Insecticide Seed Treatment Market Report

Published Date: 02 February 2026 | Report Code: insecticide-seed-treatment

Insecticide Seed Treatment Market Size, Share, Industry Trends and Forecast to 2033

This report provides comprehensive insights into the Insecticide Seed Treatment market, analyzing industry dynamics, market size, and forecasts from 2023 to 2033. It covers key segments, regional insights, and trends that shape the market.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

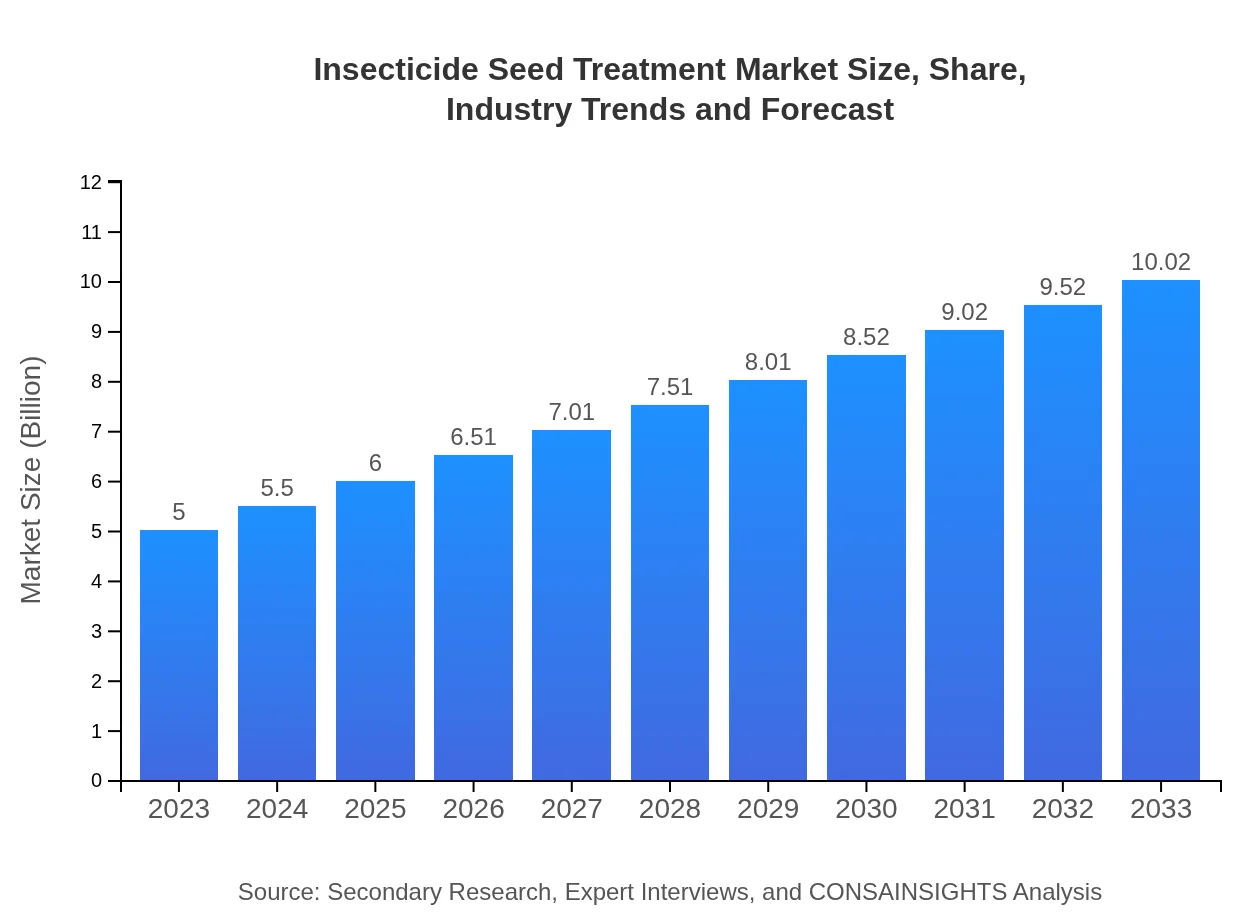

| 2023 Market Size | $5.00 Billion |

| CAGR (2023-2033) | 7% |

| 2033 Market Size | $10.02 Billion |

| Top Companies | BASF SE, Syngenta AG, Bayer AG, Corteva Agriscience, FMC Corporation |

| Last Modified Date | 02 February 2026 |

Insecticide Seed Treatment Market Overview

Customize Insecticide Seed Treatment Market Report market research report

- ✔ Get in-depth analysis of Insecticide Seed Treatment market size, growth, and forecasts.

