Insect Pest Control Products Market Report

Published Date: 02 February 2026 | Report Code: insect-pest-control-products

Insect Pest Control Products Market Size, Share, Industry Trends and Forecast to 2033

This report provides a detailed analysis of the Insect Pest Control Products market, covering insights from 2023 to 2033, including market size, industry trends, key players, and regional analyses to forecast future growth and challenges.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

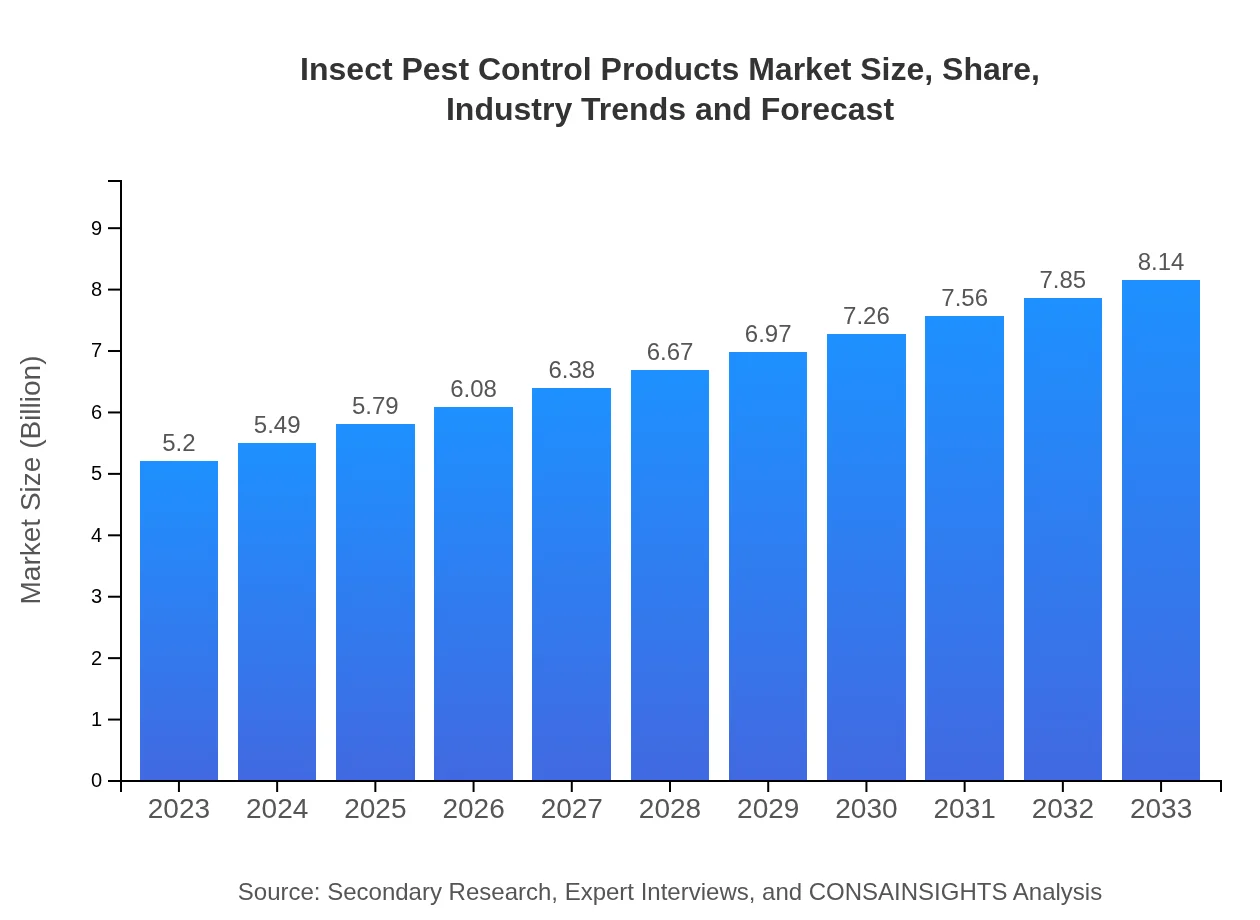

| 2023 Market Size | $5.20 Billion |

| CAGR (2023-2033) | 4.5% |

| 2033 Market Size | $8.14 Billion |

| Top Companies | BASF SE, Syngenta AG, FMC Corporation, Dow AgroSciences, Bayer AG |

| Last Modified Date | 02 February 2026 |

Insect Pest Control Products Market Overview

Customize Insect Pest Control Products Market Report market research report

- ✔ Get in-depth analysis of Insect Pest Control Products market size, growth, and forecasts.

