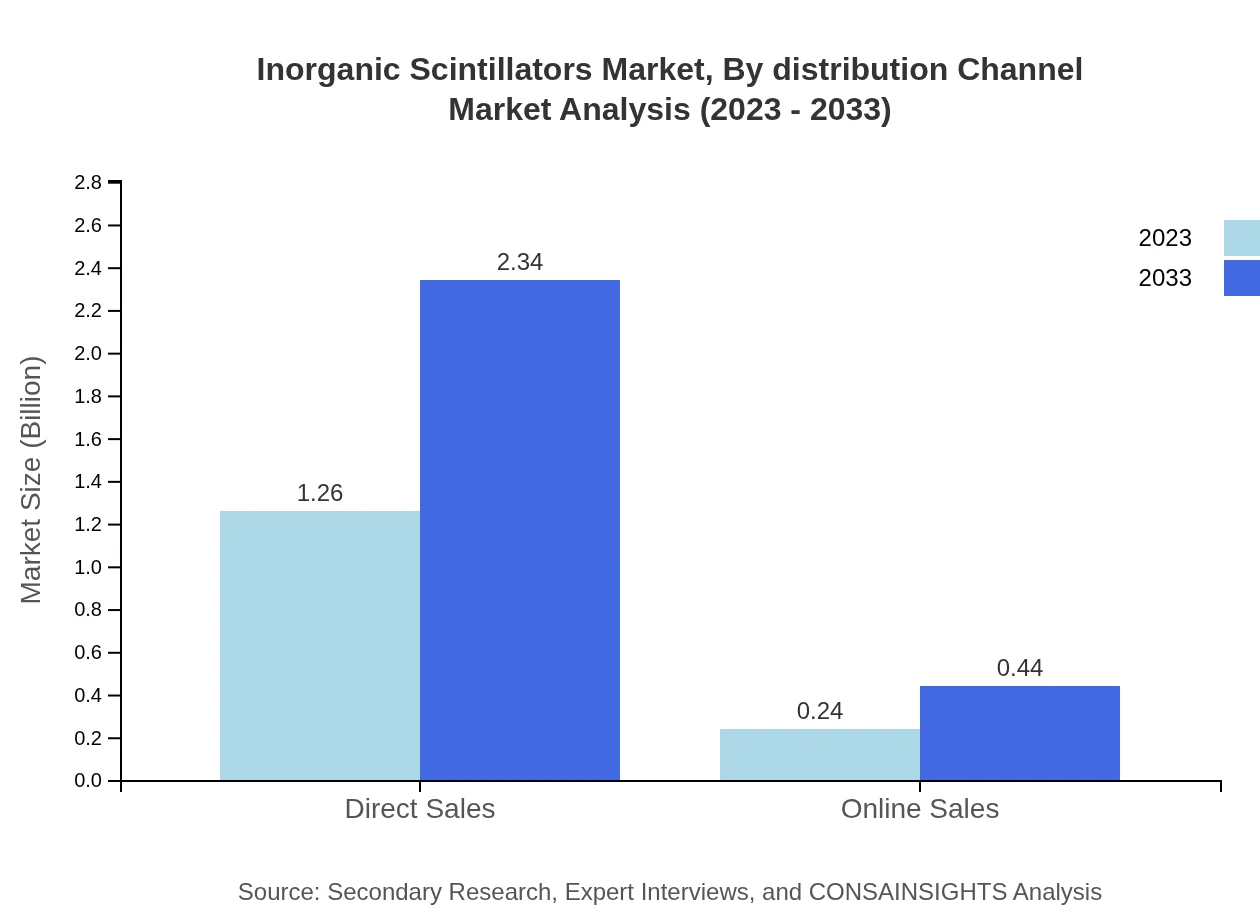

Inorganic Scintillators Market Analysis By Material

The market is primarily segmented by material into types such as Transparent Scintillators, Phosphor Scintillators, and various iodine compounds. Transparent Scintillators dominate the market size, estimated at USD 1.26 billion in 2023 and projected to grow to USD 2.34 billion by 2033, representing an 84.08% market share. Phosphor Scintillators account for 15.92% market share with sizes moving from USD 0.24 billion to USD 0.44 billion over the same period.

