Insect Based Ingredients Market Report

Published Date: 31 January 2026 | Report Code: insect-based-ingredients

Insect Based Ingredients Market Size, Share, Industry Trends and Forecast to 2033

This report delves into the Insect Based Ingredients market, offering insights into market trends, segmentation, regional analysis, and future forecasts from 2023 to 2033. The analysis encompasses market size, growth forecasts, and key players influencing the industry.

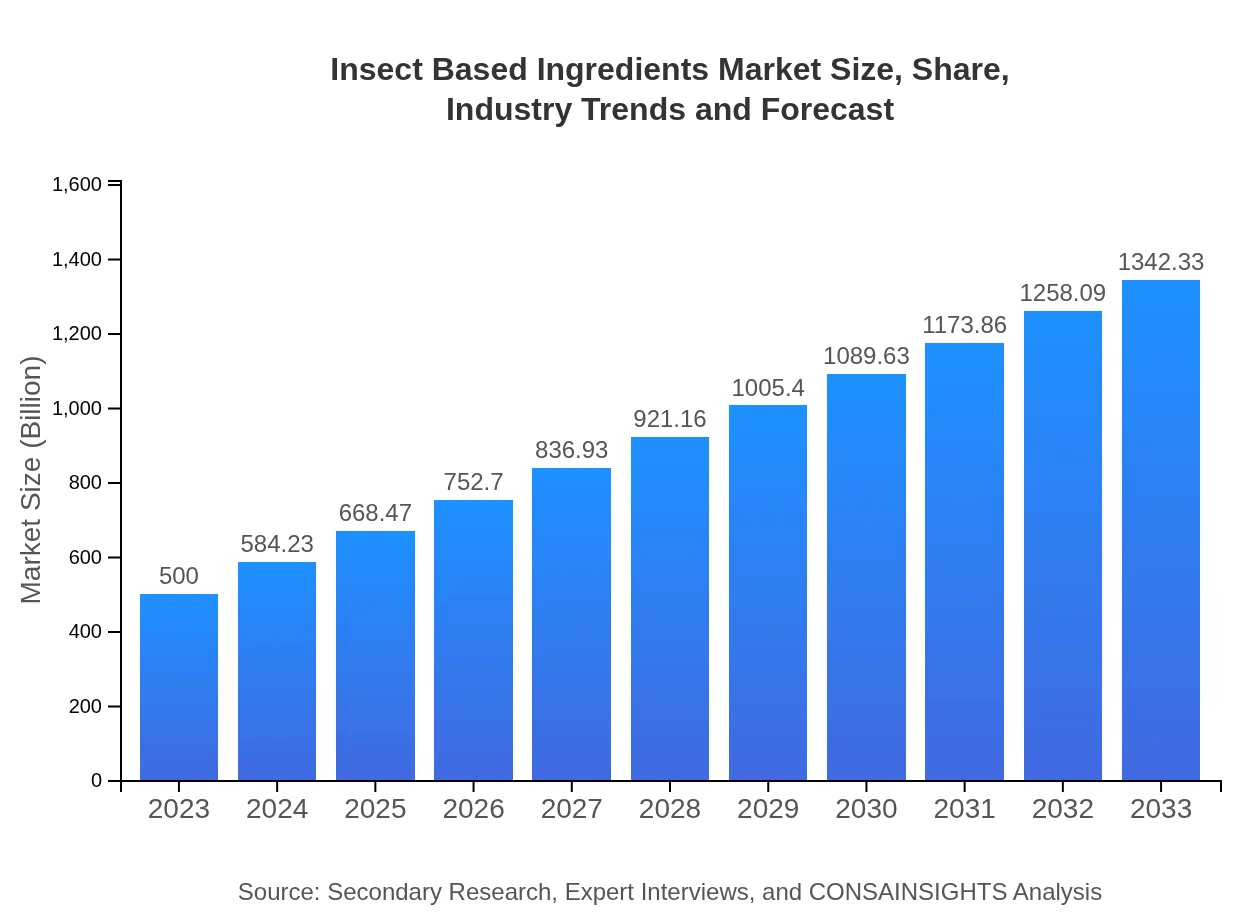

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $500.00 Million |

| CAGR (2023-2033) | 10% |

| 2033 Market Size | $1342.33 Million |

| Top Companies | Aspire Food Group, Exo Protein, Ynsect, Cricket Flours, Innsect |

| Last Modified Date | 31 January 2026 |

Insect Based Ingredients Market Overview

Customize Insect Based Ingredients Market Report market research report

- ✔ Get in-depth analysis of Insect Based Ingredients market size, growth, and forecasts.

