Insecticidal Seed Treatment Market Report

Published Date: 02 February 2026 | Report Code: insecticidal-seed-treatment

Insecticidal Seed Treatment Market Size, Share, Industry Trends and Forecast to 2033

This report presents a comprehensive analysis of the Insecticidal Seed Treatment market, covering insights into market trends, segmentation, regional performance, and a forecast for the period from 2023 to 2033, with a focus on growth potential and key players.

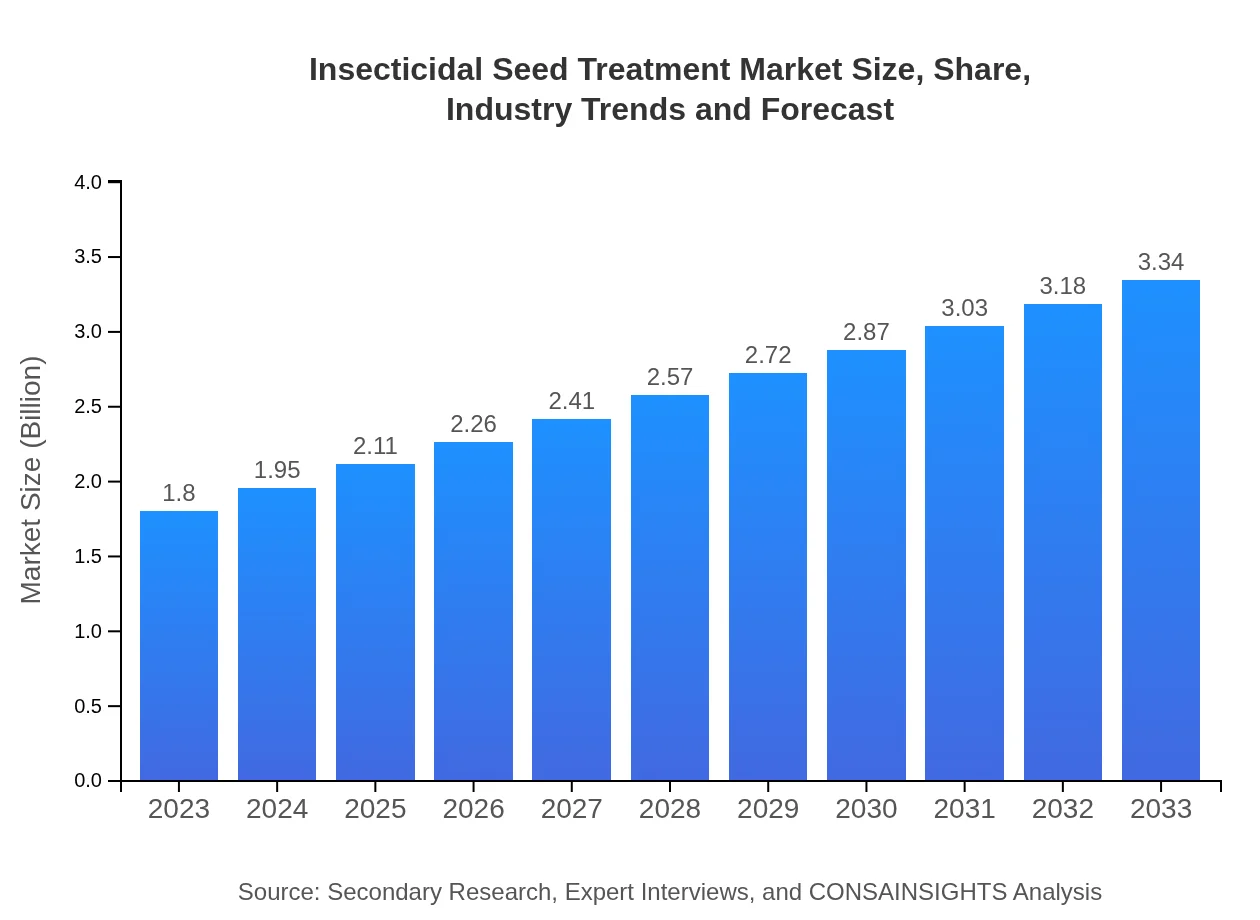

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $1.80 Billion |

| CAGR (2023-2033) | 6.2% |

| 2033 Market Size | $3.34 Billion |

| Top Companies | BASF SE, Syngenta AG, Bayer AG, Corteva Agriscience, FMC Corporation |

| Last Modified Date | 02 February 2026 |

Insecticidal Seed Treatment Market Overview

Customize Insecticidal Seed Treatment Market Report market research report

- ✔ Get in-depth analysis of Insecticidal Seed Treatment market size, growth, and forecasts.