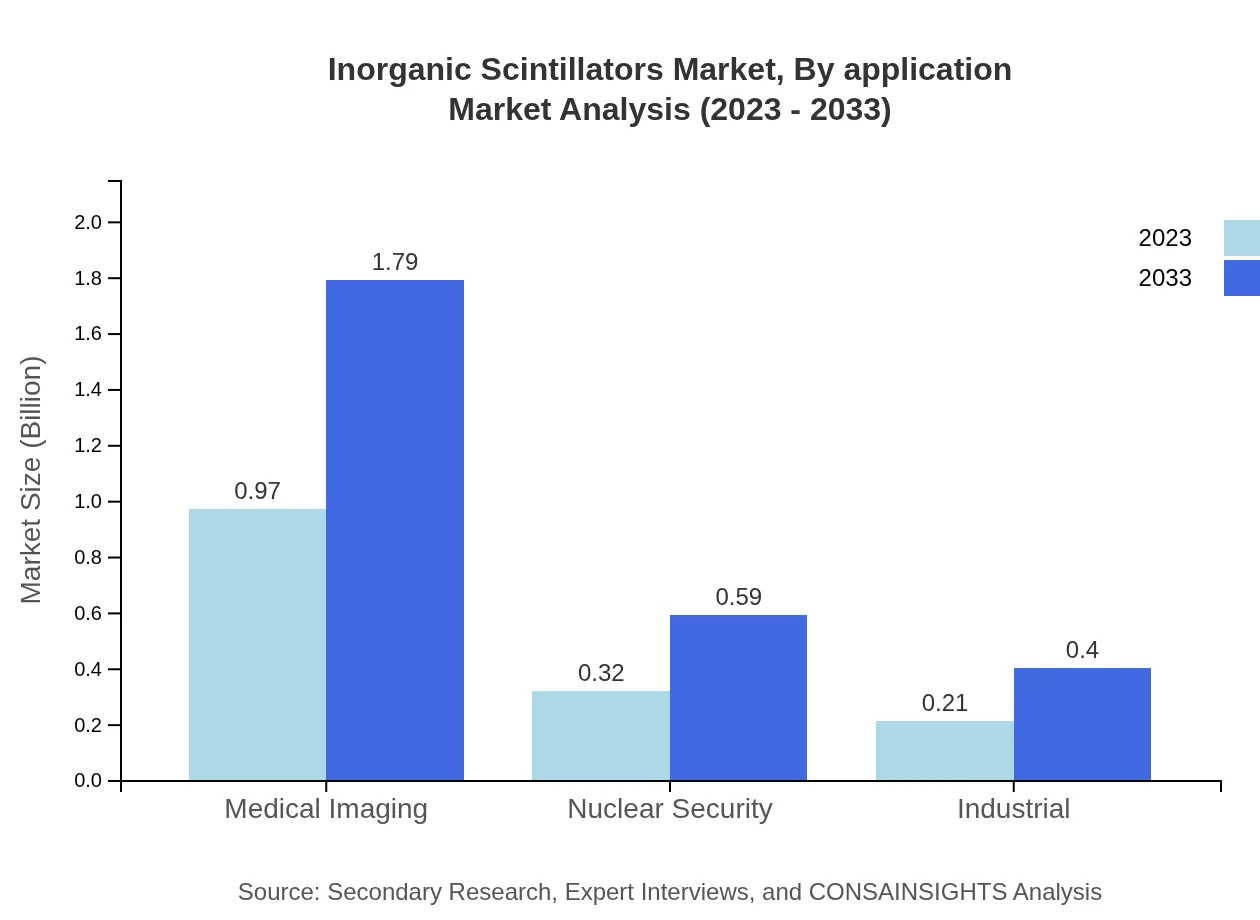

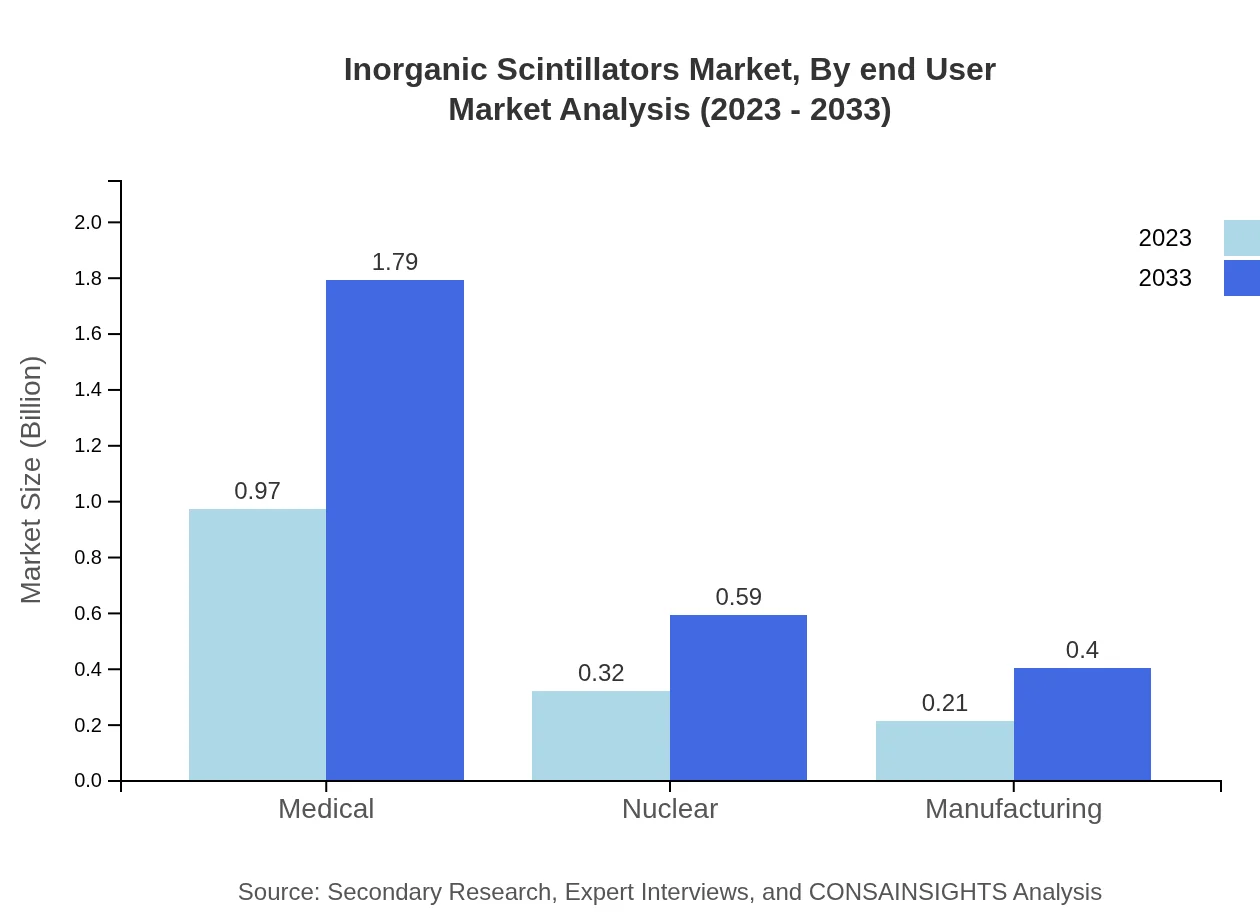

Inorganic Scintillators Market Analysis By Application

Applications include segments like Medical Imaging, Nuclear, and Industrial. The Medical Imaging segment is the largest, with a market size of USD 0.97 billion in 2023, rising to USD 1.79 billion by 2033, holding a significant share of 64.56%. The Nuclear sector also shows growth, with sizes moving from USD 0.32 billion to USD 0.59 billion.