- ✔ Understand Insect Based Ingredients's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Insect Based Ingredients

What is the Market Size & CAGR of Insect Based Ingredients market in 2023?

Insect Based Ingredients Industry Analysis

Insect Based Ingredients Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Insect Based Ingredients Market Analysis Report by Region

Europe Insect Based Ingredients Market Report:

In Europe, the market will rise from USD 137.15 million in 2023 to USD 368.20 million by 2033. The EU's supportive regulations on the use of insects in both food and feed applications, combined with consumer willingness to embrace eco-friendly products, provide a strong impetus for growth.Asia Pacific Insect Based Ingredients Market Report:

The Asia Pacific region is anticipated to grow from USD 103.80 million in 2023 to USD 278.67 million by 2033. High population density and dietary trends towards protein-rich foods drive demand. Countries like China and Thailand are spearheading the adoption of insect farming technologies and consumption.North America Insect Based Ingredients Market Report:

The North American market is set to expand from USD 163.70 million in 2023 to USD 439.48 million in 2033. The increasing focus on alternative protein sources and the growing popularity of insect protein bars and snacks among health-conscious consumers propel this growth.South America Insect Based Ingredients Market Report:

South America is projected to increase from USD 49.25 million in 2023 to USD 132.22 million in 2033. Countries such as Brazil are recognizing the potential for insect-based ingredients in animal feed to improve sustainability and reduce costs, aligning with broader environmental initiatives.Middle East & Africa Insect Based Ingredients Market Report:

The Middle East and Africa are expected to grow from USD 46.10 million in 2023 to USD 123.76 million by 2033. The region is increasingly exploring insect farming to address food security concerns and nutritional deficits, especially in rural areas.Tell us your focus area and get a customized research report.

