Insect Protein Market Report

Published Date: 31 January 2026 | Report Code: insect-protein

Insect Protein Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Insect Protein market, featuring insights into market size, growth forecasts, industry trends, and regional market dynamics for the years 2023 to 2033.

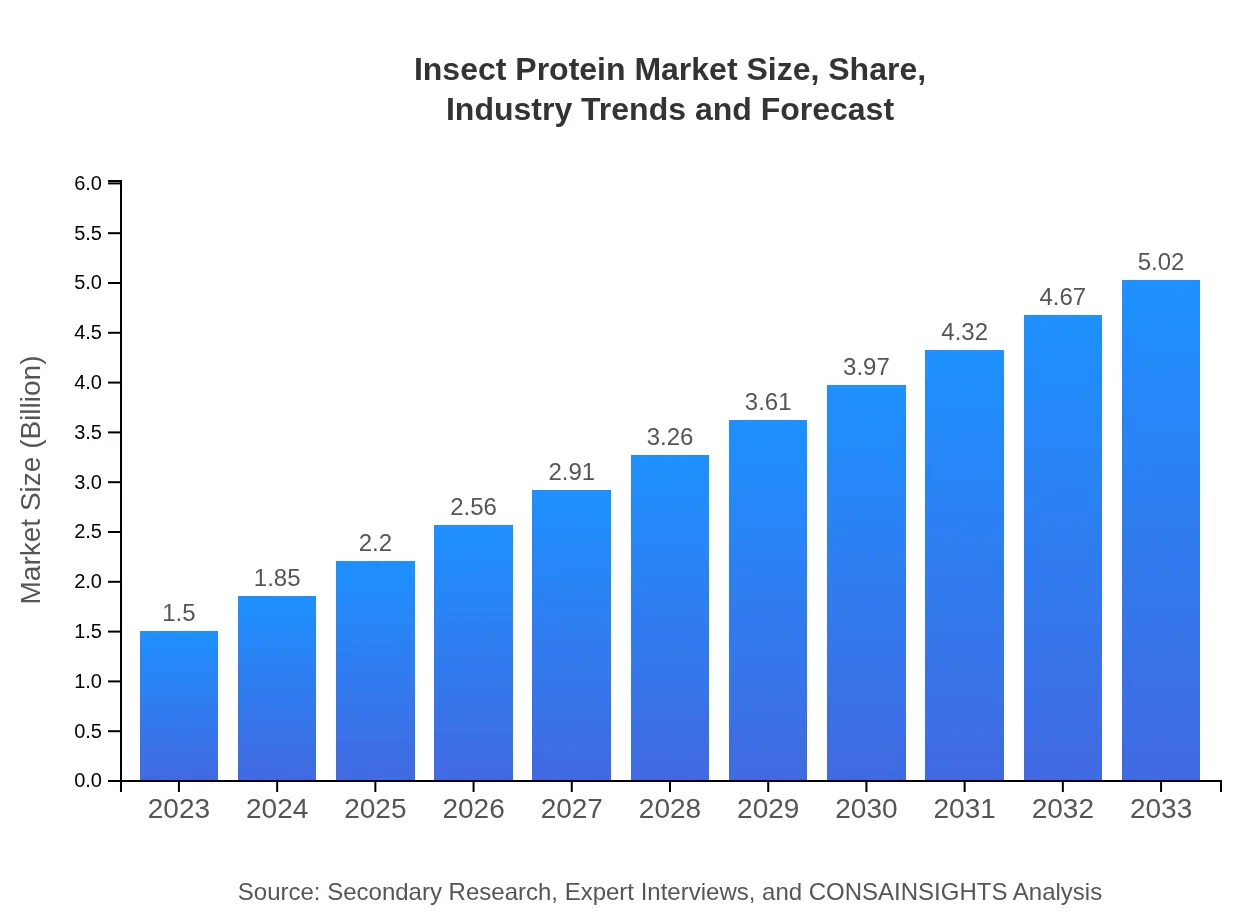

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $1.50 Billion |

| CAGR (2023-2033) | 12.3% |

| 2033 Market Size | $5.02 Billion |

| Top Companies | Ÿnsect, AgriProtein, Protix, Enterra Feed Corporation |

| Last Modified Date | 31 January 2026 |

Insect Protein Market Overview

Customize Insect Protein Market Report market research report

- ✔ Get in-depth analysis of Insect Protein market size, growth, and forecasts.