- ✔ Understand Insecticide Seed Treatment's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Insecticide Seed Treatment

What is the Market Size & CAGR of Insecticide Seed Treatment market in 2023?

Insecticide Seed Treatment Industry Analysis

Insecticide Seed Treatment Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Insecticide Seed Treatment Market Analysis Report by Region

Europe Insecticide Seed Treatment Market Report:

Europe's market, valued at $1.59 billion in 2023, is projected to reach $3.18 billion by 2033. The stringent pest control regulations and high levels of awareness among farmers about the efficacy of seed treatment are key factors driving growth.Asia Pacific Insecticide Seed Treatment Market Report:

The Asia Pacific region is witnessing robust growth, with a market size of $0.86 billion in 2023, projected to reach $1.73 billion by 2033. With agricultural mechanization and government support for enhanced crop yield, the demand for seed treatment solutions is on the rise.North America Insecticide Seed Treatment Market Report:

North America commands a significant share of the Insecticide Seed Treatment market, valued at $1.87 billion in 2023 and expected to double to $3.74 billion by 2033. The advancement in technology and product formulations tailored for local pests has bolstered market growth.South America Insecticide Seed Treatment Market Report:

In South America, the market is expected to grow from $0.44 billion in 2023 to $0.88 billion by 2033. The rising prevalence of pest resistance and increased crop diseases have driven farmers to adopt more effective seed treatment solutions.Middle East & Africa Insecticide Seed Treatment Market Report:

The Middle East and Africa market, although at a lower scale with $0.24 billion in 2023, is estimated to grow to $0.49 billion by 2033. Increased agricultural activities and investments in modern farming techniques are boosting demand in this region.Tell us your focus area and get a customized research report.