Insect Based Ingredients Market Analysis By Insect Type

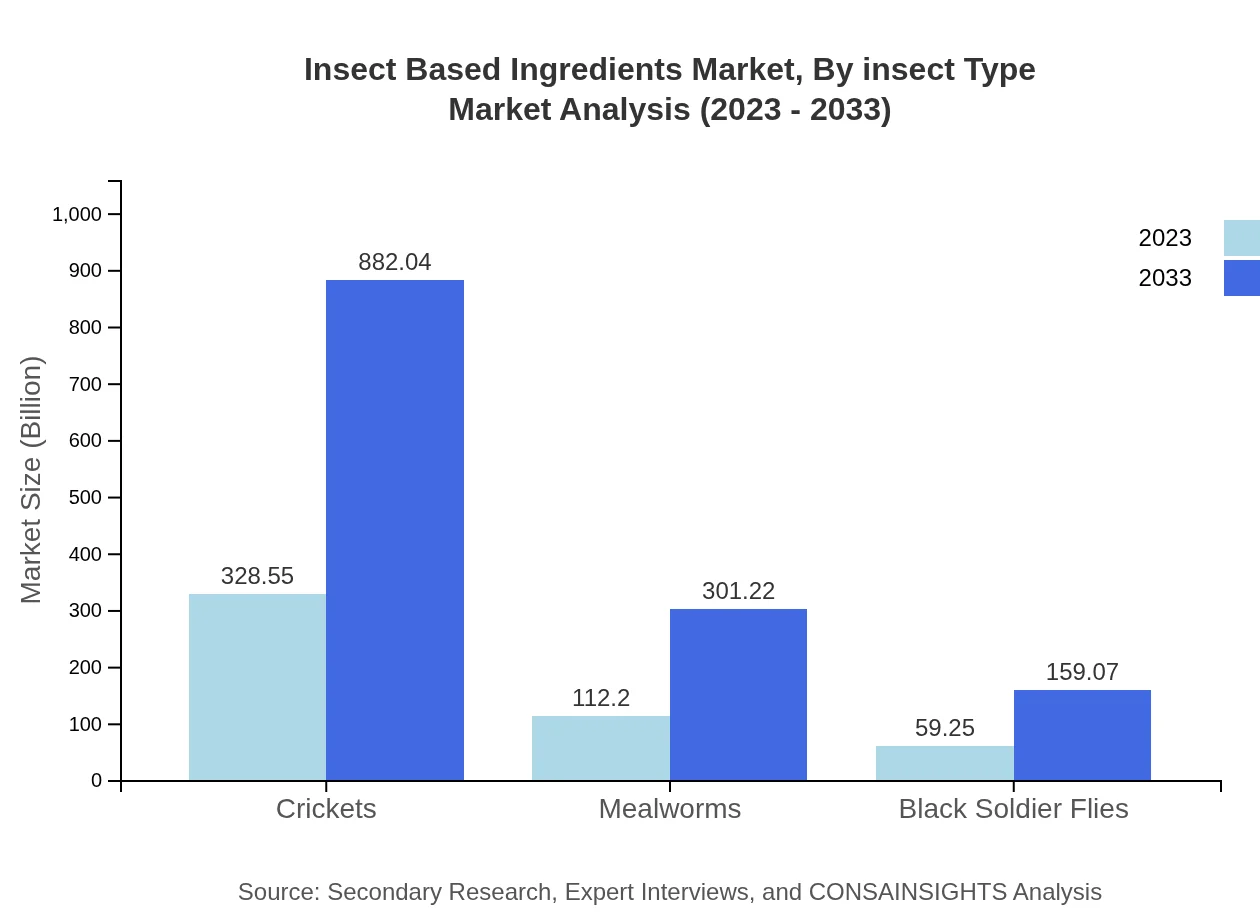

The insect-based ingredients market is dominated by crickets, which are projected to grow from USD 328.55 million in 2023 to USD 882.04 million by 2033, providing approximately 65.71% of market share. Mealworms follow with a size of USD 112.20 million in 2023, expected to reach USD 301.22 million by 2033, capturing 22.44% of the market. Black soldier flies contribute significantly as well, showing growth from USD 59.25 million to USD 159.07 million during the same period.