- ✔ Understand Insect Protein's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Insect Protein

What is the Market Size & CAGR of Insect Protein market in 2023?

Insect Protein Industry Analysis

Insect Protein Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Insect Protein Market Analysis Report by Region

Europe Insect Protein Market Report:

In Europe, the market is projected to expand from $0.51 billion in 2023 to $1.69 billion in 2033 as rising food security concerns prompt governments to explore alternative protein sources. The region is also at the forefront of promoting insect protein among consumers.Asia Pacific Insect Protein Market Report:

The Asia Pacific region is anticipated to witness significant growth, with the market size expected to reach $0.95 billion by 2033, growing from $0.28 billion in 2023. Growing demand for protein-rich diets, especially in countries like China and India, and increasing investments in insect farming technology contribute to this growth.North America Insect Protein Market Report:

North America will likely showcase robust growth, moving from $0.51 billion in 2023 to $1.72 billion by 2033. High consumer awareness regarding sustainable protein sources and regulatory support for innovative farming practices are key growth drivers.South America Insect Protein Market Report:

In South America, the Insect Protein market is expected to grow from $0.13 billion in 2023 to about $0.44 billion in 2033. The region shows potential owing to vast agricultural sectors that can integrate sustainable practices by adopting insect farming.Middle East & Africa Insect Protein Market Report:

The Middle East and Africa market, although currently modest at $0.06 billion in 2023, is expected to grow steadily to $0.21 billion by 2033. Enhanced focus on agricultural sustainability and food diversification are likely to contribute to this growth.Tell us your focus area and get a customized research report.