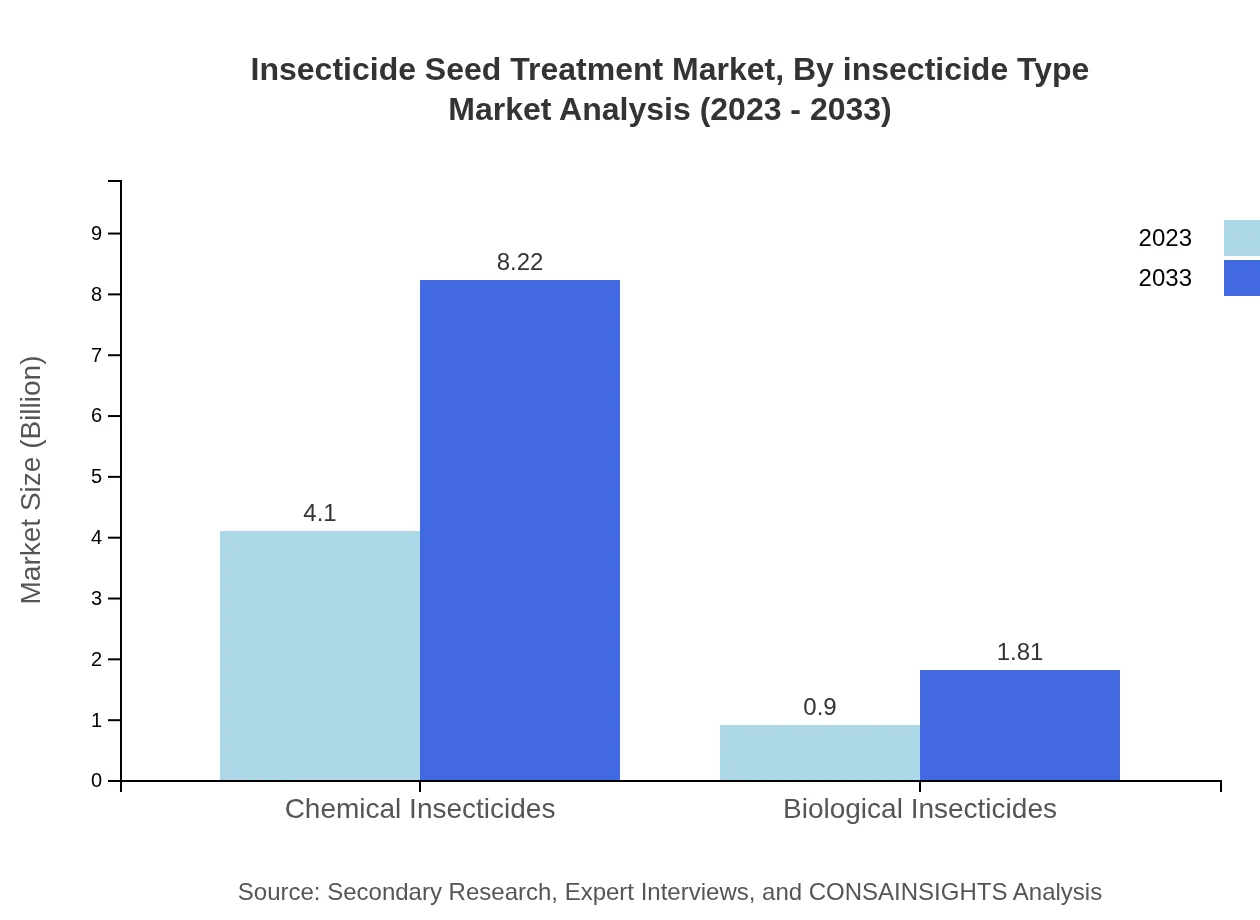

Insecticide Seed Treatment Market Analysis By Insecticide Type

The segment on Insecticide Seed Treatment showcases Chemical Insecticides leading with a market size of $4.10 billion in 2023, maintaining an 81.98% share. Biological Insecticides, valued at $0.90 billion, represent an 18.02% share, indicating a growing interest in environmentally friendly pest management solutions.