Insect Based Ingredients Market Analysis By Application

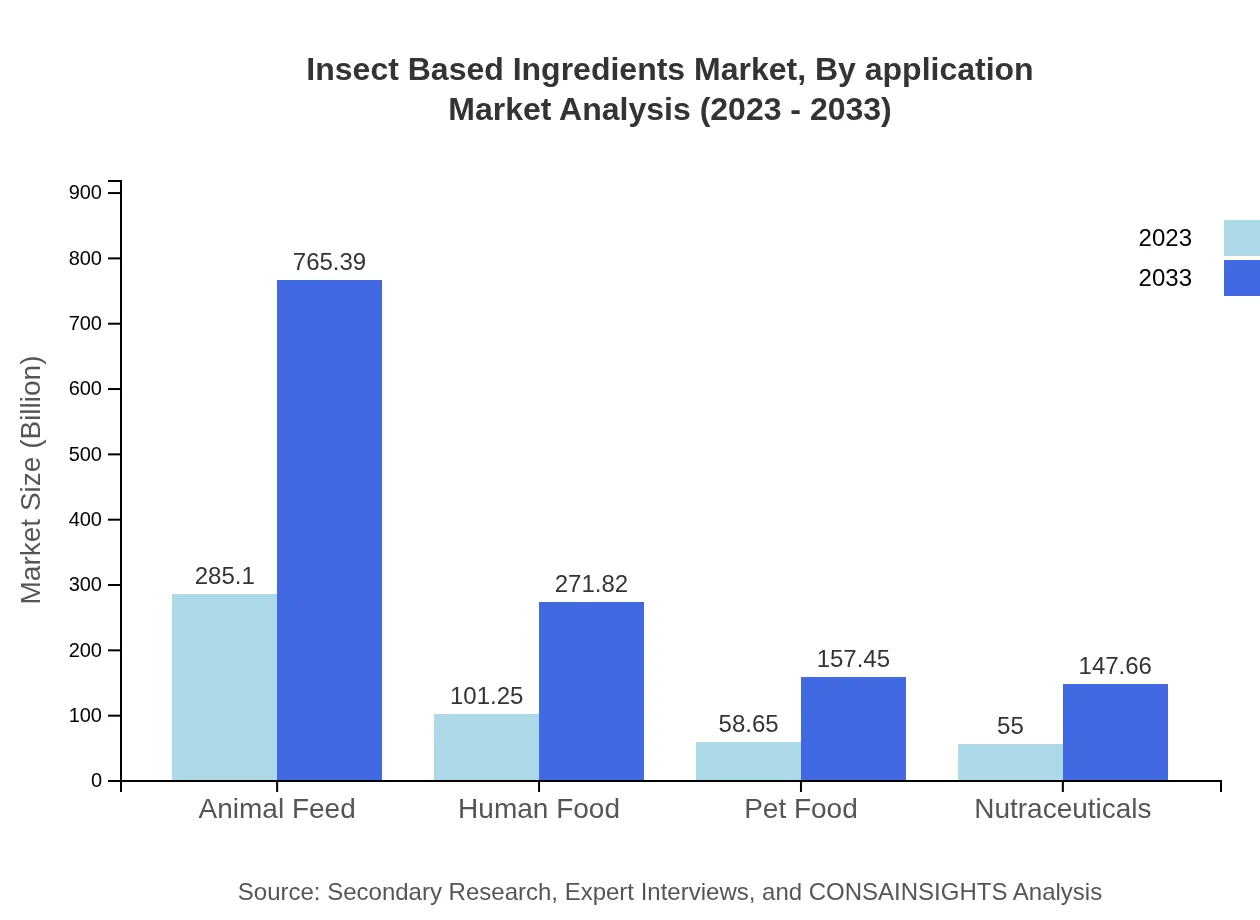

Animal Feed dominates the market share at 57.02% in 2023, with a size of USD 285.10 million, projected to grow to USD 765.39 million by 2033. Human food, with a size of USD 101.25 million in 2023 (20.25% share), is projected to reach USD 271.82 million by 2033. Pet food and nutraceuticals also show significant growth potential, ensuring diverse application of insect-based ingredients.