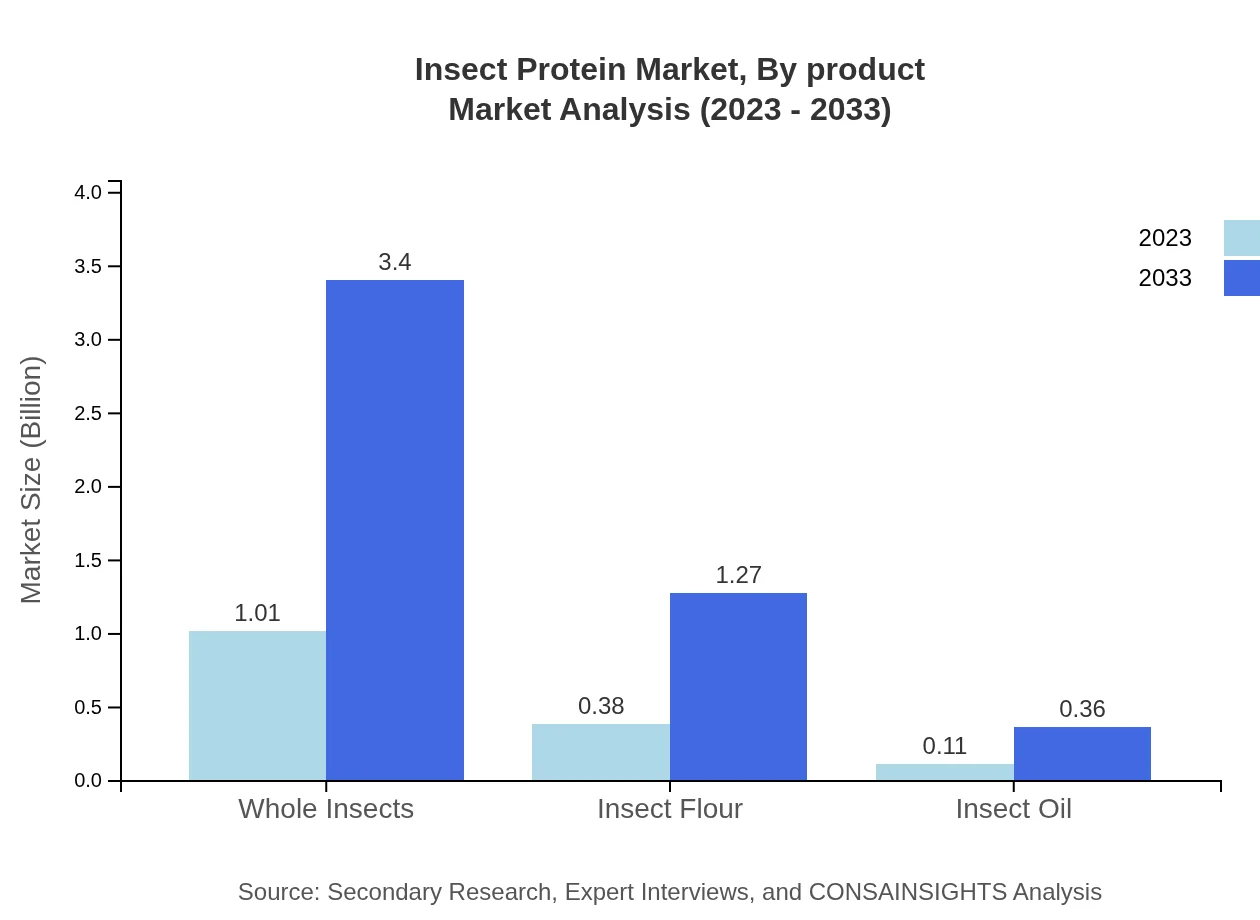

Insect Protein Market Analysis By Product

In 2023, the dry product segment dominates the market with a size of $1.33 billion, maintaining an 88.53% share. Projections for 2033 indicate a market size of $4.45 billion, driven by the continuous demand for nutrient-rich flour and powdered products.