- ✔ Understand Insecticidal Seed Treatment's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Insecticidal Seed Treatment

What is the Market Size & CAGR of Insecticidal Seed Treatment market in 2023?

Insecticidal Seed Treatment Industry Analysis

Insecticidal Seed Treatment Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Insecticidal Seed Treatment Market Analysis Report by Region

Europe Insecticidal Seed Treatment Market Report:

The European Insecticidal Seed Treatment market is expected to increase from USD 0.49 billion in 2023 to USD 0.91 billion by 2033. This growth is supported by stringent regulatory frameworks promoting biopesticides and increased awareness of environmentally friendly practices among farmers.Asia Pacific Insecticidal Seed Treatment Market Report:

In the Asia Pacific region, the Insecticidal Seed Treatment market is projected to grow from USD 0.34 billion in 2023 to USD 0.64 billion by 2033. The growth is led by increasing agricultural productivity demands and a significant rise in pest infestations in countries like China and India.North America Insecticidal Seed Treatment Market Report:

In North America, the market is anticipated to grow from USD 0.69 billion in 2023 to USD 1.28 billion by 2033, fueled by advanced agricultural practices, a high level of technology adoption, and a strong focus on sustainable farming techniques in the United States and Canada.South America Insecticidal Seed Treatment Market Report:

The South American market, valued at USD 0.09 billion in 2023, is expected to expand to USD 0.17 billion by 2033. This growth is driven by the rising demand for agricultural outputs and the adoption of innovative pest control methods across key countries like Brazil and Argentina.Middle East & Africa Insecticidal Seed Treatment Market Report:

The Middle East and Africa market, valued at USD 0.18 billion in 2023, is forecast to grow to USD 0.34 billion by 2033. Growth in this region is spurred by agricultural modernization efforts and the necessity to combat pest issues exacerbated by climatic variations.Tell us your focus area and get a customized research report.