- ✔ Understand Insect Pest Control Products's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Insect Pest Control Products

What is the Market Size & CAGR of Insect Pest Control Products market in 2023?

Insect Pest Control Products Industry Analysis

Insect Pest Control Products Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Insect Pest Control Products Market Analysis Report by Region

Europe Insect Pest Control Products Market Report:

The European market is projected to grow from $1.50 billion in 2023 to $2.35 billion by 2033, with strong emphasis on environmentally friendly pest control solutions influenced by stringent EU regulations.Asia Pacific Insect Pest Control Products Market Report:

In 2023, the Asia Pacific market for insect pest control products is valued at $1.03 billion, projected to grow to approximately $1.62 billion by 2033, largely due to increasing agricultural activity and growing urban populations in countries like India and China.North America Insect Pest Control Products Market Report:

North America is the largest market, with a valuation of $1.85 billion in 2023 and expected to grow to $2.89 billion by 2033. High disposable incomes and the prevalence of advanced pest management technologies fuel this growth.South America Insect Pest Control Products Market Report:

The South American market is estimated to be worth $0.44 billion in 2023 and expected to reach around $0.69 billion by 2033. This growth is driven by agricultural exports and the need for efficient pest management.Middle East & Africa Insect Pest Control Products Market Report:

The Middle East and Africa market is relatively smaller, valued at $0.38 billion in 2023, growing to about $0.59 billion by 2033. The growth here is primarily driven by increasing investments in agricultural modernization.Tell us your focus area and get a customized research report.