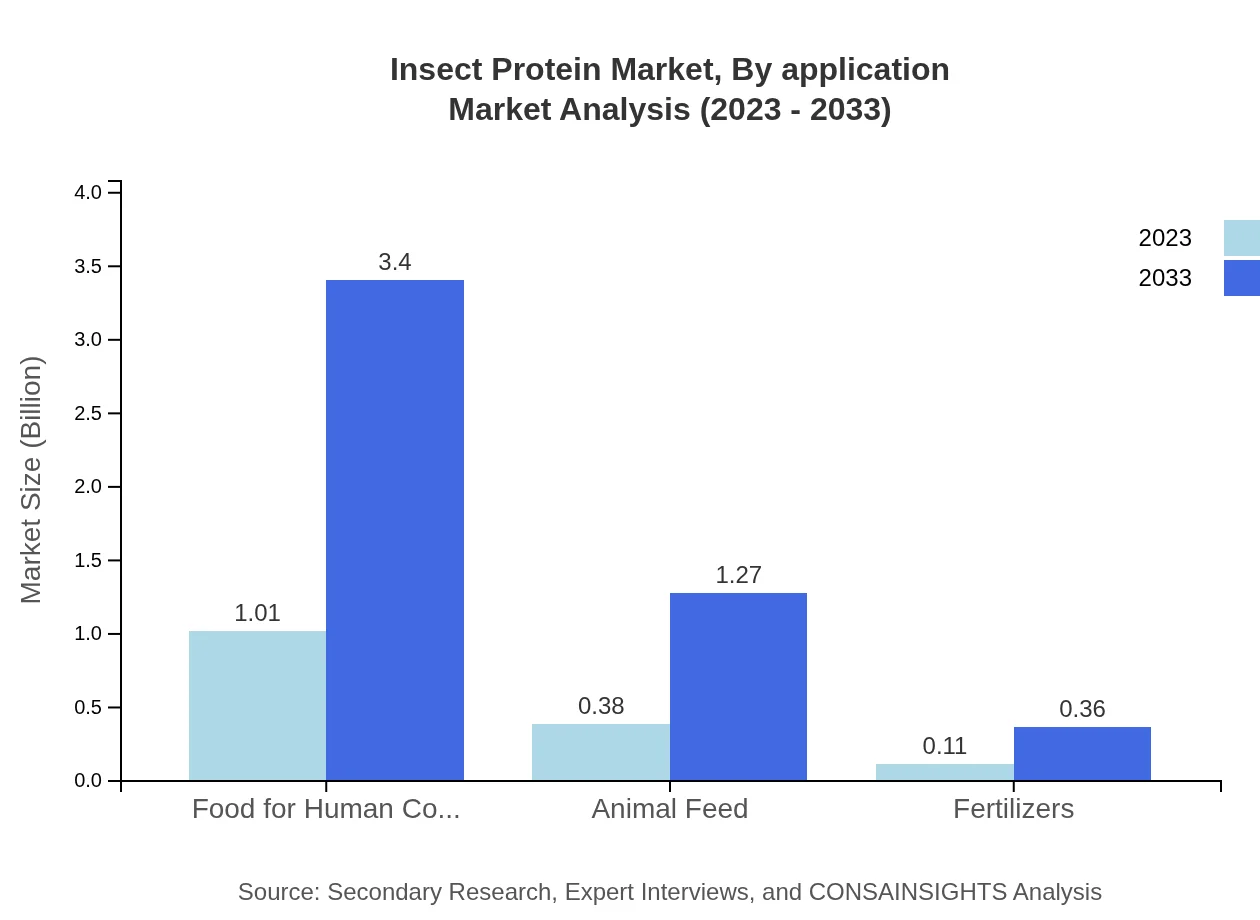

Insect Protein Market Analysis By Application

Food for human consumption is the leading application by size, accounting for $1.01 billion in 2023 and expanding to $3.40 billion by 2033, supported by shifting consumer preferences towards protein alternatives. Animal feed follows closely, with projected growth from $0.38 billion to $1.27 billion in the same period.