Insect Based Ingredients Market Analysis By Form

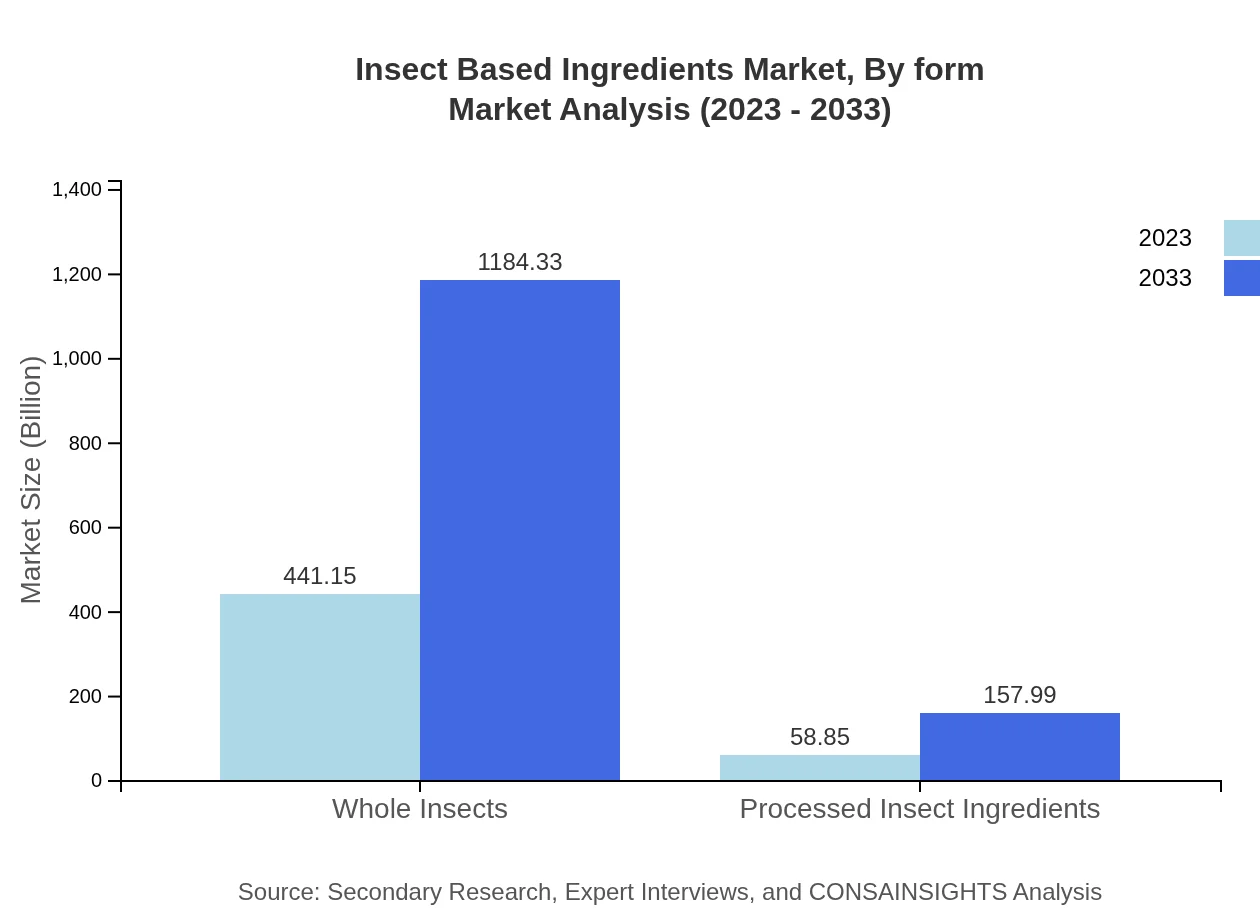

The market is concentrated in whole insects, which hold significant consumer preference and are projected to grow from USD 441.15 million in 2023 to USD 1.184 billion by 2033. This segment's popularity is driven by its nutritional density and appeal in traditional dishes. Processed insect ingredients are also gaining traction, expected to increase from USD 58.85 million to USD 157.99 million.