Insect Pest Control Products Market Analysis By Application

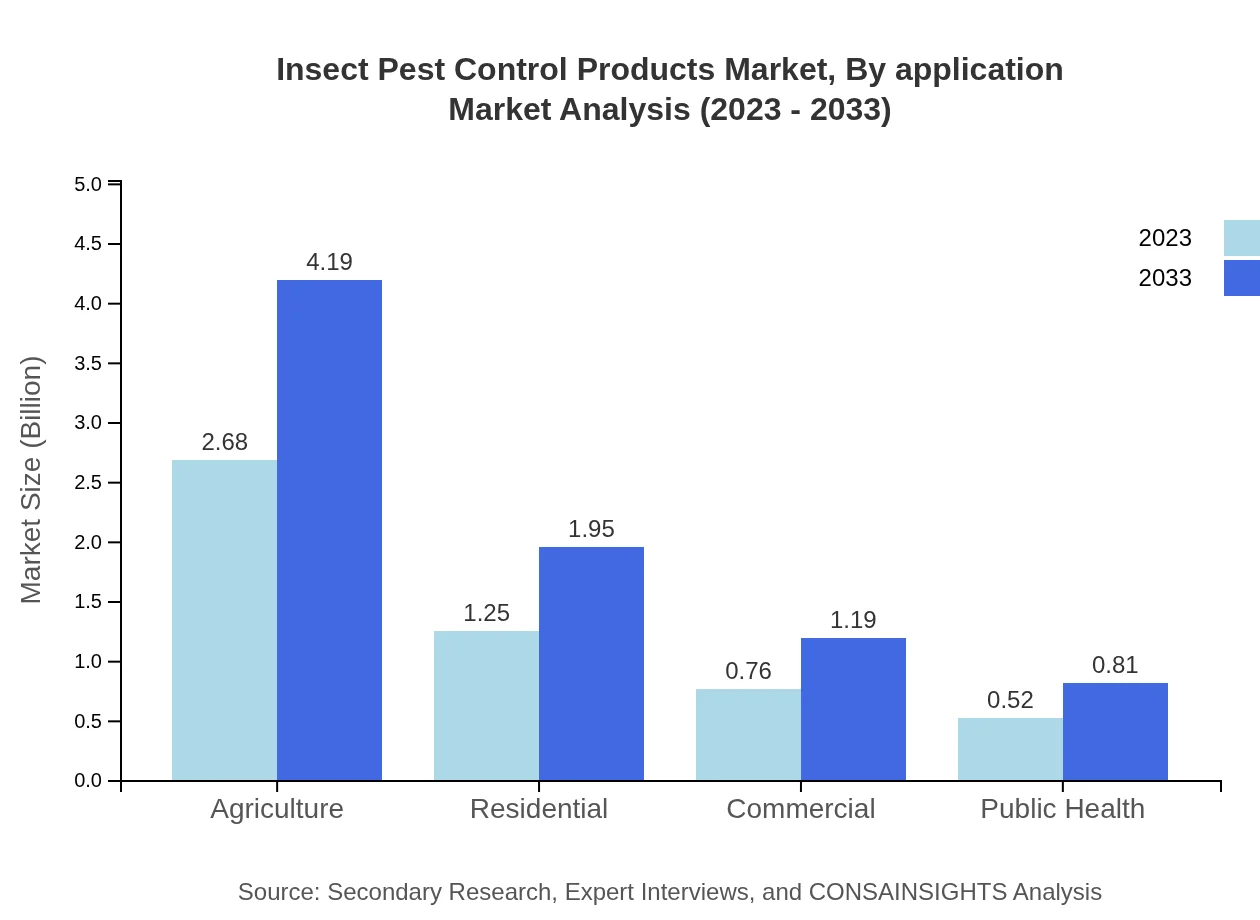

The market segmentation by application shows that agriculture is the largest application segment, valued at $2.68 billion in 2023 and expected to grow to $4.19 billion by 2033. Residential applications contribute $1.25 billion in 2023, forecasted to rise to $1.95 billion by 2033. Commercial and public health applications are also significant at $0.76 billion and $0.52 billion respectively in 2023.