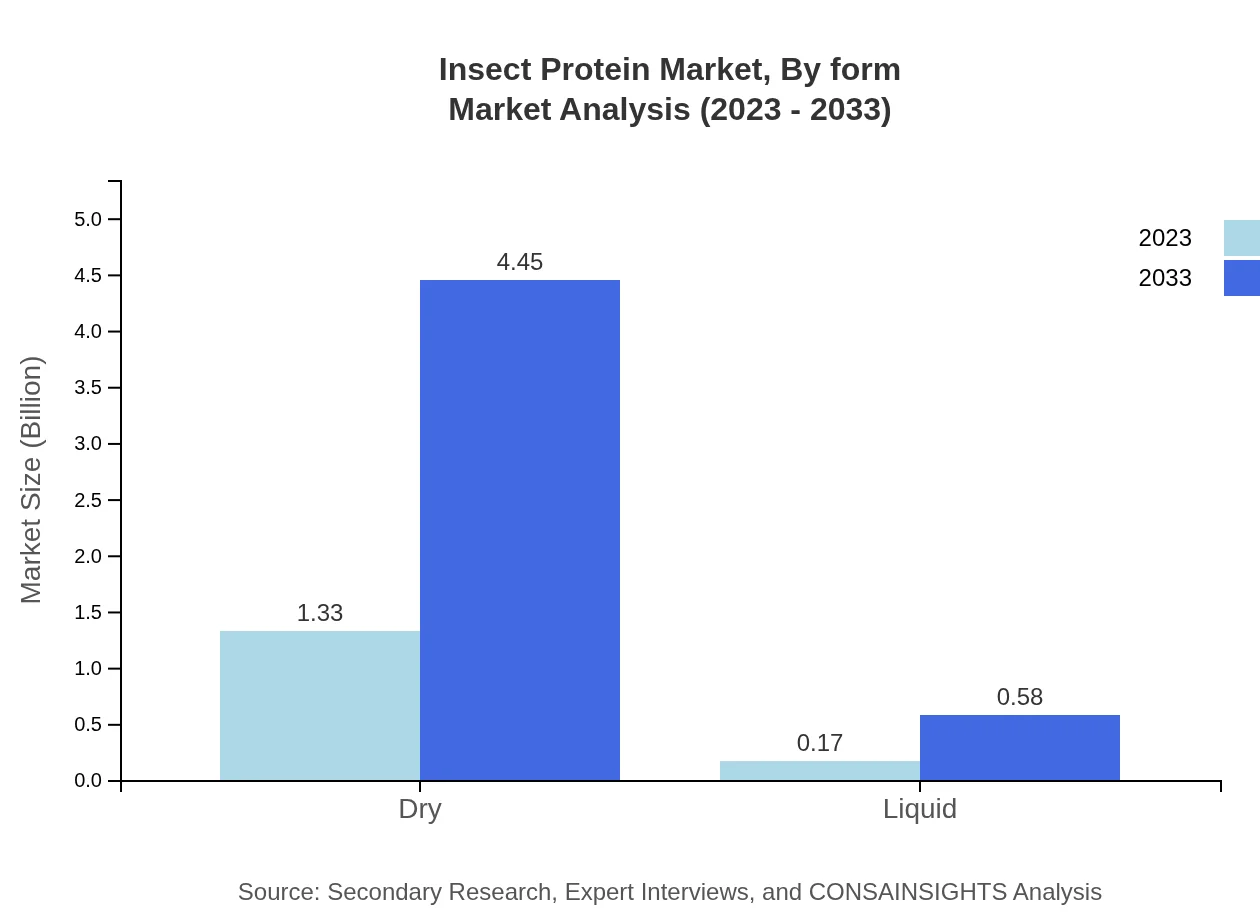

Insect Protein Market Analysis By Form

Dry insect protein, a preferred format for both consumers and manufacturers, showcases a solid market presence from $1.33 billion in 2023 to $4.45 billion by 2033, while liquid protein's market size grows from $0.17 billion to $0.58 billion.