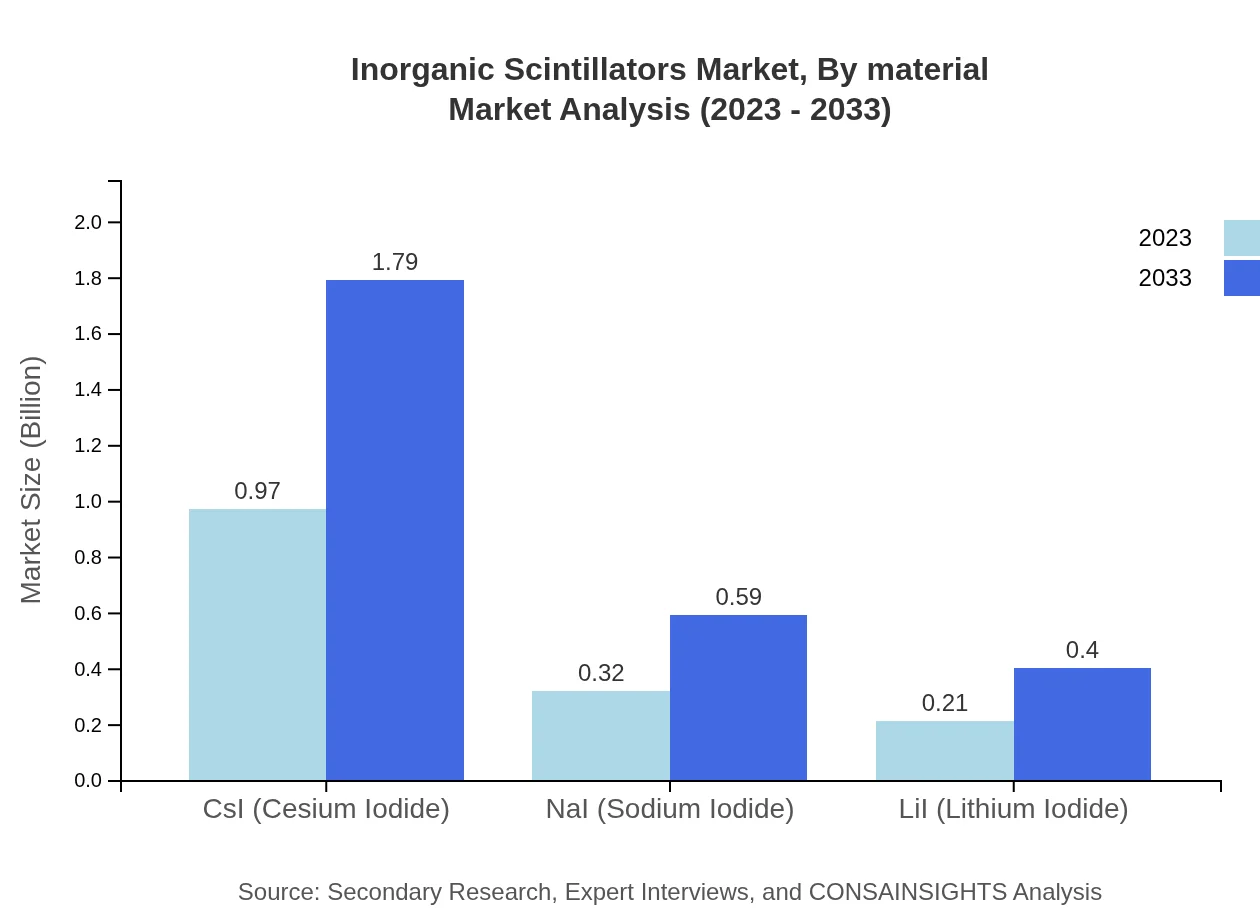

Inorganic Scintillators Market Analysis By Type

Inorganic scintillators are categorized into types like CsI (Cesium Iodide), NaI (Sodium Iodide), and LiI (Lithium Iodide). CsI remains the market leader with sizes from USD 0.97 billion in 2023 to USD 1.79 billion by 2033, and similar growth is seen in NaI and LiI.

Inorganic Scintillators Market Analysis By End User

The end-user segment includes Medical Imaging, Nuclear Security, and various industrial applications. Medical Imaging represents the largest portion of the market, highlighting the critical role of scintillators in healthcare diagnostics.

Inorganic Scintillators Market Analysis By Distribution Channel

The market is segmented by distribution channel into Direct Sales and Online Sales. Direct Sales dominate with a projected size of USD 1.26 billion in 2023, while Online Sales comprise a smaller share, growing from USD 0.24 billion to USD 0.44 billion in the same period.

Inorganic Scintillators Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Inorganic Scintillators Industry

Thallium Bromide (TlBr):

A leader in the production of innovative scintillation materials, TlBr provides advanced solutions for radiation detection applications across various sectors.Saint-Gobain:

Specializing in high-performance scintillation materials, Saint-Gobain supports advancements in healthcare and industrial applications with their extensive product range.Bicron (a subsidiary of Kuraray):

Bicron is known for its robust science behind scintillation technologies, contributing significantly to both nuclear and medical imaging markets.Hitachi Metals:

Hitachi Metals focuses on innovative scintillator technology for various applications, enhancing safety and efficacy in detection systems.We're grateful to work with incredible clients.

FAQs

What is the market size of inorganic Scintillators?

The global inorganic scintillators market is valued at approximately $1.5 billion in 2023 and is projected to grow at a CAGR of 6.2%, reaching significant growth by 2033.

What are the key market players or companies in this inorganic Scintillators industry?

Key players in the inorganic scintillators industry include notable companies such as Saint-Gobain Crystals, Nippon Carbon Co., Ltd., and Hamamatsu Photonics, which are recognized for their innovative offerings and substantial market presence.

What are the primary factors driving the growth in the inorganic Scintillators industry?

Growth in the inorganic scintillators industry is primarily driven by increasing demand in medical imaging, nuclear security, and industrial applications, coupled with advancements in scintillator technology that enhance performance and efficiency.

Which region is the fastest Growing in the inorganic Scintillators?

The fastest-growing region in the inorganic scintillators market is North America, expected to grow from $0.56 billion in 2023 to $1.04 billion by 2033, driven by advancements in medical and nuclear applications.

Does ConsaInsights provide customized market report data for the inorganic Scintillators industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the inorganic scintillators industry, ensuring clients receive relevant insights and data to support their strategic decisions.

What deliverables can I expect from this inorganic Scintillators market research project?

Key deliverables from the inorganic scintillators market research project include comprehensive market analysis, trends overview, competitive landscape, and detailed reports on demographics, segmentation, and regional insights.

What are the market trends of inorganic Scintillators?

Current market trends include a shift towards transparent and high-efficiency scintillators, increased adoption in medical imaging, and higher investments in research and development to innovate scintillation materials.