Insect Pest Control Products Market Analysis By Product Type

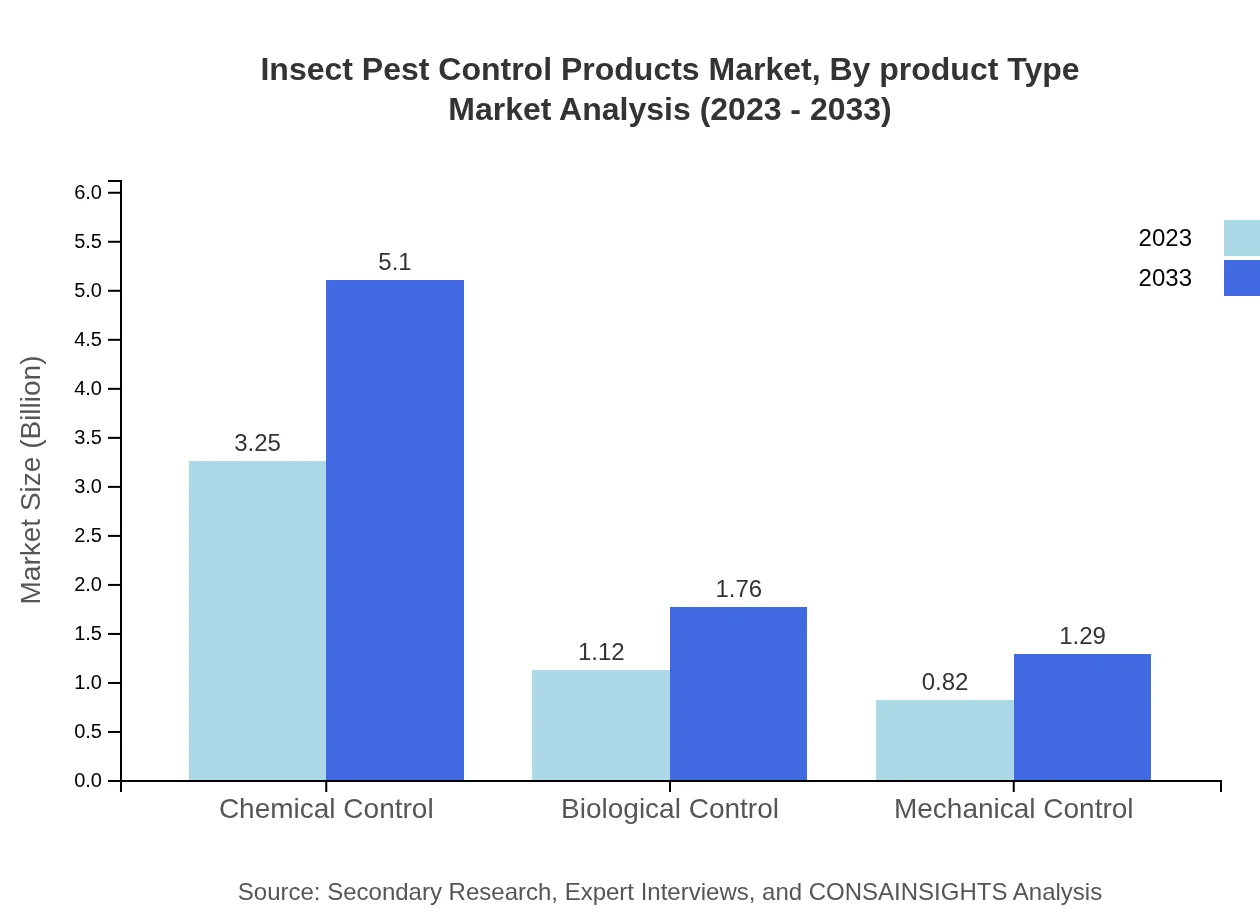

Under product types, chemical control holds the largest share at $3.25 billion in 2023, anticipated to reach $5.10 billion by 2033, driven by its effectiveness. Biological control is valued at $1.12 billion and is expected to grow to $1.76 billion, reflecting increasing acceptance of eco-friendly products. Mechanical control and other alternatives are also gaining traction.