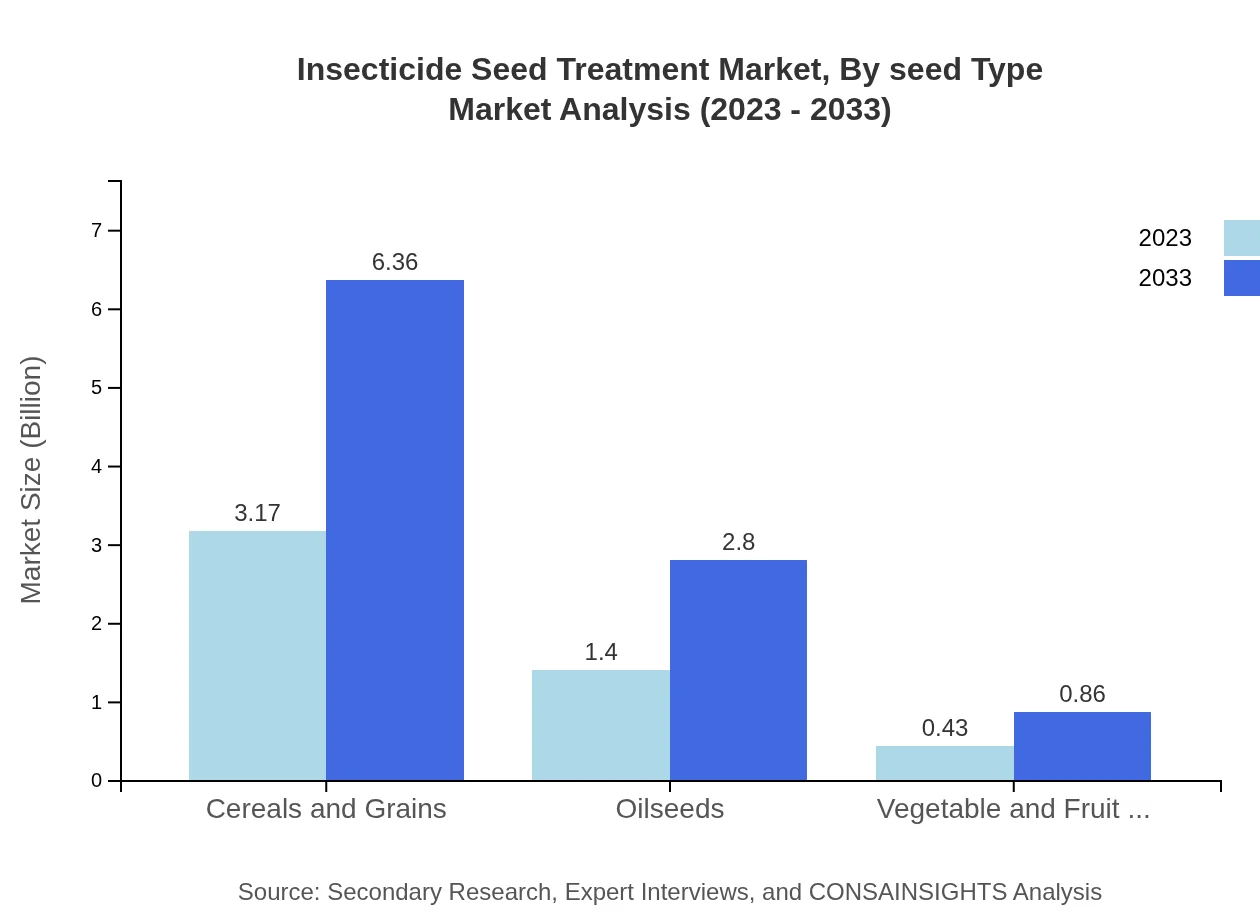

Insecticide Seed Treatment Market Analysis By Seed Type

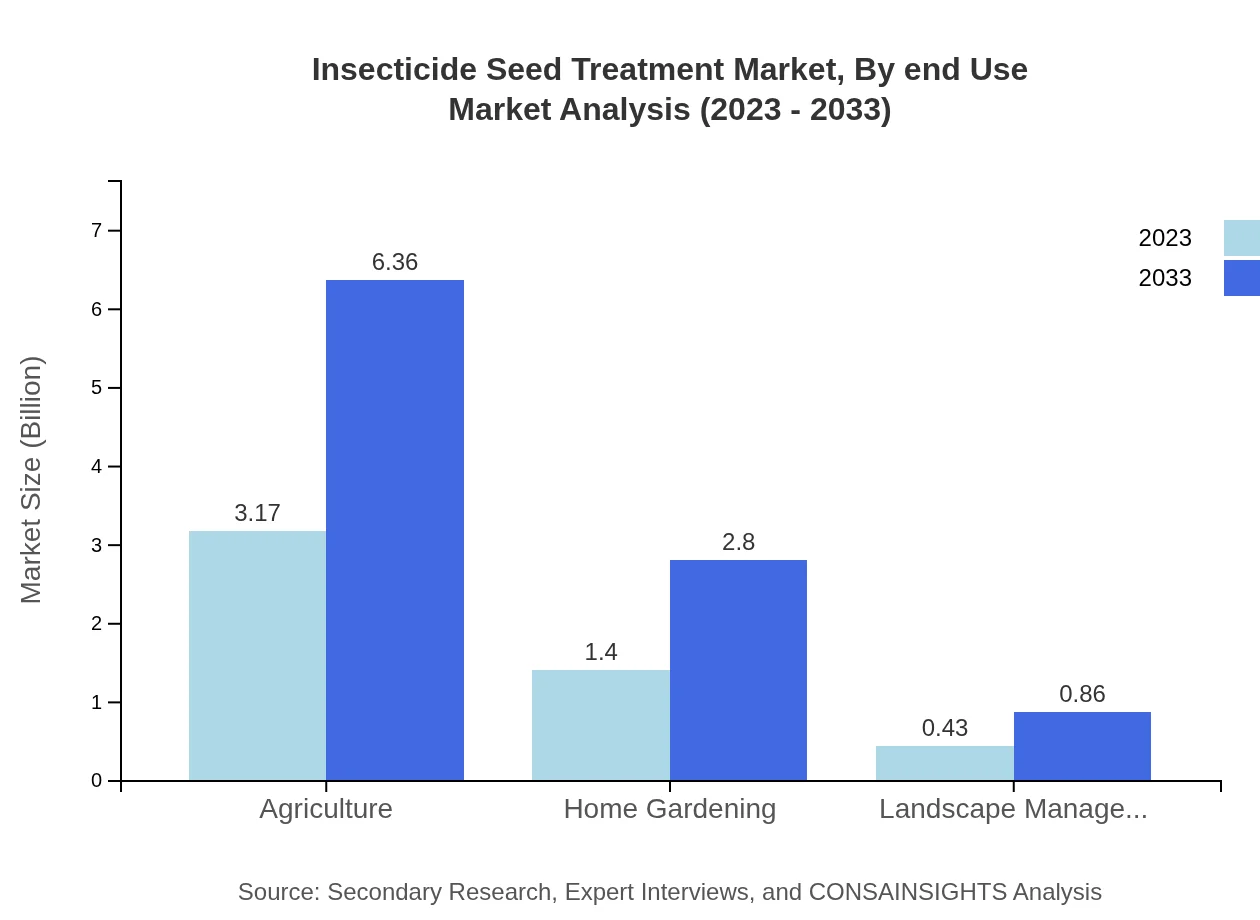

The Agriculture segment in the Insecticide Seed Treatment market is projected at $3.17 billion in 2023, expected to rise to $6.36 billion by 2033. Significant growth is expected in Cereals and Grains and Oilseeds, which reflect the highest shares in agricultural practices.