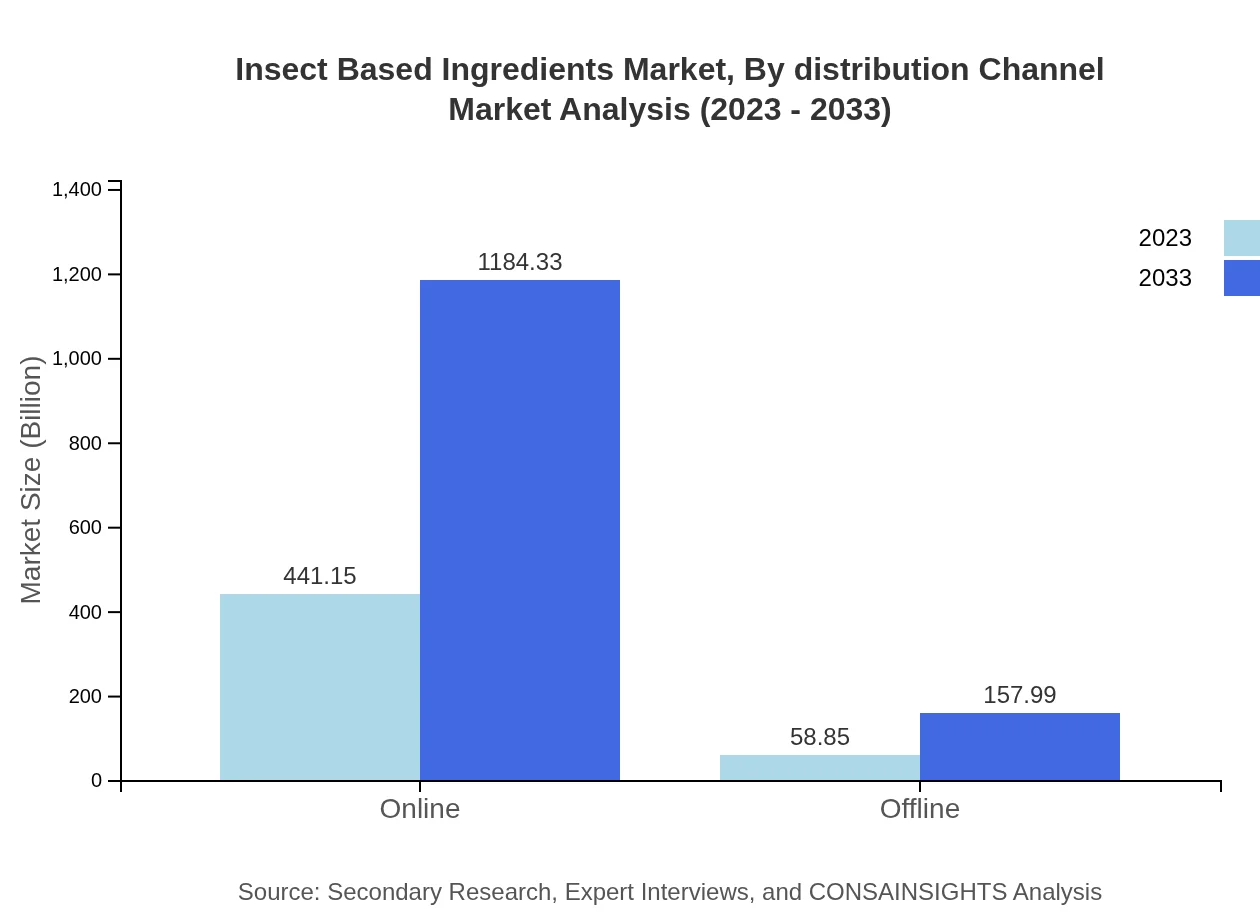

Insect Based Ingredients Market Analysis By Distribution Channel

Sales through online channels are significant, growing from USD 441.15 million in 2023 to USD 1.184 billion by 2033, indicating a shift in consumer purchasing habits. Offline channels, while less prevalent, are still growing, projected to rise from USD 58.85 million in 2023 to USD 157.99 million, as traditional retail outlets adapt to evolving market demands.