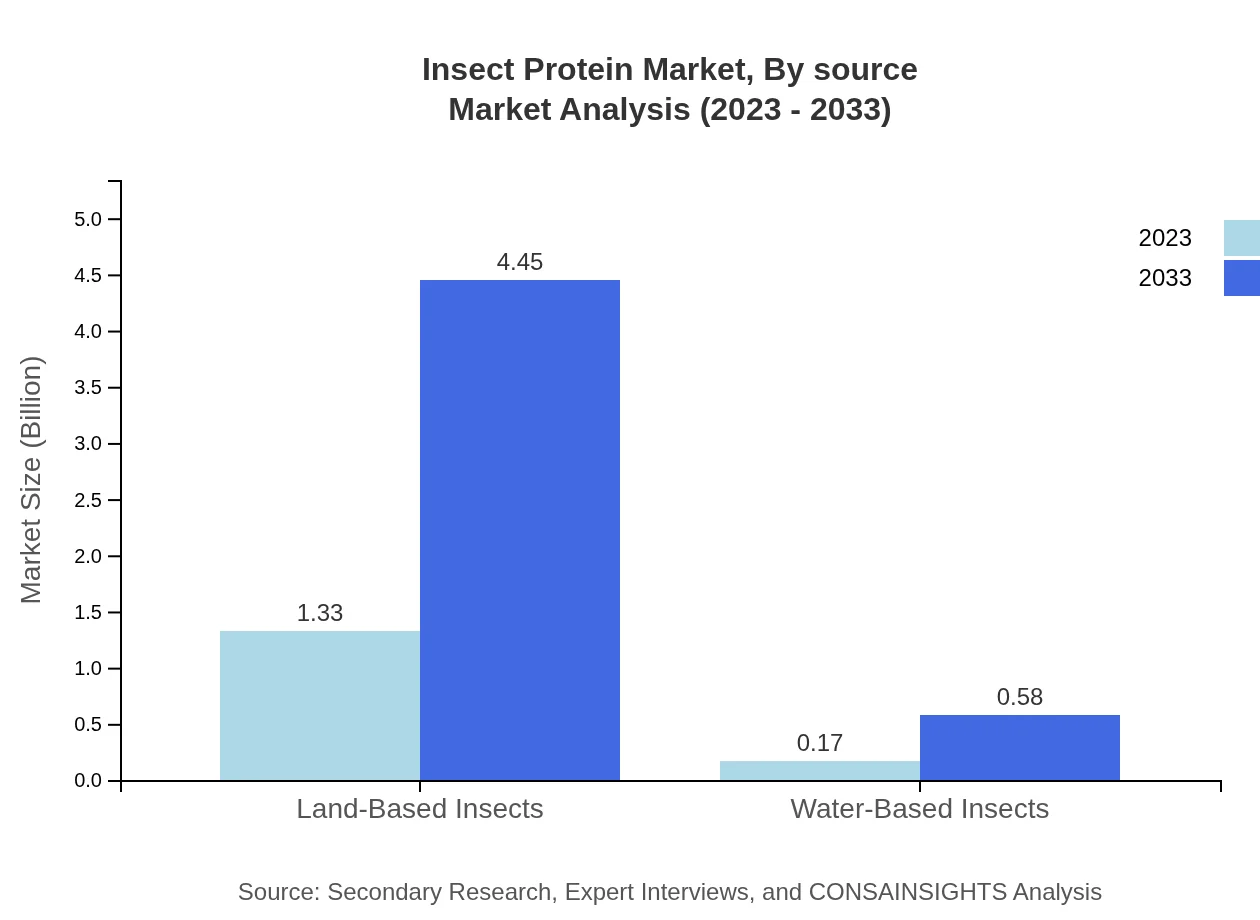

Insect Protein Market Analysis By Source

Land-based insects lead the market with a share of 88.53% in 2023, valued at $1.33 billion. This is expected to escalate to $4.45 billion by 2033. Comparatively, water-based insects, representing only 11.47% of the market, is projected to grow from $0.17 billion to $0.58 billion.