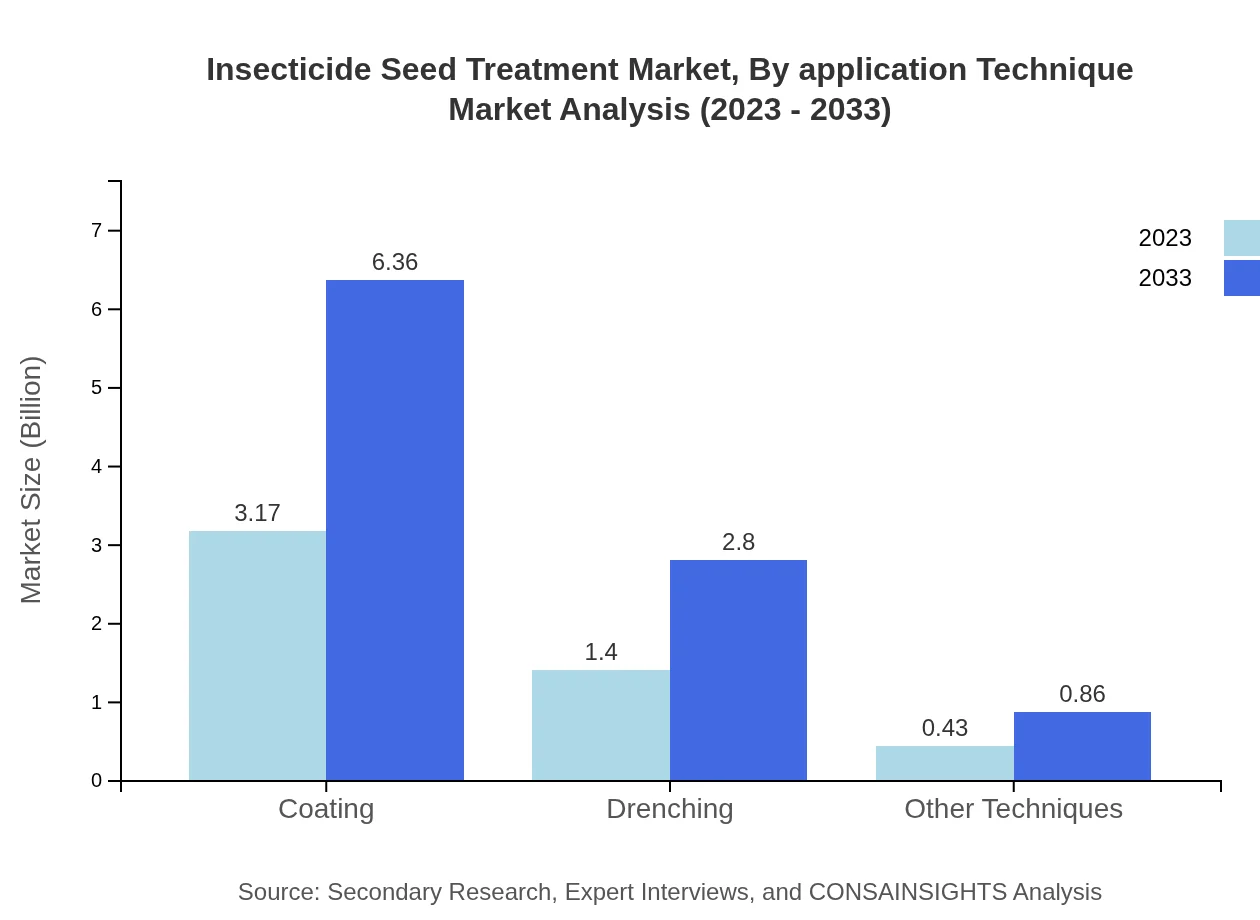

Insecticide Seed Treatment Market Analysis By Application Technique

In application techniques, Coating maintains the largest market share at 63.48%, valued at $3.17 billion in 2023. Other techniques like Drenching contribute notably as well, expanding accessibility to enhanced pest control methods.

Insecticide Seed Treatment Market Analysis By End Use

The By End-Use analysis indicates that a significant portion of Insecticide Seed Treatment is utilized in agricultural production, highlighting the critical reliance on these products for ensuring crop health and yield.