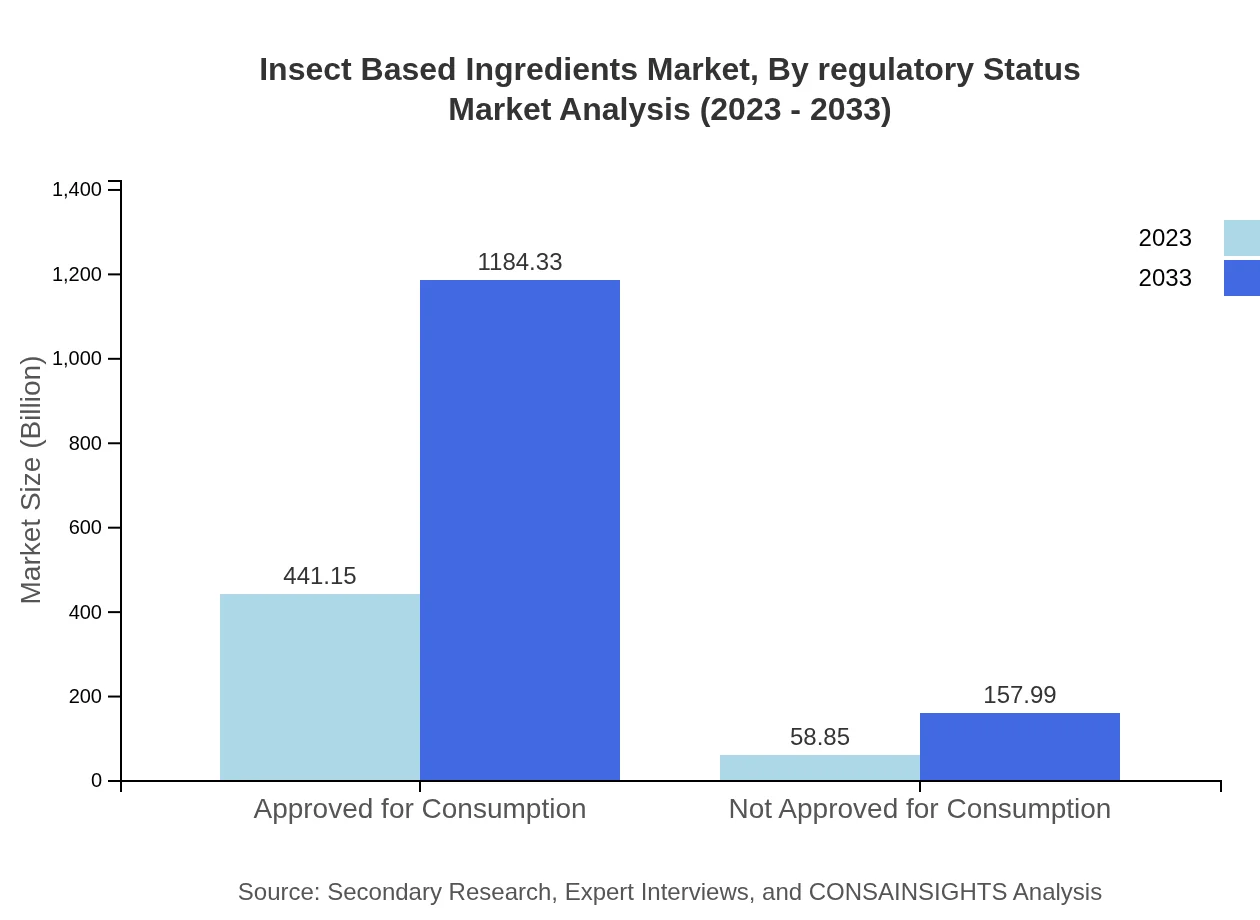

Insect Based Ingredients Market Analysis By Regulatory Status

The market is primarily segmented into 'Approved for Consumption' and 'Not Approved for Consumption' segments, with the former showing remarkable growth from USD 441.15 million to USD 1.184 billion by 2033. Compliance with food safety regulations enhances consumer confidence, facilitating broader acceptance.

Insect Based Ingredients Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Insect Based Ingredients Industry

Aspire Food Group:

A pioneer in the edible insect market, Aspire Food Group focuses on innovative sustainable solutions through entomophagy, providing ingredients for snacks and products for animal feed.Exo Protein:

Founded by athletes, Exo Protein capitalizes on cricket protein bars and snacks, promoting nutritious and sustainable eating through innovative products that cater to health-conscious consumers.Ynsect:

Ynsect specializes in breeding mealworms for animal and plant nutrition, leading the industry in large-scale insect farming and sustainability.Cricket Flours:

Cricket Flours produces cricket-based protein products, emphasizing health benefits and behind-the-scenes sustainability in food systems.Innsect:

Focused on using insect protein in human food products, Innsect pushes the envelope on taste and nutrition, aligning with global sustainability goals.We're grateful to work with incredible clients.

FAQs

What is the market size of insect Based ingredients?

The insect-based ingredients market is estimated to be valued at approximately USD 500 million in 2023, with a projected CAGR of 10%. This growth is driven by increasing demand for sustainable food sources and alternative protein sources.

What are the key market players or companies in the insect Based ingredients industry?

Key players in the insect-based ingredients industry include companies like Ynsect, Bühler Group, and Aspire Food Group. These companies are at the forefront of technological advancements and sustainability initiatives within the sector.

What are the primary factors driving the growth in the insect Based ingredients industry?

Key drivers for growth in this industry include rising consumer awareness of sustainable diets, regulatory approvals for insect consumption, and advancements in farming technologies that enhance production efficiency.

Which region is the fastest Growing in the insect Based ingredients market?

North America is identified as the fastest-growing region, with the market projected to grow from USD 163.70 million in 2023 to USD 439.48 million by 2033, showcasing a significant demand for alternative protein sources.

Does ConsaInsights provide customized market report data for the insect Based ingredients industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the insect-based ingredients industry, ensuring research aligns with particular business objectives and market opportunities.

What deliverables can I expect from this insect Based ingredients market research project?

From this market research project, you can expect comprehensive reports including market size analysis, growth projections, competitive landscape assessments, and insights into consumer trends and regulatory frameworks.

What are the market trends of insect Based ingredients?

Current trends in the insect-based ingredients market include increased adoption of insect protein in animal feed, human food products, and pet food, along with greater consumer acceptance and regulatory progress across various regions.