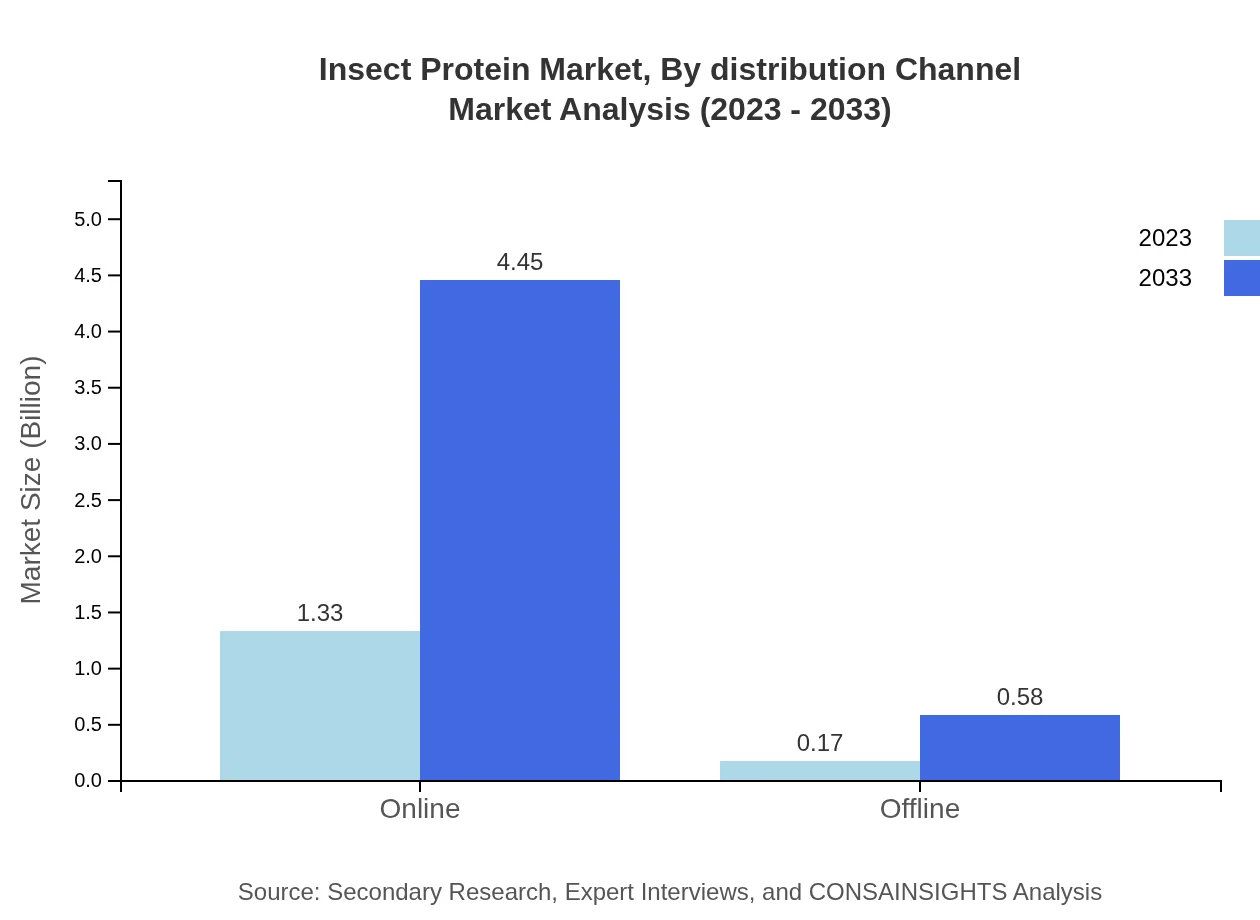

Insect Protein Market Analysis By Distribution Channel

The online distribution channel holds a commanding share of 88.53%, translating to $1.33 billion in 2023 and anticipated to reach $4.45 billion by 2033. Offline channels also demonstrate gradual growth, increasing from $0.17 billion to $0.58 billion, as retailers begin to recognize the demand for insect protein products.

Insect Protein Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Insect Protein Industry

Ÿnsect:

A frontrunner in insect farming technology, specializing in producing high-quality insect protein for animal feed and human consumption, focusing on sustainable production.AgriProtein:

Pioneering the use of insects for food waste conversion, AgriProtein is a leader in the production and supply of insect protein, catering to the growing demand in animal feed sectors.Protix:

Based in the Netherlands, Protix is a global leader in insect farming, renowned for its innovative solutions for sustainable protein production and waste management.Enterra Feed Corporation:

Enterra focuses on producing insect-based feeds using sustainable practices, driving significant advancements in biological waste recycling.We're grateful to work with incredible clients.

FAQs

What is the market size of insect Protein?

The global insect protein market is projected at $1.5 billion in 2023, with a robust CAGR of 12.3% anticipated through 2033, indicating significant growth and increasing acceptance of insect-based products in various sectors.

What are the key market players or companies in the insect Protein industry?

While specific company names are not listed, the insect protein industry includes global players focused on sustainable food sources, partnerships in agriculture, and advancements in insect farming technology, fostering market dynamics and innovation.

What are the primary factors driving the growth in the insect Protein industry?

Key growth drivers for the insect protein industry include rising demand for sustainable protein sources, concerns over traditional livestock farming's environmental impact, increasing consumer awareness of insect protein benefits, and regulatory support for insect-based food products.

Which region is the fastest Growing in the insect Protein market?

Asia-Pacific is anticipated to be the fastest-growing region in the insect protein market, escalating from $0.28 billion in 2023 to $0.95 billion by 2033, driven by rising population and food security concerns.

Does ConsaInsights provide customized market report data for the insect Protein industry?

Yes, ConsaInsights offers tailored market report data specific to the insect protein industry, supporting stakeholders with insights relevant to their business needs and strategic directions in product development and market positioning.

What deliverables can I expect from this insect Protein market research project?

Deliverables from the insect-protein market research project typically include detailed market analysis reports, segmentation data, growth forecasts, competitive landscape assessments, and strategically actionable insights for informed decision-making.

What are the market trends of insect protein?

Current market trends in insect protein include a shift towards plant-based diets, increasing innovation in product formulations, growing acceptance of insects in pet food, and enhanced investments in technology for efficient insect farming and processing.