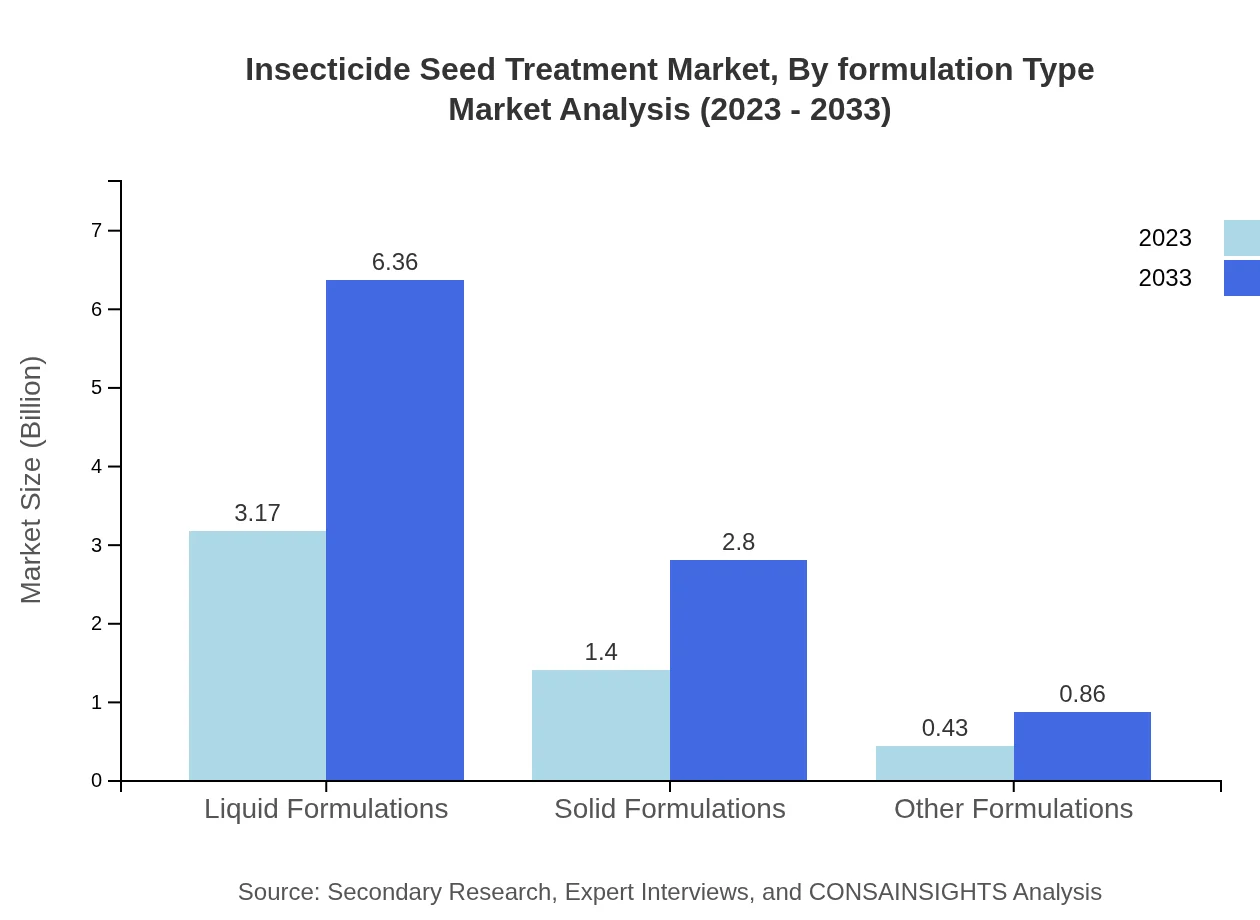

Insecticide Seed Treatment Market Analysis By Formulation Type

Liquid Formulations dominate with a market size of $3.17 billion in 2023, indicating their effectiveness and suitability for seed treatment applications, while Solid Formulations and Other Formulations supplement the market with substantial growth potential.

Insecticide Seed Treatment Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Insecticide Seed Treatment Industry

BASF SE:

A global leader in chemical production, BASF SE excels in innovative crop protection solutions and has a strong portfolio of insecticide seed treatments.Syngenta AG:

Syngenta AG focuses on sustainable agriculture and provides advanced seed treatments that improve crop resilience against pests and diseases.Bayer AG:

Bayer AG is known for its commitment to crop science, offering a variety of effective insecticide seed treatment products that cater to diverse agricultural needs.Corteva Agriscience:

Corteva Agriscience specializes in plant health, providing farmers with effective insecticide treatments that contribute to better productivity and sustainability.FMC Corporation:

FMC Corporation offers innovative insecticide seed treatments, supporting growers globally in pest management and crop protection.We're grateful to work with incredible clients.

FAQs

What is the market size of insecticide Seed Treatment?

The insecticide seed treatment market is valued at approximately $5 billion in 2023, with a projected CAGR of 7% from 2023 to 2033, indicating significant growth and investment opportunities in this sector.

What are the key market players or companies in this insecticide Seed Treatment industry?

Key players in the insecticide seed treatment industry include major companies such as Bayer Crop Science, Syngenta AG, BASF SE, and Corteva Agriscience. These companies dominate the market with their innovative products and extensive distribution networks.

What are the primary factors driving the growth in the insecticide Seed Treatment industry?

Growth in the insecticide seed treatment market is driven by increasing pest resistance, advancements in agricultural technologies, and a growing emphasis on sustainable farming practices which minimize environmental impact while ensuring crop yield.

Which region is the fastest Growing in the insecticide Seed Treatment?

The fastest-growing region in the insecticide seed treatment market is Europe, with market growth projected from $1.59 billion in 2023 to $3.18 billion by 2033, reflecting a strong demand for enhanced agricultural practices.

Does ConsaInsights provide customized market report data for the insecticide Seed Treatment industry?

Yes, ConsaInsights offers customized market report data tailored to specific client needs within the insecticide seed treatment industry, providing comprehensive insights and analyses to support informed decision-making.

What deliverables can I expect from this insecticide Seed Treatment market research project?

Deliverables from the insecticide seed treatment market research project include detailed market analysis reports, segmentation data, competitive landscape evaluations, and forecasts that help stakeholders understand potential market opportunities.

What are the market trends of insecticide Seed Treatment?

Current trends in the insecticide seed treatment market include a shift towards biological insecticides, innovations in formulation techniques, and increasing investment in research and development to enhance product efficacy and safety.