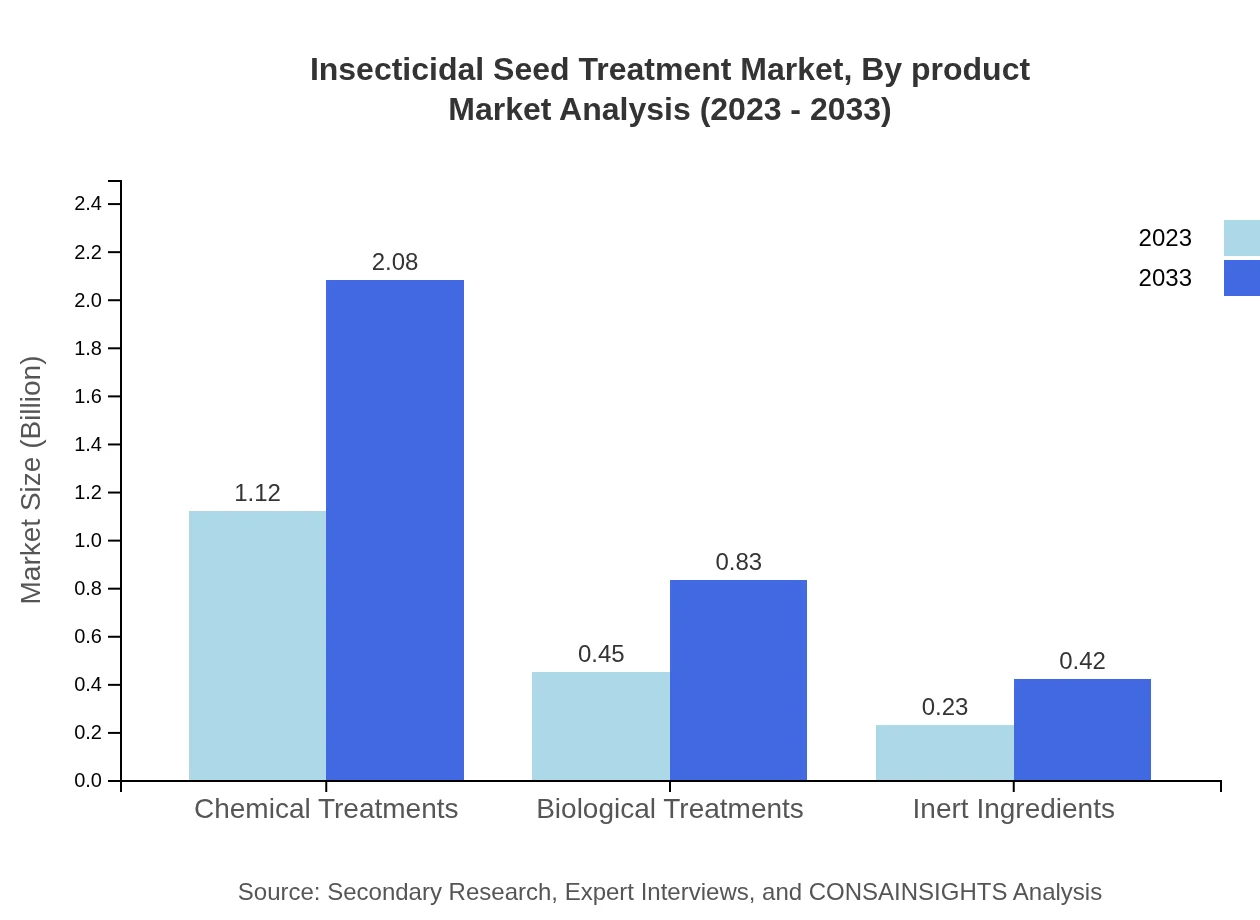

Insecticidal Seed Treatment Market Analysis By Product

The market is primarily segmented into Chemical Treatments, Biological Treatments, and Inert Ingredients. In 2023, Chemical Treatments dominate the market with a size of USD 1.12 billion, holding 62.46% market share. Biological Treatments and Inert Ingredients follow with sizes of USD 0.45 billion (24.88% share) and USD 0.23 billion (12.66% share) respectively, showing positive growth trends.