Insect Pest Control Products Market Analysis By Formulation

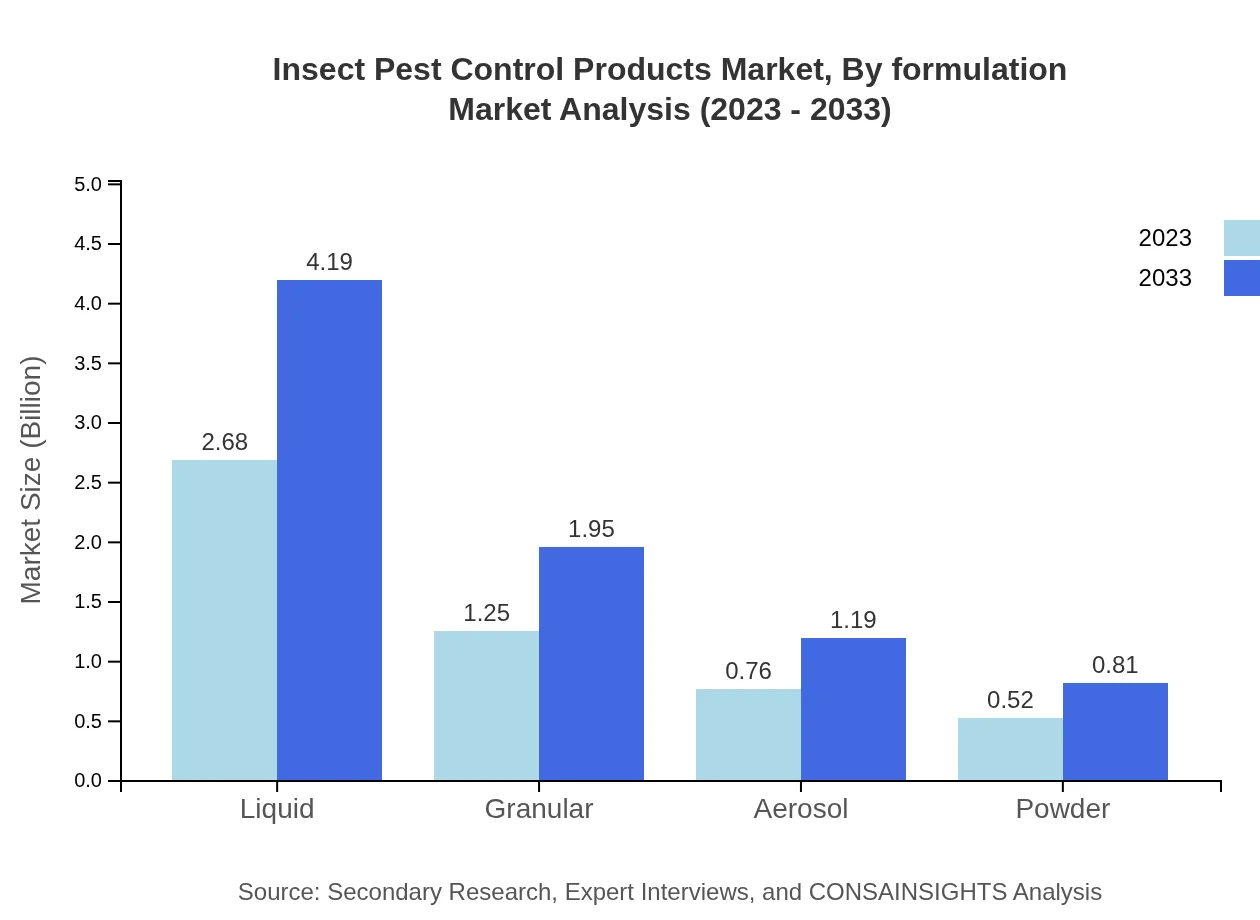

In terms of formulation, liquid products dominate at $2.68 billion in 2023, with an expected increase to $4.19 billion by 2033. Granular formulations represent a significant segment as well, forecasted to grow from $1.25 billion to $1.95 billion during the same period. Aerosol and powder formulations are showing steady growth, reinforcing the versatility across applications.