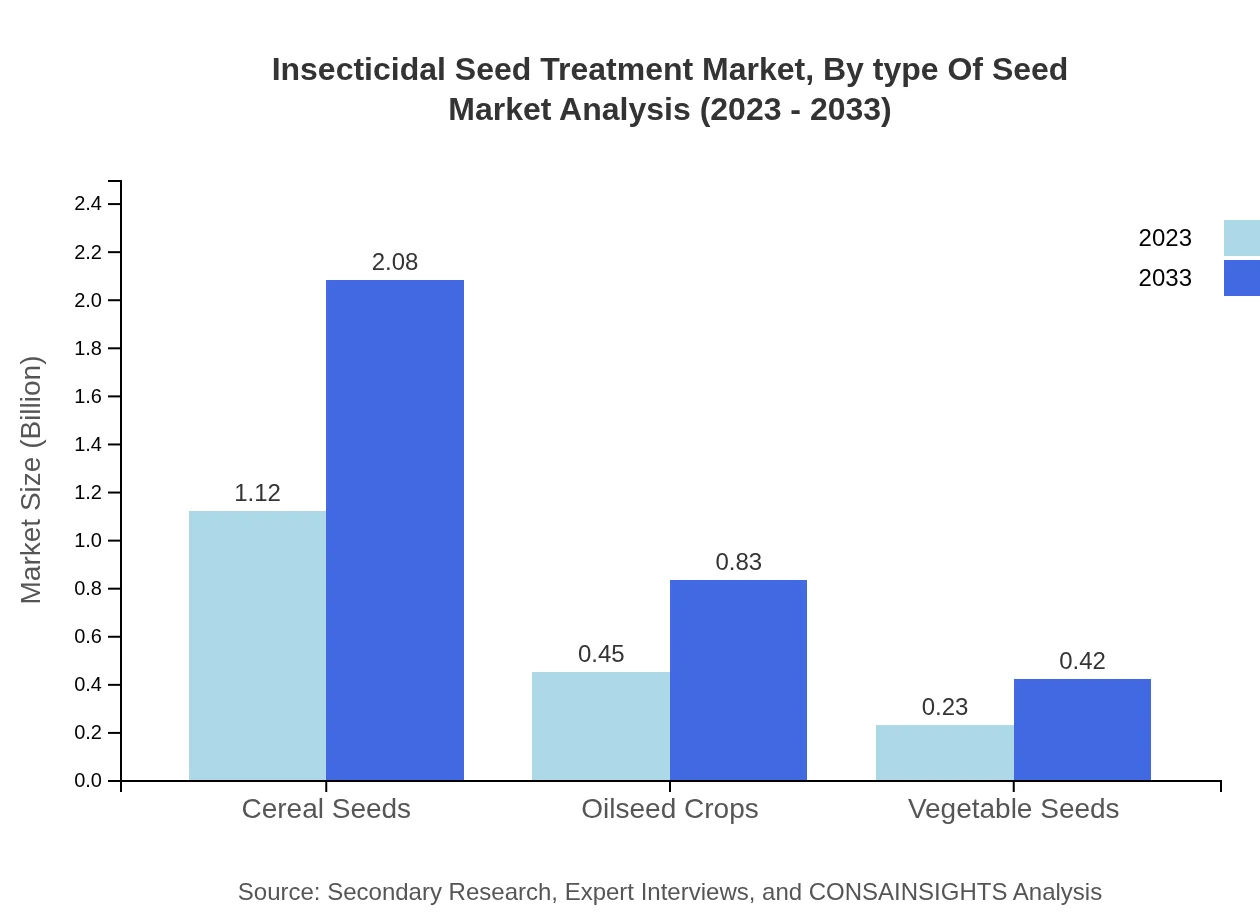

Insecticidal Seed Treatment Market Analysis By Type Of Seed

The market segments by type of seed include Cereal Seeds, Oilseed Crops, and Vegetable Seeds. Cereal Seeds represent the largest segment with a size of USD 1.12 billion and a share of 62.46% in 2023, followed by Oilseed Crops and Vegetable Seeds, reflecting increasing investments in cereal crop production.

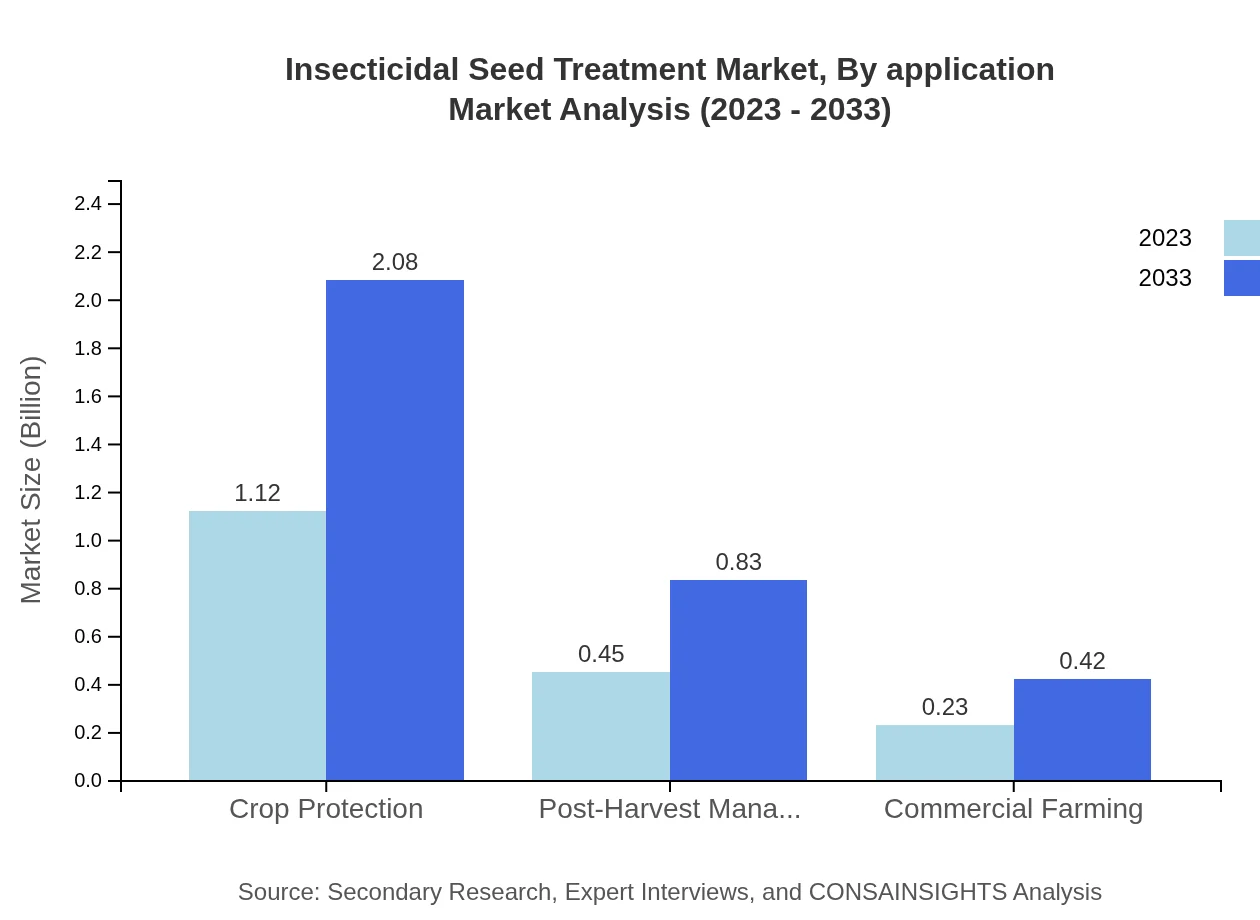

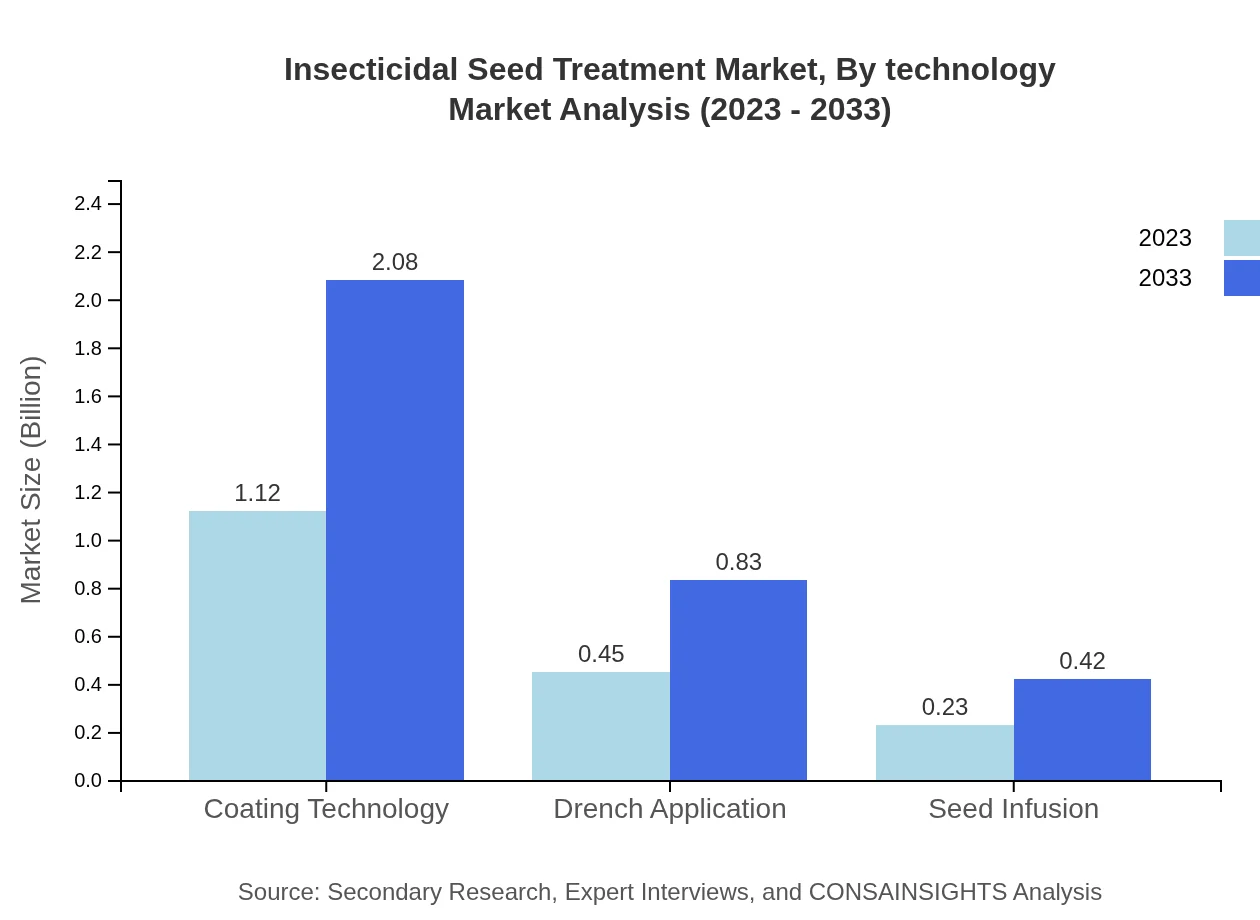

Insecticidal Seed Treatment Market Analysis By Application

Key applications include Coating Technology, Drench Application, and Seed Infusion. Coating Technology leads the market, contributing to the market size of USD 1.12 billion in 2023 (62.46% share), as it offers effective protection against pests while enhancing seed viability.