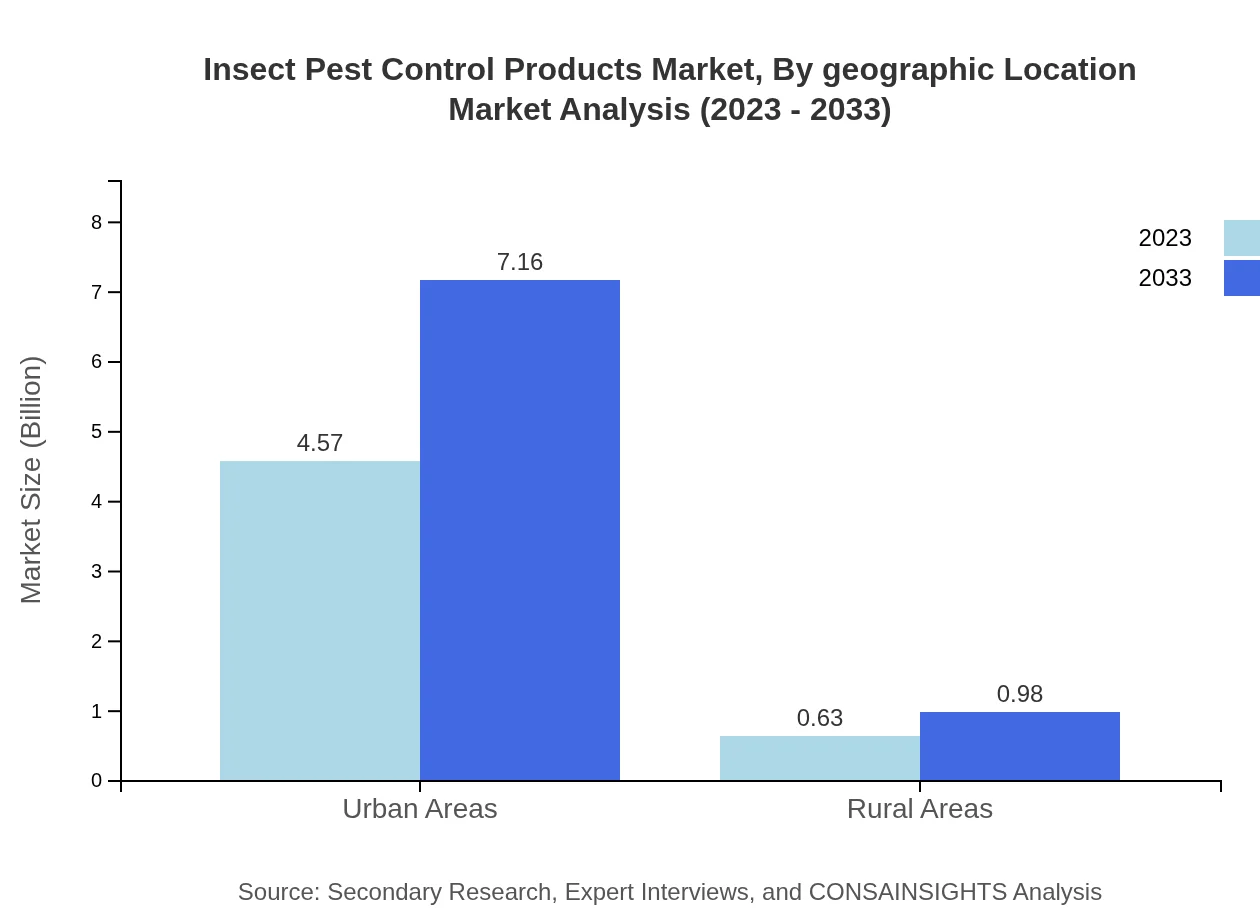

Insect Pest Control Products Market Analysis By Geographic Location

Geographical segmentation identifies urban areas as major contributors to the market, valued at $4.57 billion in 2023, expected to rise to $7.16 billion by 2033 due to rising urban populations. Rural areas, on the other hand, contribute $0.63 billion and are projected to grow to $0.98 billion, indicating a broader acceptance of pest control products in these regions.

Insect Pest Control Products Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Insect Pest Control Products Industry

BASF SE:

A global leader in the agrochemical industry, BASF offers a wide range of insect pest control solutions that are known for their innovation and environmental compliance.Syngenta AG:

Syngenta is prominent in the development of insecticides and biological control products, focusing on helping farmers enhance yields and manage pests sustainably.FMC Corporation:

FMC provides a considerable portfolio of pest control products, leveraging advanced technology and strategic partnerships to enhance effectiveness.Dow AgroSciences:

Known for its research-driven approach, Dow AgroSciences offers integrated pest management solutions that cater to agricultural and commercial sectors.Bayer AG:

Bayer is committed to innovation in pest control, with solutions tailored for both environmental sustainability and agricultural efficacy.We're grateful to work with incredible clients.

FAQs

What is the market size of insect Pest Control Products?

The global insect pest control products market is projected to grow from $5.2 billion in 2023 to an estimated size in 2033, with a compound annual growth rate (CAGR) of 4.5%. This growth reflects increasing demand for pest management solutions.

What are the key market players or companies in this insect Pest Control Products industry?

Key players in the insect pest control products market include major companies such as Bayer AG, Syngenta, BASF, and Terminix. These companies are involved in the development and marketing of various pest control products, ranging from chemicals to biological solutions.

What are the primary factors driving the growth in the insect Pest Control Products industry?

Driving factors for growth in the insect pest control products industry include urbanization, increasing agricultural productivity needs, and rising public awareness about health risks associated with pests. Technological advancements in pest control methods further support market expansion.

Which region is the fastest Growing in the insect Pest Control Products?

The fastest-growing region in the insect pest control products market is projected to be North America, moving from $1.85 billion in 2023 to $2.89 billion by 2033. This growth is driven by high urbanization rates and increased demand for residential pest control solutions.

Does ConsaInsights provide customized market report data for the insect Pest Control Products industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs in the insect pest control products industry. Clients can request customized analysis focusing on regional, segment-specific insights, and market trends.

What deliverables can I expect from this insect Pest Control Products market research project?

Deliverables from the insect pest control products market research project typically include comprehensive market analysis reports, detailed segment breakdowns, competitive landscape assessments, and customized insights per specific client requirements.

What are the market trends of insect Pest Control Products?

Current trends in the insect pest control products market include a growing preference for eco-friendly solutions, increased regulations on chemical pesticides, and advancements in smart pest control technologies. These trends indicate a significant shift towards sustainable pest management.