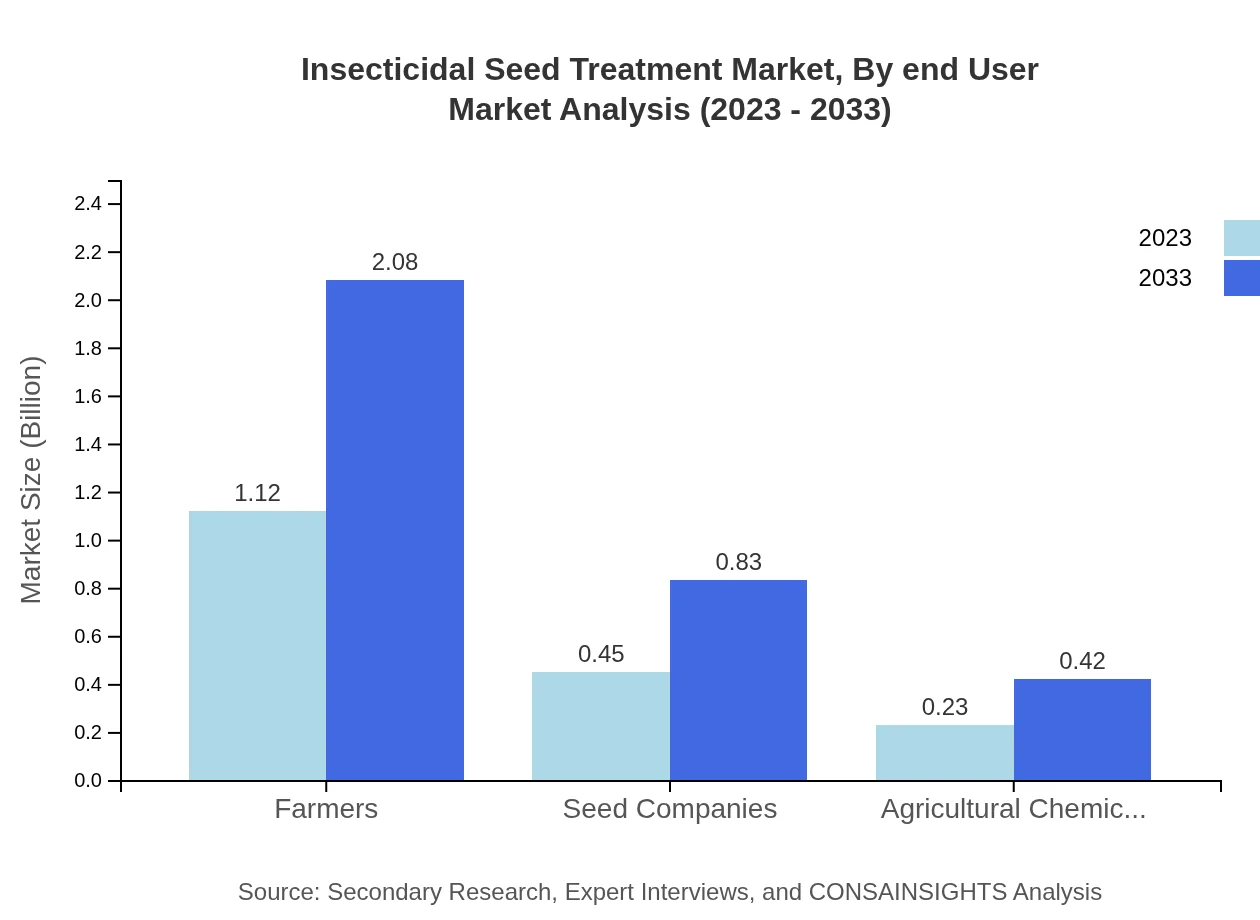

Insecticidal Seed Treatment Market Analysis By End User

The market can be analyzed based on end-users such as Farmers, Seed Companies, and Agricultural Chemical Companies. Farmers constitute the largest user group, reflecting a market size of USD 1.12 billion and a 62.46% share in 2023, driven by increasing demand for effective pest management solutions.

Insecticidal Seed Treatment Market Analysis By Technology

Technological advancements are pivotal in shaping Insecticidal Seed Treatment methods, particularly in developing efficient and environmentally friendly treatments. Coating technologies currently dominate, with a size of USD 1.12 billion and a share of 62.46%.

Insecticidal Seed Treatment Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Insecticidal Seed Treatment Industry

BASF SE:

A global leader in chemical manufacturing, BASF SE provides innovative insecticidal seed treatment solutions aimed at enhancing agricultural efficiency and crop protection.Syngenta AG:

Syngenta AG specializes in crop protection and seed products, offering cutting-edge insect treatment technologies to support sustainable agriculture.Bayer AG:

Bayer AG is a key player in crop science, delivering comprehensive insecticidal seed treatments that cater to diverse agricultural challenges.Corteva Agriscience:

Corteva Agriscience focuses on providing seed and crop protection solutions, including advanced insecticidal treatments for global farming segments.FMC Corporation:

FMC Corporation is involved in the development of innovative agricultural products, including eco-friendly insecticidal seed treatments.We're grateful to work with incredible clients.

FAQs

What is the market size of insecticidal Seed Treatment?

The global insecticidal seed treatment market is valued at $1.8 billion in 2023, with a projected growth rate of 6.2% CAGR, indicating significant potential for expansion through 2033.

What are the key market players or companies in this insecticidal Seed Treatment industry?

Prominent players in the insecticidal seed treatment market include leading agricultural chemical companies, seed companies, and firms specializing in crop protection. These entities drive innovation and competitive strategies to sustain market growth.

What are the primary factors driving the growth in the insecticidal Seed Treatment industry?

Growth in the insecticidal seed treatment industry is driven by increasing pest resistance, rising demand for high-yield crops, and advancements in treatment technologies, all of which are essential for improving agricultural productivity.

Which region is the fastest Growing in the insecticidal Seed Treatment?

North America is the fastest-growing region for insecticidal seed treatment, expected to increase from $0.69 billion in 2023 to approximately $1.28 billion by 2033, marking significant regional expansion.

Does ConsaInsights provide customized market report data for the insecticidal Seed Treatment industry?

Yes, ConsaInsights offers customized market report data tailored to clients' specific needs in the insecticidal seed treatment industry, providing insights that align with strategic objectives.

What deliverables can I expect from this insecticidal Seed Treatment market research project?

Expected deliverables from the insecticidal seed treatment market research include detailed market analysis, trend reports, competitive landscape assessments, and tailored insights to aid decision-making.

What are the market trends of insecticidal Seed Treatment?

Key trends in the insecticidal seed treatment market include an increase in biological treatments, innovative application technologies, and a focus on sustainable agriculture practices to enhance product efficacy and environmental safety.